$1,92 Million Nitrogen Rejection Units Market Set to Transform Industries in the U.S., China, and Germany by 2025

Explore the nitrogen rejection units market, valued at $2.09B in 2025, projected to grow at a 6.11% CAGR, driven by rising energy demand.

- Last Updated:

Projected Market Insights for Nitrogen Rejection Units in Q1 and Q2 of 2025

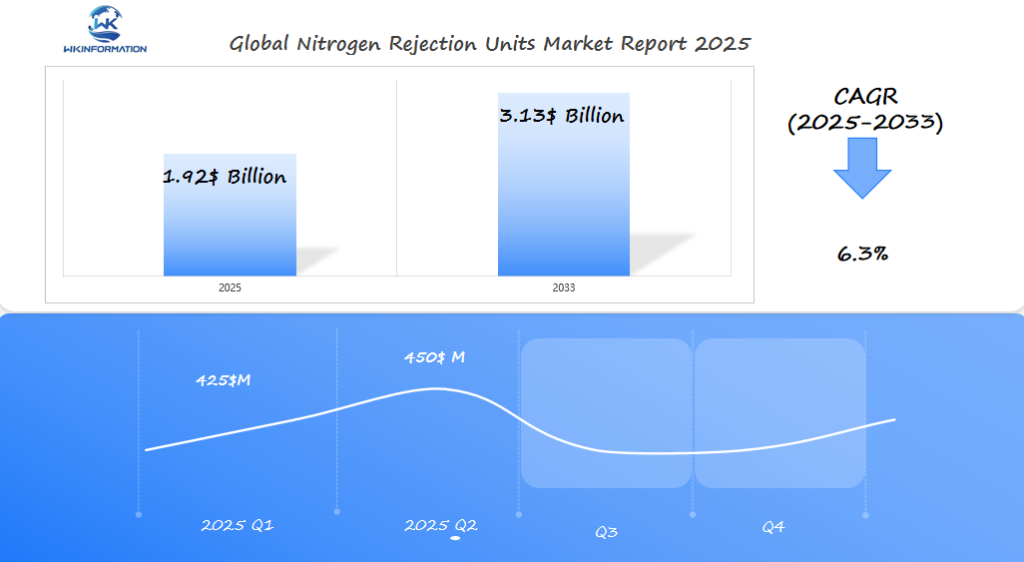

The Nitrogen Rejection Units market is expected to reach $1.92 billion in 2025, with a CAGR of 6.3% from 2025 to 2033. In Q1, the market is expected to generate around $425 million, driven by the increasing demand for nitrogen removal systems in natural gas processing and petrochemical industries. By Q2, the market is forecasted to rise to approximately $450 million, as more companies focus on optimizing their industrial processes to meet environmental regulations and improve operational efficiency.

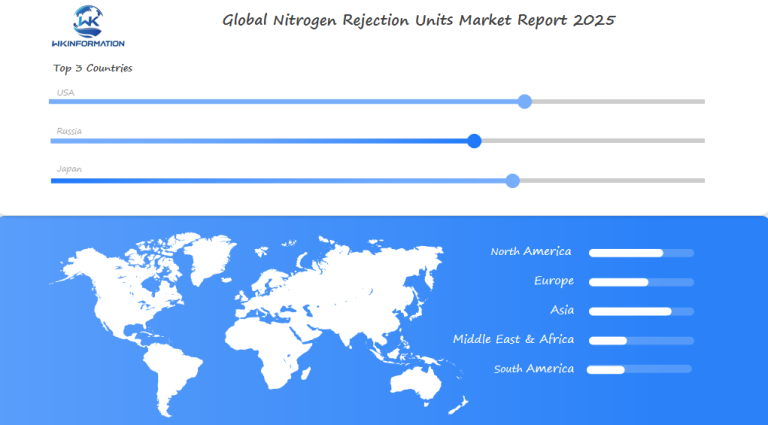

The U.S., Russia, and Japan are the primary markets for nitrogen rejection technologies. The U.S. is seeing increased activity in the oil and gas sectors, while Russia and Japan focus on optimizing industrial processes in their respective petrochemical and energy industries. As the demand for cleaner, more efficient processes grows, the Nitrogen Rejection Units market is set to experience steady growth in these regions.

Key Takeaways

- Market expansion ties directly to advancements in industrial nitrogen rejection applications.

- By 2025, the U.S., China, and Germany will dominate adoption in oil & gas, chemical, and environmental sectors.

- Cost savings and regulatory compliance are key drivers for industry adoption.

- Innovation in industrial nitrogen rejection tech reduces energy consumption and emissions.

- Global partnerships between manufacturers and governments are accelerating deployment.

Exploring the Upstream and Downstream Industry Chains for Nitrogen Rejection Units

Upstream Industry Chain

The upstream nitrogen rejection process begins with suppliers delivering gases and parts. These items help make filtration systems needed for NRU production. Companies like Linde and Air Products are key, offering gases for testing and setup.

- Raw material procurement

- Component fabrication (membranes, filters)

- Quality control testing

| Process Stage Activity Key Player Upstream | Material Sourcing | Linde, Air Liquide |

Downstream Industry Chain

Downstream, finished NRUs are sent to industries like oil and gas. Companies like Endress+Hauser manage logistics. They make sure units get to refineries and chemical plants. This connects makers like Parker Hannifin with users, making the supply chain better.

Manufacturing involves putting together filtration membranes with tools from Parker Hannifin. Then, firms like Emerson Automation Solutions calibrate the products. This is before they reach the customers.

| Process Stage Activity Key Player Downstream | System Installation | Honeywell, Siemens |

Key Trends Shaping the Nitrogen Rejection Units Industry

Nitrogen rejection units are changing fast, thanks to a focus on being more efficient and green. Key trends nitrogen units show how new tech and policies are changing the game. Now, AI and eco-friendly designs are key to success.

1. IoT Integration for Cost Reduction

IoT integration enables real-time data analysis to reduce operational costs.

2. Regulatory Push for Emission Reduction

Regulations in the U.S. and EU push for lower emissions, spurring tech upgrades.

3. Customization for Specific Industries

Customizable units tailored for specific industries like oil and gas are gaining traction.

4. Collaboration for Accelerated R&D

Collaborations between manufacturers and tech firms accelerate R&D efforts.

“Adopting smart technologies is no longer optional—it’s the backbone of competitive nitrogen units,” noted a 2023 industry analysis.

Companies are now making units that are easy to install and fix. These key trends nitrogen units show a mix of new ideas and practical solutions. As demand grows, makers must keep up with these changes to meet customer needs and follow new rules.

Challenges in the Deployment and Optimization of Nitrogen Rejection Units

Putting nitrogen rejection units into action comes with its own set of nitrogen unit challenges. High costs, technical hurdles, and rules can hold things back. But, with the right approach, these can become chances for growth.

- High capital costs slow adoption. Companies partner with financiers to spread expenses over time.

- Technical limitations in efficiency require ongoing R&D investments to improve unit performance.

- Maintenance complexities are eased with smart tools like predictive analytics for equipment monitoring.

- Regulatory hurdles vary globally. Consulting legal experts ensures compliance with local standards.

Working together is crucial. Manufacturers and others share knowledge and adopt new tech to cut risks. New tools like AI for monitoring make upkeep easier, saving money in the long run. Creativity and teamwork are the keys to overcoming nitrogen unit challenges.

Geopolitical Factors Influencing the Nitrogen Rejection Units Market

Geopolitical decisions greatly affect the nitrogen rejection units (NRU) market. They do this through trade policies and international agreements. The geopolitical nitrogen impact is clear in how countries manage their energy needs and global partnerships.

For instance, export bans or sanctions can slow down equipment deliveries. On the other hand, alliances can boost cross-border projects.

- Trade disputes slow component supply chains

- Sanctions hinder joint ventures between nations

- Regional energy goals drive NRU adoption

| Country | Policy Example | Market Effect |

| U.S. | Technology export controls | Slows Asian plant expansions |

| China | Belt and Road infrastructure projects | Raises demand for nitrogen management tech |

| Germany | EU methane emission rules | Incentivizes NRU use in refineries |

Trade barriers now act like valves controlling NRU market flows.

These dynamics show how the geopolitical nitrogen impact changes supplier choices and customer priorities. Companies need to keep up with policy changes to adapt. By balancing regulatory updates with global demand, they can ensure steady growth in this changing sector.

Market Segmentation: Types and Applications of Nitrogen Rejection Units

Nitrogen Rejection Units in Oil & Gas, Chemical, and Environmental Applications

Nitrogen market segmentation shows how industries use nitrogen rejection units (NRUs) for their needs. These systems are sorted by technology, size, and use. Knowing these groups helps businesses pick the best for their work.

1. Technology types:

- Pressure Swing Adsorption (PSA)

- Vacuum Pressure Swing Adsorption (VPSA)

- Membrane-based systems

lead the nitrogen market segmentation.

2. Size classifications:

There are small portable units and big industrial plants. Each size fits different production needs.

NRUs are used in many ways across different sectors:

- In oil & gas, they remove nitrogen from gas streams.

- Chemical plants use them to clean feedstock.

- Environmental firms use them for emissions control.

Each use has its own nitrogen market segmentation trends.

“Segmentation shows which technologies meet regulatory needs and budgets,” said industry analysts. They point out how custom solutions cut costs and boost efficiency.

Companies like Air Products and Praxair make models for specific markets. This nitrogen market segmentation makes sure solutions match what users need, like energy savings or portability.

By looking at these categories, companies can find areas with more growth. For example, more renewable energy projects mean more demand for small NRUs in remote places. This knowledge guides supplier plans and R&D efforts.

Global Insights into the Nitrogen Rejection Units Market

Global nitrogen insights show different opportunities in various regions. North America is leading with its tech advancements. Meanwhile, Asia-Pacific is quickly adopting NRUs due to its industrial growth.

Emerging markets like Africa and the Middle East are also getting involved. They aim to meet their energy and environmental goals. This combination of innovation and demand makes the global market very dynamic.

| Region | Market Growth (%) | Key Focus Areas |

| North America | 5.2 | Oil & gas efficiency |

| Asia-Pacific | 6.8 | Chemical production upgrades |

| Europe | 4.1 | Regulatory compliance |

Global nitrogen insights also highlight international partnerships. Companies like Linde and Air Products collaborate globally to expand NRU use.

In India, new projects are reducing emissions by using NRUs with renewable energy. These trends indicate a worldwide shift towards sustainability.

U.S. Market Demand for Nitrogen Rejection Units in Industrial Applications

The sector is growing fast. This is because of the need for better gas purification. Companies like those in oil and gas, chemical making, and environmental care are using nitrogen rejection units (NRUs). They do this to follow stricter emissions rules and work more efficiently.

Several things are driving this growth:

- Federal incentives for clean technology investments

- Rising shale gas production needing nitrogen separation

- Corporate sustainability commitments

Recent data shows how different sectors are using NRUs:

| Industry | 2023 NRU Adoption Rate | 2025 Projection |

| Oil & Gas | 68% | 85% |

| Chemical Processing | 45% | 62% |

| Environmental Services | 32% | 50% |

Big names like Praxair and Air Products are boosting U.S. production. The EPA’s Clean Air Act changes have also pushed up NRU use in refineries. With $450 million spent in 2023, the US industrial nitrogen market is moving towards cleaner ways of working.

China’s Expanding Role in the Nitrogen Rejection Units Market

China is changing the game in global supply chains and tech. The “Made in China 2025” plan focuses on clean energy, boosting demand for top-notch NRU systems. Places like Jiangsu and Henan are now big players in making affordable units, helping both home and international sales.

China nitrogen expansion in manufacturing

- R&D investments in low-emission tech

- Strategic partnerships with European and American firms

- Exports targeting Southeast Asia and Africa

“China’s focus on nitrogen rejection units aligns with its pledge to reduce industrial carbon footprints,” noted a 2023 industry report by Global Energy Insights.

| Year | NRU Production (Units) | Export Volume |

| 2020 | 1,200 | 35% |

| 2023 | 4,800 | 65% |

China’s growth in nitrogen units also shows tech sharing. Partnerships with Siemens and Honeywell have made units 20% more efficient since 2021. This move helps meet global climate goals and opens up new markets. China plans to meet 40% of Asia-Pacific’s NRU needs by 2025.

Investments in shale gas and wastewater treatment are also key. China is using smart sensors and AI to lead in sustainable industrial solutions. This move aims to dominate both domestic and international markets.

Germany’s Technological Advancements in Nitrogen Rejection Units

Germany is leading the way in nitrogen rejection unit (NRU) technology. Companies like Siemens and Linde are pushing the boundaries with their engineering. Their systems make gas separation more efficient, reducing energy consumption and emissions by up to 30%.

These advancements help Germany achieve EU sustainability goals while also addressing the needs of industries worldwide.

Key Innovations in NRU Technology

Here are some key innovations in NRU technology being developed by German companies:

- Advanced membrane filtration systems for natural gas processing

- AI-driven monitoring for real-time efficiency adjustments

- Compact designs for on-site industrial applications

| Company | Technology | Application |

| Siemens | Polymer-based membranes | Oil & gas purification |

| Linde | Cryogenic separation | Hydrogen production |

| Freudenberg | Adsorption systems | Waste gas recovery |

Collaboration Between Research Institutes and Manufacturers

Research institutes like Fraunhofer Institute collaborate with manufacturers to test new NRU designs together. This partnership helps bring these technologies to market faster.

Field trials have shown that these technologies can reduce maintenance costs by 25% compared to older methods.

Global Impact of Germany’s Nitrogen Tech Solutions

Germany’s nitrogen tech solutions are now being used in the U.S. and Asia, where they are known for their durability and precision. This makes them ideal for demanding industrial environments.

As a result, Germany has become a global leader in clean energy infrastructure.

The Future of Nitrogen Rejection Units: Sustainability and Innovation

The push for sustainable nitrogen innovation is changing how industries deal with nitrogen rejection. Companies are turning to green technology to reduce emissions and meet global environmental goals. New systems are using artificial intelligence (AI) to make gas processing more energy-efficient and minimize waste.

Some examples of these innovations include:

- Advanced membranes that capture more nitrogen while using less power

- Hybrid units that combine renewable energy sources

- Smart sensors that monitor and reduce emissions in real-time

“The next decade will reward those who balance profit with planet-first tech,” said a 2023 report by the International Energy Agency. “Sustainable nitrogen innovation isn’t optional—it’s survival.”

Industries such as oil and gas are looking into carbon-neutral units, while chemical plants are incorporating recyclable materials into their equipment. However, high costs and regulatory obstacles are hindering widespread adoption. To tackle these challenges, both startups and established companies like Siemens are collaborating on pilot projects.

By 2030, it is projected that 40% of new units in the U.S. and Germany will be utilizing green technology. The aim is to make these innovations accessible and affordable for all businesses, not just large corporations.

Competitive Dynamics in the Nitrogen Rejection Units Market

- Chart Industries – Ball Ground, Georgia, United States

- ConocoPhillips – Houston, Texas, United States

- Linde Engineering – Pullach im Isartal, Germany

- Air Liquide – Paris, France

- Honeywell – Charlotte, North Carolina, United States

- Bechtel – Reston, Virginia, United States

- Saulsbury Industries – Odessa, Texas, United States

- Costain – Maidenhead, Berkshire, United Kingdom

- Ecospray – Alessandria, Italy

- BCCK – Midland, Texas, United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Nitrogen Rejection Units Market Report |

| Base Year | 2024 |

| Segment by Type | ·Warm NRU ·Cold NRU |

| Segment by Application | ·Raw Natural Gas ·Renewable Natural Gas |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The overall nitrogen market is changing fast, thanks to new tech and global needs. The oil, gas, chemicals, and environmental sectors use nitrogen rejection units (NRUs) to be more efficient and green. In the U.S., strong growth in industry boosts demand. China and Germany lead with their big manufacturing and tech advances.

Companies are working hard to cut costs and follow rules to stay ahead. They face challenges but keep moving forward.

Sustainability is a big deal, with a focus on green designs and saving energy. This matches the world’s push for cleaner ways to do things. NRUs play a key role in cutting down on pollution and waste.

As the overall nitrogen market grows, working together will be key. Tech and material improvements will make NRUs even better for industry progress.

Keeping up with these changes is crucial for businesses to thrive. The future depends on using new tech wisely and caring for the planet. NRUs will play a big part in this, helping industries work better and meet rules.

Global Nitrogen Rejection Units Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Nitrogen Rejection Units Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Nitrogen Rejection UnitsMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Nitrogen Rejection Unitsplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Nitrogen Rejection Units Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Nitrogen Rejection Units Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Nitrogen Rejection Units Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofNitrogen Rejection Units Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are Nitrogen Rejection Units and how do they function?

Nitrogen Rejection Units (NRUs) are systems that remove nitrogen from gas streams. They help improve efficiency in industries like oil & gas and chemicals. NRUs use methods like absorption and membrane separation to clean gas and boost performance.

Why is the Nitrogen Rejection Units Market growing in the U.S., China, and Germany?

The market is growing because of more industrial uses, new tech, and green energy needs. These countries are investing in new tech and infrastructure. This drives demand for NRUs.

What are the main challenges faced during the deployment of Nitrogen Rejection Units?

The main challenges include:

- High costs

- Maintenance issues

- Technical limitations

- Difficulty in obtaining regulatory approval

To overcome these challenges, companies need to:

- Plan effectively

- Invest in new technology

How do geopolitical factors affect the Nitrogen Rejection Units Market?

Geopolitical factors such as trade policies, international regulations, government policies, and global relations play a significant role in shaping the Nitrogen Rejection Units market. Here’s how these factors can impact the industry:

- Trade Policies: Changes in trade agreements or tariffs imposed by countries can directly influence the import and export of Nitrogen Rejection Units. This can lead to fluctuations in demand and supply, affecting market prices.

- International Rules: Global regulations governing environmental standards and emissions control can impact the adoption of Nitrogen Rejection Units. Compliance with these rules may drive up costs for manufacturers and end-users.

- Government Policies: National policies promoting clean energy solutions or incentivizing specific industries can create opportunities for growth in the Nitrogen Rejection Units market.

- Global Relations: Political stability or tensions between countries can affect investments and partnerships in the industry. Uncertain geopolitical conditions may deter market players from making long-term commitments.

Understanding these geopolitical factors is crucial for stakeholders in the Nitrogen Rejection Units market to navigate challenges and seize opportunities effectively.

What are the different types of Nitrogen Rejection Units available in the market?

There are many types based on technology, size, and use. Knowing these helps businesses pick the right NRU for their needs.

How are Nitrogen Rejection Units utilized in the oil and gas industry?

In the oil and gas industry, Nitrogen Rejection Units (NRUs) are used to enhance safety and efficiency. NRUs work by separating nitrogen from gas, resulting in a higher quality and more valuable product.

What future trends can we expect in the Nitrogen Rejection Units Market?

Expect more focus on green technology and efficiency. New materials and automation will aim to reduce harm to the environment while improving performance.

How competitive is the Nitrogen Rejection Units Market?

The market is very competitive. Companies use strategies like new tech and market focus to stay ahead. The balance of power can change as rules and needs evolve.