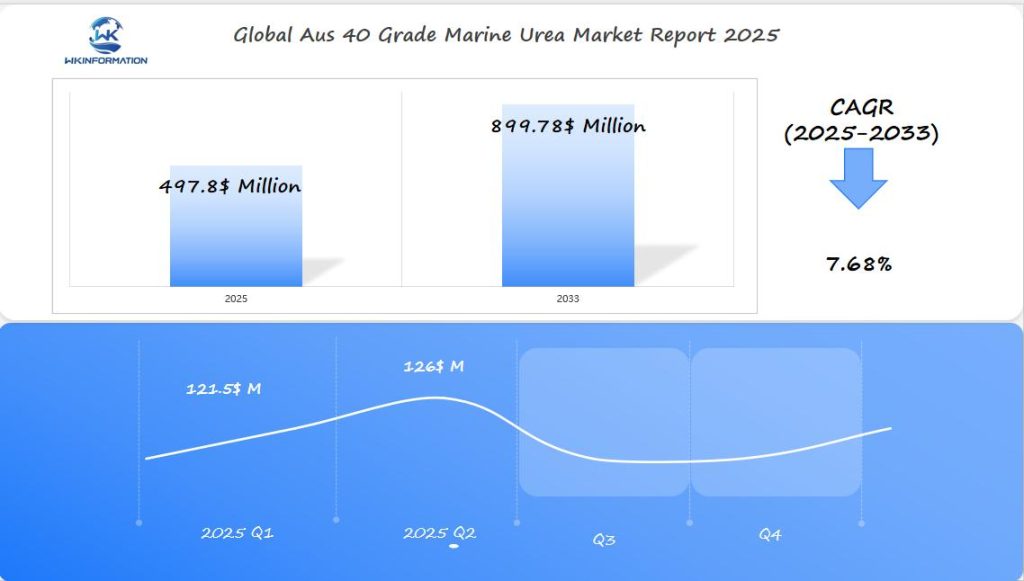

Aus 40 Grade Marine Urea Market Expected to Reach $497.8 Million by 2025: Key Insights from Australia, China, and the U.S.

The AUS 40 Grade Marine Urea Market is expected to reach $497.8 million by 2025. The market is driven by increasing environmental regulations on nitrogen oxide emissions and the growing emphasis on sustainable shipping practices.

- Last Updated:

Aus 40 Grade Marine Urea Market in Q1 and Q2 of 2025

The Aus 40 Grade Marine Urea market is projected to hit $497.8 million in 2025, with a robust CAGR of 7.68% through 2033.

Q1 2025 is estimated at around $121.5 million, growing to nearly $126 million by Q2, driven by stricter marine emission standards. Australia is seeing growing demand due to compliance with IMO 2020 sulfur limits and the expansion of shipping operations. China remains a top producer and exporter, while also scaling up domestic use in coastal regions. The U.S. is investing in cleaner maritime fuels and emission control systems, contributing to higher adoption.

Upstream and Downstream Industry Chain Analysis of the Aus 40 Grade Marine Urea Market

To fully understand the Aus 40 Grade Marine Urea market, we need to closely examine its upstream and downstream industry chains. This analysis is essential for pinpointing the main factors driving the market, the challenges it faces, and the opportunities available.

Upstream Industry Analysis

The upstream industry plays a vital role in the production of Aus 40 Grade Marine Urea. It involves the supply of raw materials necessary for the manufacturing process.

Raw Material Suppliers

Raw material suppliers are essential stakeholders in the Aus 40 Grade Marine Urea market. They provide the necessary inputs, such as urea and other chemicals, required for production. The reliability and quality of these suppliers directly impact the overall quality of the marine urea produced.

The upstream industry’s dynamics, including the availability and cost of raw materials, significantly influence the Marine Urea Industry Analysis. Fluctuations in raw material prices can affect the production costs and, subsequently, the market price of Aus 40 Grade Marine Urea.

A thorough analysis of the upstream industry involves examining the supply chain, production capacities, and market trends among raw material suppliers. This analysis helps in understanding the potential risks and opportunities in the Aus 40 Grade Marine Urea market.

Key factors influencing the upstream industry include:

- Availability of raw materials

- Quality of raw materials

- Cost of raw materials

- Supplier reliability

By understanding these factors, stakeholders can better navigate the complexities of the Aus 40 Grade Marine Urea market and make informed decisions.

Market Trends: Growth in Demand for Marine Urea in the Shipping Industry

Stricter environmental regulations are leading to an increased adoption of marine urea in the shipping sector. The International Maritime Organization (IMO) has implemented various emission standards to reduce the environmental impact of the shipping industry.

The demand for marine urea is driven by several factors, including the need to comply with emission regulations and the industry’s shift towards more sustainable practices.

Drivers of Demand

The primary driver of demand for marine urea is the regulatory environment. The IMO’s Tier III emission standards have significantly impacted the shipping industry, necessitating the use of cleaner fuels and technologies.

- Regulatory compliance

- Environmental sustainability

- Technological advancements

As the shipping industry continues to evolve, the demand for marine urea is expected to grow. The adoption of marine urea is a critical step towards reducing emissions and achieving regulatory compliance.

Regulatory Influences

Regulatory influences play a crucial role in shaping the demand for marine urea. The IMO’s emission standards have been a key factor in driving the adoption of marine urea.

The regulatory landscape is expected to continue evolving, with further reductions in emission limits anticipated in the future. This will likely drive continued growth in the demand for marine urea.

Challenges in the Production and Distribution of Aus 40 Grade Marine Urea

As the demand for Aus 40 Grade Marine Urea increases, the industry must navigate complex production and logistical issues.

The production and distribution of Aus 40 Grade Marine Urea are critical to meeting the shipping industry’s need for cleaner fuels. However, several challenges hinder the efficient supply of this product.

Production Challenges

The production of Aus 40 Grade Marine Urea involves several challenges, primarily related to the quality control of raw materials and the manufacturing process. Ensuring the purity and consistency of the urea is crucial, as it directly affects the performance and environmental benefits of the final product.

The manufacturing process requires precise control over factors such as temperature, pressure, and reaction time to produce high-quality Aus 40 Grade Marine Urea. Any deviations in these parameters can result in a product that does not meet the required standards.

Quality control measures are essential in the production process. These include regular testing of raw materials and the final product to ensure compliance with international standards.

Logistics and Supply Chain Issues

The distribution of Aus 40 Grade Marine Urea is another critical aspect that faces significant challenges. Logistics and supply chain issues can lead to delays and increased costs, affecting the overall efficiency of the supply chain.

The transportation of Aus 40 Grade Marine Urea requires specialized equipment to maintain the product’s quality and prevent degradation. Storage facilities must also be designed to keep the product dry and at the appropriate temperature.

A key challenge in the logistics of Aus 40 Grade Marine Urea is the need for a reliable and efficient supply chain. This involves not only the transportation and storage of the product but also the management of inventory levels to meet demand without excessive surplus.

| Challenge | Production | Distribution |

| Quality Control | Ensuring purity and consistency of urea | Maintaining product quality during transportation and storage |

| Equipment and Facilities | Specialized manufacturing equipment | Specialized transportation and storage facilities |

| Regulatory Compliance | Compliance with production standards | Compliance with transportation and storage regulations |

Geopolitical Influence on Marine Urea Trade and International Supply

Geopolitical dynamics play a crucial role in shaping the marine urea trade, impacting the global supply landscape. The marine urea market is sensitive to changes in international relations, trade agreements, and geopolitical tensions.

The impact of geopolitical factors on the marine urea trade can be seen in various aspects, including trade policies and tariffs. Trade policies and tariffs imposed by major economies can significantly affect the global supply chain, leading to fluctuations in demand and supply.

Trade Policies and Tariffs

Trade policies, including tariffs and quotas, can either facilitate or hinder the flow of marine urea across borders. For instance, tariffs imposed on imports can increase the cost of marine urea, making it less competitive in certain markets.

The ongoing trade tensions between major economies have led to a reevaluation of supply chain strategies. Companies are now focusing on diversifying their supply sources to mitigate risks associated with geopolitical uncertainties.

Regional Supply Chain Dynamics

Regional supply chain dynamics are also influenced by geopolitical factors. Major exporting countries play a crucial role in the global marine urea supply chain, and any disruptions in these regions can have far-reaching consequences.

The complexity of regional supply chains is further compounded by factors such as infrastructure, logistics, and local regulations. Understanding these dynamics is essential for stakeholders to navigate the challenges and opportunities in the marine urea market.

The geopolitical influence on marine urea trade and international supply is multifaceted. Stakeholders must remain vigilant and adapt to changing geopolitical landscapes to ensure a stable supply of marine urea.

Type Segmentation: Standard vs. Premium Aus 40 Grade Marine Urea

Understanding the differences between standard and premium Aus 40 Grade Marine Urea is crucial for manufacturers and suppliers to effectively cater to the diverse needs of the shipping industry.

The segmentation into standard and premium types is based on the quality and purity of the urea, which directly impacts its performance and application in marine vessels.

Characteristics of Standard and Premium Marine Urea

Standard Aus 40 Grade Marine Urea is characterized by its basic quality attributes that meet the minimum requirements for use in marine SCR systems.

- It has a urea content of at least 40% and is subject to certain impurity levels.

- On the other hand, premium Aus 40 Grade Marine Urea offers higher purity levels, lower impurity content, and often comes with additional quality assurances such as ISO certifications.

Market Preferences

The market preference between standard and premium Aus 40 Grade Marine Urea varies based on factors such as vessel type, operational requirements, and regulatory compliance.

While standard urea is sufficient for many shipping operations, premium urea is preferred by operators who require higher performance and reliability.

Uses of Aus 40 Grade Marine Urea in Marine and Industrial Sectors

Aus 40 Grade Marine Urea is highly versatile and has a wide range of applications in both marine and industrial sectors. Its high purity and specific qualities make it an essential ingredient in various processes.

Marine Applications

Aus 40 Grade Marine Urea is primarily used in the marine industry to reduce nitrogen oxide (NOx) emissions from ships. It is a critical component in Selective Catalytic Reduction (SCR) systems, which are designed to comply with international maritime regulations on emissions.

Key marine applications include:

- Reducing NOx emissions in compliance with IMO regulations

- Improving fuel efficiency in marine engines

- Enhancing the overall environmental performance of vessels

Aus 40 Grade Marine Urea Applications

Beyond its marine applications, Aus 40 Grade Marine Urea is also utilized in various industrial processes. Its purity and consistency make it suitable for use in SCR systems in power plants and other industrial facilities.

Some of the key industrial applications include:

- Selective Catalytic Reduction (SCR) systems in power plants

- Industrial boilers and furnaces

- Chemical processing and manufacturing

| Application | Description | Benefits |

| Marine SCR Systems | Reduces NOx emissions in ships | Compliance with IMO regulations, improved environmental performance |

| Industrial SCR Systems | Reduces NOx emissions in power plants and industrial facilities | Improved air quality, compliance with emissions regulations |

| Chemical Processing | Used as a reactant or intermediate in chemical manufacturing | High purity, consistent quality |

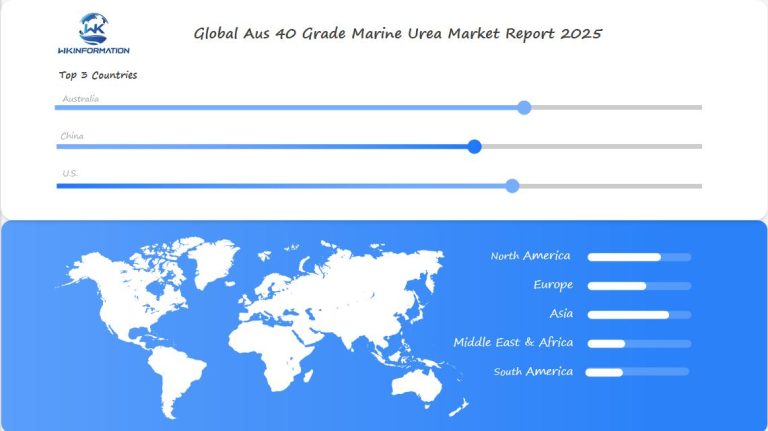

Global Market Trends: Regional Insights into the Aus 40 Grade Marine Urea Market

The global market for Aus 40 Grade Marine Urea has different trends in various regions. These trends are influenced by factors such as government regulations, economic conditions, and the presence of important companies in the market.

Regional Market Dynamics

Each region has its own unique factors that affect the market:

- In Europe, strict emission regulations have increased the demand for Aus 40 Grade Marine Urea.

- In Asia, the growth of the shipping industry is a major factor influencing the market.

Regional Market Analysis

A closer look at the regional market analysis reveals that:

- Europe: The European market is driven by the IMO 2020 regulations, which have significantly reduced sulfur emissions. The demand for Aus 40 Grade Marine Urea is high due to the large number of vessels operating in the region.

- Asia: The Asian market, particularly China, is witnessing a surge in demand due to the growing shipping industry and increasing adoption of emission control technologies.

- North America: The U.S. market is influenced by environmental regulations and the size of its maritime sector.

Emerging trends in the global Aus 40 Grade Marine Urea market include:

- Increasing adoption of cleaner fuels and technologies to reduce emissions.

- Growing demand for Aus 40 Grade Marine Urea in emerging markets due to expanding maritime trade.

- Technological innovations in the production of Marine Urea, enhancing efficiency and reducing costs.

These trends indicate a shift towards a more sustainable and environmentally friendly maritime industry, with Aus 40 Grade Marine Urea playing a crucial role.

Australia’s Role in the Supply of Aus 40 Grade Marine Urea

Australia is in a strong position to supply Aus 40 Grade Marine Urea globally due to its robust production infrastructure. Its advanced manufacturing capabilities and strategic location contribute to its significant role in the worldwide supply of Aus 40 Grade Marine Urea.

Production Capacity

Australia’s production capacity for Aus 40 Grade Marine Urea is substantial, with several major production facilities across the country. These facilities are equipped with state-of-the-art technology, enabling the production of high-quality marine urea that meets international standards.

Export Trends

The export of Aus 40 Grade Marine Urea from Australia has been on the rise, driven by growing demand from countries with significant shipping industries. Major destinations for Australian marine urea include countries in Asia and Europe.

China’s Demand for Marine Urea in Shipping and Transportation

As the largest shipping country in the world, China has a significant need for marine urea to lower emissions. China’s maritime operations must follow strict environmental rules, including regulations on nitrogen oxide (NOx) emissions.

Overview of China’s Shipping Industry

China’s shipping industry plays a crucial role in global maritime trade. A significant portion of the world’s shipping fleet is registered or operated in China. The industry’s growth is fueled by China’s economic expansion, increasing trade volumes, and its strategic position in global supply chains.

Factors Driving Demand

Several factors contribute to the demand for marine urea in China’s shipping industry:

- Environmental Regulations: The implementation of IMO 2020 and other emission standards requires the use of marine urea for NOx reduction.

- Fleet Expansion: The continuous growth of China’s shipping fleet leads to higher demand for marine urea.

- Technological Adoption: The adoption of scrubber technology and other emission-reducing systems also impacts marine urea demand.

U.S. Market: Key Factors Driving the Demand for Marine Urea in the Maritime Sector

The demand for marine urea in the U.S. maritime sector is increasing due to the implementation of stricter environmental policies. As a major player in the global shipping industry, the U.S. maritime sector must comply with emission regulations, which is fueling the demand for top-quality marine urea.

U.S. Maritime Sector Overview

The U.S. maritime sector is a complex industry that includes various activities such as shipping, cargo handling, and maritime transportation. It is regulated by different laws and rules aimed at reducing its impact on the environment.

One important regulation is the International Maritime Organization’s (IMO) sulfur cap, which limits the amount of sulfur in marine fuels. Following emission regulations is a key factor driving the need for marine urea. Marine urea is used in Selective Catalytic Reduction (SCR) systems to lower nitrogen oxide (NOx) emissions from marine engines.

Regulatory Environment

The regulatory environment in the U.S. plays a crucial role in shaping the demand for marine urea. The Environmental Protection Agency (EPA) sets emission standards for marine engines, while the U.S. Coast Guard enforces these rules.

The Tier III emission standards set by the EPA and IMO require the use of advanced emission control technologies, including SCR systems that use marine urea. Consequently, the demand for high-purity marine urea is expected to keep growing in the U.S. market.

The increasing size of the U.S. maritime fleet and the requirement for vessels to comply with emission regulations also contribute to the rise in demand for marine urea. As the industry continues to develop, marine urea will continue to play a vital role in reducing emissions.

Future Outlook: Innovations in Marine Urea Technology and Market Forecast

As the maritime industry continues to evolve, advancements in marine urea technology are expected to play a crucial role in shaping the future of the Aus 40 Grade Marine Urea market. The industry is witnessing a significant shift towards more sustainable and environmentally friendly practices, driven by stringent regulations and growing environmental concerns.

Technological Innovations

Recent innovations in marine urea technology have focused on improving the efficiency and reducing the cost of production. Some of the key developments include:

- Advanced production techniques that enhance the quality and purity of marine urea.

- More efficient distribution systems that reduce logistical challenges.

- Technologies that enable the production of marine urea from renewable energy sources.

These technological advancements are not only expected to drive growth in the Aus 40 Grade Marine Urea market but also contribute to a more sustainable maritime industry.

Market Forecast

The Aus 40 Grade Marine Urea market is forecasted to experience significant growth over the next few years, driven by increasing demand from the shipping industry and ongoing innovations in marine urea technology. Key factors influencing the market include:

- Rising global trade and the subsequent increase in maritime transportation.

- Stricter environmental regulations that necessitate the use of cleaner fuels and technologies.

- Investments in infrastructure and production capacity to meet growing demand.

The market is expected to reach $497.8 Million by 2025, with a steady growth trajectory driven by these factors.

Competitive Landscape: Key Players in the Aus 40 Grade Marine Urea Market

The competitive landscape of the Aus 40 Grade Marine Urea market is characterized by the presence of several prominent players.

These companies are not only competing based on product quality but also on their ability to innovate and adapt to changing market demands.

Major Market Players:

-

Yara International ASA – Norway

-

CF Industries Holdings – USA

-

The Mosaic Company – USA

-

SF Holdings Group Co., Ltd. – China

-

Xinfa Group Co., Ltd. – China

-

GreenChem – USA

-

Sichuan Meifeng – China

-

Shandong New Blue – China

-

CHEMO HELLAS SA – Greece

-

NOVAX Material – China

Overall

| Report Metric | Details |

|---|---|

| Report Name | Aus 40 Grade Marine Urea Market |

| Base Year | 2024 |

|

Segment by Type |

· Standard · Premium |

| Segment by Application |

· Marine SCR Systems · Industrial SCR Systems · Chemical Processing |

|

Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Aus 40 Grade Marine Urea market is expected to grow significantly, driven by increasing demand from the shipping industry and regulatory pressures. Understanding the factors influencing this market is crucial for stakeholders.

The future of the market looks promising, with innovations in marine urea technology expected to play a key role. Growing demand from countries like China and the U.S. will also contribute to the market’s growth.

Global Aus 40 Grade Marine Urea Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Aus 40 Grade Marine Urea Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Aus 40 Grade Marine UreaMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Aus 40 Grade Marine UreaPlayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Aus 40 Grade Marine Urea Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Aus 40 Grade Marine Urea Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Aus 40 Grade Marine Urea Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Aus 40 Grade Marine UreaMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is Aus 40 Grade Marine Urea used for?

Aus 40 Grade Marine Urea is used to reduce nitrogen oxide emissions in ships, complying with environmental regulations such as those set by the International Maritime Organization (IMO).

What are the key regions driving the demand for Aus 40 Grade Marine Urea?

The key regions driving the demand for Aus 40 Grade Marine Urea include Australia, China, and the U.S., due to their significant shipping industries and stringent environmental regulations.

How does Australia’s production capacity impact the global Aus 40 Grade Marine Urea market?

Australia’s production capacity plays a significant role in the global supply of Aus 40 Grade Marine Urea, with the country’s exports contributing to the global market’s growth.

What are the main challenges in the production and distribution of Aus 40 Grade Marine Urea?

The main challenges include:

- Production issues such as quality control of raw materials and manufacturing processes

- Logistics and supply chain issues that affect timely delivery to the shipping industry

How do trade policies and tariffs influence the marine urea trade?

Trade policies and tariffs can significantly impact the marine urea trade by affecting the cost of imports and exports, thereby influencing the global supply chain dynamics.

What is the difference between standard and premium Aus 40 Grade Marine Urea?

The difference lies in their quality and purity, with premium Aus 40 Grade Marine Urea having higher purity levels, which can impact their effectiveness in reducing nitrogen oxide emissions.

What are the future prospects for the Aus 40 Grade Marine Urea market?

The future prospects are promising, driven by ongoing innovations in marine urea technology and increasing demand from the shipping industry, with the market expected to reach $497.8 million by 2025.

Who are the major players in the Aus 40 Grade Marine Urea market?

The major players include companies that specialize in the production and supply of marine urea, with their competitive strategies influencing the market dynamics.

How do environmental regulations impact the demand for Aus 40 Grade Marine Urea?

Environmental regulations, such as emission standards, significantly drive the demand for Aus 40 Grade Marine Urea. Shipping companies are compelled to comply with these regulations by reducing their nitrogen oxide emissions. This compliance often involves using products like Aus 40 Grade Marine Urea, which help in achieving the required emission reductions.