Diamond Embedded Wire Market to Reach $215.71 Million by 2025: Insights from the U.S., China, and Japan

Diamond Embedded Wire Market is projected to reach $215.71 million by 2025, driven by rising demand in electronics and manufacturing. Key players include the U.S., China, and Japan, with technological advancements fueling market growth and broader adoption across industries.

- Last Updated:

Diamond Embedded Wire Market Sees High-Tech Manufacturing Demand Surge in Q1 and Q2 2025

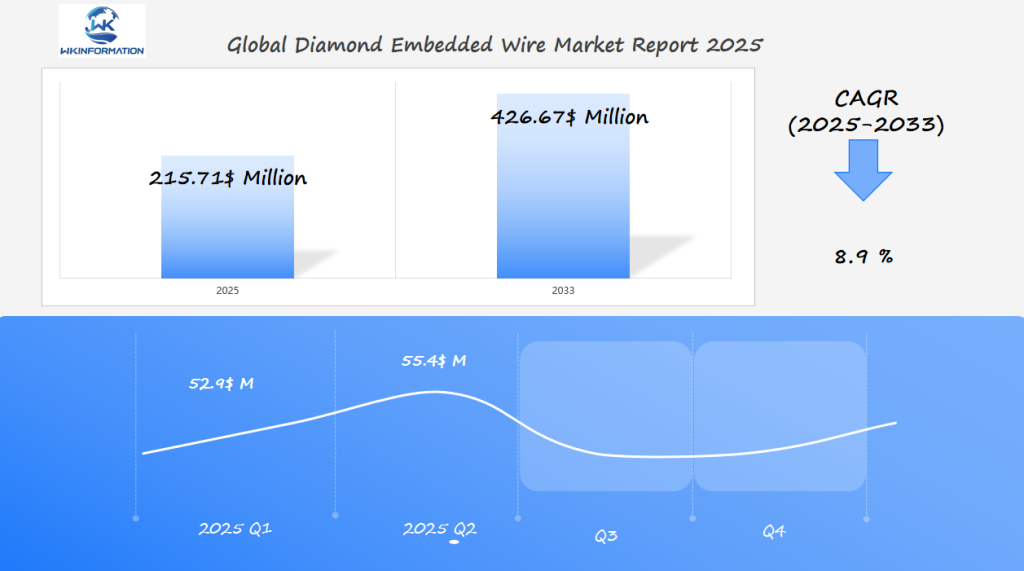

The Diamond Embedded Wire market is poised to reach $215.71 million globally in 2025, advancing at a fast-paced CAGR of 8.9% through 2033. Q1 market revenue is projected at $52.9 million, rising to $55.4 million in Q2, bolstered by the rise of high-precision manufacturing processes across the semiconductor and renewable energy sectors.

In the United States, strong Q1 demand came from advanced materials research labs and companies producing microelectronic substrates. The trend continues into Q2 with heightened activity in precision cutting for aerospace and medical imaging components. China remains a global leader in diamond wire consumption, driven by large-scale solar wafer slicing operations as well as expanding applications in ceramics and sapphire glass for electronics. Japan, known for its exacting manufacturing standards, exhibits stable growth in Q2 across laser optics, high-end instrumentation, and LED substrate processing—where embedded wire cutting delivers superior edge quality and minimal material loss.

Key Takeaways

- The Diamond Embedded Wire Market is expected to reach $215.71 million by 2025.

- Increasing demand from electronics and manufacturing industries drives growth.

- The U.S., China, and Japan are key players in the industry.

- Technological advancements contribute to market expansion.

- The adoption of diamond wire is on the rise in various applications.

Analyzing the Upstream and Downstream Industry Chain of the Diamond Embedded Wire Market

A detailed analysis of the diamond embedded wire market reveals a complex network of upstream and downstream activities that greatly impact its growth and development.

The diamond embedded wire industry functions within a complicated supply chain that includes multiple stakeholders, such as raw material suppliers and end-users. Gaining insight into this industry chain is essential for recognizing obstacles, opportunities, and market trends.

Understanding the Industry Chain

The industry chain of diamond embedded wire can be broadly categorized into upstream and downstream segments.

Upstream Segment

The upstream segment involves the production of raw materials such as diamond powders and wire materials, which are essential for manufacturing diamond embedded wire.

Downstream Segment

The downstream segment focuses on the application of diamond embedded wire in various industries, including electronics, manufacturing, and cutting tools. The demand from these industries drives the growth of the diamond embedded wire market.

Key Players in the Supply Chain

The supply chain of diamond embedded wire includes several key players:

- Manufacturers of diamond powders and wire materials

- Producers of diamond embedded wire

- Distributors and suppliers

- End-users in various industries

These players work together to ensure the smooth operation of the supply chain, from raw material sourcing to the delivery of the final product.

To illustrate the dynamics of the diamond embedded wire market, let’s examine the key statistics related to the industry chain:

| Segment | Key Activities | Major Players |

| Upstream | Production of diamond powders and wire materials | Raw material suppliers |

| Downstream | Application in electronics, manufacturing, and cutting tools | Manufacturers, distributors, end-users |

The analysis of the diamond embedded wire market’s industry chain highlights the interdependence of its upstream and downstream segments. By understanding the dynamics of this chain, stakeholders can better navigate the market and identify opportunities for growth.

Trends in Diamond Embedded Wire for 2025: Precision and Efficiency

Precision and efficiency are set to be the defining trends in the Diamond Embedded Wire market for 2025. As industries continue to evolve, the demand for high-quality, precision wire is becoming increasingly critical.

The Diamond Embedded Wire industry is witnessing significant advancements, driven by the need for more efficient production processes. Technological innovations in wire production, such as improved coating techniques and enhanced material properties, are expected to drive growth.

Emerging Trends

Several emerging trends are shaping the Diamond Embedded Wire market. One of the key trends is the increasing adoption of precision wire in electronics and manufacturing. This trend is driven by the need for high-precision components that can meet the demands of modern technology.

Technological advancements are playing a crucial role in shaping the Diamond Embedded Wire market. Improvements in wire production techniques, such as electroplating and advanced material processing, are enhancing the efficiency and quality of diamond embedded wires.

The focus on efficiency in wire production is also driving innovations in manufacturing processes. Companies are investing in research and development to create more efficient production methods, which is expected to reduce costs and improve product quality.

As the market continues to evolve, we can expect to see further advancements in diamond wire technology, leading to increased precision and efficiency in various industries.

Challenges in the Production and Supply of Diamond Embedded Wire

Manufacturing complexities and supply chain disruptions are significant concerns in the Diamond Embedded Wire industry. Despite the growth prospects, the market faces several challenges that impact the production and supply of diamond embedded wire.

Manufacturing Challenges

The production of diamond embedded wire involves several manufacturing complexities. Achieving uniform diamond coating and maintaining wire durability are crucial for the wire’s performance. The manufacturing process requires precise control over the coating process to ensure consistency and quality.

Some of the key manufacturing challenges include:

- Maintaining uniform diamond coating thickness

- Ensuring wire durability and resistance to wear

- Managing the coating process to prevent defects

Supply Chain Disruptions

Supply chain disruptions, including raw material shortages and logistics issues, can significantly impact the diamond embedded wire market. Raw material shortages can lead to production delays, while logistics issues can affect the timely delivery of products.

The industry faces several supply chain challenges, including:

- Raw material shortages due to geopolitical issues

- Logistics and transportation challenges

- Dependence on specific suppliers for critical materials

Addressing these challenges is crucial for ensuring a stable supply of diamond embedded wire. By understanding the manufacturing complexities and supply chain disruptions, industry stakeholders can develop strategies to mitigate these issues and ensure the continued growth of the market.

Geopolitical Influence on the Global Diamond Embedded Wire Industry

Geopolitics has a profound impact on the global diamond embedded wire industry’s dynamics. The industry is not only driven by technological advancements and market demand but is also significantly influenced by geopolitical factors such as trade policies, tariffs, and regional trade agreements.

The diamond embedded wire industry operates within a complex geopolitical landscape. Trade policies and tariffs imposed by governments can either hinder or facilitate the industry’s growth. For instance, tariffs on raw materials can increase production costs, making it challenging for manufacturers to maintain profitability.

Trade Policies and Tariffs

Trade policies play a crucial role in determining the competitiveness of the diamond embedded wire industry. Tariffs and non-tariff barriers can affect the import and export of diamond wire, influencing its global supply chain. The industry stakeholders must navigate these policies carefully to ensure compliance and minimize costs.

- Tariffs on raw materials can increase production costs.

- Trade agreements can facilitate the export of diamond embedded wire.

- Non-tariff barriers can affect the industry’s global supply chain.

Regional Trade Agreements

Regional trade agreements (RTAs) have become increasingly important in the global trade landscape. These agreements can reduce or eliminate tariffs among member countries, promoting the free flow of goods, including diamond embedded wire.

The impact of RTAs on the diamond embedded wire industry can be seen in several areas:

- Enhanced market access for diamond embedded wire manufacturers.

- Increased competition due to reduced tariffs.

- Potential for increased exports to member countries.

Understanding the impact of trade policies, tariffs, and regional trade agreements is essential for industry stakeholders to navigate the complex global landscape effectively.

Type Segmentation: Single vs. Multi-Core Diamond Embedded Wire

Understanding the type segmentation of Diamond Embedded Wire is essential for manufacturers and end-users to make informed decisions. The market is primarily divided into two categories: single-core and multi-core Diamond Embedded Wire.

The distinction between these types is crucial as it directly impacts their application, efficiency, and durability. Single-core Diamond Embedded Wire is known for its precision, making it suitable for applications that require high accuracy.

Single-Core Diamond Embedded Wire

Single-core Diamond Embedded Wire is characterized by its single core configuration, which provides a high level of precision. This type is particularly useful in:

- Precision cutting applications

- High-accuracy machining

- Niche manufacturing processes

The precision offered by single-core wires is unmatched, making them a preferred choice for industries that require intricate cutting or machining.

Multi-Core Diamond Embedded Wire

On the other hand, Multi-Core Diamond Embedded Wire features multiple cores, enhancing its durability and efficiency. This type is preferred for:

- Heavy-duty cutting applications

- High-volume manufacturing

- Applications requiring enhanced wire durability

The use of multi-core wires is advantageous in scenarios where both efficiency and durability are critical. The multiple cores distribute the workload, thereby increasing the wire’s lifespan and reducing the need for frequent replacements.

The choice between single-core and multi-core Diamond Embedded Wire depends on the specific requirements of the application, including precision, durability, and efficiency.

Applications of Diamond Embedded Wire in Electronics, Manufacturing, and Cutting Tools

Diamond embedded wire is used in various industries such as electronics, manufacturing, and cutting tools due to its unique properties. This material’s versatility makes it a crucial part of industries where accuracy and long-lasting performance are critical.

Applications of Diamond Embedded Wire in the Electronics Industry

In the electronics industry, diamond embedded wire is highly valued for its ability to precision-cut and slice semiconductor materials. This is crucial for the production of high-performance electronic components. The wire’s abrasive properties allow for smooth and accurate cuts, reducing material loss and enhancing the overall efficiency of the manufacturing process.

Importance of Precision Cutting in Electronics

Precision cutting is a critical application in the electronics sector, where the quality of the cut directly impacts the performance of the final product. Diamond embedded wire meets this requirement by providing a clean and precise cut, which is essential for the production of high-quality electronic devices.

Applications and Benefits of Diamond Embedded Wire in Electronics

In manufacturing, diamond embedded wire is used for its abrasive properties, which enhance the production of high-precision components. It is particularly useful in the fabrication of parts that require intricate cutting or shaping. The durability of diamond embedded wire also extends the life of cutting tools, reducing the need for frequent replacements.

| Industry Application Benefit Electronics | Precision cutting and slicing | Enhanced precision and reduced material loss |

| Manufacturing | Production of high-precision components | Increased efficiency and durability |

| Cutting Tools | Improved tool durability and performance | Extended tool life and reduced maintenance |

The use of diamond embedded wire in these industries not only improves product quality but also contributes to cost savings through reduced waste and extended tool life. As technology advances, the demand for diamond embedded wire is expected to grow, driven by its critical role in enabling precision and efficiency in manufacturing processes.

Global Market Overview: Regional Growth and Technological Advancements in Diamond Embedded Wire

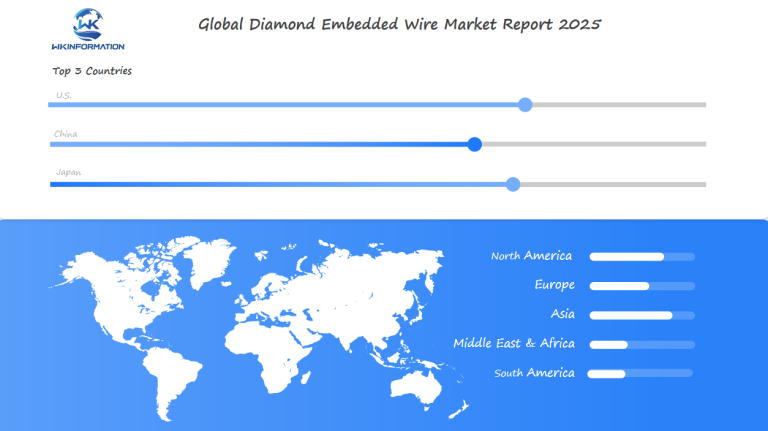

The global Diamond Embedded Wire market is expected to grow significantly due to technological innovations and regional market factors. The industry is seeing major advancements, especially in countries like the U.S., China, and Japan, where strong manufacturing and electronics industries are increasing demand.

Regional Trends in the Diamond Embedded Wire Market

The global Diamond Embedded Wire market has different trends in various regions:

- In the U.S., the market is driven by the need for high-precision wire in industrial applications.

- China is experiencing rapid growth due to its large manufacturing sector.

- Japan is also important, with its advanced technology and innovation in wire production.

Regional Market Trends

Regional market trends are significantly influencing the global Diamond Embedded Wire market. The demand for diamond wire is increasing in various regions due to its application in electronics, manufacturing, and cutting tools.

- The U.S. market is driven by industrial applications requiring high precision.

- China’s manufacturing sector is expanding, leading to increased demand for diamond wire.

- Japan’s technological advancements are enhancing the quality and efficiency of diamond wire production.

Technological Advancements

Technological advancements are a key driver of growth in the Diamond Embedded Wire market. Improvements in wire coating techniques and material properties are enhancing the performance and durability of diamond wire.

| Technological Advancement | Description | Impact on Market |

| Improved Wire Coating Techniques | Enhanced coating methods are increasing the lifespan and efficiency of diamond wire. | Increased adoption in precision industries. |

| Advanced Material Properties | New materials are being developed to enhance the strength and durability of diamond wire. | Expanded application in harsh industrial environments. |

The integration of these technological advancements is expected to drive further growth in the global Diamond Embedded Wire market. As regions continue to innovate and expand their manufacturing capabilities, the demand for high-quality diamond wire will increase.

Key regional players are focusing on developing advanced technologies to stay competitive. This competitive landscape is expected to drive innovation and growth in the market.

U.S. Market Insights: Demand for High-Precision Diamond Embedded Wire in Industrial Applications

High-precision diamond embedded wire is in high demand in the U.S., particularly in industrial applications. The U.S. diamond wire market is driven by the need for advanced manufacturing technologies and the presence of key industry players.

Industrial Applications

The demand for high-precision wire is particularly high in the electronics and aerospace sectors. These industries require wire that can meet stringent quality and performance standards.

The use of diamond embedded wire in industrial applications offers several benefits, including:

- Increased precision and accuracy

- Improved efficiency and productivity

- Enhanced product quality and reliability

Market Drivers

The growth of the U.S. diamond wire market is driven by several factors, including:

- The increasing demand for high-precision wire in industrial applications

- The need for advanced manufacturing technologies

- The presence of key industry players in the U.S.

As the demand for high-precision diamond embedded wire continues to grow, the U.S. market is expected to remain a significant player in the global industry.

China’s Expanding Market for Diamond Embedded Wire in Manufacturing and Electronic

China’s diamond wire market, particularly the diamond embedded wire, is expected to grow significantly. This growth is driven by the country’s expanding manufacturing and electronics sectors. The increasing demand for high-precision diamond embedded wire is a key factor contributing to this growth.

Manufacturing Sector Growth

The manufacturing sector in China is experiencing rapid growth, driven by government initiatives and investments in technological advancements. This growth is leading to an increased demand for diamond embedded wire, which is used in various industrial applications.

Key drivers of manufacturing sector growth include:

-

- Increased investment in industrial infrastructure

- Government support for technological innovation

- Rising demand for high-precision manufacturing tools

Electronics Industry Expansion

The electronics industry in China is also expanding, driven by the growing demand for high-tech electronics. Diamond embedded wire is used in the production of electronic components, such as semiconductors and solar cells.

The electronics industry expansion is driven by factors such as:

- Growing demand for consumer electronics

- Increasing adoption of renewable energy technologies

- Government initiatives to support the electronics industry

The combined growth of the manufacturing and electronics sectors is expected to drive the demand for diamond embedded wire in China, making it a significant market for industry players.

Japan’s Role in Diamond Embedded Wire Production and Innovation

Japan is changing the game in the Diamond Embedded Wire Market with its advanced production capabilities and innovative technologies. The country’s robust manufacturing industry and dedication to research and development have made it a leader in the global market.

Production Capabilities

Japanese companies are known for their advanced wire production technologies, which include high-precision coating techniques and durable wire materials. These capabilities allow them to produce top-quality diamond embedded wires that meet the strict requirements of various industries.

Key aspects of Japan’s production capabilities include:

- Advanced manufacturing equipment

- High-quality raw materials

- Strict quality control measures

Japan’s focus on innovation and R&D is driving continuous improvement in diamond embedded wire products. The country’s research institutions and companies work together to develop new technologies and materials, making diamond embedded wires even better and more efficient.

Innovation areas include:

- Development of new coating technologies

- Improvement of wire durability and precision

- Exploration of new applications for diamond embedded wires

Future Development: Emerging Technologies in Diamond Embedded Wire

Emerging technologies are set to transform the Diamond Embedded Wire industry, enabling new applications and enhancing product performance. The integration of advanced materials and innovative manufacturing processes is expected to drive significant advancements in the field.

Advanced Materials

The development of new materials with improved properties is essential for the future of Diamond Embedded Wire. Advanced coatings and composite materials are being researched to enhance durability and efficiency. These materials are expected to be crucial in expanding the use of Diamond Embedded Wire in different industries.

Leveraging Versatility in Renewable Energy and Advanced Electronics

The flexibility of Diamond Embedded Wire is being utilized in renewable energy and advanced electronics. It is expected that emerging uses in these sectors will drive market growth. For example, the application of Diamond Embedded Wire in manufacturing solar panels and advanced electronic components is projected to boost efficiency and lower costs.

Continuous Innovation and Adoption of Emerging Technologies

The future development of Diamond Embedded Wire will be marked by ongoing innovation and the acceptance of new technologies. As the industry progresses, we can anticipate novel uses and further improvements in product performance.

Competitive Landscape: Key Manufacturers and Innovators in Diamond Embedded Wire

Key Players

- Element Six (part of De Beers Group) – United Kingdom

- Advanced Abrasives Corporation – United States

- Klingspor AG – Germany

- Norton Abrasives (part of Saint-Gobain) – France

- 3M Company – United States

- Asahi Diamond Industrial Co., Ltd. – Japan

- Wolfram Industrie GmbH – Germany

- Wuhan Diamond Precision Machinery Co., Ltd. – China

- Dongguan Honway Technology Co., Ltd. – China

- Zhengzhou Research Institute for Abrasive & Grinding Co., Ltd. – China

These companies play a significant role in shaping the future of the diamond embedded wire market through their contributions to innovation, manufacturing capabilities, and technological advancements.

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Diamond Embedded Wire Market Report |

| Base Year | 2024 |

| Segment by Type | ·Single-Core Diamond Embedded Wire

·Multi-Core Diamond Embedded Wire |

| Segment by Application | ·Electronics

·Manufacturing ·Cutting Tools |

| Geographies Covered | ·North America (United States, Canada)

·Europe (Germany, France, UK, Italy, Russia) ·Asia-Pacific (China, Japan, South Korea, Taiwan) ·Southeast Asia (India) ·Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Diamond Embedded Wire Market is about to experience significant growth, driven by advancements in technology and increasing demand from various industries. As discussed earlier, understanding the industry chain, trends, and regional market insights is crucial for stakeholders to navigate this evolving market.

Emerging technologies and new applications will play a crucial role in shaping the future of the diamond wire market. With the U.S., China, and Japan leading the way in production and innovation, the industry is set for further growth. The diamond wire market conclusion is that it will experience significant expansion, driven by industrial demand and technological advancements.

Industry outlook suggests that as manufacturing and electronics sectors continue to evolve, the need for high-precision diamond embedded wire will increase. Stakeholders who stay informed about regional trends and technological developments will be well-positioned to take advantage of emerging opportunities in the diamond wire market.

Global Diamond Embedded Wire Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Diamond Embedded Wire Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Diamond Embedded Wire Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Diamond Embedded Wire Players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: Diamond Embedded Wire Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Diamond Embedded Wire Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Diamond Embedded Wire Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Diamond Embedded Wire Market Insights

Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the expected size of the Diamond Embedded Wire Market by 2025?

The Diamond Embedded Wire Market is expected to reach $215.71 million by 2025.

Which regions are key players in the Diamond Embedded Wire Market?

The U.S., China, and Japan are key players in the Diamond Embedded Wire Market, driving growth through technological advancements and industrial applications.

What are the main applications of Diamond Embedded Wire?

Diamond Embedded Wire is used in various industries, including electronics, manufacturing, and cutting tools, for applications such as precision cutting, slicing, and enhancing tool durability.

What are the challenges faced by the Diamond Embedded Wire Market?

The market faces challenges such as:

- Manufacturing complexities, including achieving uniform diamond coating and maintaining wire durability

- Supply chain disruptions like raw material shortages and logistics issues

How do geopolitical factors influence the Diamond Embedded Wire Market?

Geopolitical factors, including trade policies, tariffs, and regional trade agreements, can impact the industry’s growth and profitability by affecting production costs and the export of diamond embedded wire.

What is the difference between single-core and multi-core Diamond Embedded Wire?

Single-core wire is used in applications requiring high precision, while multi-core wire is preferred for its durability and efficiency.

What drives the demand for Diamond Embedded Wire in the U.S. market?

The demand for high-precision wire in applications such as electronics and aerospace drives the U.S. market, supported by the presence of key industry players and the need for advanced manufacturing technologies.

Why is China experiencing significant growth in the Diamond Embedded Wire Market?

China’s growth in the Diamond Embedded Wire Market can be attributed to several factors:

- Large-scale industrial production: China has a vast manufacturing sector that produces goods at an unprecedented scale, creating a demand for advanced tools and technologies like diamond embedded wires.

- Increasing demand for high-tech electronics: With the rise of consumer electronics and technological innovations, there is a growing need for precision manufacturing processes, which in turn drives the demand for specialized equipment such as diamond embedded wires.

- Government initiatives: The Chinese government actively promotes technological advancements and industrial development through various initiatives and policies, creating a favorable environment for industries reliant on cutting-edge technologies.

These factors combined make China a key player in the Diamond Embedded Wire Market, with significant growth potential.

What role does Japan play in the global Diamond Embedded Wire Market?

Japan is known for its production capabilities and innovation, with companies developing advanced wire technologies, including high-precision coating techniques and durable wire materials, supported by a strong focus on R&D.

What emerging technologies are expected to shape the future of the Diamond Embedded Wire Market?

Innovations in wire coating, material science, and manufacturing processes are expected to drive the development of new products and applications. These advancements are likely to open up emerging applications in industries like renewable energy and advanced electronics.