Enterprise-Grade DLT Market to Cross $3.58 Billion by 2025: Growth Centered in the U.K., Singapore, and the U.S.

Discover the rapid growth of the Enterprise-Grade DLT Market, projected to reach $3.58 billion by 2025, with the U.K. and Singapore leading the charge.

- Last Updated:

Enterprise-Grade DLT Market: Q1 and Q2 of 2025 Analysis

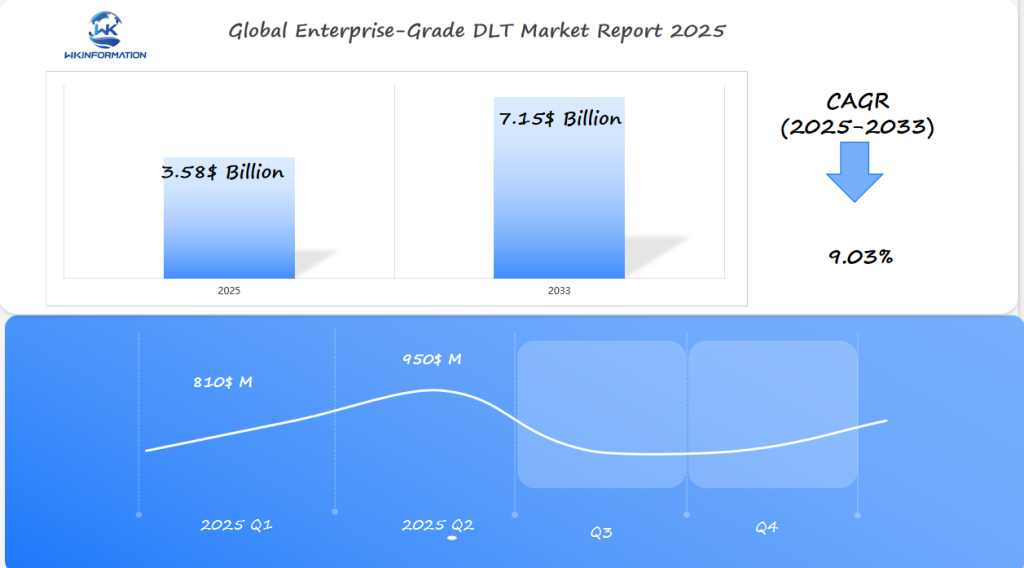

The Enterprise-Grade DLT (Distributed Ledger Technology) market is expected to reach $3.58 billion in 2025, growing at a CAGR of 9.03% from 2025 to 2033. In Q1 of 2025, the market size is projected to be approximately $810 million, with growth continuing into Q2, reaching $950 million.

This technology, which underpins secure and transparent business processes, is gaining traction in industries like finance, supply chain, and healthcare.

Key Markets for Enterprise-Grade DLT

The U.K., Singapore, and the U.S. are the key markets for enterprise-grade DLT.

- In the U.K., enterprises are leveraging DLT for regulatory compliance and financial services.

- Singapore, a hub for blockchain technology, is fostering innovation in DLT applications.

- The U.S. is seeing rapid adoption across various sectors, including banking and logistics.

As businesses increasingly look for ways to improve transparency, security, and efficiency, the enterprise-grade DLT market is poised for strong growth.

Understanding the DLT Market: Upstream and Downstream

The DLT market ecosystem is complex, with various players involved such as technology providers, service providers, and end-users. To grasp this ecosystem better, we need to look at both the upstream and downstream industry chains.

Upstream Industry Chain in Enterprise-Grade DLT Market

The upstream industry chain in the Enterprise-Grade DLT market focuses on the development and supply of DLT technologies. This encompasses areas like:

- Research and Development: Innovating new solutions and improving existing technologies.

- Technology Infrastructure: Building the underlying systems that support DLT applications.

- Platform Development: Creating user-friendly platforms for businesses to implement DLT solutions.

In this segment, the key players are primarily technology providers who design and build the core components necessary for DLT solutions.

Understanding the Enterprise-Grade DLT Market Ecosystem

The ecosystem of the Enterprise-Grade DLT market is complex, with various stakeholders interacting across the industry chain. Understanding this ecosystem is crucial for businesses looking to adopt DLT solutions.

The downstream industry chain involves the application and integration of DLT in various sectors such as finance, supply chain, and healthcare. This includes consulting services, system integration, and maintenance and support. Companies in this segment help enterprises implement DLT solutions tailored to their specific needs.

Key Players in the DLT Industry

Several key players are driving the Enterprise-Grade DLT market forward. These include technology giants, startups, and service providers. Below is a table highlighting some of the major players and their roles in the DLT industry.

| IBM | Technology Provider | Blockchain-based supply chain management |

| Microsoft | Technology Provider | Azure Blockchain Service |

| Accenture | Service Provider | DLT-based consulting and integration services |

Key digital trends in the Enterprise-Grade DLT landscape

Key digital trends are reshaping the Enterprise-Grade DLT landscape, creating new opportunities for businesses to use Blockchain technology and other distributed ledger solutions.

The Enterprise-Grade DLT market is experiencing significant growth due to the increasing adoption of decentralized finance (DeFi) solutions and the growing importance of data security. As these trends continue to develop, enterprises must stay informed to remain competitive.

Emerging Trends in DLT Adoption

Several emerging trends are shaping the adoption of DLT in enterprises. One of the key trends is the growing use of Blockchain technology for supply chain management and other applications.

Another significant trend is the increasingly growing focus on interoperability between different DLT platforms, enabling seamless interactions and enhancing the overall efficiency of DLT-based systems.

- The rise of DeFi solutions is driving the adoption of DLT in financial services.

- The growing need for data security is pushing enterprises to adopt DLT-based solutions.

- The increasing importance of Market Trends is leading to more enterprises adopting DLT.

As Enterprise Adoption of DLT continues to grow, it is essential for businesses to stay abreast of the latest Market Trends and technological advancements in the field.

Challenges in enterprise adoption of distributed ledger technologies

Enterprises face several challenges when trying to implement Distributed Ledger Technology (DLT) into their operations. Even though DLT has potential advantages like improved security and transparency, its adoption is held back by various obstacles.

Overcoming Barriers to DLT Adoption

The main barriers to DLT adoption include regulatory uncertainty, scalability issues, and integration complexities. Regulatory uncertainty makes it difficult for enterprises to navigate the legal landscape surrounding DLT. Scalability issues limit the ability of DLT to process transactions efficiently, while integration complexities hinder its seamless incorporation into existing systems.

To overcome these barriers, enterprises must invest in education and training for their workforce, ensuring that they have the necessary skills to implement and manage DLT solutions. Moreover, collaboration between industry stakeholders, including technology providers and regulatory bodies, is crucial for developing standards and frameworks that facilitate DLT adoption.

Regulatory Challenges

Regulatory challenges are a significant hurdle for DLT adoption. The lack of clear and consistent regulations across jurisdictions creates uncertainty and risk for enterprises. A comprehensive regulatory framework is needed to provide clarity on issues such as data privacy, security, and intellectual property.

| Regulatory Challenge | Description | Impact on DLT Adoption |

| Unclear Regulations | Lack of clear guidelines on DLT usage | Increased risk and uncertainty |

| Inconsistent Regulations | Different regulations across jurisdictions | Difficulty in compliance |

| Evolving Regulations | Constantly changing regulatory landscape | Need for continuous monitoring and adaptation |

Addressing these regulatory challenges is crucial for fostering an environment that supports the widespread adoption of DLT. By working together, enterprises, regulatory bodies, and technology providers can create a conducive ecosystem for DLT to thrive.

Geopolitical influences on blockchain policy and deployment

Regional geopolitical factors greatly affect how blockchain policies are created and put into action. Different parts of the world have different rules and policies about Distributed Ledger Technology (DLT), which have a big impact on how widely blockchain technology is accepted and used.

Regional Variations in Blockchain Policy

The European Union has been proactive in establishing a comprehensive regulatory framework for blockchain technology. The EU’s approach focuses on creating a unified market for DLT, ensuring consumer protection, and fostering innovation.

In contrast, the United States has a more fragmented approach, with different states having their own regulations and policies regarding blockchain. This can create challenges for companies looking to deploy blockchain solutions across multiple states.

Regional variations in blockchain policy can be attributed to differences in economic priorities, political stability, and technological infrastructure. For instance, countries with a strong fintech sector, like the U.K. and Singapore, have been more proactive in creating favorable regulatory environments for blockchain.

| Region | Blockchain Policy | Key Features |

| European Union | Comprehensive Regulatory Framework | Unified market, consumer protection, innovation |

| United States | Fragmented Regulatory Approach | State-specific regulations, varying levels of oversight |

| Singapore | Favorable Regulatory Sandbox | Innovation-friendly, clear guidelines |

The geopolitical landscape continues to evolve, with new developments and shifts in policy affecting the global blockchain ecosystem. Understanding these regional variations is crucial for businesses looking to leverage blockchain technology effectively.

- Monitor geopolitical developments and their impact on blockchain policy.

- Engage with regulatory bodies to shape favorable policies.

- Invest in compliance and regulatory affairs to navigate complex landscapes.

DLT Market Segmentation by Technology and Protocol Type

To truly understand the DLT market, we need to explore its segmentation based on technology and protocol type. This breakdown is essential for businesses looking to adopt DLT, as different technologies and protocols are better suited for different use cases.

The DLT market consists of various technologies and protocols, each with its own distinct features and applications. The primary categories of DLT include:

Types of DLT and Their Applications

- Public DLT: Open to anyone, public DLTs are decentralized and transparent, making them suitable for applications that require high security and trust.

- Private DLT: Restricted to a specific group, private DLTs offer more control over data and are often used in enterprise settings.

- Consortium DLT: A mix of public and private DLTs, consortium DLTs are controlled by a group of organizations, making them suitable for industries that require collaboration.

Different DLT protocols, such as Hyperledger Fabric, Corda, and Chaincode, are designed to meet specific business needs, including scalability, security, and interoperability.

The choice of DLT technology and protocol depends on the specific use case, with factors such as performance, security, and cost influencing the decision. By understanding the different types of DLT and their applications, businesses can make informed decisions about their DLT adoption.

How DLT is Changing Different Industries

Distributed Ledger Technology (DLT) is being used in many industries to change how businesses work. It offers a safe, clear, and effective method for carrying out transactions and handling data, which is reshaping various sectors.

Use Cases for DLT in Enterprises

Distributed Ledger Technology (DLT) has numerous applications across different enterprise sectors, including supply chain management, finance, and healthcare. In supply chain management, DLT can be used to track the origin, quality, and movement of goods. In finance, DLT can facilitate secure and efficient transactions.

Industry-Specific Applications

Different industries are leveraging DLT in unique ways. For instance, in the healthcare sector, DLT can be used to securely store and manage patient data. In the finance sector, DLT can be used for cross-border payments and trade finance.

Some of the key benefits of using DLT in enterprise sectors include:

- Increased security: DLT provides a secure way to conduct transactions and manage data.

- Improved transparency: DLT allows for real-time tracking and monitoring of transactions.

- Enhanced efficiency: DLT can automate many processes, reducing the need for intermediaries.

Here is a table highlighting some of the industry-specific applications of DLT:

| Industry | DLT Application | Benefits |

| Supply Chain Management | Tracking the origin, quality, and movement of goods | Increased transparency, improved security |

| Finance | Cross-border payments, trade finance | Enhanced efficiency, reduced costs |

| Healthcare | Securely storing and managing patient data | Improved security, increased patient control |

DLT Use Cases

As DLT continues to evolve, we can expect to see even more innovative applications across various enterprise sectors. By understanding the specific roles DLT can play in different industries, businesses can unlock new opportunities for growth and improvement.

Global Enterprise-Grade DLT Market Performance by Region

The performance of the Enterprise-Grade DLT market varies significantly across regions. This variation is influenced by factors such as local regulations, technology adoption, and market needs. The global market is also affected by various factors including government policies, technological advancements, and the demand for DLT solutions.

Regional Market Performance

The regional performance of the Enterprise-Grade DLT market can be understood by examining the different factors at play in various geographies. For instance, regions with clear and favorable regulatory frameworks tend to have a more robust DLT market.

Regional Variations

Different regions exhibit unique characteristics in their DLT market performance. For example, the U.K. and Singapore have been noted for their proactive approach to DLT regulation, creating conducive environments for DLT adoption.

| Region | DLT Market Performance | Influencing Factors |

| U.K. | Strong | Favorable regulations, fintech hub |

| Singapore | Robust | Clear regulatory guidelines, innovation-friendly |

| U.S. | Varies by state | Diverse regulatory landscape, significant innovation |

The table above illustrates the varying performance of the DLT market across different regions, highlighting the factors that influence this performance. Understanding these regional dynamics is crucial for stakeholders looking to navigate the global DLT landscape.

As the global DLT market continues to evolve, regional performances will likely be shaped by ongoing developments in regulation, technology, and market demand. Stakeholders must stay informed about these dynamics to capitalize on emerging opportunities.

U.K.’s regulatory clarity and fintech DLT integration

The U.K. has taken a proactive approach to regulating Distributed Ledger Technology (DLT), creating a favorable environment for fintech innovation. This forward-thinking strategy has played a crucial role in encouraging the adoption of DLT within the financial sector.

The financial regulatory bodies in the U.K. have worked hard to provide clear guidelines on DLT, reducing the uncertainty that often holds back technological adoption. As a result, fintech companies in the U.K. have been able to integrate DLT into their operations more effectively, driving innovation and efficiency.

U.K.’s Approach to DLT Regulation

The U.K.’s regulatory framework for DLT is characterized by its clarity and flexibility. By establishing a clear understanding of the legal and regulatory requirements for DLT, the U.K. has enabled businesses to navigate the complex landscape of fintech innovation with greater ease.

This clarity has been achieved through a combination of regulatory sandbox environments, clear guidelines, and open dialogue between regulators and industry stakeholders. The outcome is a robust ecosystem that supports the development and integration of DLT solutions.

- Regulatory sandbox environments allow fintech companies to test DLT solutions in a controlled environment.

- Clear guidelines provide certainty for businesses looking to adopt DLT.

- Open dialogue between regulators and industry stakeholders ensures that the regulatory framework remains relevant and effective.

By fostering such an environment, the U.K. has positioned itself as a leader in the global fintech landscape, particularly in the realm of DLT. This leadership is expected to continue driving growth in the Enterprise-Grade DLT market.

Singapore’s blockchain hub and enterprise readiness

Singapore’s blockchain ecosystem is thriving, driven by its enterprise readiness and supportive regulatory framework. This has enabled the city-state to become a magnet for blockchain innovation and investment.

Singapore’s Blockchain Ecosystem

The Singapore Blockchain ecosystem is known for its high level of enterprise readiness, with many businesses using Distributed Ledger Technology (DLT) for various purposes. This readiness is made possible by a supportive regulatory environment that encourages innovation while ensuring compliance with existing financial regulations.

Key Factors Behind Singapore’s Success

Several key factors have contributed to Singapore’s success in the blockchain industry:

- Proactive Regulatory Approach: The government actively promotes blockchain technology through favorable regulations and initiatives.

- Robust Fintech Infrastructure: Singapore has a strong financial technology infrastructure that supports the growth of blockchain solutions.

These factors have created an environment where startups, established companies, and regulatory bodies collaborate to advance blockchain technology.

Initiatives Supporting Blockchain Growth

The table below highlights some of the key statistics and initiatives that underscore Singapore’s position as a leading blockchain hub.

| Initiative | Description | Impact |

| Regulatory Sandbox | A framework allowing fintech firms to test innovative products in a controlled environment. | Encourages experimentation and innovation. |

| Blockchain Innovation Grants | Funding provided to support blockchain-related research and development. | Fosters technological advancements. |

| Industry Collaboration | Partnerships between enterprises, startups, and academia to drive blockchainadoption. | Promotes knowledgesharingandcollaborativedevelopment. |

By fostering a supportive ecosystem, Singapore continues to attract blockchain enterprises and talent, reinforcing its position as a global blockchain hub.

U.S. Innovation Driving Distributed Ledger Solutions

The U.S. is leading the way in developing and implementing distributed ledger solutions thanks to its strong technological infrastructure. This leadership is supported by various factors such as:

- A thriving ecosystem of technology companies

- Research institutions

- A business-friendly environment

U.S. Innovation in DLT

The U.S. has made great strides in DLT innovation, with many industries using the technology to become more efficient, secure, and transparent. Some of the main areas where this innovation is happening are supply chain management, financial services, and healthcare.

Factors Behind U.S. DLT Innovation

There are several reasons why the U.S. is leading the way in DLT innovation:

- The presence of top technology companies and research institutions creates an environment that encourages technological advancements.

- The country’s financial markets and regulatory frameworks, although challenging, push for the development of compliant and innovative DLT solutions.

Impact of U.S. DLT Innovation

U.S. DLT innovation has a wide-ranging impact. It not only improves industries within the country but also establishes the U.S. as a global leader in adopting and developing distributed ledger technology. As a result, businesses around the world turn to the U.S. for guidance on how to implement DLT effectively.

Key Players in the U.S. DLT Ecosystem

The U.S. DLT ecosystem consists of various key players:

- Technology giants

- Startups

- Academic institutions

These entities play a crucial role in shaping the future of DLT by:

- Developing cutting-edge DLT applications

- Collaborating on research projects

- Promoting the use of DLT across different sectors

Future direction of Enterprise-Grade DLT in business

The world of Enterprise-Grade DLT is changing quickly and will have a big impact on the future of business. As technology keeps improving, more businesses are expected to start using Enterprise-Grade DLT. This will lead to new ideas and better ways of doing things in many industries.

Emerging Trends and Future Outlook

The future of Enterprise-Grade DLT is closely tied to emerging trends such as the integration of artificial intelligence and Internet of Things (IoT). These technologies, combined with DLT, are expected to create new business models and opportunities.

Some of the key trends that will shape the future of Enterprise-Grade DLT include:

- Increased adoption of decentralized finance (DeFi) solutions

- Growing demand for secure and transparent supply chain management

- Expansion of DLT-based identity verification systems

The table below highlights the potential impact of these trends on the Enterprise-Grade DLT market.

| Increased adoption of DeFi solutions | Enhanced financial inclusion and security | Finance and Banking |

| Growing demand for secure supply chain management | Improved transparency and reduced counterfeiting | Manufacturing and Logistics |

| Expansion of DLT-based identity verification | Enhanced security and reduced identity theft | Government and Healthcare |

As the Enterprise-Grade DLT market continues to evolve, businesses must stay informed about the latest developments and trends. By doing so, they can harness the full potential of DLT to drive growth and innovation.

Competition among Enterprise-Grade DLT vendors and platforms

The competition among enterprise-grade Distributed Ledger Technology (DLT) vendors and platforms has intensified as more industries seek secure, transparent, and efficient ways to manage transactions and data. Each platform comes with its own set of features, target industries, and strategic goals.

- Hyperledger – United States (The Linux Foundation)

- Ethereum – Switzerland (Ethereum Foundation)

- R3 Corda – United States (R3 LLC)

- Ripple – United States

- ERIS (now Monax) – United States

- Insolar – Switzerland (originally Russia)

- Multichain – United Kingdom (Coin Sciences Ltd)

- IBM – United States

- AWS (Amazon Web Services) – United States

- Alibaba – China

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Enterprise-Grade DLT Market Report |

| Base Year | 2024 |

| Segment by Type |

· Public DLT · Private DLT · Consortium DLT |

| Segment by Application |

· Chain Management · Finance · Healthcare |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Enterprise-Grade DLT Market is about to experience significant growth, driven by increasing adoption, technological advancements, and regulatory clarity. As discussed in the previous sections, regions like the U.K. and Singapore are leading the way in DLT adoption, driven by favorable regulatory environments and a strong fintech presence.

Future Prospects

The future of the Enterprise-Grade DLT Market looks promising, with businesses continuing to explore the potential of DLT. Understanding the current landscape, challenges, and future directions is crucial for successful adoption and implementation. As the market evolves, we can expect to see new use cases emerge, further driving growth and innovation in the Enterprise-Grade DLT Market.

With a projected market value of $3.58 billion by 2025, the Enterprise-Grade DLT Market is set to experience significant expansion. As businesses and governments continue to invest in DLT, the Market Outlook remains positive, with opportunities for growth and development on the horizon.

Global Enterprise-Grade DLT Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Enterprise-Grade DLT Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Enterprise-Grade DLTMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Enterprise-Grade DLTplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Enterprise-Grade DLT Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Enterprise-Grade DLT Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Enterprise-Grade DLT Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofEnterprise-Grade DLTMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the expected size of the Enterprise-Grade DLT Market by 2025?

The Enterprise-Grade DLT Market is expected to reach $3.58 billion by 2025.

Which regions are driving the growth of the Enterprise-Grade DLT Market?

The U.K. and Singapore are significant growth centers in the Enterprise-Grade DLT Market.

What are the key factors influencing the adoption of Distributed Ledger Technology (DLT) across various enterprise sectors?

The increasing adoption of DLT is driven by its potential to enhance security, transparency, and efficiency in various business processes.

What are the major challenges faced by enterprises when adopting DLT?

Enterprises face challenges such as regulatory uncertainty, scalability issues, and integration complexities when adopting DLT.

How do geopolitical factors influence blockchain policy and deployment?

Geopolitical factors significantly influence blockchain policy and deployment, with different regions having varying regulatory frameworks and policies regarding DLT.

What are the different types of DLT and their applications?

The DLT market can be segmented based on the type of technology and protocol used, with different technologies and protocols suiting different use cases.

What are the specific roles of DLT in enterprise sectors such as supply chain management, finance, and healthcare?

DLT has various applications across different enterprise sectors, including enhancing supply chain transparency, improving financial transaction security, and streamlining healthcare data management.

How is the global Enterprise-Grade DLT market performing across different regions?

The global Enterprise-Grade DLT market is performing differently in various regions. This is influenced by factors such as regulatory environments, technological advancements, and market demand.

What is the impact of regulatory clarity on DLT adoption in the U.K.?

The U.K.’s regulatory clarity has positively impacted fintech DLT integration, encouraging businesses to adopt DLT.

Why is Singapore considered a blockchain hub?

Singapore has established itself as a blockchain hub due to its supportive environment for blockchain and DLT development, as well as its preparedness for enterprise adoption.

What is driving the growth of the Enterprise-Grade DLT market in the U.S.?

The U.S. has been leading the way in distributed ledger solutions innovation, driving the growth of the Enterprise-Grade DLT market.

What are the emerging trends shaping the future of Enterprise-Grade DLT?

Emerging trends, technological advancements, and changing regulatory landscapes will shape the future of DLT adoption.