`

Photography Equipment Market Set to Surge to $50.25 Billion by 2025: Key Insights from the U.S., Japan, and Germany

Discover how upstream and downstream market forces shape the photography equipment industry, from raw material sourcing to consumer preferences. Explore key trends including digital innovation, AI advancements, and market barriers while gaining insights into regional dynamics across the US, Japan, and Germany. Learn about major players, future developments, and growth projections in photography equipment market analysis.

- Last Updated:

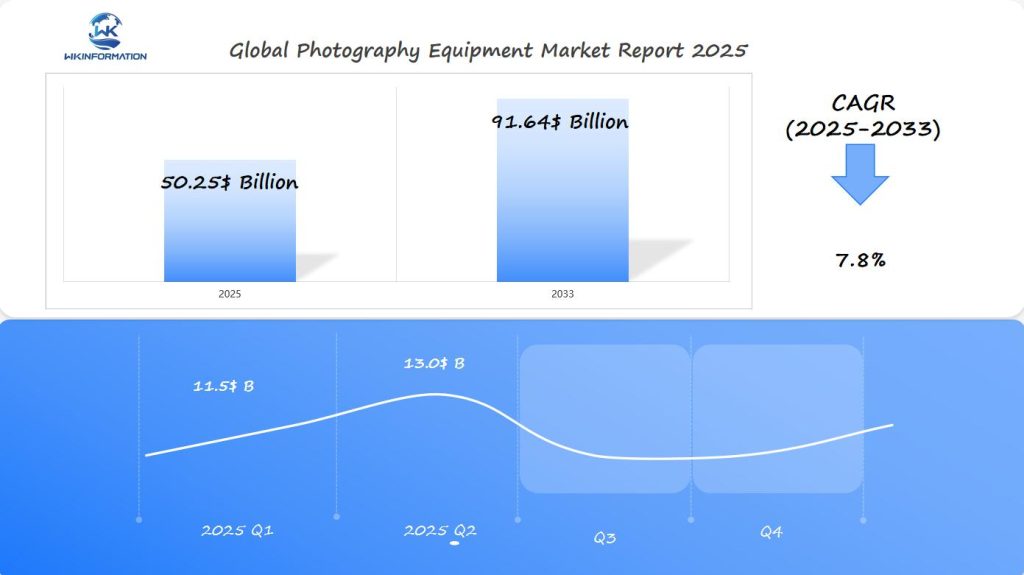

Photography Equipment Market Forecast for Q1 and Q2 2025

The global photography equipment market is projected to reach $50.25 billion in 2025, with a CAGR of 7.8% from 2025 to 2033. The market in the first half of 2025 is expected to show steady demand, with Q1 estimated at $11.5 billion and Q2 expected to reach around $13.0 billion, driven by continued advancements in digital photography and the increasing popularity of high-quality content creation.

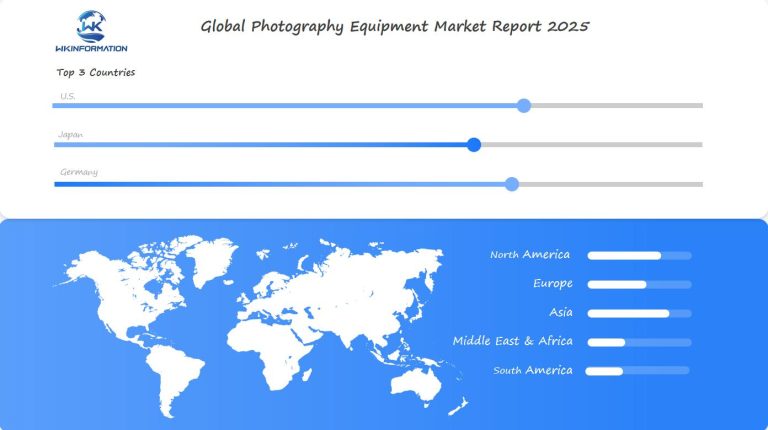

The U.S., Japan, and Germany are expected to be the most significant markets for photography equipment. The U.S. remains the largest consumer, driven by the content creation boom and professional photography services. Japan continues to lead in innovation, with its technologically advanced camera systems and components, while Germany is a key player in the European market, with strong demand from both professional photographers and enthusiasts. These countries are critical for further in-depth analysis due to their leadership in the adoption of cutting-edge photography technologies.

How the Upstream and Downstream Market Forces Shape Photography Equipment

The photography equipment market is influenced by a combination of upstream and downstream forces that affect product development, pricing, and availability.

Upstream Market Forces

The upstream segment of photography equipment manufacturing relies heavily on:

- Raw Material Sourcing

- Specialized glass for lens production

- Electronic components (sensors, processors)

- Precious metals for specific camera parts

- Technology Integration

- Semiconductor development

- Advanced coating processes

- Precision engineering capabilities

These upstream elements directly impact production costs and innovation capabilities. For instance, Canon’s recent EOS R3 development was influenced by the global semiconductor shortage, affecting both production timelines and pricing strategies.

Downstream Market Forces

The downstream segment shapes how photography equipment reaches end-users:

- Consumer Preferences

- Shift toward mirrorless systems

- Demand for compact designs

- Interest in vintage aesthetics

- Retail Dynamics

- Online vs. brick-and-mortar sales

- Rental services growth

- Direct-to-consumer channels

These downstream factors drive product development decisions. Sony’s Alpha series success stems from identifying and responding to the growing demand for compact, full-frame cameras among content creators.

The interaction between upstream and downstream forces creates a dynamic market environment. When raw material costs increase upstream, manufacturers must balance pricing strategies downstream while maintaining product quality. Similarly, consumer preferences for lighter cameras downstream influence upstream decisions about materials and manufacturing processes.

Key Trends That Are Redefining the Photography Equipment Industry

Digital technology has completely transformed the world of photography equipment, bringing about revolutionary changes in camera design and functionality. The newest mirrorless cameras are equipped with cutting-edge sensor technology, such as Sony’s A7R V which boasts an impressive 61-megapixel resolution and advanced image stabilization systems. Lens manufacturing has also progressed with the introduction of computational optics, allowing for features like built-in correction of chromatic aberration and distortion.

Digital Innovation Highlights:

- 8K video recording capabilities in professional cameras

- High-speed continuous shooting at 30+ frames per second

- Advanced weather sealing and durability improvements

- Hybrid autofocus systems combining phase and contrast detection

Social media platforms have had a significant impact on consumer preferences for photography equipment. The rise of Instagram has led to the creation of cameras with vertical grips and features specifically designed for vlogging. Similarly, TikTok’s influence has prompted manufacturers to include advanced video stabilization and quick-sharing functionalities.

Social Media-Driven Features:

- Flip-out touchscreens for selfie shooting

- Built-in wireless connectivity for instant sharing

- Vertical shooting optimization

- Live streaming capabilities

The integration of AI technology represents a major shift in the development of photography equipment. Modern cameras now utilize complex machine learning algorithms that improve shooting abilities and simplify post-processing tasks.

AI-Powered Advancements:

- Real-time subject recognition and tracking

- Intelligent scene optimization

- Advanced face and eye detection

- Automated exposure bracketing

- Neural network-based noise reduction

The combination of these technologies has given rise to a new breed of hybrid cameras. These devices merge traditional photography skills with computational photography features, catering to the needs of both professional photographers and content creators. Companies like Canon and Nikon have launched autofocus systems powered by AI that can track multiple subjects while maintaining precise focus, revolutionizing sports and wildlife photography.

Identifying the Major Barriers to Growth in the Photography Equipment Sector

The photography equipment sector faces significant challenges that impact its growth trajectory.

1. Economic Barriers

Economic downturns create substantial ripple effects throughout the industry, particularly affecting high-end camera sales. During the 2020 recession, premium camera purchases dropped by 40%, highlighting consumers’ reluctance to invest in expensive photography gear during financial uncertainty.

Key Economic Barriers:

- Reduced disposable income leading to delayed purchases

- Shift in consumer priorities during financial stress

- Decreased professional photography business affecting equipment demand

- Price sensitivity in emerging markets

2. Competition from Smartphones

The smartphone revolution presents a formidable challenge to traditional camera manufacturers. With each new smartphone generation offering enhanced camera capabilities, the distinct advantages of dedicated cameras become less apparent to casual photographers. The iPhone 14 Pro’s 48MP camera system exemplifies this trend, delivering professional-quality images in a pocket-sized device.

Industry Adaptation Strategies:

- Development of hybrid camera systems combining DSLR quality with smartphone connectivity

- Focus on unique features unavailable in smartphones (interchangeable lenses, superior low-light performance)

- Creation of specialized photography niches (underwater photography, astrophotography)

- Integration of professional post-processing tools

3. Supply Chain Disruptions

Supply chain disruptions pose additional challenges, with semiconductor shortages affecting production capabilities. Camera manufacturers report extended lead times and increased component costs, forcing them to adjust pricing strategies and potentially limiting market expansion.

4. Rising Raw Material Costs

Raw material costs continue to rise, particularly for specialized glass used in high-end lenses. These increases pressure manufacturers to balance quality maintenance with competitive pricing, impacting profit margins and innovation investment potential.

Geopolitical Insights: How Global Events Impact Photography Equipment Production

Recent global events have dramatically reshaped the photography equipment industry’s production landscape. Trade agreements between major manufacturing nations directly influence component sourcing strategies and final product pricing.

Key Trade Agreement Impacts:

- The EU-Japan Economic Partnership Agreement has reduced tariffs on camera equipment, benefiting companies like Canon and Nikon

- U.S.-China trade tensions have pushed manufacturers to diversify their production bases

- USMCA regulations affect North American distribution networks and pricing structures

The COVID-19 pandemic exposed critical vulnerabilities in photography equipment supply chains. Major manufacturers faced significant disruptions:

- Component Shortages: Sony’s Alpha series camera production slowed due to semiconductor scarcity

- Shipping Delays: Port congestion increased delivery times by 300%

- Production Relocations: Companies like Fujifilm shifted manufacturing from China to Thailand

Geopolitical tensions continue to reshape manufacturing strategies. Companies now prioritize:

- Regional manufacturing hubs

- Local supplier networks

- Redundant supply chains

- Strategic inventory management

The Russia-Ukraine conflict has created new challenges for European distribution networks. Photography equipment companies have responded by:

- Establishing alternative shipping routes

- Building regional warehousing facilities

- Implementing dynamic pricing strategies

- Developing local assembly operations

These adaptations have led to increased production costs, with manufacturers reporting 15-20% higher operational expenses. Companies now factor geopolitical risk assessment into their long-term production planning, creating more resilient but complex supply networks.

A Deep Dive into Photography Equipment Market Segmentation

The photography equipment market is divided into two main categories: digital cameras and camera accessories. Each category offers different opportunities for growth and challenges for manufacturers and retailers.

Digital Cameras: DSLR vs. Mirrorless

DSLR Cameras

- Traditional mechanical mirror system

- Superior battery life (1500+ shots per charge)

- Extensive lens compatibility

- Price range: $500-$6000

- Preferred by wildlife and sports photographers

Mirrorless Cameras

- Compact and lightweight design

- Advanced autofocus capabilities

- Real-time exposure preview

- Price range: $600-$6500

- Popular among travel and street photographers

Growth in the Camera Accessories Market

The accessories category is experiencing strong growth as both professional and amateur photographers look for ways to enhance their creativity:

Performance of Essential Accessories

- Tripods: 12% annual growth

- Filters: 8% market expansion

- Lighting equipment: 15% year-over-year increase

- Camera bags: 10% steady growth

Emerging Trends in Accessories

- Smart triggers and remote controls

- Specialized drone accessories

- Smartphone photography attachments

- Vintage lens adapters

The accessories market is a vital source of income for manufacturers, often generating higher profit margins than camera bodies. Recent data reveals that photographers spend an average of $1,200 on accessories during their first year of owning a camera.

The rise of content creation has led to an increased demand for specialized equipment:

Popular Gear for Content Creation

- Ring lights

- Wireless microphones

- Portable LED panels

- Stabilization systems

These market segments continue to evolve with technological advancements and changing consumer preferences, creating new opportunities for manufacturers to innovate and expand their product lines.

Applications Driving Photography Equipment Demand and Market Expansion

Professional Photography Sector

The professional photography sector remains a significant driver of high-end equipment sales. Commercial photographers invest heavily in specialized gear for:

- Product photography: Light boxes, macro lenses, and precision lighting equipment

- Fashion shoots: Medium format cameras, beauty dishes, and professional flash systems

- Real estate photography: Wide-angle lenses, tilt-shift capabilities, and drone equipment

- Wedding photography: Full-frame cameras, prime lenses, and professional flash systems

Social Media Content Creation Sector

The social media content creation sector has created new demands in the Photography Equipment Market. Instagram’s rise has sparked interest in specific equipment types:

- Ring lights for beauty and makeup content

- Gimbals and stabilizers for smooth video content

- Compact mirrorless cameras for travel photography

- Vintage-style filters and lenses for aesthetic appeal

Amateur Photographers and Social Media Influencers

Amateur photographers and social media influencers drive market growth through their unique equipment preferences:

Popular Equipment Choices

- Compact vlogging cameras with flip screens

- Smartphone lens attachments

- Portable LED lighting systems

- Action cameras for adventure content

Platform-Specific Trends

Platform-specific trends shape equipment development:

- TikTok: Vertical video optimization tools

- YouTube: 4K-capable cameras with extended recording capabilities

- Instagram Reels: Compact stabilization systems

Rise of Micro-Influencers

The rise of micro-influencers has created demand for mid-range equipment that balances quality with affordability. These content creators typically seek versatile gear that performs well across multiple platforms and content types, pushing manufacturers to develop hybrid photo-video solutions.

Gaming and Streaming Sector

The gaming and streaming sector presents a growing market for specialized photography equipment, with demand for:

- High-quality webcams

- Stream lighting setups

- Green screen systems

- Capture cards for high-resolution video

Key Global Insights into the Photography Equipment Market Landscape

The global photography equipment market showcases distinct regional characteristics that shape its dynamics.

North America: The Market Leader

North America stands as the market leader, driven by:

- High consumer spending power

- Early adoption of cutting-edge technology

- Strong presence of professional photography sectors

- Robust e-commerce infrastructure

Europe: Innovation through Heritage

Europe’s market strength lies in its deep-rooted photography heritage, with Germany, France, and the UK leading innovation. The region excels in:

- Premium camera manufacturing

- Specialized lens production

- High-end accessory development

- Professional photography education

Asia-Pacific: The Fastest-Growing Region

Asia-Pacific emerges as the fastest-growing region, characterized by:

- Rapid technological advancement in Japan and South Korea

- Growing middle-class population in China and India

- Increasing smartphone integration capabilities

- Cost-effective manufacturing capabilities

Unique Contributions to the Global Market

Each region brings unique contributions to the global market. North America’s technological innovation drives product development, while Europe’s craftsmanship maintains quality standards. Asia-Pacific’s manufacturing prowess and growing consumer base fuel market expansion.

Specialized Expertise in Regional Manufacturing Hubs

Regional manufacturing hubs demonstrate specialized expertise. Japan dominates camera sensor technology, Germany leads in precision optics, and China excels in accessory production. This distribution creates a complementary global ecosystem where each region’s strengths support overall market growth.

The U.S. Photography Equipment Market: Growth Drivers and Trends

The U.S. photography equipment market is experiencing strong growth due to specific consumer behaviors and industry innovations. Professional photographers in the U.S. spend an average of $3,500 each year on upgrading their equipment, which creates a consistent demand for high-quality gear.

Key Factors Driving the Market:

- Increasing interest in wildlife and nature photography, especially among millennials

- Rise of e-commerce product photography services

- Growth of the real estate photography market

- Higher demand for drone photography equipment

The U.S. market has clear preferences for certain types of products:

- Professional-Grade Mirrorless Cameras: Sales grew 32% in 2022

- Advanced Lighting Equipment: LED continuous lighting systems lead the segment

- Specialized Lenses: Premium telephoto and macro lenses maintain strong demand

The rental market is also important in the U.S. photography industry. Companies like LensRentals and BorrowLenses have reported a 45% increase in business volume, showing that photographers are changing how they access equipment.

Different regions within the U.S. market have their own unique trends:

West Coast: Strong demand for outdoor and adventure photography gear Northeast: High concentration of studio equipment purchases Southeast: Growing market for wedding photography equipment Midwest: Significant uptake in agricultural and drone photography tools

Japan’s Influence on the Photography Equipment Market

Japan is a major player in the photography equipment industry, with companies like Canon, Nikon, and Sony leading the way in global innovation. The country’s expertise in technology has greatly impacted modern photography through:

- Advancements in sensor technology

- Improvements in lens manufacturing

- Development of image processing algorithms

- Techniques for miniaturization

Dominance of Japanese Manufacturers

Japanese manufacturers hold approximately 75% of the global camera market, setting unmatched quality standards and manufacturing processes. This dominance is a result of years of investment in research and development, which has created a strong network of suppliers and specialized component manufacturers.

Influence on Global Photography Trends

Japan’s influence goes beyond just producing hardware. The country’s photography culture has popularized certain aesthetic preferences and shooting styles, shaping global photography trends. Compact cameras like the Fujifilm X series, which combine traditional design elements with modern technology, have particularly transformed street photography.

Recent Innovations from Japan

Some recent innovations from Japanese manufacturers include:

- AI-powered autofocus systems

- Advanced image stabilization

- Computational photography features

- High-resolution sensors with improved low-light performance

Testing Ground for New Products

The Japanese market serves as a testing ground for new photography products, with domestic consumer preferences often predicting global trends. This unique position allows Japanese manufacturers to refine products before international releases, helping them stay competitive in the global market.

Germany’s Photography Equipment Market: Key Trends to Watch

Germany’s photography equipment market stands out with its unique blend of traditional craftsmanship and technological innovation. The country’s market value reached €3.2 billion in 2022, driven by strong domestic demand and export capabilities.

Key Market Characteristics:

- High preference for premium-quality equipment

- Strong focus on precision engineering

- Robust presence of specialty camera stores

- Growing demand for professional-grade accessories

How German Manufacturers Stay Competitive

German manufacturers like Leica Camera AG maintain their position through:

- Emphasis on optical excellence

- Premium brand positioning

- Investment in research and development

- Strategic partnerships with global tech companies

Emerging Opportunities in Specialized Photography Segments

The rise of specialized photography segments has created new market opportunities:

- Industrial photography equipment (+15% growth)

- Medical imaging systems

- Professional studio equipment

- High-end consumer cameras

What German Consumers Value Most in Photography Gear

Recent market data shows German consumers prioritize:

- Durability and build quality

- Advanced manual controls

- Environmental sustainability

- Integration with professional workflows

How Local Retailers Are Adapting to Consumer Changes

Local retailers adapt to changing consumer behaviors by offering:

- Personalized consultation services

- Equipment rental programs

- Technical workshops

- Professional networking events

The Strength of the German Market

The German market’s strength lies in its specialized manufacturing capabilities, particularly in optical systems and precision mechanics. Cities like Wetzlar continue to serve as global hubs for photography innovation, attracting international investment and talent.

Looking Ahead: Future Developments in the Photography Equipment Industry

The photography equipment industry is set to undergo significant changes driven by innovative technologies and environmentally friendly practices.

1. Smart Integration and Connectivity

Expect to see the following advancements in camera technology:

- AI-powered autofocus systems capable of recognizing and tracking multiple subjects simultaneously

- Built-in 5G connectivity enabling instant cloud backup and remote shooting capabilities

- Advanced computational photography features merging multiple exposures in real-time

- Voice-activated controls and gesture recognition for hands-free operation

2. Mobile Integration Advancements

The integration between cameras and mobile devices will continue to evolve with:

- Direct streaming capabilities from cameras to social media platforms

- Wireless tethering with enhanced range and stability

- Real-time collaboration tools for professional photographers

- Cross-platform editing capabilities between cameras and mobile devices

3. Sustainable Manufacturing Initiatives

Major camera manufacturers are taking steps towards sustainability through:

- Nikon’s commitment to reducing CO2 emissions by 26% by 2030

- Canon’s development of bio-based plastics for camera bodies

- Sony’s implementation of recycled materials in packaging and accessories

- Fujifilm’s zero-waste manufacturing facilities

4. Eco-Friendly Materials

The use of sustainable materials in photography equipment is on the rise, with:

- Biodegradable camera straps and cases

- Solar-powered battery charging solutions

- Recycled aluminum and magnesium alloy camera bodies

- Sustainable lens coating technologies

The industry’s shift toward sustainable practices extends beyond manufacturing. Camera makers are introducing repair programs and modular designs, allowing users to upgrade specific components rather than replace entire units. These initiatives reduce electronic waste while extending product lifecycles.

Research and development teams are exploring quantum image sensors and organic photographic materials, promising significant improvements in low-light performance and energy efficiency. These advancements suggest a future where high-performance photography equipment coexists harmoniously with environmental responsibility.

Competitive Forces: Major Players in the Photography Equipment Market

The photography equipment market is highly competitive, with established industry leaders vying for dominance. Each of these companies has its own strengths and strategies that set them apart in the market.

-

Canon Inc. – Japan

-

Nikon Corporation – Japan

-

Fujifilm Holdings Corporation – Japan

-

Panasonic Corporation – Japan

-

Sony Corporation – Japan

-

Samsung Electronics Co. Ltd. – South Korea

-

Leica Camera AG – Germany

-

Olympus Corporation – Japan

-

Hasselblad AB – Sweden

-

Ricoh Imaging Company Ltd. – Japan

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Photography Equipment Market Report |

| Base Year | 2024 |

| Segment by Type |

· DSLR Cameras · Mirrorless Cameras |

| Segment by Application |

· Professional Photography · Amateur Photographers · Industrial Applications |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The photography equipment market is expected to grow to $50.25 billion by 2025, showing its ability to adapt and bounce back. This market has shown great flexibility through:

- Technological Integration: The combination of AI capabilities, cloud connectivity, and advanced imaging systems creates unprecedented opportunities for both manufacturers and users

- Regional Market Strength:

- North America leads in technological innovation

- Japan maintains manufacturing excellence

- Germany drives precision engineering advances

- Consumer-Driven Innovation: Social media’s influence shapes product development, pushing manufacturers to create equipment that meets both professional and content creator demands

The photography equipment industry is at a crucial point where traditional craftsmanship meets cutting-edge technology. Market leaders who embrace sustainable practices, invest in R&D, and adapt to changing consumer preferences will capture significant market share.

The future success of the industry depends on:

- Developing eco-friendly manufacturing processes

- Creating seamless integration between devices

- Meeting the growing demand for hybrid shooting capabilities

- Expanding into emerging markets

- Building strong direct-to-consumer relationships

These factors position the photography equipment market for sustained growth, innovation, and transformation in the coming years.

Global Photography Equipment Market Report(Can Read by Free sample)–Table of Contents

Chapter 1:Photography Equipment Market Analysis Overview

- Competitive Forces Analysis(Porter’s Five Forces)

- Strategic Growth Assessment(Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Photography Equipment Market Segmentation Overview

Chapter 2:Competitive Landscape

- GlobalPhotography Equipment Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3:Photography Equipment Market Segmentation Analysis

- Key Data and Visual Insights

- Trends,Growth Rates,and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4:Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic,Demographic,and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5:Photography Equipment Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends,Challenges,and Opportunities

Chapter 6:Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7:Photography Equipment Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8:Key Findings and Recommendations

- Summary of Photography Equipment Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the upstream factors affecting the production of photography equipment?

Upstream factors that affect photography equipment production include technological advancements and the availability of raw materials. For instance, innovations in sensor technology can lead to better image quality in cameras, while fluctuations in the supply of materials like glass for lenses can impact manufacturing processes.

How do consumer preferences influence the marketing strategies of photography equipment?

Consumer preferences significantly shape marketing strategies by dictating which features or styles are prioritized in product development. Retail strategies are adapted based on trends observed through social media platforms, where specific functionalities such as high-resolution imaging or portability become popular among users.

What barriers to growth does the photography equipment sector face?

The photography equipment sector faces several barriers to growth, including economic downturns that reduce consumer spending on high-end gear, competitive pressures from smartphones offering advanced imaging capabilities, and technological challenges that require constant innovation to keep pace with market demands.

How do geopolitical events impact the production of photography equipment?

Geopolitical events can greatly influence photography equipment production by affecting trade policies and international relations. For example, tariffs imposed on imported materials can increase costs for manufacturers, while geopolitical tensions may disrupt supply chains, leading to delays in production and distribution.

What are the key segments within the photography equipment market?

The photography equipment market is primarily segmented into digital cameras (including DSLRs and mirrorless cameras) and camera accessories. Each segment has its strengths; for instance, mirrorless cameras are known for their compactness and advanced features, while traditional DSLRs offer robust performance and battery life.

What future developments should we expect in the photography equipment industry?

Future developments in the photography equipment industry will likely include innovations such as enhanced connectivity options for seamless sharing and editing workflows. Additionally, there is a growing emphasis on sustainability practices among brands that prioritize eco-friendly materials and production methods to appeal to environmentally conscious consumers.