PEX Market Set to Reach $5.28 Billion by 2025: Rapid Growth Driven by the U.S., Germany, and China

Explore the dynamic cross-linked polyethylene (PEX) market in this comprehensive analysis covering trends, market share, and industry insights from 2025-2033. Discover how PEX’s growing adoption in construction and plumbing, driven by its superior durability and eco-friendly properties, is reshaping the industry landscape. Learn about regional market dynamics, technological innovations, and investment opportunities as the market expands from USD 3.5 billion in 2025 to a projected USD 5.66 billion by 2033, growing at a CAGR of 6.2%.

- Last Updated:

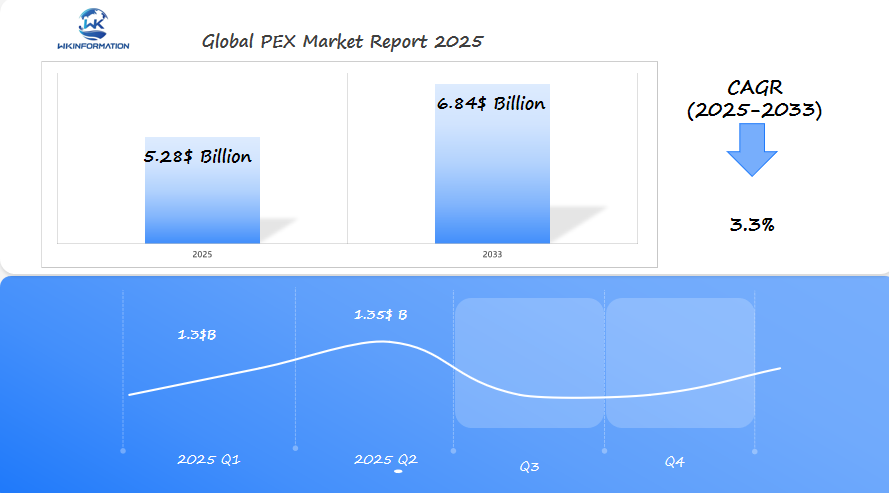

PEX Market Q1 and Q2 2025 Forecast

The PEX (cross-linked polyethylene) market is projected to reach $5.28 billion in 2025, with a CAGR of 3.3% from 2025 to 2033. In Q1 2025, the market is expected to generate around $1.3 billion, driven by its widespread use in plumbing systems, underfloor heating, and renewable energy applications. The U.S., Germany, and China will remain the largest markets for PEX due to their advanced construction sectors and growing demand for energy-efficient building solutions.

By Q2 2025, the market will likely grow to $1.35 billion, as the demand for sustainable building materials and energy-efficient piping systems continues to rise. The expansion of green building initiatives and the adoption of PEX for both residential and commercial applications will drive this growth. The U.S. will lead the market due to increasing construction projects focusing on sustainability.

Understanding the Upstream and Downstream Dynamics of the PEX Industry

The PEX industry operates through a complex network of interconnected stages, each playing a vital role in delivering high-quality cross-linked polyethylene products to end-users. Let’s break down this intricate supply chain to understand how raw materials transform into finished products.

1. Raw Material Sourcing

The production of PEX involves sourcing various raw materials, including:

- High-density polyethylene (HDPE) as the primary base material

- Chemical crosslinking agents

- Antioxidants and stabilizers

- Colorants and UV inhibitors

2. Manufacturing Process

Once the raw materials are sourced, they undergo a specific manufacturing process that includes:

- Compounding of raw materials

- Extrusion of PEX pipes

- Cross-linking through various methods:

- PEX-A: Peroxide method

- PEX-B: Silane method

- PEX-C: Electron beam method

- Quality testing and certification

3. Distribution Network

After manufacturing, the next stage involves distributing the finished products through a well-established network consisting of:

- Manufacturers maintaining regional warehouses

- Wholesale distributors stocking bulk quantities

- Local suppliers serving contractors

- Retail outlets catering to DIY customers

4. Key Players and Their Roles

Several key players are instrumental in ensuring the smooth functioning of the PEX industry:

Raw Material Suppliers

These companies provide the essential components needed for PEX production, maintaining strict quality standards and consistent supply chains.

Manufacturers

Leading manufacturers invest in advanced technology and research to produce high-quality PEX products. They implement rigorous quality control measures and maintain industry certifications.

Distributors

Professional distribution networks ensure:

- Strategic inventory management

- Just-in-time delivery systems

- Technical support

- Product training

Contractors and Installers

These professionals represent the final link in the supply chain, installing PEX systems in residential, commercial, and industrial applications. They require proper certification and training to ensure correct installation practices.

The success of the PEX industry relies heavily on strong relationships between these key players, with each entity contributing to the market’s growth and development. Efficient coordination among these stakeholders ensures consistent product quality and timely delivery to end-users.

Key Market Trends to Watch in the PEX Sector

The PEX sector’s rapid evolution brings several transformative trends that reshape industry dynamics. Smart plumbing systems integration stands out as a game-changing development, with PEX pipes now incorporating sensors for leak detection and water quality monitoring.

Emerging Application Trends:

- Integration with IoT devices for real-time performance monitoring

- Adoption in green building certifications like LEED

- Increased use in radiant floor heating systems

- Growing demand in agricultural irrigation systems

Manufacturing innovations drive significant improvements in PEX pipe performance. Advanced cross-linking technologies create stronger molecular bonds, resulting in enhanced durability and temperature resistance. The introduction of nano-materials in PEX production improves thermal conductivity and mechanical strength.

Key Manufacturing Advancements:

- UV-resistant formulations for outdoor applications

- Enhanced oxygen barrier layers for heating systems

- Improved chemical resistance for industrial applications

- Reduced wall thickness without compromising strength

The push for sustainability shapes new production methods. Manufacturers now implement energy-efficient processes and explore bio-based materials for PEX production. Water conservation features become standard, with PEX systems designed to minimize waste and optimize flow rates.

Performance Enhancements:

- Extended service life up to 50 years

- Higher pressure ratings for demanding applications

- Better flexibility in cold weather conditions

- Improved resistance to chlorine degradation

The market sees increased customization options, with manufacturers offering color-coded pipes and specialized fittings for specific applications. This trend simplifies installation processes and reduces error rates on construction sites.

Digital manufacturing technologies transform production efficiency. 3D printing enables rapid prototyping of fittings, while automated quality control systems ensure consistent product quality. These advancements reduce production costs and improve market competitiveness.

Overcoming Challenges and Barriers in the PEX Market

The PEX market faces significant hurdles that manufacturers and stakeholders must navigate to maintain growth momentum. Raw material price volatility stands as a primary concern, directly impacting production costs and market dynamics.

Raw Material Cost Fluctuations

- Polyethylene resin prices experience frequent market swings

- Manufacturing costs can surge 15-30% during supply chain disruptions

- Companies implement dynamic pricing models to maintain profit margins

- Bulk purchasing agreements help stabilize costs for larger manufacturers

Pricing Strategy Adaptations

- Implementation of cost-plus pricing mechanisms

- Development of value-based pricing models

- Integration of raw material indexes into customer contracts

- Strategic inventory management to buffer against price spikes

The environmental impact of PEX products presents another critical challenge. Industry leaders are implementing innovative solutions to address sustainability concerns:

Environmental Management Initiatives

- Creation of recycling programs for post-consumer PEX materials

- Development of eco-friendly manufacturing processes

- Investment in biodegradable packaging solutions

- Implementation of waste reduction strategies in production

End-of-Life Solutions

- Establishment of collection points for used PEX pipes

- Partnership with recycling facilities for material processing

- Research into chemical recycling technologies

- Integration of recycled content in non-pressure applications

The industry’s response to these challenges shapes its future trajectory. Manufacturers investing in sustainable practices and innovative pricing strategies position themselves for long-term success. These solutions require collaboration between manufacturers, distributors, and end-users to create effective circular economy models for PEX products.

Geopolitical Forces Shaping the Global PEX Landscape

The global PEX market operates within a complex web of international trade policies and regulatory frameworks that directly impact market dynamics. Trade agreements between nations create distinct advantages and challenges for manufacturers and distributors operating across borders.

Key Trade Agreement Impacts:

- The U.S.-Mexico-Canada Agreement (USMCA) facilitates smoother cross-border PEX material transport

- EU-China Investment Agreement influences raw material sourcing and finished product distribution

- Regional trade blocs affect tariff structures and market accessibility

Government regulations play a crucial role in shaping product standards and market access. Different regions maintain specific requirements:

North America:

- NSF/ANSI 61 certification for drinking water systems

- ASTM F876/F877 standards for dimensional and performance requirements

- UPC (Uniform Plumbing Code) compliance

European Union:

- EN ISO 15875 standards for crosslinked polyethylene systems

- CE marking requirements

- REACH compliance for chemical safety

Asia-Pacific:

- GB/T standards in China

- JIS certification in Japan

- BIS certification in India

Recent geopolitical tensions have created supply chain disruptions, leading manufacturers to adopt strategic approaches:

- Diversification of raw material suppliers

- Establishment of regional production facilities

- Development of local distribution networks

Regulatory compliance costs significantly influence pricing strategies across markets. Manufacturers must balance:

- Testing and certification expenses

- Quality control implementation

- Documentation requirements

- Market-specific packaging and labeling

The emergence of new trade corridors and changing diplomatic relationships continues to reshape market access opportunities. Countries with strong bilateral ties often experience preferential treatment in terms of:

- Reduced import duties

- Streamlined certification processes

- Expedited customs clearance

- Technical cooperation agreements

Understanding PEX Market Segmentation by Type

The PEX market has three different manufacturing processes, each producing pipes with their own unique features and uses. Knowing these differences can help you choose the best option for your specific project needs.

1. PEX-A (Peroxide Method)

PEX-A is made using the peroxide method, which gives it certain advantages:

- Highest flexibility among all PEX types: PEX-A pipes can bend and twist easily without breaking, making them ideal for tight spaces or complex installations.

- Superior resistance to crack propagation: If a small crack does occur in a PEX-A pipe, it is less likely to spread further compared to other types of PEX.

- Enhanced thermal memory for shape restoration: PEX-A has the ability to return to its original shape after being temporarily deformed by heat or pressure.

- Ideal for tight installation spaces: The flexibility of PEX-A allows it to be installed in areas where rigid pipes cannot fit.

- Higher cost due to complex manufacturing process: The peroxide method used to make PEX-A pipes is more complicated and expensive than other methods, which can result in higher prices.

2. PEX-B (Silane Method)

PEX-B is produced using the silane method, which offers its own benefits:

- Balanced cost-to-performance ratio: PEX-B pipes provide good performance at a reasonable price, making them a popular choice for many applications.

- Strong chlorine resistance: These pipes can withstand exposure to chlorine, making them suitable for use in swimming pools or areas with high chlorine levels.

- Excellent resistance to slow crack growth: If a crack develops slowly over time, PEX-B has the ability to resist its growth and prevent leaks.

- Less flexible than PEX-A: While still flexible, PEX-B pipes are not as bendable as PEX-A pipes.

- Most widely used type in residential applications: Due to its balance of cost and performance, PEX-B is commonly used in homes for plumbing installations.

3. PEX-C (Electron Beam Method)

PEX-C is made using the electron beam method, which has its own characteristics:

- Lower production costs: The electron beam method allows for cheaper production of PEX-C pipes compared to other methods.

- Good chemical resistance: These pipes can resist certain chemicals, making them suitable for specific industrial applications.

- Suitable for basic plumbing applications: PEX-C can be used in simple plumbing installations where high performance is not required.

- Reduced flexibility compared to PEX-A and PEX-B: While still somewhat flexible, PEX-C pipes are not as bendable as both types A and B.

- Higher susceptibility to crack propagation: If a crack does occur in a PEX-C pipe, it is more likely to spread further compared to other types.

Impact of Manufacturing Methods on Cross-Linking

The manufacturing method directly affects how much cross-linking occurs in each type of PEX:

- PEX-A: 85% cross-linking

- PEX-B: 65-70% cross-linking

- PEX-C: 70-75% cross-linking

Cross-linking is important because it influences key performance attributes such as thermal stability, chemical resistance, mechanical strength, and long-term durability.

Regional Variations in Market Share Distribution

The market share distribution among these types varies by region and application:

- PEX-B dominates residential plumbing installations due to its optimal balance of cost and performance.

- PEX-A commands premium applications where superior flexibility and strength are essential.

- PEX-C serves price-sensitive markets where basic performance requirements suffice.

Regional Perspectives: Global Insights into the PEX Market

Recent market studies reveal distinct regional preferences and adoption patterns for PEX piping systems across different global markets. The data shows significant variations in how different regions approach PEX implementation and usage.

North American Market Dynamics

- 65% of new residential construction projects in the U.S. and Canada opt for PEX-A type pipes

- Strong preference for American-manufactured PEX products due to strict quality standards

- High adoption rates in cold-weather states for radiant floor heating applications

European Market Characteristics

- German and Nordic markets show a clear preference for PEX-B variants

- UK contractors primarily use PEX in retrofit projects and renovation work

- Eastern European regions demonstrate growing acceptance of PEX-C due to cost advantages

Asia-Pacific Trends

- Chinese market shows rapid adoption of locally manufactured PEX products

- Japanese builders prefer premium PEX-A pipes for high-end residential projects

- Southeast Asian countries focus on PEX applications in commercial buildings

Middle East and Africa

- Gulf states demonstrate increasing PEX usage in new construction developments

- South African market shows preference for PEX in mining and industrial applications

- Growing demand for heat-resistant PEX variants in hot climate regions

Market Share Distribution by Type:

- PEX-A: Dominates Western markets (40% share)

- PEX-B: Leads in European regions (35% share)

- PEX-C: Popular in emerging markets (25% share)

Research indicates that regional preferences are heavily influenced by:

- Local building codes and regulations

- Climate conditions and environmental factors

- Economic considerations and market maturity

- Available technical expertise and installation practices

- Historical experience with traditional piping materials

These regional variations create unique market opportunities for manufacturers who can adapt their products to meet specific local requirements and preferences.

A Closer Look at PEX Market Trends in the U.S.

The U.S. PEX market has great potential for growth, with forecasts suggesting a significant increase in market value beyond 2025. Current analysis shows several key factors driving this growth:

Market Growth Indicators

- Rising residential construction activities in suburban areas

- Increased adoption of smart home plumbing systems

- Growing replacement of aging copper infrastructure

- Surge in sustainable building practices

The U.S. construction sector’s shift toward cost-effective solutions positions PEX as a preferred choice for both new installations and retrofitting projects. Market data indicates a 15% annual growth rate in PEX adoption for residential plumbing applications.

Emerging Technology Integration

- Smart leak detection systems compatible with PEX

- IoT-enabled pressure monitoring devices

- Advanced installation tools reducing labor costs

- Improved fitting technologies enhancing system reliability

U.S. contractors report significant cost savings – up to 30% compared to traditional piping materials. This cost advantage, combined with PEX’s superior performance characteristics, drives increased market penetration across commercial and residential sectors.

Regional Adoption Patterns

- Northeast: High demand for radiant heating systems

- Southwest: Growing use in hot water recirculation

- Midwest: Increased applications in agricultural facilities

- West Coast: Strong preference for eco-friendly plumbing solutions

The market demonstrates particular strength in states with extreme temperature variations, where PEX’s freeze-resistant properties offer significant advantages over traditional piping materials.

Growth and Innovation in Germany's PEX Industry

Germany’s PEX market is known for its strong technological advancement and strict quality standards. Leading manufacturers like Uponor and Rehau have established a strong presence in the region, driving innovation through advanced manufacturing processes and product development.

The German PEX industry stands out for its:

- High-precision manufacturing capabilities

- Advanced R&D facilities focused on material optimization

- Automated production lines enhancing output efficiency

- Strict quality control measures exceeding EU standards

German companies have made significant advancements in PEX technology, such as improving cross-linking methods and enhancing material durability. These innovations have strengthened Germany’s position as a key exporter of PEX products to other European markets and beyond.

The country’s emphasis on sustainable building practices has pushed manufacturers to develop eco-friendly PEX solutions, setting new benchmarks for the global industry.

China's Rapid Expansion in the PEX Market

China’s PEX market is growing rapidly, with annual growth rates exceeding 8% since 2020. The country’s construction boom, especially in smaller cities, is driving up demand for PEX piping systems.

Key Factors Driving Growth in China’s PEX Market:

- Urban development projects in 19 major city areas

- Government programs promoting energy-efficient building solutions

- Increasing use of underfloor heating systems in residential complexes

- Local manufacturers ramping up production to meet domestic demand

In China, there are specific preferences for how PEX is used. While residential plumbing still holds the largest share, industrial applications are also on the rise, particularly in industries like chemical processing and manufacturing.

Market Trends:

- Chinese manufacturers now account for 35% of global PEX production

- Domestic production helps keep prices competitive

- Strict quality control measures are being implemented to meet international standards

Chinese manufacturers are heavily investing in research and development to improve the properties of PEX materials for extreme temperature conditions. These innovations aim to solve specific problems faced by traditional piping systems in areas with severe winters.

The market is also witnessing significant growth in specialized applications such as:

- Smart building infrastructure

- District heating networks

- Agricultural irrigation systems

- Industrial fluid transport

Future Prospects: What's Next for the PEX Market?

The PEX market is expected to see significant technological advancements and market expansions through 2030. Industry experts predict several key developments:

Technological Innovations

- Integration of smart PEX systems with IoT sensors for leak detection

- Development of improved UV-resistant PEX materials

- Implementation of advanced manufacturing processes to reduce production costs

Emerging Applications

- Integration in renewable energy systems

- Expansion into aerospace and automotive industries

- Adoption in medical-grade equipment manufacturing

Market Evolution

- Formation of strategic partnerships between manufacturers and construction firms

- Increased focus on biodegradable additives

- Development of hybrid PEX materials with enhanced properties

The market’s growth potential extends beyond traditional applications, with research indicating new opportunities in:

- Agricultural Sector: Irrigation systems and greenhouse applications

- Chemical Processing: High-performance fluid transport solutions

- Electronics: Cooling system components for data centers

Research institutions are exploring nanotechnology applications in PEX manufacturing, which could potentially revolutionize material properties and performance characteristics. These developments may open up new market segments and applications that were previously unsuitable for PEX materials.

The push toward sustainable building practices is driving innovation in recycling technologies and eco-friendly production methods, positioning PEX as a key player in green construction initiatives.

Competitive Landscape: Leading Players in the PEX Market

- HDC Hyundai EP Company — Seoul, South Korea

- Solvay SA — Brussels, Belgium

- Nouryon Chemicals Holding B.V. — Amsterdam, Netherlands

- Polyrocks Chemical Co., Ltd. — Guangzhou, China

- SACO AEI Polymers — Sheboygan, Wisconsin, USA

- The Dow Chemical Company — Midland, Michigan, USA

- Exxon Mobil Corporation — Irving, Texas, USA

- SILON s.r.o. — Tábor, Czech Republic

- NKT A/S — Brøndby, Denmark

- Uponor Corporation — Vantaa, Finland

- Rehau Industries SE & Co. KG — Rehau, Germany

- Borealis AG — Vienna, Austria

- LyondellBasell Industries N.V. — Rotterdam, Netherlands

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global PEX Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The global PEX market is set to transform significantly by 2033, driven by technological advancements and shifting consumer preferences. The analysis reveals a robust growth trajectory, supported by increased adoption in construction, plumbing, and heating applications.

Key findings indicate that the market will benefit from innovations in manufacturing technologies that enhance product quality and performance. This evolution aligns with the growing demand for sustainable solutions, positioning PEX as a preferred choice among eco-conscious consumers.

Future predictions suggest a dynamic landscape where industry players are likely to capitalize on emerging trends and investment opportunities. As regulatory environments adapt and consumer expectations evolve, the PEX market will continue to offer promising prospects for businesses and investors alike.

Global PEX Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: PEX Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- PEXMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global PEX players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: PEX Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: PEX Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: PEX Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofPEX Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the PEX supply chain and what are its key components?

The PEX supply chain encompasses the entire process from raw material sourcing to end-user delivery. Key components include manufacturing processes, distribution channels, and the roles of various players involved at each stage to ensure a seamless flow of PEX products in the market.

What are the current market trends influencing the PEX industry?

Current market trends in the PEX industry include increased innovation in materials and manufacturing techniques, focusing on sustainability and enhancing performance and durability. These trends are driving the adoption of PEX pipes across various applications, including plumbing systems and industrial uses.

What challenges does the PEX market face regarding raw materials?

The PEX market faces challenges such as fluctuating raw material prices which impact pricing strategies adopted by manufacturers. Additionally, environmental concerns related to plastic waste necessitate responsible end-of-life management practices to mitigate ecological impacts.

How do geopolitical factors influence the global PEX market?

Geopolitical factors, such as trade policies and regional regulations, significantly affect the global PEX landscape. Trade agreements between countries can influence the availability and competitiveness of PEX products in different markets, while government regulations ensure product quality and safety standards.

What are the different types of PEX pipes available in the market?

There are three main types of PEX pipes: PEX-A, PEX-B, and PEX-C. Each type has unique characteristics that cater to various applications within plumbing systems, radiant heating solutions, and industrial processes.

What are some future prospects for growth in the PEX market?

Future prospects for the PEX market include continued growth driven by advancements in plumbing technology and anticipated increases in demand through 2025 and beyond. Regional analyses indicate varying preferences for specific types or brands of piping materials like cross-linked polyethylene (PEX) across different markets.