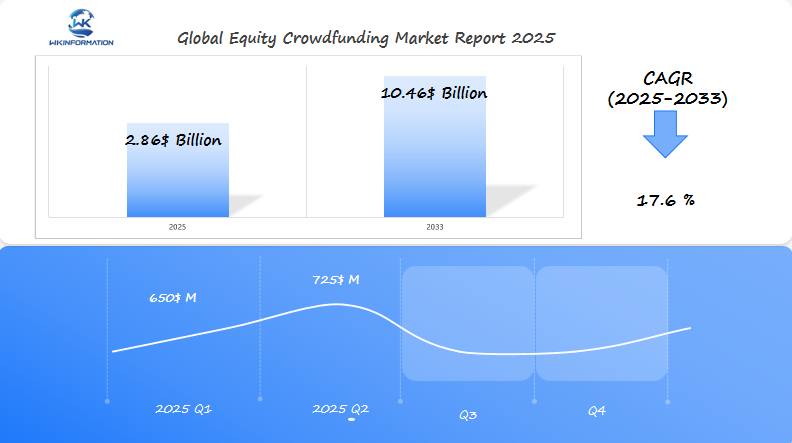

Equity Crowdfunding Market Set to Reach $2.86 Billion by 2025: Growth Prospects in the U.S., U.K., and China

Discover how the Equity Crowdfunding Market is projected to reach $2.86 billion by 2025, with analysis of key growth trends and opportunities across U.S., U.K., and global markets.

- Last Updated:

Equity Crowdfunding Market Forecast for Q1 and Q2 2025

Equity crowdfunding is projected to reach a market size of $2.86 billion in 2025, with a remarkable CAGR of 17.6% through 2033. In Q1 2025, the market is expected to generate approximately $650 million, followed by Q2, which will likely reach $725 million.

The U.S., Brazil, and India are emerging as key players in the equity crowdfunding space, with the U.S. leading in terms of platform sophistication and investor engagement. Brazil and India are rapidly expanding their crowdfunding ecosystems, fueled by growing entrepreneurial activity and a shift towards alternative financing methods. As the regulatory environment continues to evolve and more platforms become available, these countries will remain critical markets for equity crowdfunding growth.

Exploring the Upstream and Downstream Influences on Equity Crowdfunding

Equity crowdfunding is influenced by various factors that impact its growth and effectiveness. These factors can be broadly categorized into two types: upstream influences and downstream influences.

Upstream Influences

Upstream influences are the external factors that set the stage for equity crowdfunding. They include:

- Regulatory frameworks governing investment platforms

- Technological innovations in digital finance

- Emerging financial technologies

- Changes in securities law

These upstream influences play a crucial role in determining the environment in which equity crowdfunding operates. For example, regulatory changes can either promote or hinder the growth of investment platforms, while technological innovations can enhance the efficiency and accessibility of crowdfunding processes.

Downstream Influences

Downstream influences, on the other hand, directly impact how equity crowdfunding functions. They affect investor behavior and startup funding patterns, creating a dynamic ecosystem that constantly evolves. Some key downstream influences include:

- Investor behavior: Understanding how investors make decisions and what factors drive their interest in startups is essential for successful fundraising.

- Startup funding patterns: Analyzing trends in how startups raise funds can provide insights into what types of projects are attracting investment.

- Market accessibility: Examining barriers to entry for both investors and entrepreneurs can help identify opportunities for growth in the crowdfunding space.

These downstream influences shape the interactions between investors and startups within the equity crowdfunding ecosystem. By understanding these dynamics, stakeholders can better navigate the challenges and opportunities presented by this funding model.

“The future of equity crowdfunding depends on understanding and navigating these complex upstream and downstream influences.” – Financial Innovation Research Institute

The Impact of Technology

Technology has changed crowdfunding a lot. Now, digital platforms connect entrepreneurs with investors easily. This breaks down old funding barriers.

| Upstream Influences | Downstream Influences |

| Regulatory Changes | Investor Behavior |

| Technology Innovations | Startup Funding Patterns |

| Financial Policies | Market Accessibility |

To succeed, you need to understand and adapt to these influences. Investors and entrepreneurs must stay up-to-date with market changes. This way, they can make the most of equity crowdfunding.

Key Trends Driving the Growth of Equity Crowdfunding Platforms

The world of equity crowdfunding is changing fast. New market trends are making it easier for people to invest and for businesses to get funding. This shift is thanks to tech innovations that are changing how we invest.

The Role of Digital Tools

Digital tools are key in this growth. They help match investors with the right projects and assess risks better. This makes it easier for new investors to join in and feel more secure.

Here are some examples of digital tools that are contributing to the growth of equity crowdfunding:

- Enhanced digital verification systems

- Improved investor screening mechanisms

- Real-time investment tracking tools

- AI-powered investment recommendation engines

Changing Preferences of Investors

What investors want is also changing. Young people are looking for new ways to invest. They want to see where their money goes and be part of new businesses.

| Investor Age Group | Crowdfunding Platform Engagement | Average Investment Amount |

| 18-34 years | 62% High Engagement | $1,500-$3,000 |

| 35-54 years | 38% Moderate Engagement | $3,500-$5,000 |

| 55+ years | 20% Low Engagement | $500-$1,500 |

Increased Accessibility through Crowdfunding

More people can now invest in things they couldn’t before. This is thanks to crowdfunding. It’s making investment more open to everyone.

Supportive Rules and Regulations

Rules and regulations are also helping crowdfunding grow. They make it safer for investors and help more businesses get funding.

Barriers to Growth in the Equity Crowdfunding Industry

The equity crowdfunding world faces big hurdles that slow its growth. One major challenge is the complex rules that make it hard for more people to join in.

Some big challenges for equity crowdfunding include:

- Stringent regulatory compliance requirements

- Limited investor understanding of alternative investment strategies

- High perceived investment risks

- Complex legal frameworks

Rules from the Securities and Exchange Commission (SEC) are very strict. They make it tough for new platforms to start and for companies to raise money.

Small investors find it hard to use equity crowdfunding sites. Understanding complex investment options needs a lot of financial knowledge and skill in managing risks.

To grow, platform creators must keep finding new ways to make investing easier and clearer. They need to create spaces where more people can invest, not just the few who know the ropes.

Geopolitical Factors Affecting Global Equity Crowdfunding Markets

Global markets are changing fast because of complex geopolitical factors. Equity crowdfunding platforms feel these changes a lot. They are affected by international politics and how they shape investments across borders.

Political decisions can quickly change the investment scene. This is because today’s economies are very connected.

Key geopolitical influences on equity crowdfunding include:

- Regulatory frameworks across different countries

- International trade policy shifts

- Political stability in emerging markets

- Economic sanctions and investment restrictions

Investors face a complex world when they look at investing across borders. Political risk assessment is now key for equity crowdfunding strategies. Places with clear laws and stable governments get more international funding.

“Understanding geopolitical nuances is no longer optional for global investors” – International Investment Strategies Report

The global equity crowdfunding market changes fast with geopolitical shifts. Countries with good investment policies and strong tech infrastructures are becoming top choices for investors. They offer a chance to diversify funding.

Equity Crowdfunding Market Segmentation: Platforms and Funding Types

The world of equity crowdfunding has changed a lot. It now offers many chances for investors and entrepreneurs. Knowing about different platforms and funding types is key to moving through this changing financial world.

Looking at equity crowdfunding shows us several main groups. Each group meets different needs for investment and for starting a business:

- Generalist platforms supporting multiple industry sectors

- Niche platforms focusing on specific industries like technology or healthcare

- Platforms targeting different investment scales

Funding types are also important. They let investors choose how they want to invest:

| Funding Type | Key Characteristics | Investor Appeal |

| Equity Investments | Direct ownership stake in companies | Long-term growth potential |

| Revenue Sharing | Returns based on company’s revenue | Predictable income stream |

| Convertible Notes | Debt converting to equity | Flexible investment option |

Choosing the right crowdfunding platform is important. It lets investors pick what fits their risk level and financial plans. Strategic market segmentation helps both investors and entrepreneurs find the best funding options.

How Applications Are Transforming Equity Crowdfunding

Technology is changing how we invest through crowdfunding. New platforms are adding smart features. These make it easier for users and speed up investment processes.

Today’s crowdfunding apps use the latest tech to solve old problems:

- Artificial intelligence for quick checks on investments

- Blockchain for safe transactions

- Real-time analytics for investors

- Machine learning for risk checks

These apps are getting smarter and easier to use. Investors get detailed insights through simple interfaces. This makes complex financial choices easier.

New tech is making equity crowdfunding better by:

- Lowering costs

- Making things clearer

- Opening up to more investors

- Protecting investors better

Data-driven platforms are making investment more open to everyone. They help startups and small businesses get the capital they need. These tech advances are a big step towards making investments more accessible.

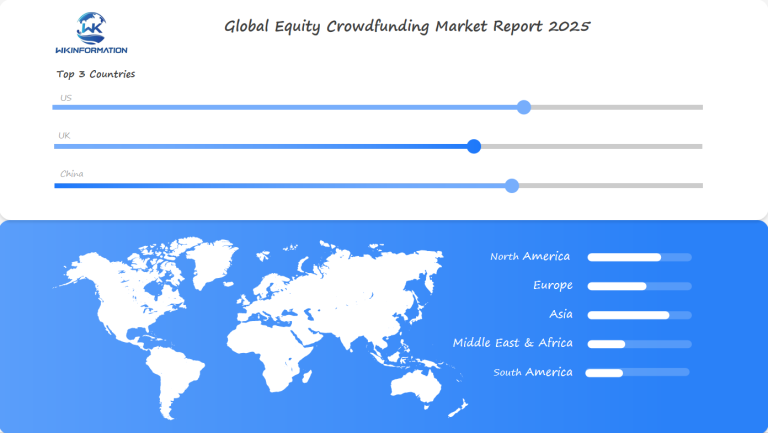

Regional Insights into the Global Equity Crowdfunding Market

The global equity crowdfunding market shows big differences in various regions. Investors and entrepreneurs face unique challenges in each area. These challenges shape how crowdfunding platforms grow around the world.

Regional markets have their own special traits in equity crowdfunding:

- North American platforms have strong tech support

- European markets have forward-thinking rules

- Asian markets are quickly innovating in digital finance

Global trends show big differences in how equity crowdfunding works in different places. The U.S. is ahead with its tech, while Southeast Asia is growing fast.

| Region | Market Maturity | Annual Growth Rate |

| North America | High | 15.2% |

| Europe | Medium-High | 12.7% |

| Asia-Pacific | Emerging | 22.5% |

Culture is key in shaping regional differences. Local views on investing, risk, and tech use greatly affect crowdfunding success. These factors vary greatly across the globe.

Knowing these regional differences helps investors and entrepreneurs better understand the global equity crowdfunding scene. It helps them make smarter choices.

The U.S. Equity Crowdfunding Market: Key Trends and Growth

The U.S. equity crowdfunding market is growing fast. It’s a new way for investors and entrepreneurs to get funding. This growth is thanks to a few big platforms that are making it easier for startups to get money.

Some big changes in the U.S. equity crowdfunding world include:

- Expanded regulatory frameworks supporting small business investments

- Increased digital platform accessibility

- Growing investor confidence in alternative funding models

Platforms like WeFunder and StartEngine are changing the game. They let regular people invest in startups, not just big investors.

| Platform | Total Funds Raised | Average Investment |

| WeFunder | $250 Million | $5,000 |

| StartEngine | $300 Million | $7,500 |

| Republic | $200 Million | $4,500 |

The U.S. market is expected to keep growing. Regulatory changes and technological advancements are making it easier for small businesses to get funding. This is a big deal for startups.

The future of startup financing is being reshaped by equity crowdfunding’s innovative approach to investment.

More investors are seeing the value in these platforms. They offer a chance to support new businesses and diversify their investments.

The U.K.’s Role in Equity Crowdfunding Expansion

The United Kingdom is a global leader in equity crowdfunding. It has expanded the market across Europe. The U.K. stands out for its innovative rules and strong support for new startups.

What makes the U.K. successful in equity crowdfunding includes:

- A forward-thinking regulatory environment managed by the Financial Conduct Authority

- Attractive tax incentives for investors through schemes like SEIS and EIS

- Strong platform screening processes that build investor confidence

Platforms like Crowdcube and Seedrs have changed how startups get funding. They use advanced screening to lower risks. This helps entrepreneurs find new funding options.

The European crowdfunding landscape owes a lot to the U.K. Its approach has made it a key place for startups and investors. The country has become a major player in alternative investments.

The U.K. shows how good rules can unlock huge potential in alternative finance markets.

Even with Brexit, the U.K. remains a leader in equity crowdfunding. It sets high standards for rules and investor protection. Other markets look up to it.

China’s Growing Impact on Equity Crowdfunding Platforms

The Chinese market is a big deal in Asian crowdfunding. It has changed the world of equity crowdfunding. From 2013 to 2015, the market grew fast, from $5.56 billion to $101.7 billion. This shows how much China is influencing the market.

What makes the Chinese equity crowdfunding market stand out includes:

- Over 400 crowdfunding platforms nationwide

- 36% of platforms focus on equity-based investments

- Represents 71% of the alternative financing market in Asia

Platforms like JD Dongjia have done very well. They helped businesses raise $170 million from over 60,000 investors. The Chinese regulatory environment has its own rules for investors. They need to meet certain financial and income standards.

The equity crowdfunding market in China is expected to grow to $2.86 billion by 2025. This shows a lot of potential for growth. Investors need to meet certain criteria, like:

- Institutional entities with net assets over RMB 10 million

- Individual investors with financial assets of RMB 3 million

- Entities capable of investing at least RMB 1 million in a single product

China is becoming a key player in the global equity crowdfunding scene. Its innovative platforms and smart investment strategies are leading to big changes in the market.

Future Prospects for the Equity Crowdfunding Industry

The equity crowdfunding industry is at a turning point. New trends show a big change in how startups and investors get funding. Experts predict big growth as new tech changes the financial world.

Several key developments are expected to drive the industry outlook:

- Advanced AI-powered investment screening platforms

- Enhanced regulatory frameworks supporting investor protection

- Increased integration of blockchain technologies

- Expanded global market accessibility

New tech will make investing easier for everyone. Machine learning algorithms will help figure out risks better. This will make equity crowdfunding more appealing to all kinds of investors.

The future of equity crowdfunding lies in creating transparent, accessible, and intelligent investment ecosystems.

Experts think the industry could grow a lot. Platforms will get better at giving insights, making it easier to start, and offering smart investment plans.

Rules around the world are getting better, seeing the good equity crowdfunding can do. It helps new businesses grow and offers new ways to fund them.

Competitive Dynamics in the Equity Crowdfunding Market

Each platform has its own way of working. Some focus on tech startups, while others look at sustainability and social impact. New players are coming in, offering clear investment options and easier ways for investors and entrepreneurs to get involved.

- WeFunder – USA

- AngelList – USA

- Republic – USA

- StartEngine – USA

- MicroVentures – USA

- Fundable – USA

- EquityNet – USA

- Localstake LLC. – USA

- SeedInvest Technology LLC. – USA

- Crowdfunder – USA

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Equity Crowdfunding Market Report |

| Base Year | 2024 |

| Segment by Type |

· Startups Businesses · Small Businesses · Medium Businesses |

| Segment by Application |

· Cultural Industries · Technology · Healthcare · Others |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The equity crowdfunding landscape is undergoing rapid transformation, reshaping the future of investment and entrepreneurial funding. As we look ahead to 2025, the market is projected to reach $2.86 billion, demonstrating significant growth potential across major markets including the U.S., U.K., and China. This expansion reflects the increasing democratization of investment opportunities and the growing acceptance of alternative funding methods.

The industry’s evolution is driven by technological innovation, regulatory developments, and changing investor preferences. While challenges remain, particularly in regulatory compliance and market stability, the fundamental shift toward more accessible investment platforms continues to gain momentum. The success of equity crowdfunding will largely depend on maintaining a balance between innovation and investor protection, while adapting to regional market dynamics and evolving technological capabilities.

Global Equity Crowdfunding Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Equity Crowdfunding Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Equity Crowdfundingplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Equity Crowdfunding Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Equity Crowdfunding Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Equity Crowdfunding Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofEquity Crowdfunding Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is equity crowdfunding?

Equity crowdfunding allows individuals to invest small amounts of money in startups in exchange for a share of the company. Unlike traditional crowdfunding, where backers only receive rewards or products, equity crowdfunding offers the potential for investors to earn a return on their investment if the company succeeds.

What are the primary types of equity crowdfunding platforms?

There are two main types of equity crowdfunding platforms:

- Generalist platforms: These platforms accept businesses from all sectors and industries, allowing a wide range of companies to seek funding.

- Niche platforms: Unlike generalist platforms, niche platforms focus on specific areas or industries such as technology, healthcare, or renewable energy. These platforms cater to businesses operating within their targeted sector.

What regulatory challenges exist in equity crowdfunding?

There are many challenges:

- Laws and investor protections vary worldwide.

- Disclosure and compliance standards also differ.

How does technology impact equity crowdfunding?

Technology makes equity crowdfunding better. It improves due diligence and screening. It also makes transactions secure and investing easy.

What risks are associated with equity crowdfunding?

There are several risks involved in equity crowdfunding:

- Startups can fail, which means your investment may not generate any returns.

- Investments made through equity crowdfunding may not be easily converted into cash or sold, making them illiquid.

- There is often limited financial information available about the startup, making it difficult to assess its potential for success.

- Investor protections in equity crowdfunding are typically minimal, meaning you have less legal recourse if things go wrong.

Which countries are leading in equity crowdfunding?

The U.S., U.K., and China are at the forefront of equity crowdfunding. These countries have robust regulations and thriving startup ecosystems that foster growth in this industry.

How do investors participate in equity crowdfunding?

Investors sign up on platforms, verify their accounts, and review startups. They can then buy shares with different minimums.

What technological innovations are transforming equity crowdfunding?

Technological innovations such as Blockchain, AI, mobile platforms, and analytics are transforming equity crowdfunding. These technologies enhance security and evaluation processes, making them more efficient and reliable.

How does geopolitical stability affect equity crowdfunding?

Stability boosts investor confidence and . It makes startup ecosystems more attractive.