Packaging Coatings Market Expected to Surpass $5.95 Billion by 2025 Driven by Sustainability Trends in the U.S., Japan, and Italy

Explore the comprehensive analysis of the Global Packaging Coatings Market from 2025-2033, examining emerging trends, market dynamics, and industry developments. This detailed report covers technological advancements in coating solutions, sustainability initiatives, and regional market insights. Learn about key players, growth drivers, and challenges shaping the future of packaging coatings across food & beverage, pharmaceutical, and cosmetic industries.

- Last Updated:

Packaging Coatings Market Outlook for Q1 and Q2 2025

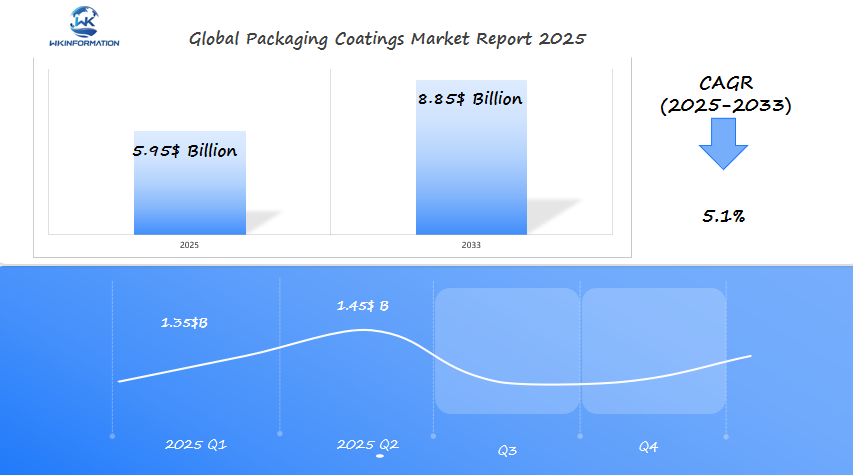

The Packaging Coatings market is expected to reach $5.95 billion in 2025, with a CAGR of 5.1% from 2025 to 2033. In Q1 2025, the market is predicted to grow to approximately $1.35 billion, with steady demand driven by the increasing need for sustainable packaging solutions in industries such as food and beverages, cosmetics, and pharmaceuticals, particularly in the U.S., Japan, and Italy. Rising consumer preference for eco-friendly and biodegradable packaging materials will propel market growth during this period.

By Q2 2025, the market is expected to expand to around $1.45 billion, supported by innovations in coating technologies that offer better protection, gloss, and moisture resistance for packaging materials. In the U.S., food brands will continue to invest in packaging solutions that improve shelf life, while Japan and Italy will focus on enhancing packaging aesthetics with coatings designed for premium products. The push for sustainability in packaging will continue to drive innovations in the market.

Key Takeaways

- The packaging coatings market is driven by sustainability trends.

- The market is projected to surpass $5.95 billion by 2025.

- The U.S. and Japan are leading the way in adopting eco-friendly packaging practices.

- Innovative coatings are being developed to meet the growing demand for sustainable packaging.

- The market size is expected to grow significantly in the coming years.

Understanding the Packaging Coatings Industry Chain: From Raw Materials to Applications

The packaging coatings industry chain is intricate and interconnected, encompassing everything from raw material suppliers to applicators. This industry depends on a wide variety of raw materials such as resins, additives, and pigments, which are obtained from different suppliers.

Packaging Coatings Industry Chain

The packaging coatings industry chain can be broadly categorized into three main segments: upstream, midstream, and downstream.

Upstream Segment

The upstream segment involves the production of raw materials, such as resins and additives, which are used to formulate coatings.

Midstream Segment

The midstream segment includes the manufacturers of packaging coatings, who formulate and produce coatings using the raw materials sourced from upstream suppliers.

Downstream Segment

The downstream segment comprises the applicators of packaging coatings, including coating applicators and packaging manufacturers. These applicators use the coatings produced by midstream manufacturers to coat packaging materials, such as metal, paper, and plastic.

“The packaging coatings industry is a complex and multifaceted industry that requires a deep understanding of the industry chain to navigate successfully.” – Industry Expert

The packaging coatings industry chain is also influenced by various external factors, including regulatory requirements, technological advancements, and changing consumer preferences. For instance, the increasing demand for eco-friendly and sustainable packaging solutions is driving the development of new coatings and technologies.

- Raw material suppliers play a crucial role in the industry chain, providing the necessary inputs for coating production.

- Coating manufacturers formulate and produce coatings using the raw materials sourced from upstream suppliers.

- Applicators of packaging coatings use the coatings produced by midstream manufacturers to coat packaging materials.

Overall, the packaging coatings industry chain is complex and interconnected, involving various stakeholders and influenced by external factors. Understanding the industry chain is essential for navigating the market and identifying opportunities and challenges.

Growing Demand for Eco-Friendly and Functional Coatings in Packaging

The trend towards sustainability is driving the demand for eco-friendly and functional coatings in packaging applications. As consumers become increasingly environmentally conscious, manufacturers are responding by developing coatings that not only reduce environmental impact but also improve packaging performance.

Eco-friendly coatings

Eco-friendly coatings are made from materials that are biodegradable, non-toxic, and free from volatile organic compounds (VOCs). These coatings are designed to replace traditional coatings that have a higher environmental impact.

Benefits of eco-friendly coatings

The benefits of eco-friendly coatings include reduced environmental impact, improved packaging performance, and compliance with regulatory requirements. Eco-friendly coatings can also enhance the overall brand image by demonstrating a commitment to sustainability.

Some of the key benefits of eco-friendly coatings are:

- Reduced VOC emissions

- Biodegradable materials

- Non-toxic and safe for use in food packaging

- Improved packaging performance and durability

As the demand for eco-friendly coatings continues to grow, manufacturers are investing in research and development to improve the performance and sustainability of these coatings. This trend is expected to drive innovation in the packaging coatings industry, leading to the development of more sustainable and functional coatings.

Barriers: Raw Material Volatility and Regulatory Limits

Despite the growing demand for packaging coatings, the industry faces challenges due to fluctuations in raw material prices and regulatory restrictions. The packaging coatings market heavily depends on raw materials like resins, solvents, and additives, which can experience price volatility caused by factors such as geopolitical events, supply chain disruptions, and shifts in global demand.

Raw material volatility

The prices of raw materials can change frequently and this can have a big impact on how much money packaging coatings manufacturers make. When the prices of raw materials go up, manufacturers might find it hard to keep making a profit, which could lead to higher prices for consumers.

To reduce this risk, manufacturers can use different strategies such as:

- Hedging against price fluctuations: This means using financial contracts to protect themselves from price increases.

- Diversifying their supply chain: This involves getting raw materials from different sources instead of relying on just one.

- Investing in research and development: This means spending money to find new types of raw materials that can be used instead of the ones that are becoming expensive.

raw material volatility on packaging coatings can be significant, leading to price increases and potential supply chain disruptions. To address this challenge, manufacturers can consider using alternative raw materials, improving their supply chain management, and developing more efficient production processes. By adopting these strategies, manufacturers can reduce their reliance on volatile raw materials and maintain a stable supply of packaging coatings.

However, regulatory limits also play a crucial role in shaping the packaging coatings market. Stringent regulations on the use of certain chemicals and materials can limit the development and application of packaging coatings. Manufacturers must comply with these regulations, which can be challenging, especially for small and medium-sized enterprises.

Geopolitical developments affecting packaging trade and standards

Geopolitical developments have a profound impact on the packaging coatings market, influencing trade and regulatory standards. The packaging coatings industry is a complex global network, with various stakeholders, including suppliers, manufacturers, and end-users, operating across different regions and countries.

The recent shifts in geopolitical landscape, such as trade agreements and regulatory changes, have significant implications for the packaging coatings market. For instance, the imposition of tariffs on imported coatings can increase the cost of production for manufacturers, making it challenging for them to remain competitive in the market.

Geopolitical developments

Geopolitical developments, such as changes in trade policies and regulatory frameworks, can affect the packaging coatings market in various ways. One of the key ways is by influencing thetrade of packaging coatings. For example, trade agreements between countries can facilitate the exchange of coatings, reducing tariffs and other trade barriers.

Regulatory changes can also impact the packaging coatings market by setting new standards for coatings used in packaging. For instance, regulations aimed at reducing the environmental impact of packaging can drive the demand for eco-friendly coatings.

In addition, geopolitical developments can also influence the packaging standards, which can have a significant impact on the coatings used in packaging. For example, changes in packaging standards can require manufacturers to reformulate their coatings to meet new regulatory requirements.

The impact of geopolitical developments on the packaging coatings market can be seen in various regions, including the United States, where changes in trade policies and regulatory frameworks are affecting the market. Manufacturers and suppliers need to stay informed about these developments to remain competitive.

Understanding the Packaging Coatings Industry

The packaging coatings industry is complex and multifaceted, with various segments such as resin type, coating technology, and finish that need to be analyzed. Understanding these segments is crucial to identifying opportunities and challenges in the market.

Market segmentation

Market segmentation is a critical aspect of understanding the packaging coatings industry. By categorizing the market based on resin type, coating technology, and finish, manufacturers and suppliers can better understand the needs of their customers and tailor their products accordingly.

Resin type segmentation

The packaging coatings market can be segmented based on resin type into several categories, including:

- Epoxy

- Polyurethane

- Acrylic

- Others

Each of these resin types has its own unique characteristics and applications. For instance, epoxy resins are known for their high chemical resistance, while polyurethane resins are valued for their flexibility and abrasion resistance.

The choice of resin type depends on the specific requirements of the packaging application, including the type of product being packaged, the desired finish, and the level of protection required.

Coating technology and finish

Coating technology and finish are also important aspects of market segmentation in the packaging coatings industry. Different coating technologies, such as solvent-based, water-based, and UV-curable coatings, offer varying benefits and drawbacks. Similarly, different finishes, such as glossy, matte, and textured, can be used to achieve specific aesthetic and functional effects.

Application sectors such as food, beverage, pharmaceuticals, and cosmetics

Packaging coatings are essential in various application sectors, including food, beverage, pharmaceutical, and cosmetic packaging. They offer both practical and visual advantages. The different needs of these industries create a demand for specialized coatings that fulfill specific requirements like barrier properties, corrosion resistance, and visual attractiveness.

Application sectors

The packaging coatings market is driven by the needs of different application sectors. Food packaging requires coatings that ensure safety, freshness, and flavor preservation. For instance, coatings used in food packaging must comply with food safety regulations and provide a barrier against moisture, oxygen, and other contaminants.

Beverage packaging also demands specialized coatings that can withstand the rigors of packaging liquids, including carbonated beverages and other drinks. These coatings must be resistant to corrosion and provide a barrier against flavor and aroma loss.

Food and beverage applications

In the food and beverage sectors, packaging coatings are used to enhance the appearance, safety, and shelf life of products. For example, coatings used in food cans must be resistant to corrosion and provide a safe and healthy packaging solution. Similarly, coatings used in beverage packaging must be able to withstand the rigors of packaging liquids.

The use of packaging coatings in these sectors is driven by the need for safe, functional, and attractive packaging solutions. As the demand for packaged food and beverages continues to grow, the importance of specialized coatings will only continue to increase.

In addition to food and beverage packaging, pharmaceutical packaging and cosmetics packaging also require specialized coatings that meet specific regulatory and functional requirements. For instance, coatings used in pharmaceutical packaging must comply with strict regulations and provide a barrier against contamination and degradation.

Global demand outlook and packaging shifts by region

Regional trends and shifts in packaging preferences significantly influence the global demand for packaging coatings.

The global demand outlook for packaging coatings is shaped by various regional factors, including economic growth, consumer behavior, and regulatory environments. In regions with high economic growth, such as Asia-Pacific, the demand for packaging coatings is increasing due to the expanding middle-class population and rising consumption of packaged goods.

Global demand outlook

The global demand for packaging coatings is expected to grow steadily, driven by the increasing demand for packaged goods, particularly in the food and beverage sector. The trend towards sustainable and eco-friendly packaging is also driving the demand for specialized coatings that can provide barrier properties, improve printability, and enhance the overall appearance of packaging materials.

| Region | Demand Growth Rate | Key Drivers |

| Asia-Pacific | 6% | Economic growth, increasing middle-class population |

| North America | 4% | Sustainable packaging trends, regulatory environments |

| Europe | 5% | Regulatory environments, consumer awareness |

The regional demand for packaging coatings varies significantly, with some regions experiencing higher growth rates than others. Understanding these regional trends and shifts in packaging preferences is crucial for manufacturers and suppliers to identify opportunities and challenges in the market.

U.S. Innovation in Barrier Coatings and Recyclability Focus

The U.S. is leading the way in creating sustainable packaging solutions due to consumer demands and government regulations. There is a lot of new development happening in the packaging coatings industry in the U.S., especially when it comes to barrier coatings and making products recyclable.

U.S. innovation

The U.S. packaging coatings market is driven by a strong focus on innovation, with companies investing heavily in research and development to create sustainable packaging solutions. play a crucial role in this innovation, providing a critical layer of protection for packaged goods while also ensuring compliance with increasingly stringent regulations.

Barrier coatings innovation

Innovation in barrier coatings is a key area of focus for the U.S. packaging coatings market. These coatings are designed to provide a barrier against moisture, oxygen, and other external factors that can affect the quality and shelf life of packaged goods. Advanced technologies are being developed to create more effective and sustainable barrier coatings that meet the evolving needs of the packaging industry.

As stated by a leading expert, “The development of new barrier coatings is crucial for the packaging industry, as it enables the creation of more sustainable and effective packaging solutions.”

The future of packaging coatings lies in the development of innovative, sustainable, and recyclable solutions that meet the needs of both consumers and regulatory bodies.

The U.S. packaging coatings market is expected to continue its growth trajectory, driven by increasing demand for sustainable packaging solutions and ongoing innovation in barrier coatings and recyclability.

Japan’s advanced packaging tech fueling coating demand

The integration of advanced packaging technologies in Japan is significantly boosting the demand for specialized coatings. Japan is renowned for its innovative packaging solutions, which are increasingly incorporating cutting-edge technologies such as nanotechnology and smart packaging.

These advanced packaging technologies require coatings that not only provide functional benefits but also meet stringent regulatory standards. As a result, the demand for coatings that can be used in conjunction with these technologies is on the rise.

Japan’s advanced packaging tech

One of the key drivers of coating demand in Japan is the growing use of nanotechnology in packaging. Nanotechnology enables the creation of packaging materials with enhanced barrier properties, improved durability, and increased sustainability.

Key applications of nanotechnology in packaging include:

- Improved barrier properties to prevent moisture and gas transmission

- Enhanced durability through the use of nano-reinforced materials

- Increased sustainability through the use of biodegradable nanomaterials

The use of smart packaging is another significant trend in Japan, driving demand for coatings that can be integrated with electronic components and sensors. These coatings must be highly specialized to meet the requirements of smart packaging applications.

Some of the key requirements for coatings in smart packaging include:

- High conductivity and electrical properties

- Compatibility with electronic components and sensors

- Flexibility and conformability to various substrate materials

Japan’s advanced packaging technologies are fueling a significant increase in coating demand, driven by the growing use of nanotechnology and smart packaging. As these technologies continue to evolve, the demand for specialized coatings is expected to remain strong.

Italy’s Premium Packaging Market and Coating Integration

The Italian premium packaging market is driven by a strong demand for luxury packaging solutions that require advanced coating integration. Italy is renowned for its premium packaging market, with a strong focus on luxury packaging and coating integration.

Italy’s premium packaging market

The demand for high-quality packaging coatings is driven by the need for premium packaging solutions. Italian manufacturers are increasingly adopting advanced coating technologies to meet the growing demand for luxury packaging.

Luxury packaging in Italy is characterized by high-end finishes, premium materials, and sophisticated designs. To achieve these high-end finishes, manufacturers rely on advanced coating integration techniques, including specialty coatings and high-gloss finishes.

The Italian premium packaging market is expected to continue growing, driven by the increasing demand for luxury packaging solutions. As a result, manufacturers will need to continue innovating and adopting new coating technologies to meet the evolving needs of the market.

Some of the key trends driving the growth of Italy’s premium packaging market include:

- Increasing demand for sustainable and eco-friendly packaging solutions

- Growing popularity of premium packaging materials, such as glass and luxury paper

- Rising demand for advanced coating technologies, including nanotechnology and smart coatings

To remain competitive in this market, manufacturers will need to focus on developing innovative coating solutions that meet the evolving needs of luxury packaging.

Innovation trends in bio-based and smart packaging coatings

The packaging coatings industry is about to undergo a transformation, driven by emerging trends in bio-based and smart coatings. As consumers increasingly demand sustainable and functional packaging solutions, manufacturers are responding with innovative products that not only meet but exceed these expectations.

Bio-Based Coatings Innovation

Innovation Trends

Bio-based coatings are gaining traction as a sustainable alternative to traditional coatings. These coatings are derived from renewable resources such as plants, algae, or microorganisms, reducing the industry’s reliance on fossil fuels and minimizing environmental impact.

Bio-Based Coatings Innovation

The development of bio-based coatings involves the use of various raw materials, including polylactic acid (PLA), polyhydroxyalkanoates (PHA), and cellulose-based coatings. These materials offer a range of benefits, including biodegradability, compostability, and improved barrier properties.

For instance, PLA-based coatings are being used in food packaging applications due to their excellent barrier properties and compostability.

| Raw Material | Benefits | Applications |

| Polylactic Acid (PLA) | Biodegradable, Compostable | Food Packaging |

| Polyhydroxyalkanoates (PHA) | Biodegradable, Biocompatible | Medical Devices, Packaging |

| Cellulose-Based Coatings | Renewable, Biodegradable | Paper Coatings, Packaging |

Smart Packaging Coatings

Smart packaging coatings are another emerging trend in the industry, offering enhanced functionality and consumer engagement. These coatings can be designed to provide specific benefits, such as improved barrier properties, antimicrobial activity, or temperature control.

For example, smart packaging coatings can be used to create packaging that changes color or displays information when a product is spoiled or has been tampered with. This not only enhances consumer safety but also provides a unique brand experience.

Competitive analysis in the global Packaging Coatings market

- Akzo Nobel NV — Amsterdam, Netherlands

- PPG Industries — Pittsburgh, USA

- The Sherwin-Williams Company — Cleveland, USA

- Kansai Paint Co. Ltd — Osaka, Japan

- Axalta Coating Systems — Philadelphia, USA

- ALTANA — Wesel, Germany

- BASF SE — Ludwigshafen, Germany

- Hempel A/S — Copenhagen, Denmark

- Henkel Corporation — Düsseldorf, Germany

- RPM International Inc. — Medina, USA

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Packaging Coatings Market Report |

| Base Year | 2024 |

| Segment by Type | · Waterborne Coatings

· Powder Coatings · UV-Cured Coatings · Acrylic Coating · Others |

| Segment by Application | · Food and Beverage Packaging

· Pharmaceuticals · Cosmetics · Others |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The packaging coatings market is expected to experience significant growth, driven by sustainability trends and increasing demand for eco-friendly and functional coatings. As geopolitical developments, raw material volatility, and regulatory limits continue to influence the market, key regions such as the U.S., Japan, and Italy are emerging as significant players.

A comprehensive packaging coatings market overview reveals a complex landscape shaped by innovation trends in bio-based and smart packaging coatings. The competitive analysis highlights the importance of market segmentation by resin type, coating technology, and finish, as well as application sectors such as food, beverage, pharmaceuticals, and cosmetics.

In summary, the packaging coatings market summary indicates a promising future, with a growing demand for sustainable and innovative coatings. As the market continues to evolve, it is essential to monitor global demand outlook and packaging shifts by region to stay ahead of the curve.

Global Packaging Coatings Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Packaging Coatings Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Packaging CoatingsMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Packaging Coatingsplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Packaging Coatings Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Packaging Coatings Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Packaging Coatings Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofPackaging Coatings Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the expected growth of the packaging coatings market by 2025?

The packaging coatings market is expected to surpass $5.95 billion by 2025, driven by sustainability trends in the U.S., Japan, and other regions.

What are the key drivers of the packaging coatings market?

The key drivers of the packaging coatings market include the increasing demand for sustainable packaging solutions, eco-friendly coatings, and functional coatings.

What are the challenges faced by the packaging coatings industry?

The packaging coatings industry faces challenges such as raw material volatility, regulatory limits, and geopolitical developments that can impact the trade of packaging coatings.

How is the packaging coatings market segmented?

The packaging coatings market can be segmented based on:

- Resin type

- Coating technology

- Finish

It can also be segmented by application sectors such as:

- Food

- Beverage

- Pharmaceuticals

- Cosmetics

What are the current innovation trends in the packaging coatings market?

The packaging coatings market is experiencing significant innovation trends, such as the development of bio-based and smart packaging coatings, improvements in barrier coatings, and increased focus on recyclability.

What is the competitive landscape of the global packaging coatings market?

The global packaging coatings market is highly competitive, with several key players competing for market share, and is influenced by factors such as geopolitical developments and regulatory changes.

Which regions are driving demand for packaging coatings?

Regions such as the U.S., Japan, and Italy are driving demand for packaging coatings, with a focus on sustainability, innovation, and premium packaging.

How do geopolitical developments affect the packaging coatings market?

Geopolitical developments, such as trade agreements and regulatory changes, can significantly impact the packaging coatings market, influencing trade and packaging standards.

What are the benefits of eco-friendly coatings in packaging?

Eco-friendly coatings offer several benefits, including reduced environmental impact and improved packaging performance, making them an attractive option for consumers and manufacturers.