26

Digital Banking Market to Reach $8.12 Billion by 2025 Driven by Fintech Innovations in the U.S., India, and Germany

Explore the rapidly expanding Digital Banking Market, projected to hit $8.12 billion by 2025, as fintech innovations reshape financial services across the U.S. and global markets.

- Last Updated:

Digital Banking Market Outlook for Q1 and Q2 2025

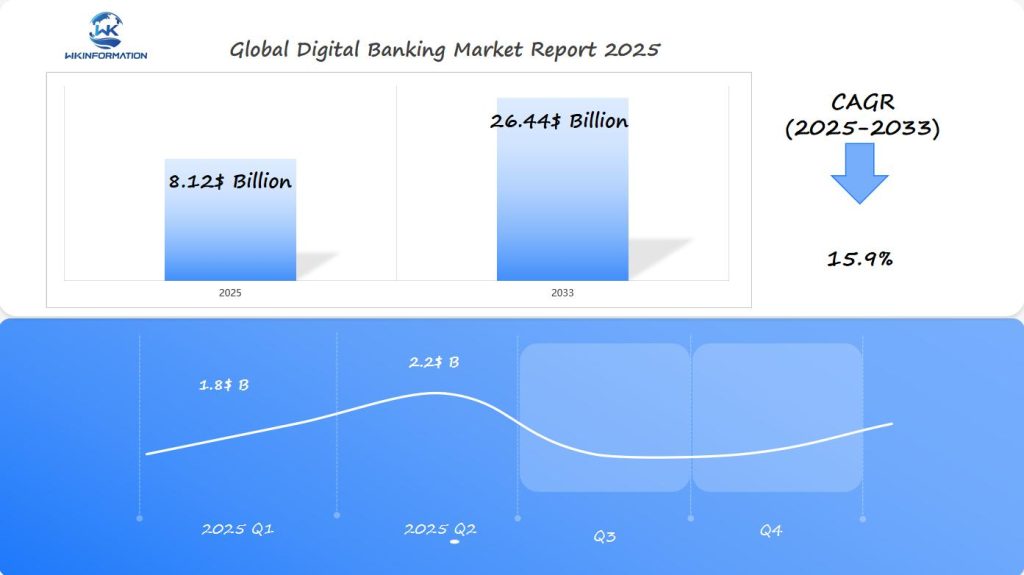

The Digital Banking market is expected to reach $8.12 billion in 2025, with a CAGR of 15.9% from 2025 to 2033. In Q1 2025, the market will likely experience steady growth, reaching around $1.8 billion. As digital banking services gain momentum in the U.S., India, and Germany, demand for mobile banking solutions, payment systems, and digital wallets will gradually rise in the first quarter.

By Q2 2025, the market is projected to grow to approximately $2.2 billion, driven by expanding adoption of digital banking services, particularly in India, where mobile-first banking solutions are becoming increasingly mainstream. The U.S. and Germany will continue to lead in digital banking infrastructure, with increased consumer reliance on online financial services during this period.

Key Takeaways

- Digital banking market expected to reach $8.12 billion by 2025

- Fintech innovations driving substantial market transformation

- 15.9% compound annual growth rate indicates strong market potential

- U.S., India, and Germany emerge as primary digital banking innovation hubs

- Consumer demand for mobile-first banking experiences accelerates market expansion

Tracking upstream and downstream shifts in the Digital Banking market

The digital banking world is seeing big changes. New tech is changing how banks work online. This includes better data analysis, AI, and cloud computing.

These changes are making banking better and safer. They help banks serve customers in new ways.

Upstream Shifts

These are the changes happening in the tech world that directly impact banks:

- AI-driven Analytics: Banks are using artificial intelligence to analyze customer data and make better decisions.

- Cloud Computing: Banks are moving their operations to the cloud for more flexibility and scalability.

- Blockchain Technology: Banks are exploring blockchain for secure and transparent transactions.

Downstream Impact

These are the effects of upstream shifts on banks and customers:

- Personalized Financial Services: With better data analysis, banks can offer tailored financial solutions to their customers.

- Scalable Banking Platforms: Cloud computing allows banks to easily scale their services as per demand.

- Enhanced Transaction Security: Blockchain technology promises improved security for transactions, reducing fraud risks.

The digital banking market is expected to grow to $26.44 billion by 2033. This shows how big the impact of these changes is. It’s changing the way we think about banking.

“Technology is not just changing banking; it’s reimagining financial interactions.” – Financial Innovation Quarterly

Current trends shaping the future of Digital Banking

The world of digital banking is changing fast. New technology and customer preferences are driving these changes. Banks are finding new ways to stay ahead and serve their customers better.

Data-Driven Decision-Making in Banking

Data-driven banking is key for banks to improve customer service and run better. They use advanced analytics and AI to understand customers better. This helps them offer services that fit each customer’s needs.

- Real-time customer behavior analysis

- Predictive risk management

- Personalized financial recommendations

Remote and Digital Onboarding Processes

More people are opening bank accounts online. Digital banking trends show a big drop in paperwork. This makes it easier and faster for customers to start using banking services.

| Onboarding Feature | Traditional Method | Digital Method |

| Account Opening Time | 5-7 days | 15-30 minutes |

| Document Verification | Manual processing | AI-powered instant verification |

Sustainability and Green Banking Initiatives

Green banking is a big trend now. Banks are focusing on being eco-friendly. They offer green products and invest in green tech to attract customers who care about the planet.

- Carbon-neutral banking services

- Sustainable investment portfolios

- Digital platforms reducing paper consumption

These trends show banks are all about innovation, serving customers, and caring for the environment.

Limitations and risks facing the Digital Banking market

The digital banking world is full of challenges. Cybersecurity risks are a big threat to it. Hackers keep finding new ways to get into financial systems and steal customer data.

Digital banking risks come from many places. Banks struggle to keep their systems safe while still making things easy for customers.

- Sophisticated cyber attack techniques targeting financial platforms

- Complex regulatory compliance requirements across different jurisdictions

- Potential vulnerabilities in digital transaction networks

- Customer data protection challenges

Keeping up with regulations is another big worry for digital banks. They need to find ways to follow the law and protect their customers.

| Risk Category | Potential Impact | Mitigation Strategy |

| Cybersecurity Threats | Data breaches, financial loss | Advanced encryption, multi-factor authentication |

| Regulatory Non-Compliance | Financial penalties, reputation damage | Continuous monitoring, legal expertise |

| Technological Disruptions | Service interruptions | Robust infrastructure, backup systems |

Digital banking is always changing. Banks need to keep up with new tech and stay ahead of risks. They must invest in the latest security and risk management to keep customers’ trust.

The future of digital banking depends on balancing innovation with comprehensive security frameworks.

New tech like AI and blockchain could help solve digital banking problems. They can make systems safer and help banks follow the law better.

Impact of geopolitical events on Digital Banking expansion

The global banking world is changing fast because of complex political issues. Digital banking faces big challenges from these issues. They change how money moves across borders and how banks plan their finances.

Key geopolitical factors affecting digital banking include:

- Economic sanctions that mess up old financial systems

- Trade wars between big countries

- Stability problems in new markets

- Changes in rules for global money moves

Financial companies are finding new ways to deal with these risks. Blockchain technology and digital money are seen as ways to keep transactions safe during uncertain times.

Digital banking is putting money into tech that can keep up with fast-changing global economies. This helps them stay strong and find new chances in tough markets.

The future of digital banking depends on its ability to navigate complex geopolitical terrains with technological agility and strategic foresight.

To tackle these challenges, digital banking is focusing on strong security, flexible money moves, and quick risk management. These steps help them stay ready for any changes in the global scene.

Analysis of Digital Banking market by product type

The digital banking world is always changing, bringing new ways to improve financial services. Digital banking products are key for both corporate and retail banking. They change how banks talk to their customers.

Financial companies are putting more money into digital banking products. These products meet specific market needs. They are changing how banking services are given and used.

Corporate Banking Platforms: Strategic Digital Solutions

Corporate banking platforms have changed how businesses handle their money. They offer:

- Real-time financial reports

- Advanced security

- Integrated cash management

- Customizable dashboards

“Digital transformation in corporate banking is not just about technology, but about creating value-driven experiences for business clients.” – Financial Technology Insights

Retail Banking Solutions: Personalized Digital Experiences

Retail banking solutions aim to make banking easy for everyone. They provide:

- Mobile deposit

- Instant transfers

- Personalized financial insights

- Enhanced security

The mix of corporate and retail banking shows how fast digital banking is growing. Financial institutions are blending tech with customer focus to meet different needs.

Application-based insights in the Digital Banking market

The digital banking world is changing fast. Online banking apps and mobile platforms are changing how we deal with money. These tools make managing money easy and accessible.

Financial companies are spending a lot on digital apps. They want to meet customer needs better. Now, people want banking that’s easy and does lots of things at once.

Online Banking Applications

Online banking apps have changed banking forever. They offer:

- 24/7 account access

- Real-time transaction monitoring

- Instant fund transfers

- Comprehensive financial dashboards

Mobile Banking Platforms

Mobile banking is where it’s at for digital users. It comes with:

- Biometric authentication

- Mobile check deposit

- Personalized financial insights

- Integrated payment solutions

| Feature Category | Online Banking Apps | Mobile Banking Platforms |

| User Authentication | Password-based | Biometric/Multi-factor |

| Transaction Speed | Standard | Instant |

| Accessibility | Desktop/Web | Smartphone/Tablet |

Digital banking apps keep getting better. They’re raising the bar for how we experience banking online.

How regions compare in the global Digital Banking market

The world of digital banking is changing fast. North America leads the way, thanks to its strong tech and quick adoption of new banking ideas.

But, emerging markets like Asia-Pacific are catching up quickly. They’re growing fast because of new tech and more people using smartphones.

- North America: Market leadership in digital banking platforms

- Asia-Pacific: Fastest growth potential

- Europe: Stringent regulatory framework supporting digital innovation

Each region has its own way of doing digital banking:

| Region | Market Maturity | Key Growth Drivers |

| North America | Highly Advanced | Technology innovation, consumer demand |

| Asia-Pacific | Rapid Development | Smartphone adoption, young population |

| Europe | Regulated Growth | Fintech investments, open banking regulations |

Every region has its own strengths in digital banking. Technological readiness and regulatory environments are key to success.

Digital banking is not just a trend, but a fundamental transformation of financial services across global markets.

U.S. Digital Banking adoption and infrastructure

The U.S. digital banking world has changed a lot in recent years. Banks and fintech companies are using new tech to change how we manage money. Digital banking platforms are getting better, making it easier for people to use their money online.

Some big changes in U.S. digital banking are:

- Rapid growth of mobile banking apps

- Better security to protect online money

- Tools that help you manage your money better

- Using artificial intelligence to improve services

The use of banking tech has grown fast. Big banks are spending a lot on digital stuff, making online banking smooth for everyone. Now, people want to do things online fast, like see their money right away and know it’s safe.

Rules have helped the fintech world grow. Open banking lets developers make new financial services. Small and medium-sized banks are really benefiting from these new tech tools.

More people are using digital banking, no matter their age. Young people are especially into mobile banking, pushing for more tech in finance.

India’s growing presence in the Digital Banking landscape

The Indian digital banking world is changing fast. It’s becoming a top player in financial tech. This growth is thanks to new tech and government support.

Several things are making Indian digital banking strong:

- Rapid smartphone penetration

- Increasing internet accessibility

- Government’s Digital India initiative

- Young, tech-savvy population

Getting more people to use banking services is a big goal. Now, people in rural areas can use mobile apps and digital platforms to access banking.

The India Brand Equity Foundation says something big is coming.

“Digital banking is not just a technology trend in India, but a powerful tool for economic empowerment.” – Financial Experts

Both private and public money is going into digital banking. This is making a strong base for new ideas. New tech like AI, blockchain, and machine learning are making banks better.

Germany’s strategic role in the Digital Banking market

Germany is a leader in the European fintech scene, pushing digital banking forward. Its strong financial system puts it at the top of banking innovation. This makes it a great place for new tech to grow.

Reasons Why German Digital Banking Stands Out

German digital banking stands out for several reasons:

- It has smart rules that help tech grow.

- It invests in the latest financial tech.

- It focuses on safe and clear digital banking.

Germany’s banks and fintech companies work together to make next-generation banking solutions. They aim to meet the high demands of today’s customers with their digital platforms.

Factors Contributing to Germany’s Digital Banking Success

What makes Germany’s digital banking successful includes:

- It has top-notch security for online banking.

- It gets a lot of investment from venture capital in fintech.

- Its people are very good at using digital tools.

“Germany represents the gold standard for digital banking innovation in Europe” – Financial Technology Review

Investors from around the world see Germany’s value as a fintech hub. Berlin is especially popular for digital banking startups. Germany’s mix of tech know-how, support from rules, and a spirit of entrepreneurship makes it key in the digital banking world.

Projected growth paths and new technologies in Digital Banking

The world of digital banking is changing fast, thanks to new banking tech trends. Banks are quickly adopting new solutions to make things easier and better for customers. AI in banking is a big part of this change.

Key areas of change

New tech is making big changes in the banking world. Here are some key areas:

- Advanced AI-powered fraud detection systems

- Personalized financial recommendation engines

- Blockchain applications for secure transactions

- Biometric authentication technologies

The role of machine learning

Machine learning is helping banks get better at spotting risks. These smart systems can look at lots of data quickly. They give banks deep insights into what customers might do next and what risks they might face.

| Technology | Primary Application | Potential Impact |

| AI | Customer Service | 24/7 Personalized Support |

| Blockchain | Cross-Border Transactions | Reduced Costs & Increased Security |

| IoT | Financial Monitoring | Real-Time Data Analysis |

Blockchain applications are very promising. They make financial transactions more open and safe. The way blockchain works helps stop fraud and makes complex financial tasks easier.

“The future of banking lies in seamless, intelligent technologies that anticipate customer needs,” says a leading financial technology expert.

As digital banking keeps growing, banks need to stay quick and creative. Using the latest tech is key to meeting the needs of today’s customers.

Competitive dynamics in the Digital Banking market

The digital banking world is changing fast. New fintech startups and big players are leading the way. Old banks are facing big challenges as new tech changes the game.

Big names in digital banking are using smart strategies to stay ahead:

• Mambu – Germany

• ebankIT – Portugal

• nCino – United States

• Q2 Digital Banking Platform – United States

• Backbase – Netherlands

• EdgeVerve (an Infosys company) – India

• CR2 – Ireland

• Finastra – United Kingdom

• NETinfo – Cyprus

• Alkami – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Digital Banking Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The future of digital banking is bright, with big growth expected. The market is set to reach $26.44 billion by 2033, growing at 15.9% each year. Banks are quickly adopting new tech to meet customer needs and improve services.

But, there are big challenges like keeping data safe, following rules, and integrating new tech. Banks like JPMorgan Chase and Wells Fargo are spending a lot on digital upgrades. They want to stay ahead in a market moving fast towards better, safer banking.

Across the globe, digital banking strategies are changing. Banks are making mobile banking easier, safer, and faster. The US is leading in innovation, with fintech and big banks working together to create new banking solutions.

In the future, digital banking will be how most people manage their money. New tech, changing what people want, and more people using digital tools will lead to big growth. Banks that adapt well will be at the forefront of this digital change.

Global Digital Banking Market Report(Can Read by Free sample)–Table of Contents

Chapter 1:Digital Banking Market Analysis Overview

- Competitive Forces Analysis(Porter’s Five Forces)

- Strategic Growth Assessment(Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Digital Banking Market Segmentation Overview

Chapter 2:Competitive Landscape

- GlobalDigital Banking Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3:Digital Banking Market Segmentation Analysis

- Key Data and Visual Insights

- Trends,Growth Rates,and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4:Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic,Demographic,and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5:Digital Banking Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends,Challenges,and Opportunities

Chapter 6:Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7:Digital Banking Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8:Key Findings and Recommendations

- Summary of Digital Banking Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is driving the growth of the digital banking market?

The digital banking market is growing fast. This is because more people use the internet and mobile devices. Also, customers want better services, and new tech and rules are helping.

Key factors include:

- The rise of fintech companies

- Improved customer experiences

- Increased availability of digital tools

These trends are particularly evident in countries like the U.S., India, and Germany.

How are digital banking platforms addressing cybersecurity concerns?

Banks are taking strong security measures to protect their customers’ data. Here are some ways they are doing it:

- Advanced encryption: Banks use advanced encryption techniques to secure customer information and transactions, making it difficult for unauthorized individuals to access the data.

- Multi-factor authentication: To ensure that only authorized users can access their accounts, banks implement multi-factor authentication. This adds an extra layer of security by requiring users to provide additional verification, such as a unique code sent to their mobile device.

- Fraud detection systems: Banks have systems in place to quickly detect and respond to fraudulent activities. These systems monitor transactions in real-time and flag any suspicious behavior for further investigation.

- Artificial intelligence (AI) for threat monitoring: Banks leverage AI technology to continuously monitor their systems for potential threats. AI algorithms can analyze large amounts of data and identify patterns that may indicate fraudulent activities or cyber attacks.

In addition to these measures, banks understand the importance of staying updated with the latest cybersecurity practices. They regularly review and upgrade their security protocols to stay one step ahead of cyber threats.

By implementing these security measures and staying proactive in their approach, banks aim to protect customer data and maintain trust in their digital banking services.

What role do mobile banking applications play in digital banking?

Mobile banking apps are very important. They offer easy-to-use interfaces and let users do transactions anytime. They also have tools for managing money and keeping customers engaged.

These apps make banking easy and convenient. Users can manage their finances and make transactions right from their phones.

How is digital banking contributing to financial inclusion?

Digital banking is making banking more accessible. It offers affordable banking options and makes it easy to open accounts. It’s especially helping in places like India.

It’s bringing banking to rural areas and helping people who didn’t have access before.

What emerging technologies are transforming digital banking?

New technologies such as AI and blockchain are revolutionizing the banking industry. AI enables personalized recommendations and fraud detection, while blockchain ensures secure transactions across borders.

Other innovations like biometric authentication, voice banking, and the Internet of Things (IoT) are also enhancing the banking experience. These technologies are reshaping both the functionality and perception of banking services.

How are geopolitical events impacting digital banking?

Global events are affecting digital banking. They make cross-border transactions harder and require adapting to sanctions. They also lead to the creation of digital currencies.

Banks are using technology to handle these challenges. They’re making banking more stable and secure worldwide.

What is the projected market size for digital banking?

The digital banking market is expected to grow significantly. It will increase from $8.12 billion in 2025 to $26.44 billion by 2033, with a growth rate of 15.9%.

This growth can be attributed to factors such as new technology, changes in banking habits, and a larger population embracing digital services.

How are traditional banks responding to digital banking innovations?

Traditional banks are partnering with fintech companies and investing in digital tools. They are also creating their own digital platforms and adopting new technologies. The goal is to provide seamless digital experiences in order to stay competitive.

What are the key differences between corporate and retail digital banking?

Corporate banking has more features for businesses. It includes treasury management and advanced reporting. Retail banking focuses on personal finance and mobile services.

How is sustainability impacting digital banking?

Banks are adding green banking options. They offer sustainable investments and track carbon footprints. They’re also creating eco-friendly digital solutions, such as the ones illustrated in this image.

This meets the growing demand for eco-friendly banking services.