Rotomolding Market Predicted to Exceed $5.56 Billion by 2025 Backed by Durable Plastics Demand in the U.S., Brazil, and South Korea

Discover the latest trends, market dynamics, and comprehensive industry analysis of the Global Rotomolding Market (2025-2033). This detailed report examines technological innovations, sustainability initiatives, and regional growth patterns in the rotomolding sector. Learn about key players, market segmentation, and future opportunities in this evolving industry landscape. With insights into growth drivers, digital transformation, and competitive strategies, this analysis provides valuable information for stakeholders in the rotomolding market.

- Last Updated:

Rotomolding Market Outlook for Q1 and Q2 2025

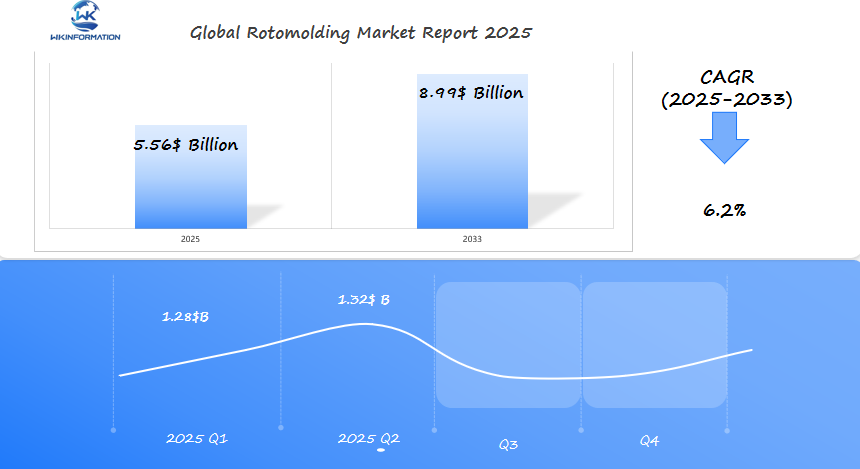

The Rotomolding market is projected to reach $5.56 billion in 2025, with a CAGR of 6.2% from 2025 to 2033. In Q1 2025, the market is expected to be valued at approximately $1.28 billion, driven by the need for lightweight, durable plastic products across industries such as automotive, consumer goods, and industrial applications, particularly in the U.S., Brazil, and South Korea. Rotomolding’s ability to produce complex shapes at relatively low cost will continue to make it an attractive manufacturing solution in these markets.

By Q2 2025, the market is anticipated to grow to around $1.32 billion, with a steady increase in demand for rotomolded products like storage tanks, plastic containers, and automotive parts. The U.S. will remain a strong market due to its diversified industrial base, while Brazil’s growing manufacturing sector and South Korea’s technological advancements in automotive and electronics will further contribute to market expansion. The trend towards sustainability and the use of recyclable materials in rotomolded products will also be a key driver.

Key Takeaways

- The Rotomolding Market is expected to exceed $5.56 billion by 2025.

- Durable Plastics Demand is driving the growth of the industry.

- The U.S. and Brazil are key contributors to this growth.

- The industry is witnessing significant advancements and innovations.

- The demand for durable plastics is expected to continue rising.

Understanding the Rotomolding Industry Chain

Understanding the rotomolding industry chain is crucial for stakeholders to navigate the market effectively. The rotomolding industry encompasses a broad range of processes, from the supply of raw polymers to the manufacturing of end-use products.

Raw Polymers and Material Supply

The rotomolding process begins with the supply of raw polymers, which are crucial for determining the quality and characteristics of the final product. Polyethylene is one of the most commonly used materials due to its versatility and durability. Other materials like polypropylene and PVC are also used, depending on the application and required properties.

End-use Manufacturing Applications

End-use manufacturing applications of rotomolded products are diverse, ranging from tanks and containers to toys and furniture. The process allows for the creation of complex shapes and designs, making it suitable for a wide array of industries. For instance, rotomolding is used in the automotive industry for manufacturing parts like fuel tanks and ducts.

“The rotomolding industry is poised for significant growth, driven by advancements in material science and manufacturing technologies.”

| Stage | Description | Key Activities |

| Raw Material Supply | Supply of raw polymers | Procurement, quality control |

| Rotomolding Process | Manufacturing of products | Molding, cooling, finishing |

| End-use Manufacturing | Application of rotomolded products | Assembly, distribution, sales |

Material Innovation and Customization Trends in Rotomolding

The rotomolding industry is undergoing a major change with a strong focus on material innovation and customization. Manufacturers are working hard to adapt to the changing needs of different industries, and improvements in material science and technology are proving to be essential in this process.

Advances in Rotomolding Materials

The development of new materials and the enhancement of existing ones are driving the rotomolding industry forward. New materials with improved propertiessuch as durability, flexibility, and resistance to environmental factors are being introduced. For instance, the use of advanced polymers and composites is becoming more prevalent.

According to industry experts, “The innovation in materials is opening up new possibilities for rotomolded products, enabling them to be used in more demanding applications.”

“The future of rotomolding lies in its ability to adapt to new materials and technologies, thereby expanding its application scope.”

Key Trends in Rotomolding

As the rotomolding industry continues to evolve, the trends of material innovation and customization are expected to play a pivotal role in shaping its future. Manufacturers who embrace these trends are likely to gain a competitive edge in the market.

1. Material Innovation

The introduction of new materials with enhanced properties is a key driver of growth in the rotomolding industry. These materials offer improved performance characteristics, making them suitable for a wider range of applications.

Some examples of advanced materials being used in rotomolding include:

- Polypropylene (PP): Known for its excellent chemical resistance and low density, PP is increasingly being used in outdoor furniture and automotive components.

- Polyethylene (PE): With its high impact strength and flexibility, PE is commonly used for storage tanks and playground equipment.

- Recycled materials: The use of recycled plastics in rotomolding is gaining traction as manufacturers strive to reduce their environmental footprint.

2. Customization

Customization is becoming a key trend in rotomolding, driven by the need for products that meet specific customer requirements. This trend is particularly prominent in industries such as packaging, where tailored solutions are essential.

Customization options include variations in color, texture, and design, as well as the incorporation of specific features such as UV resistance or antimicrobial properties.

| Customization Option | Description | Benefits |

| Color Variation | Products can be manufactured in a wide range of colors | Aesthetic appeal, brand differentiation |

| Texture Modification | Surface texture can be altered for functional or aesthetic purposes | Improved grip, reduced slip, visual appeal |

| Design Customization | Products can be designed to meet specific dimensional or functional requirements | Enhanced performance, tailored to specific applications |

The ability to offer customized solutions gives manufacturers a competitive advantage and allows them to cater to niche markets.

Market constraints including cycle time, tooling costs, and design limits

Despite its numerous benefits, the rotomolding process is constrained by several factors. The rotomolding market faces challenges that impact its growth and profitability. Understanding these constraints is essential for manufacturers to optimize their production processes and improve product quality.

Cycle Time and Production Efficiency

Cycle time is a critical factor in the rotomolding process, as it directly affects production efficiency and costs. Long cycle times can lead to increased labor costs, higher energy consumption, and reduced productivity. To mitigate this, manufacturers can implement various strategies, such as:

- Optimizing mold design to reduce heating and cooling times

- Improving material selection to minimize cycle time

- Implementing advanced process control systems to monitor and adjust the process in real-time

The production efficiency of rotomolding is also influenced by the complexity of the product design and the tooling used. Complex designs require more sophisticated tooling, which can increase costs and lead times. Manufacturers must balance product design with production efficiency to achieve optimal results.

Tooling Costs and Design Limitations

Tooling costs are another significant constraint in the rotomolding process. The cost of designing and manufacturing molds can be high, especially for complex products. To minimize tooling costs, manufacturers can consider:

- Simplifying product design to reduce tooling complexity

- Using modular tooling designs to reduce costs and lead times

- Implementing cost-effective tooling materials and manufacturing processes

Design limitations also play a crucial role in the rotomolding process. The limitations of the process can affect product design, material selection, and overall product quality. Manufacturers must understand these limitations to design and produce high-quality products that meet customer requirements.

Geopolitical shifts impacting polymer sourcing and export markets

Geopolitical changes are reshaping the global rotomolding landscape, particularly in terms of polymer sourcing and trade. The rotomolding industry, reliant on the steady supply of polymers, faces challenges due to geopolitical tensions and trade policy changes.

Impact of Geopolitical Shifts on Polymer Sourcing

The sourcing of polymers is a critical component of the rotomolding industry. Geopolitical shifts can disrupt supply chains, leading to volatility in polymer prices and availability. For instance, trade tensions between major polymer-producing countries can result in tariffs and export restrictions, affecting the global supply.

To mitigate these risks, companies are adopting strategic sourcing practices, including diversifying their supplier base and investing in local production capacities. This approach not only reduces dependence on international suppliers but also helps in navigating the complexities of global trade policies.

Effects on Export Markets and Trade

Geopolitical shifts also have significant implications for export markets. Changes in trade policies, such as the imposition of tariffs or the renegotiation of trade agreements, can alter the competitive landscape for rotomolded products. Companies that rely heavily on exports must navigate these changes carefully to maintain their market share.

The table below illustrates the potential impacts of geopolitical shifts on polymer sourcing and export markets:

| Geopolitical Shift | Impact on Polymer Sourcing | Impact on Export Markets |

| Trade Tensions | Increased tariffs on polymer imports | Reduced competitiveness in global markets |

| Export Restrictions | Reduced availability of certain polymers | Increased prices for rotomolded products |

| Trade Agreements | Potential for reduced tariffs and increased supply | Increased competitiveness in signatory countries |

As the global geopolitical landscape continues to evolve, the rotomolding industry must remain adaptable, leveraging strategies such as diversification and local production to mitigate risks associated with polymer sourcing and export markets.

Segmentation by product type, material type, and molding design

To understand the rotomolding market, we need to look closely at its segmentation based on product type, material type, and molding design. This breakdown is essential for manufacturers to pinpoint specific markets and customize their products accordingly.

Product Type Segmentation

The rotomolding market is segmented into various product types, each catering to different industries and applications. Key product types include tanks, containers, and custom-molded products. Tanks and containers are widely used in industrial and agricultural sectors for storage purposes.

Material Type and Molding Design Segmentation

In addition to product type, the rotomolding market is also segmented by material type and molding design. Material types include polyethylene, polypropylene, and PVC, each offering unique properties that suit different applications. Molding design segmentation involves various techniques to create complex shapes and designs.

The combination of material type and molding design segmentation enables manufacturers to produce a wide range of products with specific characteristics. For instance, custom molding designs can be used to create products with intricate details and complex geometries.

- Polyethylene is commonly used for its durability and resistance to chemicals.

- Polypropylene is preferred for its lightweight and impact resistance.

- PVC is used for its versatility and ability to be formulated for various applications.

Application areas including tanks, toys, furniture, and automotive parts

The versatility of rotomolding is evident in its diverse applications across various sectors. For instance, rotomolded tanks are widely used in water storage and industrial applications due to their durability and resistance to corrosion.

In the realm of toys, rotomolding allows for the creation of colorful, sturdy playthings that can withstand rough handling.

The furniture industry also benefits from this process, enabling the production of stylish yet resilient pieces. Lastly, in the automotive sector, rotomolded parts provide lightweight yet strong components essential for vehicle performance. This showcases the process’s flexibility and the durability of the products it yields.

Tanks and Containers

One of the main uses of rotomolding is making tanks and containers. These products are known for their toughness and ability to resist rust, making them perfect for holding various substances. Rotomolded tanks find applications in several industries such as agriculture, industrial, and municipal sectors for storing water, chemicals, and other liquids.

The process enables the production of tanks with intricate shapes and seamless constructions, enhancing their strength and minimizing the chances of leaks. This makes rotomolded tanks a preferred choice for situations where dependability and long-lasting performance are essential.

Toys, Furniture, and Automotive Parts Applications

In addition to tanks and containers, rotomolding is also used to manufacture a wide range of other products.

Toys and playground equipment benefit from the process’s ability to create durable, hollow parts with complex shapes. Rotomolded furniture is also gaining popularity due to its durability and weather resistance, making it suitable for both indoor and outdoor use.

In the automotive sector, rotomolded parts are used for various applications, including automotive components that require high durability and resistance to environmental factors. The process enables the production of complex parts with integrated features, contributing to the overall efficiency and performance of vehicles.

The use of rotomolding in these diverse application areas highlights its flexibility and the value it brings to various industries. As technology improves and the demand for tough, top-notch products increases, the importance of rotomolding is expected to grow even more.

Regional Expansion of Rotomolding Capabilities and Investments

As the rotomolding industry continues to evolve, regional expansion and investments are becoming increasingly important. The growing demand for rotomolded products across various sectors is driving companies to expand their capabilities and invest in new markets.

Regional Market Analysis

The regional market analysis for rotomolding reveals a diverse landscape with varying growth patterns. In regions like North America and Europe, the demand for rotomolded products is driven by the industrial and agricultural sectors. In contrast, regions like Asia-Pacific are witnessing rapid growth due to the expanding consumer goods market.

To capitalize on these regional trends, companies are adopting different strategies. Some are focusing on developing local manufacturing capabilities, while others are investing in advanced technologies to improve their competitiveness.

Investments and Expansion Strategies

Investments in the rotomolding industry are primarily focused on enhancing manufacturing capabilities, improving product quality, and reducing production costs. Companies are also investing in research and development to innovate new products and applications.

Expansion strategies include entering new markets, either through organic growth or strategic acquisitions. Companies are also focusing on building strong distribution networks and partnerships to improve their market presence.

Some key regions for expansion include the United States, Brazil, and South Korea, where the demand for rotomolded products is growing rapidly. In these regions, companies are investing in new manufacturing facilities, advanced technologies, and local talent acquisition.

U.S. Demand Driven by Industrial and Agricultural Storage

The demand for rotomolded products in the U.S. is increasing in the industrial and agricultural sectors due to the need for long-lasting and adaptable storage solutions. Rotomolded products provide a distinct blend of durability, versatility, and affordability, making them an appealing choice for different storage requirements.

Industrial Storage Applications

Industrial storage applications are a significant driver of the U.S. rotomolding demand. Rotomolded tanks and containers are used in various industries, including chemical processing, oil and gas, and wastewater treatment. The durability and resistance to corrosion of rotomolded products make them ideal for storing hazardous materials.

Key benefits of rotomolded products in industrial storage include:

- Durability and resistance to corrosion

- Flexibility in design and customization

- Cost-effectiveness compared to traditional storage solutions

Agricultural Storage Needs

Agricultural storage needs are another significant driver of the U.S. rotomolding demand. Rotomolded tanks and containers are used to store water, fertilizers, and other agricultural chemicals. The ruggedness and weather resistance of rotomolded products make them suitable for outdoor storage applications.

The use of rotomolded products in agricultural storage offers several advantages, including:

- Improved durability and resistance to weathering

- Easy cleaning and maintenance

- Customization options to meet specific agricultural needs

| Industry | Rotomolded Product | Benefits |

| Industrial | Tanks and Containers | Durability, corrosion resistance |

| Agricultural | Tanks and Containers | Ruggedness, weather resistance |

Brazil’s Rotomolded Product Usage in Infrastructure and Logistics

Rotomolded products are playing a crucial role in Brazil’s infrastructure development and logistics management. The durability and versatility of rotomolded products make them an ideal choice for various applications in these sectors.

Infrastructure Applications

The infrastructure sector in Brazil is experiencing significant growth, driven by government investments in transportation, water management, and other public infrastructure projects. Rotomolded products, such as tanks and containers, are being used extensively in these projects due to their durability and resistance to corrosion.

Key Infrastructure Applications:

- Water storage tanks

- Septic tanks

- Industrial containers

Logistics and Supply Chain Solutions

In the logistics sector, rotomolded products are used for various applications, including storage containers and shipping materials. The use of rotomolded products in logistics helps in reducing costs and improving efficiency.

The benefits of using rotomolded products in logistics include:

- Durability and resistance to damage

- Lightweight, reducing transportation costs

- Customizable designs to meet specific needs

Here’s a comparison of the use of rotomolded products versus traditional materials in logistics:

| Criteria | Rotomolded Products | Traditional Materials |

| Durability | High | Variable |

| Cost | Competitive | Higher |

| Customization | High | Limited |

The growth of the rotomolding market in Brazil is expected to continue, driven by the increasing demand for durable and versatile products in infrastructure and logistics. As the market evolves, we can expect to see new applications and innovations in rotomolded products.

South Korea’s consumer goods market adopting custom rotomolding

South Korea’s consumer goods sector is experiencing a significant shift towards custom rotomolding. This trend is driven by the increasing demand for durable, versatile, and cost-effective products. Custom rotomolding offers manufacturers the ability to produce complex designs with high precision, catering to the evolving needs of consumers.

Consumer Goods Market Trends

The consumer goods market in South Korea is characterized by a growing preference for innovative and customized products. Rotomolding technology allows for the creation of products with intricate designs and enhanced durability, making it an attractive option for manufacturers. The trend is further supported by the rising demand for sustainable and eco-friendly products, which rotomolding can fulfill through the use of recyclable materials.

Market trends indicate a significant shift towards products that offer both functionality and aesthetic appeal. Custom rotomolding enables the production of goods that meet these criteria, driving its adoption in the consumer goods sector.

Custom Rotomolding Applications

Custom rotomolding is being applied across various consumer goods categories, including furniture, toys, and storage containers. The technology allows for the production of seamless, durable products that can withstand harsh conditions. For instance, rotomolded furniture is gaining popularity due to its durability and ease of maintenance.

| Product Category | Custom Rotomolding Applications | Benefits |

| Furniture | Outdoor furniture, storage units | Durability, weather resistance |

| Toys | Playground equipment, toy boxes | Safety, durability |

| Storage Containers | Industrial storage, household containers | Versatility, cost-effectiveness |

The adoption of custom rotomolding in South Korea’s consumer goods market is expected to continue growing, driven by technological advancements and increasing consumer demand for high-quality, customized products.

Future outlook for automation and eco-friendly materials

Automation and eco-friendly materials are set to transform the rotomolding industry, promoting growth and sustainability. The implementation of automated processes and the use of environmentally friendly materials are anticipated to have a substantial effect on the industry’s future.

Automation in Rotomolding

The use of automation in rotomolding is expected to enhance production efficiency, reduce labor costs, and improve product quality. Some of the key benefits of automation in rotomolding include:

- Increased precision: Automated processes can achieve higher accuracy and consistency in production.

- Reduced cycle time: Automation can significantly reduce the time required for production, enabling faster turnaround times.

- Improved product quality: Automated processes can minimize the risk of human error, resulting in higher-quality products.

Automation in Rotomolding

Eco-friendly Materials and Sustainability

The shift towards eco-friendly materials is a key trend in the rotomolding industry, driven by growing environmental concerns and regulatory pressures. Some of the key eco-friendly materials being adopted include:

- Bioplastics: Made from renewable biomass sources, bioplastics offer a sustainable alternative to traditional plastics.

- Recycled materials: The use of recycled materials in rotomolding can significantly reduce waste and minimize environmental impact.

The adoption of eco-friendly materials is expected to not only reduce the industry’s environmental footprint but also drive innovation and growth.

Competitor positioning in the global Rotomolding landscape

- Myers Industries, Inc. — Akron, USA

- Ocean Plastic Intertrade Co., Ltd. — Bangkok, Thailand

- A.G Industries Pvt. Ltd. — Mumbai, India

- Rototek Limited — Dublin, Ireland

- Top Rotomolding Technology Co., Ltd. — Taichung, Taiwan

- Ningbo Fly Plastic Co., Ltd. — Ningbo, China

- Yantai Fangda Rotational Molding Co., Ltd. — Yantai, China

- DUTCHLAND Quality Rotomolding Solutions — Netherlands

- Centro Incorporated — Niles, USA

- Sherman Roto Tank — Sherman, USA

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Rotomolding Market Report |

| Base Year | 2024 |

| Segment by Type | · Rotational Molding Machines

· Rotomolded Products |

| Segment by Application | · Industrial Applications

· Recreational Products · Medical Equipment · Agricultural Products · Consumer Goods |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The rotomolding market is set for significant growth, driven by increasing demand for durable plastics in various industries.

Summary of Key Findings

The market is expected to exceed $5.56 billion by 2025, with the U.S., Brazil, and South Korea emerging as key players. The demand for rotomolded products is driven by their versatility, durability, and cost-effectiveness.

Future Prospects and Recommendations

As the market continues to evolve, industry stakeholders should focus on developing eco-friendly materials, improving production efficiency, and investing in automation technologies. The future of rotomolding looks promising, with opportunities for growth in various application areas, including tanks, toys, furniture, and automotive parts.

To capitalize on these opportunities, manufacturers should prioritize innovation, quality, and customer satisfaction. By doing so, the rotomolding industry can continue to thrive and meet the demands of a rapidly changing global market.

Global Rotomolding Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Rotomolding Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- RotomoldingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Rotomoldingplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Rotomolding Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Rotomolding Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Rotomolding Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofRotomolding Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is driving the growth of the Rotomolding Market?

The growth of the Rotomolding Market is primarily driven by the increasing demand for durable plastics across various industries. Countries such as the U.S., Brazil, and others are playing a crucial role in this growth.

What are the key stages in the rotomolding industry chain?

The rotomolding industry chain involves various stages, from the supply of raw polymers to end-use manufacturing, including raw polymers and material supply, and end-use manufacturing applications.

What trends are shaping the rotomolding industry in terms of materials?

The rotomolding industry is experiencing significant trends in material innovation and customization, with new materials and technologies being developed to improve the qualities of rotomolded products.

What are the constraints faced by the rotomolding market?

The rotomolding market faces several constraints, including cycle time, tooling costs, and design limits, which manufacturers need to optimize to improve production processes and product quality.

How do geopolitical shifts impact the rotomolding industry?

Geopolitical shifts can significantly impact the rotomolding industry, particularly in terms of polymer sourcing and export markets, requiring manufacturers to develop mitigation strategies.

How is the rotomolding market segmented?

The rotomolding market can be segmented based on product type, material type, and molding design, allowing manufacturers to target specific markets and tailor their products accordingly.

What are the application areas of rotomolded products?

Rotomolded products have a wide range of applications across various industries, including:

- Tanks

- Toys

- Furniture

- Automotive parts

These products offer benefits such as durability and versatility.

What is driving the demand for rotomolded products in the U.S.?

The U.S. demand for rotomolded products is driven by industrial and agricultural storage applications, with opportunities for growth in these sectors.

How will automation shape the future of the rotomolding industry?

Advancements in automation are expected to shape the future of the rotomolding industry, likely improving efficiency and reducing production costs.

What is the outlook for eco-friendly materials in rotomolding?

The adoption of eco-friendly materials is expected to be a significant trend in the rotomolding industry, driven by growing concerns about sustainability and environmental impact.