2025 CV Axle Joint Market Surging with $3.63 Billion Growth in United States, Germany, and Japan

Investigate the CV Axle Joint Market’s response to Trump’s auto tariffs, with insights into the leading producers in the US, Germany, and Japan.

- Last Updated:

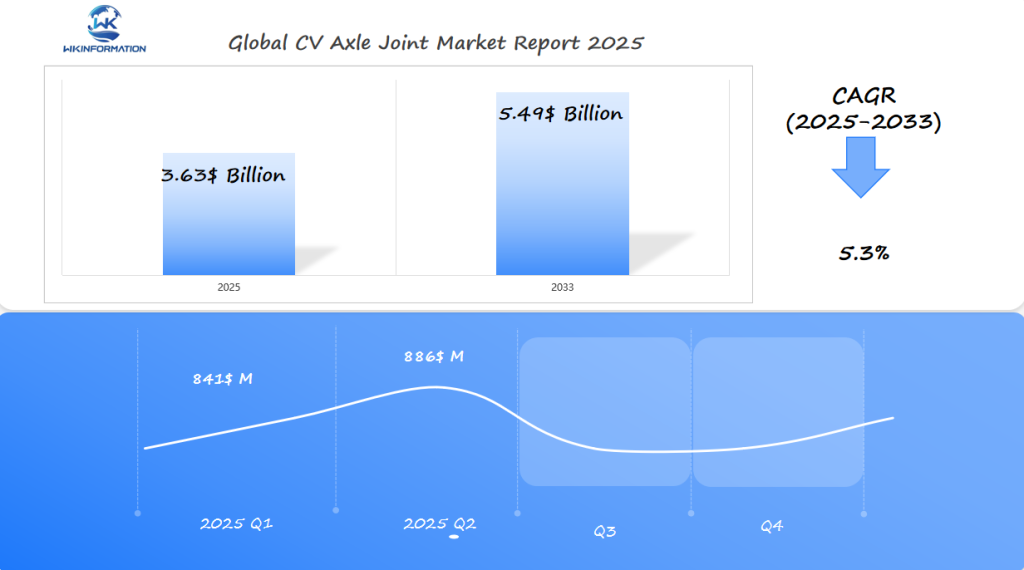

Market Forecast for CV Axle Joint in Q1 and Q2 of 2025

The global CV Axle Joint market was valued at USD 3.63 billion in 2025, growing at a CAGR of 5.3% from 2025 to 2033. Based on this projected growth, the estimated market size for Q1 2025 is around USD 841 million, rising to approximately USD 886 million in Q2 2025. The market is expanding due to the growing demand for high-performance and durable drivetrain components, especially in electric and all-wheel-drive vehicles.

The United States, Germany, and Japan are the most significant regions driving CV Axle Joint demand. The US market benefits from strong aftermarket sales and the increasing trend of off-road and performance vehicles. Germany, as a leading hub for automotive engineering and premium vehicle production, sees steady demand for high-precision axle components. Japan, home to some of the world’s most reliable vehicle manufacturers, continues to innovate in drivetrain efficiency and lightweight axle solutions. To maintain market growth, manufacturers should focus on material advancements, improved durability, and integration with electric vehicle drivetrains.

CV Axle Joint Market Upstream and Downstream Industry Chain Analysis

The automotive supply chain for CV axle joints connects raw material suppliers to end-users. It shapes market dynamics. This section explains how materials become finished components and reach global markets.

Raw Material Suppliers and Manufacturing Process Flow

Steel, aluminum, and polymer suppliers are at the heart of CV joint manufacturing. They get their materials from metallurgy firms and chemical producers. The production process includes:

- Forging: Raw metals are shaped into axle joint blanks.

- Machining: Precision cuts ensure tight tolerances for joint movement.

- Assembly: Bearings, grease, and boots are combined into finished joints.

- Quality checks: Testing for torque load and durability standards.

Distribution Channels and End-User Industries

Downstream, OEM suppliers send components directly to automakers like Ford and Volkswagen. The aftermarket distribution network includes auto parts retailers and repair shops. Here’s a comparison of the two channels:

| Channel Type | Key Functions | Primary Clients |

|---|---|---|

| OEM Supply | Production-line integration | Automobile manufacturers |

| Aftermarket | Replacement parts distribution | Repair shops, individual buyers |

Understanding these connections helps stakeholders optimize logistics. They meet demand shifts in both new vehicle production and repair sectors.

Key Trends Driving the CV Axle Joint Market Growth in 2025

Automotive technology trends are changing how CV axle joints are made. Automakers want better efficiency and performance. Innovations in durability and making parts lighter are key to growth.

Every gram saved in parts means better fuel savings and faster drivetrain response.

Technological Innovations in Joint Durability and Performance

Companies like NSK and Schaeffler are leading in CV joint tech. They use self-lubricating materials and 3D-printed designs. A study by SAE International shows these changes can cut maintenance costs by up to 25% in fleets.

Shift Towards Lightweight and Fuel-Efficient Components

Car makers are using aluminum and carbon fiber to make cars lighter. Steel companies like ArcelorMittal are making stronger, lighter steel. This helps meet EPA’s 2025 fuel efficiency goals.

Electric cars are also changing the game. They need joints that can handle more torque and less noise. Nexteer Automotive is working on magnetic dampers for CV joints to meet these needs.

As SUV sales grow, so does the need for stronger CV joints. These trends make 2025 a critical year for joint makers to meet both traditional and electric car demands.

Market Challenges and Restrictions Impacting CV Axle Joint Industry Expansion

The automotive parts industry is facing big changes. Material shortages and new rules are making it hard for companies to grow. They must deal with global supply chain problems and changing rules that test their ability to make products.

Supply Chain Vulnerabilities and Material Cost Fluctuations

CV joint production is being hit hard by supply chain issues. Prices for steel and aluminum, key for making axle parts, are going up and down. This is causing financial stress for makers. They are facing delays in getting bearings and heat-treated alloys, leading some to pay more for substitutes.

- Steel shortages delayed 15% of 2024 deliveries (per Automotive News)

- Shipping costs rose 22% in Q2 2024 due to port congestion

Regulatory Hurdles and Environmental Compliance Requirements

New rules are forcing CV joints to be redesigned. They must meet stricter standards for emissions and recycling. For example, the EU’s 2025 rules require 80% of new CV joints to be recyclable by 2026.

| Issue | Impact | Compliance Deadline |

|---|---|---|

| Carbon Emissions | Material substitution costs | 2026 |

| Toxic Substances | Component redesign | 2025 |

Companies need to be quick and innovative to keep up. Those investing in local suppliers and research and development are more likely to succeed.

Geopolitical Factors Influencing the CV Axle Joint Market Landscape

Automotive trade policies are changing the international automotive market. Geopolitical changes create both challenges and chances. Trade disputes and alliances affect where parts like CV axle joints are made. For example, US tariffs on Chinese steel have made some suppliers rethink their global supply chains.

Trade Policies and International Market Access

- EU-Japan free trade agreements reduce customs duties, boosting joint exports.

- USMCA requirements mandate higher North American content for automotive parts.

- India’s Make in India initiative prioritizes local suppliers over imports.

“Trade wars are supply chain wars,” said Dr. Elena Torres, automotive economist at IHS Markit, emphasizing how tariff fluctuations destabilize component pricing.

Regional Economic Conditions Affecting Demand

| Region | Economic Factors | Impact on Demand |

|---|---|---|

| India | Rising middle class + infrastructure spending | Commercial vehicle joint demand up 12% (2023) |

| Latin America | Currency volatility + inflation | Import restrictions reduce joint procurement |

| EU | Green subsidies + emission standards | Electric vehicle joint designs gaining traction |

Regional vehicle demand in emerging markets depends on government incentives. Countries like Brazil are lowering interest rates for auto loans, which helps axle joint sales. The US-China tech rivalry has also made automakers spread their suppliers across continents.

Companies need to keep an eye on automotive trade policies to stay ahead. They must balance local production with global supply chains to be ready for any changes.

Market Segmentation of CV Axle Joint by Type and Material

Knowing about CV joint types and automotive joint materials is crucial. There are two main types: outboard CV joints for the outer axle ends and inboard CV joints near the transmission. The material used affects how well it works and its price.

Outboard and Inboard Joint Variations and Applications

| Type | Design | Primary Use | Key Features |

|---|---|---|---|

| Outboard CV Joints | Rzeppa (ball-and-socket) | Passenger cars, rear axles | Handles high torque, compact size |

| Inboard CV Joints | Tripod or double-offset | Trucks, front axles | Withstands heavy loads, low friction |

Emerging Materials and Composition Innovations

- Steel and aluminum: Traditional choices for automotive joint materials due to strength and cost-effectiveness.

- Carbon-fiber composites: Reduce weight in luxury vehicles while maintaining rigidity.

- Nano-coatings: Enhance corrosion resistance without adding bulk.

Manufacturers weigh material choices between durability and environmental impact. Inboard CV joints often use high-carbon steel for heavy-duty trucks. Meanwhile, outboard CV joints in cars might use aluminum for lighter builds.

Applications of CV Axle Joints in Passenger and Commercial Vehicles

CV axle joints are key to vehicle drivetrain systems. They ensure smooth power transfer in various vehicles. Passenger cars use them for everyday driving, while commercial trucks need them for heavy-duty tasks. These components play a crucial role in modern transportation.

Performance Requirements Across Vehicle Classes

In passenger vehicle components, front-wheel drive cars aim for quiet and compact designs. All-wheel-drive SUVs need joints that handle more torque from bigger engines. For instance, crossover SUVs use stronger joints for better agility and load handling.

Rear-wheel-drive sports cars focus on low friction for better handling.

Special Applications in Off-Road and Heavy-Duty Vehicles

- Passenger cars: Prioritize space-saving designs and low noise

- Commercial trucks: Need high durability for constant load cycles

- Off-road vehicles: Feature water-tight seals and reinforced bearings

CV joints adapt to every need, from city streets to remote terrains. They prove their vital role in keeping vehicles moving under any condition.

Global CV Axle Joint Market Regional Performance and Forecast Analysis

Regional performance in the global automotive market shows big differences in CV axle joint demand. Regional market analysis finds Asia-Pacific leading the growth. Meanwhile, mature markets like North America look at aftermarket chances. Insights into emerging automotive markets reveal both opportunities and challenges for the market forecast until 2025.

- Asia-Pacific: Vehicle production in India and Indonesia increases raw material demand.

- Latin America: Growing car ownership in Brazil and Mexico boosts aftermarket sales.

- Middle East: Infrastructure projects increase commercial vehicle joint demand.

Adoption rates differ due to economic conditions and manufacturing trends. For example, European markets focus on lightweight materials. African regions face logistical challenges. Here’s a comparison of key regions:

| Region | Forecasted CAGR (%) | Growth Drivers |

|---|---|---|

| North America | 3.2% | Strong commercial vehicle sales, steady replacement demand |

| Europe | 2.8% | EU emissions rules driving innovation |

| Asia-Pacific | 5.1% | Automotive production hubs in Thailand and Vietnam |

These trends highlight the need for tailored strategies. While emerging automotive markets promise high growth, manufacturers face challenges like supply chain gaps and local rules. The market forecast shows Asia-Pacific will lead by 2025. Yet, adapting to each region’s needs is crucial for success.

USA CV Axle Joint Market Growth and Competitive Strategies

The U.S. market for CV axle joints is growing fast. This is because car makers are focusing on US automotive components for American vehicle production. The need for domestic CV joint manufacturing and US aftermarket parts

Domestic Production vs. Import Dynamics

Trade policies play a big role in where parts come from. The USMCA trade agreement lowers tariffs, making domestic CV joint manufacturing more appealing. Companies like Ford and GM choose local suppliers to save time.

Important factors include:

- Lower shipping costs for American vehicle production hubs in the Midwest

- Customs duties increase prices for imported joints by 15-20%

- Automakers invest in US automotive components to meet “Buy American” rules

Market Concentration and Key Players

Big firms hold 65% of the market. The leaders are:

- Dana Incorporated: Expands Ohio factories for domestic CV joint manufacturing

- ZF Friedrichshafen: Partners with U.S. dealers for US aftermarket parts distribution

- Timken: Supplies 40% of heavy-duty truck joints through vertical integration

Trucks and SUVs are in high demand, needing joints for tough conditions. Companies like Tesla and Rivian are working with local foundries for American vehicle production. As electric cars become more popular, suppliers are making joints for EVs that are quiet.

Germany CV Axle Joint Market Expansion and Market Insights

Germany’s car industry is a big player worldwide in making CV axle joints. The German automotive industry is known for its top-notch engineering and quality checks. This makes it a leader in making high-quality car parts.

Germany focuses on new ideas and selling more cars abroad. This helps it stay on top in the CV axle joint market.

Companies like Schaeffler and ZF Friedrichshafen set the bar high. They follow European CV joint standards closely. Their products are key for luxury brands like BMW and Mercedes-Benz.

They use advanced labs to test materials and digital twins for better designs. They also meet EU rules on emissions and safety.

Export-Driven Growth and EU Integration

More than 60% of German CV axle joints are sold abroad. This is thanks to strong German automotive exports to Europe and other places. Germany’s location and EU trade deals make it easy to send goods across borders.

Even with more competition, Germany keeps its lead. It does this by using automation and focusing on premium vehicle components. This mix of old and new makes Germany a key player in the CV axle joint world.

Japan CV Axle Joint Market Trends and Development Potential

Japan is a leader in Japanese auto parts thanks to its long history of excellence in Asian automotive manufacturing. The country’s CV axle joint sector is at the top globally, thanks to its focus on innovation and precision. Toyota, Honda, and Nissan use advanced Japanese CV joint technology in their vehicles around the world.

Japan is also the birthplace of hybrid vehicles. Now, its CV joint producers are working hard to make components for hybrid vehicle components (see Figure 1).

Japanese Manufacturing Innovation and Efficiency

Japan’s manufacturing success comes from lean production and continuous improvement (kaizen). Key features include:

- Rigorous quality checks at every production stage

- Automation integration reducing waste and errors

- Collaboration between suppliers and automakers for seamless supply chains

Adaptation to Electric and Hybrid Vehicle Requirements

As the world moves toward electric vehicles (EVs), Japan’s CV joints need to be lighter and more durable. Japanese companies are redesigning their components to handle the higher torque of EV motors. They also aim to reduce friction.

Japan’s hybrid vehicle components market is strong, with a 40% global share. Domestic automakers and part suppliers work together to ensure CV joints meet high standards. Despite rising production costs and competition, Japan’s focus on R&D keeps it at the forefront.

Future Innovations and Advancements in CV Axle Joint Technology

Automotive innovation is changing how CV axle joints work. Next-gen CV joints are smart parts linked to drivetrain tech. They aim to last longer, work better, and be kinder to the planet.

Integration with Vehicle Control Systems and Sensors

Today’s CV joints have sensors that send data to the car’s systems. For instance, Bosch and ZF Friedrichshafen are making joints with sensors. These sensors track angles and forces, helping with maintenance and safety.

- Sensors detect wear patterns to prevent failures

- Data feeds into driver-assist systems for stability control

- Automated lubrication systems based on usage patterns

Sustainability Initiatives and Eco-Friendly Manufacturing

3D printing is making custom parts for electric cars, cutting down on waste. These new CV joints also meet EU’s 2030 emission goals. They help cars run more efficiently and meet environmental standards.

Competitive Landscape and Leading Players in the CV Axle Joint Market

The CV axle joint market is growing fast. Companies are competing to be the best. They focus on being innovative, cost-effective, and forming strong partnerships.

-

American Axle & Manufacturing, Inc. – United States

-

GKN Automotive Limited – United Kingdom

-

GSP Automotive Group Wenzhou Co. Ltd. – China

-

Hyundai WIA Corporation – South Korea

-

Neapco Holdings LLC – United States

-

Nexteer Automotive – United States

-

NTN Corporation – Japan

-

SKF – Sweden

-

Wanxiang Qianchao Co. Ltd. – China

-

Zhejiang ODM Transmission Technology Co., Ltd. – China

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global CV Axle Joint Market Report |

| Base Year | 2024 |

| Segment by Type |

· Outboard Joints · Inboard Joints |

| Segment by Application |

· Passenger Vehicle · Commercial Vehicle |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The global CV axle joint market faces a complex environment due to tariffs and policy changes. Adaptability and innovation are key for manufacturers to succeed. The effects of Trump’s auto tariffs have impacted raw material prices, production costs, and supply chain dynamics. Yet, leading German and Japanese manufacturers have shown resilience, using their technological prowess and quality standards to maintain their market dominance.

The CV axle joint market must evolve further, anticipating and adapting to market and policy changes. By investing in research and development, diversifying supply chains, and building stronger international partnerships, industry players can overcome challenges and seize opportunities in the dynamic global landscape.

Global CV Axle Joint Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: CV Axle Joint Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global CV Axle Jointplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: CV Axle Joint Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: CV Axle Joint Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: CV Axle Joint Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofCV Axle Joint Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are CV axle joints and why are they important?

CV axle joints, or constant velocity axle joints, are key parts of a vehicle’s drivetrain. They help transfer power smoothly when the vehicle turns. This ensures the vehicle moves well and performs well.

What factors are driving the growth of the CV axle joint market?

The CV axle joint market is growing fast. This is because of more cars being made, a rise in all-wheel drive vehicles, new car tech, and a focus on fuel efficiency and lighter parts.

How is the manufacturing process for CV axle joints structured?

Making CV axle joints involves several steps. First, raw materials are sourced. Then, parts are machined and assembled. Finally, quality checks are done before they are sold to car makers and retailers.

What trends are shaping the future of CV axle joint technology?

New trends are emerging. These include working with vehicle systems and sensors, using lighter materials, and making manufacturing more eco-friendly.

What are the primary challenges facing the CV axle joint industry?

The industry faces several challenges. These include supply chain issues, changing material costs, environmental rules, and more competition. These can slow down market growth.

How are geopolitical factors affecting the CV axle joint market?

Global politics, like trade rules and tariffs, affect the market. Changes in international relations can bring both chances and challenges for companies.

In what types of vehicles are CV axle joints utilized?

CV axle joints are used in many vehicles. This includes cars, SUVs, light trucks, and heavy machinery. Each type needs specific features based on how it’s used.

What are the growth prospects for the USA CV axle joint market?

The USA market is expected to grow. This is due to a strong car industry, more demand for parts, and a preference for bigger, more versatile vehicles.

What role does innovation play in the German CV axle joint market?

Innovation is key in Germany. Companies focus on engineering and quality. They aim to stay ahead by making new tech.

How is the Japanese CV axle joint market adapting to electric vehicles?

Japan is adapting by making CV joints for electric and hybrid cars. They use new materials and designs to improve performance.

What strategic movements are influencing the competitive landscape of CV axle joints?

The market is changing with mergers, partnerships, and new players. These moves are reshaping the market and guiding growth strategies.