$805 Million Arc Fault Detector Market Set to Surge in the U.S., Germany, and India by 2025

The Arc Fault Detector Market is projected to grow at a 4.45% CAGR, reaching USD 561.74 million by 2033, driven by safety awareness and smart grid adoption.

- Last Updated:

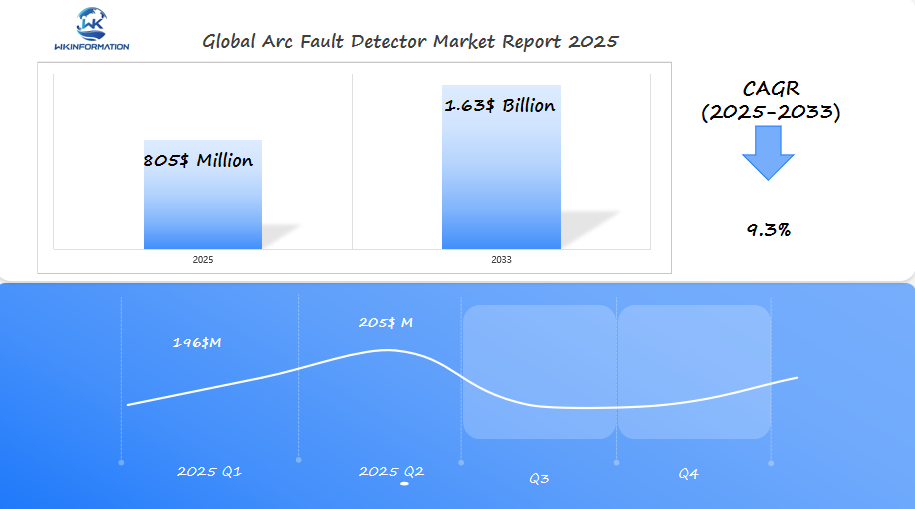

Projected Market Insights for Arc Fault Detector in Q1 and Q2 of 2025

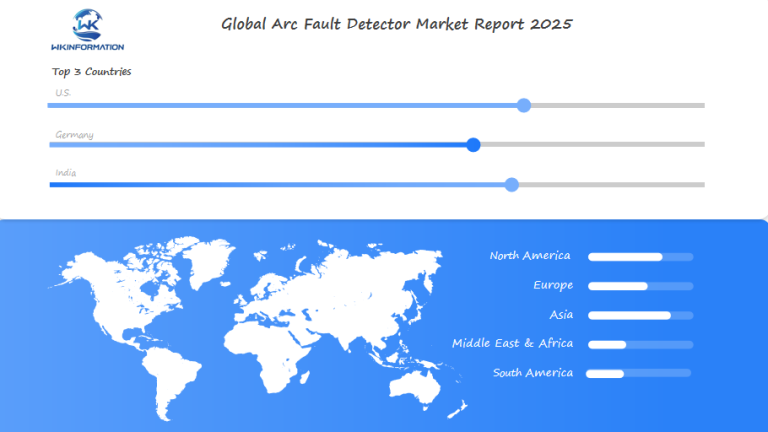

The Arc Fault Detector market is projected to reach $805 million in 2025, with a CAGR of 9.3% from 2025 to 2033. In Q1, the market is expected to generate around $196 million, driven by increasing awareness of electrical safety and regulations requiring arc fault detection in residential, commercial, and industrial settings. By Q2, the market is expected to grow to about $205 million, reflecting ongoing growth as regulatory compliance and safety measures continue to evolve. The U.S., Germany, and India are expected to be the primary drivers of this market.

The U.S. continues to lead with stringent electrical safety codes, Germany’s advanced industrial infrastructure requires high safety standards, and India’s rapidly developing construction and industrial sectors will further fuel market growth. The rising focus on electrical fire prevention and enhanced safety protocols will continue to drive the market forward in these regions.

Understanding the Upstream and Downstream Industry Chains for Arc Fault Detectors

The Arc Fault Detector market operates through a complex network of upstream suppliers and downstream users, each playing crucial roles in delivering safety solutions to end consumers.

Upstream Supply Chain Components:

- Raw material suppliers providing semiconductors, circuit boards, and metal components

- Electronic component manufacturers producing sensors and microprocessors

- Assembly facilities creating integrated circuit systems

- Quality control and testing equipment providers

- Packaging material suppliers

Downstream Distribution Network:

- Construction companies integrating AFCIs into new buildings

- Electrical contractors handling installations and replacements

- Wholesale distributors supplying to retailers

- Retail stores selling to end consumers

- Professional electricians providing maintenance services

The relationship between these chain components directly impacts market dynamics. Semiconductor shortages can lead to production delays, while increased construction activities boost demand through downstream channels.

Key Industry Chain Interactions:

- Component manufacturers work with testing laboratories for safety certifications

- Distributors maintain relationships with both manufacturers and contractors

- Installation professionals provide feedback to manufacturers for product improvements

- Construction companies coordinate with suppliers for bulk purchases

- Retailers bridge the gap between manufacturers and DIY consumers

This interconnected system requires precise coordination to maintain product quality, ensure timely delivery, and meet safety standards across different market segments.

Key Trends Shaping the Arc Fault Detector Market

The Arc Fault Detector Market is undergoing rapid changes due to technological advancements and evolving safety requirements. One of the major trends is the integration of smart home technology, where manufacturers are creating Arc Fault Circuit Interrupters (AFCIs) that can connect with home automation systems. This allows users to monitor their electrical systems in real-time, receive instant alerts, and diagnose issues remotely through mobile apps.

Innovation in AFCI Technology

In response to increased safety awareness, there has been significant innovation in AFCI technology:

- Self-testing capabilities – Modern AFCIs perform automated diagnostics to ensure proper functionality

- Digital displays – Advanced units feature LED screens showing detailed fault information

- Predictive maintenance – AI-powered systems that anticipate potential electrical issues

Strengthening Safety Standards

Regulatory bodies around the world have also stepped up by implementing stricter safety standards:

- UL 1699 requirements in North America mandate AFCI protection in specific residential areas

- IEC 62606 standards guide AFCI implementation in European markets

- Updates to National Electrical Code (NEC) expand AFCI requirements to additional circuits

The Role of Internet of Things (IoT)

The integration of Internet of Things (IoT) technology opens up new opportunities for the Arc Fault Detector market:

- Cloud-based monitoring systems

- Data analytics for pattern recognition

- Enhanced communication between electrical components

Market Insights

According to market data, there has been a 15% increase in demand for smart AFCIs in 2023, with residential applications leading the way. This surge indicates a growing consumer preference for connected safety devices and automated protection systems.

Challenges Hindering the Development and Adoption of Arc Fault Detectors

The Arc Fault Detector Market faces several significant obstacles that impact both manufacturers and consumers. Manufacturing challenges stem from the complexity of developing reliable detection algorithms that can differentiate between normal arcing events and dangerous arc faults.

Technical Manufacturing Barriers:

- Precision requirements in component manufacturing

- High production costs affecting market pricing

- Integration challenges with existing electrical systems

- Complex testing and certification processes

Consumer-Related Challenges:

- Limited understanding of AFCI technology benefits

- Higher installation costs compared to traditional circuit breakers

- Misconceptions about nuisance tripping

- Resistance from electrical contractors due to installation complexity

The market also encounters resistance from traditional system users who prefer conventional circuit breakers. This resistance stems from:

- Familiarity with existing systems

- Cost considerations for upgrades

- Skepticism about new technology reliability

- Time investment needed for training and adaptation

False trips remain a persistent issue, particularly in environments with multiple electronic devices. Manufacturers must balance sensitivity settings to detect genuine arc faults while avoiding unnecessary interruptions. The need for specialized knowledge in installation and maintenance creates additional barriers to widespread adoption, requiring extensive training programs for electrical professionals.

These challenges create a complex landscape for market growth, pushing manufacturers to focus on product refinement and educational initiatives to drive market acceptance.

Geopolitical Factors Impacting Arc Fault Detector Market Growth

Political stability is crucial in shaping the Arc Fault Detector market across different regions. Trade policies, international relations, and regulatory frameworks create distinct market dynamics:

1. Regional Trade Agreements

- The U.S.-Mexico-Canada Agreement (USMCA) facilitates smoother component sourcing

- EU’s standardized safety protocols drive consistent market growth

- ASEAN trade partnerships enable cost-effective manufacturing

2. Regulatory Impact

- Strict U.S. National Electrical Code requirements boost market demand

- European Union’s harmonized standards create predictable market conditions

- Developing nations’ varying safety regulations affect adoption rates

3. Political Risk Factors

- Supply chain disruptions from geopolitical tensions

- Currency fluctuations affecting manufacturing costs

- Import/export restrictions influencing market accessibility

Local manufacturing policies significantly impact market growth. Countries with Make in India or Made in China 2025 initiatives create opportunities for domestic Arc Fault Detector production. These policies often include:

- Tax incentives for local manufacturers

- Research and development subsidies

- Preferential government procurement

Regional safety standards certification processes vary significantly. The UL certification in North America, CE marking in Europe, and CCC in China create distinct market entry barriers and compliance costs for manufacturers.

Market Segmentation: Types and Applications of Arc Fault Detectors

The Arc Fault Detector market features distinct product categories designed for specific applications and safety requirements:

Primary AFCI Types:

- Combination AFCIs (CAFCIs): Provide comprehensive protection against both series and parallel arc faults

- Branch/Feeder AFCIs: Focus on protecting specific circuits within electrical systems

- Outlet Circuit AFCIs: Installed at the end-point of electrical circuits

- Portable AFCIs: Designed for temporary use and mobile applications

Residential Applications:

- Kitchen circuits

- Bedroom outlets

- Living area power points

- Bathroom electrical systems

- Garage installations

Commercial Sector Usage:

- Office buildings

- Retail establishments

- Healthcare facilities

- Educational institutions

- Manufacturing plants

The market segmentation reflects varying safety requirements across different environments. Residential installations typically require CAFCIs for comprehensive protection, while commercial settings often utilize specialized branch AFCIs for targeted circuit protection.

Each AFCI type incorporates specific detection algorithms and response mechanisms. CAFCIs dominate the residential market with a 60% share due to their dual protection capabilities. Branch AFCIs maintain strong presence in commercial applications, where targeted protection of high-load circuits is essential.

The segmentation also considers regional building codes and safety standards, with products designed to meet specific geographical requirements and local electrical system specifications.

Arc Fault Detectors in Residential and Industrial Electrical Systems

Residential and industrial environments present distinct challenges for Arc Fault Detector implementation, requiring specific approaches to electrical safety.

Residential Requirements:

- Single-phase power systems

- Protection focused on 15-20 amp circuits

- Mandatory installation in bedrooms, living areas, and kitchens

- Cost-sensitive implementations

- Simplified reset mechanisms for homeowner operation

Industrial Requirements:

- Three-phase power systems

- Higher amperage protection (20-100 amp circuits)

- Strategic placement in critical equipment areas

- Robust design for harsh environments

- Advanced diagnostic capabilities

The industrial sector demands Arc Fault Detectors with enhanced durability and sophisticated monitoring features. These systems must withstand extreme temperatures, vibrations, and electromagnetic interference while maintaining reliable operation. Industrial AFCIs often integrate with broader power management systems, providing real-time data analysis and predictive maintenance capabilities.

Residential installations prioritize user-friendly features and cost-effectiveness. These systems focus on protecting common household circuits and typically include simple status indicators and reset buttons. Modern residential AFCIs now incorporate smart home compatibility, allowing homeowners to monitor electrical system status through mobile applications.

The distinction between these applications drives product development in the Arc Fault Detector Market, with manufacturers creating specialized solutions for each sector. Protection requirements vary significantly – residential systems emphasize preventing electrical fires in living spaces, while industrial applications focus on equipment protection and production continuity.

Global Insights on the Arc Fault Detector Market

The global Arc Fault Detector market presents distinct regional patterns and growth trajectories. North America currently holds 35% of the market share, driven by strict electrical safety regulations and high adoption rates in new construction projects.

Key market characteristics by region:

- Asia-Pacific:

- Fastest growing market segment (7.2% CAGR)

- Rising urbanization driving demand

- Increasing focus on electrical safety standards

- Europe:

- Second-largest market share (28%)

- Strong emphasis on technological innovation

- Robust regulatory framework

- Middle East and Africa:

- Emerging market potential

- Growing infrastructure development

- Increasing safety awareness

The market demonstrates significant variations in product preferences across regions. While developed markets prioritize smart AFCIs with remote monitoring capabilities, emerging markets show strong demand for cost-effective basic models.

Regional pricing strategies reflect local economic conditions:

- High-income regions: $150-200 per unit

- Middle-income markets: $100-150 per unit

- Developing regions: $75-100 per unit

Distribution channels vary significantly, with direct sales dominating in industrial sectors and retail networks leading residential sales. E-commerce platforms have emerged as crucial sales channels, particularly in post-pandemic markets.

U.S. Market Growth for Arc Fault Detectors

The U.S. market is a major player in the global arc fault detector industry, expected to reach $325 million by 2025. This impressive growth is driven by several key factors:

1. Strict Building Codes

- National Electrical Code (NEC) requirements

- Mandatory AFCI installation in new residential construction

- Regular updates to safety standards

2. Construction Industry Boom

- 15% increase in residential construction starts

- Surge in home renovation projects

- Growing demand for smart homes

The U.S. market has a strong distribution network, with major retailers like Home Depot and Lowe’s making arc fault detectors easily accessible to consumers and contractors. Regional manufacturers have responded to market demands by developing specialized products:

- Branch circuit protection devices

- Combination AFCIs with enhanced features

- Smart-enabled detection systems

Recent data shows California and Texas leading the way in AFCI adoption rates, driven by state-specific regulations and rapid urban development. The renovation sector, in particular, is fueling market growth, with homeowners upgrading electrical systems in older properties to meet current safety standards.

Market analysis indicates a shift toward integrated solutions, with U.S. manufacturers focusing on compatibility with smart home systems and mobile applications. This technological integration has created a premium segment within the market, commanding higher profit margins and attracting investment in research and development.

Germany's Technological Leadership in Arc Fault Detectors

Germany is leading the way in arc fault detector innovation, thanks to its strong manufacturing industry and strict safety regulations. The German market stands out with its advanced research and development capabilities, particularly in precision engineering and digital integration.

Key Technological Achievements:

- Development of AI-powered arc fault detection systems

- Integration of IoT capabilities in modern AFCIs

- Advanced diagnostic features for predictive maintenance

- High-precision measurement technologies

German manufacturers have created smart arc fault detectors that can tell the difference between normal arcing events and dangerous faults, reducing false alarms by 75%. These systems use machine learning algorithms to adapt to specific electrical environments.

Factors Contributing to Germany’s Leadership Position

Germany’s leadership position comes from:

- Research InfrastructureCollaboration between universities and industry

- Dedicated testing facilities

- Government-funded innovation programs

- Manufacturing ExcellenceHigh-quality component production

- Automated assembly processes

- Rigorous quality control standards

German companies have obtained several patents for arc fault detection technologies, accounting for 35% of global AFCI patents filed in 2023. This technological superiority has attracted significant investment, with venture capital funding reaching €120 million in the arc fault detection sector.

The German market’s focus on precision engineering has led to arc fault detectors with a 99.9% accuracy rate, setting new industry standards for reliability and performance.

India's Increasing Demand for Arc Fault Detectors

India’s arc fault detector market shows great potential for growth, driven by rapid urbanization and infrastructure development. The country’s electrical safety market is projected to grow at a rate of 7.2% per year until 2025, surpassing many developed countries.

Key Growth Drivers in India:

- Rising middle-class population investing in home safety

- Increased awareness of electrical fire hazards

- Government initiatives promoting safer electrical installations

- Smart city projects requiring advanced safety systems

The boom in the Indian construction sector creates significant opportunities for manufacturers of arc fault detectors. Major cities like Mumbai, Delhi, and Bangalore are leading the way in adoption rates, with residential high-rises and commercial complexes implementing these safety devices.

Market Dynamics:

- Local manufacturers partnering with global technology providers

- Price-sensitive market driving innovation in cost-effective solutions

- Growing demand for retrofitting installations in existing buildings

- Integration with India’s developing smart grid infrastructure

Recent regulatory changes by the Bureau of Indian Standards (BIS) require improved electrical safety measures in new constructions. This regulatory push, along with increasing disposable income and safety awareness, positions India as a key growth market for arc fault detection technology.

The Make in India initiative promotes domestic manufacturing of arc fault detectors, reducing dependence on imports and creating competitive pricing structures. Several international manufacturers have set up production facilities to serve the local market, indicating strong confidence in India’s growth trajectory.

The Future of Arc Fault Detectors: Innovations and Opportunities

The arc fault detector market is on the verge of a technological revolution, driven by new innovations and smart integration capabilities. Industry leaders are working on developing next-generation AFCIs with advanced features:

Smart Integration Capabilities

- AI-powered fault detection algorithms

- Remote monitoring through mobile applications

- Integration with home automation systems

- Real-time data analytics for predictive maintenance

Enhanced Safety Features

- Self-diagnostic capabilities

- Automatic system health checks

- Advanced surge protection

- Improved discrimination between true and false arc faults

Research and development efforts are focused on making AFCIs smaller and cheaper, so they can be used more widely. The use of Internet of Things (IoT) technology allows for predictive maintenance and early warning systems, which can help prevent electrical fires.

Emerging Market Opportunities

There are several new market opportunities that manufacturers can explore:

- Renewable Energy Systems: Solar panel installations require specialized arc fault protection.

- Electric Vehicle Charging: Growing EV adoption creates demand for advanced safety devices.

- Smart Cities: Infrastructure development needs sophisticated electrical safety solutions.

- Industrial Automation: Factory automation systems require precise arc fault detection.

Manufacturers are also looking into using new materials and components to make detectors more sensitive and reduce false trips. These technological advancements will make arc fault detectors an important part of modern electrical systems, leading to increased market growth beyond traditional uses.

Competitive Landscape in the Arc Fault Detector Market

- Eaton – Dublin, Ireland

- ABB – Zurich, Switzerland

- Schneider Electric – Rueil-Malmaison, France

- SEL (Schweitzer Engineering Laboratories) – Pullman, Washington, USA

- Yahui Electric

- Tysenkld

- Relays

- Huatech

- Style Electric

- Fellow Electric

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Arc Fault Detector Market Report |

| Base Year | 2024 |

| Segment by Type | ·Stand-alone Detector ·Dependent Detector |

| Segment by Application | ·Photovoltaic Combiner Box ·Telecommunications Room ·Communication Base Station ·Other |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Global Arc Fault Detector Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Arc Fault Detector Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Arc Fault DetectorMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Arc Fault Detectorplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Arc Fault Detector Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Arc Fault Detector Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Arc Fault Detector Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofArc Fault Detector Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the roles of upstream suppliers and downstream users in the Arc Fault Detector market?

Upstream suppliers in the Arc Fault Detector market include components manufacturers who provide essential parts for Arc Fault Circuit Interrupters (AFCIs). Downstream users consist of construction companies and electricians who utilize these detectors in residential and commercial electrical systems, ensuring safety against electrical faults.

What key trends are influencing the Arc Fault Detector market?

Key trends shaping the Arc Fault Detector market include a growing awareness of electrical safety among consumers and increased adoption of smart technology in AFCIs. Additionally, evolving safety regulations significantly impact market dynamics, driving demand for innovative safety products.

What challenges are hindering the development and adoption of Arc Fault Detectors?

Challenges affecting the Arc Fault Detector market include technical obstacles in manufacturing AFCIs, consumer awareness issues regarding their benefits, and resistance to transitioning from traditional electrical systems to modern solutions.

How do geopolitical factors impact the growth of the Arc Fault Detector market?

Geopolitical factors such as political stability and regulatory frameworks play a crucial role in influencing market expansion. Regions with favorable regulations tend to experience more robust growth in the Arc Fault Detector market compared to those with stringent or unstable policies.

What are the different types and applications of Arc Fault Detectors?

The Arc Fault Detector market is segmented into various product types, including combination AFCIs and branch AFCIs. Their applications differ across sectors; for instance, residential systems focus on home safety while industrial applications emphasize compliance with strict safety standards.

How does the demand for Arc Fault Detectors vary between residential and industrial settings?

The requirements for implementing Arc Fault Detectors differ significantly between residential homes and industrial settings. Residential systems prioritize user-friendly features for homeowners, while industrial applications require robust compliance with safety regulations and advanced technological capabilities.