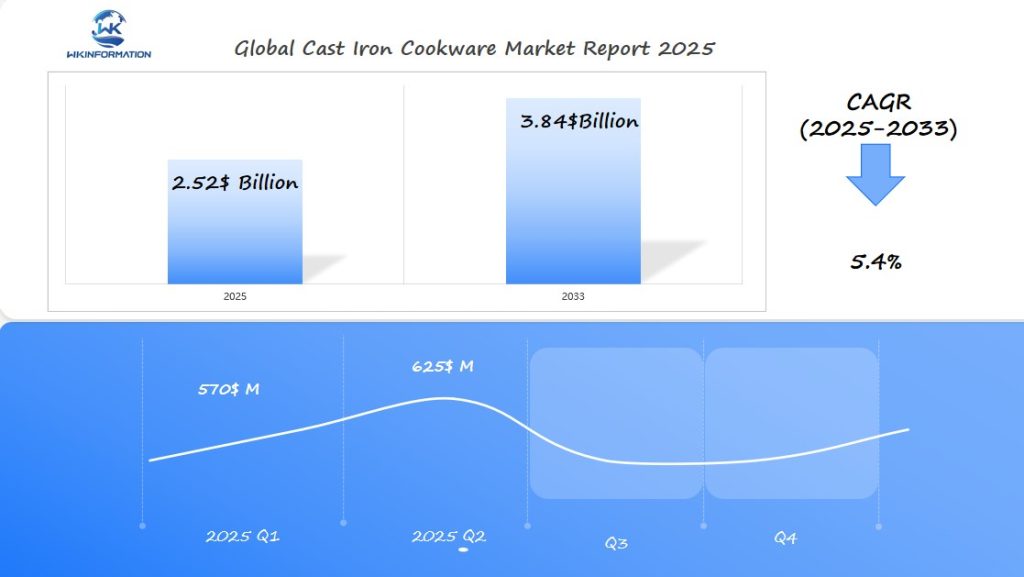

Cast Iron Cookware Market Set to Reach $2.52 Billion by 2025: Key Growth Drivers in the U.S., China, and Germany

Explore the cast iron cookware market’s growth, trends, and challenges as it evolves into a $2.52 billion industry by 2025.

- Last Updated:

Cast Iron Cookware Market Forecast for Q1 and Q2 2025

The global cast iron cookware market is projected to reach $2.52 billion in 2025, with a CAGR of 5.4% through 2033.

The first half of 2025 is expected to show steady growth, with Q1 estimated at around $570 million and Q2 expected to rise to approximately $625 million, driven by the increasing popularity of cast iron cookware for its durability, heat retention, and versatility in home cooking.

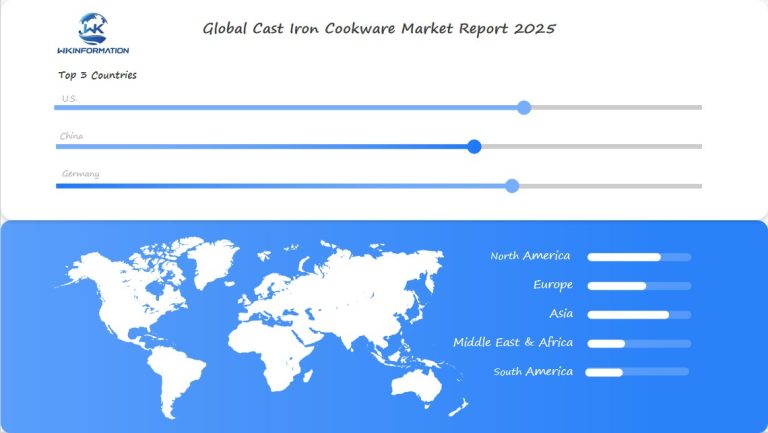

The U.S., China, and Germany are key markets for cast iron cookware. The U.S. remains the largest market, with strong demand driven by both traditional home cooking and culinary enthusiasts. China, as a major producer of cast iron cookware, continues to see growing domestic consumption and export volumes. Germany, known for its strong culinary traditions and appreciation for quality cookware, remains a significant market.

These countries are crucial for understanding the dynamics of the global cast iron cookware market.

Understanding the Cast Iron Cookware Market: Upstream and Downstream Dynamics

The cast iron cookware supply chain involves a complex network of various players, including raw material suppliers, manufacturers, distributors, and retailers. Let’s delve into the upstream and downstream dynamics that shape this market.

Upstream Dynamics: Raw Materials and Manufacturing Process

At the upstream level, the primary raw materials used in cast iron cookware production are iron ore and recycled iron. These materials are sourced from mining operations and recycling facilities around the world.

The manufacturing process of cast iron cookware involves several key components:

- Melting and molding of raw iron: The raw iron is melted down and shaped into the desired form using molds.

- Sand casting techniques for shape formation: Sand casting is employed to create intricate shapes and designs in the cookware.

- Surface treatment and seasoning: The cookware undergoes surface treatment processes to enhance its durability and non-stick properties. Seasoning, which involves applying oil and baking the cookware, is also done to create a natural non-stick surface.

- Quality control and testing: Stringent quality control measures are implemented throughout the production process to ensure that each piece meets the required standards.

- Packaging and preparation for distribution: Once the cookware has passed all quality checks, it is packaged and prepared for distribution to various channels.

Leading manufacturers such as Lodge Manufacturing and Le Creuset prioritize quality at every stage of production. They invest in advanced technologies that allow for precise temperature control during casting, ensuring consistent results. Additionally, innovative coating processes are employed to further enhance the durability of their products.

Downstream Dynamics: Distribution Channels and Consumer Behavior

The distribution landscape for cast iron cookware has witnessed significant changes in recent years, primarily due to the rise of e-commerce.

Online sales now account for the majority of cast iron cookware purchases, indicating a significant shift away from traditional brick-and-mortar retail channels. E-commerce platforms like Amazon, Wayfair, and direct-to-consumer websites have played a pivotal role in driving this digital transformation.

Breakdown of Distribution Channels

As consumer behavior continues to evolve, manufacturers are adapting their distribution strategies accordingly. Many brands now offer virtual showrooms and augmented reality tools to enhance online shopping experiences.

Direct-to-consumer sales channels have also become increasingly popular among manufacturers as they provide greater control over product presentation and customer service. Moreover, these channels allow brands to collect valuable consumer data that can be utilized for future product development initiatives.

Opportunities for Smaller Manufacturers

The shift towards digital sales presents new opportunities for smaller manufacturers to compete with established brands. Through targeted marketing efforts and specialized product offerings, these smaller players can carve out their own niche in the market.

Social media platforms such as Instagram and TikTok have become powerful tools for brand promotion among younger consumers who value authenticity and uniqueness. Collaborating with influencers who align with their brand values can help these manufacturers reach wider audiences and build credibility within specific consumer segments.

In conclusion, understanding both upstream (raw materials) and downstream (distribution) dynamics is crucial for stakeholders operating within the cast iron cookware market. By staying attuned to industry trends such as e-commerce growth or shifting consumer preferences, businesses can make informed decisions that drive success in this competitive landscape.

Key Trends Shaping the Cast Iron Cookware Industry

The cast iron cookware industry is undergoing significant changes due to shifting consumer preferences and market dynamics. Recent studies show a increase in consumer awareness about potential health risks associated with traditional non-stick and aluminum cookware. This increased awareness has created a strong demand for cast iron alternatives, especially among health-conscious consumers looking for chemical-free cooking options.

Impact of COVID-19 on Cooking Habits

The COVID-19 pandemic has transformed cooking habits globally:

- Most of households report preparing more meals at home

- Social media platforms are witnessing a rise in traditional cooking content

- Home chefs are placing greater importance on durability and versatility in cookware

This shift towards home cooking has reignited interest in traditional cooking methods, with cast iron cookware becoming a popular choice for its natural non-stick properties and excellent heat retention abilities.

Innovations Addressing Modern Consumer Needs

In response to the evolving needs of consumers, the industry has introduced groundbreaking innovations:

Lightweight Cast Iron

- Improved maneuverability without compromising durability

- Specialized manufacturing processes ensuring even heat distribution

Smart Cookware Integration

- Built-in temperature sensors

- Mobile app connectivity for cooking guidance

- Real-time temperature monitoring capabilities

Enhanced Coating Technologies

- Advanced enamel formulations

- Improved seasoning techniques

- Greater resistance to rust and wear

Market research shows that most young consumers are interested in the functions of smart cookware, while most experienced chefs prefer traditional uncoated cast iron cookware for a more realistic cooking experience. These diverse preferences have prompted manufacturers to develop diverse product lines to meet the needs of different consumer groups.

Influencers and Celebrity Chefs Driving Popularity

The rise of cooking influencers and celebrity chefs has further boosted the appeal of cast iron cookware. Many of them are showcasing its benefits through social media platforms and cooking shows, thereby increasing its visibility among potential buyers.

This exposure has led to a significant uptick in interest, as evidenced by a surge in online searches for cast iron cooking techniques and recipes.

Barriers to Growth in the Cast Iron Cookware Market

The cast iron cookware market faces several significant challenges that impact its growth trajectory.

Competition from Modern Alternatives

Modern alternatives like aluminum and non-stick cookware present strong competition by offering:

- Lighter Weight Options: Traditional cast iron’s heaviness can deter consumers, particularly elderly users or those with physical limitations

- Quick Cleaning Solutions: Non-stick surfaces require minimal maintenance compared to cast iron’s seasoning requirements

- Lower Price Points: Budget-friendly alternatives attract price-sensitive consumers

Raw Material Cost Pressures

Raw material costs put enormous pressure on manufacturers’ profit margins. Iron ore prices fluctuate wildly, with recent increases in some regions too high. These cost variations force companies to either:

- Raise product prices, potentially losing market share

- Absorb higher costs, reducing profitability

- Seek alternative materials or manufacturing processes

High Market Entry Barriers

Market entry barriers remain high for new players due to:

- Capital-Intensive Setup: Manufacturing facilities require substantial initial investment

- Technical Expertise: Specialized knowledge needed for quality production

- Established Brand Dominance: Strong consumer loyalty to heritage brands

Challenges in the Manufacturing Process

The manufacturing process itself presents challenges:

- Energy-intensive production methods

- Complex quality control requirements

- Strict environmental regulations affecting production costs

These factors create a competitive landscape where established manufacturers must balance quality maintenance with price competitiveness while new entrants struggle to gain market share.

Geopolitical Factors Impacting Cast Iron Cookware Production

Trade tensions between major economies have had a significant impact on the cast iron cookware industry. The US-China trade relationship in particular has influenced market dynamics, with the US imposing excessive tariffs on Chinese cast iron imports having a direct impact on product pricing and availability.Recent trade policies have triggered several market shifts:

- U.S. manufacturers face increased costs for raw materials sourced from China

- Chinese producers seek alternative markets in Southeast Asia

- European manufacturers gain competitive advantages in both markets

The global supply chain disruptions of 2025-2033 have intensified these challenges. Key impacts include:

- Extended lead times for raw material delivery

- Increased shipping costs affecting final product prices

- Shifts in manufacturing locations to avoid tariff zones

Regional manufacturing hubs adapt their strategies to navigate these challenges:

- U.S. producers invest in domestic supply chains

- Chinese manufacturers expand into emerging markets

- European companies strengthen their position as alternative suppliers

The implementation of the Inflation Reduction Act in the U.S. has created new considerations for manufacturers, with tax credits available for companies using domestically sourced materials. This policy shift encourages local production but potentially increases costs for international brands seeking market entry.

Raw material tariffs across different regions, forcing manufacturers to carefully balance production costs against market accessibility. These varying rates create a complex pricing landscape where manufacturers must constantly adjust their strategies to maintain competitiveness.

Cast Iron Cookware Market Segmentation: Types and Their Impact

The cast iron cookware market features distinct product categories, each serving specific cooking needs and consumer preferences:

1. Enamel Coated Cast Iron

- Combines traditional cast iron with porcelain enamel coating

- Requires no seasoning maintenance

- Available in various colors for aesthetic appeal

- Higher price point due to manufacturing complexity

- Ideal for acidic foods without metal leaching

- Popular among premium cookware buyers

2. Seasoned Cast Iron

- Pre-treated with oil or fat at manufacturing

- Ready-to-use out of the box

- Natural non-stick properties

- Builds additional seasoning with use

- Lower price point than enameled options

- Preferred by traditional cooking enthusiasts

3. Unseasoned Cast Iron

- Raw cast iron requiring initial seasoning

- Most affordable option

- Complete control over seasoning process

- Popular among DIY cooking enthusiasts

- Requires significant maintenance

4. Popular Cookware Styles

Dutch Ovens

- Driving market revenue

- Preferred for slow cooking and braising

- High demand in both home and professional kitchens

Skillets

- Represents half of market share

- Essential for high-heat cooking

- Popular for stovetop-to-oven versatility

Specialty Items

- Griddles

- Grill pans

- Woks

Growing niche market segment

Market research indicates consumer purchasing decisions are heavily influenced by cooking habits and maintenance preferences. Home cooks prioritizing convenience opt for enameled products, while cooking enthusiasts often choose traditional seasoned options for their superior heat retention and cooking performance. The rising trend of multi-functional cookware has sparked increased demand for versatile pieces that work across different cooking methods and heat sources.

How Applications Are Driving Demand for Cast Iron Cookware

Cast iron cookware’s versatility spans across residential kitchens and professional culinary establishments, each sector contributing uniquely to market growth.

Residential Applications

- Home chefs value cast iron for high-temperature searing and slow-cooking methods

- Multi-generational appeal drives purchases as families pass down cooking traditions

- Dual-purpose functionality allows stovetop-to-oven transitions in a single pot

- Growing popularity in outdoor cooking activities like camping and grilling

Professional Kitchen Usage

- Restaurant kitchens rely on cast iron for consistent heat distribution

- Steakhouses specifically choose cast iron for achieving perfect sear marks

- Catering services appreciate the durability during high-volume cooking

- Food service establishments benefit from reduced replacement costs

Heat Performance Benefits

- Superior heat retention creates ideal conditions for braising and stewing

- Even temperature distribution eliminates hot spots during cooking

- Heat sustainability reduces energy consumption in commercial kitchens

- Thermal mass properties maintain food temperature for buffet service

The adaptability of cast iron across cooking methods has sparked interest in specialized applications:

- Artisanal bread baking: Dutch ovens create perfect crust formation

- Pizza making: Skillets achieve restaurant-quality results at home

- Slow cooking: Deep pots excel in traditional recipe preparation

- Tableside service: Cast iron pieces double as serving vessels in restaurants

Regional Insights into the Global Cast Iron Cookware Market

North America: The Leading Market

North America is the largest market for cast iron cookware, accounting for around 35% of the global market share. Several factors contribute to this leading position:

- Health-Conscious Consumers: There is a growing awareness of potential health risks associated with non-stick coatings, leading to an increased demand for chemical-free cooking solutions and a rising preference for iron-fortified cooking methods.

- Market Dynamics:

The North American market is mainly driven by US demand.

The Asia-Pacific region is expected to maintain the fastest growth. Europe, especially Germany and France, is also growing steadily.

The Asia-Pacific region shows great potential for growth, especially in emerging economies:

- Key Growth Indicators

- Rising disposable incomes in urban areas

- Expanding middle-class population

- Growing adoption of Western cooking methods

- Increasing preference for durable kitchen equipment

Distinct Market Preferences

Regional market preferences reveal different patterns:

- North American Market:

- Strong demand for enameled cast iron cookware

- Premium brand dominance in retail channels

- High penetration of online sales platforms

- Asia-Pacific Trends:

- Traditional cooking methods driving demand

- Price-sensitive market segments

- Growing e-commerce penetration in rural areas

Emerging Markets

Market research indicates that Latin America and the Middle East are emerging as promising regions for cast iron cookware manufacturers. Brazil and the UAE are showing significant year-over-year growth rates of 6.5% and 5.8% respectively.

Steady Growth in Europe

The European market continues to grow steadily due to:

- Heritage brand loyalty

- Sustainable product preferences

- Demand from the professional culinary sector

- Expansion of the hospitality sector driven by tourism

U.S. Cast Iron Cookware Market: Trends and Opportunities Ahead Of 2025

The U.S. cast iron cookware market shows strong potential for growth until 2025, driven by changing consumer preferences and effective marketing strategies. Celebrity chef endorsements have changed how people view cast iron cookware, turning it from a traditional kitchen item into an essential culinary investment.

Key Market Influencers:

- Celebrity chefs like Ina Garten and Gordon Ramsay regularly showcase premium cast iron brands in their cooking shows

- Social media food influencers create content specifically highlighting cast iron cooking techniques

- Cooking shows featuring cast iron cookware reach millions of American viewers

The retail landscape for cast iron cookware in the U.S. has evolved significantly, with premium brands like Le Creuset and Staub establishing strong market positions. These brands have successfully marketed their products as both functional cooking tools and aesthetic kitchen accessories.

Consumer Behavior Patterns:

- Most of U.S. consumers prefer multi-functional cookware that can transition from stovetop to oven

- half consider aesthetic appeal when purchasing kitchen equipment

- half are willing to invest in premium cookware brands endorsed by professional chefs

The direct-to-consumer (DTC) sales channel has gained significant traction, with brands like Lodge Manufacturing Company reporting a increase in online sales since 2025. This shift has enabled manufacturers to maintain competitive pricing while offering personalized shopping experiences.

Emerging Market Opportunities:

- Custom color options and limited-edition releases

- Subscription-based seasoning and care products

- Specialized cooking classes and online tutorials

- Bundle deals combining different pieces of cookware

The U.S. market has seen a rise in demand for enameled cast iron cookware, especially in urban areas where consumers want products that combine traditional cooking benefits with modern looks. Retailers have responded by expanding their product ranges and offering exclusive collections through both physical and digital channels.

The combination of functionality and design continues to drive innovation in the U.S. cast iron cookware industry. Manufacturers are investing in research and development to create lighter-weight options while still keeping the traditional benefits of heat retention and durability that American consumers value.

China's Influence on the Global Cast Iron Cookware Market

China’s impact on the global cast iron cookware market extends far beyond its role as a major consumer. The country’s manufacturing capabilities have reshaped industry dynamics through:

Production Dominance

- Control of half of global cast iron cookware production

- Advanced manufacturing facilities equipped with automated systems

- Cost-effective labor and operational expenses

Raw Material Advantage

- Access to extensive iron ore deposits

- Established metallurgical infrastructure

- Strategic partnerships with global suppliers

The Chinese market has experienced a year-over-year growth in cast iron cookware demand, driven by:

- Rising middle-class population

- Growing interest in traditional cooking methods

- Increased focus on sustainable kitchen products

Chinese manufacturers have adapted to international quality standards by implementing:

- Strict quality control measures

- Third-party testing protocols

- Enhanced finishing techniques

Local brands like Zhang Xiao Quan and Cooker King have gained international recognition through:

- Innovative product designs

- Competitive pricing strategies

- Strong e-commerce presence

The country’s export strategies have created new market opportunities through:

- Direct-to-consumer channels

- Cross-border e-commerce platforms

- Strategic partnerships with global retailers

Chinese manufacturers are investing in research and development to create:

- Lightweight cast iron alternatives

- Enhanced coating technologies

- Smart cooking features

Germany's Role in Cast Iron Cookware Production

Germany plays a crucial role in the European cast iron cookware market, known for its precise engineering and high-quality standards. The country’s manufacturing skills have given rise to top brands like Staub and ZWILLING, which hold a significant share of the luxury cookware market.

Key Focus Areas in German Cast Iron Production

German cast iron production places great importance on:

- Advanced enameling techniques that enhance durability

- Sustainable manufacturing processes

- Rigorous quality control measures

- Innovation in ergonomic design

The Significance of the “Made in Germany” Label

The “Made in Germany” label carries substantial weight in the cookware industry, with German manufacturers focusing on:

- Premium pricing strategies

- Direct-to-consumer sales channels

- Specialized retail partnerships

- Custom product development

Integration of Industry 4.0 Technologies

German production facilities have integrated Industry 4.0 technologies, enabling:

- Automated quality inspection systems

- Real-time production monitoring

- Reduced environmental impact

- Enhanced product consistency

Adoption of Green Technologies

The country’s strict environmental regulations have pushed manufacturers to adopt green technologies, setting new industry standards for sustainable production. These innovations include water recycling systems and energy-efficient heating processes during manufacturing.

Preservation of Traditional Craftsmanship

German cast iron producers have also pioneered specialized coatings and treatments that improve the cookware’s performance while maintaining traditional craftsmanship methods. This blend of innovation and tradition has established Germany as a leader in premium cast iron cookware production.

Future Growth Prospects For The Global Cast Iron Cookware Industry Beyond 2025

Market forecasts paint a bright picture for the Cast Iron Cookware industry, which is expected to reach an estimated USD by 2033. This growth trajectory stems from several key factors:

Rising Consumer Spending Power

- Increased disposable income in emerging markets

- Growing middle-class population in Asia-Pacific regions

- Higher willingness to invest in premium cookware

Sustainability-Driven Innovation

- Implementation of eco-friendly manufacturing processes

- Use of recycled materials in production

- Integration of renewable energy sources in factories

- Development of water conservation techniques

Market Evolution Through Technology

- Smart cast iron cookware with temperature monitoring

- Enhanced coating technologies for better durability

- Lightweight cast iron alternatives

- Digital integration for cooking guidance

Industry Adaptation to Consumer Demands

- Customizable product options

- Direct-to-consumer sales channels

- Subscription-based maintenance services

- Educational content creation for proper usage

The industry’s commitment to sustainability has sparked investments in green manufacturing practices. Companies now focus on reducing carbon footprints through:

- Solar-powered production facilities

- Waste reduction initiatives

- Sustainable packaging solutions

- Local sourcing strategies

These environmental considerations, combined with technological advancements, position the cast iron cookware market for sustained growth beyond 2025. The intersection of tradition and innovation continues to drive product development and market expansion.

Competitive Landscape in the Cast Iron Cookware Industry

The cast iron cookware market features a mix of established heritage brands and emerging players competing for market share. Leading manufacturers have carved out distinct market positions:

- Lodge Manufacturing Company— United States

- Le Creuset— France

- Victoria Cookware— Colombia

- Staub en France Cookware (Groupe SEB)— France

- FINEX Cast Iron Cookware Co.— United States

- Tramontina USA Inc.— United States

- Smithey Ironware Company LLC.— United States

- Stargazer Cast Iron LLC.— United States

- Meyer Corporation— United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Cast Iron Cookware Market Report |

| Base Year | 2024 |

| Segment by Type |

· Enamel Coated Cast Iron · Seasoned Cast Iron · Unseasoned Cast Iron |

| Segment by Application |

· Home Cooking · Commercial Kitchens |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The cast iron cookware market size is expected to grow to the expected value by 2025, which means that the future is bright for this cooking essential tool. This growth reflects the changing consumer behavior, wherein the focus on health and sustainability is driving the demand in key markets.

The resilience of the market can be attributed to cast iron cookware’s ability to meet both traditional and modern cooking needs. Manufacturers who understand local market trends while also considering global influences will be better positioned for success in this changing landscape.

The cast iron cookware industry is at a crucial point where tradition meets innovation. As consumers prioritize healthy cooking methods and sustainable products, the market is likely to continue growing beyond 2025. Success in this industry will depend on manufacturers’ ability to combine traditional craftsmanship with modern consumer demands, while also managing complex global supply chains and regional market preferences.

Global Cast Iron Cookware Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Cast Iron Cookware Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Cast Iron Cookware MarketSegmentation Overview

Chapter 2: Competitive Landscape

- Global Cast Iron CookwarePlayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Cast Iron Cookware Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Cast Iron Cookware Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Cast Iron Cookware Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Cast Iron Cookware MarketInsights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the cast iron cookware market by 2025?

The cast iron cookware market is projected to grow to $2.52 billion by 2025, indicating significant opportunities for both consumers and manufacturers.

What are the key drivers of growth in the cast iron cookware market?

Key growth drivers include increasing consumer awareness about health risks associated with aluminum and non-stick cookware, a rise in home cooking trends post-COVID-19, and innovations in lightweight and smart cookware.

How is the supply chain structured for cast iron cookware?

The supply chain for cast iron cookware encompasses raw material sourcing, manufacturing processes, and distribution channels, with a notable shift towards online sales due to changing consumer behavior.

What barriers does the cast iron cookware market face?

Barriers to growth include competition from cheaper alternatives like aluminum and non-stick options, rising raw material costs, and challenges related to market entry for new manufacturers.

How do geopolitical factors impact the production of cast iron cookware?

Geopolitical factors such as trade policies and tariffs can significantly influence import/export dynamics and pricing strategies for manufacturers in major markets like the U.S. and China.

What types of cast iron cookware are available in the market?

The market features various product types including enamel coated, unseasoned, and seasoned cast iron cookware. Consumer preferences vary based on styles such as Dutch ovens or skillets, which impact purchasing decisions.