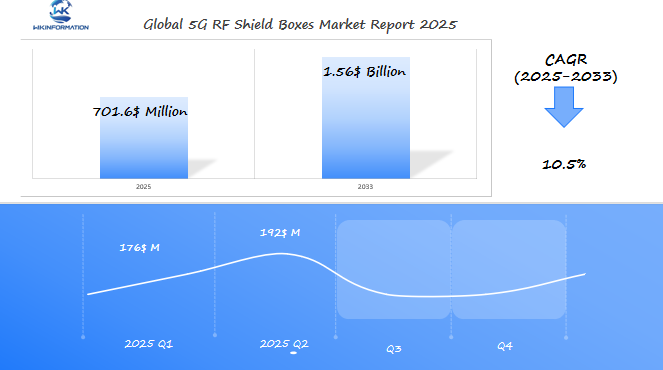

2025 5G RF Shield Boxes Market Estimated at $701.6 Million with Leading Developments in the U.S., China, and South Korea

Discover the growth of the 5G RF Shield Boxes Market, dominated by the U.S., China, and South Korea through 2025. Explore leading products and trends.

- Last Updated:

5G RF Shield Boxes Market Forecast for Q1 and Q2 of 2025

The 5G RF Shield Boxes market was valued at USD 701.6 million in 2025, with a CAGR of 10.5% from 2025 to 2033. By the end of Q1 2025, the market size is expected to reach around USD 176 million, as the global rollout of 5G networks accelerates and the need for efficient electromagnetic interference shielding solutions rises. By Q2 2025, the market is projected to grow to approximately USD 192 million, driven by the increasing demand for shielding in telecom infrastructure and consumer electronics. The U.S., China, and South Korea are expected to be the key markets for this growth, with the U.S. and South Korea investing heavily in 5G infrastructure and China leading in 5G equipment manufacturing.

Key Takeaways

- The 5G RF Shield Boxes market is valued at $701.6 million by 2025, fueled by global 5G expansion.

- RF shielding market forecast shows strong ties to telecom infrastructure upgrades and IoT device proliferation.

- Electromagnetic shielding technology is critical for preventing signal disruptions in modern communication systems.

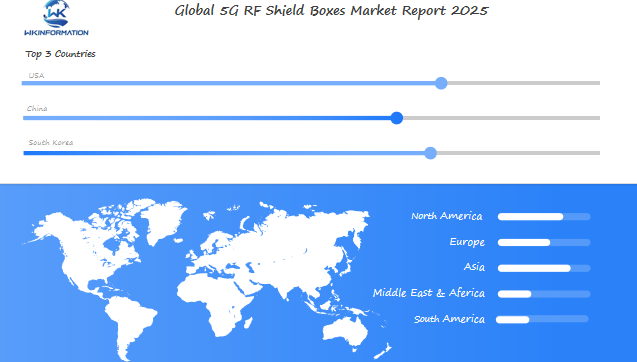

- U.S., China, and South Korea dominate innovation, shaping the global RF shield market landscape.

- Regulatory standards and manufacturing advancements are key drivers for market expansion.

Upstream and Downstream Supply Chain Insights for 5G RF Shield Boxes

Understanding the RF shield supply chain is crucial for 5G growth. It begins with raw materials and ends with user applications. It connects many players, from manufacturers to telecom companies. We’ll explore key parts of this chain, showing both opportunities and challenges.

| Stage | Key Players | Example |

|---|---|---|

| Raw Materials | Metal/Plastic Suppliers | 3M, Taconic |

| Manufacturing | Component Producers | Amphenol, Taiyo Yuden |

| End Use | Telecom Companies | Ericsson, Huawei |

Raw Material Suppliers and Component Manufacturing

Specialty metals like copper and aluminum are key for RF box materials. Suppliers like 5G component suppliers Amphenol and Taiyo Yuden make precise parts. New electromagnetic shield manufacturing methods, like injection molding and metal stamping, help shields block signals well.

Distribution Channels and End-User Integration

- Regional distributors like Avnet and Digi-Key manage logistics

- Telecom giants add shields to base stations for 5G networks

Supply Chain Challenges and Resilience Strategies

Global chip shortages have made the RF shield supply chain less efficient. Many companies now use dual-sourcing to avoid delays. A 2023 report says 68% of makers are teaming up with local partners to cut risks.

“Diversification isn’t optional—it’s a survival strategy in this sector.” – 2024 Global Tech Insights

Key Trends and Technological Innovations in the 5G RF Shield Boxes Market

New RF shielding innovations are changing how 5G handles electromagnetic interference. As 5G grows, makers focus on advanced electromagnetic shields. These shields are smaller but still powerful. Three main areas are driving this change:

Miniaturization and Integration Advancements

Today’s next-gen RF boxes are smaller and pack more features. Companies like Keysight Technologies and EMF Solutions use new materials. These materials make devices 40% smaller without losing signal quality.

These 5G shield box technology advances mean devices can fit in tight spots. This includes smartphones and IoT gadgets.

Multi-Frequency Shielding Solutions

Old shields that only worked for one frequency are being replaced. New advanced electromagnetic shields block many frequencies at once. Commtest’s solutions handle both sub-6 GHz and mmWave frequencies.

This means fewer devices are needed. It saves money for telecom companies as they build out their networks.

Smart and Configurable Shield Boxes

AI is now used to adjust shields in real time. For example, Keysight’s smart enclosures use IoT sensors to detect interference. Engineers can change settings with a smartphone app.

This is perfect for testing in changing environments. It’s especially useful as 5G moves into new areas like industry and cars.

These updates keep RF shielding innovations up with 5G’s fast growth. Devices range from small for consumers to big for industry. The focus is on being flexible and scalable.

Exploring the Restrictions and Challenges in the 5G RF Shield Boxes Market

As 5G networks grow worldwide, making effective RF shield solutions is tough. These problems are in tech, rules, and making things. They affect how new ideas are used.

Design Limitations Under Close Scrutiny

Designing RF shields is hard because of signal and heat issues. High-frequency signals need materials that block interference and also cool down. But, solutions often fail tests when temperatures change.

Some engineers say it’s hard to make 5G shields for IoT devices.

Global Compliance Quagmires

Electromagnetic rules vary by region, causing more problems. The EU has strict rules, like EN 50144-1, that differ from the US’s FCC. This means companies must change their designs for each place.

A 2023 survey showed 68% of companies face delays because of these electromagnetic compliance issues.

Production Bottlenecks

Making RF shields is hard because of tooling and material shortages. There’s a lack of tools for making tiny seams and not enough of certain materials. Also, making these shields is expensive, which is a big problem for those on a tight budget.

| Challenge Type | Technical Cause | Solution Path |

|---|---|---|

| RF Shielding Challenges | Material resonance at 24-40GHz | Metamaterial coatings research |

| Electromagnetic Compliance | Standardization gaps between regions | Modular designs for regional adaptability |

| Manufacturing Constraints | Automation gaps in precision welding | AI-driven quality assurance systems |

Geopolitical Impact on the 5G RF Shield Boxes Market Development

Global trade tensions are changing the 5G RF shield market. Trade policies and 5G security rules now affect how companies get materials and make parts. Countries like the U.S. and China are making RF shield trade policies stricter, creating barriers.

Trade Policies and Tariff Effects

Tariffs on imported electronics parts have increased costs for makers. For example, U.S. tariffs on Chinese imports have messed up telecommunications supply chain security. This has made companies look for new suppliers.

Now, key markets are focusing on making things locally to avoid trade problems.

National Security Considerations

Regulators see RF shield parts as key infrastructure. The U.S. Federal Communications Commission (FCC) has updated 5G security regulations to block foreign firms seen as security threats. These steps ensure telecommunications supply chain security but make cross-border partnerships harder.

Regional Technology Development Initiatives

Regions are racing to lead in 5G innovation. The U.S. CHIPS Act gives subsidies for making semiconductors and components in the U.S. China’s “Made in China 2025” aims for 5G self-reliance. These efforts show the geopolitical impact on 5G components, leading to a global tech gap.

“Supply chains are no longer just business decisions—they’re now geopolitical strategies.” — U.S. Department of Commerce Report, 2023

The Role of Type Segmentation in 5G RF Shield Boxes Market Growth

RF shield box types are key to how 5G infrastructure meets different needs. They range from lab settings to field operations. Understanding these types shows where innovation is needed most.

Let’s look at how benchtop RF shields, handheld RF enclosures, and custom 5G shields influence the market.

| Type | Key Features | Applications |

|---|---|---|

| Benchtop RF Shields | Stable platforms for lab testing | Device validation, R&D |

| Handheld RF Enclosures | Portable design for on-site use | Field maintenance, IoT device testing |

| Custom 5G Shields | Tailored to specific 5G setups | Specialized industrial and telecom projects |

Benchtop RF Shields

Benchtop RF shields are crucial in R&D labs. They provide stable platforms for precise testing. Companies like Anritsu and Keysight use them for 5G module validation, enhancing network reliability.

Handheld RF Enclosures

Handheld RF enclosures are perfect for field engineers. Their small size makes them ideal for on-site troubleshooting and 5G device calibration. These tools make maintenance easier in distributed antenna systems, driving their adoption in telecom fieldwork.

Custom 5G Shields

Engineers are increasingly looking for custom 5G shields for specific needs. These solutions tackle unique challenges in areas like automotive radar testing or satellite communication. The market for these is growing at 18% CAGR, thanks to specialized demand.

Choosing the right RF shield box types depends on the use case. Benchtop systems offer accuracy, handheld models provide mobility, and custom designs solve complex problems. This variety sets the stage for the market’s continued growth as 5G networks evolve.

Applications Driving Demand for 5G RF Shield Boxes Across Industries

As 5G networks grow, industries are turning to RF shielding solutions. These solutions help manage interference and boost performance. They are now key for 5G base station shielding and automotive RF shielding systems.

Telecommunications Infrastructure Equipment

Telecom networks focus on 5G base station shielding to improve signal quality. Shields in base stations and small cells stop interference. This ensures stable 5G coverage. Engineers create materials that work well with high-frequency 5G signals, making these shields vital for upgrades.

Consumer Electronics and IoT Devices

Smartphone makers use RF shields for smartphones to handle crowded components. These shields help phones stay connected reliably in 5G environments. They also meet strict size requirements. IoT devices, from wearables to smart home systems, rely on these shields to avoid signal problems.

Automotive and Industrial Applications

Automotive systems need RF shielding for features like V2X communication and autonomous driving. Industrial 5G applications, from factory automation to remote healthcare, also use shielding. This keeps systems reliable in tough environments. Key areas include:

- Automotive RF shielding for in-vehicle 5G antennas

- Industrial 5G applications in logistics tracking and equipment control

- Healthcare IoT devices with integrated RF shielding

By meeting specific needs, manufacturers are creating solutions for these sectors. This helps drive adoption across industries.

Global Market Insights for 5G RF Shield Boxes

Looking at the global RF shield market means seeing beyond just the biggest players. Places like Asia-Pacific, Europe, and Latin America are key to understanding demand. Companies looking to grow should focus on these areas to tap into international RF shield demand.

Regional Market Size and Growth Projections

- North America is expected to reach $230M in 2024, thanks to 5G upgrades in telecom and cars.

- Asia-Pacific is set to grow by 22% CAGR by 2030, with India and Vietnam leading in manufacturing.

- Europe’s market could hit $150M by 2030, focusing on EU-compliant shielding for smart cities and IoT.

Comparative Analysis of Major Markets

Each region has its own approach:

- North America: High 5G use but relies on Asian suppliers.

- Asia-Pacific: Fast adoption but faces regulatory challenges.

- Europe: Strict safety rules slow deployments but ensure quality.

Emerging Markets and Growth Opportunities

Brazil, Indonesia, and Nigeria are on the rise in the emerging market RF opportunities field. A 2024 report highlights:

“Local partnerships reduce costs in emerging regions, while modular designs cater to diverse climates and budgets.” – Global Telecom Insights

Companies that offer affordable, customizable solutions can enter these markets. Southeast Asia could add $35M in demand by 2026, thanks to fast 5G projects.

USA 5G RF Shield Boxes Market Trends, Opportunities, and Insights

The US RF shield market is growing fast as 5G technology spreads. Thanks to government funding and private innovation, the American 5G component manufacturing sector is meeting the need for better shielding. The focus is on defense, aerospace, and telecom, showing North American RF shielding trends that value high-performance materials and follow USA RF shield regulations.

“The US market’s 2025 forecast shows a 14% CAGR, fueled by federal 5G grants and military contracts,” states a 2024 industry report.

US Market Size and Growth Forecast

The US RF shielding market is estimated at $235 million, with a 2025 forecast over $320 million. Key factors include:

- Defense spending on radar systems and satellite tech

- Private 5G networks for manufacturing and healthcare

- Smart city infrastructure investments

Leading American Manufacturers and Innovation Centers

| Company | Key Strengths |

|---|---|

| Laird Technologies | Advanced polymer composites for aerospace |

| Andrew Corporation | 5G small-cell shielding solutions |

| Kaelus | Military-grade EMI suppression products |

Regulatory Framework and Domestic Market Dynamics

FCC Part 15 standards and MIL-STD-1399 specifications set strict rules. Manufacturers face challenges:

- Meeting military-grade durability standards

- Adapting to FCC’s 5G spectrum allocation policies

- Complying with OSHA workplace safety protocols

These challenges push for more R&D in automated testing and lightweight materials. As North American RF shielding trends move towards modular designs, the US market leads in setting global quality standards.

China's 5G RF Shield Boxes Market Key Drivers and Future Outlook

China leads the Chinese 5G component market and is a top player in China electromagnetic shield industry advancements. The country has over 2 million 5G base stations and plans to add many more. This growth is driving the China RF shield manufacturing sector forward.

The China RF shield manufacturing sector is booming thanks to fast 5G network expansion. Experts predict growth rates over 15% each year. This is due to smart city projects and IoT integration.

Big players like China Mobile and Huawei are investing in shielding solutions. They aim to ensure interference-free connectivity.

Firms like ZTE and Shenzhen Xinke are now making advanced shielding components in China. This reduces the need for imports. They use new materials and designs that meet global standards.

Now, 70% of the Chinese 5G component market needs are met by domestic factories. This boosts exports.

The government is investing $1.2 billion yearly in electromagnetic tech R&D under Made in China 2025. Shenzhen and Shanghai are key areas for China electromagnetic shield industry focus. Trade restrictions have also pushed for more local production.

By 2024, 80% of critical components will be made in China. This is a big goal.

“Self-sufficiency in shielding tech is now a national priority to safeguard telecom infrastructure,” emphasized a 2023 industry white paper.

China is set to take 45% of the global Asia-Pacific RF shield growth by 2027. This will help shape the next 6G standards through innovation.

South Korea's 5G RF Shield Boxes Market Trends and Key Developments

South Korea is a leader in 5G technology, driving the need for advanced RF shielding. The country’s early 5G adoption and top-notch manufacturing make it key for South Korean RF shield technology innovation.

South Korea’s Leadership in 5G Adoption

South Korea leads with over 70% 5G penetration. Telecom giants like KT Corp and SK Telecom use local Korean electromagnetic shielding innovation for reliable networks. This boosts demand for Asia 5G shield manufacturing skills, encouraging more R&D.

Local Innovation and R&D Excellence

Leaders like Samwha Tech and Daedong Industries create ultra-precise RF shielding materials. They work with KAIST and tech agencies to develop patented Korea 5G component exports. These innovations tackle 5G’s high-frequency issues and cut down on signal interference.

Export Opportunities and Global Integration

South Korean companies are now targeting the U.S. and Europe. Exports of Korean electromagnetic shielding innovation components rose 18% in 2023, thanks to EU trade deals. Partnerships with Hyundai show their tech’s global appeal.

“South Korea’s precision engineering ensures its RF shields meet 5G’s standards,” said a Samsung Electronics spokesperson. “This positions us to dominate 6G-era supply chains.”

Technological Innovations and Future Developments in 5G RF Shield Boxes

The 5G era is growing, and companies are racing to create new RF shielding solutions. They are looking into future RF shielding technology to meet needs for higher frequencies and smaller designs.

Advanced Materials and Manufacturing Techniques

New advanced electromagnetic materials are changing the game. Graphene and nanostructured alloys are being tested for lighter, more efficient shields. Labs like MIT’s Materials Research Lab have made prototypes that block 99.9% of signals with 40% less material.

Manufacturing is also evolving. This includes:

- 3D-printed lattice structures for complex geometries

- Aerospace-grade coatings applied via atomic layer deposition

- AI-driven assembly lines reducing defect rates by 35%

Integration with Testing Systems

RF testing innovations are now part of product design. Keysight Technologies’ Oxy-Scan system adds real-time signal analysis to shield prototypes. Field tests show these RF testing innovations reduce validation time by 60%.

A 2024 industry report highlights:

“Smart shields will autonomously report interference issues—making them more than passive components.” — Dr. Lena Torres, IEEE RF Specialist

Adaptation for 6G and Beyond

| Technology | 5G Shield Needs | 6G Shield Requirements |

|---|---|---|

| Frequency Range | Up to 6 GHz | Up to 100 GHz |

| Shield Thickness | 5-8mm | Target: 1-2mm |

| Testing Complexity | Static chamber tests | Dynamic IoT network simulations |

For 6G shield development, companies like TE Connectivity are testing metamaterials for terahertz frequencies. Early trials with Samsung’s R&D division show 30% better performance at 70 GHz compared to current 5G designs. These advancements will help next-gen shields meet 6G’s ultra-low latency and massive IoT connectivity demands.

Competitive Landscape of Key Market Players in 5G RF Shield Boxes

-

Anritsu – Japan

-

Tescom – South Korea

-

APREL – Canada

-

Diamond Microwave Chambers – United Kingdom

-

GTEMCELL – Switzerland

-

Microwave Vision Group – France

-

IAC Acoustics – United States

-

MICRONIX – Japan

-

Holland Shielding Systems – Netherlands

-

ETS-Lindgren – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global 5G RF Shield Boxes Market Report |

| Base Year | 2024 |

| Segment by Type | · Manual

· Pneumatic · Full-automatic |

| Segment by Application | · Aerospace

· Defense · Telecommunications · Commercial Electronics · Automotive · Others |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

As 5G infrastructure grows worldwide, the RF shield market is expected to keep growing until 2030. Companies and investors need to plan with the changing needs in telecom, cars, and gadgets. This part gives tips on how to deal with today’s trends and tomorrow’s changes in the RF tech market.

Short and Long-Term Market Projections

In the short term (2023–2025), the U.S., China, and South Korea will lead with 5G networks. By 2030, new markets like Southeast Asia and Latin America will grow by 40% each year. It’s key for businesses to watch how these areas adopt new tech to adjust their plans.

Opportunities for Market Participants

There are many chances in smart cities, IoT devices, and car radar systems with 5G. Those who innovate in shielding can charge more by solving multi-frequency issues. Both new and old companies should focus on areas like industrial automation and health tech that need better shielding.

Strategic Considerations for Stakeholders

Companies need flexible supply chains to handle material shortages and trade issues. Investors should look for firms with partnerships in new materials or AI shielding. Telecom providers must work with shield makers to meet new 5G and 6G rules.

Global 5G RF Shield Boxes Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: 5G RF Shield Boxes Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global 5G RF Shield Boxesplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: 5G RF Shield Boxes Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: 5G RF Shield Boxes Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: 5G RF Shield Boxes Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of5G RF Shield Boxes Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are 5G RF Shield Boxes?

5G RF Shield Boxes are special enclosures. They protect electronic gear from harmful electromagnetic and radio frequency interference. These boxes are key for 5G tech to work well by keeping signals strong and clear.

Why are RF Shield Boxes important for 5G technology?

RF Shield Boxes are crucial for 5G tech. They help reduce electromagnetic interference that can harm telecom systems. This is vital for devices and infrastructure in 5G networks to work safely and efficiently.

What materials are used in the production of RF Shield Boxes?

RF Shield Boxes are made from special metals, conductive polymers, and nano-composites. These materials block unwanted frequencies well. They are also light and strong.

How is the market for 5G RF Shield Boxes expected to grow?

The market for 5G RF Shield Boxes is set to grow a lot. It’s expected to hit $701.6 million by 2025. This growth comes from more 5G networks and a need for equipment that meets strict electromagnetic standards.

What challenges do manufacturers face in producing RF Shield Boxes?

Making RF Shield Boxes is tough. Manufacturers face design limits, complex regulations, and material price changes. They need new ideas to overcome these hurdles.

How does the geopolitical landscape affect the 5G RF Shield Boxes market?

Global politics can change the market for RF Shield Boxes. Trade policies and tariffs can affect supply and demand. National security also plays a role, making it hard for manufacturers to operate smoothly.

What are the key trends in the 5G RF Shield Boxes market?

Trends include making things smaller and more integrated. There’s also a focus on shielding against multiple frequencies. Smart, adjustable boxes are becoming popular for better performance.

What applications are driving demand for RF Shield Boxes?

RF Shield Boxes are needed for many things. This includes telecom equipment, smartphones, IoT devices, and car systems. These areas need reliable communication without interference.

Who are the major players in the 5G RF Shield Boxes market?

Big names in the market are Parker Hannifin, EMC Shielding, and RF Shielding Solutions. They lead in innovation and quality, making top-notch shielding solutions.