$153.5 Million Alkylated Naphthalene Market Poised for Explosive Growth in the U.S., Germany, and China by 2025

The Alkylated Naphthalene Market is growing at a CAGR of 7.18%, driven by demand for high-performance lubricants in automotive, aerospace, and industrial sectors.

- Last Updated:

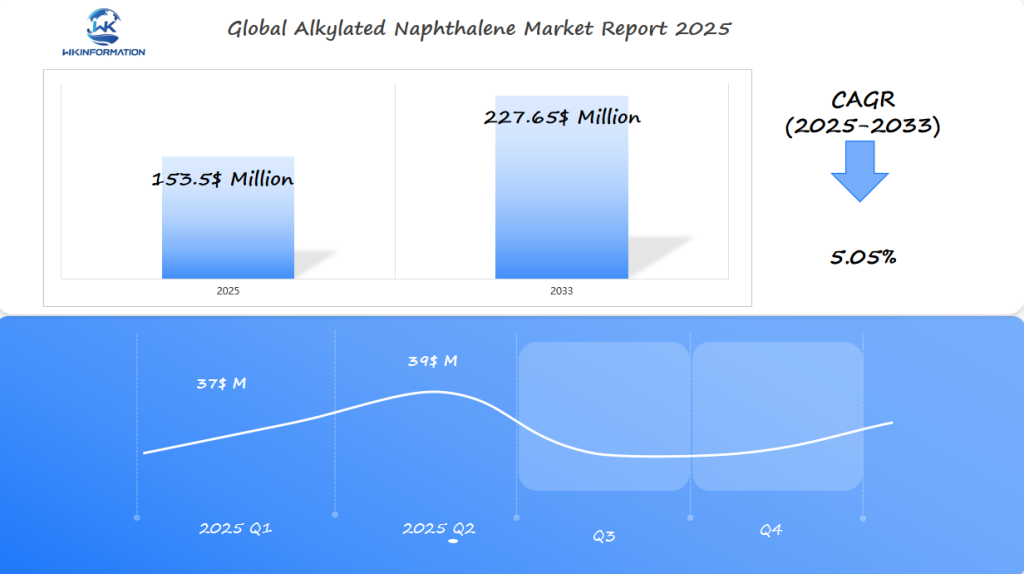

Projected Market Insights for Alkylated Naphthalene in Q1 and Q2 of 2025

The Alkylated Naphthalene market is projected to reach $153.5 million in 2025, with a CAGR of 5.05% from 2025 to 2033. In Q1, the market is expected to reach approximately $37 million, driven by the use of alkylated naphthalene in industrial applications, including lubricants and as a solvent in chemicals. By Q2, the market is expected to grow to around $39 million, maintaining a steady increase.

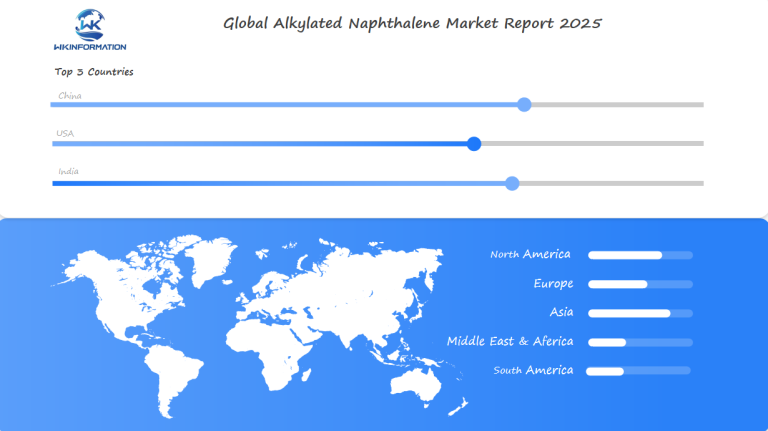

The U.S., Germany, and China are expected to be the leading markets, with the U.S. continuing to drive demand in chemical manufacturing, Germany focusing on industrial applications, and China’s large-scale production driving the market in Asia. The continued use of alkylated naphthalene in petrochemical and automotive industries, along with an increase in demand for high-performance chemicals, will help support the market’s growth in these countries.

Understanding the Upstream and Downstream Industry Chains for Alkylated Naphthalene

The journey of alkylated naphthalene begins with raw materials and ends with end-user applications. This creates a complex yet interconnected supply chain. It starts with the extraction of naphthalene from petroleum refining byproducts.

These byproducts are then processed into naphthalene derivatives. These derivatives serve as the foundation for alkylated naphthalene production, which plays a vital role in the creation of high-performance synthetic lubricants.

Raw Material Sourcing and Production Processes

- Petroleum-based naphthalene is sourced globally, with major suppliers focusing on refining efficiency.

- Catalytic alkylation methods dominate alkylated naphthalene production, balancing cost and quality.

- Alternative methods like non-catalytic processes offer sustainability benefits but face scalability challenges.

Distribution Channels and End-User Applications

Once produced, alkylated naphthalene enters the synthetic lubricant supply chain. It moves through distributors to manufacturers. Key end markets include:

- Automotive lubricant production for engine and gear oils.

- Industrial machinery lubrication in heavy manufacturing.

- Specialty chemicals for electronics and coatings.

Value Chain Analysis and Market Integration

Each stage adds value, from industrial lubricant manufacturing to retail. Bottlenecks often arise in raw material pricing or regulatory hurdles. This requires close coordination between suppliers and manufacturers.

Streamlining logistics and partnerships strengthens market integration. This ensures a steady supply to global industries.

How Market Trends Are Shaping the Future of Alkylated Naphthalene

Global trends towards sustainability and digital innovation are changing alkylated naphthalene production. Eco-friendly manufacturing and AI-powered factories are leading these changes. They are redefining the

Sustainability Initiatives and Green Chemistry

Companies like BASF and Clariant are focusing on green lubricant technology. This technology reduces emissions without losing performance. New biodegradable formulas meet EU’s 2030 carbon goals, reducing plant waste by up to 30%.

This move supports global efforts towards a circular economy in lubricant production.

Industry 4.0 and Digital Transformation

Leading facilities now embrace smart manufacturing. Automated systems keep track of:

- Viscosity sensors in blending tanks that provide real-time measurements

- Energy management for reactors powered by artificial intelligence

These improvements lead to a 40% decrease in downtime, supporting the growing trend of alkylated naphthalene towards technology-driven efficiency. Through data analytics, it becomes possible to forecast equipment wear patterns up to six months in advance.

Changes in Consumer Demand for Key Applications

General Motors, one of the leading automotive companies, now requires synthetic lubricant to support longer service intervals. In the wind energy sector, specialized alkylated naphthalene grades are being utilized for turbine gearboxes. As a result, the industrial oil market is projected to grow at an annual rate of 6.8% until 2030.

These shifts demonstrate how the needs of end-users are influencing research and development initiatives globally.

Key Challenges Facing the Alkylated Naphthalene Industry and Potential Solutions

The alkylated naphthalene sector is growing, but companies face big hurdles. They need to find ways to keep growing and stay innovative. This means solving alkylated naphthalene challenges with smart strategies.

Raw Material Price Volatility and Supply Constraints

Changes in crude oil prices and supply issues make it hard to keep costs down. To deal with these problems:

- Make long-term deals with suppliers for stable prices

- Look into using bio-based materials for different inputs

- Use the latest tech to manage inventory better

Regulatory Compliance and Environmental Concerns

Stricter synthetic lubricant regulations are now prioritizing industrial chemical sustainability. In order to comply with EPA standards, companies must implement eco-friendly practices such as recycling and utilizing renewable energy sources.

Technical Barriers to Market Entry and Innovation

Starting up is tough due to high R&D costs and special equipment. Ways to overcome this include:

- Working with universities to develop new tech

- Getting government funding for early projects

- Building smaller, more affordable production sites

By tackling these issues, companies can turn obstacles into chances for growth and improvement across the industry.

Geopolitical Impacts on the Alkylated Naphthalene Supply Chain

Global chemical supply chain disruptions are changing the alkylated naphthalene trade. Trade policy changes in the U.S., China, and EU have made it harder to import and export synthetic lubricants. Companies now deal with unpredictable tariffs that raise production costs and change where they source materials.

Trade Policy Changes and Global Relations

Trade tensions have forced companies to reconsider their supply chain strategies. In 2023, the U.S. imposed 25% tariffs on Chinese imports, impacting the trade of synthetic lubricants. Additionally, new EU regulations now mandate third-party certifications for chemical exports to Asia, resulting in an extra 3-6 weeks for delivery times.

Regional Production Capacities and Dependencies

“Geopolitical shifts are forcing companies to decentralize production hubs,” says Dr. Lena Müller of BASF’s supply chain team. “Regions like Southeast Asia are emerging as alternative production centers to reduce reliance on politically volatile markets.”

Strategic Resource Management in Volatile Markets

In response to the fluctuating market conditions, US firms are diversifying suppliers across 3+ regions to stabilize the alkylated naphthalene trade. This strategy is essential for maintaining a steady supply amidst global uncertainties.

For instance, German exporters are proactively building localized storage facilities to mitigate EU tariff risks. This move not only secures their supply chain but also provides a buffer against sudden market changes.

Similarly, China’s state-owned chemical firms are securing long-term contracts with Middle Eastern suppliers. This strategic partnership not only ensures a steady supply of raw materials but also stabilizes their operations in the volatile market.

In such an unpredictable global landscape, businesses need to stay updated with geopolitical news to keep their supply chains robust. Implementing strategies like dual-sourcing and regional partnerships will be crucial in navigating through these turbulent times.

Understanding the Different Types of Alkylated Naphthalene and Their Impact on the Market

Knowing the different types of alkylated naphthalene is crucial for understanding their market potential. This section will look at how different product variations influence demand in various industries. Each formulation has its own specific uses, such as high-performance lubricants or specialty chemicals.

Mono-Alkylated vs. Poly-Alkylated Naphthalene Products

Mono-alkylated naphthalene properties include lower molecular weight, making them ideal for applications needing flexibility. Poly-alkylated variants, with higher stability, excel in extreme environments like heavy machinery. Both types cater to distinct needs, balancing cost and performance.

Application-Specific Grades and Formulations

- Synthetic lubricant formulations often use poly-alkylated naphthalene for high-temperature resistance.

- Mono-alkylated grades dominate in electrical insulation due to their dielectric strength.

- Custom blends meet automotive, industrial, and electronics sectors’ unique requirements.

Performance Benchmarking Across Product Categories

Poly-alkylated naphthalene applications require testing for thermal stability and oxidation resistance. Mono-alkylated variants are benchmarked for viscosity and compatibility. Manufacturers tailor synthetic lubricant formulations to meet these benchmarks, ensuring reliability in demanding conditions.

Market success hinges on aligning product chemistry with end-use demands. This segmentation drives innovation, as companies refine mono-alkylated naphthalene properties and expand poly-alkylated naphthalene applications into new markets.

Innovative Applications of Alkylated Naphthalene in Key Industries

Alkylated naphthalene is changing the game in many industries. It’s used in electric vehicles and advanced electronics. This chemical is leading to synthetic lubricant innovations and specialty chemical solutions that set new standards.

Innovations in the Automotive and Transportation Sector

Car manufacturers are using alkylated naphthalene applications to solve problems with electric vehicles (EVs). This solution is effective in high temperatures, making it ideal for new gear oils and transmission fluids. Currently, tests are being conducted to reduce friction in electric motors, which would result in longer-lasting batteries and lower maintenance costs.

According to a report from 2023, the use of synthetic lubricants containing alkylated naphthalene has the potential to decrease wear by 40% in EV drivetrains.

Industrial Machinery and Equipment Applications

In factories, industrial oil uses now include safe hydraulic fluids and greases that resist corrosion. Food processing plants use these oils to meet FDA standards while keeping machines running smoothly. A Midwest manufacturer saw a 25% drop in downtime after switching to these lubricants for heavy-duty bearings.

Emerging Uses in Electronics and Specialty Chemicals

Electronics makers use alkylated naphthalene for specialty chemical solutions like thermal interface materials. Its properties are crucial in 5G server cooling systems. A top semiconductor company used it to prevent overheating in high-power chips, increasing their life by 30%.

Global Insights into the Alkylated Naphthalene Market's Regional Performance

The alkylated naphthalene global market shows big differences in growth and challenges by region.

- Asia-Pacific is leading with more factories, thanks to growing regional lubricant demand from cars and machines.

- Europe focuses on new products because of strict green rules.

- North America has strong demand but also has plenty of oil from shale.

Asia-Pacific is growing fast, especially in China. Factories in India and Indonesia are also working hard to meet local needs. This change is affecting international chemical trade, with more Asian exports reaching the world.

Asia-Pacific’s Rapid Growth and Manufacturing Expansion

China’s factories make up 60% of the world’s production, thanks to low costs and government help. India’s car industry is using more alkylated naphthalene-based lubricants, growing 9% each year. This is increasing demand in the region.

Europe’s Innovation Hubs and Regulatory Influence

EU rules on green chemistry are making companies like Germany’s BASF and France’s Arkema create greener products. These rules have cut carbon emissions by 15% in Europe since 2020.

North American Market Dynamics and Consumption Patterns

In the U.S., refineries use shale oil to save money, lowering synthetic oil prices by 12% in 2023. Big car companies like Ford and GM are testing new oil blends to meet stricter fuel standards.

Opportunities and Growth Drivers in the U.S. Alkylated Naphthalene Market

The U.S. alkylated naphthalene market is growing fast. Industries are looking for better materials. This is pushing demand for high-performance solutions in manufacturing and automotive.

Industrial Modernization and Lubricant Performance Demands

Producers of United States industrial oils are using alkylated naphthalene. This meets the American synthetic lubricant demand. It’s great for high-pressure machinery in energy and aerospace.

- Advanced lubricants reduce downtime in manufacturing plants

- Oil refineries integrate the compound for cleaner processes

Changes in the Automotive Industry and Their Impact on Lubricant Needs

Automakers are increasingly seeking American synthetic lubricants due to the rise of electric vehicles (EVs) and fuel-efficient engines. Alkylated naphthalene is particularly beneficial for cooling systems in EV batteries.

- Lubricant requirements for EVs are 30% greater compared to conventional oils.

- In 2023, automotive research and development budgets allocated for lubricants experienced an 18% increase.

Domestic Production Advantages and Export Potential

U.S. chemical manufacturing is significantly bolstered by the availability of shale gas, which lowers production costs. As a result, 65% of North American demand is now met by U.S. output. According to a recent guide to the business of chemistry, this trend is likely to continue.

| Category | 2023 Value | 2024 Forecast |

| U.S. Alkylated Naphthalene Market | $120M | $145M |

| American Synthetic Lubricant Demand | 8% growth | 12% growth |

Moreover, exports to Asia-Pacific could see substantial growth as Asian manufacturers increasingly seek U.S.-made products for their superior quality. This trend further solidifies the U.S.’s position as a global leader in specialty chemicals.

China's Strategic Role in the Alkylated Naphthalene Industry

China is changing the game in the global market with its alkylated naphthalene production progress. It’s investing in Asian chemical manufacturing and teaming up with global companies. This makes it a key player in supply chains.

Home demand for Chinese industrial oil demand is growing fast. This is because more people are using synthetic lubricants and machinery in their work.

Manufacturing Capacity Expansion and Technological Advancement

Major companies like Sinopec and CNPC are increasing their production of alkylated naphthalene in China. They are implementing AI technology for quality control, which aligns with the demands of the Chinese synthetic lubricant market that now fulfills 70% of the country’s requirements.

Collaboration with German and Japanese firms is accelerating the transfer of advanced technology, enabling China to bridge the gap with global standards.

Domestic Consumption Growth and Application Trends

- The car industry is a big user of Chinese industrial oil demand, making up 40%. This is because electric cars need special lubricants.

- More use in wind turbines and space parts is leading to the creation of special products.

Export Strategies and International Market Positioning

China’s focus on exports is on being affordable and meeting ISO standards. It’s sending products to Europe (35% of exports) and Southeast Asia. New deals with European car makers help China meet EU green rules while keeping costs low.

Germany's Market Position and Developments in Alkylated Naphthalene

Germany is a leader in alkylated naphthalene innovations. They combine advanced chemical manufacturing with a strong global presence. Their products excel in high-performance areas where accuracy is crucial.

Engineering Excellence and High-Performance Applications

The automotive and machinery industries rely on Germany’s European synthetic lubricants for their durability. These products are utilized in:

- High-temperature lubricants for industrial gear

- Electronics cooling systems

- Custom blends for precise engineering

European Regulatory Leadership and Green Chemistry Initiatives

Germany is at the forefront of establishing EU lubricant regulations that strike a balance between performance and environmentally-friendly standards. The new regulations mandate reduced emissions and the use of biodegradable formulas. This shift is transforming the landscape of European synthetic lubricants production, with an emphasis on incorporating eco-friendly additives while maintaining optimal performance levels.

Research Partnerships and Innovation Ecosystems

German companies collaborate with universities and research institutions such as the Fraunhofer Institute to enhance Germany’s chemical manufacturing processes. These partnerships accelerate research and development (R&D) for new lubricants by integrating academic and industrial initiatives. Together, they focus on projects related to recycling and nanotechnology.

Future Growth and Technological Innovations in Alkylated Naphthalene

The future of alkylated naphthalene looks promising, thanks to new technology. This technology is transforming the way we produce and utilize this substance. The focus is on innovations in synthetic lubricants and advancements in industrial oils to cater to the increasing global demand.

Next-Generation Production Processes

Manufacturers are using chemical industry technology to make things better. They’re focusing on:

- Continuous flow reactors that use 30% less energy in some cases

- Smart sensors for checking quality as it happens

- New catalysts that cut down waste by making reactions more efficient

Performance-Driven Molecular Designs

Scientists are creating specialized molecules with the following features:

- Improved heat resistance for high-temperature machinery

- Environmentally friendly biodegradable alternatives

- Hybrid materials combining synthetic and bio-based components

Sustainability and Digital Integration

Companies are using AI for:

- Finding better, renewable sources for making things

- Creating recycling systems that go full circle

- Figuring out when machines need maintenance

These changes are making production greener and smarter. They’re helping the alkylated naphthalene future meet global green goals.

Competitive Landscape: Who's Leading in Alkylated Naphthalene Market Share

The alkylated naphthalene market is changing fast. Knowing who’s leading helps businesses find their place. Big names like Clariant, ExxonMobil, and Naphthenic Products lead the way. They use advanced tech and invest in research to stay ahead.

-

Shanghai NACO Lubrication Co., Ltd. – China

-

ExxonMobil Corporation – United States

-

King Industries Inc. – United States

-

Quaker Chemical Corporation – United States

-

NACO Corporation – United States

-

Huntsman Corporation – United States

-

Kao Corporation – Japan

-

NOVITAS CHEM SOLUTIONS, LLC. – United States

-

Nease Co. LLC. – United States

-

Akzo Nobel N.V. – Netherlands

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Alkylated Naphthalene Market Report |

| Base Year | 2024 |

| Segment by Type |

· Mono-Alkylated · Poly-Alkylated Naphthalene |

| Segment by Application |

· Automotive and Transportation Sector · Industrial Machinery and Equipment Applications · Electronics and Specialty Chemicals |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The alkylated naphthalene market has demonstrated remarkable progress, with its current valuation reflecting steady growth and expanding applications. Key drivers, such as rising demand for high-performance lubricants and advancements in production technologies, continue to propel the market forward. Its economic significance extends across industries, contributing to global and regional economies through innovation and efficiency.

Global Alkylated Naphthalene Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Alkylated Naphthalene Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Alkylated NaphthaleneMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Alkylated Naphthaleneplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Alkylated Naphthalene Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Alkylated Naphthalene Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Alkylated Naphthalene Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofAlkylated NaphthaleneMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the current value of the alkylated naphthalene market?

The alkylated naphthalene market is worth $153.5 million. It’s growing fast, especially in the U.S., Germany, and China.

What are the main applications of alkylated naphthalene?

Alkylated naphthalene is used in various industries for several important applications, including:

- Synthetic lubricants: Alkylated naphthalene is used as a base oil in the formulation of synthetic lubricants. Its excellent thermal stability and low volatility make it suitable for high-performance lubrication applications.

- Industrial oils: It is employed in the production of industrial oils, such as hydraulic fluids and metalworking fluids, where its properties contribute to improved lubrication and protection of machinery.

- Other chemicals: Alkylated naphthalene serves as a building block in the synthesis of other chemicals, including surfactants and additives used in various formulations.

The significance of alkylated naphthalene extends across multiple industries, making it a valuable compound in the production of lubricants, oils, and other chemical products.

How does raw material sourcing impact the alkylated naphthalene industry?

Getting raw materials, like petroleum-derived naphthalene, is key. It affects how products are made, their quality, and if they’re sustainable.

What trends are currently shaping the alkylated naphthalene market?

Trends include more focus on being green, new tech from Industry 4.0, and demand for better lubricants.

What challenges does the alkylated naphthalene industry face?

Challenges include price changes in raw materials, strict rules, and barriers to entering the market.

How do geopolitical factors affect the alkylated naphthalene supply chain?

Politics, including trade policies and international relations, have a significant impact on production and the supply chain.

What are the different segments of alkylated naphthalene products?

The market has mono-alkylated and poly-alkylated naphthalene. Each is made for specific uses and performance.

How is alkylated naphthalene innovating in key industries?

It’s being used in new car lubricants, industrial machines, electronics, and specialty chemicals.

What are the growth opportunities in the U.S. market for alkylated naphthalene?

Growth comes from modernizing industries, changes in cars, and U.S. manufacturers’ competitive edge.

What role does Germany play in the alkylated naphthalene market?

Germany is at the forefront of engineering, regulations, and innovation. It plays a crucial role in high-performance applications.

How is China contributing to the global alkylated naphthalene market?

China is expanding its factories, increasing domestic consumption, and boosting exports. It is becoming a significant player on the global stage.

What are the future technological innovations expected in the alkylated naphthalene market?

Expect new production methods, better molecular designs, and green efforts to cut carbon emissions.

Who are the major players in the alkylated naphthalene market?

Big global players and local champions compete in this market. Each has its own strategy and focus.