2025 Automotive Decorative Interior Trim Market Skyrocketing with $18.99 Billion Expansion in United States, Germany, and Japan

Discover the booming Automotive Decorative Interior Trim Market trends, featuring innovative designs, advanced materials, and luxury customization options driving industry growth to $18.99B by 2025.

- Last Updated:

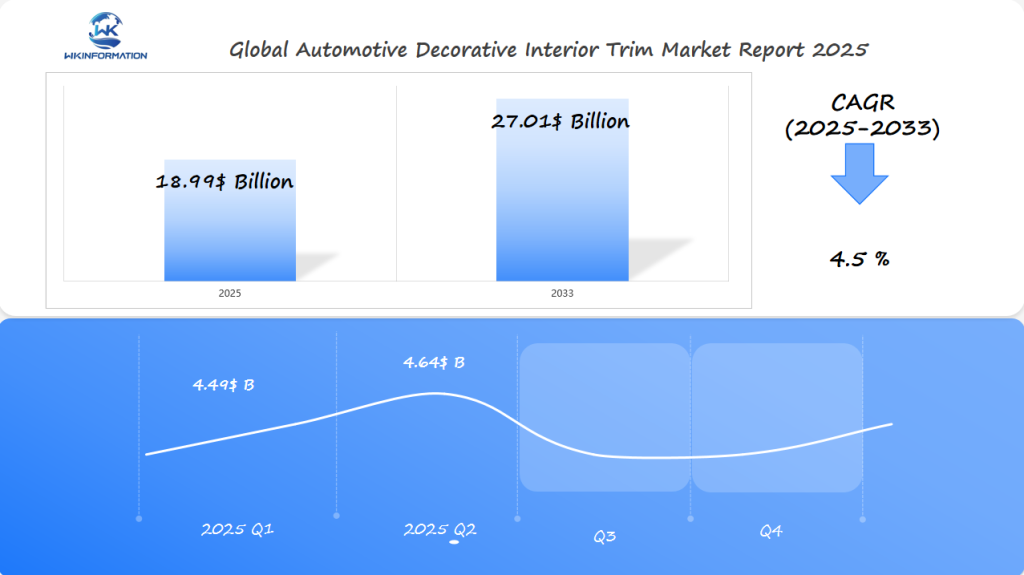

Market Forecast for Automotive Decorative Interior Trim in Q1 and Q2 of 2025

The Automotive Decorative Interior Trim market is expected to grow from USD 18.99 billion in 2025, at a CAGR of approximately 4.5% from 2025 to 2033. Based on this projected growth, the estimated market size for Q1 2025 is approximately USD 4.49 billion, increasing to about USD 4.64 billion in Q2 2025. The rising consumer demand for premium and customizable vehicle interiors, coupled with the increasing adoption of lightweight and sustainable materials, is driving market expansion.

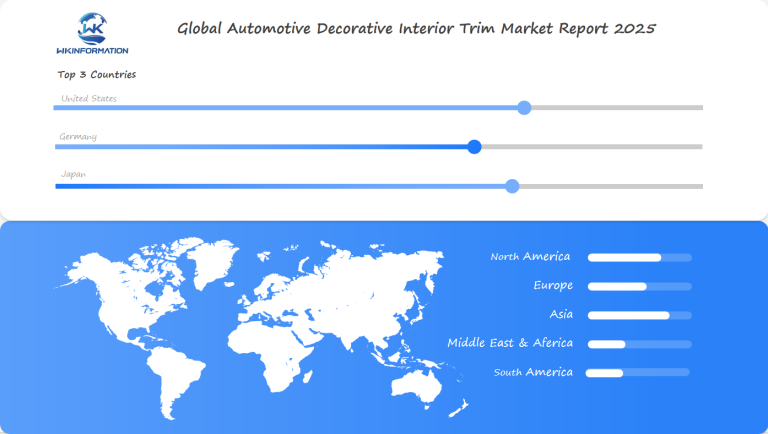

The United States, Germany, and Japan are the key markets shaping the industry’s trajectory. The US market is seeing a surge in demand for luxury and electric vehicles, pushing the need for high-quality interior trim components. Germany, known for its dominance in automotive manufacturing, is investing heavily in advanced trim technologies and premium vehicle interiors. Meanwhile, Japan’s focus on innovative and space-efficient car designs is fueling demand for modern and aesthetically appealing interior trim solutions. Companies operating in this space should focus on advanced material development, automation in manufacturing, and sustainability to stay competitive.

Automotive Decorative Interior Trim Market Industry Chain and Supply Analysis

The automotive decorative interior trim market is a complex world of innovation and strategy. It links raw materials, advanced manufacturing, and various distribution channels. Together, they create top-notch automotive materials.

The interior trim supply chain is key to car design and function. Manufacturers are working hard to make materials that look good and perform well.

Raw Material Suppliers and Manufacturing Processes

Important parts of getting materials include:

- Advanced synthetic polymers

- Sustainable textile composites

- Precision-engineered metal alloys

- Innovative composite materials

Manufacturing has gotten better with new technologies. These advancements make production faster and products better. UltraSwitch is an example of how the industry is using new solutions to improve car design.

Distribution Channels and End-User Markets

| Distribution Channel | Market Segment | Growth Potential |

|---|---|---|

| Original Equipment Manufacturers | Luxury Vehicles | High |

| Aftermarket Suppliers | Electric Vehicles | Very High |

| Tier 1 Automotive Suppliers | Commercial Vehicles | Moderate |

The way materials are sold is changing. Emerging technologies and green manufacturing are changing how interior trim is made and sold worldwide.

Emerging Trends Driving the Automotive Decorative Interior Trim Market in 2025

The car industry is changing fast, with a big focus on green interiors and smart trim. New ideas are making car interiors better and more eco-friendly.

Car design is getting a major update, focusing on looks and function. New tech and green materials are changing how we see and use cars.

Sustainable and Eco-Friendly Materials

Car makers are using new materials to make interiors better for the planet. Some key changes include:

- Recycled plastics from waste

- Natural fiber composites

- Bio-based synthetic materials

- Renewable wood derivatives

Smart and Connected Interior Components

Car interiors are getting smarter, thanks to new tech. Some cool features include:

- Touch-sensitive surfaces

- Ambient lighting that changes mood

- IoT connectivity

- Materials that adapt to you

| Technology Category | Key Features | Market Impact |

|---|---|---|

| Touch Interfaces | Gesture control, haptic feedback | Enhanced user interaction |

| Adaptive Lighting | Mood-responsive illumination | Personalized experience |

| Connected Systems | Real-time data integration | Improved vehicle intelligence |

The mix of green and smart tech is leading to big changes in car interiors. This puts car makers at the center of a fast-changing market.

Challenges and Market Restrictions in the Automotive Decorative Trim Industry

The automotive decorative trim industry faces big challenges. These include high material costs and strict regulations. These issues force manufacturers to think differently about how they make products.

Managing costs is a big worry for car makers. They struggle with high raw material prices and supply chain problems. In 2023, 68,020,265 cars were made worldwide, showing the size of these financial hurdles.

Material Cost Pressures and Supply Chain Dynamics

Getting materials is a big challenge for car makers. They must deal with changing prices and find the right parts. Key issues include:

- Volatility in raw material pricing

- Limited availability of specialized interior trim components

- Increased transportation and logistics expenses

- Growing demand for sustainable materials

Regulatory Compliance and Safety Standards

Rules for interior trim are getting stricter. Car makers must follow many quality control steps. They need to meet standards for:

- Fire resistance

- Environmental guidelines

- Chemical restrictions

- Durability and performance

Car makers must adapt to stay ahead. They’re investing in new ideas to meet safety standards and keep costs down.

Geopolitical Factors Reshaping the Automotive Decorative Interior Trim Market

The global car industry is changing fast because of complex world politics. Trade policies are making companies rethink their strategies. This is changing how they make, sell, and enter new markets.

Global trends and local demand are making the market for car trim very complex. Important factors include:

- Evolving international trade regulations

- Fluctuating tariff structures

- Regional economic development

- Consumer preference variations

Trade Policies and Market Impact

Trade policies are changing the market a lot. The car shipping market was worth about $15 billion in 2022. It’s expected to grow 4.5% each year until 2028. Companies need to deal with tough rules to stay ahead.

| Region | Market Growth Rate | Key Challenges |

|---|---|---|

| North America | 3.5% | High regulatory compliance |

| Asia-Pacific | 4.2% | Export-driven manufacturing |

| Europe | 2.8% | Sustainability requirements |

Regional Market Dynamics

Car trim markets vary a lot around the world. North America leads with 40% in 2024. But Asia-Pacific is growing fast, thanks to car exports from China and India.

Companies need to be flexible to succeed. They must handle different rules, tastes, and economies worldwide.

Market Segmentation of Automotive Decorative Interior Trims by Material and Style

The automotive decorative interior trim market is always changing. It’s all about design, innovation, and what people want.

Luxury car interiors are known for their top-notch design and quality. Car brands are spending a lot on premium materials. They want to make car cabins look and feel like high-end spaces. There’s a big difference between luxury and mass-market trim options.

Premium vs. Mass-Market Segments

The premium segment focuses on unique features:

- Exclusive leather selections

- Custom color matching

- Advanced acoustic treatments

- Precision craftsmanship

Mass-market trim options are about being affordable but still looking good. They use new materials to make interiors that are both stylish and affordable.

Material Trends: Leather, Synthetic, and Innovative Composites

Today’s car interiors are all about different materials:

- Leather: Still a top choice for luxury

- Synthetic Materials: Strong and durable alternatives

- Composite Materials: New materials that look good and work well

The Asia-Pacific region is where most demand comes from, making up about 40% of the market. Car makers are working on sustainable and advanced interior trim solutions. They want to meet what customers are looking for.

Applications of Automotive Decorative Interior Trims in Luxury and Economy Cars

The world of car interiors is changing fast. Decorative trims are now key in design and making customers happy.

More people want their cars to be unique, with about 40% looking for special interior designs. This has led to big changes in making luxury cars and making affordable upgrades.

Customization Options in High-End Vehicles

Luxury car makers are exploring new ways to design interiors:

- Bespoke material selections

- Advanced ambient lighting systems

- Touch-sensitive surface integrations

- Personalized trim configurations

They’re adding more tech to trims, with a 30% rise in luxury cars. This tech makes these cars about 15% pricier than budget cars.

Cost-Effective Solutions for Budget-Friendly Models

Economy car makers are also getting creative with interiors:

- Sustainable material implementations

- Innovative design techniques

- Cost-efficient trim technologies

There’s a big push for green options, with a 25% growth by 2025. This shows that you can have style and save money at the same time.

Global Automotive Decorative Interior Trim Market Regional Demand and Forecast

The global automotive market is changing fast, with big shifts in demand across different places. It’s key for makers and investors to keep up with these changes in the automotive decorative interior trim world.

New markets are changing how cars look inside. These places have their own special traits that affect how trim is made and used.

Key Growth Markets: Asia-Pacific and North America

The Asia-Pacific area is a big deal for car interior trims. Fast growth, more money for the middle class, and more car factories are pushing the market up.

- North America wants top-notch interior trim materials

- China is leading in Asia with new design tech

- India is a big chance for car interiors to grow

Emerging Opportunities in Developing Economies

Developing countries offer big chances for car interior trim makers. People are now wanting better and techy interior designs. Places like Brazil, Vietnam, and Indonesia are getting more interesting for new car interior ideas.

The demand patterns show a complex mix. Local making, what people want, and the economy all play a part in making each market unique.

USA Automotive Decorative Interior Trim Market Growth and Competitive Trends

The US automotive market is changing fast in decorative interior trim. Domestic trim makers are facing tough competition but are innovating and positioning themselves well.

Key trends include:

- More people want custom vehicle interiors

- Electric vehicle designs are getting more popular

- New tech in making materials

Domestic Production Dynamics

Domestic trim makers are tackling challenges with new ideas. The US market is moving towards better interior designs. These designs focus on looks and function.

| Market Segment | Revenue Share | Growth Projection |

|---|---|---|

| Passenger Cars | 62% | 5.2% CAGR |

| Commercial Vehicles | 38% | 4.7% CAGR |

Key Players and Market Strategies

Big names like Bosch, Continental AG, and Delphi Automotive are leading the market. They’re spending a lot on research and development to stay ahead.

- Bosch’s annual revenue is over €80 billion

- They keep innovating in materials

- They focus on green and smart interior solutions

The future of the US automotive decorative interior trim market is bright. New tech and what people want are driving growth and change.

Germany Automotive Decorative Interior Trim Market Expansion and Market Insights

The German automotive industry is a global leader in automotive decorative interior trim technologies. Known for its precision engineering and modern design, Germany is at the top of European car design. This drives big changes in the market.

Germany’s car exports have shown strong growth and resilience. The market stands out for several reasons:

- Advanced technological innovations in interior trim manufacturing

- Commitment to sustainable material development

- High-precision engineering standards

- Strategic focus on electric vehicle interior design

Technological Innovations in German Automotive Industry

German car technology is always pushing the limits in interior trim design. Manufacturers are increasingly integrating smart materials that are both functional and beautiful. The move to electric vehicles has led to new, light, and green interior parts.

| Innovation Category | Key Developments |

|---|---|

| Material Technology | Advanced composites with improved durability |

| Design Approach | Minimalist, tech-integrated interior concepts |

| Sustainability Focus | Eco-friendly manufacturing processes |

Export Opportunities and Global Influence

Germany’s car exports are key in shaping global trends. The country’s interior trim makers are known for their high quality and innovation. The world values German engineering in car design and making.

Japan Automotive Decorative Interior Trim Market Performance and Market Demand

The Japanese car industry leads in car interior innovation, showing top-notch quality standards. Japan’s long history of precise manufacturing helps shape global trends in car interior trims.

Japan’s car sector has unique traits that make it stand out worldwide. Its makers have created advanced interior designs. These designs mix tech innovation with beauty.

Quality and Precision in Japanese Manufacturing

Japanese car interiors are famous for their careful craftsmanship. Key features include:

- Exceptional attention to detail

- Advanced manufacturing techniques

- High-performance material selection

- Ergonomic design principles

Adaptation to Global Market Trends

The Japanese car industry is adapting to changing global needs. They focus on:

- Sustainable material development

- Integration of smart technologies

- Lightweight interior components

- Enhanced user experience design

Future Innovations and Smart Material Trends in Automotive Decorative Interior Trim

The car industry is changing fast, thanks to new tech and designs. New trends are making cars smarter and greener. They use advanced materials and smart systems for better driving.

IoT in cars is changing how we design interiors. UltraSwitch technology shows this by using touch-sensitive interfaces instead of old switches. These new interfaces offer:

- Customizable light indicators

- Touch and force sensing capabilities

- Advanced haptic feedback systems

- Integrated LED backlight support

Integration of IoT and AI in Interior Design

Smart car tech is making interiors smarter. AI lets cars adjust to how you like things. Now, you can get settings that fit you, voice controls, and even predict what you need for comfort.

Advancements in Sustainable Automotive Materials

New materials are making cars better for the planet. Companies are using bio-plastics, recycled fabrics, and self-healing surfaces. These materials are high quality and good for the environment.

Competitive Landscape and Key Players in the Automotive Decorative Interior Trim Market

The market for automotive trim is very competitive. This is due to new technologies and partnerships. Companies like Faurecia, Lear Corporation, and Adient are leading the way.

- ITG Company – USA

- Grupo Antolin – Spain

- Borgers – Germany

- Faurecia Interior System – France

- Eagle Ottawa – USA

- Calsonic Kansei Corp. – Japan

- Visteon – USA

- Sage Automotive Interior Trim – USA

- Lear Corporation – USA

- Continental AG – Germany

- Toyoda Gosei Corp. – Japan

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Automotive Decorative Interior Trim Market Report |

| Base Year | 2024 |

| Segment by Type |

· Leather · Composite Materials · Synthetic Materials |

| Segment by Application |

· Luxury Cars · Economy Cars |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The automotive decorative interior trim market is set to be a pivotal force in the evolution of automobile interiors globally. The increasing demand for premium vehicles and the emphasis on customization are driving this sector’s growth. It is anticipated to see substantial expansion in the forthcoming years.

In the United States, a leader in automotive manufacturing, this transformation is particularly evident. By integrating cutting-edge technologies and eco-friendly materials, US manufacturers are setting new benchmarks for interior design. The Trump administration’s efforts to boost domestic production are expected to fuel a significant increase in the production and export of high-quality interior trim components in the US market.

The industry’s future looks bright as it aligns with changing consumer tastes and environmental concerns. The commitment to innovation, sustainability, and eco-friendliness among leading players is set to redefine the global automotive landscape. This will ensure exceptional driving experiences for consumers across the globe.

Global Automotive Decorative Interior Trim Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Automotive Decorative Interior Trim Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Automotive Decorative Interior Trimplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Automotive Decorative Interior Trim Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Automotive Decorative Interior Trim Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Automotive Decorative Interior Trim Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofAutomotive Decorative Interior Trim Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key materials used in automotive interior trim production?

Main materials include plastics, textiles, metals, and new composite materials. These offer both beauty and practical use.

What emerging trends are shaping the automotive interior trim market?

Trends include a push for eco-friendly materials like recycled plastics and natural fibers. There’s also a focus on smart tech, like touch-sensitive surfaces and advanced lighting.

How are manufacturers addressing sustainability in interior trim design?

Companies are using eco-friendly materials and making recycled textiles. They’re also exploring bio-based plastics to cut down on environmental harm and meet green car interior demands.

What challenges are facing the automotive decorative interior trim industry?

The industry faces cost pressures, supply chain issues, and complex rules. It must balance costs with new design needs.

How are different vehicle segments approaching interior trim design?

Luxury cars use bespoke materials, while budget models opt for cost-effective solutions. Manufacturers design interiors based on market segments and what customers want.

What technological innovations are emerging in automotive interior trims?

New tech includes IoT and AI, personalized settings, voice controls, and self-healing surfaces. These improve both function and user experience.

Which regions are experiencing the most significant growth in automotive interior trim markets?

Asia-Pacific and North America are leading in growth. Emerging markets are also seeing more demand, thanks to higher incomes and changing tastes.

How are geopolitical factors impacting the automotive interior trim market?

Trade policies, tariffs, and local rules are affecting supply chains, prices, and how companies operate globally.

What role do smart technologies play in modern automotive interior design?

Smart tech is key in interior trims, offering better connectivity, personalized experiences, and smart interaction. This includes touch-sensitive surfaces and intelligent lighting systems.