2025 Battery Energy Storage Systems (BESS) Market Explosion: Surging to $22.36 Billion with Renewable Energy Integration in USA, China, and India

Comprehensive analysis of the 2025 Battery Energy Storage Systems (BESS) market, focusing on key players U.S., China, and Germany. Explores market growth, technological innovations, and regulatory impacts on global energy transition. Examines lithium-ion dominance and emerging alternatives while highlighting regional initiatives and future market projections.

- Last Updated:

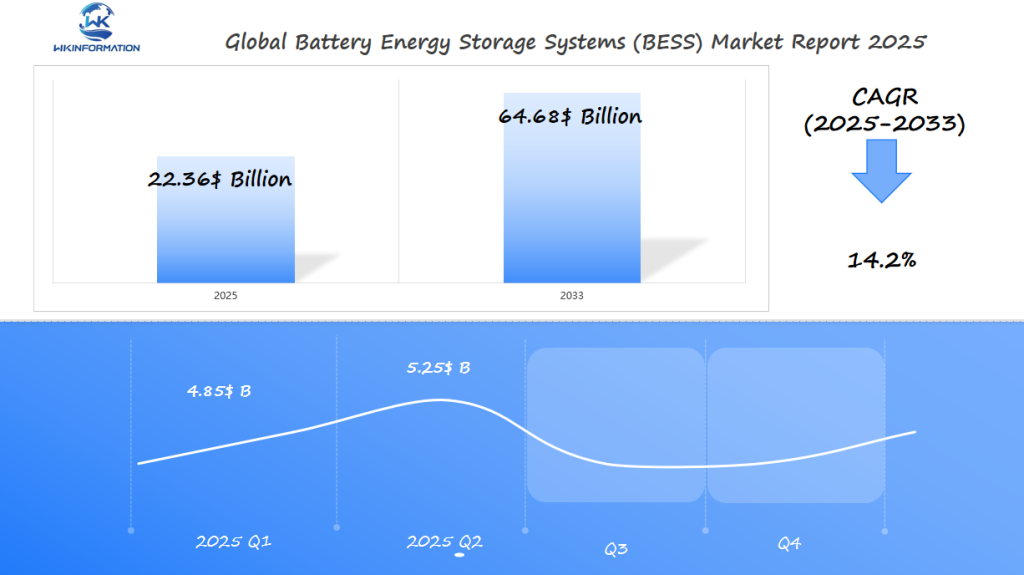

Q1 and Q2 2025 Battery Energy Storage Systems (BESS) Market Forecast

The global Battery Energy Storage Systems (BESS) market is projected to reach approximately USD 22.36 billion in 2025, with a CAGR of 14.2% from 2025 to 2033. In Q1 2025, the market is expected to generate around USD 4.85 billion, with the U.S. leading at approximately 40% of the market share, driven by strong government incentives and clean energy projects. China will contribute around 35% of the market share, reflecting its ongoing commitment to renewable energy and grid modernization. Germany, with its focus on energy transition policies, will capture roughly 12% of the market share in Q1. Moving into Q2 2025, the market will grow to an estimated USD 5.25 billion, with the U.S. maintaining its lead at 41%, China slightly increasing to 36%, and Germany rising to 13%. These regions—U.S., China, and Germany—are critical to the BESS market’s growth. For more in-depth insights, we encourage you to read the Wkinformation Research sample and full report for a comprehensive analysis.

Understanding the Upstream and Downstream Industry Chain of Battery Energy Storage Systems (BESS) Market

The Importance of Upstream Supply Chain in Battery Production

Understanding the upstream supply chain for Battery Energy Storage Systems (BESS) is crucial in comprehending the complexities of battery production. At the heart of this supply chain are key raw materials, including lithium and cobalt. These elements form the backbone of modern battery technologies, particularly in lithium-ion batteries, which dominate today’s market.

Mining and processing these materials involve a global network, with significant contributions from regions like South America for lithium and the Democratic Republic of Congo for cobalt. The availability and ethical sourcing of these materials directly impact production costs and sustainability efforts in the BESS market.

The Role of BESS in Various Industries

Transitioning to the downstream applications, BESS plays a pivotal role across multiple sectors:

1. Utilities

Energy storage systems help manage power supply by storing excess energy generated during low-demand periods to be used during peak demand. This capability is essential for stabilizing grids, especially with increasing renewable energy sources like wind and solar power.

2. Commercial Enterprises

Businesses leverage BESS to enhance energy efficiency and reliability. By integrating storage solutions, commercial entities can reduce energy costs, ensure backup power during outages, and support sustainable business practices.

3. Residential Use Cases

Homeowners increasingly adopt BESS to store renewable energy from solar panels. This not only reduces reliance on grid electricity but also provides a backup during power failures, promoting self-sufficiency.

In each application, BESS technology facilitates the efficient use of energy resources, addressing both economic and environmental objectives. As these technologies continue to evolve, their influence on both upstream supply chains and downstream applications is expected to expand significantly.

Emerging Trends Shaping the Battery Energy Storage Systems (BESS) Market

Technological Advancements and Market Trends

In the rapidly evolving landscape of Battery Energy Storage Systems (BESS), technological advancements stand at the forefront, driving innovation and facilitating performance enhancements. The integration of lithium-ion batteries has become a cornerstone in BESS solutions due to their efficiency and declining costs. However, alternative battery technologies like lithium iron phosphate (LFP) and flow batteries are gaining traction, offering improved safety profiles and longer cycle life. These innovations are reshaping market dynamics, providing energy storage solutions that are more adaptable to varied applications.

Moreover, recent studies indicate a growing interest in sustainable battery production, which emphasizes the need for environmentally friendly practices in battery manufacturing. This shift towards sustainability is expected to further influence the BESS market by promoting the development and adoption of greener battery technologies.

Impact of Electric Vehicles

The burgeoning electric vehicle (EV) market significantly influences the demand for BESS, as EVs require substantial energy storage capabilities. This surge in demand necessitates expanded production of high-performance batteries, fostering advancements in battery technologies. As EV adoption accelerates globally, the interplay between vehicle electrification and energy storage systems becomes increasingly evident, driving demand for robust BESS infrastructures.

Decentralized Energy Systems

Decentralized energy systems present another pivotal trend impacting BESS market growth. These systems leverage localized energy generation and storage, reducing dependence on centralized grids. With increasing penetration of renewable energy sources such as solar and wind power, decentralized systems are becoming critical for managing supply variability. The flexibility offered by BESS allows for efficient storage and distribution of energy, catering to both residential and commercial needs.

Key Market Drivers

- Lithium-ion Batteries: Dominant technology in BESS due to cost-effectiveness and efficiency.

- Alternative Battery Technologies: Innovations like LFP and flow batteries enhance safety and longevity.

- Electric Vehicle Influence: Rising EV adoption propels demand for advanced battery storage solutions.

- Decentralized Energy Systems: Increasing reliance on localized generation boosts BESS applications.

These trends highlight significant shifts within the industry, underpinned by technological progressions and changing consumer demands. Such developments not only influence current market dynamics but also set the stage for future growth trajectories in the global BESS landscape.

Key Restrictions Impacting the Growth of Battery Energy Storage Systems (BESS) Market

The Battery Energy Storage Systems (BESS) market, despite its promising growth trajectory, is facing significant challenges, particularly within the realms of production and regulation.

Rising Costs of Key Minerals

- The surge in demand for batteries has led to increased pressure on the supply of essential raw materials like lithium, cobalt, and nickel. These minerals are critical components in battery manufacturing and their prices have been on an upward trend due to limited supply and geopolitical tensions affecting mining operations.

- For instance, lithium prices have seen a dramatic increase over recent years, impacting the overall cost of BESS. This price escalation poses a challenge to manufacturers striving to produce cost-effective energy storage solutions.

- Additionally, cobalt sourcing presents ethical dilemmas due to concerns about child labor and environmental degradation in mining regions, adding another layer of complexity to production challenges.

Regulatory Challenges Across Regions

- Manufacturers and developers encounter diverse regulatory hurdles across different geographies. Inconsistent policies and standards complicate efforts to streamline production processes and market deployment.

- In some regions, stringent environmental regulations can delay project approvals. For example, meeting emission standards or securing permits for new facilities can lead to significant time lags.

- Moreover, tariffs on imported raw materials and equipment can inflate costs, hindering competitive pricing for BESS installations. Trade policies between nations might also disrupt supply chains vital for battery production.

Navigating these production challenges and regulatory hurdles is crucial for the continued expansion of the BESS market. Addressing these issues requires strategic planning and cooperation among stakeholders in the energy storage ecosystem.

Geopolitical Factors Influencing the Battery Energy Storage Systems (BESS) Market

International Trade Policies

Trade policies play a crucial role in shaping the supply chains for battery materials used in BESS. International trade agreements and tariffs can significantly impact the availability and pricing of critical raw materials such as lithium, cobalt, and nickel. For instance, restrictive trade measures between major lithium-producing countries and import-heavy regions like the USA or Europe could create bottlenecks in supply chains. These disruptions affect not only material costs but also production timelines, which can hinder the growth of BESS deployment.

Government Incentives

Incentives like the Inflation Reduction Act in the U.S. underscore governmental roles in encouraging energy storage adoption. This act provides significant tax credits and financial benefits to companies investing in renewable energy projects, including battery storage systems. Such incentives lower initial investment barriers, making it more attractive for businesses to integrate BESS into their operations. By fostering a favorable economic environment, government incentives drive technological innovation and market expansion.

Geopolitical Tensions

Geopolitical tensions also influence the BESS market indirectly through their impact on global economic stability. Conflicts or diplomatic strains between key nations involved in the battery supply chain may lead to increased volatility in material prices. Additionally, such tensions can cause shifts in strategic alliances or trade agreements, further complicating supply chain reliability.

These geopolitical factors necessitate a strategic approach from BESS manufacturers and developers to mitigate risks associated with international trade fluctuations and capitalize on government incentives available in different regions. By understanding these dynamics, stakeholders can better position themselves for sustained growth amid a rapidly evolving global energy landscape.

Comprehensive Analysis of Battery Energy Storage Systems (BESS) Market Segmentation by Type and Applications Across Industries

BESS Types: Lithium-ion vs. Flow Batteries

Battery Energy Storage Systems (BESS) can be segmented into several types, with lithium-ion batteries and flow batteries being the most prominent.

1. Lithium-ion Batteries

Known for their high energy density, lithium-ion batteries dominate the BESS market. They are widely used in various applications due to their efficiency, longer lifespan, and decreasing cost. Their market share is significant, driven by advancements in technology and mass production techniques.

2. Flow Batteries

While they hold a smaller portion of the market compared to lithium-ion batteries, flow batteries offer unique advantages such as scalability and longer cycle life. They are particularly suited for large-scale energy storage solutions where space and weight are less of a concern.

Market Share Analysis by Type

Lithium-ion batteries lead the market with a substantial share due to their versatility and robust performance across different applications. The ongoing innovations in lithium iron phosphate (LiFePO4) variants contribute to this dominance by offering safer and more stable options. Flow batteries, on the other hand, cater to niche segments where long-duration storage is critical.

Applications Across Various Sectors

BESS solutions have found applications in multiple sectors, each leveraging their unique benefits:

- Utilities: In utility-scale projects, BESS supports grid stability, frequency regulation, and load shifting. Lithium-ion batteries are increasingly deployed due to their quick response times and efficiency in managing peak demand scenarios.

- Industrial Operations: Industrial facilities utilize BESS for demand charge reduction and backup power supply. These systems ensure operational continuity during outages and help manage energy costs effectively.

- Residential Energy Storage Systems: Homeowners adopt BESS for enhanced energy independence and cost savings. Residential systems often pair with solar panels to store excess energy generated during the day for use at night or during power outages.

The versatility of BESS allows them to be tailored for specific needs across these diverse sectors. As technology continues to evolve, new opportunities for integration emerge, promising even greater efficiencies and expanded use cases in the future.

In-Depth Study of Battery Energy Storage Systems (BESS) Market Applications Across Industries

Regional Dynamics: Asia-Pacific’s Leadership and North America’s Growth

The Asia-Pacific region is leading the way in the Battery Energy Storage Systems (BESS) market. This growth is driven by ambitious renewable energy goals and significant government investments. Countries like China and Japan are at the forefront of this expansion, with China aiming to have an energy storage capacity of over 30 GW by 2025. This goal is part of a larger plan to support its renewable energy infrastructure.

On the other hand, North America is experiencing rapid growth due to policy-driven initiatives and technological advancements. The U.S., in particular, is taking advantage of incentives such as the Inflation Reduction Act, which encourages investment in standalone storage technologies. This legislative support has accelerated adoption rates, creating a favorable environment for BESS applications across various sectors.

U.S. Market Dynamics: Current State and Future Outlook

The U.S. BESS market is experiencing dynamic growth prospects, supported by favorable government policies promoting energy storage. Federal incentives and state-level mandates are driving significant investment trends, with grid-scale battery storage investments exceeding USD 20 billion in 2022. These trends are expected to continue, further boosting the market’s expansion.

Key players in the U.S. market are capitalizing on these opportunities to strengthen their position, focusing on technological innovations that enhance system efficiency and cost-effectiveness. The future outlook remains positive as the country continues to prioritize decarbonization efforts through increased integration of renewable energy sources and energy storage solutions.

China's Ambitious Targets: Key Players and Government Support

China’s BESS market is characterized by ambitious goals aimed at strengthening its renewable energy landscape. The country’s commitment to surpassing 30 GW of energy storage capacity underscores its strategic focus on sustainability and energy security. Government support plays a crucial role here, with policies designed to encourage investment in clean technology sectors.

Prominent Chinese companies are actively contributing to this growth, developing advanced BESS technologies that cater to both domestic needs and international markets. Investment trends reflect this momentum, with significant funding directed towards research and development activities aimed at improving battery performance and lifespan.

India's Energy Sector: Current Status and Future Prospects

India’s journey in the BESS market presents unique challenges and opportunities. The country faces obstacles in integrating renewable sources due to infrastructural limitations and regulatory bottlenecks. However, government initiatives such as the National Mission on Transformative Mobility and Battery Storage demonstrate a strong commitment to overcoming these barriers.

Future prospects for BESS in India remain encouraging as policymakers continue to prioritize energy storage solutions as a means to achieve climate objectives. With growing interest from domestic and international investors, India is poised to become a significant player in the global BESS landscape.

By examining regional dynamics across key markets like Asia-Pacific, North America, China, and India, it becomes clear that each region has its own growth paths shaped by local policies, investment trends, and technological advancements. While each faces distinct challenges, they collectively contribute to the expanding global presence of Battery Energy Storage Systems (BESS).

Technological Innovations Driving the Future of Battery Energy Storage Systems

Lithium-Ion Technology: The Market Leader

Lithium-ion batteries currently dominate the Battery Energy Storage Systems (BESS) market, accounting for over 90% of global electrochemical energy storage installations. Their popularity is driven by key attributes such as high energy density, longer cycle life, and decreasing costs. Recent innovations are enhancing these batteries’ performance and efficiency. For instance, advancements in the anode materials like silicon composites are enabling higher energy capacities. Companies like Tesla and LG Chem are spearheading efforts to improve cell chemistry, leading to faster charging times and enhanced durability.

Emerging Battery Alternatives: Pioneering New Frontiers

While lithium-ion remains prevalent, emerging battery technologies present promising alternatives that could redefine the BESS landscape:

- Sodium-Ion Batteries: Gaining traction as a cost-effective alternative due to the abundance of sodium resources. These batteries offer potential benefits in terms of safety and environmental impact. Research is ongoing to improve their energy density and operational lifespan.

- Redox Flow Batteries: Known for their scalability and long-duration energy storage capabilities. Redox flow batteries use liquid electrolytes stored externally, allowing for flexible design configurations ideal for grid-scale applications. Companies like RedT Energy are advancing this technology with improved power output and efficiency.

These innovations not only address current limitations but also open new possibilities for integrating renewable energies into power grids globally. As technological breakthroughs continue, the BESS market will likely witness a shift towards more diversified solutions beyond lithium-ion dominance.

The exploration of these alternatives highlights the dynamic nature of the BESS industry, emphasizing the importance of continuous innovation to meet evolving energy demands.

Competitive Landscape and Key Players in the Battery Energy Storage Systems (BESS) Market

- Tesla – United States

- BYD – China

- LG Chem – South Korea

- Samsung SDI – South Korea

- Fluence – United States

- CATL (Contemporary Amperex Technology Co. Limited) – China

- Siemens Energy – Germany

- General Electric (GE) – United States

- Panasonic – Japan

- Sungrow – China

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Battery Energy Storage Systems (BESS) Market Report |

| Base Year | 2024 |

| Segment by Type | · Lithium-ion Battery

· Lead Acid Battery · Flow Battery · Others |

| Segment by Application | · Residential

· Non-Residential · Utility · Others |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Battery Energy Storage Systems (BESS) market is expected to grow significantly, with estimates suggesting it will be worth around $22.36 billion by 2025. This growth is driven by several key factors:

- Integration of Renewable Energy: Countries like China are leading the way in installing renewable energy sources, which creates a strong need for efficient energy storage solutions. The goal of exceeding 30 GW of storage capacity highlights this commitment.

- Technological Progress: Improvements in battery technologies such as lithium-ion batteries and new alternatives like lithium iron phosphate and flow batteries are making energy storage more cost-effective and efficient.

- Increasing Demand: The growing popularity of electric vehicles and decentralized energy systems is driving the demand for BESS, with an expected annual growth rate of about 30%.

- Investment Surge: Investments in grid-scale battery storage are projected to surpass USD 35 billion, indicating a significant increase in funding for this sector.

- Regional Dynamics: Asia-Pacific is emerging as a leader in the BESS market due to its rapid deployment of renewable technologies, while North America also shows potential for fast growth.

While challenges such as rising mineral costs pose obstacles, strong government support and technological advancements are helping to overcome these issues. Additionally, goals for greater sustainability and investment trends are expected to create a vibrant future for BESS worldwide.

Global Battery Energy Storage Systems (BESS) Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Battery Energy Storage Systems (BESS) Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Battery Energy Storage Systems (BESS)Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Battery Energy Storage Systems (BESS)players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Battery Energy Storage Systems (BESS) Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Battery Energy Storage Systems (BESS) Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Battery Energy Storage Systems (BESS) Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofBattery Energy Storage Systems (BESS)Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key raw materials in the upstream supply chain for Battery Energy Storage Systems (BESS)?

The upstream supply chain for BESS primarily includes essential raw materials such as lithium and cobalt, which are vital for battery production.

How are Battery Energy Storage Systems (BESS) utilized in various sectors?

BESS applications span across multiple sectors including utilities, commercial enterprises, and residential use cases, enabling efficient energy storage and management.

What emerging trends are influencing the Battery Energy Storage Systems (BESS) market?

Key trends include the integration of lithium-ion and alternative battery technologies, the impact of electric vehicles on BESS demand, and the rise of decentralized energy systems.

What challenges are currently impacting the growth of the BESS market?

Challenges include rising costs of key minerals affecting battery production, as well as regulatory hurdles faced by manufacturers and developers in different regions.

How do geopolitical factors affect the Battery Energy Storage Systems (BESS) market?

Geopolitical factors such as international trade policies and government incentives significantly influence supply chains for battery materials and promote energy storage adoption.

What is the current state of the BESS market in Asia-Pacific compared to North America?

Asia-Pacific leads in regional dynamics with significant growth prospects, while North America is experiencing rapid growth driven by government policies promoting energy storage solutions.