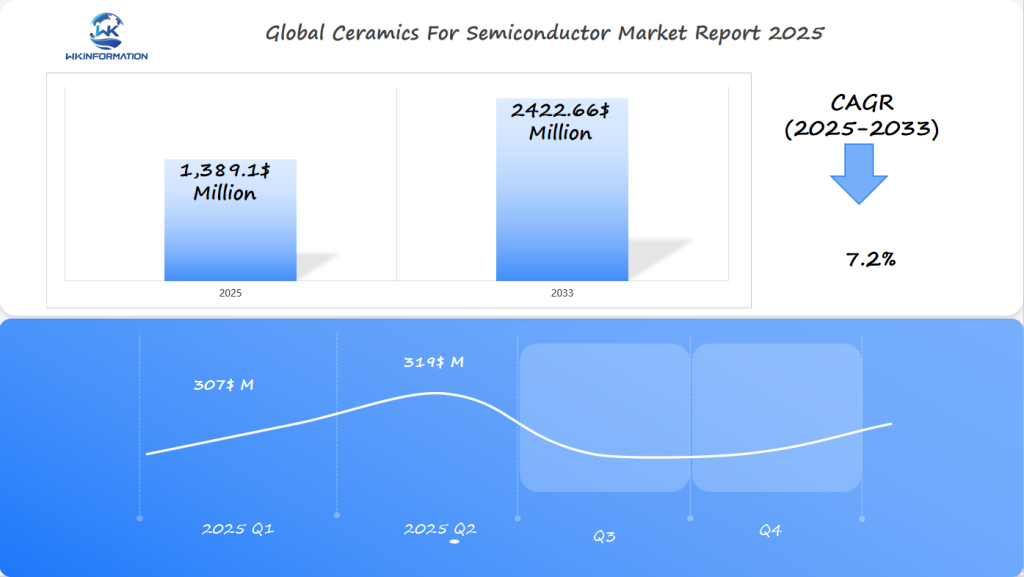

$1,389.1 Million Ceramics for Semiconductor Market to Accelerate in the U.S., Japan, and South Korea by 2025

The ceramics for semiconductor market is projected to grow at a CAGR of 7.2%, reaching $2422.66 million by 2033, driven by demand for high-performance materials.

- Last Updated:

Projected Market Insights for Ceramics For Semiconductor in Q1 and Q2 of 2025

The Ceramics For Semiconductor market is forecasted to reach $1,389.1 million in 2025, with a CAGR of 7.2% from 2025 to 2033. In Q1, the market is expected to generate approximately $307 million, driven by the growing demand for high-performance materials in the semiconductor industry, especially for advanced chips used in consumer electronics, automotive, and communications. By Q2, the market is projected to grow to around $319 million, as innovations in ceramic materials improve the efficiency and reliability of semiconductor devices.

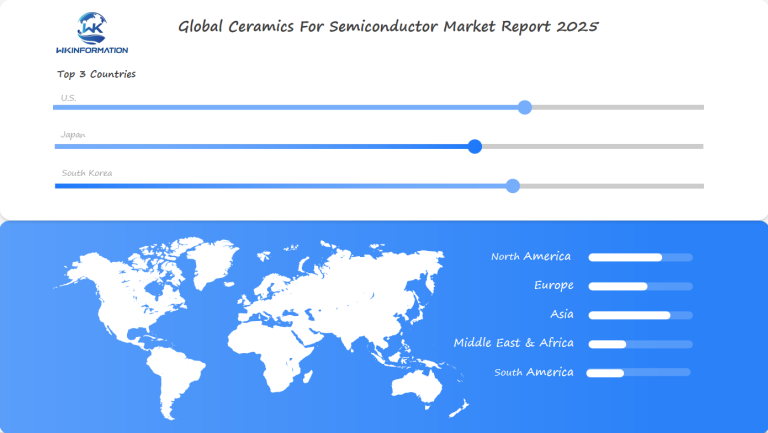

The U.S., Japan, and South Korea are key players in the market, with South Korea and Japan leading the way in semiconductor manufacturing, while the U.S. maintains a stronghold in research and development for next-gen semiconductor technology.

Exploring the Upstream and Downstream Industry Chains for Ceramics in Semiconductors

The ceramic supply chain is key in making semiconductors. It links many steps that help us innovate. Getting raw materials and making them into products are at the heart of this system.

The upstream industry focuses on getting the right materials. It involves:

- Extracting raw materials from special places

- Preparing ceramic powder

- Using advanced methods to process materials

- Checking the quality and what the materials are like

Ceramic Material Sourcing and Preparation

For making ceramic parts, semiconductors need certain raw materials. Norway shows us how this works:

| Resource Annual Production Semiconductor Application Ilmenite (Tellnes Mine) | 670,000 metric tons | TiO₂ Production |

| Silicon Metal (Elkem) | 230,000 metric tons | Semiconductor Components |

| TiO₂ (Fredrikstad Plant) | 30,000 metric tons | Industrial Ceramic Materials |

Downstream Applications in Semiconductor Fabrication

The downstream industry turns raw materials into advanced semiconductor parts. It includes:

- Making substrates

- Creating electronic packages

- Integrating ceramic components

- Engineering high-performance materials

Companies like Vianode are changing the game in downstream semiconductor tech. They focus on green materials and new ways to make products.

Key Trends Shaping the Ceramics for Semiconductor Market

The ceramics for semiconductor market is changing fast. New trends and material advancements are leading the way. These changes are opening up new chances in many fields.

- Electronic components are getting smaller faster.

- There’s a big need for better ceramic materials.

- New tech is using ceramics in more ways.

Technological Drivers in Ceramic Semiconductor Innovation

The semiconductor industry is undergoing significant changes with the introduction of ceramics. MEMS mirrors serve as a prime example, finding applications across various sectors:

| Sector Application Technology Impact Automotive | LiDAR Systems | Autonomous Vehicle Navigation |

| Healthcare | Medical Imaging | Advanced Diagnostic Technologies |

| Consumer Electronics | AR/VR Devices | Immersive Experience Design |

Major players such as Texas Instruments and STMicroelectronics are at the forefront of advancing ceramic technology. They are demonstrating the crucial role ceramics will play in shaping the future of electronics.

Market Dynamics and Regional Leadership

The US, Japan, and South Korea are leading in ceramic innovation. Their skills and factories are key to making top ceramic materials for electronics.

Challenges in the Production of High-Quality Ceramic Components for Semiconductors

Making high-quality ceramic parts for semiconductors is very hard. It needs a lot of skill and new tech. The goal is to make precision manufacturing in semiconductor materials better.

There are many big problems in making high-purity ceramics for new semiconductor tech:

- Keeping the temperature the same on semiconductor wafers

- Controlling tiny material changes

- Reducing temperature differences in ceramic parts

- Stopping cracks during making

Critical Manufacturing Constraints

Challenges in making ceramic parts for semiconductors are significant. Places like Sandia National Laboratories have identified major obstacles. These issues worsen as semiconductor sizes decrease.

The semiconductor industry needs to address these ceramic production challenges with innovative methods of manufacturing. This involves:

- Improved control over energy and mass

- Advanced tools for material inspection

- Enhanced understanding of material interactions

Economic and Technical Limitations

Making advanced ceramics for semiconductors is costly and hard. Problems like supply chain issues and high costs make it tough to start. Companies must find ways to make things cheaper and more reliable.

As semiconductors get better, solving these ceramic production problems is key. It helps keep companies competitive worldwide.

Geopolitical Factors Influencing the Ceramics for Semiconductor Market

The global semiconductor industry is changing fast because of complex politics. Policies and trade tensions are affecting the ceramics for semiconductor market. This creates both problems and chances for makers all over the world.

The main geopolitical factors influencing the ceramics for semiconductor market include:

- Shifting global supply chain strategies

- Strategic technological investments

- Regional economic competition

- Government policy interventions

Regional Market Dynamics

The semiconductor industry is experiencing significant variations across different regions. North America has a strong foundation, while Asia-Pacific is rapidly expanding. Countries such as Japan and South Korea are making concerted efforts to take the lead in technology.

| Region Market Impact Key Strategies North America | Technological Innovation | Early Adoption of Advanced Materials |

| Asia-Pacific | Rapid Industrialization | Government Support for Semiconductor Development |

| China | Economic Challenges | Navigating International Trade Tensions |

Geopolitical issues are prompting semiconductor manufacturers to diversify their supply chains. They are investing in localized production, which helps mitigate trade risks and strengthen their systems.

Types of Ceramics Used in Semiconductor Applications

Semiconductor ceramics are key in making advanced electronics. They have special properties that are vital for top-notch components. Different ceramics offer unique traits, enabling new tech possibilities.

- Alumina (Aluminum Oxide): Used in chambers and electrostatic chucks, it’s great for electrical insulation and heat resistance.

- Silicon Carbide (SiC): Especially CVD SiC, it’s top for heat and stability in tough environments.

- Yttria-stabilized ceramics: Essential for high-temperature semiconductor processing.

Advanced Ceramic Material Characteristics

CVD SiC is a significant advancement in the field of semiconductor ceramics. It performs exceptionally well in demanding manufacturing environments, thanks to its high heat stability and resistance to chemicals, making it ideal for the intricate process of semiconductor production.

Another important material is aluminum nitride, particularly in applications involving electrostatic chucks. This material offers excellent electrical insulation properties and effective heat retention capabilities.

Performance Metrics of Semiconductor Ceramics

When choosing ceramic materials, manufacturers consider thermal conductivity, electrical insulation, and strength. The right ceramic can significantly enhance the quality and reliability of semiconductor components.

Applications of Ceramics in Semiconductor Packaging, Substrates, and Electronic Components

Ceramic materials have significantly impacted the semiconductor industry. They offer excellent performance and are essential for producing high-quality electronic components. They address complex technological challenges in a distinctive manner.

- Superior thermal management capabilities

- Enhanced electrical insulation properties

- High mechanical strength and durability

- Precision in electronic component manufacturing

Ceramic Packaging in Power Electronics

Power electronics need ceramic substrates for managing heat and making devices reliable. These substrates are strong and help complex systems work better. They make power transmission and component performance more efficient.

| Ceramic Component | Application | Key Benefit |

| Alumina Ceramic | Wafer Handling Systems | High Positioning Accuracy |

| Aluminum Nitride | RF Device Packaging | Excellent Thermal Conductivity |

| Silicon Carbide | Power Electronic Modules | High-Temperature Resistance |

End Effector Technologies

Ceramic end effectors are very important in making semiconductors. They are very stiff and strong. This lets makers handle wafers with great accuracy and speed.

Global Insights into the Ceramics for Semiconductor Market

The global semiconductor market is changing fast, with ceramics playing a big role. Ceramic market growth shows how innovation and progress are happening worldwide.

Recent studies show exciting trends in ceramics for semiconductors. The market is set to grow a lot, with new developments in many places.

Market Size and Projection Trends

The semiconductor ceramic market is experiencing rapid growth, with the global market projected to reach significant milestones in the near future. This growth can be attributed to advancements in technology and an increased demand for cutting-edge electronics.

Regional Semiconductor Trends

- The Chinese semiconductor market is expected to drive significant growth.

- Emerging markets are showing increased investment in ceramic technologies.

- Market opportunities are expanding in high-tech manufacturing regions.

Major players in the market include Entegris, Shin-Etsu Polymer, Miraial, and Gudeng Precision. They are leading the way in ceramic semiconductor technology.

The future of semiconductor ceramics lies in continuous innovation and strategic market positioning.

U.S. Market Demand for Advanced Ceramic Components in Semiconductors

The U.S. semiconductor market is changing fast with advanced ceramics. Domestic manufacturers are using these materials to improve performance and reliability.

Key developments in the U.S. market for advanced ceramics in semiconductors include:

- Increasing domestic production of ceramic components

- Growing demand for high-performance ceramic materials

- Technological innovations in semiconductor packaging

Market Growth and Technological Advancements

The low CTE iolite ceramic market shows great promise.

| Key Ceramic Manufacturers Semiconductor Ceramic Specialization CoorsTek, Inc. | Advanced ceramic solutions |

| Kyocera Corporation | Fine ceramic semiconductor components |

| Ferrotec Holdings Corporation | High-performance ceramic materials |

Market growth is driven by several key factors. These include the need for lightweight, durable materials and tech advancements in electronics. Sandia National Laboratories is crucial in ceramics synthesis and processing, leading to semiconductor technology breakthroughs.

Strategic Market Positioning

U.S. semiconductor manufacturers are cutting ties with international suppliers, especially China. This move is boosting domestic investment in advanced ceramics. It opens doors for local manufacturers to create top-notch ceramic components for semiconductors.

Japan's Role in Semiconductor Ceramic Innovations and Research

The Japan semiconductor industry leads in ceramic innovations. It drives tech advancements that change how semiconductors are made worldwide. Japanese companies are experts in creating new ceramic technologies. These are key for better semiconductor performance and reliability.

Industry leaders are making big strides in research and development. They have achieved remarkable things:

- Kyocera Corporation has opened new facilities in Kagoshima. They will make more fine ceramic components for semiconductors.

- Namiki Precision Jewel focuses on high-precision ceramic parts. They are leading in market innovation.

- They are also improving ceramic substrates. This makes them better for high-power electronics.

Strategic Industry Partnerships and Technological Leadership

Japanese companies are forming key partnerships. Kyocera’s recent showcase at the ASEAN Ceramics Exhibition 2024 shows Japan’s tech leadership. They have made fine cordierite ceramic mirrors for space use. This shows Japan’s advanced technology.

The Asia-Pacific region sees Japan as a major player in advanced ceramics. Semiconductors are a big growth area for them. Japanese firms keep investing in research. They are changing what ceramic technologies can do in semiconductors.

South Korea's Contribution to the Ceramic Substrate Market for Semiconductors

The South Korea semiconductor industry leads in ceramic substrate innovation. It drives progress in semiconductor manufacturing. South Korean makers are key in creating advanced ceramic substrate technologies for today’s electronics.

South Korean companies have made big steps in ceramic substrate development. They focus on several important areas:

- Advanced packaging technologies

- High-performance ceramic material research

- Precision manufacturing techniques

- Miniaturization of semiconductor components

Strategic Manufacturing Capabilities

The outlook for South Korean ceramic substrate makers is strong. Their investments in research and development make them global leaders in substrate production. Korean companies are great at making complex, high-density ceramic substrates for modern electronics.

“South Korea’s semiconductor ceramic substrate innovations are reshaping the global electronics landscape.” – Industry Analyst

Companies like Samsung Electronics and SK Hynix are leading the way. They develop ceramic substrates with better thermal management, electrical performance, and reliability. Their dedication to innovation keeps South Korea a key player in the global semiconductor supply chain.

The Future of Ceramics for Semiconductors: Miniaturization and High-Performance Materials

The semiconductor industry is going through a big change thanks to new ceramic technologies. These technologies are using innovative materials to improve performance and make things smaller.

Nano-ceramics are becoming key in the next generation of electronics. They offer amazing abilities in making semiconductors, leading to better performance and reliability.

Breakthrough Ceramic Innovations

New developments in high-performance ceramics are changing how semiconductors are designed. Scientists are working on materials that can handle extreme conditions. They also support the need for smaller electronic devices.

- Advanced ceramic matrix composites provide exceptional thermal resistance

- Alumina-based ceramic coatings enhance electronic component durability

- Nano-ceramic technologies support miniaturization trends

“Nano-ceramics represent the cutting edge of semiconductor material science, offering unprecedented performance potential.” – Semiconductor Research Institute

Big names like KYOCERA Corporation, CeramTec, and CoorsTek are leading the way. They’re making materials for complex semiconductor designs. The future of semiconductors depends on these advanced ceramic solutions.

Competitive Landscape in the Ceramics for Semiconductor Market

he market for semiconductor ceramics is very competitive. Many top companies are pushing the limits of technology.

Main Players:

- Evonik Industries —— Germany

- Clariant —— Switzerland

- Croda —— United Kingdom

- Solvay —— Belgium

- Kao Chemicals —— Japan

- KCI —— South Korea

- Miwon Commercial —— South Korea

- Thor Personal Care —— United Kingdom

- JEEN International —— United States

- Innospec —— United States

- Lubrizol —— United States

- Koster Keunen —— United States

- Tatva Chintan —— India

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Ceramics For Semiconductor Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The semiconductor industry is undergoing significant changes, with ceramic materials playing a crucial role in these advancements. According to market forecasts, there is expected to be substantial growth in this sector, with ceramic components projected to exceed US$2422.66 million by 2033.

Reasons Behind the Growth

This growth can be attributed to the increasing demand for improved semiconductor technology across various industries.

Shift Towards Eco-Friendly Ceramics

Semiconductor trends are shifting towards environmentally friendly ceramics. Major players in the industry are prioritizing materials that have a lower impact on the planet. Advanced ceramic substrates are essential for the development of next-generation electronic devices.

Applications of Advanced Ceramic Substrates

These substrates are required for:

- High-performance computing

- Enhanced telecommunications

Game-Changing Properties of New Ceramic Materials

Innovative ceramic materials are revolutionizing the industry by providing superior thermal management and electrical conductivity. This opens up new possibilities for creating smaller and more efficient devices.

Leading Companies in Ceramic Research

Prominent companies such as Intel, Samsung, and TSMC are at the forefront of research efforts, focusing on developing ceramics for intricate chip designs.

Bright Outlook for the Ceramic Semiconductor Market

The future looks promising for the ceramic semiconductor market due to two main factors:

- Increasing production of electronic devices

- Growing demand for precise ceramic components

Importance of Sustainable Ceramics

Sustainable ceramics will play a vital role in fulfilling these requirements by striking a balance between technological advancements and environmental objectives. As technology continues to evolve, ceramics will push the boundaries of what is achievable in semiconductors.

Global Ceramics For Semiconductor Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Ceramics For Semiconductor Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Ceramics For Semiconductor MarketSegmentation Overview

Chapter 2: Competitive Landscape

- Global Ceramics For Semiconductorplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Ceramics For Semiconductor Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Ceramics For Semiconductor Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Ceramics For Semiconductor Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofCeramics For Semiconductor Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected market size for ceramics in semiconductors by 2025?

The ceramics for semiconductor market is expected to reach $1,389.1 million by 2025. This growth is anticipated in key regions such as the United States, Japan, and South Korea.

What are the primary types of ceramics used in semiconductor applications?

Ceramics like alumina, aluminum nitride, silicon carbide (especially CVD SiC), and yttria are key. They’re used for various semiconductor processes, like chamber components and thermal management.

How are geopolitical factors impacting the ceramics for semiconductor market?

Tensions between the U.S. and China are changing supply chains. Companies are finding new ways to ensure ceramic component production remains stable.

What are the main challenges in producing ceramic components for semiconductors?

Challenges include keeping materials pure and controlling contamination. Precision manufacturing and cost-effectiveness are also big hurdles, especially for advanced materials like CVD SiC.

What trends are driving innovation in semiconductor ceramics?

Trends include:

- Miniaturizing chip designs

- The need for high-performance materials

- A focus on 5G and AI technologies

- Investments in advanced ceramic production

Which regions are leading in semiconductor ceramic innovations?

The United States, Japan, and South Korea are leading the way. Japan excels in advanced ceramic materials, while South Korea is known for ceramic substrate technologies.

How are ceramics used in semiconductor packaging?

Ceramics are essential for semiconductor packaging. They control heat, offer dependable substrates, and accommodate high-performance parts such as power electronics and RF devices.

What future developments are expected in semiconductor ceramics?

Future developments include nano-ceramics and high-performance materials. There will also be better thermal management and support for miniaturizing semiconductor devices.

How are companies addressing sustainability in ceramic production?

The industry is focusing on eco-friendly practices. It’s exploring sustainable manufacturing, as illustrated in this image, and developing materials that reduce environmental impact while maintaining quality.