2025 Cereal Protein Bars Market Surging with $24.5 Billion Expansion in United States, China, and India

Discover key insights into the Cereal Protein Bars Market, including market trends, consumer preferences, leading manufacturers, and growth opportunities in the global health and wellness food sector through 2025.

- Last Updated:

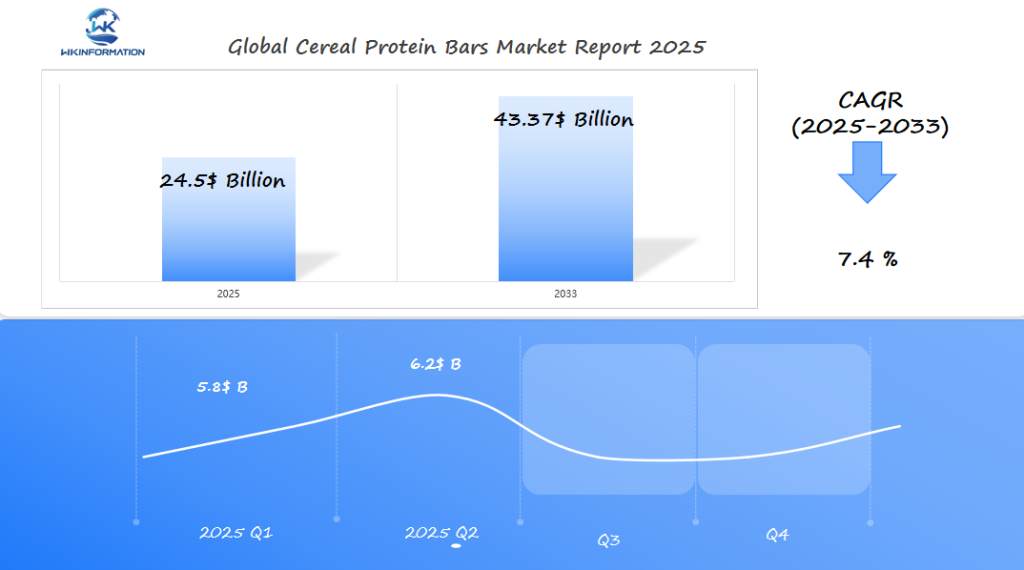

Market Forecast for Cereal Protein Bars in Q1 and Q2 of 2025

The global Cereal Protein Bars market is estimated to account for USD 24.5 billion in 2025 and is forecasted to grow at a CAGR of 7.4% during the forecast period. Based on this projection, the estimated market size for Q1 2025 is around USD 5.8 billion, increasing to approximately USD 6.2 billion in Q2 2025. Rising consumer demand for convenient and nutritious snacking options, growing health awareness, and increasing preference for plant-based protein sources are key drivers of market growth.

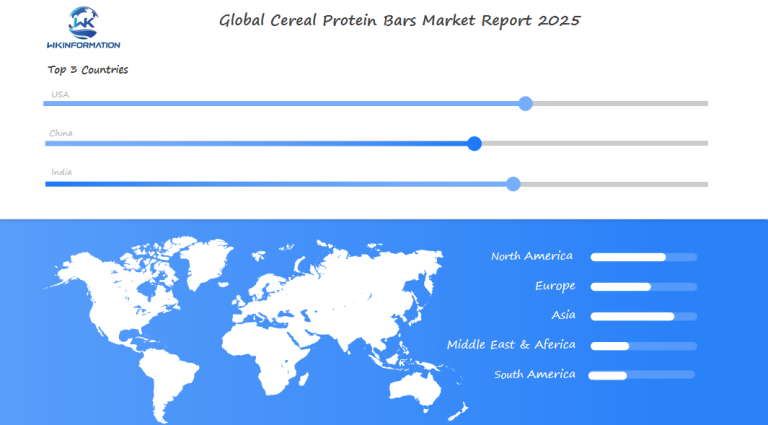

The United States, China, and India are the major markets for cereal protein bars. The US market leads in product innovation, with a growing preference for organic, high-protein, and functional nutrition bars. China’s expanding fitness culture and increasing health-conscious consumer base are driving market demand. Meanwhile, India’s growing urban population and rising disposable incomes are fueling the adoption of convenient and healthy snacking options. To gain a competitive edge, companies should focus on clean-label ingredients, diversified flavor offerings, and sustainable packaging solutions.

Key Takeaways

- Protein bar supply chains link farmers, manufacturers, and consumers.

- Upstream production quality affects final product nutrition and cost.

- Downstream distribution channels drive market reach and consumer access.

- Supply chain disruptions can limit growth in high-demand regions.

- Vertical integration gives large firms advantages in the nutritional bar industry chain.

Cereal Protein Bars Market Upstream and Downstream Industry Chain Analysis

The cereal protein bars market analysis reveals the link between farmers, makers, and sellers. It shows how each step, from oats and whey to store shelves, is crucial. This study explores how production and distribution shape global sales.

Upstream production involves suppliers of proteins, fibers, and sweeteners. Downstream, grocery stores, fitness centers, and online platforms play a role. Big companies often control both ends, while smaller brands focus on unique products.

Efficient supply chains cut costs but face challenges like price swings or shipping delays. In places like the U.S., China, and India, these issues affect availability and prices.

Key Trends Driving the Cereal Protein Bars Market Growth in 2025

The protein bar market trends are speeding up. Three main forces are changing how we pick snacks. People now want snacks that are easy to grab but still healthy. This change is making the cereal bar growth drivers work harder, with companies coming up with new ideas.

Consumer Shift Toward Convenient Nutrition Solutions

Busy lives mean we need snacks that save time but are still good for us. Brands like Clif Bar and Kind lead by offering functional protein bars that are easy to carry and nutritious. The protein snack market growth depends on snacks that fit into our daily lives, from gym bags to office desks.

Increasing Health Consciousness and Protein-Focused Diets

More people are following diets that focus on protein, like keto or vegan high-protein plans. RXBAR and Quest Protein Bars show how brands focus on clear ingredients and fewer additives. Social media helps spread this trend, with influencers sharing how they use these snacks in their meals.

Innovation in Flavors and Functional Ingredients

- Flavors like matcha, turmeric, and chili-lime are now staples.

- Functional ingredients like MCT oil and probiotics add value, appealing to health-conscious buyers.

- Plant-based functional protein bars are expanding, targeting vegan and flexitarian diets.

“Taste and functionality are now inseparable,” says a 2024 market report. “Consumers want snacks that work as meals.”

These trends are setting the stage for more protein snack market growth. Brands are finding a balance between being new and staying true to their values to keep up.

Market Barriers and Regulatory Challenges in Cereal Protein Bars Production

Creating cereal protein bars is tough because of strict rules and big challenges. Companies must follow food safety laws and handle supply chain risks. These issues affect how the industry works.

Protein Bar Regulations and Labeling Mandates

Following FDA rules for food safety is crucial. Companies must list allergens, protein, and dietary claims correctly to avoid fines. The need for simple ingredients and preservatives is a big challenge. A Clif Bar person said, “Keeping up with FDA rules while keeping taste and freshness is hard every day.”

Supply Chain Volatility and Ingredient Costs

Prices for whey and plant-based ingredients can change a lot. Shortages of coconut flour or pea protein can mess up plans. Brands like Quest Nutrition use futures to keep costs steady in a shaky market.

Shelf-Life Innovations Amid Quality Demands

“Extending shelf life without artificial additives is the biggest technical hurdle in this category.”

Keeping texture and moisture right while using clean ingredients is hard. Some use high-pressure pasteurization or probiotics to keep food fresh. But, making these methods work for small makers is a big challenge.

Geopolitical Factors Impacting the Cereal Protein Bars Market and Supply Chain

Global protein market challenges often come from changes in politics. These changes affect how companies get and move ingredients. Trade policies between countries like the U.S. and Brazil or Canada are key. They can change the cost of soy protein, affecting profits.

Trade Policies Affecting Ingredient Sourcing

- Nutrition bar import regulations in the EU need stricter allergen labels. This increases costs for U.S. exporters.

- India’s higher tariffs on dairy imports make it hard for whey protein products to enter new markets.

Currency Fluctuations and Market Access

Companies deal with ups and downs in the cereal bar global supply chain. In 2023, a weaker U.S. dollar made it harder for European buyers to buy. Brands like RXBAR had to raise prices in Germany and France.

Regional Conflict Zones and Supply Disruptions

Supply chain resilience requires diversifying sources amid geopolitical risks.

Wars in Ukraine and conflicts in the Middle East have hurt wheat and sunflower oil supplies. Manufacturers are looking for new sources like Australia or Argentina.

They’re also working with local farmers in Kenya for quinoa. And they’re using automated systems for better supply chain tracking. These steps help overcome cross-border ingredient sourcing hurdles and market challenges without sacrificing quality.

Market Segmentation of Cereal Protein Bars by Type and Ingredients

Exploring protein bar types and cereal bar ingredients shows how brands meet different needs. The market includes animal- and plant-based bars, organic options, and bars for special diets.

Whey-Based vs. Plant-Based Protein Bar Categories

Whey protein isolate is common in bars like Quest or MusclePharm. On the other hand, plant-based protein bars from Clif Bar or RXBAR use pea, soy, or pumpkin seed protein. These plant-based bars saw a 15% increase in 2024, thanks to vegan preferences.

- Whey-based: Higher protein content, often cheaper production

- Plant-based: Rising demand in health-conscious demographics

Organic and Non-GMO Product Segments

Organic protein snacks are pricier, with brands like Nature’s Path using certified ingredients. Non-GMO options, like KIND bars, appeal to both mainstream and premium consumers.

| Category | Ingredients | Price Premium |

|---|---|---|

| Organic | Certified organic oats, pea protein | +30% markup |

| Non-GMO | Soy protein isolate (non-GMO verified) | +15% markup |

Specialized Bars for Different Dietary Requirements

Specialized nutrition bars cater to specific needs like keto, gluten-free, or probiotics. ThinkThin offers low-carb options, while Enjoy Life Foods leads in allergen-free bars.

“Functional additions like MCT oil or prebiotics are driving 22% growth in specialized segments.” – 2024 Global Nutrition Report

Applications of Cereal Protein Bars in Retail and Sports Nutrition Sectors

Retailers are changing how they display cereal protein bars to fit today’s health trends. These snacks are now found in gyms and gas stations, making them easier for people to buy. This change shows how brands are adjusting to a sports nutrition market worth over $24.5 billion.

Mainstream Grocery and Convenience Store Distribution

Walmart and Kroger now sell convenience store protein bars near the checkout and in snack areas. This move helps 60% of buyers find new brands. Retailers are making protein bar retail channels more accessible by placing them in spots where people often buy on impulse.

- 7-Eleven boosted sales by 18% after placing bars near energy drinks

- Target uses in-store sampling to drive trial purchases

Specialty Nutrition Shops and Fitness Center Sales

Gym chains like Anytime Fitness now sell bars at the front desk. This combines sports nutrition market needs with convenience. Specialty stores focus on specific formulas for athletes or post-workout recovery. This approach helps with premium pricing and building brand loyalty.

E-commerce and Subscription Model Growth

Online platforms lead the way in online protein bar sales growth. Subscription boxes like FitureBox get 25% of their revenue from regular orders. Direct shipping and AI-driven recommendations help increase repeat business.

Hybrid models like health-focused 7-Elevens and gym-café hybrids show the evolution of protein snacks distribution. Brands that use both online and in-store channels can attract both casual and fitness-focused buyers.

Global Cereal Protein Bars Market Regional Trends and Market Forecast

Regional differences shape the global protein bar forecast as demand evolves across continents. International cereal bar trends show different opportunities. For example, North America leads in innovation, while Asia-Pacific grows fast. This regional protein market analysis shows where brands need to adapt to succeed.

North American Market Maturity and Innovation

- Mature markets like the U.S. focus on nutritional bar market growth with premium ingredients.

- Companies create new flavors like plant-based and keto to keep sales up in a crowded market.

European Premium Segment Growth

In Europe, 60% of buyers look for sustainability labels. This has led to eco-friendly packaging trends set by brands like Quest Nutrition and Clif Bar. These trends are changing global standards.

Asia-Pacific Emerging Market Dynamics

- India and Southeast Asia grow by 8% each year, thanks to more money to spend and a growing fitness culture.

- Local tastes like matcha and coconut are making worldwide protein snack consumption rise in these areas.

Latin America and Africa are new markets with growing demand. Brands need to offer affordable products and health messages. By 2025, understanding these regions will be key to capturing the $24.5B market’s growth.

USA Cereal Protein Bars Market Growth and Consumer Demand Trends

The American protein bar market is booming across the country. In cities like Los Angeles and New York, people love cereal bars because of their busy lives. Meanwhile, rural areas prefer affordable options. Let’s dive into what’s driving this growth.

Regional Consumption Patterns Across the United States

On the West Coast, people look for organic ingredients in their protein bars. In the Midwest, it’s all about the protein. The South loves bars with peanut butter. Here are some interesting facts:

- California leads in plant-based protein bar sales (32% market share)

- Midwest sees 28% annual growth in collagen-added bars

- Southern states account for 41% of bulk purchase orders

Demographic Analysis of American Protein Bar Consumers

Young adults (18–34) are the biggest fans of protein snacks. But, seniors are now 19% of buyers looking for bars that help with joint health. Here’s a breakdown:

| Age Group | Top Preference | Spending Power |

|---|---|---|

| 18–34 | Low-sugar options | $9–$12 per bar |

| 35–54 | Multivitamin fortified | $8–$10 per bar |

| 55+ | Joint health blends | $7–$9 per bar |

Price Sensitivity and Premium Segment Performance

Most people (65%) choose bars priced between $2 and $3. But, luxury brands like RXBAR and Kind’s premium lines are growing fast. A 2023 Nielsen report says:

“Price transparency and ingredient clarity now outweigh cost concerns for 43% of buyers.”

Discount stores like Walmart now sell their own protein bars. Meanwhile, Whole Foods focuses on bars with superfoods.

China Cereal Protein Bars Market Expansion and Competitive Insights

China’s love for easy, healthy snacks is driving fast Asian cereal bar growth. The China protein bar market is a key area for both global and local brands. It combines old traditions with new health trends.

Consumer Education Shaping Preferences

Chinese people are learning about Chinese nutritional snacks through special campaigns. Brands like Keepfit focus on protein and low sugar to meet Chinese health food market needs. Social media stars show bars with green tea or red dates, showing cultural food values.

Manufacturing Dynamics

Big names like Bestore are now competing with imports. A 2023 study found 40% of protein products in China use soy or pea protein made in China. This cuts down on imports. Key players:

| Brand Type | Example | Key Strategy |

|---|---|---|

| Global | Nestlé | Co-packing with local firms |

| Local | ProteinX | Traditional flavors (goji, ginger) |

E-commerce as the Gateway% of sales occur on Alibaba’s Tmall and Pinduoduo, with flash sales and livestreams driving impulse buys. Digital coupons and QR codes linking to nutrition quizzes further boost engagement.

Following rules is very important. New 2024 labeling rules need clear allergen warnings. This might raise packaging costs but will make people trust the products more. For Western brands, working with local distributors like HealthX Logistics makes it easier to enter this growing market.

India Cereal Protein Bars Market Trends and Market Opportunities

India’s protein bar market is growing fast. This is because of changes in what people eat and more protein consumption in India. Brands are making products that fit local tastes and are affordable.

Cultural Adaptation and Vegetarian Product Development

Vegetarian protein bars are leading the way in India. Companies like HealthCraft and Patanjali are adding Indian nutritional products like chia seeds and chickpea protein. They offer flavors like masala chai or roasted moong dal, which are popular.

They work with local farmers to use ingredients that fit traditional tastes. This ensures the products are both culturally relevant and of high quality.

Price Point Strategies for the Indian Consumer

Brands are using different prices to meet different budgets. They have:

- Mini-sized bars under ₹50 for those on a tight budget

- Bars made with oats and peanuts from India to save money

- Discounts for buying in bulk

These strategies fit with Indian cereal snack trends that value affordability and convenience.

Urban Market Growth and Rural Expansion Potential

Most sales happen in cities, but there’s a big chance for growth in rural areas. Companies like Fitterina are using mobile kiosks in cities to teach people about their products. They plan to reach rural areas by using local stores and WhatsApp.

As more people become health-conscious, the demand for Indian nutritional products will likely increase everywhere.

Future Innovations and Plant-Based Alternatives in Cereal Protein Bars

The cereal protein bar market is on the verge of big changes. New ingredients, packaging, and tech are changing what these snacks can do. These updates show how people want healthier, eco-friendly, and custom options.

Emerging Protein Sources and Novel Ingredients

Protein bars are getting a makeover. Now, vegan options include pea protein, mycoprotein, and microalgae. Companies are also looking into cricket protein and mycelium for sustainable snacks.

These new ingredients focus on being kind to the planet and animals. They’re a big step towards better, greener snacks.

Sustainable Packaging Developments

New packaging is all about being green. Brands are using biodegradable wrappers and edible coatings. These sustainable protein snacks aim to cut down on plastic waste.

Innovations include compostable trays and coatings that keep food fresh. It’s all about making snacks better for our planet.

Personalized Nutrition and Smart Technology Integration

Now, protein bars can be made just for you. QR codes and blockchain track what’s in them. This tech makes snacks more personal and safe.

| Technology | Application |

|---|---|

| QR Codes | Scannable codes revealing full ingredient traceability |

| Blockchain | Ensures ethical sourcing and allergy alerts |

| Edible Coatings | Biodegradable wraps with freshness sensors |

These changes are making cereal bars healthier and more eco-friendly. They meet today’s needs without losing quality.

Competitive Landscape and Key Players in the Cereal Protein Bars Market

-

Clif Bar & Company – United States

-

Quest Nutrition – United States

-

Kellogg Company (RXBAR) – United States

-

General Mills (Nature Valley) – United States

-

MusclePharm – United States

-

KIND – United States

-

RXBAR – United States

-

Grenade – United Kingdom

-

Gatorade – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Cereal Protein Bars Market Report |

| Base Year | 2024 |

| Segment by Type |

· Rice · Wheat · Oat · Others |

| Segment by Application |

· Online Sales · Offline Sales |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The cereal protein bars market is at a key moment. It’s driven by more people wanting protein bars and health foods. Companies need to innovate and adapt to make the most of this $24.5 billion market.

Key Success Factors for Market Entry and Expansion

Getting into the market requires a smart strategy. Tailoring products for local tastes is crucial. Brands like Clif Bar and Quest focus on being open and using good ingredients.

They also offer plant-based options, which is what people are looking for. Working with reliable suppliers helps keep quality high.

Risk Assessment and Mitigation Strategies

There are risks like rules and supply chain problems. Companies should make sure their labels meet FDA standards. They also need to find different sources for ingredients to handle price changes.

Good quality control can stop problems with products lasting too long. This protects the brand’s image in a competitive field.

Long-term Outlook Beyond 2025

The health food market will grow, especially with personalized nutrition and green packaging. New products like protein snacks from Beyond Meat and Hampton Creek show what’s coming. These snacks have clean labels and extra benefits.

As more people want easy and ethical food, the market will expand. This will attract new customers and open up new areas to sell in.

Global Cereal Protein Bars Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Cereal Protein Bars Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Cereal Protein BarsMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Cereal Protein Barsplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Cereal Protein Bars Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Cereal Protein Bars Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Cereal Protein Bars Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofCereal Protein BarsMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What factors contribute to the growth of the cereal protein bars market?

The market is growing because people want easy-to-eat healthy snacks. They also care more about health and enjoy trying new flavors.

How does quality control impact the production of cereal protein bars?

Quality control is key. It ensures the bars are safe and taste good. This builds trust with customers and boosts sales.

Are there any regulatory challenges in the cereal protein bars industry?

Yes, there are. Companies must follow FDA rules about what’s in the bars and how they’re labeled. This affects how they market and make their products.

What role does e-commerce play in the distribution of cereal protein bars?

E-commerce is huge. It lets brands sell directly to customers. They can offer subscriptions and special nutrition plans with cereal protein bars.

How important is sustainability in the cereal protein bars market?

It’s very important. People want to buy from brands that care about the planet. This is changing how products are made and marketed.

What emerging trends are shaping the future of cereal protein bars?

New trends include using different proteins and making bars for specific diets. There’s also a focus on packaging that’s better for the environment.

How does market segmentation affect consumer choices in cereal protein bars?

Segmentation means there’s a wide range of bars to choose from. This includes options for different diets, like non-GMO or keto-friendly.

Which regions are seeing the most growth in the cereal protein bars market?

North America is still the biggest market. But Asia-Pacific, especially China and India, is growing fast. This is due to more people moving to cities and changing their eating habits.

Who are the leading brands in the cereal protein bars market?

Top brands include Kellogg’s, General Mills, Clif Bar, Quest Nutrition, and KIND. Each uses its own approach to win over customers in different places.

How do cultural preferences influence the success of protein bars in different markets?

Cultural tastes, like what people eat and like to eat, really matter. They guide how products are made and marketed, especially in places like India and China.