$126.3 Million Chlorosulfonated Polyethylene Market Set to Expand in the U.S., China, and India by 2025

The Chlorosulfonated Polyethylene Market is projected to reach $126.3M by 2028, driven by growing demand in construction, automotive, and industrial sectors across the US, China, and India.

- Last Updated:

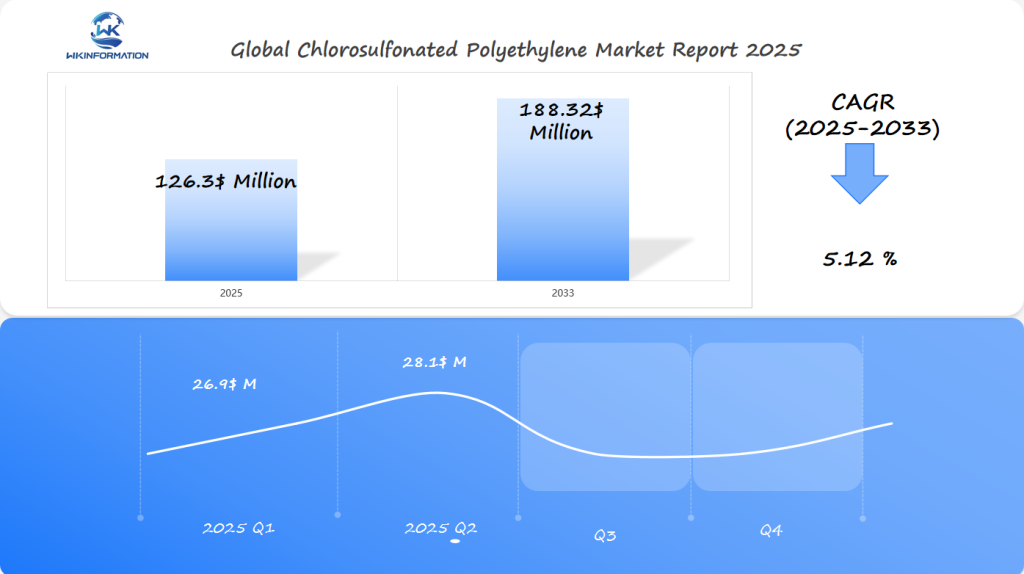

Projected Market Insights for Chlorosulfonated Polyethylene in Q1 and Q2 of 2025

The Chlorosulfonated Polyethylene market is expected to reach $126.3 million in 2025, with a CAGR of 5.12% from 2025 to 2033. In Q1, the market is forecasted to generate approximately $26.9 million, driven by its use in producing durable, weather-resistant coatings for industrial and automotive applications. By Q2, the market is anticipated to increase to around $28.1 million, as demand for high-performance elastomers in industries such as chemical processing and construction rises.

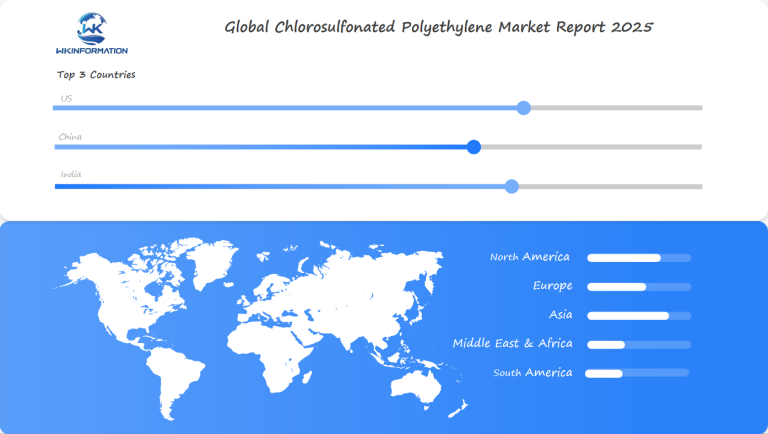

The U.S., Switzerland, and Belgium are the primary markets, with Switzerland and Belgium being prominent in chemical production and industrial coatings, while the U.S. maintains a strong presence in manufacturing and automotive sectors. The steady growth in demand for durable materials will continue to support market expansion.

Exploring the Upstream and Downstream Industry Chains for Chlorosulfonated Polyethylene

The chlorosulfonated polyethylene market is a complex web of supply chains, raw materials, and new manufacturing methods. Knowing how it goes from start to finish helps us see its big role in industry.

Creating chlorosulfonated polyethylene involves many important steps. These steps turn basic materials into top-notch industrial products. Makers pick and mix certain chemicals to make this special rubber.

Raw Material Suppliers and Manufacturing Processes

Making chlorosulfonated polyethylene needs careful engineering and advanced chemistry. Suppliers of raw materials focus on giving the best polymers and chlorinating agents. These are key for making this material.

- Petrochemical-based ethylene sources

- Specialized chlorination reagents

- High-performance catalysts

- Advanced processing equipment

“The quality of raw materials directly influences the performance characteristics of chlorosulfonated polyethylene,” explains industrial polymer experts.

End-Use Industries and Applications

After being manufactured, chlorosulfonated polyethylene is transformed into various valuable products that find applications across multiple industries. This widespread usage demonstrates the versatility and advanced nature of this material.

Some of the key industries and applications where chlorosulfonated polyethylene is utilized include:

- Automotive weatherstripping

- Industrial protective coatings

- Mechanical sealing systems

- Specialized electrical insulation

The combination of innovative manufacturing processes and specialized applications continues to drive the growth and development of the chlorosulfonated polyethylene market.

Key Trends Driving the Chlorosulfonated Polyethylene Market Forward

The chlorosulfonated polyethylene market is changing fast. New technologies and uses in many industries are leading the way. Researchers and makers are looking into new ways to make the material better and more eco-friendly.

Market trends show a lot of room for growth in certain industrial areas. Its special chemical makeup is catching the eye of those looking for top-notch synthetic rubber substitutes.

Technological Advancements in Production

New technology has transformed the production process of chlorosulfonated polyethylene. The significant improvements include:

- Enhanced molecular engineering techniques

- Improved chemical synthesis methods

- Advanced purification technologies

- Precision control of material characteristics

Emerging Applications and Market Opportunities

New uses are opening up more chances for the market in different fields. It’s becoming popular in areas that need strong durability and resistance to chemicals.

| Industry Sector | Emerging Application | Market Potential |

| Automotive | Weatherproof Sealing | High Growth |

| Construction | Protective Coatings | Moderate Growth |

| Electronics | Specialized Insulation | Emerging Potential |

Companies are putting a lot of money into research to find new chances in the market. Innovative product development is key to staying ahead in this fast-changing tech world.

Challenges in the Production and Application of Chlorosulfonated Polyethylene

The chlorosulfonated polyethylene (CSPE) industry faces big challenges. It needs new solutions and smart strategies. Companies must overcome tough technical issues and follow strict rules.

CSPE production has many technical hurdles. These include complex material processing and chemical changes. The material’s special properties make it hard to make:

- Complex thermoplastic properties that degrade over 5-10 years

- Specialized adhesive requirements for repairs

- Sensitive material composition vulnerable to environmental factors

Technical Manufacturing Complexities

The production process requires precise control over chemicals. Companies must handle material degradation effectively and maintain high product quality.

Regulatory and Environmental Considerations

Environmental rules have changed CSPE production a lot. Some methods stopped because of environmental worries. Now, making CSPE must be more green.

| Challenge Category | Key Considerations | Impact Level |

| Chemical Processing | Hazardous byproduct management | High |

| Environmental Compliance | Reducing chlorinated hydrocarbon use | Critical |

| Material Durability | Preventing UV and chemical degradation | Moderate |

The future of CSPE production relies on solving these challenges. New research, better manufacturing, and working with regulators are key. Companies that overcome these hurdles will lead the market.

Geopolitical Factors Impacting the Chlorosulfonated Polyethylene Market

The global chlorosulfonated polyethylene market is influenced by complex geopolitical factors. These factors impact production, trade, and market growth. Strategic relationships between major economies play a crucial role in determining market opportunities and obstacles.

Here are some key geopolitical factors affecting the chlorosulfonated polyethylene market:

- Shifting trade policies between major manufacturing nations

- Regional market competition and strategic investments

- International supply chain reconfiguration

Trade Policies and International Relations

Trade policies are crucial in the chlorosulfonated polyethylene market. The United States, China, and India are key players. Government incentives and strategic investments are driving market growth.

| Country | Market Investment | Strategic Focus |

| United States | High | Advanced Manufacturing |

| China | Medium-High | Production Capacity |

| India | Growing | Emerging Market Potential |

Regional Market Dynamics

Regional markets have unique characteristics influenced by geopolitical factors. Supply chain disruptions and strategic investments are reshaping competitive landscapes. This is especially true in emerging economies like India and China.

Manufacturers must navigate complex international relationships. They need to balance technological innovation with geopolitical constraints. This is to maintain market relevance and competitive advantage.

Market Segmentation: Types and Applications of Chlorosulfonated Polyethylene

The chlorosulfonated polyethylene (CSM) market is complex. It has many product types and uses. This complexity drives innovation in various industries.

Researchers have found different categories in the market. These categories shape the industry’s growth.

Product Types and Characteristics

CSM market segments fall into two main categories:

- High-end products: Expected to grow fast by 2033

- Low-end products: Meet standard industrial needs

Key Application Areas and Market Share

CSM is used in many important sectors:

- Construction sector (biggest market share)

- Automotive sector

- Industrial products sector

- Wire and cable sector

CSM is versatile in many industrial uses:

- Power generating stations

- Oil & gas infrastructure

- Desalination plants

- Chemical processing facilities

- Water treatment installations

CSM stands out because it resists ozone, UV, and chemicals. It works well in temperatures up to 90°C. This makes it valuable in many industries.

Chlorosulfonated Polyethylene in Industrial Coatings and Automotive Sectors

Chlorosulfonated polyethylene (CSM) is key in today’s industrial and car world. It’s a synthetic rubber that shines because of its top-notch performance. This makes it super valuable in many fields.

CSM’s special traits have changed the game for coatings and car parts. It’s known for lasting long and handling tough weather well. This is why more and more makers turn to CSM.

Performance Benefits in Industrial Coatings

Coatings made with CSM offer top-notch defense against harsh chemicals. They come with:

- Exceptional chemical resistance

- Superior weatherability

- Robust UV and ozone protection

- Long-lasting durability

Automotive Applications and Future Prospects

In cars, CSM is a real game-changer. It’s tough and perfect for parts that need to perform well.

- Fuel system seals

- Hose manufacturing

- Gasket production

- Temperature-resistant components

The future of chlorosulfonated polyethylene looks bright. Research is finding new ways to use it in green cars and industries.

Global Market Insights into Chlorosulfonated Polyethylene

The global chlorosulfonated polyethylene market is growing fast. This is thanks to more industrial uses and new tech. Recent studies show a bright future for this special synthetic rubber.

Important market trends show a big increase in the global market.

Market Size and Growth Projections

The chlorosulfonated polyethylene market has significant growth potential, with expectations of substantial expansion across various industries. The growth will be primarily driven by high-end products, particularly in sectors such as construction, automotive, and industrial applications.

Regional Market Share Analysis

Regional trends are key to market growth. North America leads the market. But, China and India are growing fast. India, with “Make in India,” is a big chance for makers.

Factors driving India’s growth in synthetic rubber demand:

- India’s synthetic rubber demand projected to increase from 671,000 tonnes in FY2021 to 1,055,000 tonnes by FY2030

- Cost advantages in manufacturing

- Availability of skilled labor

Investments and new research are changing the chlorosulfonated polyethylene market. They help it grow and get better.

U.S. Market Demand for Chlorosulfonated Polyethylene in Manufacturing

The U.S. manufacturing industry is evolving rapidly, with chlorosulfonated polyethylene (CSM) being a significant contributor. The U.S. market for chlorosulfonated polyethylene is expanding due to emerging applications and a demand for superior materials.

Key Industries Driving Demand

Several key industries are driving the need for chlorosulfonated polyethylene:

- Construction sector: Uses CSM for weather-resistant roofing and special building materials

- Automotive industry: Uses CSM in lightweight parts and special components

- Wire and cable manufacturing: Uses CSM for high-temperature resistant insulating layers

- Electrical equipment production: Makes durable gaskets and seals

Market Trends and Future Outlook

The demand for chlorosulfonated polyethylene in U.S. manufacturing is expected to rise significantly. Trends indicate a focus on producing better CSM products that are both flame retardant and environmentally friendly.

The wire and cable industry plays a major role in this, accounting for approximately 35% of the market. This highlights the importance of CSM in advanced manufacturing.

The future of chlorosulfonated polyethylene in U.S. manufacturing looks promising, with continued innovation driving market expansion.

New technologies and partnerships, such as the agreement between Safic-Alcan and Ningxia Boyuan Rubber, are contributing to the growth of the market. These developments are making the manufacturing sectors more diverse and resilient.

China’s Role in Chlorosulfonated Polyethylene Production and Innovation

China has become a significant player in the production of chlorosulfonated polyethylene (CSM), leading the way in innovation and technology on a global scale. Chinese manufacturers have experienced rapid growth, establishing themselves as major players in the industry worldwide.

Production Capacity and Market Dynamics

Chinese companies have grown a lot in making CSM. They have made big investments and improved their tech:

- Ningxia Boyuan Rubber Co., Ltd. is the top in China’s market

- Jiangxi Hongrun Chemical Co., Ltd. keeps growing its production

- Guangzhou Ecopower New Material Co., Ltd. has brought in new manufacturing ways

Research and Development Initiatives

Innovation is key for Chinese CSM makers. Cutting-edge research aims to use CSM in more areas. For example, Ningxia Boyuan Rubber works with Safic-Alcan to sell new materials worldwide.

They focus on:

- High-performance wire and cable jacket materials

- Advanced gasket and seal technologies

- Specialty roofing solutions

Chinese makers are serious about improving tech and growing globally in the CSM field.

India’s Growing Demand for Chlorosulfonated Polyethylene in Industrial Applications

The demand for chlorosulfonated polyethylene (CSM) in India is growing fast. This is because of more industrial uses and new economic chances. The synthetic rubber market is also growing well, showing strong growth in many industries.

In India, the industrial world is creating new chances for chlorosulfonated polyethylene. The demand for synthetic rubber is expected to rise from 671 thousand tonnes in FY2021 to 1055 thousand tonnes by FY2030. This shows a big market potential.

Emerging Industrial Sectors

Several sectors are driving the demand for CSM in India:

- Automotive manufacturing

- Construction and infrastructure development

- Consumer goods production

- Specialized industrial coatings

Market Growth Drivers and Challenges

The growth of chlorosulfonated polyethylene in industrial applications is helped by several key factors:

- Infrastructure investments create a lot of demand for materials

- More focus on high-performance, durable materials

- Increased interest in sustainable manufacturing

But, there are challenges too. These include managing price changes in raw materials and dealing with complex rules. Still, the Indian market is ready for big growth in synthetic rubber technologies.

The Future of Chlorosulfonated Polyethylene: Innovation and Sustainability

The chlorosulfonated polyethylene (CSM) industry is changing fast. New trends and sustainable ideas are leading the way. Companies are finding new ways to make CSM that’s better for the planet without losing quality.

New technologies are changing how CSM is made. Some big changes include:

- Advanced green manufacturing techniques

- Reduced carbon footprint production methods

- Enhanced material recycling capabilities

Emerging Technologies and Product Developments

New ideas are making CSM even better. Materials from the sea, like seaweed and algae, are being used. They offer big environmental benefits, such as:

- Growing without using land

- Helping to capture carbon dioxide

- Supporting marine life

Sustainability is no longer an option but a critical necessity in modern material science.

Sustainability Initiatives and Green Manufacturing

The industry is joining forces for a greener future. For instance, Safic-Alcan and Ningxia Boyuan Rubber are collaborating to introduce advanced materials to global markets.

| Sustainability Focus | Key Advantages |

| Biodegradable Materials | Reduced environmental impact |

| Eco-friendly Production | Lower carbon emissions |

| Circular Economy Integration | Enhanced material recycling |

CSM elastomers remain excellent for various applications, offering strong resistance to chemicals, weather, and heat. The future of CSM involves maintaining high standards while prioritizing environmental sustainability.

Competitive Landscape in the Chlorosulfonated Polyethylene Market

Players are now focusing on technology and expanding their reach. Chinese companies are taking on the mid- to low-end markets. They do this by keeping costs low, which challenges the big brands.

- Tosoh Corporation – Japan

- Jilin Petrochemical – China

- Lianyungang JTD Rubber Material – China

- Jiangxi Hongrun Chemical Industry – China

- Hejian Lixing Special Rubber – China

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Chlorosulfonated Polyethylene Market Report |

| Base Year | 2024 |

| Segment by Type |

· High-end Products · Low-end Products |

| Segment by Application |

· Construction · Automotive · Power · Oil & Gas · Chemical · Water Treatment |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Key drivers include the material’s superior resistance to heat, oil, and weathering, making it indispensable in automotive, construction, and electrical sectors. Segmentation by product type, application, and region provides a clear understanding of market dynamics. Major players focus on innovation, sustainability, and strategic partnerships to maintain their competitive edge.

Future opportunities lie in emerging markets and the growing demand for sustainable solutions. Companies that align with environmental regulations and invest in advanced formulations will likely lead the market. The adoption of CSM in diverse industries ensures its relevance and continued growth in the years ahead.

Global Chlorosulfonated Polyethylene Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Chlorosulfonated Polyethylene Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Chlorosulfonated Polyethyleneplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Chlorosulfonated Polyethylene Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Chlorosulfonated Polyethylene Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Chlorosulfonated Polyethylene Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofChlorosulfonated Polyethylene Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

How is chlorosulfonated polyethylene made?

The manufacturing process is complex. Polyethylene is reacted with sulfur chloride. This creates a specialized synthetic rubber with unique performance characteristics for various industrial applications.

What are the primary industries using chlorosulfonated polyethylene?

Key industries include automotive manufacturing, industrial coatings, construction, and specialized equipment production. The material’s chemical resistance and durability are highly valued in these areas.

What challenges does the chlorosulfonated polyethylene industry currently face?

The chlorosulfonated polyethylene industry is currently facing several major challenges:

- Technical manufacturing difficulties: The production of chlorosulfonated polyethylene involves complex manufacturing processes that can be challenging to execute efficiently.

- Stringent environmental regulations: The industry must comply with strict environmental regulations, which can impact production methods and costs.

- Complex production processes: The intricacies involved in the production of chlorosulfonated polyethylene can create hurdles in terms of efficiency and scalability.

- Need for continuous technological innovation: To keep up with changing market demands, the industry must constantly innovate and adopt new technologies in its production processes.

How are sustainability initiatives impacting chlorosulfonated polyethylene development?

Manufacturers are focusing on green manufacturing processes. They are developing more environmentally friendly production methods. They are also exploring sustainable alternatives to reduce carbon footprint and meet regulatory requirements.

Which regions are leading in chlorosulfonated polyethylene production?

The United States, China, and India are the primary markets for chlorosulfonated polyethylene. China is becoming a major producer and innovator in research and development of chlorosulfonated polyethylene technologies.

What technological advancements are emerging in chlorosulfonated polyethylene?

Recent advancements include:

- Improved production techniques

- Enhanced material performance

New application developments in high-performance coatings and innovative solutions for automotive and industrial sectors are also emerging.

How do geopolitical factors influence the chlorosulfonated polyethylene market?

Trade policies, international relations, regional economic conditions, and global supply chain dynamics significantly impact production, distribution, pricing, and market opportunities for chlorosulfonated polyethylene.

What makes chlorosulfonated polyethylene unique in industrial applications?

Chlorosulfonated polyethylene is a preferred material in industrial applications due to its:

- Exceptional chemical resistance: It can withstand exposure to various chemicals without deteriorating.

- Durability: It has a long lifespan and can endure harsh conditions.

- Weather resilience: It is resistant to UV radiation, moisture, and extreme temperatures.

- Versatility: It can be used in a wide range of applications.

These properties make chlorosulfonated polyethylene suitable for use in:

- Industrial coatings: It provides a protective layer on surfaces exposed to corrosive environments.

- Automotive components: It is used in parts that require resistance to chemicals and weathering.

- Specialized manufacturing processes: Its unique characteristics make it ideal for specific production methods.

What is the future outlook for chlorosulfonated polyethylene?

The market for chlorosulfonated polyethylene is expected to continue growing. This growth will be driven by technological innovations, increasing demand in emerging industries, sustainability initiatives, and expanding applications across multiple sectors globally.