2025 Global Class 7 Ethernet Cable Market Insights Unlocking $2,403.5 Billion Potential in the US, China, and Germany

The Class 7 Ethernet Cable Market is thriving in the US, China, and Germany amid Trump’s focus on safeguarding networks.

- Last Updated:

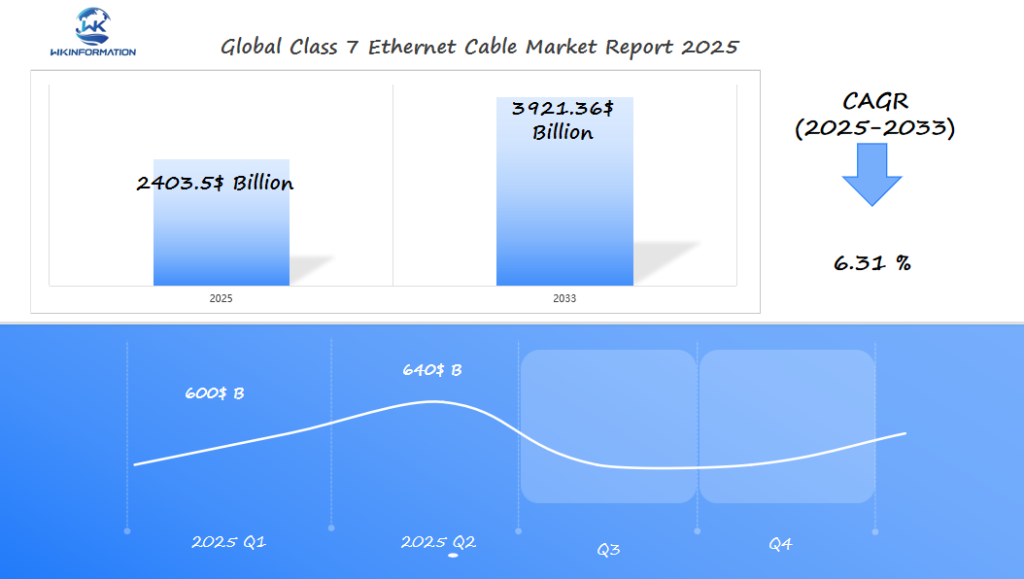

Class 7 Ethernet Cable Market Outlook for Q1 and Q2 of 2025

The Class 7 Ethernet Cable market is expected to reach USD 2,403.5 billion in 2025, growing at a CAGR of 6.31% from 2025 to 2033. The market is projected to see substantial growth in the first half of 2025, reaching around USD 600 billion by the end of Q1 2025. By Q2 2025, the market is anticipated to grow to approximately USD 640 billion, as demand for faster data transmission speeds and more reliable network infrastructure increases across industries such as telecommunications, data centers, and smart cities.

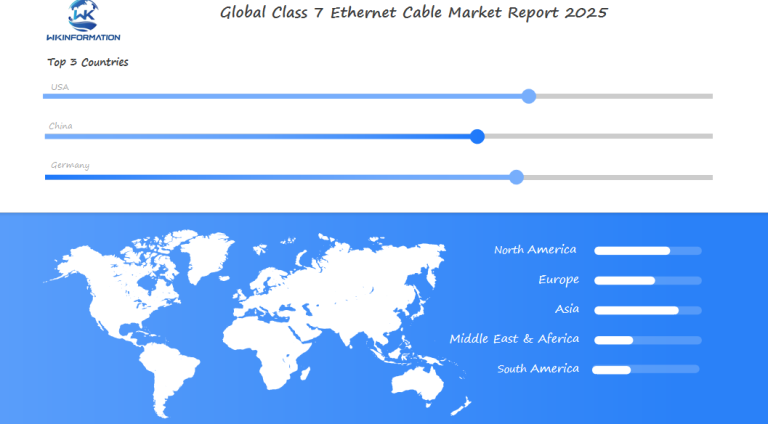

The US, China, and Germany are anticipated to be the leading countries in this sector, driven by their strong positions in technology and infrastructure development. In the US, the rapid expansion of data centers and the continued rollout of 5G networks will drive substantial demand for high-speed Ethernet cables. China’s ongoing infrastructure projects and adoption of next-generation networks will further bolster market growth, while Germany’s advanced manufacturing sector will continue to push for higher performance Ethernet cables in industrial applications.

Key Takeaways

- The Class 7 Ethernet Cable Market could reach $2,403.5 billion by 2025, led by the US, China, and Germany.

- Class 7 cables support 10-Gbps speeds, making them vital for data centers and industrial automation.

- Global ethernet market growth is tied to 5G rollout and smart manufacturing trends.

- Market potential expands as industries prioritize reliable networking infrastructure.

- Regulatory standards and trade policies will shape regional market dynamics.

Exploring the Upstream and Downstream Flow of the Class 7 Ethernet Cable Market

Every high-performance Ethernet cable has a complex story. It involves suppliers, manufacturers, and distributors. This part explains how raw materials, production, and distribution shape the market.

From mining copper to delivering cables to data centers, each step affects availability and price. Every link in the ethernet cable supply chain plays a role.

Upstream Manufacturing Processes and Raw Material Suppliers

Class 7 cable manufacturing requires careful engineering to meet high standards. Suppliers of copper conductor provide top-quality metals. Materials like special insulators keep signals clear.

Delays in getting these materials can stop production. For example, copper shortages have led some to use different alloys.

Downstream Distribution Channels and End-User Relationships

Ethernet cable distribution connects factories to users through various channels. Big buyers like cloud providers often make large deals. This creates strong partnerships.

This model helps keep prices stable. But, with fewer distributors, market control is shifting. Some companies now handle both making and delivering cables to save money.

Users in smart manufacturing need special cables. They want cables that can bend tightly and are fire-resistant. This pushes suppliers to create new materials.

These changes show how both ends of the chain affect product development and market reach.

Key Market Trends to Watch for in the Class 7 Ethernet Cable Industry

The need for quicker and more dependable connections is on the rise. This is changing the ethernet cable industry trends fast. Companies are focusing on high-speed networking cables to meet today’s data needs. Let’s look at the main trends shaping this area.

Technological Innovations Driving Market Growth

New cable designs are breaking performance limits. Improvements like better shielding and smaller connectors let for thinner cables without losing speed. For data center ethernet infrastructure, these changes help handle the huge data needs of cloud and AI systems. Key improvements include:

- Lightweight materials for easier installation in tight spaces

- Low-latency designs for real-time data processing

- Robust durability for industrial and outdoor use

Shifting Consumer Demands and Industry Applications

Businesses are using IoT connectivity solutions on a large scale, driving demand for cables that work in many settings. Industrial ethernet applications are growing in manufacturing, logistics, and smart cities. Trends include:

- Rising use of Ethernet in IoT devices for automation

- Adaptation of cables for extreme temperatures and harsh conditions

- Growing focus on eco-friendly materials to meet sustainability goals

These trends show a market that balances speed, durability, and innovation to meet global tech needs.

The Roadblocks: Restrictions in the Class 7 Ethernet Cable Market

Producers of Class 7 Ethernet cables face ethernet cable market restrictions that slow growth. Network infrastructure regulations change around the world. This means manufacturers must follow different safety and environmental rules.

Meeting these standards can be costly. The EU, for example, has strict cable manufacturing challenges for green reasons.

Regulatory Challenges and Compliance Issues

Companies must follow network infrastructure regulations like RoHS and REACH. They also need fire safety certifications, like UL and IEC. These steps add time and money.

- Fire safety tests delaying product launches

- Carbon footprint limits for production facilities

- Certification delays in emerging markets

Supply Chain Vulnerabilities and Material Shortages

Copper supply constraints cause production delays. International trade barriers like tariffs on raw materials have raised costs by 15% in 2023 (Data Source: Industry Report 2024).)*. There are also labor shortages in skilled roles.

| Challenge | Impact |

|---|---|

| Fluctuating copper prices | 20% cost variability annually |

| Component shortages | 12-week delivery delays |

| Trade disputes | 30% tariff increases on imports |

Companies like CommScope and TE Connectivity are using local sources and automation to reduce risks. Planning ahead and finding different suppliers can help overcome these ethernet cable market restrictions.

How Geopolitical Factors Shape the Class 7 Ethernet Cable Market

Geopolitical tensions are changing the ethernet cable geopolitics scene. Trade fights between big players like the U.S. and China have led to technology trade restrictions. This makes global supply chains harder to manage.

Countries are focusing more on networking infrastructure security. They’re making rules that say critical projects must use local products. This push for

Trade Policies and International Relations Impact

New technology export controls are making companies rethink their plans. For example:

- U.S. tariffs on Chinese cables raised costs for telecom companies

- EU rules now need third-party checks for infrastructure parts

- India’s “Make in India” policy favors local suppliers for government deals

“Trade barriers are making firms diversify suppliers and invest in local factories,” said a 2023 ITU report.

Regional Manufacturing Strategies and Market Access

| Country | Initiatives | Market Access Impact |

|---|---|---|

| United States | CHIPS Act funding for semiconductor-linked cabling | Priority access to federal projects |

| China | Made in China 2025 tech push | Export dominance in low-cost cables |

| Germany | €1.2B investment in industrial infrastructure | EU market leadership in high-speed cabling |

These plans show how technology export controls and domestic production initiatives are building regional centers. Companies are trying to balance risks with costs. They aim to follow rules and stay competitive.

The Market Segmentation Breakdown of Class 7 Ethernet Cables: Key Factors to Consider

Class 7 Ethernet cables come in different types. They vary based on technical specs and how they’re used. Knowing about ethernet cable categories like Cat7 vs. Cat7A helps businesses pick the best one. These cables are classified by speed, shielding, and how long they last.

Performance Specifications Define Value

There are shielded and unshielded ethernet options. Shielded cables protect against noise, while unshielded ones don’t. Cat7 cables can handle up to 600 MHz, and Cat7A goes up to 1,000 MHz. These network cable classifications meet the needs of data centers versus offices.

Prices vary. Cat7 is more affordable for small businesses. But Cat7A is better for fast server networks.

Applications Drive Market Divisions

Applications split the market into different areas:

- Data centers needing ultra-low latency

- Industrial automation systems in factories

- Healthcare facilities needing electromagnetic immunity

- Retail stores optimizing commercial ethernet infrastructure

Shielded cables are best in busy cities. Unshielded ones work better in quiet places. Distributors sell to different groups: enterprises buy in bulk, and integrators get certified Cat7A for projects.

Choosing the right cable depends on the job’s needs. This guide helps understand how specs and use cases influence buying decisions across industries.

The Impactful Applications of Class 7 Ethernet Cables in High-Demand Industries

Class 7 Ethernet cables are changing how we build modern infrastructure. They offer fast, reliable connections that many industries need. They play a big role in high-performance networking and data center cabling, pushing innovation forward.

Data Center and Cloud Infrastructure Requirements

Data centers need data center cabling to handle AI and cloud storage. These cables help reduce latency for quick analytics. They also make sure systems can grow without problems.

They are built to last, keeping operations running smoothly 24/7.

Smart Manufacturing and Industrial Automation Needs

In manufacturing, industrial ethernet protocols control robots and automated systems. They make sure machines talk to each other accurately. This cuts down on downtime and increases productivity.

Automotive and aerospace use them for precise assembly lines.

| Industry | Key Applications |

|---|---|

| Data Centers | Support for AI-driven cloud platforms |

| Manufacturing | Real-time automation via industrial protocols |

| Healthcare | Medical imaging and telehealth systems |

| Smart Buildings | Smart building infrastructure for IoT and security |

Healthcare uses these cables for MRI machines and monitoring patients. Smart building infrastructure connects HVAC, security, and lighting through one network. Transportation uses them for testing self-driving cars and rail systems.

Regional Market Dynamics: Class 7 Ethernet Cable Performance Across the Globe

Class 7 Ethernet cables are changing the global ethernet market in different ways. In places like Southeast Asia, fast growth in cities is pushing for better enterprise network upgrades. This is to help with manufacturing and IT needs. On the other hand, in Europe, older markets are focusing on updating their regional network infrastructure.

“Asia-Pacific’s ethernet cable demand forecast is growing faster than anywhere else. This is because of big digital projects,” says a 2023 report.

Emerging Markets Growth Potential

- Latin America: Brazil and Mexico are investing in telecom. They’re focusing on fiber-to-the-home (FTTH) projects.

- Sub-Saharan Africa: Countries like Kenya and Nigeria are using cables for smart grid projects. They’re getting help from the World Bank.

- India: India plans to roll out 5G. This will need 25% more fast cabling by 2025.

Mature Markets Replacement Cycles

In North America and Europe, there’s a push for enterprise network upgrades. They want to meet IEEE 802.3bz standards. For example, Germany’s car industry is updating its systems every 4-5 years. This matches their regional network infrastructure goals.

| Region | Key Driver | 2025 Demand Forecast (Millions USD) |

|---|---|---|

| Asia-Pacific | Data center expansion | 840 |

| Europe | Smart manufacturing | 620 |

| North America | Cloud infrastructure | 590 |

Places like the UAE are making it easier to use Class 7 Ethernet cables. They have special programs for this. Companies need to understand the global ethernet market in each area to do well.

US Market Insights: Growth and Challenges for Class 7 Ethernet Cables

Class 7 Ethernet cables are in high demand in the US ethernet market. This is due to the fast growth of American data centers and US network infrastructure spending. The US telecommunications standards influence how businesses and governments use these cables. Let’s explore the opportunities and challenges in this market.

Key Growth Sectors in the American Market

- American data centers need fast connections, boosting demand for Class 7 cables in cloud projects.

- Healthcare and finance are focusing on enterprise networking upgrades for better data security and bandwidth.

- Government contracts, especially in defense and smart city projects, are driving the adoption of these cables.

Competitive Landscape and Market Entry Barriers

Big names like CommScope, Amphenol, and Panduit lead the market, thanks to their knowledge of US telecommunications standards. New companies face tough competition because of:

| Challenge | Impact |

|---|---|

| High R&D costs for compliance with FCC and IEEE standards | Slows innovation for smaller firms |

| Trade tariffs on imported components | Raise production expenses for non-domestic suppliers |

Places like Silicon Valley and Texas are seeing a lot of demand. But, rural areas are behind in infrastructure. Companies looking to upgrade their networks must deal with high costs and the need for top-notch solutions.

China's Role in the Expansion of the Class 7 Ethernet Cable Market

China is a leader in China ethernet production thanks to its huge Asian cable manufacturing sector. Its Chinese network infrastructure projects and export needs push innovation. This makes China a major player in the $2.4 trillion market.

Manufacturing Capabilities and Export Strategies

Chinese factories make over 70% of the world’s Class 7 cables. They use cost-effective China ethernet production and advanced automation. Big names like CommScope and Panduit team up with local companies to reach markets in Europe and Southeast Asia. Their strategies include:

- Being price competitive by using economies of scale

- Getting custom certifications for different markets

- Working together with tech companies

Domestic Market Growth and Technology Adoption

The Made in China 2025 plan focuses on Chinese technology standards for 5G and IoT. The Digital Silk Road project improves Chinese network infrastructure. Smart cities are using Class 7 cables for fast data networks.

| Technology Standard | Key Focus | 2024 Growth (%) |

|---|---|---|

| Chinese Tech Standards | Data Center Networks | 14% |

| Global Standards | International Trade | 8% |

Companies like Huawei Technologies and Guanghui Telecom are using AI in their production lines. This is to meet Made in China 2025 goals. Their focus on both exports and local projects strengthens China’s market position.

Understanding the Role of Germany in the Class 7 Ethernet Cable Market

Germany is a world leader in high-performance networking. Its German ethernet manufacturing sector combines precision with European network standards. This makes German brands leaders in quality.

German Engineering Excellence and Quality Standards

German makers focus on durability and performance. They use advanced shielding and connector designs. This meets Industrie 4.0 connectivity needs.

Companies like Leoni and Roth test their products strictly. This sets global standards. It also affects European data infrastructure projects needing low latency and reliability.

European Market Leadership and Innovation Hubs

Germany leads in German industrial automation. Factories adopting Industrie 4.0 need fast networks. Local suppliers meet these needs.

Partnerships between Bosch and Fraunhofer Institute boost R&D. This keeps Germany at the forefront of innovation.

“Germany’s cables are not just products—they’re engineered for the future of smart manufacturing.”

German cables are key in sectors like automotive and renewable energy. As European data infrastructure grows, German innovations will influence global Ethernet cable use.

Future Growth Prospects for the Class 7 Ethernet Cable Market

As industries grow, Class 7 Ethernet cables need to keep up with new tech. Networking technology forecast shows a big increase in demand. This is because of the need for high-speed cable demand in smart systems and buildings.

Emerging Technologies Driving Next-Generation Demand

- 5G backhaul infrastructure boosts ethernet future trends by adding high-bandwidth cables to telecom networks.

- Edge computing hubs use Class 7 cables for fast data processing in fields like manufacturing and healthcare.

- Electric vehicles and self-driving cars are using these cables for reliable in-car connections.

New materials could make cables cheaper and stronger. This could open up new markets for connectivity growth.

Long-Term Market Forecast and Growth Opportunities

By 2030, the next-generation ethernet market is expected to grow a lot. Asia-Pacific will lead because of fast urban growth and industrial projects. North America’s data center growth and Europe’s focus on green tech also show big opportunities.

| Region | Key Drivers | Growth Potential |

|---|---|---|

| Asia-Pacific | 5G rollouts | High |

| North America | Data centers | Moderate |

| Europe | Smart city projects | Steady |

Companies should look into both traditional cabling and wireless options like Li-Fi. Being ready for change will help them succeed in the connectivity growth markets race.

Competitive Analysis of the Class 7 Ethernet Cable Market

-

Belden – United States

-

CommScope – United States

-

Panduit – United States

-

Siemon – United States

-

Nexans – France

-

Schneider Electric – France

-

Legrand – France

-

Leviton – United States

-

TE Connectivity – Switzerland

-

Reichle & De-Massari – Switzerland

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Class 7 Ethernet Cable Market Report |

| Base Year | 2024 |

| Segment by Type |

· Twisted Pair · Coaxial · Fiber Optic |

| Segment by Application |

· Data Centers · Server Rooms · Telecom Rooms · Others |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Class 7 Ethernet Cable Market is growing fast. To succeed, everyone needs to keep up with the networking industry outlook. It’s important to mix new ideas with keeping things running smoothly.

Being proactive with your ethernet market strategy is key. This way, you can meet the growing demand worldwide.

Key Takeaways for Industry Stakeholders

Manufacturers should focus on making high-quality products. These are needed for data centers and industrial automation. It’s also crucial to work closely with suppliers to avoid supply chain problems.

Investors should look at places like the U.S. and Germany. These areas are seeing more tech adoption. Keeping up with changing standards is essential for everyone.

Strategic Positioning for Sustainable Growth

To grow sustainably, focus on network infrastructure planning. This means finding a balance between cost and growth. It’s important to stay updated with the latest tech and rules.

Adopting standards like IEEE 802.3bz and having flexible supply chains is vital. This will help you stay strong in the competitive market.

Global Class 7 Ethernet Cable Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Class 7 Ethernet Cable Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Class 7 Ethernet Cable Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Class 7 Ethernet Cable players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Class 7 Ethernet Cable Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Class 7 Ethernet Cable Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Class 7 Ethernet Cable Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Class 7 Ethernet Cable Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are Class 7 Ethernet Cables?

Class 7 Ethernet cables are advanced networking cables. They support high-speed data transmission up to 1 GHz. They’re used in places needing fast networking, like data centers and smart buildings.

Why is there a growing demand for Class 7 Ethernet Cables?

The demand for Class 7 Ethernet cables is growing fast. This is because of cloud computing, AI, and the Internet of Things (IoT). These technologies need cables that can handle lots of data well.

What makes Class 7 cables different from earlier classifications?

Class 7 cables are different because of better shielding and a wider frequency range. This lets them send data more efficiently and reliably. It also reduces cross-talk and signal interference.

How are Class 7 Ethernet cables manufactured?

Making Class 7 Ethernet cables requires high-quality materials, like special copper and insulation. The process focuses on precision and quality standards to ensure top performance.

What challenges does the Class 7 Ethernet Cable market face?

The market faces challenges like regulatory issues and supply chain problems. Raw material costs, especially for copper, can also change. Labor skill gaps can affect production quality and capacity.

How do geopolitical factors influence the Class 7 Ethernet cable market?

Geopolitical factors like trade policies and tariffs can impact the market. For example, tensions between countries can raise costs and make it hard to get materials. This can slow down the market.

What are the key applications for Class 7 Ethernet Cables?

Class 7 Ethernet cables are used in many areas. These include data centers, industrial automation, and healthcare systems. They’re needed for fast and reliable wiring in these sectors.

What is the future outlook for the Class 7 Ethernet Cable market?

The future looks bright for the Class 7 Ethernet Cable market. New technologies like 5G and edge computing will drive demand. The market is expected to grow as industries need faster connectivity.

How do different regions compare in the Class 7 Ethernet Cable market?

Different regions have different market dynamics. For example, North America focuses on upgrading infrastructure, while Asia-Pacific sees fast growth. Knowing these differences is key for companies to succeed.

What strategies can companies adopt to succeed in this market?

Companies can succeed by focusing on technical differences and optimizing supply chains. Staying updated on regulations is also important. Building strong supplier partnerships and investing in innovation will help companies adapt to the market.