$371.04 Billion Consulting Services Market Surges in the U.S., U.K., and India – 2025 Growth Trends & Competitive Outlook

Discover an in-depth analysis of the Global Consulting Services Market (2025-2033), exploring key trends, growth drivers, and industry insights. Learn about technological advancements, digital transformation, and regional market dynamics shaping the future of consulting services. This comprehensive guide examines market projections, competitive landscapes, and strategic recommendations for businesses navigating the evolving consulting industry.

- Last Updated:

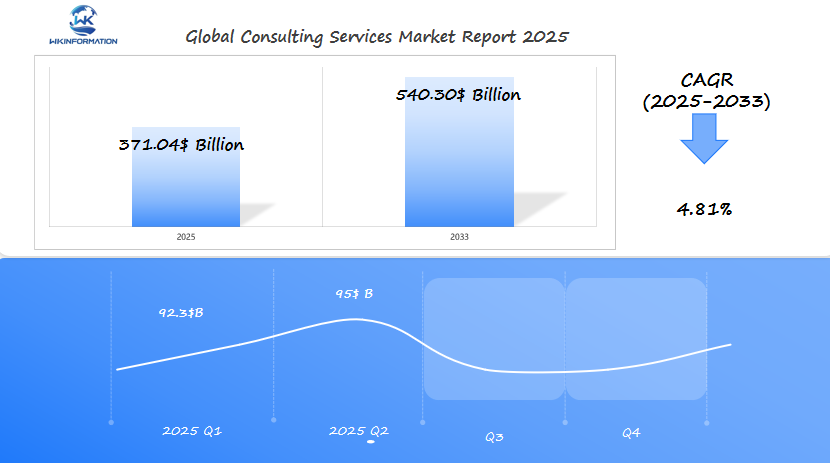

Consulting Services Market Q1 and Q2 2025 Forecast

The Consulting Services market is expected to reach $371.04 billion in 2025, growing at a CAGR of 4.81% from 2025 to 2033. In Q1 2025, the market is forecasted to generate approximately $92.3 billion, driven by the increasing demand for digital transformation consulting, management advisory, and business strategy services in the U.S., U.K., and India. Companies are investing in AI integration, cloud migration, and process automation, fueling market expansion.

By Q2 2025, the market is projected to reach $95 billion, with a strong focus on cybersecurity consulting, supply chain optimization, and sustainability consulting. The U.S. remains the dominant player, leveraging technology-driven advisory services. The U.K. is a hub for financial and legal consulting, while India sees rising demand for IT and business process outsourcing (BPO) consulting.

With the acceleration of AI-driven advisory models, remote consulting platforms, and hybrid workforce strategies, the consulting industry will continue to evolve, offering high-value expertise to global enterprises.

Key Takeaways

- Global consulting services market revenue hit $371.04 billion in 2025.

- U.S., U.K., and India dominate regional growth due to strong tech and business ecosystems.

- Digital transformation and globalization are top drivers of industry expansion.

- Consulting services market competition is intensifying as firms adopt AI and data-driven tools.

- 2025 trends highlight focus on sustainability and client-centric service models.

Exploring the Global Consulting Services Industry: Key Players and Supply Chain Dynamics

Big names like McKinsey & Company, Boston Consulting Group (BCG), and Deloitte lead the way in global consulting. They use data analytics and AI to create solutions for their clients. Their work matches U.S. consulting trends, focusing on digital transformation.

How Top Firms Adjust to Supply Chain Dynamics

Supply chain dynamics are key. Here’s how top firms adjust:

- Client-Centric Models: They offer tailored advice for manufacturing and tech sectors.

- Partnerships: They team up with tech startups to improve their services.

- Global Expansion: They open offices in new markets to serve global clients.

| Company | Key Focus | Market Influence |

| McKinsey | Operational efficiency | Guides Fortune 500 firms on cost reduction |

| BCG | Innovation strategy | Promotes AI adoption across industries |

| Deloitte | Risk management | Helps clients navigate regulatory changes |

A 2024 report shows 68% of U.S. firms now focus on sustainability in consulting. This shift is a big U.S. consulting trends change. It makes global partners add eco-friendly practices to their services.

“The race isn’t just about tech; it’s about understanding client pain points deeply,” said a senior advisor at BCG.

Local expertise helps regional supply chains. For instance, U.S. consultants advise Asian manufacturers on U.S. trade rules. This teamwork makes operations smoother and boosts the need for specialized advice.

Emerging Trends Shaping the Future of Consulting Services

The consulting world is changing fast, thanks to U.K. consulting innovation focusing on tech. Companies are using AI and data to create custom plans. This approach saves money and improves results. Now, making projects green is a must for clients.

Key Trends Driving Change

- AI-Powered Insights: U.K. firms like PwC use AI tools to predict market shifts, giving clients a competitive edge.

- Remote Collaboration: Post-pandemic, virtual advisory models from EY and KPMG allow real-time global team coordination.

- ESG Integration: Deloitte’s U.K. teams now prioritize environmental, social, and governance metrics in every strategy.

“Innovation isn’t optional—it’s survival. The U.K. is leading this charge with tech and ethics at its core.” – McKinsey U.K. Strategy Lead

Rise of Micro-Specialization

Now, we see more micro-specialization. Consultants offer deep knowledge in areas like fintech or AI ethics. Startups like Innovate UK work with big firms to mix old and new ways.

This shift shows a move towards being quick and smart. Clients want solutions that fit their specific needs fast. With global markets getting more complex, U.K. consulting innovation keeps the industry ahead.

Barriers and Challenges Hindering Market Expansion in Consulting Services

Despite growth in the consulting sector, several hurdles slow progress. Regulatory hurdles, such as data privacy laws, complicate cross-border projects. For example, India business transformation initiatives often face fragmented state-level policies, complicating nationwide strategies.

- Technological adoption gaps delay innovation in sectors like manufacturing and retail.

- Competitive pricing pressures force firms to cut margins, risking service quality.

Consulting firms in India report struggles balancing client demands with local talent shortages. A 2023 McKinsey report highlights that 40% of businesses hesitate to adopt AI-driven solutions due to cost and integration fears. This hesitation impacts India business transformation efforts, slowing sector modernization.

“Complex regulatory landscapes and skill gaps remain top obstacles to scaling consulting services,” said a Deloitte analyst at the World Economic Forum 2024.

Global players like Accenture and EY face resistance in sectors where legacy systems dominate. Meanwhile, smaller firms lack resources to keep pace with digital tools, widening the gap between market leaders and newcomers. These challenges highlight the need for adaptive strategies to unlock growth potential in emerging economies.

The Role of Geopolitics in Shaping Consulting Services Demand

Geopolitical changes affect how businesses work across borders. Trade tensions, new rules, and conflicts create uncertainty. This uncertainty boosts the need for expert advice.

A strong global consulting supply chain is key. Companies look for quick solutions to these challenges.

“The interplay of geopolitical forces and business strategy is now inseparable. Firms relying on a robust global consulting supply chain can pivot faster to seize opportunities in volatile markets.” – Roberta Singh, Partner at Deloitte Global

Impact of Trade Policies

Trade policies like tariffs or sanctions affect cross-border work. Experts in compliance and risk management are in high demand. This is because companies are rethinking their supply chains.

- U.S.-China trade disputes: These disputes have led to more legal and operational advice needs.

- Brexit: This has increased the need for strategies to enter the EU market.

Demand for Geopolitical Risk Assessments

Sanctions on industries or countries also raise the demand for geopolitical risk assessments. Energy companies looking to expand into unstable areas need consultants to guide them. This creates a cycle:

- Instability

- More consulting needs

- Stronger global consulting supply chain networks

Evolving Strategies of Consulting Firms

Consulting firms are now adding geopolitical analysts to their teams. This helps clients get ahead of changes rather than just reacting to them. As trade alliances change, the flexibility of the global consulting supply chain will show its worth in a world that’s getting more divided.

Types of Consulting Services and Their Impact on the Market

Consulting services cover many areas, each with its own role in the competitive consulting landscape. They help with everything from making operations smoother to keeping up with new technology. These areas show how business needs are changing.

1. Management Consulting

Management consulting offers advice on strategy, leadership, and mergers. It helps big companies work better.

2. IT Consulting

IT consulting deals with cybersecurity, moving to the cloud, and using AI. It’s key for companies to go digital.

3. Financial Consulting

Financial consulting helps with budgeting, risk management, and following tax laws worldwide.

4. HR Consulting

HR consulting works on keeping good employees, improving diversity, and handling remote work. It makes workplaces better.

5. Sustainability Consulting

Sustainability consulting helps companies follow ESG rules. It makes them more eco-friendly and boosts their image.

Specialized expertise in niche markets like ESG and digitalization is becoming a key differentiator in the competitive consulting landscape.

New trends like AI and climate rules make companies want specific solutions. The IT and sustainability areas are growing fast. This means both new and old companies are looking at these fields.

Big names like McKinsey focus on specific areas. Smaller firms find their own special spots. Clients want advisors who really get their industry’s problems. This changes how companies see their place in the market.

Widespread Adoption of Consulting Services Across Industries

Consulting services are now a must for businesses all over the world. They help in many fields, from healthcare to manufacturing. This move shows a big change towards making decisions based on data.

How Different Industries are Leveraging Consulting Services

Here are some examples of how various industries are partnering with consulting firms to drive improvements:

- Finance: Banks like JPMorgan and fintech startups work with McKinsey to strengthen cybersecurity and regulatory compliance.

- Healthcare: Hospitals partner with Deloitte to streamline EHR systems and improve patient outcomes.

- Technology: Companies like Google and startups use BCG advisors to accelerate AI adoption and innovation pipelines.

- Manufacturing: Automotive giants collaborate with PwC to optimize supply chains and reduce carbon footprints.

- Retail: Walmart and luxury brands consult Accenture on omnichannel strategies to boost customer engagement.

These partnerships lead to big improvements in how businesses work. A 2023 McKinsey study found 85% of Fortune 500 firms now have consulting budgets. This shows how important outside help is for dealing with changes like AI or climate rules.

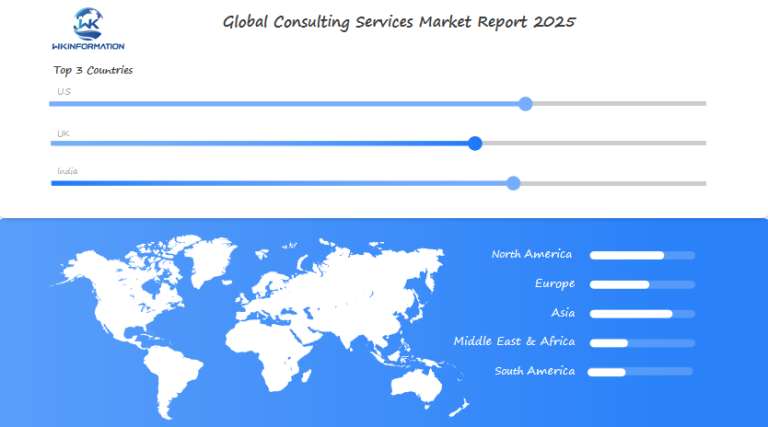

Consulting Services Market Outlook: Global Expansion and Regional Highlights

Consulting firms are working on market expansion strategies to tap into new markets. Asia-Pacific and Europe are leading with a focus on technology. The Middle East is focusing on infrastructure and sustainability. Companies are making sure their solutions fit local rules and cultural values.

Key Strategies for Global Expansion

- Digital-first approaches: AI and data analytics tools help firms scale globally.

- Local partnerships: Collaborations with regional experts boost client trust and market entry efficiency.

- Sustainability consulting: Rising demand for ESG compliance drives tailored advisory services.

Success Stories in Consulting

Success stories show how effective strategies work:

- In India, digital adoption has grown 35% since 2023.

- EU firms use their regulatory knowledge to attract clients from other countries.

- The Middle East’s consulting sector grew 18% in 2024, thanks to energy transition projects.

“The next wave of growth hinges on balancing global expertise with hyper-local execution,” noted a 2024 report by PwC. “Adapting market expansion strategies to regional priorities will define winners in this space.”

North American and Latin American Trends

North American firms are moving into Africa with fintech and logistics consulting. Latin America’s need for compliance and supply chain advice is growing boutique consultancies. These trends show a move towards flexible, region-specific market expansion strategies that focus on client needs.

U.S. Consulting Services Market: Growth Trends and Investment Hotspots

The U.S. consulting sector is all about innovation and looking ahead. It’s driven by the need to understand trade policies and global changes. Tech and energy are the main areas where investments are flowing, thanks to uncertainty in the market.

Key Factors Driving Growth in the U.S. Consulting Services Market

- Tech innovation speeds up the need for digital transformation plans.

- Changes in finance and healthcare laws increase the need for advice.

- Geopolitical consulting helps companies manage risks.

| Region | Sector Focus | Growth Drivers |

| California | Technology | AI, cybersecurity, and geopolitical strategy |

| Texas | Energy | Renewable investments and policy adaptation |

| New York | Finance | Global trade compliance and regulatory shifts |

Energy and tech consulting firms are growing their teams. They’re tackling the geopolitical consulting impact on supply chains. Investors are looking at areas where politics meets market chances.

For example, California’s tech companies focus on cybersecurity to fight off global threats. Texas energy clients want strategies to fit with global climate policies.

New areas like AI ethics and data laws across borders are opening up. The U.S. market is quick to adapt to global changes. It’s a top player in global advisory services.

The U.K.’s Thriving Consulting Services Market: A Hub for Innovation

The U.K. consulting sector is a leader in blending tradition with innovation. It drives future consulting growth through tech-driven solutions. London, a global finance and tech hub, attracts top firms like McKinsey and Accenture.

These firms invest in AI and sustainability projects. This focus on cutting-edge tools helps businesses navigate post-Brexit challenges. It also expands into emerging markets.

Future Consulting Growth Strategies in the U.K.

“The U.K.’s consulting industry isn’t just adapting—it’s redefining what advisory services can achieve,” said a PwC spokesperson. “Clients demand faster, smarter solutions, and we’re delivering them.”

Key factors fueling this momentum include:

- Strong demand for ESG (environmental, social, governance) consulting as regulations tighten

- Growth in fintech partnerships boosting digital transformation projects

- Government initiatives like the U.K. Innovation Strategy attracting global talent

London’s universities also play a role, producing skilled graduates. They join firms innovating in AI analytics and cloud-based consulting models. This ecosystem positions the U.K. to capture 12% of global consulting revenue by 2026, per a Gartner report.

As clients prioritize agility, the sector’s adaptability ensures sustained future consulting growth through 2030.

India’s Consulting Services Boom: Driving Business Transformation

India’s consulting sector is changing the game worldwide. With a 22% annual growth rate, leaders like Deloitte India and EY India are at the forefront. This growth is not just about numbers; it’s about bringing new ideas to the table.

Key Factors Behind India’s Consulting Growth

- Cost Efficiency: India’s lower prices draw in clients from around the world without sacrificing quality.

- Tech Expertise: Indian consultancies use AI and analytics to cut project times by 30%.

- Skilled Talent: More than 500,000 experts focus on digital transformation and sustainability.

“India’s consultancies are the new innovation hubs for Fortune 500 companies.”

Startups Leading the Change

Startups like Fractal Analytics and Zinnov are shaking up old ways. They team up with U.S. companies to create smart supply chains and ESG plans. This teamwork boosts international partnerships. For instance, Tata Consultancy Services (TCS) helped a U.S. retail giant save $150 million with AI in logistics.

Meeting Global Needs with Local Solutions

India’s growth also meets the need for tailored solutions. Companies adjust global plans to fit local markets, impacting areas like healthcare and finance. This sector’s expansion is more than a regional trend; it’s a model for business change worldwide.

What’s Next for Consulting Services? Future Growth and Strategic Shifts

Consulting services are moving into a new era. This era is driven by innovation and global demands. Companies need to adapt to three main shifts to stay ahead: digitization, sustainability, and expanding globally.

Key Areas of Focus

- Adopting AI tools to streamline client solutions

- Building ESG expertise for carbon-neutral strategies

- Prioritizing emerging markets like Southeast Asia and Africa

| Shift | Focus Area | Outcome |

| Technology Integration | Machine learning, predictive analytics | Enhanced decision-making speed |

| Sustainability | Carbon footprint reduction | Meeting regulatory and client demands |

| Global Reach | Local partnerships in high-growth regions | Increased market share |

Big firms like McKinsey and Accenture are already using AI and focusing on green initiatives. Clients want fast data and ethical practices. To thrive, consultancies should:

- Train teams in emerging tech like blockchain and cloud computing

- Partner with tech startups for innovation

- Develop regional expertise in underserved markets

By 2030, firms focusing on these shifts could gain 40% more market share. Being flexible and forward-thinking will mark the next leaders in the industry.

Competitive Dynamics: Key Players Reshaping the Consulting Services Industry

- McKinsey & Company – New York, New York, USA

- Boston Consulting Group (BCG) – Boston, Massachusetts, USA

- Bain & Company – Boston, Massachusetts, USA

- Accenture – Dublin, Ireland

- Deloitte – London, England, UK

- PwC (Strategy&) – London, England, UK

- EY-Parthenon – Boston, Massachusetts, USA

- KPMG – London, England, UK

- Oliver Wyman – New York, New York, USA

- Roland Berger – Munich, Germany

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Consulting Services Market Report |

| Base Year | 2024 |

| Segment by Type | · Strategy Consulting

· Operations Consulting · Technology Advisory · Others |

| Segment by Application | · Life Sciences

· Financial Services · Government · IT & Telecommunications · Energy · Others |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The consulting services market is growing fast, reaching $371.04 billion by 2025. This growth is driven by new technologies and changing global needs. The U.S., U.K., and India are leading the way, thanks to their focus on

- innovation

- specific industry needs

Businesses in these areas are focusing on data analytics, sustainability, and AI. They want to stay ahead in a world where digital transformation is changing everything.

Changes in global trade policies and politics affect what clients need. Companies are looking for strategies to deal with complex supply chains and new markets. The rise of agile consulting and specialized areas like ESG and cybersecurity shows the industry’s ability to adapt.

But, there are still challenges like high prices and a lack of skilled workers. Big firms like McKinsey & Company and Deloitte are working to overcome these. They’re focusing on delivering results through customized solutions that meet client needs.

The future of the market depends on keeping up with innovation and working together across regions. Clients in the U.S. and elsewhere want services that can predict and prepare for changes. Businesses need to adopt hybrid models and use new technologies to succeed in this fast-changing world.

Global Consulting Services Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Consulting Services Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Consulting Services Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Consulting Servicesplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Consulting Services Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Consulting Services Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Consulting Services Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Consulting Services Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key trends currently driving growth in the consulting services market?

The market is growing due to a few key trends. These include:

- The need for digital transformation

- A focus on sustainability

- Making decisions based on data

Companies are using technology and new strategies to work better. This is especially true in big markets like the U.S., U.K., and India.

How are geopolitical factors affecting consulting services demand?

Geopolitical factors such as international relations and global economic policies play a significant role in influencing the demand for consulting services. These factors impact market stability and determine the regions where companies can invest.

As businesses navigate through these complex issues, they turn to consulting firms for guidance in making critical decisions.

What role does innovation play in the U.K. consulting services market?

Innovation is key in the U.K. consulting market. It leads to unique solutions that meet client needs. The U.K. is known for its creative consulting strategies.

This makes it a leader in growth and industry.

How are various industries adopting consulting services?

Finance, healthcare, and technology are using consulting services to improve. This shows how valuable consulting can be for growth.

It’s helping these industries grow and succeed.

What challenges are currently hindering the expansion of the consulting services market?

The market faces challenges like regulatory hurdles and intense competition. Technological changes also pose a challenge.

India’s unique business transformation processes add to the complexity of growing the market.

What does the future outlook look like for the consulting services market?

The future looks bright for the consulting market. There will be a focus on integrated technology solutions and personalized consulting.

Firms that adapt to these changes will find opportunities for growth and innovation.

How important is the supply chain in the consulting industry?

The supply chain is very important in the consulting industry. It affects how firms deliver value and work efficiently.

A strong and flexible supply chain can help operations run smoothly. It also impacts market performance and client satisfaction.