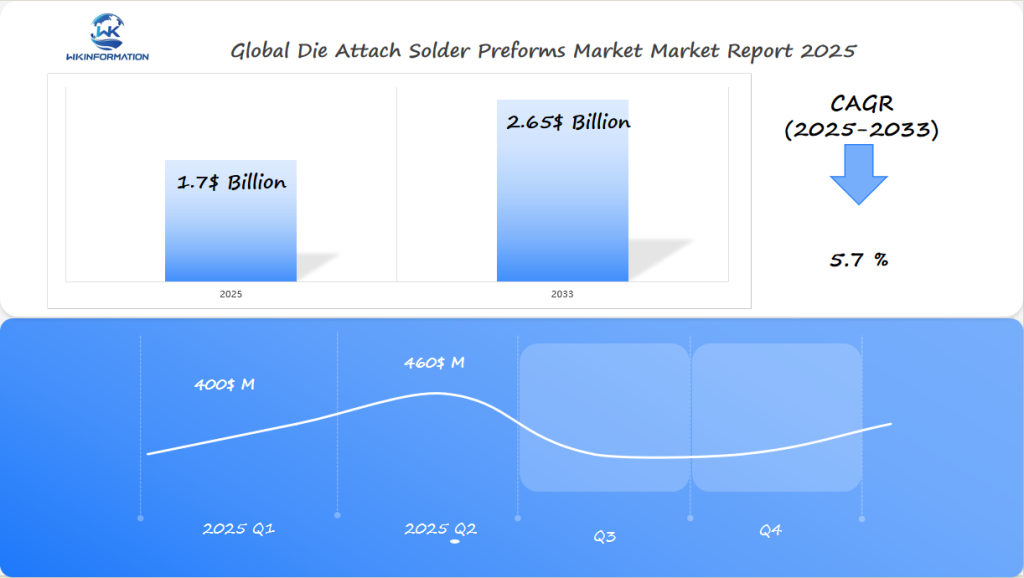

Die Attach Solder Preforms Market to Reach $1.7 Billion by 2025 Backed by Electronics Growth in Germany, Japan, and the U.S.

Explore the Die Attach Solder Preforms Market growth driven by rising electronics demand, semiconductor advancements, and IoT integration across automotive and consumer sectors.

- Last Updated:

Die Attach Solder Preforms Market Q1 and Q2 of 2025

The global Die Attach Solder Preforms market is expected to reach $1.7 billion in 2025, with a CAGR of 5.7% from 2025 to 2033. In Q1 2025, the market size is forecasted to be around $400 million, increasing to $460 million in Q2 as demand from the semiconductor and electronics industries accelerates.

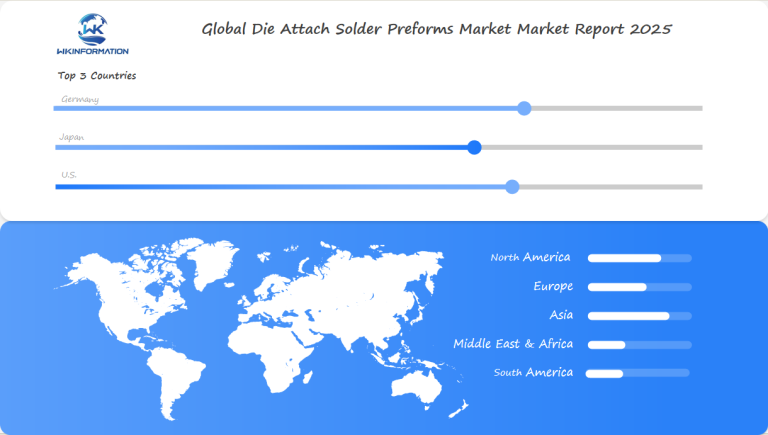

Germany, a leader in precision engineering and advanced manufacturing, is expected to drive a significant portion of the European market, especially as industries adopt more advanced packaging solutions. Japan’s technological expertise in semiconductor production and its emphasis on high-performance electronics will further propel market growth, particularly in Q2. The U.S. is also anticipated to see a steady rise in demand for solder preforms, fueled by innovations in chip packaging technologies and the expansion of the electric vehicle sector.

Key Takeaways

- Die attach solder preforms market expected to reach $1.7 billion by 2025

- Major growth drivers include Germany, Japan, and United States electronics sectors

- Increased demand for miniaturized and high-performance electronic devices

- Significant investments in semiconductor packaging technologies

- Strategic importance of advanced soldering materials in modern electronics

Supply Chain Structure and Downstream Device Integration in Die Attach Solder Preforms

The semiconductor packaging industry is built on a complex supply chain. This chain drives innovation in die attach solder preforms. Advanced manufacturing techniques have made downstream integration more efficient. This has improved how electronic devices are made.

Key Parts of the Semiconductor Packaging Supply Chain

Key parts of the supply chain for semiconductor packaging include:

- Raw material sourcing

- Precision manufacturing processes

- Quality control mechanisms

- Distribution networks

Importance of Downstream Integration

Downstream integration is crucial for improving die attach solder preform performance. Manufacturers are working hard to create solutions that meet high thermal and electrical conductivity needs. They aim to serve various industries.

| Industry Sector | Key Supply Chain Requirements | Performance Metrics |

| Automotive Electronics | High-reliability components | Temperature resistance |

| 5G Infrastructure | Miniaturization capabilities | Signal integrity |

| High-Performance Computing | Advanced thermal management | Power efficiency |

Changing Dynamics of the Supply Chain

Strategic partnerships are changing the supply chain. Collaborative approaches are making production more flexible. This helps meet the fast pace of technological changes.

2025 trends in semiconductor packaging and advanced assembly

The semiconductor industry is changing fast. New packaging trends are making devices smaller and more powerful. Companies are working hard to make tiny electronics that do a lot.

Advanced assembly is changing how we make microelectronics:

- 3D packaging technologies enable multi-layer chip designs

- Heterogeneous integration reduces device size

- Precision die attach methods boost electrical performance

Miniaturization is key, with engineers finding new ways to pack more into smaller spaces. Solder preform technologies are getting better. This lets makers:

- Control bond-line thickness precisely

- Reduce voids in interconnects

- Improve thermal management

New assembly methods are pushing what’s possible. They let us build more complex chips without losing reliability or performance. As devices get more complex, packaging trends will keep changing fast through 2025.

Regulatory, thermal, and material challenges facing solder preform suppliers

The solder preform industry is facing big challenges. These come from strict rules and new technologies. Environmental laws have changed how materials are chosen for semiconductors.

1. Regulatory Challenges: The Shift to Greener Options

Rules have made companies switch from old tin-lead mixes to greener options. The EU RoHS Directive has been key in this change. It’s pushing for lead-free and halogen-free solders.

- Environmental compliance drives material innovation

- SAC (Sn-Ag-Cu) alloys dominate current market compositions

- Thermal management becomes increasingly complex in advanced packages

2. Thermal Challenges: Meeting the Demands of New Semiconductor Packages

Thermal management is another big challenge for solder preform makers. New semiconductor packages need better heat handling. This calls for new materials that can handle extreme heat.

3. Material Challenges: Finding Solutions through Innovation

Material innovation is key to solving these challenges. Companies are making new alloy mixes. These mixes meet green rules, improve heat handling, and stay reliable in many electronic uses.

Studies show over 68% of global solder preform sales use SAC alloys. This shows the industry’s focus on green and high-quality materials.

Geopolitical tensions impacting chip manufacturing ecosystems

The world of chip making is changing fast because of global tensions. Countries are working hard to make their own chips and not rely on others. They want to be independent in technology.

Chip makers face new challenges that go beyond just making chips. Now, getting the right materials and keeping control over technology are top concerns. These issues are key for a country’s security and success.

- Semiconductor companies are spreading out their supply chains to avoid problems

- Nations are putting money into making chips at home

- Export rules are changing how countries work together on tech

Now, making supply chains strong means:

- Finding different sources for important materials

- Building factories at home

- Creating plans for keeping control over technology

Places like the U.S., China, and the European Union are making big changes. They want to not depend on just one supplier. They’re building stronger, more flexible networks for making chips.

These global issues are changing how countries and companies make chips. They focus on security, new ideas, and keeping control over technology.

Type-based segmentation including gold, lead-free, and hybrid solder preforms

Die attach solder preforms are key in microelectronics packaging. They come in three main types: gold solder preforms, lead-free solder, and hybrid solder solutions. These materials help in precise assembly of semiconductors for various electronic uses.

The global solder preform market shows a lot of diversity. SAC (Tin-Silver-Copper) alloys lead with over 68% market share. This change shows the electronics industry moving towards greener options, away from old tin-lead mixes.

Key Characteristics of Solder Preform Types

- Gold Solder Preforms: High thermal stability, corrosion resistance

- Lead-Free Solder: RoHS compliant, reduced environmental impact

- Hybrid Solder Solutions: Customized material combinations

Primary Applications of Solder Preform Types

- Aerospace and Military Electronics

- Consumer Electronics and Automotive

- Advanced RF and Power Devices

Engineers use these advanced solder preform technologies to solve tough thermal and mechanical issues. They aim to improve next-generation electronic systems.

Application-specific adoption in LED, RF, and power devices

Die attach solder preforms are key in LED, RF, and power electronics. The semiconductor world keeps innovating. They create soldering solutions that meet tough performance needs.

Power electronics are growing fast with new solder preform tech. Silicon carbide (SiC) and gallium nitride (GaN) semiconductors are changing power device making. They need special soldering to handle high heat and electrical demands.

- Electric vehicle power systems demanding high-temperature reliability

- Renewable energy inverter technologies

- High-frequency RF device interconnections

LEDs need precise die attach for good heat management and electrical connection. Gold-tin alloy solder preforms help make stronger, more efficient lights. They handle more current and better heat than old soldering methods.

RF devices need very precise soldering to keep signals clear and avoid interference. Special solder preforms with exact compositions help make top-notch communication and sensing tech in many fields.

Worldwide market dynamics for Die Attach Solder Preforms

The global market for die attach solder preforms is changing fast. This is thanks to new technologies and shifts in how semiconductors are made. Different regions have their own ways of meeting these changes.

Key regions shaping the industry’s trajectory include:

- Asia-Pacific: Dominant market leader in semiconductor manufacturing

- North America: Innovation and technological research hub

- Europe: Strategic manufacturing and precision engineering center

The Asia-Pacific region is leading the way, making up almost 60% of the market. Countries like China, South Korea, and Taiwan are key players. They drive growth with their strong manufacturing bases.

Important factors affecting the market include:

- Increasing miniaturization of electronic devices

- Growing demand for high-performance semiconductors

- Expanding automotive and consumer electronics sectors

- Technological investments in advanced packaging techniques

Emerging markets are changing the game, bringing new ways of making things and challenging old methods. The world of semiconductors is always evolving. Politics and technology play big roles in where money goes.

Germany's strong semiconductor and automotive electronics sectors

The Germany semiconductor industry is leading in innovation, boosting growth in automotive electronics across Europe. Companies like Infineon and Bosch are key players, driving change in electric vehicle production.

Important advancements in Germany automotive electronics include:

- A 19% increase in automotive chip production from last year

- More investment in advanced sensor technologies

- Focus on parts for electric and self-driving cars

There’s a huge demand for advanced electronic solutions in car making. The move to electric cars has made Germany a key player worldwide.

The European market gains a lot from Germany’s tech skills. Precision engineering and new manufacturing methods make German companies leaders in electronic parts for future cars.

Germany keeps its lead by investing in research and staying ahead in the fast-changing semiconductor world.

Japan's legacy and innovation in microelectronics manufacturing

Japan’s microelectronics industry is a shining example of technological excellence. It has been a leader in Asia for semiconductor manufacturing. Japanese companies have always been at the forefront of electronic engineering.

Recently, Japan has seen a boost in power semiconductor manufacturing. Semiconductor innovation has been especially strong in silicon carbide devices. These devices are crucial for electric vehicle power modules.

- Silicon carbide devices gained substantial market traction

- Electric vehicle power modules became a key focus area

Japanese microelectronics has several key strengths:

| Manufacturing Capability | Technological Expertise |

| Precision engineering | Advanced material development |

| High-quality semiconductor production | Innovative packaging techniques |

The semiconductor world is always changing. Japanese companies keep up with these changes. Their focus on research and development keeps them ahead in the global market.

The U.S. resurgence in chip design and onshore assembly

The U.S. semiconductor industry is undergoing a significant transformation, driven by strategic investments and government support.

How onshore manufacturing is reshaping the chip industry

Onshore manufacturing is making a significant impact on the chip industry:

- Intel’s massive fabrication plant in Ohio demonstrates its commitment to domestic chip production.

- Texas Instruments is expanding its factory in Utah.

- Innovative packaging techniques are enabling the creation of more intricate and efficient chips.

At the heart of this transformation lies advanced technology. The use of specialized alloys plays a crucial role in producing complex chips. This drive to establish chip manufacturing within the U.S. is motivated by the desire to maintain American technological leadership.

The role of research and development in shaping the future of chips

Major semiconductor companies are investing heavily in research and development activities. Their focus areas include:

- Improving chip designs

- Exploring new manufacturing processes

- Developing next-generation packaging solutions

The CHIPS Act has sparked a fresh wave of innovation, positioning the United States as a frontrunner in chip technology. By promoting domestic production, the country aims to strengthen its technological foundation and secure its position as a global leader in this critical field.

Future trajectory through 2033 for advanced soldering materials

The future of soldering materials looks bright, thanks to fast tech progress in semiconductors. By 2033, we expect big changes in how we attach dies in electronics. This will impact many areas of tech.

Three main areas will see big improvements:

- Nanoscale material engineering

- High-performance thermal management

- Sustainable and eco-friendly compositions

The market is set for a huge leap forward. New tech like quantum computing and AI will need better soldering. This will help devices work in extreme conditions.

Research points to exciting breakthroughs:

- Nanostructured metallic alloys

- Self-healing conductive materials

- Ultra-low temperature bonding techniques

As tech advances, so will soldering. Companies are pouring money into new solutions. These will make devices more reliable, green, and better performing.

Competitive benchmarking and supplier strategies

The die attach solder preforms market is very competitive. Industry leaders are fighting to become the best. They need to keep up with new technologies in semiconductor packaging.

Key Players:

-

Palomar Technologies, Inc. – United States

-

Shinkawa Ltd. – Japan

-

MicroAssembly Technologies, Ltd. – United Kingdom

-

ASM Pacific Technology Limited – Hong Kong

-

Be Semiconductor Industries N.V. – Netherlands

-

Kulicke and Soffa Industries, Inc. – United States

-

Dr. Tresky AG – Switzerland

-

Fasford Technology Co Ltd. – Taiwan

-

Inseto UK Limited – United Kingdom

-

Anza Technology Inc. – United States

Here’s how key players stay ahead:

- Creating special high-reliability solder preform technologies

- Investing in new material research

- Expanding their reach in different markets

- Forming partnerships with semiconductor makers

Indium Corporation is a great example of how to lead the market. They have a wide range of solder preforms for important applications. This shows how leaders stay ahead with new products.

New players are shaking things up with new tech and cheaper solutions. The market keeps changing because of new ideas and smart strategies.

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Die Attach Solder Preforms Market Report |

| Base Year | 2024 |

| Segment by Type |

· Gold Solder Preforms · Lead-Free Solder · Hybrid Solder Solutions |

| Segment by Application |

· LED · RF · Power Devices · Others |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The die attach solder preforms market is complex, with technology and strategy playing big roles. The industry trends show a slow move towards older electronics.

Future chances in semiconductor packaging focus on being adaptable and precise. Companies face tech challenges while keeping costs and quality high. The market is moving towards green materials and new ways to make things, helping with complex electronics.

Being strategic is key for companies in this field. Chip makers need to invest in R&D to stay ahead. Those who innovate in materials, heat management, and packaging will lead the industry soon.

Expect big changes in die attach solder preforms tech. While old uses stay strong, new areas like car electronics and medical devices open up. Companies that mix tech progress with practical use will thrive in the changing world of electronic materials.

Global Die Attach Solder Preforms Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Die Attach Solder Preforms Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Die Attach Solder Preforms Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Die Attach Solder Preforms Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Die Attach Solder Preforms Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Die Attach Solder Preforms Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Die Attach Solder Preforms Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Die Attach Solder Preforms Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected market size for die attach solder preforms by 2025?

The market for die attach solder preforms is expected to grow to $1.7 billion by 2025. This growth is driven by the expansion of electronics industries in key markets like Germany, Japan, and the United States.

What are the primary applications of die attach solder preforms?

Die attach solder preforms play a crucial role in semiconductor packaging. They find application in various devices such as LED, RF, and power devices. The demand for these preforms is on the rise in several sectors including:

- Electric vehicle power electronics

- Renewable energy systems

- High-frequency applications

How are environmental regulations affecting solder preform manufacturing?

Environmental regulations, such as the EU RoHS Directive, are pushing for lead-free and halogen-free solder solutions. This is driving innovation in material composition and sustainability.

What challenges do solder preform suppliers face in the current market?

Suppliers face challenges like thermal management and meeting strict regulations. They must also develop advanced alloy compositions. Maintaining performance and reliability in complex semiconductor packages is another challenge.

How are geopolitical tensions impacting the die attach solder preforms market?

Trade disputes and export controls are reshaping supply chains. Companies are focusing on supply chain resilience and localization of semiconductor production. They are also implementing risk mitigation strategies.

What types of solder preforms are most commonly used?

Lead-free options like SAC (Tin-Silver-Copper) alloys are the most common. There is growing interest in hybrid solder solutions, which combine multiple material benefits for specific application requirements.

How is the U.S. semiconductor industry responding to market challenges?

The CHIPS Act’s $52 billion investment is supporting domestic semiconductor infrastructure. Major companies like Intel and Texas Instruments are expanding onshore manufacturing capabilities.

What emerging technologies are influencing die attach solder preforms?

Advanced technologies like 3D packaging, heterogeneous integration, artificial intelligence, and quantum computing are driving innovation. They are influencing solder preform materials and techniques.

What role do countries like Germany and Japan play in the solder preforms market?

Germany leads in automotive electronics and semiconductor manufacturing. Japan has a strong position in microelectronics, especially in power semiconductor and electric vehicle technologies.

What are the key trends in semiconductor packaging through 2033?

Key trends include miniaturization and improved thermal and electrical conductivity. There is a focus on high-performance alloys and sustainability. Adaptation to emerging technologies in electronic packaging is also important.