2025 Diesel Exhaust Fluid Market Growth: Surging to $30.71 Billion with Environmental Regulations in U.S., India, and Brazil

Explore the dynamic landscape of the Diesel Exhaust Fluid (DEF) market across leading countries – U.S., India, and Brazil – as they adapt to evolving emission regulations and sustainable transportation solutions. Discover how these nations are shaping the future of DEF through innovative technologies, infrastructure development, and environmental policies aimed at reducing harmful emissions by 2025.

- Last Updated:

Diesel Exhaust Fluid Market: Q1 and Q2 2025 Predictions

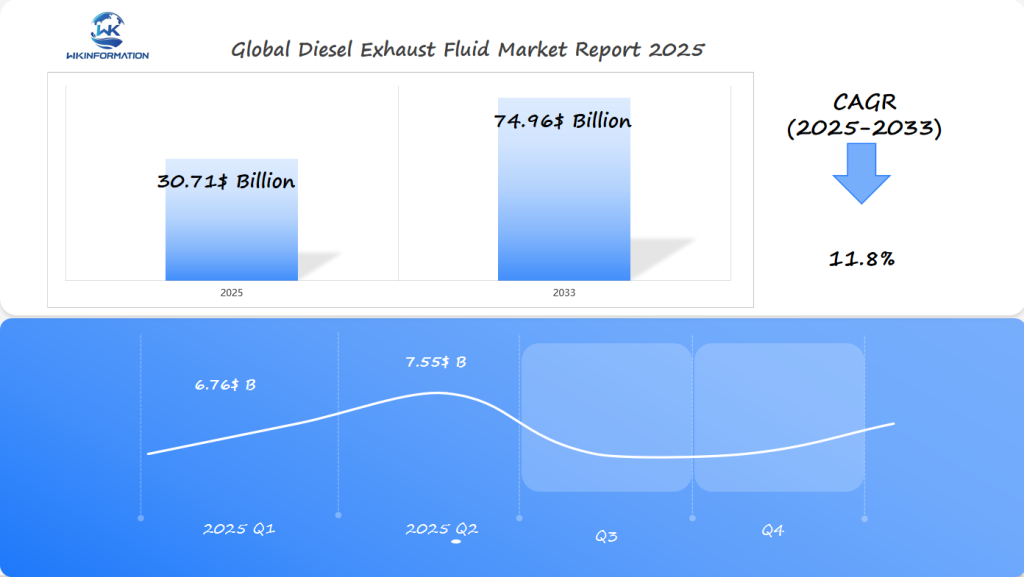

The Diesel Exhaust Fluid (DEF) market is projected to reach approximately USD 30.71 billion in 2025, driven by tightening regulations aimed at reducing emissions from diesel engines. As countries continue to implement stricter emission standards, the demand for DEF, which is crucial for reducing nitrogen oxide emissions in diesel-powered vehicles, is expected to surge. With a compound annual growth rate (CAGR) of 11.8% anticipated from 2025 to 2033, the market is set for robust expansion.

In Q1 2025, the DEF market is expected to generate about 22% of the annual value, equating to roughly USD 6.76 billion, as businesses in the U.S., India, and Brazil gear up for new compliance deadlines. By Q2 2025, the market will likely rise to around USD 7.55 billion, driven by continued adoption in industries such as transportation, agriculture, and construction. As emissions standards tighten, particularly in the U.S. and Europe, demand for DEF will intensify, accelerating the market’s growth trajectory.

Understanding the Upstream and Downstream Industry Chain for Diesel Exhaust Fluid

The Diesel Exhaust Fluid (DEF) supply chain is a complex network involving both upstream suppliers and downstream users.

Upstream Components:

- Raw Materials Sourcing: High-purity urea and deionized water.

- Manufacturing Processes: Blending of components under controlled conditions to maintain product integrity.

At the upstream level, the production of DEF begins with sourcing high-purity raw materials. The primary component, urea, is derived from natural gas and requires stringent quality controls to meet industry standards. This urea is then combined with deionized water through a precise manufacturing process to produce DEF, ensuring it adheres to the necessary purity levels essential for its effectiveness.

Downstream Applications:

- Automotive Sector: Heavy-duty trucks and buses equipped with SCR systems.

- Industrial Sector: Construction equipment like excavators and agricultural machinery such as tractors.

Downstream, DEF plays a critical role in various applications, primarily within the automotive and industrial sectors. Vehicles equipped with Selective Catalytic Reduction (SCR) technology rely on DEF to convert harmful nitrogen oxides into harmless nitrogen and water vapor. This application is prevalent in heavy-duty trucks, buses, agricultural machinery, and construction equipment.

The interaction between upstream suppliers and downstream consumers is pivotal for maintaining a seamless flow of DEF from production to end-use. Suppliers must ensure consistent quality and adequate supply to meet the demands of consumers who depend on DEF for regulatory compliance and operational efficiency.

Effective communication and logistics play crucial roles in this supply chain. Manufacturers work closely with distributors to manage inventory levels, transportation logistics, and storage solutions that prevent contamination or degradation of the product. This collaboration ensures that end-users receive high-quality DEF, vital for maintaining their equipment’s compliance with environmental standards.

Understanding this intricate supply chain helps stakeholders anticipate challenges and opportunities within the DEF market landscape.

Key Trends Shaping the Future of the Diesel Exhaust Fluid Market

Market trends in the Diesel Exhaust Fluid (DEF) sector are largely influenced by the adoption of Selective Catalytic Reduction (SCR) technology. This technology has emerged as a major driver for DEF consumption, primarily because it offers an effective solution for reducing nitrogen oxides (NOx) emissions from diesel engines. SCR systems inject DEF into the exhaust stream, converting harmful NOx into harmless nitrogen and water vapor. This capability aligns closely with stringent environmental regulations, making SCR-equipped vehicles increasingly popular in markets like the U.S., India, and Brazil.

The rise in environmental awareness among both consumers and businesses is another key trend impacting the DEF market. As global consciousness about climate change and pollution grows, there is mounting pressure on industries to comply with emissions standards. DEF provides a practical compliance solution, facilitating adherence to regulations while promoting sustainability. This demand is reflected in various sectors adopting DEF as part of their environmental strategies.

In tandem with these developments, there is a noticeable shift towards cleaner transportation solutions. While diesel engines remain prevalent, the push for hybrid and electric vehicles poses a potential challenge to DEF market growth in the long term. Cleaner alternatives are being developed to meet rigorous emission targets without relying on DEF. However, until these technologies become economically viable and widespread, SCR systems using DEF will continue to play a critical role.

This evolving landscape presents both opportunities and challenges for stakeholders in the DEF market. Companies must navigate these trends carefully, balancing innovation with regulatory compliance to stay competitive. The future of the DEF market will be shaped by how effectively industry players adapt to these changing dynamics while continuing to support environmental goals through reduced emissions.

Restrictions and Regulatory Challenges Impacting the Diesel Exhaust Fluid Market

Regulatory Landscape and Emissions Standards

Government-imposed stringent emissions regulations in prominent markets like the U.S., India, and Brazil play a pivotal role in shaping the Diesel Exhaust Fluid (DEF) market. These regulations aim to reduce nitrogen oxides (NOx) emissions from diesel engines, driving the necessity for DEF usage.

United States

The Environmental Protection Agency (EPA) enforces rigorous emissions standards, mandating diesel vehicles to significantly lower NOx emissions. Compliance with these standards is often achieved through the integration of Selective Catalytic Reduction (SCR) technology, which relies heavily on DEF.

India and Brazil

Both countries have embarked on similar regulatory paths, implementing Bharat Stage VI (BS VI) and PROCONVE P8 emission norms, respectively. These regulations align closely with European standards, necessitating advanced emission-control technologies.

Compliance Challenges for Manufacturers

Manufacturers face multiple challenges in maintaining product quality and consistency while adhering to regulatory requirements:

- Quality Assurance: Ensuring that DEF meets international standards is critical for effective NOx reduction. Variability in raw material quality can lead to inconsistency in DEF composition, impacting its efficacy.

- Supply Chain Complexities: The sourcing and transportation of high-purity urea and deionized water involve logistical hurdles. Any disruption can affect supply continuity and product quality.

Impact of Non-Compliance

Non-compliance with emissions standards poses significant risks:

- Market Growth Prospects: Failure to meet regulatory targets can hinder market growth by restricting access to key markets with stringent environmental mandates.

- Reputation of Industry Players: Companies failing to comply risk damage to their reputation. In an industry where environmental responsibility is paramount, maintaining compliance is essential for sustaining consumer trust and brand integrity.

Understanding these challenges helps stakeholders navigate the complex regulatory landscape, ensuring they remain competitive in a market poised for substantial growth by 2025.

Geopolitical Factors Affecting the Global Diesel Exhaust Fluid Market

Geopolitical influences play a significant role in shaping the global Diesel Exhaust Fluid (DEF) market. Trade policies, tariffs, and export restrictions are crucial factors that can alter the landscape of DEF supply chains. Recent geopolitical tensions among major economies have heightened the importance of these elements, potentially leading to shifts in sourcing strategies and cost structures for DEF manufacturers.

1. Trade Policies and Tariffs

International trade policies can either enhance or hinder the flow of DEF across borders. Tariffs imposed on raw materials or finished products might lead to increased costs for manufacturers, affecting pricing strategies and market competitiveness. For instance, trade disputes between large economies can result in restrictive measures that disrupt the smooth transit of DEF components globally.

2. Export Restrictions

National export controls can further complicate the situation. Countries may impose restrictions on the export of urea, a key component of DEF, to prioritize domestic markets or respond to international political pressures. Such decisions can create supply bottlenecks and force manufacturers to seek alternative sources.

3. Regional Stability

The stability or instability of regions significantly impacts DEF market growth opportunities. Political unrest or economic volatility in a region can deter investment and slow down market expansion efforts. Conversely, stable regions with supportive policies tend to attract more investment and innovation in clean technologies like Selective Catalytic Reduction (SCR) systems.

Government initiatives promoting environmental sustainability offer a counterbalance to these geopolitical challenges. Nations worldwide are increasingly supporting clean technology adoption, including SCR systems that utilize DEF, by providing incentives and regulatory frameworks conducive to sustainable practices. This support helps stabilize demand for DEF and encourages technological advancements in emissions reduction solutions.

In navigating these geopolitical dynamics, DEF manufacturers must remain agile, adapting their strategies to mitigate risks while capitalizing on emerging opportunities presented by government-backed sustainability efforts.

Segmentation Insights: Types of Diesel Exhaust Fluid and Their Sector Applications

Understanding the varieties of Diesel Exhaust Fluid (DEF) is crucial for optimizing its application across different industries. Primarily, DEF is a high-purity urea solution consisting of 32.5% urea and 67.5% deionized water. This specific formulation ensures compatibility with the Selective Catalytic Reduction (SCR) systems found in modern diesel engines.

Types of DEF

- Standard Grade DEF: The most common type used universally in on-road vehicles, including passenger cars and heavy-duty trucks. Its consistency aligns with ISO 22241 standards, ensuring proper NOx reduction.

- High-Purity Variants: Designed for specialized applications where higher purity levels are required to prevent SCR system damage. These are often used in environments with extreme operating conditions.

Sector Applications

Different sectors rely on DEF for efficient emission reductions:

- Transportation: Involves extensive use in heavy-duty trucks and buses. These vehicles demand large volumes of DEF due to their significant NOx emissions. The primary challenge here includes maintaining adequate supply chains to meet the high consumption rates.

- Construction Equipment: Excavators, loaders, and bulldozers require DEF to comply with stringent Tier IV/Stage IV emissions regulations. These machines operate under demanding conditions, necessitating robust SCR systems that can effectively utilize DEF without compromising performance.

- Agricultural Machinery: Tractors and harvesters also rely on DEF to adhere to environmental standards. The agricultural sector faces unique challenges such as remote equipment locations which can complicate regular DEF replenishment.

Specific needs within each sector highlight the importance of selecting the appropriate DEF type to ensure optimal engine performance and compliance with environmental standards. The intricacies of these applications underscore the significance of having high-quality DEF solutions tailored to each industry’s requirements.

Market Applications of Diesel Exhaust Fluid Across Industries

Diesel Exhaust Fluid (DEF) is used in various industries beyond just cars and farming. It’s also becoming important in construction, where manufacturers of construction equipment are using more DEF to follow strict emission rules. These rules require the use of Selective Catalytic Reduction (SCR) systems, which need DEF injection, to ensure compliance and protect the environment.

Construction Industry

In the construction industry, large machines like bulldozers, excavators, and cranes use DEF to meet Tier IV/Stage IV and Stage V emission standards. This pressure from regulations encourages manufacturers to come up with new ideas and create better SCR systems that work smoothly with high-quality DEF.

Mining Operations

Similarly, mining operations also rely on DEF for their heavy-duty vehicles and equipment. The tough conditions in mining require strong and dependable solutions for controlling emissions, making top-notch DEF crucial for keeping things running smoothly while reducing harm to the environment.

Several real-life examples demonstrate the clear advantages of using certified DEF products in different industries:

- A well-known construction company successfully cut down NOx emissions by 90% in their fleet of excavators by switching to a high-purity DEF product. This change not only ensured compliance but also improved fuel efficiency, resulting in significant cost savings.

- An agricultural cooperative reported better engine performance and lower maintenance costs after implementing a branded DEF solution across their fleet of tractors and harvesters. This strategic move aligned with their sustainability goals while optimizing operational costs.

These examples highlight the significance of choosing the appropriate type and quality of DEF that suits specific industry needs. The smart use of high-quality DEF guarantees adherence to environmental standards, boosts equipment performance, and offers economic benefits across various sectors that rely on diesel engines.

Regional Insights: Growth Prospects for Diesel Exhaust Fluid Markets Around The World

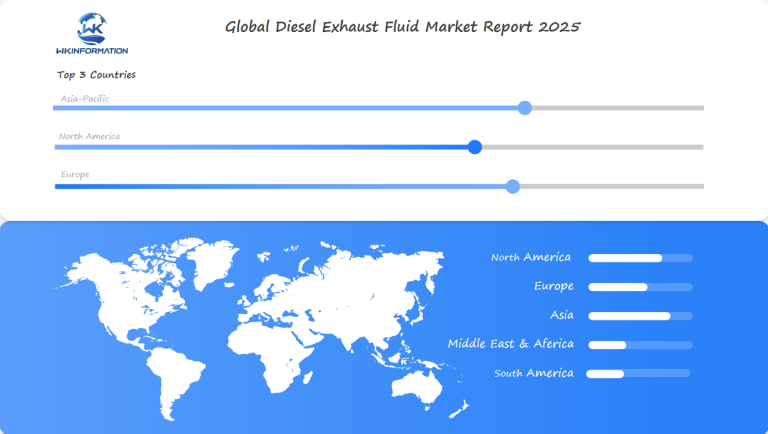

Looking at regional market insights shows clear differences between North America and Asia Pacific, two major players in the Diesel Exhaust Fluid (DEF) market. Each region has its own factors driving growth and challenges that may affect future developments.

North America: Leading the DEF Market

North America is currently the leader in the DEF market. This leadership position is mainly due to:

- Infrastructure Development: Ongoing projects and investments in infrastructure across the region are creating a demand for DEF in construction and transportation sectors.

- Air Quality Regulations: Strict regulations imposed by local authorities to improve air quality are pushing industries to adopt cleaner technologies like Selective Catalytic Reduction (SCR), which in turn drives the need for DEF.

The United States, especially, has witnessed a surge in construction activities supported by a healthy economy and regulatory frameworks promoting emissions compliance. The widespread use of SCR technology in vehicles further boosts DEF demand across various industries.

Asia Pacific: Emerging Growth Hub

On the other hand, the Asia Pacific region is experiencing rapid growth, primarily driven by:

- Demand from Emerging Economies: Countries like India and China are witnessing an increase in demand for DEF due to their growing economies and efforts to combat pollution.

- Government Initiatives: Significant construction projects and government initiatives aimed at reducing environmental impacts from heavy-duty vehicles are contributing to this growth.

India’s increasing focus on cleaner transportation solutions highlights its commitment to sustainability, making it an important player in the regional DEF market dynamics.

Potential Challenges Ahead

Despite these positive signs, there are several potential challenges that both regions may face:

- Raw Material Sourcing: Fluctuations in the availability of raw materials could pose significant obstacles for both North America and Asia Pacific. Ensuring a consistent supply chain will be crucial for maintaining production levels.

- Regulatory Scrutiny: As air quality standards become more stringent, manufacturers will need to navigate complex compliance requirements to stay competitive in the market.

- Post-Approval Processes: The process of getting products approved after production involves various stages, each with its own challenges that can impact timelines and costs.

These challenges need to be addressed proactively by stakeholders in order to sustain growth momentum in the DEF markets of both regions.

The Current State of Diesel Exhaust Fluid Market in the U.S. & Brazil and Its Future Prospects

U.S. DEF Market Analysis

The U.S. Diesel Exhaust Fluid (DEF) market is thriving, driven by increased infrastructure development funding and stringent emissions regulations. Recent reports suggest a robust market size with significant growth prospects due to:

- Infrastructure Development: Government-backed plans for new highway projects are underway, aligning demand surges with completion timelines. These projects fuel the need for DEF, essential for emissions compliance in diesel engines.

- Regulatory Support: Emission standards necessitate the use of DEF to mitigate pollutants from combustion processes in diesel engines. This regulatory framework ensures that vehicles comply with environmental guidelines, boosting DEF usage.

Brazil’s DEF Market Strategy

Brazil’s approach focuses on reducing environmental impact primarily from heavy-duty vehicles. The country employs strategies similar to those in the U.S., aiming for sustainable transportation solutions:

- Environmental Impact Reduction: Initiatives target emissions from heavy-duty vehicles using Selective Catalytic Reduction (SCR) technology, a method proven effective in neighboring regions.

- Government Policies: Brazilian policies incentivize the adoption of DEF among fleet operators, promoting wider acceptance across the value chain—from producers to end-consumers.

Trends and Adoption Rates

In both countries, the adoption of DEF is gaining momentum among fleet operators:

- Fleet Operators’ Role: Businesses operating regionally are increasingly integrating DEF into their operations, driven by both regulatory pressures and economic incentives.

- Government Incentives: Policies encouraging the use of environmentally friendly technologies enhance acceptance and utilization rates of DEF.

This analysis highlights how government initiatives and infrastructure developments are crucial in shaping the future of the Diesel Exhaust Fluid market in both the U.S. and Brazil.

Analysis of Diesel Exhaust Fluid Market Trends in Brazil

Brazil’s diesel exhaust fluid (DEF) market is experiencing significant growth due to various factors that align with global trends and national initiatives. Stringent emission regulations enforced by the Brazilian government are a primary driver, compelling industries to adopt DEF solutions for compliance with environmental standards. The country’s focus on reducing the ecological footprint of heavy-duty vehicles contributes to increased demand for DEF.

Several trends underscore Brazil’s burgeoning DEF market:

1. Government Initiatives

Brazil has introduced policies encouraging the use of cleaner technologies. This includes incentives for adopting Selective Catalytic Reduction (SCR) systems which necessitate DEF usage.

2. Industrial Growth

The expansion of construction and agriculture sectors in Brazil drives DEF consumption. Heavy machinery used in these industries must comply with emission regulations, creating robust demand for DEF.

3. Investment in Infrastructure

Recent investments in infrastructure development further bolster the need for compliant vehicles and machinery, thus accelerating DEF market growth.

4. Local Production and Innovation

Companies in Brazil are enhancing their production capabilities to meet rising demand, focusing on innovation to improve DEF quality.

These dynamics illustrate a vibrant trajectory for Brazil’s DEF market, positioning it as a key player in Latin America’s transition towards environmentally sustainable practices.

Growth Prospects of Diesel Exhaust Fluid in India

India is a rapidly growing market for Diesel Exhaust Fluid (DEF), driven by strict government regulations and increasing environmental awareness. The Indian government’s efforts to reduce vehicle emissions are a major factor, with requirements for Bharat Stage VI (BS-VI) emission standards mandating the use of technologies such as Selective Catalytic Reduction (SCR).

Key Factors Driving the Growth of DEF in India

1. Regulatory Influence

The implementation of BS-VI norms has accelerated the demand for DEF, as these regulations require SCR technology to lower nitrogen oxides (NOx) emissions in diesel vehicles.

2. Industrial Expansion

India’s rapid industrialization and urbanization contribute to the growing need for heavy-duty vehicles, which in turn supports the DEF market. Increased infrastructure projects and transportation demands are central to this growth.

3. Market Opportunities

There is significant potential for growth, especially in industries like agriculture and construction where diesel-powered machinery is common. Meeting emission standards presents opportunities for DEF producers targeting these sectors.

A significant challenge remains the cost sensitivity of consumers in India, making pricing strategies crucial for entering the market. However, as awareness increases about environmental impacts and regulatory compliance becomes unavoidable, the DEF market in India is set for substantial growth.

Innovations And Future Innovations In DEF Technology

The Diesel Exhaust Fluid (DEF) market is not only expanding due to regulatory pressures but also evolving through technological advancements aimed at enhancing production efficiency and performance characteristics. Emerging technologies are playing a crucial role in transforming the way DEF is produced and utilized, ensuring it remains fit for purpose across various demanding applications.

Enhancing Production Efficiency

1. Automation and Process Optimization

Modern manufacturing facilities are increasingly adopting automation technologies to streamline the production of DEF. Automated systems help in reducing human error, ensuring consistency in product quality, and optimizing resource utilization. This shift towards process optimization allows manufacturers to scale up output without compromising the integrity of the final products.

2. Advanced Purification Techniques

The purity of urea, a critical component of DEF, directly impacts its effectiveness. Innovations in purification techniques are enhancing the quality of urea used, thus improving the overall efficacy of DEF. These techniques ensure that even under extreme conditions, DEF maintains its performance standards as dictated by ISO specifications.

Performance Characteristics Under Extreme Conditions

1. Robust Formulations

The development of robust DEF formulations that withstand prolonged exposure to harsh environmental conditions is a key area of innovation. These formulations are designed to maintain their chemical stability and effectiveness even when subjected to temperature variations and extended storage times.

2. Improved Packaging Solutions

Advancements in packaging solutions aim to protect DEF from contamination and degradation over time. Innovative packaging materials and designs provide better barriers against environmental factors such as moisture and UV radiation.

Manufacturing Process Advancements

1. Sustainable Practices

As global demand for DEF rises, there is a concerted effort towards incorporating sustainable practices into manufacturing processes. This includes the use of renewable energy sources, waste minimization techniques, and eco-friendly raw materials to reduce the environmental footprint of DEF production.

2. Dedicated Production Facilities

To meet surging demand levels, companies are establishing dedicated facilities capable of significantly scaling up output volumes. These state-of-the-art plants are equipped with cutting-edge technology designed to enhance production capacity while maintaining strict quality control standards.

Future innovations in DEF technology focus on enhancing both production efficiency and product performance. By addressing these areas, manufacturers are better equipped to meet rising global demand while adhering to stringent quality requirements. As these technological advancements continue to unfold, they promise to shape a more sustainable and efficient future for the Diesel Exhaust Fluid Market.

Key Players in the Global Diesel Exhaust Fluid Market

The Diesel Exhaust Fluid (DEF) market is influenced by several key players in the industry.

- BASF SE

- China Petrochemical Corporation (Sinopec)

- Brenntag AG

- TotalEnergies

- Shell PLC

- Yara International ASA

- CF Industries Holdings, Inc.

- Mitsui Chemicals, Inc.

- Cummins Filtration

- Honeywell International Inc.

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Diesel Exhaust Fluid Market Report |

| Base Year | 2024 |

| Segment by Type |

·Standard Grade DEF ·High-Purity Variants |

| Segment by Application |

·Transportation ·Construction Equipment ·Agricultural Machinery |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Diesel Exhaust Fluid Market is set to grow significantly, with projections indicating it will reach $30.71 billion by 2025. This growth is primarily driven by strict environmental regulations in countries such as the U.S., India, and Brazil. DEF plays a vital role in reducing nitrogen oxides emissions through Selective Catalytic Reduction technology, highlighting its importance in achieving sustainability goals.

Key players in the market, including Total Energies, Shell, and BASF SE, are actively shaping the industry by focusing on production improvements to meet increasing demand. Additionally, there are opportunities for growth in sectors such as construction and agriculture, further solidifying the significance of the DEF market in global emission reduction efforts.

Global Diesel Exhaust Fluid Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Diesel Exhaust Fluid Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Diesel Exhaust Fluid MarketSegmentation Overview

Chapter 2: Competitive Landscape

- Global Diesel Exhaust Fluid players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Diesel Exhaust Fluid Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Diesel Exhaust Fluid Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Diesel Exhaust Fluid Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Diesel Exhaust Fluid Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is Diesel Exhaust Fluid (DEF) and why is it important?

Diesel Exhaust Fluid (DEF) is a high-purity urea solution used in diesel engines to reduce nitrogen oxides (NOx) emissions. It plays a crucial role in helping vehicles comply with stringent environmental regulations, thereby contributing to improved air quality.

What factors are driving the growth of the Diesel Exhaust Fluid market?

The Diesel Exhaust Fluid market is projected to grow to $30.71 billion by 2025, driven by stringent environmental regulations in key regions such as the U.S., India, and Brazil, as well as the increasing adoption of Selective Catalytic Reduction (SCR) technology in vehicles.

How does the supply chain for Diesel Exhaust Fluid work?

The DEF supply chain involves upstream suppliers who source raw materials and manufacture DEF, and downstream users who apply DEF in various sectors, including automotive and industrial applications. This interaction ensures a seamless flow of DEF from production to end-use.

What regulatory challenges do manufacturers face in the Diesel Exhaust Fluid market?

Manufacturers face challenges related to maintaining product quality and consistency while adhering to stringent emissions standards imposed by governments in major markets. Non-compliance can negatively impact market growth prospects and affect industry reputations.

What geopolitical factors influence the global Diesel Exhaust Fluid market?

Geopolitical factors such as trade policies, tariffs, and international relations significantly affect the global supply chain of DEF. Recent geopolitical tensions have led to increased scrutiny on market growth opportunities for DEF manufacturers operating worldwide.

Which industries are major consumers of Diesel Exhaust Fluid?

While the automotive sector is a primary consumer of DEF, other industries such as construction equipment manufacturing and agriculture also utilize DEF to ensure compliance with emission regulations through effective integration of SCR systems.