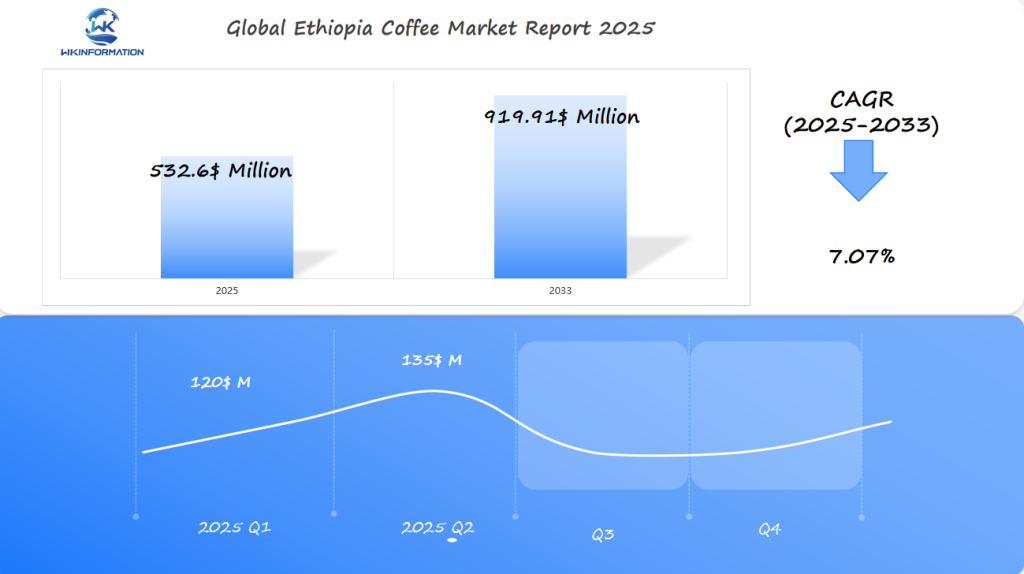

Ethiopia Coffee Market Set to Reach $532.6 Million by 2025: Key Growth Drivers in Ethiopia, the U.S., and Germany

Discover Ethiopia’s thriving coffee market, projected to reach $532.6 million by 2025. From traditional farming practices to modern innovations, explore how this African coffee powerhouse is shaping global coffee trade through sustainable practices, premium quality production, and strong partnerships with the U.S. and Germany.

- Last Updated:

Ethiopia Coffee Market Forecast for Q1 and Q2 2025

The global Ethiopia coffee market is expected to reach $532.6 million in 2025, with a CAGR of 7.07% through 2033. The market is projected to grow steadily in the first half of 2025, with Q1 estimated at approximately $120 million and Q2 expected to increase to around $135 million, driven by both rising global demand for high-quality, specialty coffee and Ethiopia’s position as one of the world’s most important coffee producers.

Ethiopia, the U.S., and Germany are key markets for Ethiopia coffee. Ethiopia remains the heart of the coffee industry, with strong domestic consumption and growing exports to global markets. The U.S. continues to be the largest importer, driven by increasing consumer interest in premium, single-origin coffee. Germany, with its large coffee culture and increasing focus on sustainable, high-quality coffee, also shows strong demand for Ethiopia’s coffee exports. These markets are crucial for analyzing the global coffee market dynamics, particularly for premium offerings like Ethiopia coffee.

Exploring the Upstream and Downstream Dynamics in the Ethiopia Coffee Market

The Ethiopian coffee supply chain is a complex network of producers, processors, and distributors working together to deliver premium coffee to global markets. Understanding these dynamics reveals the intricate relationship between production methods and market delivery systems.

Upstream Dynamics

Ethiopia’s coffee production thrives in diverse ecological zones, with altitudes ranging from 1,500 to 2,200 meters above sea level. These conditions create ideal growing environments for Arabica coffee, producing distinct flavor profiles unique to each region:

- Yirgacheffe: Known for its floral and citrus notes

- Sidamo: Celebrated for wine-like characteristics

- Harrar: Distinguished by its fruity, wine-toned essence

- Limu: Recognized for balanced, sweet undertones

Small-scale farmers dominate the production landscape, with traditional cultivation practices passed down through generations. These farmers typically manage plots of 1-2 hectares, implementing shade-grown techniques that preserve biodiversity and enhance coffee quality.

The terroir impact on Ethiopian coffee manifests through:

- Volcanic soil composition

- Natural shade from indigenous trees

- Seasonal rainfall patterns

- Temperature variations

Coffee cooperatives play a vital role in organizing production efforts:

- Providing technical support to farmers

- Facilitating access to processing facilities

- Managing quality control measures

- Negotiating better prices for members

Downstream Dynamics

The path from farm to cup involves multiple stakeholders and processes:

Primary Processing Centers

- Wet processing facilities

- Dry processing stations

- Quality grading facilities

Distribution Channels

- Ethiopian Commodity Exchange (ECX)

- Direct specialty coffee exports

- Local market networks

Consumer preferences shape downstream operations, with growing demand for:

- Single-origin offerings

- Certified organic products

- Fair trade certifications

- Traceable coffee lots

The Ethiopian Coffee and Tea Authority maintains strict quality standards throughout the supply chain, ensuring consistency in:

- Bean size uniformity

- Moisture content

- Defect assessment

- Cup quality evaluation

Modern market dynamics have introduced digital trading platforms and blockchain technology, enhancing transparency and traceability in coffee transactions. These innovations enable direct relationships between producers

Major Trends Shaping the Ethiopia Coffee Industry

The global specialty coffee movement has sparked a revolution in Ethiopia’s coffee industry. Premium Ethiopian coffee beans now command higher prices in international markets, with specialty grade coffees selling at 20-30% above commodity prices.

Key Market Trends:

- Rise of Single-Origin Offerings: Leading coffee shops worldwide showcase Ethiopian beans as exclusive single-origin options

- Direct Trade Relationships: Roasters establish direct partnerships with Ethiopian farmers, ensuring quality control and fair pricing

- Micro-lot Productions: Small-batch processing of distinctive coffee varieties from specific regions gains traction

The sustainability wave reshapes production practices across Ethiopia’s coffee sector. Farmers adopt organic cultivation methods, while exporters implement traceable supply chains. These initiatives resonate with environmentally conscious consumers willing to pay premium prices for sustainably sourced Ethiopian coffee.

Sustainable Practices Gaining Ground:

- Organic certification programs

- Water conservation methods

- Shade-grown coffee cultivation

- Carbon footprint reduction initiatives

Ethiopia’s rich coffee heritage serves as a powerful marketing tool. The traditional Ethiopian coffee ceremony attracts global attention, creating unique storytelling opportunities for brands. This cultural narrative differentiates Ethiopian coffee in saturated markets, particularly appealing to millennials seeking authentic experiences.

Cultural Elements Driving Sales:

- Traditional coffee ceremony demonstrations at international trade shows

- Heritage-focused packaging designs

- Story-driven marketing campaigns highlighting regional coffee traditions

- Educational initiatives about Ethiopia’s coffee history

The intersection of these trends – specialty focus, sustainability practices, and cultural authenticity – positions Ethiopian coffee uniquely in the global market. Coffee shops worldwide now feature Ethiopian coffee prominently, often charging premium prices for these distinctive beans.

Barriers to Growth in the Ethiopia Coffee Market

The Ethiopian coffee market faces significant structural challenges that impact its growth potential. Infrastructure limitations create substantial hurdles for producers and exporters:

1. Transportation Networks

Poor road conditions and limited access to rural areas increase logistics costs by 20-30%

2. Storage Facilities

Inadequate warehousing leads to quality degradation and post-harvest losses

3. Processing Equipment

Outdated processing facilities reduce production efficiency and bean quality

Price volatility poses a critical risk to market stability:

- Daily price fluctuations of up to 15% affect farmer income

- Limited access to price risk management tools

- Dependency on international market prices creates income uncertainty

Local businesses struggle with:

- Limited Access to Finance: High interest rates and collateral requirements restrict business expansion

- Power Supply Issues: Frequent electricity outages disrupt processing operations

- Quality Control: Inconsistent standards affect export potential

Global market dynamics create additional pressure through:

- Currency exchange rate fluctuations

- International competition from other coffee-producing nations

- Changing buyer preferences and demand patterns

The lack of modern technology adoption hampers productivity:

- Digital Infrastructure: Limited internet connectivity affects market information access

- Banking Systems: Underdeveloped financial infrastructure complicates international transactions

- Quality Testing Equipment: Shortage of modern testing facilities impacts quality certification

Geopolitical Factors Affecting Ethiopia Coffee Production and Export

Political Stability and Regional Conflicts

Political stability is crucial for Ethiopia’s coffee market performance. Recent regional conflicts have disrupted supply chains and affected production schedules in key growing areas. The 2020-2022 Tigray conflict created significant challenges:

- Delayed harvests in northern regions

- Reduced access to essential farming supplies

- Disrupted transportation networks

- Decreased investor confidence

International Relations and Trade Agreements

Ethiopia’s coffee export landscape is shaped by its international relations. The country’s diplomatic ties directly influence market access and trade agreements. Key diplomatic factors include:

- Trade Partnerships: Ethiopia’s participation in the African Continental Free Trade Area (AfCFTA) opens new market opportunities

- Bilateral Agreements: Special arrangements with the EU and U.S. provide preferential market access

- Quality Standards: International compliance requirements affect export potential

Government Reforms and Market Dynamics

The Ethiopian government’s coffee sector reforms have reshaped market dynamics:

- Implementation of the Ethiopia Commodity Exchange (ECX)

- Streamlined export procedures

- Direct trade opportunities for farmers

- Enhanced traceability systems

Political Tensions and Port Access

Political tensions with neighboring countries can impact vital port access. Ethiopia’s dependence on Djibouti’s ports makes the coffee industry vulnerable to regional diplomatic shifts. Trade routes through Sudan and Somalia present alternative options but require stable diplomatic relations.

U.S.-Ethiopia Relations and Coffee Trade Patterns

Current U.S.-Ethiopia relations influence coffee trade patterns. American buyers represent a significant market share, making diplomatic stability between these nations essential for sustained growth.

Ethiopia Coffee Market Segmentation: Types and Their Impact

Whole-Bean Coffee

This segment dominates the market, driven by demand for premium quality and specialty brews. Whole-bean coffee is particularly favored by cafes and coffee enthusiasts who prefer grinding beans fresh for optimal flavor.

Ground Coffee

Convenient for everyday use, ground coffee appeals to a broad consumer base. It’s commonly used in households and is popular among those seeking a balance between quality and convenience.

Instant Coffee

While representing a smaller market share, instant coffee caters to consumers prioritizing speed and ease of preparation, especially in urban settings.

Applications Driving Global Demand for Ethiopia Coffee

Ethiopian coffee’s versatility spans multiple applications in the global market, each contributing to its growing demand:

1. Specialty Coffee Shops

- Single-origin Ethiopian beans feature prominently in third-wave coffee establishments

- Baristas showcase Ethiopian varieties through pour-over and cold brew methods

- Premium pricing reflects the beans’ distinctive flavor profiles

2. Commercial Coffee Blends

- Major coffee brands incorporate Ethiopian beans to enhance blend complexity

- Roasters use Ethiopian varieties as base notes in signature espresso blends

- Ready-to-drink coffee products highlight Ethiopian origins

3. Food Service Industry

- High-end restaurants pair Ethiopian coffee with dessert menus

- Hotels showcase Ethiopian coffee ceremonies as unique guest experiences

- Coffee chains feature seasonal Ethiopian single-origin offerings

4. Retail Products

- Ground coffee packages for home brewing

- Coffee pods and capsules for convenience

- Instant coffee formulations using Ethiopian beans

5. Emerging Applications

- Coffee-flavored confectionery products

- Coffee-based beauty and skincare items

- Specialty food ingredients (coffee-rubbed meats, baked goods)

The growing diversity in coffee applications has created new market opportunities for Ethiopian producers, with each segment demanding specific bean characteristics and processing methods. This specialization drives innovation in cultivation and processing techniques across Ethiopia’s coffee-growing regions.

Regional Insights into the Ethiopia Coffee Market

Ethiopia’s coffee production landscape showcases distinct regional characteristics, each contributing unique flavor profiles and production volumes to the market. The country’s diverse geographical regions create a rich tapestry of coffee varieties:

1. Yirgacheffe Region

- Known for floral and citrus notes

- Premium pricing in international markets

- High-altitude cultivation (1,700-2,200 meters)

2. Sidamo Region

- Produces full-bodied, wine-like coffees

- Significant export volume contributor

- Strong cooperative farming presence

3. Harrar Region

- Distinctive wild berry notes

- Traditional dry-processing methods

- Limited but highly valued production

The regional distribution of coffee production aligns with specific market demands:

- Local Markets: 40% of production serves domestic consumption

- Export Markets: 60% distributed across international buyers

- Specialty Segment: Growing demand for region-specific beans

Climate variations across regions impact production patterns:

- Western regions: Higher rainfall, consistent yields

- Eastern regions: Drought-resistant varieties

- Central highlands: Optimal growing conditions

These regional differences create market opportunities through:

- Price differentiation based on origin

- Specialized marketing campaigns

- Direct trade relationships with specific regions

The Ethiopian Commodity Exchange (ECX) plays a crucial role in standardizing regional coffee classifications and facilitating trade between these distinct growing areas and international buyers.

Ethiopia's Coffee Market: Key Growth Areas

The Ethiopian coffee market reveals promising growth opportunities across multiple sectors. The specialty coffee segment stands out as a primary growth driver, with premium beans commanding higher prices in international markets.

Value-Added Processing

- Local roasting facilities expansion

- Packaging innovations for extended shelf life

- Development of instant coffee products

- Ready-to-drink coffee beverages

Digital Integration

- E-commerce platforms connecting farmers to buyers

- Blockchain technology for supply chain transparency

- Mobile apps for quality control and pricing

- Digital payment solutions for rural farmers

Sustainable Practices

- Organic certification programs

- Fair trade initiatives

- Shade-grown coffee cultivation

- Water conservation methods

The domestic market shows significant potential through café culture expansion in urban areas. Young professionals drive this trend, creating demand for modern coffee shops and specialized brewing methods.

Research and development initiatives focus on:

- Disease-resistant coffee varieties

- Yield improvement techniques

- Post-harvest processing technology

- Quality enhancement methods

Investment in coffee tourism presents another growth avenue, with coffee farm tours and traditional ceremony experiences attracting international visitors. These experiential offerings create additional revenue streams while promoting Ethiopian coffee culture globally.

The government’s commitment to infrastructure development supports these growth areas through improved transportation networks and storage facilities, enabling efficient market access and quality preservation.

The Role of the U.S. in Ethiopia Coffee Demand

The U.S. market is crucial for Ethiopia’s coffee exports, importing around $150 million worth of Ethiopian coffee each year. American consumers are increasingly fond of specialty coffee, which has led to a strong demand for Ethiopia’s unique Arabica varieties.

Key Market Dynamics:

- The U.S. specialty coffee sector values Ethiopian beans for their complex flavor profiles

- Direct trade relationships between U.S. roasters and Ethiopian cooperatives

- Premium pricing for Ethiopian coffee in the U.S. market

- Strong presence in third-wave coffee shops and artisanal roasteries

The U.S. coffee industry’s emphasis on origin stories and sustainable sourcing aligns perfectly with Ethiopia’s coffee heritage. American consumers show particular interest in Ethiopian Yirgacheffe, Sidamo, and Harrar varieties, driving demand for these premium beans.

Market Growth Factors:

- Rising consumer awareness about coffee origins

- Increased preference for single-origin coffees

- Growth of specialty coffee shops featuring Ethiopian beans

- Enhanced distribution networks connecting Ethiopian producers with U.S. buyers

U.S. coffee chains have played a significant role in popularizing Ethiopian coffee. Major retailers like Starbucks and Peet’s Coffee regularly feature Ethiopian varieties in their premium coffee lines, exposing millions of American consumers to these distinctive flavors.

Trade Relationships:

- Direct sourcing programs with Ethiopian farmers

- Quality control partnerships

- Investment in Ethiopian coffee infrastructure

- Technical assistance for improved production methods

The U.S. market’s influence extends beyond pure consumption. American coffee industry standards have prompted Ethiopian producers to enhance their quality control measures and adopt more sustainable farming practices. This relationship has fostered improvements in processing methods and post-harvest handling, benefiting Ethiopia’s entire coffee sector.

The U.S. Agency for International Development (USAID) actively supports Ethiopian coffee farmers through various programs, strengthening the trade relationship between both countries. These initiatives focus on improving coffee quality, market access, and farmer livelihoods.

Germany's Impact on the Ethiopia Coffee Industry

Germany is a major player in the European coffee market and serves as a key entry point for Ethiopian coffee into the European Union (EU). However, Germany’s influence goes beyond just consuming coffee directly. The port city of Hamburg in Germany is actually the largest coffee trading hub in Europe, which means that a significant amount of coffee trade happens through this port.

How German Roasters Are Supporting Ethiopia’s Coffee Industry

German roasters have had a significant impact on Ethiopia’s coffee industry by:

- Implementing Quality Standards: German importers have strict quality controls in place, which encourages Ethiopian producers to maintain high production standards.

- Building Direct Trade Relationships: Many German specialty roasters have established direct partnerships with Ethiopian coffee cooperatives.

- Providing Technical Support: German companies offer training and technology transfer to Ethiopian farmers.

The Benefits of Germany’s Preference for Ethiopian Coffee

The German market’s preference for high-quality Arabica beans perfectly matches Ethiopia’s coffee profile. As a result, this has led to several positive outcomes:

- Annual imports exceeding 18,000 metric tons of Ethiopian coffee

- Premium pricing for Ethiopian specialty coffees

- Investment in sustainable farming practices

GIZ’s Role in Supporting Ethiopian Coffee Farmers

The Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) is actively involved in supporting Ethiopian coffee farmers through various initiatives such as:

- Agricultural training programs

- Market access initiatives

- Certification assistance for organic and fair-trade labels

New Opportunities for Ethiopian Producers in the Specialty Coffee Segment

German consumers are increasingly interested in single-origin coffees, which has created new opportunities for Ethiopian producers, especially in the specialty coffee segment. This trend has motivated Ethiopian farmers to focus on developing unique regional coffee profiles that can command higher prices in the German market.

What's Next for Ethiopia Coffee?

The Ethiopian coffee industry is going through a major change. It has the potential to grow significantly through strategic initiatives and new opportunities:

1. Digital Integration

- Implementing blockchain technology for supply chain transparency

- Using mobile apps to connect farmers directly with international buyers

- Applying smart farming techniques for better yield management

2. Value Addition Strategies

- Developing ready-to-drink coffee products

- Creating premium packaging solutions for export markets

- Making Ethiopian coffee pods for home brewing systems

3. Climate Adaptation Programs

- Introducing drought-resistant coffee varieties

- Using shade-grown coffee techniques

- Implementing water conservation methods in processing facilities

4. Market Expansion Plans

- Expanding into Asian markets, especially China and South Korea

- Creating coffee tourism experiences

- Opening Ethiopian coffee shops in key export markets

The future of the industry depends on finding a balance between traditional practices and modern innovations. Research institutions are working on new processing methods while still preserving Ethiopia’s unique coffee heritage. Private sector investments in processing facilities and quality control systems indicate a shift towards higher value-added products. These developments position Ethiopian coffee for steady growth in premium market segments.

The Ethiopian Coffee and Tea Authority’s five-year strategic plan focuses on improving quality and diversifying markets. This includes setting up regional coffee excellence centers and strengthening partnerships with international coffee organizations.

Competitive Landscape in the Ethiopia Coffee Market

The Ethiopian coffee market is characterized by a diverse and competitive landscape, featuring a mix of local cooperatives, private enterprises, and international corporations. This blend of participants contributes to the market’s dynamic nature and its significant role in both domestic and global coffee industries.

-

Adulina Coffee Exporter PLC – Ethiopia

-

BNT Industry & Trading PLC – Ethiopia

-

Daye Bensa Coffee – Ethiopia

-

Garden of Coffee – Ethiopia

-

Kerchanshe Trading PLC – Ethiopia

-

Lucy Ethiopian Coffee – Ethiopia

-

Mercanta – United Kingdom

-

Moyee Coffee – Netherlands / Ethiopia (dual presence)

-

Mullege PLC – Ethiopia

-

Snap Trading & Industry PLC – Ethiopia

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Ethiopia Coffee Market Report |

| Base Year | 2024 |

| Segment by Type |

· Whole-Bean Coffee · Ground Coffee · Instant Coffee |

| Segment by Application |

· Specialty Coffee Shops · Commercial Coffee Blends · Food Service Industry · Retail Products · Emerging Applications |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Ethiopian coffee market continues to evolve and demonstrate remarkable potential across multiple sectors. From specialty coffee shops to emerging applications, Ethiopian coffee has established itself as a premium product with diverse uses and growing global appeal. The market’s strength lies in its ability to adapt to changing consumer preferences while maintaining its distinctive quality and cultural heritage.

The success of Ethiopian coffee in various applications, from traditional brewing methods to innovative product formulations, underscores its versatility and enduring appeal. As the industry continues to develop, the focus on quality, sustainability, and market diversification will be crucial for maintaining Ethiopia’s position as a leading coffee producer and exporter.

Global Ethiopia Coffee Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Ethiopia Coffee Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Ethiopia CoffeeMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Ethiopia Coffee players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: Ethiopia Coffee Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Ethiopia Coffee Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Ethiopia Coffee Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofEthiopia Coffee Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected value of the Ethiopia coffee market by 2025?

The Ethiopia coffee market is projected to reach $532.6 million by 2025, driven by key growth factors such as increasing global demand for premium coffees and the significance of coffee to the Ethiopian economy.

What are the major trends shaping the Ethiopia coffee industry?

Major trends include a growing specialty coffee culture, an emphasis on sustainability, and the cultural significance of Ethiopian coffee, which serves as a unique selling point in global markets.

What challenges does the Ethiopia coffee market face?

The Ethiopia coffee market faces several barriers to growth, including inadequate infrastructure, price volatility risks for producers and exporters, and the impact of global market dynamics on local businesses.

How do geopolitical factors influence Ethiopia’s coffee production and export?

Geopolitical factors significantly impact trade policies and can affect production levels and export volumes. Political stability in Ethiopia is crucial for maintaining consistent coffee supply and access to international markets.

What role does the U.S. play in the demand for Ethiopian coffee?

The U.S. is a key export market for Ethiopian coffees, with significant demand for high-quality beans driven by consumer preferences for specialty coffees. This influences import trends from Ethiopia.

How do regional dynamics affect coffee consumption patterns in Ethiopia?

Regional dynamics within Ethiopia shape domestic consumption trends, with cultural practices influencing local demand for different types of coffees and affecting overall market segmentation.