$43.8 Billion Expanding Ethylene Glycol Market in the U.S., China, and Germany by 2025

Explore the evolving ethylene glycol market across key regions, with insights into production processes, industry applications, and market dynamics. This comprehensive analysis covers sustainability trends, competitive landscapes, and growth projections in the U.S., China, and Germany, where the market is expected to reach $43.8 billion by 2025.

- Last Updated:

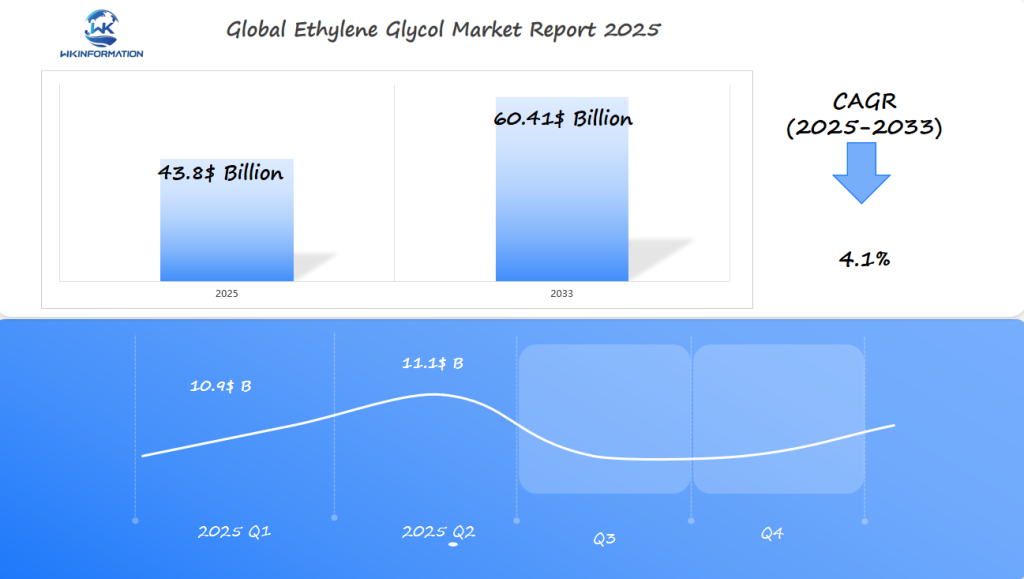

Ethylene Glycol Market Q1 and Q2 2025 Forecast

The Ethylene Glycol market is expected to reach $43.8 billion in 2025, growing at a CAGR of 4.1% from 2025 to 2033. In Q1 2025, the market is anticipated to generate approximately $10.9 billion, driven by the continued demand for antifreeze and de-icing fluids, primarily in the automotive and industrial sectors in the U.S., China, and Germany. Ethylene glycol is also a key component in polyester production, which is contributing to its growth.

By Q2 2025, the market is expected to reach $11.1 billion, with increasing use of ethylene glycol in the production of synthetic fibers and resins, particularly in China and Germany, where manufacturing industries remain strong. Additionally, growth in automotive production and winter sports industries will continue to drive demand.

Understanding the Ethylene Glycol Industry: Upstream and Downstream Processes

The ethylene glycol industry operates through a complex network of upstream and downstream processes, creating a dynamic supply chain that spans multiple sectors.

Upstream Production Process

The production of ethylene glycol begins with:

- Ethylene oxidation to create ethylene oxide

- Hydration of ethylene oxide under pressure

- Purification through vacuum distillation

- Quality control and testing procedures

Raw material sourcing plays a crucial role in the upstream process. Natural gas and crude oil derivatives serve as primary feedstocks, with ethylene as the key intermediate product. The efficiency of these processes directly influences market prices and product availability.

Downstream Applications

Ethylene glycol’s versatility creates diverse downstream applications:

1. Polyester Fiber Production

- PET bottle manufacturing

- Textile fiber creation

- Packaging materials

2. Automotive Industry

- Antifreeze formulations

- Coolant systems

- Heat transfer applications

3. Industrial Uses

- Aircraft de-icing

- Heat transfer medium

- Industrial solvent

Supply Chain Dynamics

The ethylene glycol supply chain connects multiple stakeholders:

- Raw material suppliers

- Chemical manufacturers

- Distributors

- End-users across industries

Price fluctuations in crude oil and natural gas directly impact production costs. Transportation logistics and storage requirements add complexity to the supply chain. Regional manufacturing capabilities influence market accessibility, with major production hubs in:

- Asia Pacific region

- North America

- Western Europe

Manufacturing facilities require specialized equipment and strict safety protocols, creating barriers to entry for new market players. The integration of advanced technologies and automation systems enhances production efficiency and quality control measures throughout the supply chain.

Key Trends in the Ethylene Glycol Market: Demand from Automotive and Chemical Industries

1. Growing Demand from the Automotive Sector

The automotive industry’s demand for ethylene glycol is on the rise, primarily due to its critical function in vehicle cooling systems. Modern cars necessitate advanced temperature control solutions, with ethylene glycol-based coolants becoming the preferred option for:

- Maintaining engine cooling systems

- Enhancing heat transfer efficiency

- Preventing corrosion

- Ensuring year-round temperature stability

The increasing production of electric vehicles (EVs) has generated additional sources of demand. EVs use ethylene glycol in their battery thermal management systems, requiring up to 40% more coolant compared to conventional internal combustion engines.

2. Expansion of the Chemical Manufacturing Sector

The growth of the chemical manufacturing industry has led to a rise in ethylene glycol production. Key indicators of this growth include:

- Increasing production of polyester fibers

- Higher manufacturing rates of PET bottles

- Growth in industrial solvent applications

- Expanding capacity for antifreeze production

China’s chemical industry is at the forefront of this growth, with manufacturing plants operating at 85-90% capacity. In response, U.S. chemical manufacturers are ramping up their production capabilities by investing in new technologies and expanding existing facilities.

3. Understanding Market Dynamics

Recent market data reveals specific trends shaping the industry:

- 15% year-over-year increase in automotive coolant demand

- 22% growth in PET manufacturing applications

- 30% rise in heat transfer fluid requirements

The semiconductor industry has emerged as a significant consumer of high-purity ethylene glycol, using it in cleaning processes and as a cooling agent in chip manufacturing. This application requires specialized grades of ethylene glycol, driving innovation in purification technologies.

Raw material availability and pricing fluctuations have prompted manufacturers to develop strategic partnerships with suppliers, ensuring stable production capabilities and consistent market supply.

Challenges in Ethylene Glycol Production: Environmental Concerns and Raw Material Sourcing

The ethylene glycol production industry faces significant environmental and operational challenges that impact market dynamics and production capabilities.

1. Environmental Regulatory Pressures

- Strict emission control requirements mandate expensive filtration systems

- Water contamination concerns require advanced treatment processes

- Air quality regulations necessitate additional production safeguards

- Worker safety protocols demand specialized handling procedures

2. Health Impact Considerations

The production process generates several health concerns:

- Exposure risks for facility workers

- Potential groundwater contamination in production areas

- Air quality impacts on surrounding communities

- Long-term health monitoring requirements

3. Raw Material Sourcing Challenges

Manufacturers encounter multiple obstacles in securing necessary raw materials:

- Price volatility of ethylene oxide

- Supply chain disruptions affecting natural gas availability

- Transportation logistics complications

- Storage capacity limitations

4. Production Cost Factors

The industry grapples with rising operational expenses:

- Energy-intensive production processes

- Increasing compliance costs

- Equipment maintenance requirements

- Specialized storage facility needs

5. Supply Chain Dependencies

Raw material sourcing faces regional variations:

- Limited availability of ethylene oxide in certain markets

- Dependency on specific geographical locations

- Transportation infrastructure constraints

- Storage facility distribution challenges

The ethylene glycol market adapts to these challenges through technological innovations and process improvements. Companies invest in advanced filtration systems and explore alternative production methods to meet environmental standards. The industry’s response includes developing more efficient catalysts and implementing closed-loop production systems to minimize waste and emissions.

These challenges drive manufacturers to explore sustainable alternatives and optimize their production processes. The market sees increased investment in research and development focused on environmentally friendly production methods and improved raw material utilization efficiency.

Geopolitical Impact on the Ethylene Glycol Market

Global trade dynamics shape the ethylene glycol market through complex international relationships and policy decisions. Recent geopolitical tensions have created significant ripple effects across the supply chain:

Trade Relations Impact

- U.S.-China trade disputes have led to increased tariffs on ethylene glycol imports

- Middle Eastern producers face shipping route challenges through the Strait of Hormuz

- Regional production capacities shift as countries implement protectionist policies

Market Access Barriers

- Import duties ranging from 2% to 25% across different regions

- Non-tariff barriers including:

- Quality certification requirements

- Environmental compliance standards

- Local content regulations

The strategic importance of ethylene glycol in manufacturing has prompted countries to develop domestic production capabilities. China has invested heavily in new production facilities, reducing dependency on imports and reshaping traditional trade flows.

Regional Policy Effects

Asia Pacific

- Chinese government’s dual circulation strategy impacts supply chain configurations

- Southeast Asian countries implement preferential trade agreements

North America

- USMCA agreement influences regional production patterns

- Stricter environmental regulations affect production costs

Europe

- EU Green Deal requirements create new compliance standards

- Brexit impacts UK-EU ethylene glycol trade flows

Supply chain disruptions have prompted manufacturers to adopt risk mitigation strategies:

- Development of alternative sourcing routes

- Investment in local production facilities

- Creation of strategic stockpiles

- Formation of long-term supply partnerships

The market witnesses constant shifts as countries implement new trade policies. Recent sanctions and export controls have forced producers to reevaluate their supply chain strategies, leading to increased regionalization of production networks.

Types of Ethylene Glycol: Monoethylene Glycol, Diethylene Glycol, and Triethylene Glycol

The ethylene glycol market consists of three main types, each used in different industries across major economies:

1. Monoethylene Glycol (MEG)

- Holds 56% of the U.S. market share

- Mainly used in making polyester fibers

- Widely used in automotive antifreeze products

- Current demand in the U.S.: 3.2 million tons per year

2. Diethylene Glycol (DEG)

- Represents 28% of market consumption

- Important for textile manufacturing processes

- Key ingredient in industrial solvent applications

- Increasing demand in China’s growing chemical industry

3. Triethylene Glycol (TEG)

- Accounts for 16% of market share

- Specific uses in natural gas dehydration

- Rising demand in pharmaceutical manufacturing

China’s rapid industrial growth leads to a significant increase in ethylene glycol usage, especially in the MEG sector. The country’s chemical industry expansion projects a 6.5% CAGR through 2025, with manufacturing capacity reaching 15 million tons annually.

German manufacturers are at the forefront of developing sustainable alternatives:

- Creating plant-based ethylene glycol

- Applying green chemistry principles

- Incorporating circular economy practices

- Exploring carbon-neutral production methods

The U.S. market shows strong demand across various industries:

- Polyester fiber manufacturing

- Automotive coolant systems

- Heat transfer solutions

- Industrial coating production

German technological advancements are focused on sustainable production methods, with bio-based solutions accounting for 15% of current production capacity. These innovations include enzymatic conversion processes and renewable feedstock utilization, setting new industry standards for environmental responsibility.

Applications of Ethylene Glycol in Automotive, Textiles, and Antifreeze

Ethylene glycol serves as a crucial component across multiple industries, with distinct applications that showcase its versatility:

1. Automotive Applications

- Engine coolant systems rely on ethylene glycol-based solutions to maintain optimal operating temperatures

- Heat transfer fluid in radiators prevents engine overheating during extreme conditions

- Brake fluid formulations contain ethylene glycol to ensure consistent performance

2. Textile Industry Integration

- Polyester fiber production uses ethylene glycol as a primary raw material

- Fabric finishing processes benefit from ethylene glycol’s moisture-retention properties

- Textile lubricants incorporate this compound for improved manufacturing efficiency

3. Antifreeze Solutions

- Aircraft de-icing fluids contain high concentrations of ethylene glycol

- Industrial cooling systems depend on ethylene glycol-based antifreeze

- HVAC systems utilize specialized formulations for year-round temperature control

The demand for these applications continues to rise, with the automotive sector leading consumption at 35% of global usage. Textile manufacturers report a 15% increase in ethylene glycol utilization for polyester production since 2020. The antifreeze segment maintains steady growth, particularly in regions with extreme weather conditions.

Recent innovations include smart temperature-control solutions in electric vehicles and eco-friendly textile processing methods that optimize ethylene glycol usage. These developments drive market expansion while addressing environmental considerations.

Global Insights into the Ethylene Glycol Market

The ethylene glycol market displays distinct regional patterns and growth trajectories across different continents. Asia-Pacific dominates the global market share, with China leading production capacity and consumption rates. The region’s robust manufacturing sector and expanding industrial base drive this dominance.

Key market indicators reveal:

Production Capacity Distribution

- Asia-Pacific: 65% of global capacity

- North America: 18% of global capacity

- Europe: 12% of global capacity

- Rest of World: 5% of global capacity

The Middle East has emerged as a significant player, leveraging its abundant raw material resources and strategic location. Saudi Arabia and UAE have invested heavily in ethylene glycol production facilities, establishing themselves as major exporters to Asian markets.

Latin America presents untapped potential, with Brazil and Mexico showing increased demand in their growing automotive and textile sectors. The region’s market value is expected to rise by 5.2% annually through 2025.

India’s rapid industrialization has sparked a surge in ethylene glycol demand, particularly in the polyester fiber industry. The country’s market is projected to grow at 7.3% CAGR, driven by expanding textile manufacturing capabilities.

Russia’s market dynamics are shaped by its vast natural gas resources, enabling cost-effective ethylene glycol production. The country’s strategic focus on chemical industry development has strengthened its position as a key supplier to European markets.

U.S. Ethylene Glycol Market: Industrial Applications and Consumer Demand

The U.S. ethylene glycol market, valued at $12.3 billion in 2023, is experiencing strong growth across various industrial sectors. The automotive industry is the main consumer, using ethylene glycol in antifreeze formulations and heat transfer applications.

Key Industrial Applications in the U.S. Market:

- Polyester Manufacturing: U.S. textile producers use ethylene glycol as a crucial component in polyester fiber production

- Electronics Industry: Circuit board manufacturing requires high-purity ethylene glycol for specialized applications

- Construction Sector: PET-based materials incorporating ethylene glycol see increasing demand in building materials

The consumer market shows steady demand for ethylene glycol-based products, particularly in:

- Automotive maintenance products

- De-icing solutions

- Heat transfer fluids for HVAC systems

U.S. manufacturers have implemented advanced production technologies to meet stringent quality standards and environmental regulations. The market sees growing interest in bio-based alternatives, with several companies investing in research and development of sustainable production methods.

Regional distribution networks play a vital role in meeting demand across different states, with major production facilities concentrated in Texas and Louisiana. These strategic locations provide easy access to raw materials and efficient transportation routes for product distribution.

The market demonstrates strong potential for growth in specialized applications, particularly in emerging technologies such as electric vehicle cooling systems and renewable energy storage solutions.

China's Ethylene Glycol Market: Growth in Chemicals and Manufacturing

China’s ethylene glycol market is experiencing significant growth, with an expected annual growth rate of 6.5% until 2030. This growth is primarily driven by the country’s manufacturing sector, which is benefiting from:

Key Growth Drivers:

- Rapid industrialization in key chemical processing regions

- Increasing domestic demand for polyester fibers

- Expansion of PET bottle manufacturing facilities

- Strategic investments in production capacity

The Chinese market is also receiving substantial government support through the Made in China 2025 initiative, which aims to promote the development of chemical manufacturing. In response, local producers are ramping up their production capabilities and establishing new facilities in industrial areas of Jiangsu and Zhejiang provinces.

Market Dynamics:

- Production capacity: 23.5 million tons annually

- Domestic consumption: 16.8 million tons

- Export volume: 6.7 million tons

Chinese manufacturers are making significant investments in upgrading their technology to enhance production efficiency. Leading domestic producers such as Sinopec and PetroChina are at the forefront of this effort, establishing integrated chemical complexes that streamline the entire manufacturing process from ethylene to finished ethylene glycol products.

The textile industry remains the largest consumer of ethylene glycol in China, utilizing the chemical for polyester fiber production. The demand from this sector continues to grow, supported by China’s status as a global hub for textile manufacturing.

Germany's Ethylene Glycol Market: Advancements in Bio-based Solutions

Germany is leading the way in sustainable innovation in the ethylene glycol market, being the first to introduce bio-based alternatives to traditional petroleum-derived products. The country’s dedication to environmental sustainability has resulted in significant investments in research and development of eco-friendly production methods.

Key Innovations in Bio-based Solutions:

- Development of sugar-based ethylene glycol production using renewable feedstock

- Implementation of carbon-neutral manufacturing processes

- Integration of waste biomass conversion technologies

German manufacturers have successfully developed processes to produce ethylene glycol from agricultural waste products and sustainable biomass sources. These innovative approaches reduce carbon emissions by up to 70% compared to conventional production methods.

The German market has seen a 25% increase in bio-based ethylene glycol adoption across various industries, particularly in:

- Automotive manufacturing

- Textile production

- Pharmaceutical applications

Leading German chemical companies have established partnerships with biotechnology firms to scale up bio-based production capabilities. These collaborations have resulted in the development of proprietary enzymatic processes that enable more efficient conversion of renewable resources into ethylene glycol.

The shift towards bio-based solutions has attracted substantial government support through research grants and tax incentives. German facilities now operate with advanced fermentation technologies and innovative catalyst systems, setting new industry standards for sustainable chemical production.

The Future of Ethylene Glycol: Sustainability Trends and Recycling Technologies

The ethylene glycol industry is undergoing a significant transformation driven by sustainability imperatives and technological innovations. Companies are investing heavily in green production methods to reduce their environmental footprint while maintaining production efficiency.

Key Sustainability Initiatives:

- Bio-based feedstock integration

- Carbon capture implementation

- Energy-efficient manufacturing processes

- Water conservation systems

- Waste reduction protocols

Recycling technologies have emerged as a crucial component in creating a circular economy for ethylene glycol. Advanced chemical recycling processes now allow for the recovery of up to 99.9% pure ethylene glycol from waste streams, making it suitable for reuse in high-grade applications.

Innovative Recycling Methods:

- Vacuum distillation

- Membrane separation

- Advanced oxidation processes

- Biological treatment systems

- Crystallization techniques

The industry has developed closed-loop systems that capture and purify used ethylene glycol from automotive and industrial applications. These systems reduce raw material consumption by 40-60% while decreasing production costs by 25-30%.

Environmental Impact Reduction:

- CO2 emissions cut by 45%

- Water usage reduced by 35%

- Energy consumption decreased by 50%

- Waste generation minimized by 60%

Research institutions and chemical companies are developing catalytic processes that enable ethylene glycol production from renewable resources. These methods use agricultural waste and biomass as feedstock, reducing dependency on fossil fuels.

The integration of artificial intelligence and machine learning optimizes recycling processes, improving efficiency and reducing operational costs. Smart sensors and automated sorting systems enhance the quality of recycled ethylene glycol, making it competitive with virgin material.

Companies are establishing collection networks and reverse logistics systems to ensure a steady supply of recyclable materials. These initiatives create new business opportunities while supporting environmental sustainability goals.

Competitive Landscape in the Ethylene Glycol Market

The global ethylene glycol market has several major players who influence the industry through strategic actions and technological advancements. These key manufacturers hold a significant portion of the market through large-scale production capabilities and strong distribution networks.

-

BASF SE – Germany

-

China Petrochemical Corporation (Sinopec) – China

-

Indorama Ventures – Thailand

-

EQUATE Petrochemical Company – Kuwait

-

INEOS Group – United Kingdom

-

LG Chem Ltd. – South Korea

-

SABIC – Saudi Arabia

-

Huntsman Corporation – United States

-

LyondellBasell Industries N.V. – Netherlands

-

Reliance Industries Limited – India

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Ethylene Glycol Market Report |

| Base Year | 2024 |

| Segment by Type |

· Monoethylene Glycol · Diethylene Glycol · Triethylene Glycol |

| Segment by Application |

· Automotive · Textiles · Antifreeze |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Ethylene glycol plays a vital role in various industries, including automotive, textiles, and antifreeze solutions. Its versatility as a coolant in automotive applications, as well as its integration in polyester fiber production and antifreeze formulations, underscores its importance in modern manufacturing and consumer products.

As the market continues to evolve, driven by sustainability initiatives and technological advancements, the demand for ethylene glycol is expected to remain robust. The industry’s ability to adapt to environmental challenges and innovate through bio-based solutions will be crucial for its future growth and acceptance across different sectors.

Global Ethylene Glycol Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Ethylene Glycol Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Ethylene GlycolMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Ethylene Glycolplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Ethylene Glycol Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Ethylene Glycol Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Ethylene Glycol Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofEthylene Glycol Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the global ethylene glycol market by 2025?

The global ethylene glycol market is projected to reach $43.8 billion by 2025, with significant growth expected particularly in the U.S., China, and Germany.

What are the main upstream processes involved in ethylene glycol production?

Upstream processes in ethylene glycol production involve the synthesis of ethylene from raw materials, followed by its conversion into ethylene oxide and subsequently into ethylene glycol. These processes are crucial for ensuring a stable supply chain and meeting market demand.

Which industries are the largest consumers of ethylene glycol?

The largest consumers of ethylene glycol include the automotive industry, where it is used for cooling systems, as well as the textile industry and antifreeze solutions. The chemical manufacturing sector also significantly contributes to the demand for ethylene glycol.

What environmental challenges does the ethylene glycol industry face?

The ethylene glycol industry faces several environmental challenges, including regulatory scrutiny over health effects associated with its production processes and issues related to sourcing sustainable raw materials.

How do geopolitical factors affect the ethylene glycol market?

Geopolitical factors such as international trade relations and tariffs can significantly influence supply chains within the ethylene glycol market, impacting overall growth and market dynamics across different regions.

What advancements are being made towards sustainability in the ethylene glycol sector?

The future of the ethylene glycol market includes a focus on sustainability trends and recycling technologies aimed at mitigating environmental impacts. Advancements in recycling technologies are particularly important for creating a circular economy for this chemical compound.