2025 Gas Control Equipment Market Unlocking $82.54 Billion Potential in United States, Russia, and China

Trump’s push for energy independence spurs growth in the US, Russia, and China’s Gas Control Equipment Market.

- Last Updated:

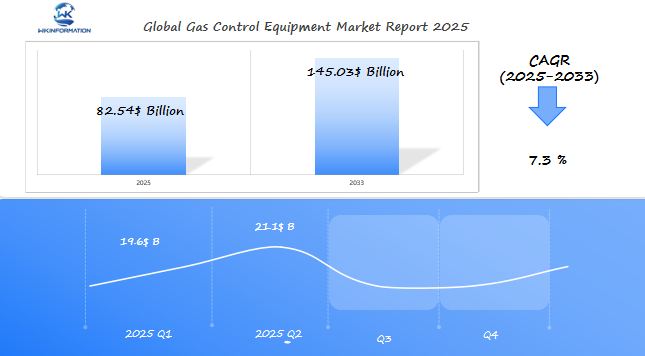

Market Forecast for Gas Control Equipment in Q1 and Q2 of 2025

The Gas Control Equipment market is projected to reach USD 82.54 billion in 2025, growing at a CAGR of 7.3% from 2025 to 2033. Based on this growth trend, the estimated market size for Q1 2025 is approximately USD 19.6 billion, increasing to around USD 21.1 billion in Q2 2025. The market expansion is driven by the increasing demand for industrial gas management solutions, advancements in energy infrastructure, and the growing need for precision control in sectors like healthcare, manufacturing, and energy production.

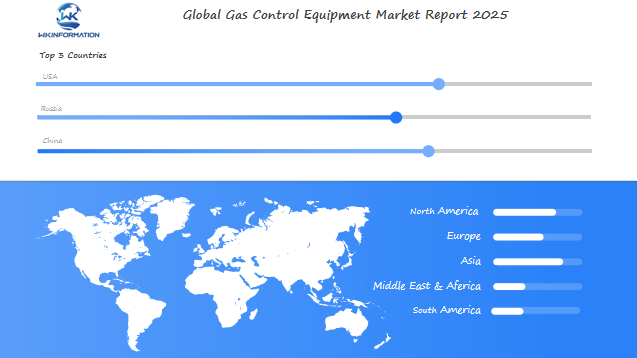

The United States, Russia, and China are the most significant markets for gas control equipment. The US is investing heavily in advanced gas control technologies to support industrial automation and safety regulations. Russia, with its extensive oil and gas industry, continues to drive demand for high-quality gas control solutions. Meanwhile, China’s rapid industrialization and focus on clean energy solutions contribute to the sector’s dynamic growth. Market players should focus on enhancing digital integration, improving efficiency, and developing sustainable gas management solutions to stay competitive.

Key Takeaways

- Global gas control equipment market size reflects demand from energy, industrial, and healthcare sectors.

- Upstream suppliers and downstream users are interconnected through the gas equipment supply chain.

- U.S., Russia, and China dominate manufacturing and market expansion strategies.

- Supply chain efficiency directly impacts product innovation and cost stability.

- Rising safety regulations and technological advancements drive value chain evolution.

Gas Control Equipment Market Upstream and Downstream Industry Chain Analysis

The global gas control equipment market is set to grow a lot. This growth comes from the mix of its upstream and downstream parts. We look at how materials like metals and electronics move through making, shaping the market.

Knowing how the upstream and downstream parts work is crucial. It helps us see how new ideas and changes in demand affect the market. The market could reach $82.54 billion by 2025.

The gas equipment supply chain links raw material makers, part makers, and users in energy, industrial, and healthcare fields. Places like the U.S., Russia, and China play big roles. Their strengths shape the global market.

This system affects prices, new ideas, and meeting growing demand for better solutions. It’s all about making things safer and smarter.

Key Trends Transforming the Gas Control Equipment Market in 2025

The gas control equipment market is set for big changes. New tech and focus on sustainability are changing the game. By 2025, we expect to see a market worth $82.54 billion. Let’s dive into the main trends driving this change.

Technological Innovations Driving Market Growth

IoT sensors and AI analytics are changing how equipment works. Companies like Emerson and ABB are at the forefront. They offer smart regulators and meters that guess when you need maintenance.

These smart tools cut down on downtime and make operations more precise. They fit right with the 2025 forecast’s emphasis on being efficient.

Sustainability Initiatives Reshaping Equipment Design

Now, makers focus on green materials and energy-saving parts. They follow ISO 14001 standards, using light alloys and designs that emit less. This meets global green policies and meets growing demand from renewable energy fields.

Digital Integration and Remote Monitoring Solutions

- Cloud-based systems from Siemens let you track data in real-time and adjust things from afar.

- These systems can save up to 30% by sending alerts and using predictive analytics, as the 2025 forecast shows.

These tools also boost safety. They’re key for industries like oil refining and healthcare gas management.

Companies that invest in digital gas control systems and green practices will lead the market. The 2025 forecast says being quick to adopt these changes will be key to success.

Market Restrictions and Regulatory Challenges in the Gas Control Equipment Industry

Working in the gas control equipment field means dealing with many rules. From making products to shipping them around the world, gas equipment regulations affect every step. This part explains how following rules and policy changes are changing the $82.54 billion market.

Evolving Safety Standards and Compliance Requirements

Companies must meet stricter safety standards gas control to avoid leaks and accidents. In the U.S., OSHA demands thorough testing. The EU’s REACH rules also limit harmful materials. Now, companies spend 10–15% more on tests to follow these international gas equipment standards.

Environmental Regulations Impacting Manufacturing

- China’s “Dual Carbon” policy pushes for cleaner production of valves and regulators.

- Russia’s new eco-standards require changes in pipeline parts.

- In the U.S., EPA rules encourage making products that emit less.

Cross-Border Trade Restrictions and Tariffs

Trade barriers, like U.S. Section 232 tariffs on steel, increase costs by 25% for valves. Also, regulatory compliance gas industry rules mean getting two certifications for EU and ASEAN markets. Companies like Emerson and Honeywell make it easier to sell across borders by following global standards early.

Even with these hurdles, leaders like Siemens Energy gain trust by adopting safety rules early. By focusing on compliance, companies can stand out in the market.

Geopolitical Factors Shaping the Gas Control Equipment Market Outlook

Global politics are changing the gas control equipment market. Energy security and supply chain issues are key for businesses. The $82.54 billion market potential by 2025 is at stake.

Trade policies and alliances now affect demand for gas control systems. This is a big deal for companies.

Energy Security Policies and Their Market Impact

Energy security is a big deal for major countries. The U.S. is helping its energy security with subsidies for geopolitical impact gas equipment production. China is focusing on being self-sufficient in key areas.

Russia is working on projects to boost gas exports. These moves are creating a big demand for top-notch equipment.

International Relations Affecting Supply Chains

Trade tensions and sanctions are breaking up global international gas supply chains. Here are some key points:

- The EU wants to reduce its dependence on Russian gas

- U.S. sanctions limit Russian access to certain tech

- Asia-Pacific countries are investing in LNG to avoid problems

Regional Investment Patterns in Gas Infrastructure

Regional gas infrastructure investment shows different strategies:

| Country | Strategy | Market Impact |

|---|---|---|

| United States | Shale gas development funding | Boosts demand for high-pressure control systems |

| Russia | Arctic LNG projects | Drives valve and pipefitting procurement |

| China | Western China gas pipeline expansions | Increases flow control device orders |

These changes show how politics affect gas control equipment use. Companies need to watch trade policies to stay on track.

Market Segmentation of Gas Control Equipment by Type

Gas control equipment falls into three main types: pressure regulators, valves, and safety systems. Each type has its own role in managing gas flow, safety, and efficiency. Together, they are expected to reach a market value of $82.54 billion by 2025.

| Category | Market Share | 5-Year Growth Rate |

|---|---|---|

| Pressure Regulators & Flow Control | 35% | 6.2% |

| Valves & Fittings | 45% | 5.8% |

| Safety Monitoring Systems | 20% | 8.1% |

Pressure Regulators and Flow Control Devices

The market for gas pressure regulators is evolving, moving from mechanical to smart systems. Gas flow control equipment includes mass flow controllers and pressure-reducing valves. These are crucial in energy, manufacturing, and HVAC sectors. In the U.S., there’s a focus on gas pressure regulators for hydrogen infrastructure.

- Mechanical regulators for stable pressure

- Electronic systems with IoT integration

- Oil and gas refining applications

Valves, Fittings, and Connection Technologies

Industrial valve types like ball and gate valves are common. Globe and butterfly valves are used for different pressures and flows. New materials are making these valves last longer in tough environments.

- Ball valves for on/off control

- Gate valves for full-bore flow

- Applications in pipelines and refineries

Monitoring and Safety Systems

Gas safety monitoring systems use sensors, alarms, and automatic shutdowns. They prevent leaks and explosions in industrial settings. The U.S. and Russia are leading in adopting these systems to meet safety standards.

- Real-time leak detection sensors

- Automated emergency response

- Adoption rising in chemical and healthcare sectors

Applications of Gas Control Equipment in Industrial and Medical Sectors

Gas control technologies are key in industries needing precision. They are used in refineries and hospitals. These systems keep processes safe and efficient.

Oil and Gas Production and Processing Applications

Oil and gas process control systems are crucial for extraction and refining. In the U.S., automated valves stop leaks during shale gas drilling. Russia’s Arctic projects use frost-resistant industrial gas control applications for extreme conditions. China’s LNG terminals use flow meters to meet export needs. Key uses include:

- Pressure regulation in pipeline networks

- Hydrocarbon separation during crude refining

- Gas flare management at offshore platforms

Manufacturing and Chemical Processing Uses

Chemical manufacturing gas systems ensure safe handling of hazardous materials. Plants in Texas use explosion-proof sensors for ammonia production. European chemical parks use smart valves for polymer synthesis. Applications include:

- Temperature-sensitive gas mixing

- Emergency shutdown systems for toxic gas leaks

- Gas purity monitoring in pharmaceuticals

Healthcare and Laboratory Gas Management Systems

Hospitals rely on medical gas equipment for oxygen and anesthesia. Regional standards vary widely:

| Region | Key Standards | Key Uses |

|---|---|---|

| U.S. | NFPA 99 | Operating theaters, neonatal ICUs |

| EU | EN 13268 | Clinical labs, emergency care |

| Asia | ISO 7396 | Medical research facilities |

These systems ensure compliance and support telemedicine and personalized healthcare.

Global Gas Control Equipment Market Regional Trends and Market Forecast

Regional trends are key to understanding the future of gas control equipment demand. The global gas equipment forecast shows different paths for different regions. Asia-Pacific and the Middle East are growing fast, while Europe and North America are upgrading.

Emerging Markets and Growth Hotspots

Places like Southeast Asia and the Middle East are on the rise. Fast growth in India and the UAE is driving this. For instance, Qatar’s big LNG projects need better flow control systems.

These areas are expected to grow by 40% by 2025, according to regional gas market analysis.

Established Markets and Replacement Demand

- North America: 25% of demand is for replacing old systems

- Europe: 30% of spending is on smart safety systems

- Japan: Updating plants for hydrogen use

Regional Tech Adoption Patterns

| Region | Adoption Rate (%) | Key Drivers |

|---|---|---|

| Asia-Pacific | 65% | Government funding for infrastructure |

| Europe | 58% | EU rules on emissions |

| MENA | 72% | Investments in LNG export terminals |

Companies looking at the global gas equipment forecast must consider both fast-growing and mature markets. This approach helps them tap into the $82.54B industry.

USA Gas Control Equipment Market Growth and Industry Performance

The gas control sector in North America is key to the global US gas control market. It’s driven by homegrown innovation and upgrades to infrastructure. The USA gas industry growth is expected to grow at 7% each year until 2025. This growth comes from investments in local production and new technologies.

Domestic Manufacturing and Supply Chain Development

More American gas equipment manufacturers are focusing on making things at home. Companies like Emerson Electric and Cameron are using automation and local R&D. This helps them not rely so much on parts from other countries. Key trends include:

- Partnerships between manufacturers and energy firms to meet North American gas control standards.

- Adoption of Industry 4.0 tools for precision manufacturing.

- Government incentives boosting domestic production capacity.

Key Industry Players and Market Concentration

The US gas control market is mostly held by a few big players, with over 60% of the market. These leaders are pushing innovation through buying other companies and investing in research and development:

| Company | Market Share | Key Focus |

|---|---|---|

| Emerson Automation Solutions | 22% | Smart valve controls |

| General Electric | 18% | IoT-enabled sensors |

| Rockwell Automation | 15% | AI-driven analytics |

Technological Leadership and Innovation Hubs

“North American gas control standards set global benchmarks, accelerating adoption of hydrogen-ready systems and leak detection tech.” – Industry Report 2023

Innovation centers in Houston and California are driving progress. Houston is known for oil and gas, while California focuses on clean energy. Universities like Texas A&M work with companies to test new gas control equipment. This partnership helps the U.S. lead in exports and meet strict safety standards.

As the USA gas industry growth speeds up, everyone is focusing on following new rules and using more green energy. Places are now testing how to add carbon capture to current systems. This shows a way to grow sustainably.

Russia Gas Control Equipment Market Expansion and Competitive Insights

The Russian gas control market is growing fast. This is thanks to state gas projects Russia like exploring the Arctic and building pipelines in Siberia. These projects need top-notch Russia gas equipment manufacturers to work in tough conditions.

Big investments, like the Power of Siberia-2 pipeline, show how serious Russia is about updating its gas infrastructure.

State-Backed Projects and Market Development

Big state gas projects Russia like Arctic LNG-2 are pushing for better equipment that can handle cold. Now, over 60% of new projects need gear that works in freezing temperatures. Key areas include:

- Arctic offshore platforms needing corrosion-resistant valves

- Siberian gas fields requiring automated flow control

- Export pipelines integrating smart monitoring tools

Domestic Manufacturing Capabilities and Export Potential

Russian companies like Tomskneft and Gazprom Neft are making more Russia gas equipment manufacturers products. Now, 70% of what Russia needs is made locally, up from 45% in 2020. They’re aiming to sell more to CIS countries and Asia-Pacific:

| Market | 2025 Export Target (USD mn) |

|---|---|

| China | 320 |

| India | 150 |

| Central Asia | 85 |

Technology Adoption and Modernization Initiatives

New tech in Russian gas technology development aims to cut downtime by 30% by 2025. Modernization efforts include:

- AI-driven leak detection systems

- Hydrogen-ready valve designs

- IoT-enabled pressure regulators

State subsidies are putting $1.2 billion into R&D for Russian gas control market tech by 2026.

China Gas Control Equipment Market Trends and Investment Opportunities

China’s gas control equipment sector is a key player in the global market, worth $82.54 billion. It’s driven by its strong China gas equipment manufacturing and strategic investments. Fast urban growth and changes in energy policies are creating new chances for investors.

Manufacturing Scale and Export Competitiveness

- China’s factories make 40% of the world’s gas control equipment. They use efficient China gas equipment manufacturing and strong supply chains.

- Export centers in Zhejiang and Jiangsu send most goods to Southeast Asia and the Middle East.

Domestic Demand Drivers and Urban Gas Infrastructure

Urban growth is pushing the need for more gas infrastructure China. By 2025, 80% of new cities will use gas networks. Policies switching from coal to gas are also increasing demand for control devices and safety systems.

Technology Acquisition and Indigenous Innovation

Companies like gas control technology China leader Shanghai Nuclear Engineering Research and Design Institute team up with foreign companies to improve R&D. They work with Siemens and General Electric to bring in smart valve and sensor technology.

Innovation centers in Shenzhen are working on IoT gas management systems. They match the Belt and Road Initiative’s projects.

Investors should look into gas infrastructure China updates and export chances in new markets. Working with state-owned companies can help get into the $32 billion domestic market.

Future Innovations and Smart Control Technologies in Gas Control Equipment

The gas control equipment market is set to hit $82.54 billion. Smart gas control systems are key to this growth. Innovations like AI gas monitoring and IoT gas equipment bring new levels of precision and safety.

“AI-driven platforms cut maintenance costs by 30% while improving safety margins,” says Emerson’s 2023 sustainability report.

AI and Machine Learning Applications in Gas Management

AI gas monitoring changes how we manage gas. It uses data to adjust valves automatically. This means better safety and less downtime.

Predictive analytics also help by spotting equipment problems early. This cuts downtime by 25% in tests.

- Dynamic pressure adjustments using real-time data

- Failure prediction models cutting repair costs

- Self-optimizing pipelines for energy efficiency

IoT Integration and Predictive Maintenance Systems

IoT gas equipment connects devices into a network. Sensors alert for leaks or pressure drops. This lets teams fix problems from afar.

Remote monitoring hubs also connect to the cloud. This cuts on-site visits by 50%.

- Real-time data streams for global oversight

- Smart sensors that communicate with central dashboards

- Autonomous systems for rural or hard-to reach facilities

Green Technologies and Hydrogen-Ready Equipment

Hydrogen-ready gas technology is leading the energy shift. New materials and valves handle hydrogen safely. The U.S. and China are leading in these green projects.

- Specialized valves for hydrogen-blend pipelines

- Materials engineered to withstand hydrogen exposure

- U.S. adoption in West Coast energy hubs

These technologies are real and are shaping the future. Investors are backing startups like HydroGenius and big names like Siemens Energy. The race to 2025 is on.

Competitive Landscape and Leading Players in the Gas Control Equipment Market

-

GCE Group – Sweden

-

Honeywell International Inc. – United States

-

Emerson Electric Co. – United States

-

MSA Safety Inc. – United States

-

Teledyne Technologies Inc. – United States

-

Dragerwerk AG & Co. KGaA – Germany

-

Thermo Fisher Scientific Inc. – United States

-

Halma plc – United Kingdom

-

Industrial Scientific Corporation – United States

-

Carrier Global Corporation – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Gas Control Equipment Market Report |

| Base Year | 2024 |

| Segment by Type | · Gas Control Equipment

· Medical Gas Control Equipment · Specialty Gas Control Equipment · Other |

| Segment by Application | · Petroleum

· Chemical Industry · Healthcare · Automotive Electronics · Other |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The gas equipment industry is changing fast. New technologies and global demand are opening up new chances. By 2025, the market is expected to grow, with the U.S., Russia, and China leading the way.

Five-Year Growth Projections and Market Scenarios

The market could reach $82.54 billion by 2025, thanks to more energy needs and big projects. If technology keeps improving and trade stays stable, the future looks bright. But, if rules change or supply chains get disrupted, things might slow down. The forecast suggests that investing in hydrogen and IoT will be key.

Gas Control Investment Opportunities and Risk Factors

New markets are looking to smart gas management tools, offering big investment chances. The U.S. is into AI, while Russia and China are focusing on making things cheaper and selling more. But, there are risks like oil price swings, changing emissions rules, and global tensions. Companies need to innovate but also manage risks well.

Strategic Considerations for Market Participants

Manufacturers should follow local rules and team up with tech companies to stay ahead. New players can target specific areas like medical gas or lab equipment. Users should use predictive maintenance to cut down on lost time. The key to success is being quick to adapt and think ahead.

Global Gas Control Equipment Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Gas Control Equipment Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Gas Control Equipmentplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Gas Control Equipment Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Gas Control Equipment Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Gas Control Equipment Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofGas Control Equipment Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key trends driving growth in the gas control equipment market?

The gas control equipment market is growing fast. This is thanks to new tech, green efforts, and digital tools. These changes make things safer, more efficient, and better for the planet.

How do regulatory challenges impact the gas control equipment industry?

Rules and regulations are big for the gas control equipment world. They set safety and environmental standards. Companies must follow these, which can be costly but also opens doors for new ideas and better market spots.

What role do geopolitical factors play in the gas control equipment market?

Politics and global relations really affect the gas control equipment market. They influence energy policies, trade, and where money goes. This can lead to more local making, change supply chains, and create hotspots for demand.

What types of gas control equipment are most commonly used in various industries?

The market has many types, like regulators, flow devices, valves, and monitors. Each is used in places like oil and gas, making, chemicals, and health care. New tech keeps improving them.

How is the gas control equipment market segmented by application?

The market is split by use into oil and gas, chemicals, and health care. Each area has its own needs and chances for growth. This adds to the market’s potential.

What are the global trends affecting market demand for gas control equipment?

Trends like new markets, building up, and adopting new tech affect demand. These trends show the differences between old and new markets. They guide where to invest.

How is the U.S. gas control equipment market expected to perform in the coming years?

The U.S. market is set to grow. This is thanks to better making at home, supply chain work, and focus on new ideas. As the country updates its infrastructure, it will keep being key globally.

What unique characteristics define the Russian gas control equipment market?

Russia’s market is known for government support, strong making, and need for tough gear. It’s also adapting to sanctions and global issues, changing how things are made and sold.

What investment opportunities does China present in the gas control equipment sector?

China is a big chance for investment. It has lots of making, big gas projects, and buys new tech. The Belt and Road Initiative also opens up more chances for local suppliers.

What future innovations should we expect in gas control equipment?

We’ll see more AI, IoT, and green tech for hydrogen. These will be key for better gas management and meeting new market needs.

How does the competitive landscape affect companies in the gas control equipment market?

The competition is shaped by who has the most market share, mergers, and where companies stand. Those who use new ideas, stand out, and know their region well will do best.