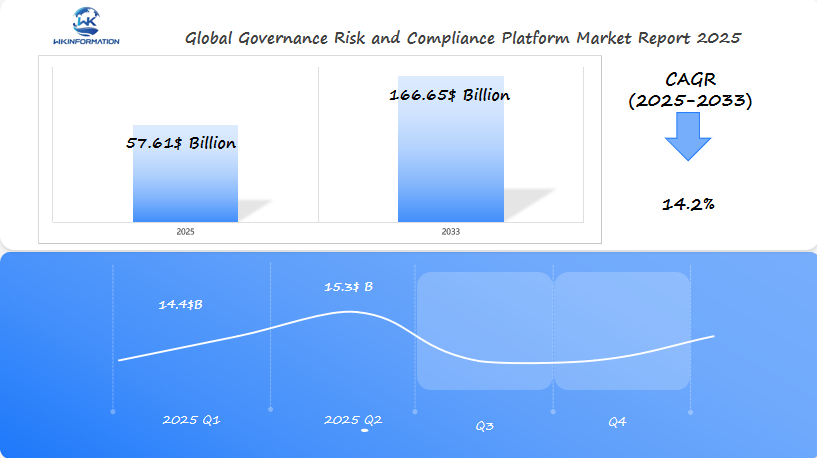

Governance Risk and Compliance Platform Market Insights: $57.61 Billion Global Growth by 2025 with Key Insights from the U.S., Germany, and the U.K.

Explore the comprehensive analysis of the Global Governance Risk and Compliance Platform Market from 2025-2033. This in-depth report covers market trends, key players, technological innovations, and growth projections. Learn how organizations are leveraging GRC platforms to enhance risk management, ensure regulatory compliance, and streamline operations in an increasingly complex business environment. Discover the latest advancements in AI and ML integration, regional market dynamics, and strategic insights for businesses navigating the future of governance, risk, and compliance solutions.

- Last Updated:

Governance Risk and Compliance Platform Market Q1 and Q2 2025 Forecast

The Governance Risk and Compliance (GRC) Platform market is expected to reach $57.61 billion in 2025, with a strong CAGR of 14.2% from 2025 to 2033. In Q1 2025, the market is forecast to generate around $14.4 billion, fueled by increasing regulations, data privacy laws, and a growing focus on enterprise risk management. The U.S., Germany, and the U.K. will lead the demand for advanced GRC solutions as organizations face increasing pressure to comply with international regulations and mitigate risks in a complex, global business environment.

By Q2 2025, the market will likely grow to $15.3 billion, driven by investments in cloud-based platforms and AI-powered risk management solutions. U.S. companies, especially in the finance, healthcare, and energy sectors, will continue to invest heavily in GRC platforms. Germany and the U.K. will also see steady growth, as businesses focus on regulatory compliance and data security in light of new laws such as GDPR.

Upstream and Downstream Dynamics in the Governance, Risk, and Compliance Platform Market

The GRC ecosystem operates through a complex network of upstream and downstream dynamics that shape market evolution and business outcomes.

Upstream Factors Driving GRC Development:

- Rapid technological innovations in AI and machine learning

- Evolving regulatory frameworks across industries

- Increasing cybersecurity threats and data privacy concerns

- Market demand for integrated compliance solutions

- Changes in global business operations and risk landscapes

These upstream elements push GRC platform providers to continuously adapt their offerings, creating more sophisticated and comprehensive solutions.

Downstream Impact on Business Operations:

- Enhanced risk detection and mitigation capabilities

- Streamlined compliance processes through automation

- Reduced operational costs from consolidated GRC functions

- Improved decision-making through data-driven insights

- Better stakeholder confidence and reporting transparency

The downstream effects manifest in tangible business improvements. Organizations implementing GRC platforms report up to 25% reduction in compliance-related costs and 40% faster risk assessment processes.

Real-World Applications:

“Our GRC platform implementation has transformed our risk management approach, enabling real-time monitoring and automated compliance checks across our global operations.” – Chief Risk Officer, Fortune 500 Company

The interconnected nature of upstream and downstream dynamics creates a feedback loop, where business outcomes influence future platform development priorities and market direction.

Key Trends Shaping the Governance, Risk, and Compliance (GRC) Platform Market

1. The Power of AI and Machine Learning

The integration of AI and machine learning transforms GRC platforms into powerful decision-making tools. These technologies enable:

- Real-time risk assessment through pattern recognition

- Automated compliance monitoring with predictive analytics

- Smart alerts for potential regulatory violations

- Data-driven insights for strategic planning

AI-powered GRC solutions analyze vast amounts of data to identify emerging risks and compliance gaps. Machine learning algorithms adapt to new threats and regulatory changes, providing organizations with proactive risk management capabilities.

2. The Rise of Cloud-Based Solutions

Cloud-based GRC platforms revolutionize how businesses approach governance and compliance:

- Scalable infrastructure adapts to growing business needs

- Remote access enables global team collaboration

- Automatic updates ensure regulatory compliance

- Cost-effective deployment with reduced IT overhead

The shift to cloud solutions creates a flexible environment for organizations to manage their GRC needs. These platforms integrate seamlessly with existing business systems while providing robust security measures to protect sensitive data.

3. Streamlining Processes with API Connectivity

Modern GRC platforms leverage API connectivity to create unified ecosystems that streamline:

- Third-party risk management

- Regulatory reporting

- Audit processes

- Incident response procedures

The combination of AI capabilities and cloud infrastructure positions GRC platforms as essential tools for organizations navigating complex regulatory landscapes and emerging risks.

Barriers and Regulatory Challenges in the GRC Industry

Organizations implementing GRC solutions face significant hurdles in navigating complex regulatory landscapes. Data privacy regulations like GDPR and CCPA create strict requirements for data handling, storage, and processing – demanding sophisticated compliance mechanisms within GRC platforms.

Industry-Specific Standards Present Unique Challenges:

- Financial Services: Basel III requirements, anti-money laundering regulations

- Healthcare: HIPAA compliance, patient data protection

- Manufacturing: Environmental regulations, safety standards

- Technology: Data sovereignty laws, cybersecurity requirements

The implementation of stringent regulations creates substantial cost implications:

- Infrastructure upgrades to meet security requirements

- Staff training on new compliance protocols

- Regular system audits and certifications

- Integration with legacy systems

Technical Complexity Barriers

- Cross-border data transfer restrictions

- Multi-jurisdiction compliance requirements

- Real-time monitoring capabilities

- Documentation and reporting demands

The cost of non-compliance drives organizations to invest heavily in robust GRC solutions. Small and medium enterprises face particular challenges balancing comprehensive compliance needs with budget constraints. Many organizations struggle with resource allocation between maintaining existing compliance programs and implementing new regulatory requirements.

These challenges push vendors to develop more sophisticated yet user-friendly solutions, sparking innovation in automated compliance monitoring and risk assessment capabilities. The regulatory landscape continues to evolve, requiring GRC platforms to maintain flexibility and adaptability in their core functionalities.

Geopolitical Factors Affecting GRC Platform Adoption

Geopolitical dynamics create significant ripple effects across the global compliance landscape, directly impacting how organizations implement and utilize GRC platforms. Recent trade tensions between major economies have reshaped compliance requirements:

U.S.-China Trade Relations

- Stricter data localization requirements

- Enhanced supply chain documentation

- Modified intellectual property protection protocols

Brexit Impact

- Dual compliance frameworks for UK-EU operations

- New cross-border data transfer regulations

- Restructured financial services compliance

Regional regulatory variations demand specialized GRC platform features:

Asia-Pacific

- Data sovereignty requirements

- Industry-specific certification standards

- Local language support capabilities

European Union

- GDPR compliance tools

- ESG reporting mechanisms

- Cross-border transaction monitoring

Middle East

- Shariah-compliant financial modules

- Local partnership documentation

- Region-specific reporting formats

Political instability in key markets creates additional compliance layers:

- Sanctions monitoring systems

- Enhanced due diligence requirements

- Real-time regulatory update tracking

- Political risk assessment tools

GRC vendors adapt their platforms to address these geopolitical complexities through:

- Configurable compliance workflows

- Multi-jurisdiction reporting capabilities

- Automated regulatory updates

- Risk assessment matrices for political events

GRC Platform Market Segmentation: Types and Features

GRC platforms divide into distinct categories based on their primary functions:

1. Risk Management Platforms

These platforms focus on identifying, assessing, and mitigating risks within an organization. Key features include:

- Threat identification and assessment tools

- Real-time risk monitoring capabilities

- Predictive analytics for risk forecasting

- Incident management features

- Risk reporting dashboards

2. Compliance Management Platforms

These platforms are designed to help organizations adhere to regulatory requirements and internal policies. Key features include:

- Regulatory requirement tracking

- Automated compliance workflows

- Policy management tools

- Audit trail documentation

- Compliance reporting functions

3. Integrated GRC Solutions

These solutions combine both risk management and compliance features into a single platform. Key benefits include:

- Combined risk and compliance features

- Enterprise-wide visibility

- Unified reporting capabilities

- Cross-functional collaboration tools

Organizations must evaluate these platform types against their specific needs, industry requirements, and operational scale. The right GRC solution balances comprehensive functionality with practical usability, ensuring effective risk management and compliance oversight across the enterprise.

Key features driving platform selection decisions include:

1. User Interface Design

An intuitive and user-friendly interface is crucial for ensuring that employees can easily navigate the platform and access the information they need. Key considerations include:

- Intuitive navigation

- Customizable dashboards

- Mobile accessibility

- Role-based access controls

2. Integration Capabilities

The ability to integrate with existing systems and tools is essential for seamless data flow and collaboration. Key integration capabilities to look for include:

- API connectivity

- Third-party system compatibility

- Data import/export functionality

- Single sign-on support

3. Vendor Considerations

When selecting a GRC platform, it’s important to consider the reputation and expertise of the vendor. This includes evaluating factors such as:

- Market reputation

- Technical support quality

- Implementation expertise

- Product roadmap clarity

Applications Driving Growth in Governance, Risk, and Compliance Platforms

Risk management applications are leading the growth of GRC platforms, solving important operational problems in various industries. These applications excel in:

- Threat Detection and Assessment

- Real-time monitoring of potential risks

- Predictive analytics for emerging threats

- Impact analysis on business operations

- Business Continuity Planning

- Automated risk scoring systems

- Incident response protocols

- Resource allocation optimization

The compliance management landscape has transformed into sophisticated, integrated solutions. Modern compliance applications now offer:

- Multi-Regulatory Coverage

- Single-platform management of diverse regulations

- Cross-border compliance monitoring

- Industry-specific requirement tracking

- Dynamic Reporting Capabilities

- Customizable compliance dashboards

- Real-time status updates

- Automated report generation

Organizations implementing these applications report significant improvements in risk identification rates and compliance efficiency. A recent industry survey reveals 73% of businesses using integrated GRC platforms experience reduced compliance violations and faster audit completions.

The applications continue to evolve, incorporating advanced features like:

- AI-powered risk predictions

- Blockchain-based compliance verification

- Natural language processing for regulatory updates

- Automated workflow management

- Cross-functional data integration

These technological advancements create robust solutions that adapt to changing business environments and regulatory landscapes.

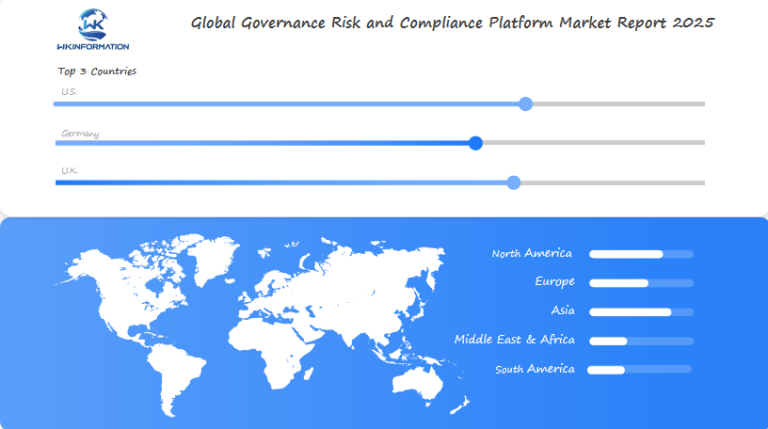

Regional Insights: Key Growth Areas for GRC Platforms

The GRC platform market exhibits distinct regional patterns, with three key areas driving significant growth:

1. North America

- Mature market with high technology adoption rates

- Strong presence of established GRC vendors

- Strict regulatory environment driving demand

- Banking and healthcare sectors leading implementation

2. Europe

- Growing emphasis on data protection regulations

- Rising adoption of cloud-based GRC solutions

- Strong focus on cybersecurity compliance

- Financial services sector showing robust demand

3. Asia Pacific

- Rapid digital transformation across industries

- Emerging markets creating new opportunities

- Increasing regulatory complexity

- Manufacturing and retail sectors showing high growth potential

Each region presents unique market dynamics. North American organizations prioritize advanced analytics and AI integration in their GRC platforms. European businesses seek solutions with built-in GDPR compliance capabilities. Asia Pacific companies demand scalable platforms that can adapt to rapidly evolving regulatory landscapes.

The competitive landscape varies by region. North America hosts major vendors like IBM and Microsoft. Europe features strong regional players specializing in local compliance requirements. Asia Pacific sees increasing participation from local technology providers offering customized GRC solutions.

Market penetration rates differ across regions, with North America showing the highest adoption levels, followed by Europe. Asia Pacific demonstrates the fastest growth rate, driven by increasing awareness and regulatory pressures.

U.S. Market: GRC Platform Solutions and Key Drivers

The U.S. market is a leader in adopting GRC platforms, driven by complex regulations and strict compliance needs across industries. The introduction of important laws has created a strong demand for advanced GRC solutions:

SOX Compliance Requirements

Organizations must follow these requirements to comply with the Sarbanes-Oxley Act (SOX):

- Financial reporting controls: Organizations must maintain comprehensive internal control frameworks

- Data accuracy verification: Automated systems for tracking and validating financial data

- Audit trail documentation: Solutions that provide detailed records of all financial transactions

- Real-time monitoring: Platforms offering continuous assessment of control effectiveness

HIPAA Healthcare Compliance

The Health Insurance Portability and Accountability Act (HIPAA) sets specific compliance standards for the healthcare industry, including:

- Protected Health Information (PHI) management

- Security risk assessment tools

- Patient data privacy controls

- Breach notification systems

The U.S. healthcare sector has seen a 73% increase in adopting GRC platforms, mainly due to:

- Rising cybersecurity threats

- Increased digital health initiatives

- Remote healthcare delivery expansion

- Stricter enforcement of privacy regulations

Industry-Specific Drivers

Different industries have their own specific factors driving the need for GRC solutions:

Financial Services

In the financial services sector, compliance requirements such as Basel III, anti-money laundering (AML) regulations, Know Your Customer (KYC) protocols, and Dodd-Frank Act compliance are key drivers for adopting GRC platforms.

Technology Sector

The technology sector is influenced by data privacy regulations, cybersecurity requirements, cloud service compliance, and digital rights management as important factors pushing the adoption of GRC solutions.

Market Response and Innovation

U.S. organizations are heavily investing in GRC platforms that offer:

- Integrated Solutions

- AI-Powered Features

- Mobile Accessibility

Integrated Solutions

These solutions focus on managing compliance across different functions, automating risk assessments, and providing real-time reporting capabilities.

AI-Powered Features

By leveraging artificial intelligence (AI), GRC platforms can offer predictive risk analytics, automated compliance monitoring, and pattern recognition for fraud detection.

Mobile Accessibility

With the increasing need for flexibility and remote work options, GRC providers are also prioritizing mobile accessibility features such as remote access capabilities, on-the-go compliance checking, and real-time alert systems.

The U.S. market has witnessed a significant shift towards cloud-based GRC solutions, with 82% of new implementations opting for cloud deployment instead of on-premises options. This trend reflects the growing need for:

- Scalability in managing compliance

- Cost-effective deployment choices

- Quick updates to adapt to changing regulations

- Improved collaboration among stakeholders

Germany's Growing Role in GRC Technology

Germany is leading the way in GRC (Governance, Risk, and Compliance) technology innovation. This is largely due to its strict regulatory environment and commitment to digital transformation. The country’s approach to GRC platforms reflects its reputation for precision engineering and strong data protection standards.

Key Technology Developments in German GRC Solutions:

- AI-powered risk assessment tools that analyze real-time data streams

- Blockchain integration for immutable audit trails

- Natural Language Processing capabilities for automated document review

- Predictive analytics for early risk detection

German GRC providers prioritize data privacy by using advanced encryption protocols and secure cloud architectures. This focus aligns with the country’s strict data protection laws and has an impact on global GRC platform development.

Regulatory Evolution Impact:

- Implementation of Supply Chain Due Diligence Act (Lieferkettensorgfaltspflichtengesetz)

- Enhanced ESG reporting requirements

- Stricter cybersecurity standards for critical infrastructure

- Integration of EU-wide regulatory frameworks

The German market is known for its innovative features in modern GRC platforms:

- Multi-language compliance documentation

- Cross-border regulatory mapping

- Automated regulatory updates

- Real-time compliance monitoring dashboards

German companies are at the forefront of developing GRC solutions that combine technical excellence with practical usability. Their platforms are increasingly incorporating machine learning algorithms to detect patterns in compliance violations and predict potential risks before they occur.

German GRC technology continues to influence international standards through its emphasis on precision, data protection, and regulatory compliance. These advancements position Germany as a key player in shaping the future of the global GRC platform market.

The U.K. Market: GRC Platform Adoption and Trends

The GRC platform market in the U.K. has its own unique features influenced by regulatory changes related to Brexit and the strict requirements set by the Financial Conduct Authority (FCA). British organizations face specific challenges in ensuring compliance with both EU and U.K. regulatory systems.

Key Market Drivers:

- Post-Brexit regulatory divergence

- Data protection requirements under U.K. GDPR

- Financial services sector modernization

- Cybersecurity compliance demands

The financial services industry in the U.K. is leading the way in adopting GRC platforms. Banks and insurance companies are implementing advanced solutions to manage their regulatory reporting obligations. These organizations usually choose cloud-based platforms that provide real-time monitoring capabilities.

Emerging Adoption Patterns:

- Integrated Risk Management: 76% of U.K. businesses now prioritize integrated risk management solutions

- Automated Compliance: Rising demand for AI-powered compliance monitoring tools

- Third-Party Risk Management: Enhanced focus on vendor risk assessment capabilities

U.K. organizations are particularly interested in GRC platforms that offer advanced reporting features for regulatory submissions to the FCA and PRA (Prudential Regulation Authority). There is a growing demand for solutions that provide customizable dashboards and automated risk assessment tools specifically designed for U.K. regulatory frameworks.

Small and medium-sized enterprises in the U.K. market are leaning towards modular GRC solutions, which allow them to expand their compliance capabilities as their businesses grow. These platforms typically offer flexible pricing models and industry-specific compliance templates.

Future Outlook for Governance, Risk, and Compliance Platforms

The GRC platform landscape is set to undergo significant changes through 2025 and beyond. Key technological advancements are reshaping platform capabilities:

- Blockchain Integration: Smart contracts and distributed ledger technology will enhance transparency and automate compliance verification processes

- Real-time Risk Analytics: Advanced AI algorithms will enable continuous monitoring and instant risk assessment capabilities

- IoT Integration: Connected devices will provide granular data for enhanced risk detection and compliance monitoring

The rise of industry-specific GRC solutions marks a shift from one-size-fits-all approaches. Healthcare organizations can expect platforms tailored to HIPAA requirements, while financial institutions will see solutions optimized for Basel III compliance.

As businesses navigate complex international regulations, cross-border collaboration features will become standard. These features include:

- Multi-language support

- Region-specific compliance templates

- Automated regulatory updates

- Cross-jurisdiction reporting capabilities

The emergence of predictive compliance capabilities will help organizations anticipate regulatory changes and adapt proactively. Machine learning models will analyze regulatory trends and enforcement patterns to forecast potential compliance requirements.

Mobile-first GRC platforms will gain prominence, enabling real-time risk management and compliance monitoring from any location. This shift reflects the growing need for flexible, accessible governance solutions in remote work environments.

Competitive Landscape: Leading GRC Platform Providers

- ACL Services Ltd. dba Galvanize – Vancouver, Canada

- Check Point Software Technologies Ltd. – Tel Aviv, Israel

- Corporater AS – Stavanger, Norway

- Fidelity National Information Services Inc. – Jacksonville, Florida, USA

- IBM Corporation – Armonk, New York, USA

- LogicManager Inc. – Boston, Massachusetts, USA

- Mega International SA – Paris, France

- MetricStream Inc. – Palo Alto, California, USA

- Microsoft Corp. – Redmond, Washington, USA

- Mitratech Holdings Inc. – Austin, Texas, USA

- NAVEX Global Inc. – Lake Oswego, Oregon, USA

- OneTrust LLC – Atlanta, Georgia, USA

- Oracle Corp. – Austin, Texas, USA

- SAP SE – Walldorf, Germany

- SAS Institute Inc. – Cary, North Carolina, USA

- Software AG – Darmstadt, Germany

- Thomson Reuters Corp. – Toronto, Canada

- Wolters Kluwer NV – Alphen aan den Rijn, Netherlands

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Governance Risk and Compliance Platform Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The GRC platform market is expected to reach $57.61 billion by 2025, indicating a significant change in how organizations handle risk management and compliance. This growth is driven by the complexity of regulatory requirements and the need for integrated solutions across business functions.

Key Market Dynamics:

- AI and ML technologies drive intelligent automation

- Cloud-based solutions enable scalability

- Regional regulations shape product development

- ESG considerations influence adoption rates

The U.S., Germany, and U.K. markets have distinct characteristics in GRC platform adoption, with each region’s regulatory framework fostering innovation and implementation. The U.S. leads with SOX and HIPAA compliance demands, Germany emphasizes ESG standards, and the U.K. focuses on post-Brexit regulatory alignment.

Strategic Recommendations:

- Evaluate current GRC capabilities against emerging risks

- Consider cloud-based solutions for enhanced flexibility

- Prioritize platforms with strong AI/ML integration

- Select vendors with proven regional compliance expertise

The GRC platform market is continuously evolving due to technological advancements and changing regulatory environments. Organizations must take a proactive approach to governance, risk, and compliance in order to stay competitive and resilient in an increasingly complex business landscape.

Global Governance Risk and Compliance Platform Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Governance Risk and Compliance Platform Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Governance Risk and Compliance PlatformMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Governance Risk and Compliance Platform players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: Governance Risk and Compliance Platform Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Governance Risk and Compliance Platform Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Governance Risk and Compliance Platform Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofGovernance Risk and Compliance Platform Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the upstream dynamics influencing the Governance, Risk, and Compliance (GRC) platform market?

Upstream dynamics in the GRC platform market include technological advancements that enhance platform functionality and regulatory changes that organizations must adapt to. These factors significantly influence how GRC solutions are developed and implemented.

How do downstream dynamics affect businesses using GRC solutions?

Downstream dynamics impact businesses by improving risk management practices and enhancing compliance capabilities through the use of GRC solutions. This leads to better decision-making and operational resilience for organizations.

What key trends are shaping the GRC platform market today?

Key trends in the GRC platform market include the integration of AI and machine learning for automation and data analytics, as well as the adoption of cloud-based solutions which provide scalability, flexibility, and cost-effectiveness for organizations.

What regulatory challenges do organizations face when implementing GRC solutions?

Organizations encounter various regulatory challenges such as data privacy regulations and industry-specific standards. These challenges can increase implementation costs and complexity, impacting the adoption of GRC platforms.

How do geopolitical factors influence GRC platform adoption?

Geopolitical factors like trade wars or political instability shape compliance requirements for businesses operating internationally. Additionally, regional differences in regulatory expectations necessitate that GRC vendors tailor their products accordingly.

What applications are driving growth in Governance, Risk, and Compliance platforms?

Growth in GRC platforms is driven by risk management applications that help identify operational risks and compliance applications that evolve towards integrated solutions addressing multiple regulatory requirements simultaneously.