2025 HIC Substrates Market: Harnessing $392 Million Global Potential, Supported by Key Players in China, US, and Germany

A comprehensive analysis of the global HIC substrates market, focusing on China, US, and Germany’s dominance in 2025. Explores key trends, manufacturing capabilities, R&D investments, and sustainability initiatives shaping the electronics industry’s future. Essential insights for stakeholders in high-performance electronic components.

- Last Updated:

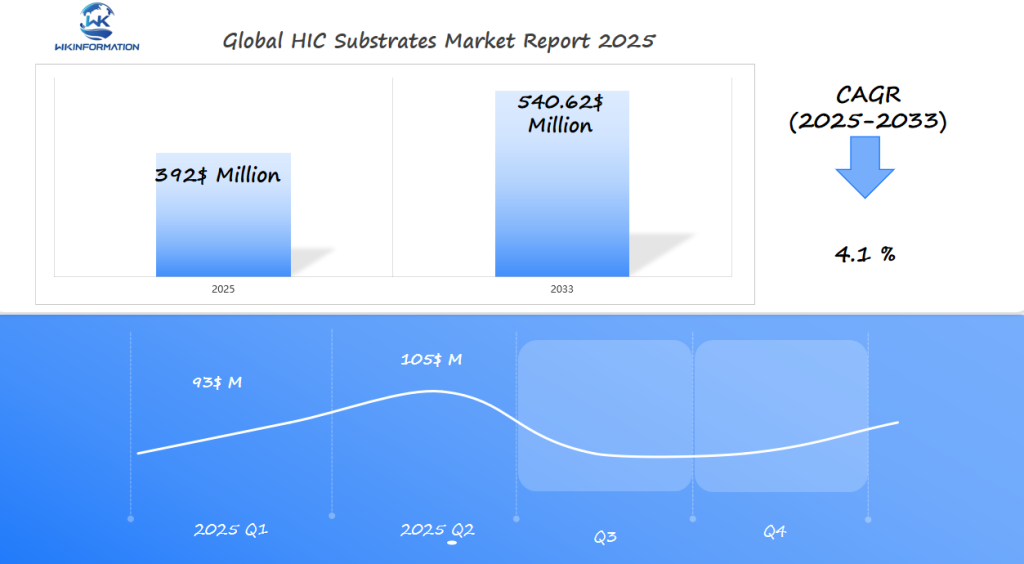

HIC Substrates Market Forecast for Q1 and Q2 of 2025

The global HIC Substrates market is estimated to reach approximately $392 million by the end of 2025, with steady growth fueled by demand across key industries such as automotive electronics, telecommunications, and consumer devices. For Q1 2025, we forecast the market will be valued at around $93 million, driven by initial demand in regions like China, the U.S., and Germany, where electronics manufacturing is expected to pick up pace at the beginning of the year.

By Q2 2025, the market is anticipated to grow to approximately $105 million, as increased demand for high-frequency applications and miniaturization of electronic devices boosts the need for high-quality HIC substrates. China, the U.S., and Germany will continue to be the most significant countries in driving the market forward, with China leading in production capacity, the U.S. maintaining strong demand from automotive and tech sectors, and Germany emerging as a key player in high-tech and industrial applications.

The market is expected to achieve a Compound Annual Growth Rate (CAGR) of 4.1% by 2033, reflecting long-term, sustainable growth in line with technological advancements. For a deeper analysis of regional dynamics, market trends, and competitive strategies, we encourage you to explore the full Wkinformation Research report.

Key Takeaways

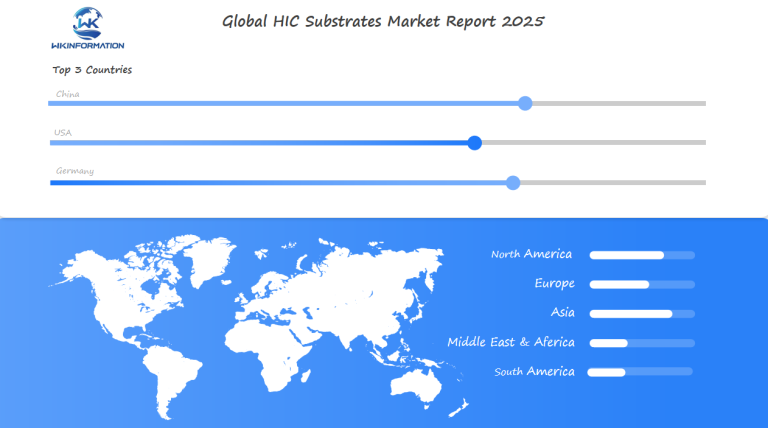

- China, the U.S., and Germany lead the HIC substrates market growth race in 2025.

- Hybrid integrated circuit substrates innovation is critical for staying competitive in electronics manufacturing.

- Market expansion hinges on these three countries’ strategies for scaling production and advancing tech.

- Global electronics market leaders are prioritizing material science and automation to meet demand.

- Understanding regional advantages helps businesses capitalize on HIC substrates’ rising importance.

Upstream and Downstream Industry Chain Analysis: The HIC Substrates Supply Chain Explained

Every HIC substrate has a complex story behind it. The HIC substrates supply chain connects raw materials to electronics makers. It shapes the global industry. This section dives into how materials, production, and use come together in modern electronics.

Raw Material Sourcing: Critical Components for HIC Substrate Manufacturing

Getting started with electronics involves special materials like alumina ceramics and silver-filled epoxies. TDK and Murata lead in ceramics, while DuPont offers advanced polymers. Japan leads in ceramics, and Germany excels in precision pastes.

But, regional shortages in rare metals can slow down the HIC substrates supply chain. This affects global production times.

Manufacturing Process Flow: From Materials to Finished Substrates

The hybrid circuit manufacturing process has four main steps:

- Material blending in cleanroom environments

- Laser-printed circuit etching

- High-temperature sintering

- Automated testing for thermal/ electrical specs

End-User Integration: How HIC Substrates Enter Consumer Products

Finished substrates find their way into many products. They’re in automotive ECUs, 5G modems, and medical devices. Companies like Bosch use them in engine control systems, while Apple puts them in wearables.

Markets vary: U.S. firms focus on quick prototyping, while German ones aim for long-term reliability.

Trend Analysis: Innovations and Trends in HIC Substrates Technology

From smaller phone parts to quicker data centers, HIC technology innovations are changing electronics. Companies are working hard to make things smaller but still powerful. Here are the main trends leading this change.

Miniaturization Advancements in HIC Substrate Design

Electronics are getting smaller and smaller. Companies like Panasonic and Ibiden make substrates just 50 microns thick. This lets devices like wearables stay small but still pack a punch.

They use special tools to make layers thinner and circuits closer together. This cuts down space without losing heat dissipation.

Material Science Breakthroughs Enhancing Performance

New materials are opening up new possibilities. Murata Manufacturing has made ceramic substrates with 96% alumina purity. This cuts down signal loss by 30%.

German companies like SCHURTER are working on copper-molybdenum composites. These materials help devices handle more power.

Energy Efficiency Improvements Through Substrate Innovation

Now, substrate design focuses on saving energy. U.S. innovators like 3M have made polymer-based substrates. These reduce power use by 15% in IoT devices.

New dielectric materials also help. They lower resistance, making batteries last longer in phones and drones. These changes save a lot of energy in data centers.

Restriction Analysis: Challenges Facing the HIC Substrates Industry

The HIC substrates sector is facing big challenges. These include HIC substrate manufacturing challenges. Issues like material shortages and rules from the electronics industry are major hurdles. To grow, innovators must find ways to overcome these problems.

Supply Chain Vulnerabilities and Material Shortages

Global supply chains struggle with substrate production limitations. For example, Japan controls some rare earth elements. This creates risks for makers.

The U.S. is focusing on working with local suppliers. Germany is pushing for recycling in the EU. China is expanding its mineral reserves to avoid supply problems.

Technical Manufacturing Limitations and Yield Challenges

Creating complex designs is hard. Low yield rates make it tough to meet demand. Japan’s Murata Manufacturing is using AI to improve quality.

In the U.S., Rogers Corp is working on better layer alignment. Germany’s Schott AG is using precise tools to reduce defects.

Environmental and Regulatory Compliance Hurdles

Environmental rules differ around the world. Here’s how different places handle these rules:

| Region | Key Challenge | Solution |

|---|---|---|

| China | Waste management | State-backed recycling R&D |

| U.S. | Toxic material bans | Bi-metal alloy development |

| Germany | Energy quotas | Renewable energy partnerships |

By working together, we can turn these challenges into opportunities. Collaboration between governments and manufacturers could change the industry for the better.

Geopolitical Analysis: The Impact of Global Politics on HIC Substrates Production and Trade

Global politics is changing the HIC substrates industry. Electronics trade policy disputes and HIC market geopolitics are affecting where and how products are made. Governments now see advanced manufacturing as a strategic asset, changing traditional supply chains.

“Technology leadership depends on secure, resilient supply chains,” emphasized the U.S. Commerce Department in 2023, highlighting national security technology concerns driving policy changes.

Trade Policies and Tariff Impacts on the HIC Supply Chain

- U.S. Section 301 tariffs on Chinese imports have forced companies like TTM Technologies and Ibiden to rethink Asia-Pacific sourcing strategies

- EU’s Critical Raw Materials Act now mandates dual-sourcing for HIC substrates used in defense electronics

- Japan’s revised export controls target HIC materials used in AI chip fabrication

National Security Considerations in Advanced Electronics

U.S. CHIPS Act subsidies are redirecting $52B toward domestic HIC production facilities. Germany’s Red Carpet Program offers tax breaks for HIC factories near automotive clusters. These policies reflect growing fears over reliance on foreign tech.

Regional Manufacturing Alliances and Strategic Partnerships

U.S.-Japan semiconductor pacts now include HIC substrate co-development projects. South Korea’s Lotte Chemical expanded EU partnerships to avoid China-centric supply risks. Such alliances aim to balance national security technology concerns with cost efficiency.

Companies like Samsung Electro-Mechanics are building tri-national facilities spanning U.S., Mexico, and Taiwan to navigate geopolitical risks. This “friend-shoring” strategy shows how HIC manufacturing is becoming a geopolitical battleground.

Segmentation Type Market Analysis: HIC Substrates Market Segmentation by Type and Application

Understanding HIC substrate types is crucial in this fast-changing market. The choice between ceramic and aluminum substrates affects performance, cost, and use. Specialized applications in different industries also shape demand, leading to unique growth chances.

Aluminum Substrate Segment Analysis and Growth Projections

Aluminum substrates are popular in cost-conscious markets because they are affordable and good at conducting heat. They are used in cars and gadgets for LED lights and power modules. Experts predict a 6.2% growth rate by 2030 as makers work to improve how they make things.

Ceramic Substrate Market Share and Performance Metrics

Ceramic substrates make up 45% of the market in precise applications. Alumina and aluminum nitride types are top choices for aerospace and 5G projects. Ceramic outshines aluminum in heat resistance, making it more expensive for medical and defense needs.

Application-Specific Substrates for Specialized Electronics

- Automotive: High-temperature sensors in cars need ceramic substrates that can handle over 200°C.

- Medical: Special materials are used in medical tools because they are safe for the body.

- Consumer tech: Aluminum substrates help make thinner phones and wearables.

Preferences differ by region. China likes aluminum for making lots of products, while Germany chooses ceramic for industrial needs. This variety leads to focused research and development worldwide.

Application Market Analysis: The Role of HIC Substrates in Advanced Electronic Components

HIC substrates are key in today’s tech world. They help make devices faster and smarter. Let’s look at their role in three main areas.

| Application Area | Key Uses | Leading Countries |

|---|---|---|

| Automotive HIC applications | Electric vehicle systems, engine control units | US, Germany |

| Industrial electronics substrates | Factory automation, robotics | Germany, China |

| Consumer electronics components | Smartphones, wearable tech | US, China |

Automotive Electronics: HIC Substrates in Vehicle Systems

HIC substrates are crucial for EVs and driver-assistance systems. Companies like Tesla in the US and German automakers use them. These substrates keep engines and batteries running smoothly, even in extreme heat.

Industrial Applications: HIC Implementation in Manufacturing Equipment

In factories, HIC substrates control assembly lines and robotics. German engineering and Chinese manufacturing lead here. They make factories run more efficiently, cutting down on downtime and costs.

Consumer Electronics: Evolution of HIC Substrate Requirements

For gadgets, HIC substrates need to be small and affordable. US tech giants and Chinese makers work together. They create substrates for smartphones that support advanced 5G and sensors without losing performance.

Global HIC Substrates Market Region Analysis: Regional Market Dynamics

Regional HIC market differences shape global substrate manufacturing and electronics production geography. This section explores how regions beyond top markets like China, the U.S., and Germany contribute to industry evolution.

“Regional diversification is key to mitigating supply chain risks and unlocking new growth pathways.”

APAC Region: Beyond China to Emerging Manufacturing Hubs

Japan and South Korea lead in R&D for global substrate manufacturing. Vietnam and Thailand offer low-cost production. Taiwan’s semiconductor expertise boosts APAC’s dominance.

Challenges like supply chain volatility still exist. But Thailand’s 8% annual growth shows the region’s potential.

Americas: Market Trends Beyond the United States

- Mexico benefits from its close location to U.S. auto and tech sectors, cutting down on logistics costs.

- Brazil’s aerospace and industrial markets drive demand for specialized substrates.

- Canada’s materials innovation supports North American supply chain resilience.

EMEA: European Specialization and Middle East Growth Potential

Eastern Europe, including Poland, offers cost-effective production sites. The UAE and Saudi Arabia invest in smart manufacturing ecosystems. This capitalizes on electronics production geography shifts.

EU regulations influence sustainability practices across the region.

| Region | Key Drivers | Growth Rate |

|---|---|---|

| APAC | Technological innovation | 7-9% (2023-2030) |

| Americas | Supply chain proximity | 5-7% |

| EMEA | Government tech initiatives | 6-8% |

Understanding these dynamics helps businesses navigate global substrate manufacturing opportunities. It also addresses regional challenges like infrastructure gaps and regulatory barriers.

China HIC Substrates Market Analysis

China is a leader in China HIC manufacturing thanks to huge industrial parks in Shenzhen, Dongguan, and Shanghai. These areas make over 60% of the world’s Asian substrate production. Recent factory expansions have added $15 billion to this effort. Companies like Shenzen Circuits and Unimicron are key players, serving the Chinese electronics industry.

They supply parts for cars, phones, and other tech gadgets.

Manufacturing Scale and Capacity Investments

- Shenzhen: 40+ advanced substrate factories with 2024 output targets exceeding 100 million units

- Dongguan: New 5G substrate lines reducing lead times by 30%

- Government-backed “Integrated Circuit Parks” adding 20% annual capacity growth

Technological Development and Innovation Centers

| Institution | Focus Areas |

|---|---|

| Chinese Academy of Sciences | High-frequency substrate R&D |

| Harbin Institute of Technology | Material science collaborations |

| ShanghaiTech University | AI-driven quality control systems |

Government Policies Supporting Electronics Manufacturing

Policies like Made in China 2025 focus on China HIC manufacturing. They include:

- $300M annual subsidies for substrate R&D

- Customs duty exemptions for semiconductor imports

- IP protection reforms addressing past disputes

Now, new facilities must recycle 30% of wastewater. This shows a balance between growth and protecting the environment.

US HIC Substrates Market Analysis

US electronics manufacturing is at the forefront of HIC substrates innovation worldwide. Companies like Intel and Texas Instruments are leading American HIC innovation through their R&D efforts. They partner with top universities like MIT and Sandia National Labs to develop new materials.

This ensures the US remains a key player in substrate technology.

Innovation Ecosystem Fuels Growth

Research centers in Silicon Valley, Austin, and Boston are driving substrate breakthroughs. These centers work with the government to speed up development. This partnership makes the US a leader in high-performance substrate solutions.

Reshoring Investments Boost Production

CHIPS Act funding and state tax incentives are boosting domestic substrate production. New factories in Arizona and Texas are focusing on defense and 5G markets. By automating production, costs are lowered, making domestic production more competitive.

Defense Contracts Drive Demand

Aerospace companies like Lockheed Martin and Boeing need substrates for their systems. Military contracts provide a steady demand for reliable substrates. This demand drives specialized R&D investments.

Germany HIC Substrates Market Analysis

Germany’s HIC substrates sector is known for its German precision electronics skills. The country’s engineering excellence shapes every stage of European HIC production. This ensures products meet high quality standards.

This focus on precision drives innovation in the automotive field. Substrates play a key role in enabling advanced automotive substrate applications. These include electric vehicles and autonomous systems.

Automotive integration is a major driver. German manufacturers work closely with carmakers like BMW and Mercedes. They design substrates that handle high thermal demands.

A recent industry report shows 78% of automotive electronics in premium vehicles use substrates made via European HIC production methods.

“Precision isn’t optional—it’s the foundation of trust in automotive electronics.” – Bosch Electronics Systems Division

| Factor | Germany’s Approach | Impact |

|---|---|---|

| Quality Control | Automated defect detection systems | 99.4% yield rates in substrate manufacturing |

| Industry 4.0 | AI-driven production adjustments | 20% faster time-to-market for automotive components |

| Regulatory Leadership | EU compliance standards development | Streamlined exports across 27 EU member states |

Factories in Bavaria and Baden-Württemberg use Industry 4.0 tools to improve production. Sensors and real-time data analytics reduce defects and boost output. This tech integration meets EU’s green manufacturing directives, ensuring substrates meet performance and sustainability targets.

Future Development Analysis: The Future of HIC Substrates in High-Performance Electronics

The HIC substrates sector is set for major advancements. This is thanks to new future electronics materials and advanced HIC manufacturing. Scientists are working hard to make substrates with graphene for better conductivity. They also aim to use bio-based composites to cut down on e-waste.

Next-Gen Materials R&D

New substrates are being developed with exciting features. They might have self-healing properties or handle heat really well. Companies like Taiyo Nippon Thompson and Panasonic are exploring nanoceramic blends for 5G needs.

Universities and companies are teaming up. They aim to turn lab ideas into products everyone can use.

Smart Manufacturing Shifts

Advanced HIC manufacturing is getting smarter with AI. Tools like laser direct structuring and 3D printing are making complex designs possible. Bosch and Siemens are testing new ways to make things faster.

They’re combining old methods with new ones. This could make production 40% quicker.

New Markets Take Shape

- Quantum computing: IBM and Intel seek substrates with cryogenic stability

- Medical tech: Flexible substrates for wearable health monitors

- Space exploration: Radiation-resistant substrates for satellite systems

New uses for substrates are emerging. These could make niche markets three times bigger by 2030. Asian makers are leading in material research. Meanwhile, Western companies are focusing on space-related needs.

“The next decade will see substrates as critical as semiconductors themselves,” says Dr. Li Wei from the Institute of Microelectronics, Shanghai.

Competitor Analysis: Major Players in the HIC Substrates Market

- Shinko Electric Industries

- Ibiden

- Nan Ya PCB

- Unimicron

- Kinsus

- SEMCO (Samsung Electro-Mechanics)

- Simmtech

- Daeduck

- Ajinomoto

- TOWA Corporation

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global HIC Substrates Market Report |

| Base Year | 2024 |

| Segment by Type |

· Al2O3 HIC Substrates · AlN HIC Substrates |

| Segment by Application |

· Telecommunications · Consumer Electronics · Automotive · Aerospace · Medical Devices |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

As we look towards 2025, the HIC substrates market is set for big changes. The mix of new tech, global politics, and competition will open up new chances for growth. Here’s how businesses can get ready to succeed.

Investment Potential Across Regional Markets

Investors in the HIC market investment need to look at each region’s strengths. China’s big factories, the U.S.’s R&D, and Germany’s precision engineering are all key areas. Focusing on fast-growing fields like cars and industrial electronics can lead to big gains, matching global needs.

Technology Acquisition and Partnership Strategies

Partnerships are key in the electronics industry strategy. Deals with Chinese innovators, U.S. firms, and German makers bring in the latest tech. Working together across borders cuts risks and speeds up innovation.

Long-Term Market Positioning for Sustained Growth

To stay strong, companies must focus on sustainability and train skilled workers. Those who use green practices and flexible supply chains will lead the substrate market growth opportunities. Keeping up with rules in places like the EU and U.S. will also help stay ahead.

By 2025, the world may see a shift in who leads the market. New uses like 5G and self-driving cars will increase demand. Companies that invest in R&D and stay flexible will do well in this changing world.

Global HIC Substrates Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: HIC Substrates Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- HIC SubstratesMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global HIC Substratesplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: HIC Substrates Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: HIC Substrates Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: HIC Substrates Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofHIC SubstratesMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are HIC substrates and why are they important in electronics?

HIC substrates are key in modern electronics. They support electronic parts, making devices like smartphones and cars work well. This support is crucial for high performance and reliability.

Which countries are leading the HIC substrates market?

China, the United States, and Germany lead the HIC substrates market. Each country has strengths like big manufacturing, R&D, and precision engineering. These strengths help them stay on top.

What challenges does the HIC substrates industry face?

The HIC substrates industry faces challenges like supply chain issues and material shortages. There’s also a need to follow more rules. These problems can slow down production and affect prices.

How do geopolitical factors influence HIC substrates production?

Trade policies, tariffs, and national security worries affect HIC substrates. These issues can shake up supply chains. Companies are looking for ways to make their production more stable.

What innovations are shaping the future of HIC substrates?

New materials like graphene and advanced polymers are changing HIC substrates. So are new ways of making things, like 3D printing. These advancements help meet new tech needs.

How are HIC substrates integrated into consumer products?

HIC substrates are vital in consumer electronics. They help support parts in gadgets like smartphones and smart home devices. Their role is key for good performance and energy use.

What applications most benefit from HIC substrates?

HIC substrates are especially useful in cars, industry, and gadgets. They meet specific needs like keeping cars cool and making gadgets smaller.

How does industry specialization vary among the top players in HIC substrates?

China, the US, and Germany each have their own focus. China is big on making things, the US is great at inventing, and Germany is known for quality and precision.