$1.89 Billion High Emissivity Coating Market Set to Revolutionize Industries in South Korea, the U.S., and France by 2025

Discover how the High Emissivity Coating Market is transforming industrial efficiency with innovative thermal solutions, driving growth across manufacturing and automotive sectors globally

- Last Updated:

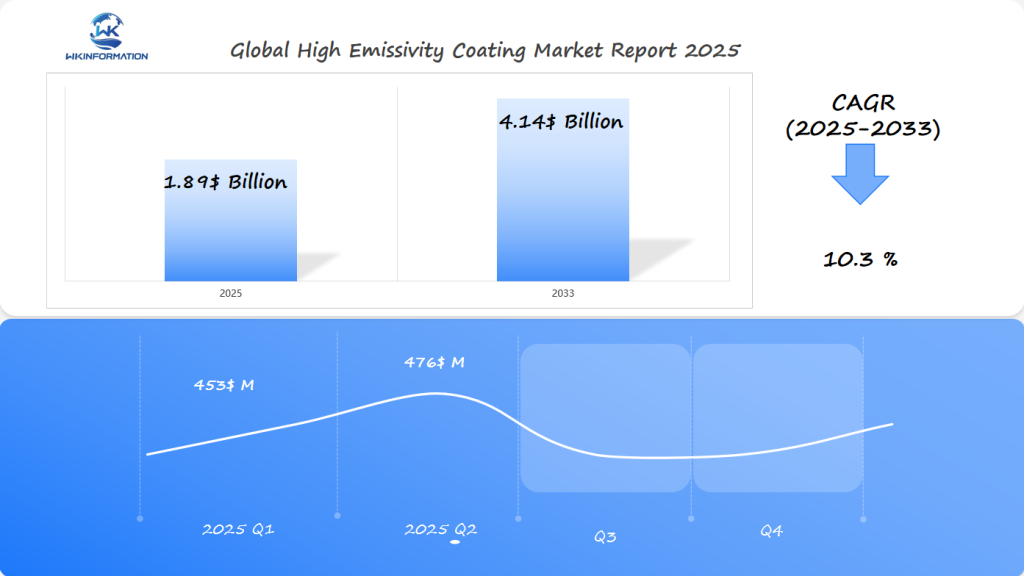

Projected Market Insights for High Emissivity Coating in Q1 and Q2 of 2025

The High Emissivity Coating market is projected to reach $1.89 billion in 2025, with a CAGR of 10.3% from 2025 to 2033. In Q1, the market is expected to generate approximately $453 million, driven by the increasing demand for high-efficiency coatings in industries like aerospace, automotive, and electronics. By Q2, the market is expected to grow to about $476 million, reflecting continued expansion.

Key Contributors to Market Growth

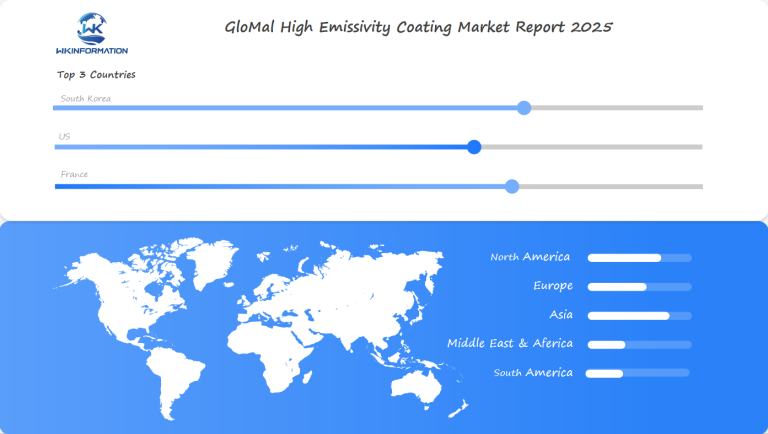

South Korea, the U.S., and France are expected to be the primary contributors to this market:

- South Korea leads with its strong aerospace and electronics sectors

- The U.S. continues to drive demand through innovation in industrial coatings

- France’s aerospace and energy industries will further fuel market growth

The trend towards energy-efficient solutions and advanced coatings technologies will continue to drive the market forward in these countries.

Understanding the Upstream and Downstream Industry Chains for High Emissivity Coatings

The high emissivity coating industry is a complex web of supply chain parts. It drives innovation and market growth. Each stage, from raw materials to distribution, is crucial for delivering advanced coatings to various industries.

The supply chain for high emissivity coatings has many stages. It turns basic materials into specialized industrial products. Manufacturers use advanced technologies to make coatings that manage heat well.

Raw Material Suppliers and Manufacturing Processes

Choosing the right raw materials is key in making high emissivity coatings. Important components include:

- Ceramic compounds

- Metal oxides

- Advanced polymer systems

- Specialized chemical additives

Creating high emissivity coatings requires precise engineering and controlled environments. The process involves:

- Chemical formulation

- Substrate preparation

- Coating application

- Thermal curing

- Quality control testing

Distribution Channels and End-User Industries

Distribution channels for high emissivity coatings cover many sectors. This creates a strong market ecosystem. Key end-user industries are:

| Industry Sector Primary Applications Aerospace | Thermal management systems |

| Automotive | Engine component protection |

| Electronics | Heat dissipation solutions |

| Industrial Manufacturing | Equipment thermal regulation |

“The future of high emissivity coatings lies in understanding and optimizing each stage of the supply chain.” – Industrial Coating Research Institute

Strategic partnerships between suppliers, manufacturers, and users are key. They drive tech advancements in high emissivity coatings.

Key Trends Driving the High Emissivity Coating Market

The high emissivity coating market is changing fast. New technologies and market trends are leading the way. Companies are working hard to create better coatings that solve big problems. Market research shows the coating technology market is growing fast.

Technological Advancements in Coating Formulations

New coating technology is changing how we do things in industry. Scientists are making new formulas that:

- Make things work better

- Last longer

- Transfer energy better

Growing Demand for Energy-Efficient Solutions

More people want coatings that save energy. Industries are looking for coatings that:

- Save heat

- Manage temperature better

- Use less energy

Increasing Focus on Sustainable Manufacturing

Green manufacturing is changing the coating industry. Companies are using eco-friendly coatings that are good for the planet and work well.

The sol-gel coating segment is leading the way, especially in cars. This shows the market’s push for green and innovative solutions.

Challenges and Opportunities in High Emissivity Coating Production

The high emissivity coating market is complex, with both challenges and opportunities. Manufacturers are dealing with new technologies and economic limits.

Overcoming Technical Limitations

High emissivity coating production faces big technical hurdles. These include:

- Ensuring consistent material performance in various conditions

- Creating scalable manufacturing methods

- Keeping high solar reflectivity and thermal emissivity

Addressing Cost Concerns

Cost-effectiveness is key for manufacturers. Ways to lower costs include:

- Using advanced roll-to-roll fabrication

- Exploring new materials like PDMS sponges

- Applying machine learning for better material design

Expanding into New Application Areas

New market opportunities are driving innovation in many fields. The growth of electric vehicles and green infrastructure is huge. Asia Pacific and North America are leading with new projects and tech.

Geopolitical Factors Impacting the High Emissivity Coating Industry

The global high emissivity coating market is undergoing significant changes due to complex political dynamics. Actions taken by countries, trade regulations, and economic trends are all influencing the industry. This creates both challenges and opportunities for manufacturers and investors.

New political developments are reshaping the production and distribution of high emissivity coatings. Governments are implementing policies that have an impact on markets and the global economy.

Trade Policies and Market Regulations

International trade rules are making things tricky for high emissivity coating makers. Key things include:

- Strict green rules pushing for new ideas

- Changes in tariffs affecting material trade

- Rules to protect ideas and inventions

Regional Market Dynamics

Every area has its own way of growing the high emissivity coating industry:

| Region | Market Characteristic | Growth Potential |

| North America | Focus on new tech | High |

| Asia-Pacific | Low costs for making | Very High |

| European Union | Emphasis on being green | Moderate |

Impact of Global Economic Trends

The world economy is putting a lot of pressure on high emissivity coating markets. Economic interdependence and new tech are opening up big chances for growth and expanding markets.

Companies need to be flexible, invest in research, and have plans that can quickly adjust to market shifts.

Segmentation: Types and Applications of High Emissivity Coatings

The high emissivity coating market is full of new ideas and solutions. It covers many different areas. Each type of coating is made for a specific need in industry.

Coating types are key to how well high emissivity coatings work. The market shows a wide range of ways to make these coatings.

Water-Based vs. Solvent-Based Coatings

Water-based coatings are leading the market, making up over 52.34% of it. They are good for the environment because they:

- Release fewer harmful chemicals

- Have less impact on the environment

- Are cheaper to make

- Are better for the planet

Industry-Specific Applications

High emissivity coatings are very important in many fields. Mirrors and Low-E coatings are big parts of the market.

| Industry Sector | Market Share | Key Applications |

| Construction | 40.42% | Thermal insulation, energy efficiency |

| Automotive | 25.6% | Windshield coatings, temperature management |

| Aerospace | 15.3% | Temperature regulation, performance optimization |

Emerging Niche Markets

New coating technologies are entering special markets. These include:

- Radiative cooling materials for solar cells

- Nanoparticle-based TiO2 coatings for cooling below ambient temperature

- Personal thermal management textiles

- Advanced solar power generation solutions

These new markets show how high emissivity coatings can solve tough thermal problems in many fields.

Key Applications of High Emissivity Coatings in Various Industries

High emissivity coatings have changed how we work in many fields. They help manage heat and save energy. These coatings are key in:

- Aerospace

- Automotive

- Construction

- Manufacturing

Aerospace and Automotive Performance

In space, these coatings keep aircraft parts cool. They help prevent overheating. Cars also use them to run better and use less fuel.

- Improved thermal management for aircraft structures

- Enhanced heat resistance in automotive glass surfaces

- Reduced energy consumption in vehicle systems

Construction Industry Innovations

Buildings now use high emissivity coatings to save energy. They help keep buildings cool without using much power.

Industrial Equipment and Machinery

Manufacturers of industrial machines use these coatings to maintain optimal temperatures, resulting in prolonged lifespan and improved performance of the equipment.

With the implementation of advanced coating technologies, various industries are enhancing their operational efficiency, leading to energy conservation and increased productivity.

Global Market Performance: High Emissivity Coatings Around the World

The global market for high emissivity coatings is changing fast. It’s all about new technologies and growth. Companies and researchers are looking at how different places perform and what opportunities they offer.

- North American markets show strong tech leadership

- Asian markets are growing fast

- European regions focus on green coating solutions

Market Leaders and Regional Powerhouses

Major players in the market have a significant presence in key industries, with the United States and South Korea at the forefront. These countries heavily invest in research and development for these coatings.

Emerging Markets and Growth Potential

Emerging markets in Southeast Asia and Latin America are full of growth opportunities. Countries like India, Brazil, and Indonesia are embracing advanced coatings rapidly. This indicates they’re poised for significant growth in the future.

Comparative Analysis of Regional Adoption Rates

Adoption rates differ a lot around the world. Richer countries use these coatings more, but poorer ones are catching up fast. This shows a big potential for growth in these areas.

Growth Factors in the U.S. High Emissivity Coating Market

The U.S. high emissivity coating market is growing fast. This growth comes from new technologies and lots of R&D investments. These changes are opening up new chances for advanced coatings in many fields.

The market is also growing because of energy efficiency rules. Scientists are making new coating technologies that are better for the environment and work well.

Regulatory Support for Energy Efficiency

Government and state energy regulations are driving market growth. Here are some key actions being taken:

- Implementing stricter energy standards for buildings

- Offering tax incentives for environmentally friendly industrial projects

- Enforcing regulations to reduce energy consumption

Technological Innovation and R&D Investments

Large investments in research and development (R&D) are driving the creation of new high emissivity coating technologies. Companies are focusing on:

- Developing new nanomaterials

- Creating smart coatings with adjustable properties

- Finding more efficient methods for heat management

Increasing Industrial Demand

| Industry Sector | Coating Application | Growth Potential |

| Automotive | Thermal management | High |

| Aerospace | Thermal insulation | Medium-High |

| Construction | Energy efficiency | Very High |

More and more industries want high emissivity coatings. They need them for better heat control and energy use. This is true for cars, planes, and buildings.

South Korea’s Contribution to High Emissivity Coating Advancements

South Korea is a major contributor to the field of high emissivity coatings. The country is at the forefront of technology and market expansion, thanks to its strategic research and development efforts. With its emphasis on cutting-edge technology, South Korea is driving innovations in coating solutions.

Innovative Research and Development Approach

Korean research centers are key in advancing high emissivity coating tech. They work on making coatings more efficient and green. Their efforts tackle big industrial problems.

- Advanced materials research at leading universities

- Cutting-edge nanotechnology applications

- Precision engineering of coating formulations

Strategic Partnerships Driving Growth

South Korean firms have strong partnerships worldwide. These partnerships help them stand out in high emissivity coatings. They work in fields like electronics, cars, and space.

| Industry Sector | Partnership Focus | Innovation Impact |

| Electronics | Advanced thermal management | Enhanced device performance |

| Automotive | Energy-efficient coatings | Reduced thermal waste |

| Aerospace | High-temperature resistant solutions | Improved material durability |

Export-Oriented Growth Strategies

South Korean makers use smart export plans to show off their tech skills. Export-oriented approaches help them reach global markets with top-notch coatings.

- Targeted market expansion

- Competitive pricing models

- Emphasis on quality and innovation

The Future of High Emissivity Coatings in France and Europe

The European market for high emissivity coatings is at a turning point. France is leading the way in advanced coating technologies. These technologies meet EU regulations and environmental standards.

The European sustainable coatings market is changing fast. Several key factors are shaping its future:

- More investment in green technology research

- Focus on making manufacturing more energy-efficient

- Support for working together on technology across borders

European Union Regulations and Market Impact

EU rules are key to innovation in high emissivity coatings. The European Commission’s strict environmental rules are pushing for better, greener coatings. These coatings help reduce carbon emissions in industries.

Sustainable Coating Solutions in France

France is a leader in advanced sustainable coating technologies. French research groups and companies are investing in top-notch coatings. These coatings meet environmental and industrial standards.

| Market Segment | Growth Potential | Key Innovations |

| Aerospace Coatings | High | Nano-engineered thermal barrier coatings |

| Industrial Applications | Medium | Low-emission thermal management solutions |

| Construction Materials | Very High | Energy-efficient thermal reflective coatings |

Cross-Border Collaborations and Market Integration

Market integration is crucial for European high emissivity coating makers. Working together on research and development is breaking down old barriers. This creates a more united and innovative industry.

High Emissivity Coating Market: Challenges and Growth Opportunities

The high emissivity coating market is changing fast. It faces big challenges but also offers great chances for growth. Companies are working hard to overcome technical hurdles and find new ways to manage heat.

Scientists are making big strides in thermal materials. They’re working on:

- Nanoporous polyethylene coatings

- Y2O3/TiO2 advanced materials

- UV-reflective BaSO4 innovative solutions

Overcoming Technical and Cost Barriers

Companies are finding new ways to beat technical challenges. The global glass coatings market is set to grow a lot. New methods are making it possible to produce large films for cooling.

Expanding into New Application Areas

New areas are opening up for high emissivity coatings. These include:

- Construction thermal regulation

- Personal thermal comfort technologies

- Solar cell cooling systems

- Renewable energy infrastructure

Leveraging Sustainability Trends

Sustainability is driving the market forward. Researchers are looking at materials that work well in different conditions. This focus on saving energy is opening up new paths for these coatings.

| Market Segment | Growth Potential | Key Innovations |

| Automotive | High | Thermal management coatings |

| Construction | Very High | Energy-efficient building solutions |

| Solar Power | Moderate | Cooling system enhancements |

The future of high emissivity coatings is bright. With ongoing tech improvements, they’re tackling challenges and unlocking new growth chances.

Competitive Landscape of the High Emissivity Coating Industry

The high emissivity coating market is very competitive. Several key players are leading the way with innovation.

These companies are investing in new coating technologies. They aim to grow their market share and meet new industrial needs.

- Emisshield – United States

- Furnace Mineral Products – United Kingdom

- Tiodize – United States

- Ultramet – United States

- Applied Thin Films – United States

- Okitsumo – Japan

- Aremco – United States

- Aibang Technology – China

- ZSWH – China

- Jinshi High Temperature Material – China

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global High Emissivity Coating Market Report |

| Base Year | 2024 |

| Segment by Type |

· Water-Based · Solvent-Based |

| Segment by Application |

· Aerospace · Automotive · Construction · Manufacturing |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The global high emissivity coating market demonstrates remarkable growth, driven by technological advancements and the increasing demand for energy-efficient solutions. With a projected robust CAGR, the market is set to expand significantly, particularly in emerging regions like Asia-Pacific and Latin America. Innovation in material science and the adoption of sustainable technologies play a pivotal role in shaping its future. These coatings offer immense potential for industries aiming to enhance thermal efficiency and reduce environmental impact. The market’s promising trajectory highlights lucrative investment opportunities and underscores its critical role in advancing industrial and energy applications.

Global High Emissivity Coating Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: High Emissivity Coating Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global High Emissivity Coatingplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: High Emissivity Coating Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: High Emissivity Coating Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: High Emissivity Coating Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofHigh Emissivity Coating Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are high emissivity coatings and how do they work?

High emissivity coatings are special treatments that help surfaces release heat better. They make it easier for surfaces to send out thermal energy. This boosts energy use in many fields.

Which industries benefit the most from high emissivity coatings?

High emissivity coatings are particularly beneficial for the following industries:

- Aerospace

- Automotive

- Construction

- Industrial manufacturing

These coatings play a crucial role in these sectors by helping to manage heat, conserve energy, and enhance overall performance.

How do high emissivity coatings contribute to energy savings?

High emissivity coatings help surfaces release heat more effectively, resulting in reduced energy consumption. This leads to decreased heat loss and improved thermal efficiency, ultimately lowering costs in various aspects.

What are the main types of high emissivity coatings?

There are two main types of high emissivity coatings: water-based and solvent-based coatings. Each type has its own strengths for different applications. They differ in terms of effectiveness, environmental impact, and compatibility with other materials.

What technological challenges exist in high emissivity coating development?

Challenges include:

- Making coatings last longer

- Cutting costs

- Working well in extreme temperatures

- Finding environmentally friendly manufacturing methods

How are countries like South Korea and the United States advancing high emissivity coating technology?

Both countries are investing in new research. They’re working on better coatings, new ways to make them, and finding new uses. They focus on green tech and saving energy.

What market trends are driving growth in high emissivity coatings?

Several market trends are contributing to the growth of high emissivity coatings:

- Increased demand for energy savings: Industries are actively seeking ways to reduce energy consumption and improve efficiency, leading to a higher demand for coatings that can enhance thermal performance.

- Focus on sustainability: There is a growing emphasis on environmentally friendly practices across various sectors. High emissivity coatings align with this trend by promoting energy conservation and reducing greenhouse gas emissions.

- Advancements in coating technology: Ongoing innovations in coating formulations and application methods are expanding the possibilities for high emissivity coatings, making them more versatile and effective.

- Cost-cutting initiatives: Industries are constantly looking for ways to optimize operational costs. High emissivity coatings offer a cost-effective solution by minimizing heat loss and reducing energy expenses.

- Reduction of carbon footprints: With increasing awareness about climate change, businesses are actively seeking solutions to lower their carbon emissions. High emissivity coatings contribute to this goal by improving energy efficiency and reducing reliance on fossil fuels.

These trends indicate a positive outlook for the high emissivity coatings market as industries prioritize energy savings, sustainability, and technological advancements.

Are there environmental considerations in high emissivity coating development?

Yes, manufacturers are developing coatings that are more environmentally friendly. Their goal is to minimize the use of harmful chemicals and comply with international green standards.

How do regulatory policies impact high emissivity coating adoption?

Regulations that promote energy efficiency, such as those in the EU and US, are driving the increased popularity of coatings like high emissivity ones. These policies establish strict requirements for both performance and environmental sustainability.