Projected $3.6 Billion Growth in High Pressure Washer Market by 2025: U.S., Germany, and Japan to Lead the Way

Discover key insights into the high pressure washer market’s projected $3.6 billion growth by 2025, with detailed analysis of leading markets in the U.S., Germany, and Japan, and emerging industry trends.

- Last Updated:

High Pressure Washer Market Q1 and Q2 2025 Forecast

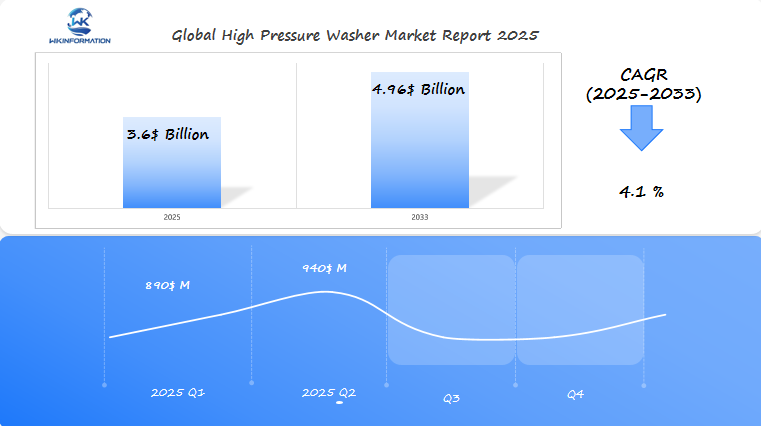

The High Pressure Washer market, projected to reach $3.6 billion in 2025, is expected to grow at a CAGR of 4.1% from 2025 to 2033. In Q1 2025, the market will likely generate approximately $890 million, with strong demand in the U.S., Germany, and Japan. The need for high-pressure washers in automotive, industrial cleaning, and residential sectors will drive growth, along with increasing consumer interest in DIY cleaning solutions.

By Q2 2025, the market is expected to reach $940 million, as demand in Germany and Japan continues to grow due to strong emphasis on eco-friendly and efficient cleaning technologies. Additionally, the growing trend of smart pressure washers with IoT integration will fuel further market growth.

Analyzing the Upstream and Downstream Industry Chain of High Pressure Washers

The high pressure washer industry chain involves a complex network of suppliers, manufacturers, and distributors working together to deliver products to end-users.

Production Process Components:

- Raw material sourcing (metals, plastics, electronic components)

- Component manufacturing (pumps, motors, nozzles)

- Assembly and quality testing

- Packaging and distribution

Key suppliers in the industry include specialized component manufacturers producing critical parts such as:

- Annovi Reverberi for pumps

- Bosch for motors and electrical systems

- Parker Hannifin for fluid control systems

Major Manufacturers’ Network:

- Kärcher (Germany)

- Nilfisk (Denmark)

- Briggs & Stratton (USA)

- Simpson (USA)

The distribution network operates through multiple channels:

- Direct sales to commercial clients

- Retail partnerships with home improvement stores

- Online marketplaces

- Specialized equipment dealers

Market reach extends across various sectors:

- Residential users through retail stores

- Commercial clients via direct sales

- Industrial customers through specialized distributors

- Rental companies serving temporary needs

The efficiency of the industry chain relies on strong relationships between suppliers and manufacturers, with just-in-time inventory management playing a crucial role in production scheduling and cost control. Quality control measures at each stage ensure product reliability and performance standards meet market expectations.

Key Trends Shaping the High Pressure Washer Market

The high pressure washer market has been greatly influenced by changing consumer behaviors and technological advancements. The COVID-19 pandemic brought about a greater awareness of hygiene, resulting in a higher demand for professional-grade cleaning equipment in both residential and commercial sectors.

Post-Pandemic Hygiene Focus

- 73% increase in sanitization-focused cleaning practices

- Growing adoption of high pressure washers in public spaces

- Enhanced cleaning protocols in healthcare facilities

Rise in Home Improvement Activities

- Surge in DIY projects creating demand for residential units

- Increased focus on outdoor space maintenance

- Growth in rental market for professional-grade washers

Technological Advancements

- Introduction of smart pressure washers with IoT connectivity

- Development of energy-efficient models with reduced water consumption

- Implementation of advanced spray patterns and adjustable pressure settings

The trend of urbanization has also opened up new opportunities in the market, especially in developing regions. As cities expand, there is an increase in vehicle ownership and commercial properties, which drives the need for effective cleaning solutions.

Recent innovations are aimed at making these products more user-friendly, such as:

- Introduction of digital pressure control systems

- Implementation of automated detergent mixing

- Design of compact models to address storage limitations in urban areas

Market data shows that there is a strong preference for eco-friendly models, with features that save water becoming an important factor for both residential and commercial buyers when making purchasing decisions.

Understanding the Restrictions Impacting the High Pressure Washer Industry

The high pressure washer industry faces significant regulatory challenges that shape product development and market accessibility. Manufacturers must navigate complex regulatory frameworks across different regions:

1. Safety Standards and Certifications

Manufacturers need to comply with various safety standards and certifications to ensure their products meet regulatory requirements. Some key safety standards include:

- UL 1776 safety requirements for high-pressure cleaning machines

- CE marking requirements in European markets

- Specific noise emission limitations

- Electrical safety compliance standards

2. Environmental Regulations

Environmental regulations play a crucial role in shaping the operations of high pressure washer manufacturers. These regulations aim to minimize the environmental impact of cleaning activities and promote sustainable practices. Some important environmental regulations include:

- Water usage restrictions in drought-prone areas

- Runoff control requirements for commercial applications

- Chemical cleaning agent limitations

- Energy efficiency standards for electric models

3. Manufacturing Compliance Challenges

Manufacturers also face compliance challenges related to their production processes and supply chain activities. These challenges can affect their ability to meet regulatory requirements and maintain competitiveness in the market. Some common manufacturing compliance challenges include:

- Raw material sourcing restrictions

- Production process emissions control

- Packaging waste reduction requirements

- Product recyclability mandates

The EPA’s Clean Water Act impacts commercial pressure washer operations, requiring proper wastewater management and runoff control. Manufacturers face additional pressure to develop water-efficient models that maintain cleaning effectiveness while reducing consumption.

Local regulations add another layer of complexity, with some municipalities implementing specific restrictions on pressure washer use during certain hours or seasons. These varying requirements create significant challenges for manufacturers in designing products that meet diverse regulatory standards while remaining cost-effective.

Recent sustainability initiatives have pushed manufacturers to incorporate eco-friendly features, including water recycling systems and biodegradable component materials. These adaptations require substantial investment in research and development, impacting production costs and market pricing.

Geopolitical Factors Affecting High Pressure Washer Production and Distribution

The high pressure washer industry faces significant challenges due to shifting global trade dynamics. Recent tariff implementations between major manufacturing countries have directly impacted production costs and market availability.

Key Trade Policy Effects:

- 25% tariff increases on components from Asia affecting U.S. manufacturers

- European Union’s stringent import regulations creating barriers for non-EU producers

- Brexit-related changes disrupting UK-EU supply chains

Supply chain vulnerabilities have become apparent through recent global events. Manufacturing bottlenecks in China, coupled with shipping container shortages, have led to:

- Extended lead times for component delivery

- Increased transportation costs

- Reduced inventory levels across distribution networks

Regional Market Disruptions:

- North American manufacturers seeking alternative component suppliers

- European producers investing in local production facilities

- Asian manufacturers expanding into new markets to offset trade restrictions

The semiconductor shortage has particularly affected electronic pressure washer production, with manufacturers competing for limited chip supplies. This scarcity has prompted industry leaders to:

- Develop strategic partnerships with component suppliers

- Invest in regional manufacturing capabilities

- Implement inventory management systems

Political tensions between major economies continue to reshape distribution networks, pushing companies to diversify their supply chains and establish multiple manufacturing hubs across different regions.

Exploring High Pressure Washer Market Segmentation by Type

The high pressure washer market divides into two primary categories: electric-powered and gas-powered units. Each type serves distinct user needs and applications.

Electric Pressure Washers

- Compact and lightweight design

- Lower maintenance requirements

- Quieter operation

- Ideal for residential use

- Power range: 1300-1900 PSI

- Market share: 65% of total sales

Gas-Powered Pressure Washers

- Higher pressure output

- Greater mobility without power cord

- Enhanced durability

- Suited for professional applications

- Power range: 2000-4000 PSI

- Market share: 35% of total sales

Consumer preferences show a strong lean toward electric models in residential settings. These units attract buyers through:

- Lower initial cost

- Ease of operation

- Environmental friendliness

- Indoor usability

- Reduced noise pollution

Professional users gravitate toward gas-powered units due to:

- Superior cleaning power

- Extended operational range

- Ability to handle heavy-duty tasks

- Performance in remote locations

- Faster cleaning times

Recent market data indicates electric pressure washers gaining additional market share, driven by improvements in battery technology and increasing environmental consciousness among consumers. Manufacturers respond to this trend by developing more powerful electric models that bridge the performance gap with gas-powered alternatives.

The Role of Applications in Shaping High Pressure Washer Demand

High pressure washers serve distinct purposes across multiple sectors, each with unique requirements and usage patterns. The construction industry relies heavily on these machines for cleaning equipment, preparing surfaces, and maintaining job sites. In automotive applications, pressure washers are essential tools in car washes, dealerships, and fleet maintenance facilities.

Commercial Applications:

- Industrial cleaning of heavy machinery

- Building exterior maintenance

- Professional cleaning services

- Agricultural equipment washing

- Marine vessel maintenance

Residential Applications:

- Driveway and deck cleaning

- Vehicle washing

- Fence and siding maintenance

- Patio furniture restoration

- Garden equipment cleaning

The commercial sector demands robust machines capable of extended operation periods, with higher PSI ratings and specialized attachments. These units typically feature industrial-grade components and advanced safety features. Residential users prioritize convenience, storage capability, and versatility in their pressure washer selection.

New application areas continue to emerge, particularly in specialized industries:

- Solar panel cleaning systems

- Graffiti removal services

- Food processing facility sanitization

- Sports facility maintenance

- Airport runway cleaning

The expansion into these specialized sectors drives innovation in pressure washer design, leading to the development of application-specific features and attachments. This diversification of use cases strengthens market growth potential and creates opportunities for manufacturers to develop targeted solutions.

Regional Insights into the Global High Pressure Washer Market

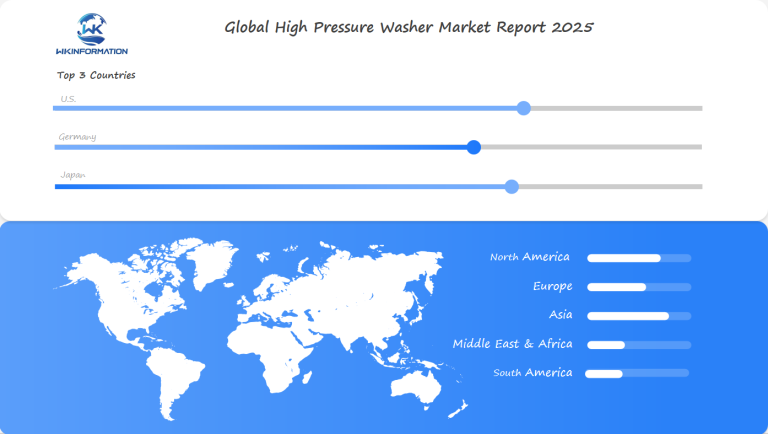

North America: The Leading Market

North America is the largest player in the global high pressure washer market, holding about 35% of the market share. The region’s strong position can be attributed to:

- High disposable income levels

- Widespread property ownership

- Strong DIY culture

- Strict industrial cleaning regulations

The U.S. market particularly excels in commercial applications, with businesses investing heavily in cleaning equipment for:

- Shopping centers

- Industrial facilities

- Public spaces

- Agricultural operations

Europe: The Second-Largest Market

Europe is the second-largest market for high pressure washers, driven by:

Germany: Leading manufacturer of premium pressure washers

UK: Growing demand in construction sector

France: Strong focus on eco-friendly cleaning solutions

Key Influences on Regional Markets

Key factors influencing regional markets include:

- Consumer BehaviorNorth Americans prefer high-powered units for thorough cleaning

- Europeans prioritize water-efficient models

- Both regions show increasing interest in smart features

- Economic FactorsConstruction industry growth

- Industrial sector expansion

- Rising commercial cleaning services

Asia-Pacific: A Region with Growth Potential

The Asia-Pacific region has significant growth potential, especially in countries like China and India, where urbanization and industrialization are driving the demand for professional cleaning equipment.

Local Regulations and Their Impact

Regional market dynamics are influenced by local regulations. In North America, standards focus on safety features, while European requirements emphasize environmental impact and water conservation.

In-Depth Analysis of the U.S. High Pressure Washer Market

The U.S. market is a major player in the global high pressure washer industry, with unique features influenced by American consumer preferences and lifestyle habits. The market value has reached $1.2 billion, representing a 35% share of the global market.

Key Market Drivers

- Rising home ownership rates driving DIY cleaning projects

- Increased vehicle ownership creating demand for car washing equipment

- Growing commercial cleaning services sector

- Surge in construction activities requiring heavy-duty cleaning

Consumer Behavior Patterns

- 65% of U.S. homeowners own at least one pressure washer

- Preference for electric models in residential settings

- Strong demand for rental services in urban areas

- Seasonal peaks during spring and fall cleaning periods

Market Leaders and Competition

The U.S. market features intense competition among major players:

- Kärcher: 28% market share, known for innovative technology

- Generac Power Systems: 22% market share, specializing in gas-powered units

- Briggs & Stratton: 18% market share, popular in residential segment

- Simpson: 15% market share, focused on professional-grade equipment

Regional distribution networks play a crucial role in market penetration, with big-box retailers like Home Depot and Lowe’s controlling 45% of retail sales. E-commerce platforms have seen a 200% growth in pressure washer sales since 2020, reflecting changing purchasing patterns among U.S. consumers.

Trends and Growth in Germany's High Pressure Washer Market

Germany is a major player in the European high pressure washer market, thanks to its strong manufacturing industry and preference for top-notch cleaning equipment. Here’s a closer look at what makes the German market unique:

Market Leadership

- Home-grown manufacturer Kärcher dominates with 60% market share

- Strong presence of premium brands like Nilfisk and Bosch

- Emphasis on engineering excellence and product durability

Consumer Behavior

- Germans invest heavily in home maintenance equipment

- Average household owns 1.3 pressure washers

- Strong preference for electric models due to environmental concerns

The growth of the German market can be attributed to several factors:

- Industrial Applications: Manufacturing facilities require regular cleaning

- Automotive Sector: Car washing remains a significant use case

- Municipal Services: Cities invest in pressure washers for street cleaning

German manufacturers are at the forefront of innovation when it comes to pressure washer technology:

- Integration of smart features and IoT connectivity

- Development of water-saving technologies

- Enhanced energy efficiency systems

There’s a noticeable shift towards sustainable solutions in the market, with manufacturers prioritizing eco-friendly designs and water conservation features. Additionally, German engineering standards continue to shape global pressure washer development, setting benchmarks for quality and performance across the industry.

Overview of Japan's High Pressure Washer Market

Japan’s high pressure washer market has its own unique features influenced by the country’s culture and technology preferences. The market has great potential for growth, driven by several important factors:

Cultural Influence on Market Demand

- Japanese consumers’ emphasis on cleanliness and precision cleaning

- Strong focus on maintaining property appearance

- High adoption rate in commercial sectors, particularly automotive and manufacturing

Market Dynamics

- Compact, space-efficient designs dominate sales

- High preference for electric models due to strict noise regulations

- Premium pricing strategy successful due to quality-conscious consumers

Innovation Leadership

- Integration of IoT capabilities in premium models

- Advanced water-saving technologies

- Smart control systems with mobile app connectivity

Japanese manufacturers like Ryobi and Makita have established strong market positions by developing products specifically tailored to local needs. These companies emphasize:

- Lightweight construction

- Low noise operation

- Energy efficiency

- Compact storage solutions

The commercial sector represents a significant market share, with industries such as:

- Manufacturing facilities

- Auto detailing shops

- Building maintenance services

- Public infrastructure cleaning

Urban areas like Tokyo, Osaka, and Nagoya drive substantial demand, particularly in residential and light commercial applications. The market shows consistent growth in both replacement purchases and new customer acquisition, supported by Japan’s robust maintenance culture and technological advancement.

Future Development Prospects for High Pressure Washers

The high pressure washer industry is on the verge of significant technological evolution. Smart integration capabilities now allow users to control and monitor their devices through mobile applications, enabling precise pressure adjustments and maintenance scheduling.

Key Innovations on the Horizon:

- IoT Integration: Connected pressure washers with real-time performance monitoring and predictive maintenance alerts

- Water Conservation Technology: Advanced systems reducing water consumption by up to 50% while maintaining cleaning efficiency

- Battery Technology: Enhanced lithium-ion batteries extending runtime and reducing charging periods

- Eco-friendly Solutions: Development of biodegradable cleaning agents and reduced carbon footprint systems

Emerging Market Opportunities:

- Industrial automation integration

- Specialized attachments for specific industries

- Compact designs for urban households

- Solar-powered options for remote locations

Research and development efforts focus on creating multi-functional units that adapt to various cleaning requirements. The integration of artificial intelligence promises enhanced cleaning efficiency through surface recognition and automatic pressure adjustment.

Market projections indicate a shift toward rental services and subscription-based models, particularly in urban areas. This trend aligns with the growing sharing economy and provides accessibility to professional-grade equipment without significant upfront investments.

The development of specialized nozzles and attachments continues to expand application possibilities across industries, from delicate electronics cleaning to heavy-duty industrial applications.

Competitive Landscape of the High Pressure Washer Industry

The competitive landscape shows increasing consolidation through mergers and acquisitions, particularly in emerging markets. Companies are expanding their service offerings to include maintenance contracts and rental options, creating additional revenue streams and strengthening customer relationships.

- Alfred Kärcher SE & Co. KG – Germany

- Annovi Reverberi Spa – Italy

- Briggs & Stratton AG – United States

- Deere & Company – United States

- Generac Power Systems Inc. – United States

- IPC Tools Spa – Italy

- Koki Holdings Co. Ltd. – Japan

- Lavorwash S.p.A. – Italy

- Nilfisk Group – Denmark

- Stanley Black & Decker Ltd. – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global High Pressure Washer Market Report |

| Base Year | 2024 |

| Segment by Type |

· Electric Pressure Washers · Gas-Powered Pressure Washers |

| Segment by Application |

· Commercial Applications · Residential Applications |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The high pressure washer market demonstrates robust growth potential, with projections indicating a significant expansion to $3.6 billion by 2025. This comprehensive analysis reveals several key insights about the industry’s trajectory.

The market’s strong performance is driven by multiple factors, including heightened hygiene awareness post-pandemic, technological advancements, and increasing adoption across residential, commercial, and industrial sectors. The U.S., Germany, and Japan continue to lead market innovation and set global standards for product development.

Key trends shaping the industry include the integration of smart technologies, focus on sustainability, and development of water-efficient solutions. The competitive landscape remains dynamic, with established players and new entrants leveraging innovation and strategic partnerships to maintain market positions.

Environmental regulations and safety standards continue to influence product development and manufacturing processes. The industry’s response through eco-friendly innovations and improved efficiency demonstrates its adaptability to changing market demands.

Regional markets show distinct characteristics, with developed economies focusing on technological advancement while emerging markets present growth opportunities. The industry’s supply chain has shown resilience despite recent global challenges, adapting through diversification and localization strategies.

Looking ahead, the market’s growth trajectory appears sustainable, supported by increasing urbanization, rising vehicle ownership, and expanding professional cleaning services. The continued focus on innovation, sustainability, and meeting evolving consumer needs positions the high pressure washer industry for continued success and expansion in the coming years.

Global High Pressure Washer Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: High Pressure Washer Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global High Pressure Washerplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: High Pressure Washer Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: High Pressure Washer Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: High Pressure Washer Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofHigh Pressure Washer Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key components of the high pressure washer industry chain?

The high pressure washer industry chain includes an analysis of supply chain dynamics, production processes, key suppliers and manufacturers, as well as distribution channels and market reach.

How has hygiene awareness influenced the high pressure washer market?

Post-COVID-19, there has been an increased awareness of hygiene which has driven demand for high pressure washers. This trend is further supported by a rise in home improvement projects, particularly in residential settings.

What regulatory challenges do manufacturers face in the high pressure washer industry?

Manufacturers face various regulatory challenges including compliance with environmental regulations that restrict water usage and other production-related guidelines affecting the manufacturing and use of high pressure washers.

How do geopolitical factors impact the production and distribution of high pressure washers?

Geopolitical influences such as trade policies can significantly affect the availability of high pressure washers. Additionally, geopolitical tensions may disrupt supply chains and distribution networks, impacting overall market stability.

What are the main types of high pressure washers available in the market?

The high pressure washer market is primarily segmented into electric and gas-powered washers. Each type has distinct consumer preferences and market shares based on their functionalities and applications.

What applications drive demand for high pressure washers across different sectors?

High pressure washers are utilized across various sectors including construction and automotive industries. Demand varies between commercial and residential users, with emerging applications continuously driving new demand within these markets.