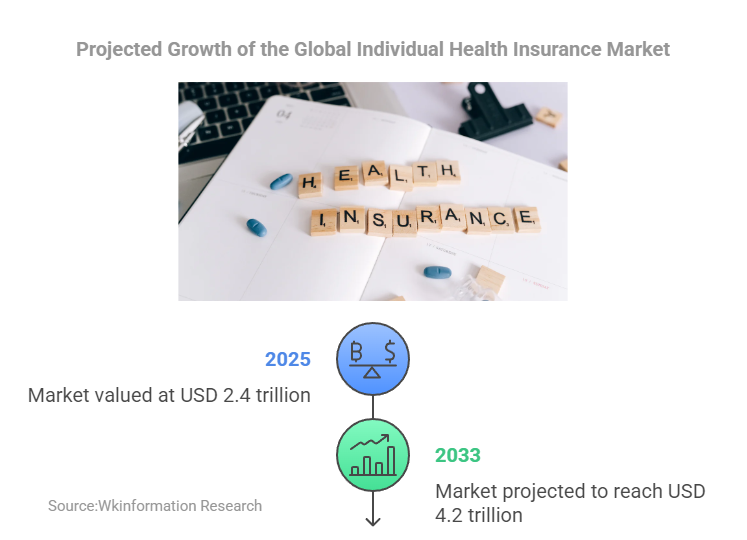

The global individual health insurance market is poised for significant growth, with projections estimating a compound annual growth rate (CAGR) of 7.25%. This market, valued at USD 2.4 trillion in 2025, is expected to reach USD 4.2 trillion by 2033. Such growth highlights the importance of understanding the individual health insurance market trend and its implications for consumers, insurers, and healthcare systems worldwide.

Shifts in consumer behavior, such as the adoption of consumer-directed health plans (CDHPs), have encouraged individuals to make cost-conscious healthcare decisions. Many now check coverage details, choose generic medications, and discuss treatment costs with providers. These behaviors not only influence personal healthcare expenses but also drive demand for cost-effective care solutions globally. Additionally, advancements in medical technologies and pharmaceuticals continue to shape the financial landscape of healthcare, with 69% of insurers citing new technologies as a primary driver of rising costs.

Data-driven insights play a critical role in navigating these changes. By leveraging analytics, stakeholders can better anticipate challenges and adapt to evolving market dynamics, ensuring sustainable growth and improved healthcare outcomes.

Key Takeaways

- The global health insurance market may grow from $2.4 trillion in 2025 to $4.2 trillion by 2033. This is a yearly growth rate of 7.25%. People need to learn about their insurance choices as the market grows.

- People are now making smarter money decisions. They pick cheaper medicines and talk about treatment costs. These steps help them save on healthcare.

- New technology like AI and telemedicine is changing insurance. Companies use these tools to make claims faster and create custom plans. This makes customers happier.

- Mental health coverage is growing because more people care about it. Insurance now includes therapy and counseling. This helps people stay healthier and saves money over time.

- Developing countries offer big chances for insurance companies. Using mobile tech and partnerships, they can give cheap insurance to more people. This helps more people get healthcare.

Individual Health Insurance Market Size

The individual health insurance market continues to expand, driven by demographic shifts, lifestyle changes, and increased awareness of healthcare needs. Projections indicate steady growth over the next decade, reflecting its critical role in global healthcare systems.

Key market size estimates include:

- Valued at USD 2.1 trillion in 2023.

- Estimated to reach USD 2.4 Tillion by 2025.

- Projected to grow to USD 4.2 trillion by 2033.

- Expected compound annual growth rate (CAGR) of 7.25% until 2033.

From 2025 to 2033, the market is anticipated to grow at a CAGR of 7.25%, highlighting sustained demand for individual health insurance.

Several factors contribute to this growth, as outlined below:

| Factor | Description |

|---|---|

| Rising Elderly Population | Increased demand due to age-related chronic conditions. |

| Increased Awareness in Rural Areas | Growing understanding of health insurance benefits in underserved regions. |

| Impact of Sedentary Lifestyles | Higher prevalence of chronic diseases requiring coverage. |

| Rising Health Insurance Premiums | Higher healthcare costs leading to increased premiums. |

| Limited Awareness | Lack of knowledge about insurance options in some areas. |

The rising elderly population and sedentary lifestyles significantly impact the market. However, challenges such as limited awareness and rising health insurance premiums may hinder growth in certain regions. Understanding these trends allows stakeholders to adapt strategies and meet evolving consumer needs effectively.

Key Individual Health Insurance Market Trends

Rising Premiums and Cost Pressures

Factors driving premium increases

Rising premium costs have become a significant concern in the individual health insurance market. Several factors contribute to this trend. The increasing prevalence of chronic diseases, driven by sedentary lifestyles and an aging population, has led to higher claims. Additionally, advancements in medical technologies and pharmaceuticals, while improving care quality, have escalated healthcare costs. Insurers often pass these rising medical costs to policyholders through higher health insurance premiums. Favorable government programs and regulatory environments have also influenced premium adjustments, aiming to balance affordability with sustainability.

Consumer responses to rising costs

Consumers have responded to rising premium costs in various ways. Many low-risk individuals have opted out of coverage, leading to adverse selection. This phenomenon increases the financial burden on insurers, further driving up premiums. Over half of the decline in coverage rates during the 1990s was linked to rising health insurance premiums. To mitigate these challenges, consumers are adopting cost-conscious behaviors, such as choosing high-deductible plans and exploring telemedicine options. These strategies help individuals manage healthcare costs while maintaining essential coverage.

Regulatory Changes and Global Policy Shifts

Key regulatory updates by region

Regulatory changes continue to shape health insurance trends globally. In North America, reforms aim to improve affordability and expand access to individual health insurance. Europe has seen a rise in private insurance options within universal healthcare systems. In Asia-Pacific, governments are introducing policies to address diverse healthcare needs, driven by urbanization and income growth. These updates reflect efforts to adapt to evolving healthcare trends and ensure equitable access to coverage.

Impacts on insurers and policyholders

Regulatory shifts impact both insurers and policyholders. Insurers face challenges in complying with new standards while maintaining profitability. Policyholders benefit from enhanced protections, such as mental health coverage and cashless hospitalization. However, navigating complex regulations can be daunting for individuals, emphasizing the need for transparent communication from insurers.

AI and Digital Health Integration

AI in claims processing and fraud detection

Artificial intelligence (AI) is revolutionizing the individual health insurance sector. Insurers use AI to streamline claims processing and detect fraud. AI systems analyze large datasets with speed and accuracy, identifying anomalies such as duplicate billing or upcoding. Curacel’s machine learning technology exemplifies this trend, enabling insurers to detect fraudulent claims efficiently. This digital transformation enhances operational efficiency and reduces costs, benefiting both insurers and policyholders.

Growth of telemedicine and wearable health tech

Telemedicine and wearable health technology are transforming healthcare trends. Wearable devices collect real-time health data, allowing insurers to tailor plans based on individual health profiles. This approach fosters trust and promotes healthier lifestyles through financial incentives. Telemedicine, on the other hand, offers cost-effective solutions for routine care, reducing the rising cost of healthcare. These innovations highlight the role of digital transformation in reshaping the individual health insurance market trend.

Mental Health Coverage Expansion

Increasing demand for mental health services

The demand for mental health services has grown significantly in recent years. Several factors contribute to this trend. Increased awareness of mental health issues has encouraged individuals to seek professional help. Stress from modern lifestyles, economic pressures, and the aging population has also played a role. In the United States, the Affordable Care Act (ACA) and Medicaid expansions have improved access to mental health services. These expansions increased the number of patients with Medicaid coverage, particularly among previously uninsured individuals. Providers’ acceptance of Medicaid insurance rose by 1.94%, reducing the share of providers not accepting Medicaid from 12.73% to 11.04%. This shift highlights the importance of expanding mental health coverage to meet growing needs.

Insurers enhancing mental health benefits

Insurers have responded to this rising demand by enhancing mental health benefits. Many now include therapy sessions, counseling, and substance abuse treatment in their plans. These additions aim to address gaps in coverage and improve overall health outcomes. Insurers also recognize the financial benefits of early mental health interventions, which can reduce long-term healthcare costs. By integrating mental health services into individual health insurance plans, insurers align with evolving healthcare trends and consumer expectations. This approach not only improves access but also promotes operational efficiency by streamlining care delivery.

Value-Based Care Models

Focus on outcomes over service volume

Value-based care models are reshaping the individual health insurance market trend. These models prioritize patient outcomes rather than the volume of services provided. Insurers now reward healthcare providers for improving patient health and reducing unnecessary procedures. This shift encourages a focus on quality care, which benefits both patients and insurers. By minimizing redundant treatments, value-based care reduces healthcare costs and enhances the efficiency of insurance plans.

Collaboration between insurers and providers

Collaboration between insurers and healthcare providers is essential for the success of value-based care models. Insurers work closely with providers to develop reimbursement strategies that align with these goals. For example, shared data systems allow providers to track patient progress and adjust treatments as needed. This partnership fosters trust and ensures that patients receive the best possible care. As healthcare trends evolve, such collaborations will play a critical role in improving health outcomes and reducing costs.

Challenges in the Individual Health Insurance Market

Aging Population and Chronic Diseases

Impact of aging demographics on claims and costs

The aging population presents significant challenges for the individual health insurance market. Older adults often require more frequent medical care, leading to higher claims. This demographic shift increases the financial strain on insurers as they manage rising healthcare costs. Additionally, the prevalence of age-related conditions such as arthritis, diabetes, and cardiovascular diseases further escalates claims. These trends highlight the need for insurers to adapt their strategies to maintain affordability and sustainability.

Financial burden of chronic conditions

Chronic diseases contribute heavily to the financial burden on health insurance systems.

- Increased care needs and higher treatment costs strain resources.

- Lack of stable coverage exacerbates these issues, especially for socioeconomically disadvantaged groups.

- Individuals without insurance often experience rapid disease progression, leading to costly hospitalizations.

Studies reveal that gaining insurance improves the detection and management of chronic conditions. Early diagnosis through preventive services reduces long-term costs. However, insurance instability remains a challenge, particularly for vulnerable populations.

Inflation and Economic Pressures

Effects of inflation on healthcare costs

Inflation significantly impacts healthcare costs and health insurance premiums.

- Higher prescription costs drive up premiums.

- Multiyear provider contracts often reflect higher inflation assumptions, further increasing premiums.

- The demand for expensive treatments, such as weight-loss drugs and gene therapy, adds upward pressure on premiums.

Although these treatments offer long-term health benefits, their immediate costs challenge affordability. Legal uncertainties, such as those surrounding the No Surprises Act, also contribute to premium volatility.

Economic challenges for consumers and insurers

Economic pressures affect both consumers and insurers. Rising premium costs force many individuals to choose between maintaining coverage and meeting other financial obligations. Insurers face difficulties balancing profitability with the need to offer affordable plans. These challenges underscore the importance of innovative solutions to address affordability and ensure access to essential healthcare services.

Data Privacy and Cybersecurity Risks

Risks associated with digital health tools

The integration of digital health tools introduces cybersecurity risks.

- Remote work environments increase vulnerabilities.

- Endpoint device management and human errors pose significant threats.

- Poor cybersecurity practices can lead to compromised data, affecting both insurers and policyholders.

Brokers frequently cite inadequate care in digital settings and technology errors as major concerns. These risks highlight the need for robust security measures to protect sensitive information.

Regulatory requirements for data protection

Regulatory frameworks play a crucial role in addressing cybersecurity challenges. Insurers must comply with stringent data protection laws to safeguard consumer information. Coordinated incident response plans and senior-level risk assessments are essential for mitigating threats. By prioritizing data security, insurers can build trust and enhance the adoption of digital health tools.

Accessibility and Equity Gaps

Disparities in access to affordable coverage

Access to affordable health insurance coverage remains a significant challenge for many individuals worldwide. Economic inequality plays a major role in creating these disparities. Low-income families often struggle to afford premiums, even when subsidies or government programs are available. In some cases, individuals face high out-of-pocket costs, which discourage them from seeking necessary medical care.

Geographic location also influences access to coverage. Urban areas typically offer more insurance options compared to rural regions. People living in rural areas often encounter limited provider networks, making it harder to find plans that meet their needs. Additionally, language barriers and a lack of health literacy further widen the gap, especially among immigrant populations. These factors highlight the need for targeted solutions to improve affordability and accessibility for vulnerable groups.

Challenges in underserved regions

Underserved regions face unique challenges in accessing health insurance. Many developing countries lack robust healthcare infrastructure, which limits the availability of insurance products. In these areas, informal employment is common, leaving workers without employer-sponsored plans. This forces individuals to rely on out-of-pocket payments, which can lead to financial hardship.

Cultural factors also contribute to low insurance adoption rates. In some communities, traditional beliefs about health and medicine discourage people from purchasing insurance. Additionally, insurers often hesitate to enter underserved markets due to perceived risks and low profitability. This creates a cycle where limited options and high costs prevent residents from obtaining adequate coverage.

Addressing these challenges requires innovative approaches. Governments and insurers must collaborate to design affordable plans tailored to the needs of underserved populations. Expanding digital platforms can also help bridge gaps by providing easier access to information and enrollment services. These efforts can reduce inequities and align with global health trends focused on improving coverage for all.

Opportunities in the Individual Health Insurance Market

Personalized and Flexible Plans

Data analytics for tailored insurance plans

Data analytics plays a pivotal role in creating tailored insurance plans. Insurers analyze customer data to identify specific needs and preferences. This approach enables them to design plans that align with individual health profiles and financial situations. For example, predictive analytics helps insurers assess risk levels and recommend appropriate coverage. This strategy not only improves customer satisfaction but also enhances the efficiency of insurance offerings. As health trends evolve, data-driven customization ensures that insurers remain competitive while addressing diverse consumer demands.

Growth of modular and on-demand products

Modular and on-demand insurance products are reshaping the individual health insurance market. These products emphasize flexibility and personalization, catering to a segmented customer base.

- Insurers now offer unbundled coverage options that address situational needs.

- On-demand features allow consumers to select coverage for specific periods, moving away from traditional annual policies.

- Digital transformation enhances transparency and customer control in insurance contracts.

These customizable options empower individuals to choose plans that suit their unique circumstances. This innovation reflects a shift toward consumer-centric insurance models, which prioritize adaptability and convenience.

Ecosystem Partnerships

Collaborations between insurers, tech firms, and providers

Collaborations between insurers, technology firms, and healthcare providers are transforming the insurance landscape. These partnerships enable insurers to extend their reach and diversify their offerings. By integrating advanced technologies, insurers can deliver data-driven solutions that improve customer experience. For instance, partnerships with telemedicine providers enhance access to care, while collaborations with wearable tech companies offer real-time health monitoring. This synergy fosters a customer-centric approach, which is essential for staying ahead in a competitive market.

Benefits of integrated healthcare ecosystems

Integrated healthcare ecosystems provide significant advantages for insurers and consumers. These ecosystems streamline operations, allowing insurers to expand into new markets efficiently. They also enhance customer experience by offering seamless access to healthcare services. For example, shared data systems within ecosystems improve care coordination and reduce administrative burdens. This integration not only drives operational efficiency but also aligns with global health trends focused on improving accessibility and affordability.

Cost Containment Strategies

Preventive care and wellness programs

Preventive care and wellness programs help insurers contain costs while promoting healthier lifestyles.

- Vaccines and screenings prevent diseases or detect them early, reducing treatment expenses.

- Wellness initiatives, such as stress management and weight control, lower the risk of chronic conditions.

- Many plans include preventive services at no cost, making them accessible and cost-effective for consumers.

These strategies reduce long-term healthcare costs and improve overall health outcomes. By focusing on prevention, insurers can minimize claims and maintain affordable premiums.

Technology-driven administrative cost reductions

Technology-driven solutions play a crucial role in reducing administrative costs. Automation streamlines claims processing, while AI detects errors and fraud efficiently. Digital platforms simplify enrollment and policy management, enhancing operational efficiency. These advancements not only lower costs but also improve customer experience by reducing delays and errors. As digital transformation continues, insurers can leverage technology to deliver cost-effective solutions that benefit both providers and policyholders.

Emerging Market Expansion

Rising demand in developing regions

Emerging markets in developing regions are experiencing a surge in demand for individual health insurance. Rapid urbanization and rising incomes have increased awareness of the importance of health insurance. Many individuals in these regions seek financial protection against unexpected medical expenses. Governments in countries like India and Nigeria have also launched initiatives to promote health insurance adoption. These efforts aim to reduce the financial burden of healthcare on low-income populations.

Insurtech startups are playing a pivotal role in meeting this growing demand. They are leveraging mobile apps and data analytics to provide insurance solutions tailored to underserved populations. These technologies enable insurers to offer customizable plans that address local healthcare needs. For example, mobile platforms allow users to access affordable insurance options and manage their policies conveniently. This approach improves customer experience and expands coverage in regions with limited access to traditional insurance services.

Opportunities for insurers to reach new customers

Emerging markets present significant opportunities for insurers to expand their operations. Partnerships with multilateral development banks (MDBs) offer a strategic pathway for insurers to enter these markets. These collaborations help insurers diversify their product offerings and share risks, making it easier to invest in challenging environments. Additionally, insurers can underwrite loans from MDBs, creating a new asset class that generates high-yield returns. This strategy not only supports market entry but also enhances development impact in underserved regions.

Insurers can also capitalize on the growing adoption of digital health tools in emerging markets. Wearable devices and telemedicine platforms are gaining popularity, providing cost-effective solutions for healthcare delivery. By integrating these technologies into their offerings, insurers can attract new customers and improve health outcomes. These trends highlight the potential for insurers to drive growth while addressing global health trends focused on equitable access to care.

| Opportunity Type | Description |

|---|---|

| Partnerships with MDBs | Enhance development impact, diversify products, and share risks. |

| Insuring Loans | Underwrite MDB loans to create high-yield returns and expand market reach. |

Emerging markets represent a promising frontier for the individual health insurance industry. By embracing innovation and forming strategic partnerships, insurers can unlock new opportunities and contribute to the global expansion of health coverage.

Regional Insights on Health Insurance Trends

North America

Medical inflation and utilization trends

Healthcare costs in North America continue to rise, driven by several factors. Pharmaceutical expenditures increased by 13.6% in 2023, reaching $722.5 billion. This growth reflects the aging population and the prevalence of chronic conditions, which have led to higher utilization of prescription drugs. Hospital services also experienced a 6.3% cost increase in the fourth quarter of 2023 compared to the previous year. Insurers predict that medical trends will escalate globally over the next three years, with mental health services seeing significant cost increases. Advancements in medical technology and pharmaceuticals further contribute to these rising expenses.

Regulatory changes in the U.S. and Canada

Regulatory changes in North America aim to address affordability and access. In the United States, reforms focus on expanding Medicaid and improving protections for pre-existing conditions. Canada emphasizes reducing wait times and enhancing private sector involvement in non-essential services. These policies aim to balance cost pressures while ensuring equitable access to healthcare. However, navigating these regulations remains a challenge for insurers and consumers alike.

Europe

Growth of private insurance in universal systems

Private insurance is gaining traction within Europe’s universal healthcare systems. The private sector plays a key role in delivering services like community pharmacy and dental care. These services benefit from standardization, allowing consumers to compare costs and accessibility. Financing structures, often managed by governments, influence the mix of public and private services. This dynamic impacts patient choice and out-of-pocket expenses, driving the growth of private insurance as a complementary option.

Regional differences in affordability

Affordability varies significantly across Europe. Northern European countries, with robust economies, offer more affordable private insurance options. In contrast, Southern and Eastern Europe face challenges due to lower income levels and higher out-of-pocket costs. These disparities highlight the need for tailored solutions to address regional economic differences and ensure broader access to private insurance.

Asia-Pacific

Market growth driven by urbanization and incomes

Urbanization and rising incomes are key drivers of health insurance market growth in Asia-Pacific. Urbanization increases insurance penetration by expanding access to healthcare services. Higher disposable incomes improve affordability, encouraging more individuals to purchase insurance. Expanding internet access and growing literacy rates also enhance awareness of insurance benefits. Investments in healthcare infrastructure further support market growth by making insurance more viable.

| Factor | Contribution to Growth |

|---|---|

| Urbanization | Expands the market through increased insurance penetration |

| Rising Disposable Income | Increases affordability and demand for health insurance |

| Expanding Internet Access | Facilitates access to insurance information and services |

| Growing Literacy | Enhances understanding of health insurance benefits |

| Investments in Healthcare | Improves infrastructure, making insurance more viable |

| Public Awareness of Insurance | Drives demand for health insurance products |

Addressing diverse healthcare needs

Insurers in Asia-Pacific are adopting innovative approaches to meet diverse healthcare needs. Technology plays a central role, with telemedicine improving access to care in remote areas. Customized healthcare solutions allow customers to pay only for necessary services, enhancing affordability. Insurers emphasize flexibility and customer-centric strategies to cater to the region’s varied demands. These efforts align with global health trends focused on improving accessibility and affordability.

Latin America and Africa

Expansion in underserved regions

Latin America and Africa present significant opportunities for health insurance expansion. In Latin America, the insurance market reached $174 billion in 2022, growing at an annual rate of 11%. Rising incomes and demographic shifts have driven this growth, creating a favorable environment for insurers. Similarly, Africa, the eighth-largest insurance market globally, generated a gross written premium of approximately $68 billion. However, only 3% of Africa’s population has insurance coverage, leaving a vast untapped market.

Mobile technology plays a pivotal role in expanding insurance access in these regions. In Africa, mobile phones account for 75% of internet traffic, enabling insurers to offer microinsurance products to newly banked populations. These products provide affordable coverage tailored to low-income individuals, addressing the financial barriers that often prevent insurance adoption. Insurtech startups are leveraging mobile platforms and data analytics to deliver innovative solutions, making insurance more accessible to underserved communities.

Barriers to adoption and innovation potential

Despite the opportunities, several barriers hinder health insurance adoption in Latin America and Africa. Limited awareness of insurance benefits remains a significant challenge. Many individuals in these regions lack knowledge about how insurance works or its potential to reduce financial risks. Cultural factors also play a role, as traditional beliefs about health and medicine can discourage people from purchasing insurance.

Economic constraints further complicate adoption. In Africa, the insurance penetration rate is only 2%, far below the global average. High poverty levels and informal employment leave many without the means to afford traditional insurance plans. Similarly, in Latin America, out-of-pocket healthcare expenses remain high, deterring individuals from seeking coverage.

Innovation offers a pathway to overcome these barriers. Insurers can collaborate with mobile banking platforms to reach unbanked populations. By integrating health insurance with mobile financial services, they can provide affordable and flexible options. Partnerships with insurtech firms can also drive innovation, enabling insurers to develop data-driven products that cater to local needs. These strategies align with global health trends focused on improving accessibility and affordability in underserved regions.

Overview

The individual health insurance market trend highlights a dynamic landscape shaped by rising premiums, regulatory changes, and technological advancements. Stakeholders must address challenges such as health plan cost pressures, accessibility gaps, and cybersecurity risks. Opportunities lie in developing customizable health plans, leveraging ecosystem partnerships, and expanding into emerging markets. Patients are becoming informed consumers, influencing healthcare plans and decision-making. Innovations in information technology and value-based care models are enhancing communication and care standards. To thrive, stakeholders must adopt adaptable strategies and deliver tailored health insurance solutions. Explore diverse health insurance options to stay ahead of insurance trends 2025.

FAQ

What is individual health insurance?

Individual health insurance provides coverage for medical expenses for a single person or family. Unlike employer-sponsored plans, individuals purchase these policies directly from insurers. These plans offer flexibility in choosing coverage options based on personal needs and budgets.

How do rising premiums affect policyholders?

Rising premiums increase the cost of maintaining health insurance. Many policyholders respond by choosing high-deductible plans or reducing coverage. This trend highlights the importance of cost-effective solutions to ensure affordability for consumers.

Why is mental health coverage expanding?

Mental health coverage is expanding due to increased awareness and demand for services. Stress, economic pressures, and aging populations contribute to this need. Insurers now include therapy, counseling, and substance abuse treatments to address these growing concerns.

How does AI improve health insurance processes?

AI enhances efficiency by automating claims processing and detecting fraud. It analyzes large datasets to identify anomalies, reducing errors and costs. This technology also supports personalized insurance plans by assessing individual health risks.

What opportunities exist in emerging markets?

Emerging markets offer growth potential due to rising incomes and urbanization. Insurers can leverage mobile platforms and partnerships to provide affordable, tailored plans. These strategies help expand coverage in underserved regions, aligning with global health trends.