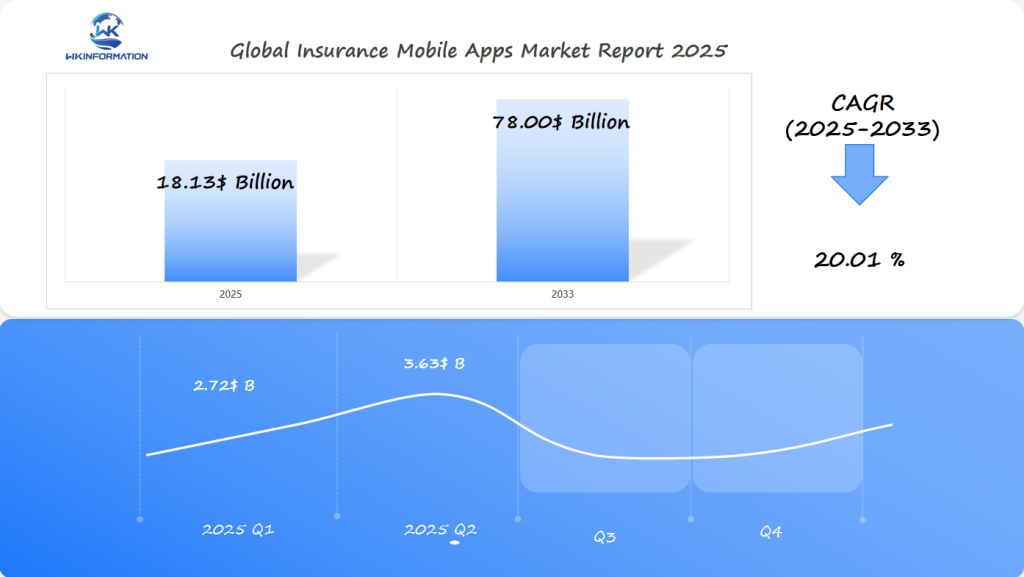

2025 Insurance Mobile Apps Market Breakthrough: Soaring to $18.13 Billion with Enhanced Digitalization in U.S., China & India

Comprehensive analysis of insurance mobile apps market trends and growth opportunities in the U.S., China, and India through 2025. Explores technological innovations, emerging market dynamics, consumer adoption factors, and strategic challenges facing insurers in the digital transformation of insurance services.

- Last Updated:

Insurance Mobile Apps Market: Q1 and Q2 2025 Predictions

The Insurance Mobile Apps market is expected to reach USD 18.13 billion in 2025, driven by the accelerating digitalization in the insurance industry. With a projected CAGR of 20.01% through 2033, Q1 2025 is estimated to generate around USD 2.72 billion, or 15% of the total market. Q2 is expected to see a more notable increase, accounting for roughly 20%, or USD 3.63 billion, reflecting the growing adoption of mobile insurance services as more insurers enhance their digital offerings.

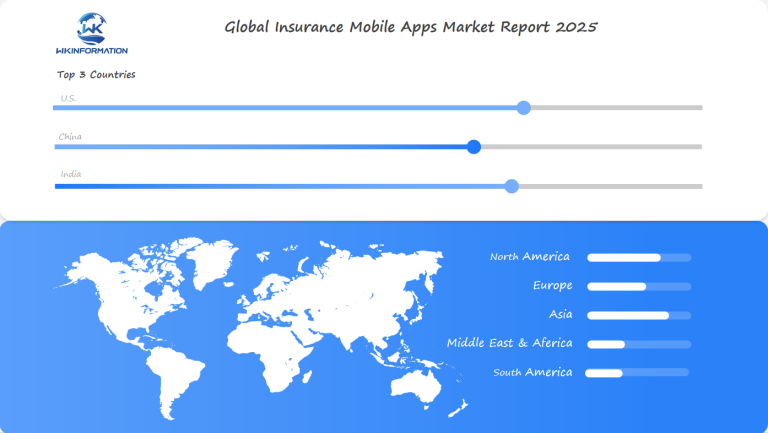

The U.S., China, and India are anticipated to be key drivers of market growth. The U.S. will maintain its lead with widespread mobile insurance app usage. China and India are rapidly catching up, driven by large populations and increasing shifts toward mobile-first insurance platforms, making them critical regions to study in 2025.

Understanding the Insurance Mobile Apps Supply Chain

To fully understand the insurance mobile apps market and its potential for growth, it’s important to analyze the supply chain involved. This ecosystem can be broken down into two main parts: upstream and downstream.

Upstream Segment

The upstream segment includes the following key players:

- Technology Providers: These are the innovators who drive advancements in mobile app functionalities, integrating cutting-edge technologies such as AI.

- Software Developers: They play a pivotal role in creating user-friendly applications that meet insurers’ needs.

- Cloud Service Providers: Essential for ensuring that apps have the scalability and security required to handle large volumes of data.

Downstream Segment

The downstream segment consists of:

- Insurers: Utilize these apps to offer enhanced customer service and streamlined operations, such as claims processing and policy management.

- End Users (Policyholders): Benefit from easier access to insurance services via mobile platforms, driving demand for more sophisticated apps.

The collaboration between these stakeholders ensures a seamless flow of technology and services, reflecting the interconnected nature of the supply chain. In this ecosystem, technology providers and insurers work closely to deliver innovative solutions that align with evolving consumer expectations. This synergy underscores the importance of each segment in propelling the market towards its projected growth.

Trend Analysis: Innovations and Trends in Insurance Mobile Apps Technology

The world of insurance mobile apps is changing quickly, thanks to new technologies that are changing how services are provided. One of the most important developments is the use of artificial intelligence (AI), which is making user experiences better by providing personalized interactions and automating everyday tasks. This technology improves customer service with features like virtual assistants and predictive analytics, which can anticipate what users need and make support more efficient.

Key Technological Innovations

Some of the main technological advancements in the insurance industry include:

- Real-time Data Processing: This allows insurers to offer flexible pricing models and risk assessments, making their processes more efficient.

- Blockchain Technology: This ensures secure transactions and transparent data management, which are essential for building trust in online platforms.

- Wearable Integration: This benefits health insurance apps by connecting real-time health data to policy terms, resulting in customized insurance plans.

Emerging Trends

New trends suggest a move towards app features that are more engaging and user-friendly. Users want smooth navigation and quick access to information, so developers are prioritizing mobile interface optimization. Furthermore, the growth of telematics in auto insurance apps demonstrates the shift towards usage-based policies that rely on data gathered from mobile devices.

These improvements not only make operations smoother but also raise the expectations of modern consumers when it comes to service quality. As technology continues to progress, it’s vital for insurers to stay up-to-date with these changes if they want to remain competitive in the market.

Restriction Analysis: Challenges Facing the Insurance Mobile Apps Industry

The rapid digital transformation in the insurance sector brings a host of challenges that insurers must navigate as they adopt mobile apps. A primary concern is ensuring robust data governance and security measures. Maintaining data integrity and protecting sensitive customer information is crucial, given the increasing sophistication of cyber threats. Insurers need to implement comprehensive strategies to safeguard data, which includes encryption, regular audits, and compliance with international standards.

Regulatory issues also pose significant hurdles. Different regions have varying regulatory frameworks that can complicate app development and deployment. Navigating this landscape requires a deep understanding of local laws related to data privacy, consumer protection, and financial transactions. Regulatory compliance is not just a legal obligation; it is integral to building trust with users.

Insurers face the challenge of integrating these apps into their existing systems without disrupting current operations. This requires investments in technology infrastructure and talent capable of managing such integrations. The demands for continuous updates and improvements further complicate this process, as insurers must ensure their apps remain relevant in a fast-evolving digital environment.

Understanding and addressing these challenges is vital for insurers looking to leverage mobile apps effectively in their business models. They form the cornerstone of sustained growth in the Insurance Mobile Apps Market.

Geopolitical Analysis: The Impact of Global Politics on Insurance Mobile Apps Production and Trade

Global political dynamics play a critical role in shaping the insurance mobile apps market. Geopolitical factors influence production decisions, with developers needing to navigate international relations and economic stability. Political tensions can lead to increased costs or delays in app development, as seen in instances where trade sanctions affect technology imports.

Trade policies are another pivotal element impacting the distribution of mobile apps across regions. Countries with protectionist measures may impose tariffs or restrictions that hinder market entry for foreign-developed applications. This can result in limited accessibility to innovative apps, affecting consumer choices and potentially slowing down market growth.

Several case studies illustrate these geopolitical impacts on specific markets. For example, the U.S.-China trade tensions have led to heightened scrutiny over data privacy and security concerns, influencing insurance app regulations and adoption rates. In contrast, India’s push for digitalization aligns with its focus on strengthening domestic tech capabilities, fostering a conducive environment for local app developers.

Understanding these geopolitical influences is essential for stakeholders aiming to navigate the complex landscape of global markets effectively. Recognizing the interconnectedness of political and economic factors helps ensure strategic planning and successful market penetration.

Segmentation Type Market Analysis: Insurance Mobile Apps Market Segmentation by Type and Application

Understanding the market segmentation of insurance mobile apps provides valuable insights into their diverse functionalities and applications. These apps can be categorized based on their primary use cases:

1. Claims Processing Apps

Streamline the claims filing process, offering users a user-friendly interface to submit claims, upload necessary documents, and track progress. These apps enhance efficiency for both insurers and policyholders.

2. Policy Management Apps

Enable users to manage their insurance policies in real time. Features include viewing policy details, making premium payments, updating personal information, and accessing policy documents.

3. Customer Support Apps

Provide direct communication channels between insurers and policyholders. Chatbots powered by AI are often integrated to assist with inquiries and provide solutions promptly.

In terms of application within various insurance sectors:

- Health Insurance: Apps focus on facilitating claims submissions, tracking healthcare expenses, and providing wellness tips.

- Auto Insurance: Features such as accident reporting, roadside assistance requests, and premium calculations are prominent in these apps.

- Life Insurance: Emphasizes policy management and beneficiary updates while providing educational content about life insurance benefits.

These diverse types of insurance mobile apps cater to specific needs within each sector, enhancing user experience through tailored functionalities.

Application Market Analysis: The Role of Insurance Mobile Apps in Digital Insurance Services

Insurance mobile apps are changing the way insurers provide digital services to their customers. With these apps, policyholders can easily access a variety of services without needing to interact with anyone in person. The apps offer a smooth and user-friendly experience, allowing users to manage their policies, pay premiums, and get instant updates on their insurance status.

Customer engagement through mobile platforms has become a key focus for insurers. Features like personalized notifications, chatbots, and virtual assistants make customer interactions more engaging, resulting in higher satisfaction and retention rates. These tools not only offer immediate support but also empower users by giving them more control over their insurance needs.

Another major benefit of insurance mobile apps is the ability to streamline claims processing. By using AI and machine learning technologies, claims assessments can be done faster, which means policyholders will receive payouts sooner. Users can submit claims directly through the app, upload any required documents using their smartphones, and track the progress of their claims in real-time. This efficiency is vital for building trust and providing an excellent customer experience, making mobile apps an essential part of the Insurance Mobile Apps Market.

Global Insurance Mobile Apps Market Region Analysis: Regional Market Trends

Regional Analysis and Market Trends Globally

The insurance mobile apps market is influenced by different factors in each region.

United States

In the U.S., many people are using digital technologies and smart devices, which makes it easier for insurance companies to use mobile apps. Customers want to be able to manage their policies and process claims easily on their phones, so insurance companies are coming up with new ideas to meet this need.

China

China has a different situation with its growing middle class and more people using smartphones. The Chinese market is seeing a huge increase in the use of mobile apps as insurance companies focus on attracting tech-savvy consumers who prefer digital interactions instead of traditional methods. Companies are using artificial intelligence (AI) to make their services more personalized and gain the trust of consumers in online platforms.

India

In India, the insurance industry is changing because of government efforts to promote digital inclusion. There is a strong demand for insurance services that can be accessed through mobile apps, leading to significant growth in this market. Insurance companies are taking advantage of this trend by creating easy-to-use applications that cater to various customer groups in both cities and rural areas.

U.S. Insurance Mobile Apps Market Analysis

The U.S. insurance mobile apps market is leading the way in digital transformation, with expected significant growth by 2025. Insurers are increasingly focusing on consumer behavior and AI implementation strategies to make the most of this growing segment.

Key Factors Driving the U.S. Market:

1. Consumer Behavior

There is a clear shift towards digital-first experiences among American consumers. This trend is pushing insurers to innovate and offer personalized offerings based on user data insights. Enhanced convenience, accessibility, and tailored services are becoming standard expectations.

2. AI Implementation Strategy

Insurers in the U.S. are integrating AI technologies into their core operations. Generative AI and machine learning tools enable companies to analyze large amounts of data for actionable insights, improving product personalization and customer interaction.

3. Personalized Offerings

By using AI-driven analytics, insurers can create customized insurance solutions that meet individual policyholders’ needs. This approach not only builds customer loyalty but also distinguishes firms in a competitive marketplace.

4. Proactive Claims Handling

Automation tools such as chatbots streamline claims processing, providing real-time assistance and reducing turnaround times. These innovations significantly contribute to improved customer satisfaction levels.

5. Regulatory Environment

The regulatory framework in the U.S., while strong, supports technological innovation, allowing insurers to explore new avenues for growth without compromising compliance standards.

The combination of advancing technology and changing consumer demands presents a unique opportunity for insurers in the U.S. market to enhance their competitive edge through strategic adoption of AI and automation tools, leading to a future where digital solutions drive business success.

China Insurance Mobile Apps Market Analysis

The China Insurance Mobile Apps Market is expected to grow significantly by 2025, mainly due to the increasing number of people using smartphones. With over one billion mobile phone users in the country, the shift towards a digital-first approach is changing the way consumers interact with insurance products. This trend shows a growing preference for convenience over traditional methods when buying policies or making claims.

Factors Driving Growth

Several factors contribute to this growth:

- Digital Transformation: Chinese consumers are increasingly embracing mobile solutions for their insurance needs. This shift aligns with the country’s broader digital transformation initiatives, which emphasize enhancing consumer experiences through technology.

- Policy Purchases and Claims Processing: Consumers in China are favoring mobile applications for managing policies and processing claims. The apps offer ease of access and streamlined processes that are particularly appealing to tech-savvy users.

- Strategic Partnerships: Insurers are collaborating with leading tech companies to integrate advanced features like AI-driven chatbots and predictive analytics. These collaborations aim to enhance customer service and operational efficiency.

- Regulatory Support: The Chinese government has introduced favorable policies to encourage the development of digital insurance platforms. This regulatory environment supports innovation and investment in mobile technologies.

- Rising Middle Class: The growing middle class in China represents a burgeoning market for insurance products, further fueling demand for digital solutions that cater to their evolving expectations.

These factors highlight China’s crucial role in driving global growth in the Insurance Mobile Apps Market. As smartphone usage continues to increase, insurers must use technological advancements to efficiently meet consumer demands, ensuring they stay competitive in this rapidly changing landscape.

India Insurance Mobile Apps Market Analysis

The Indian insurance mobile apps market is set for significant growth, driven by a large uninsured population seeking affordable coverage options. This market potential is projected to soar by 2025 as digital accessibility and smartphone penetration continue to rise across the nation.

Key Factors Driving Growth

1. Large Uninsured Population

A sizable segment of India’s populace remains uninsured, presenting a vast opportunity for insurers to tap into this market with mobile solutions that offer cost-effective policies.

2. Affordable Coverage Options

Many consumers look for budget-friendly insurance products. Mobile apps can facilitate access to micro-insurance products designed for low-income individuals, offering tailored coverage at minimal costs.

3. User-Friendly Applications

The success of mobile apps hinges on their ease of use. Insurers are focusing on developing intuitive interfaces that cater to diverse user demographics, ensuring seamless access to insurance services via smartphones.

Catering to Unique Requirements

1. Vernacular Language Support

With numerous languages spoken across India, providing support in local languages enhances user engagement and broadens reach. Mobile apps offering vernacular language options can better serve regional markets.

2. Micro-Insurance Products

Designed specifically for low-income groups, these products are gaining traction. They offer basic coverage at an affordable rate, making them accessible through mobile platforms.

Market Potential and Projections

Industry experts predict substantial growth in the adoption of insurance mobile apps in India by 2025. As digital literacy improves and technology becomes more integrated into daily life, the demand for convenient, user-centric insurance solutions is expected to rise considerably.

India’s unique market dynamics present an exciting opportunity for insurers looking to expand their digital offerings and capture a larger share of the burgeoning mobile app-based insurance sector.

Future Development Analysis: The Future of Insurance Mobile Apps in Personalized Insurance

The insurance industry is on the verge of a major transformation, thanks to personalized insurance solutions. As we approach 2025, the focus is shifting towards tailoring services to individual preferences. This change is primarily driven by advanced technologies like machine learning algorithms.

1. Machine Learning for Customization

Insurers are using machine learning to analyze large amounts of data, which allows them to offer customized pricing models. With this technology, insurers can better understand and evaluate risks, resulting in premiums that accurately reflect each person’s situation.

2. Targeted Recommendations

Through mobile apps, insurers have the ability to provide targeted recommendations. Users will receive personalized advice on how to adjust their policies or information about new products that may be of interest to them, all based on their unique profiles and behaviors.

3. Enhanced Customer Satisfaction

Personalization leads to higher customer satisfaction because it ensures that products are aligned with what users actually need. When customers feel that services are directly tailored to their requirements, they are more likely to remain loyal and continue using those services.

4. Profitability for Insurers

Offering tailored services can also boost profitability for insurance companies. By minimizing risks associated with underwriting processes and making better use of resources, these companies can achieve improved financial results. Additionally, personalized solutions create opportunities for cross-selling and upselling products during interactions with customers.

5. Future Trends Outlook

The trend of personalization is expected to keep growing in the future. Consumers are increasingly seeking out experiences that are specifically designed for them, which puts pressure on insurers to constantly come up with new ideas and improvements. As technology continues to advance, it is likely that even more complex algorithms will be integrated into insurance services, further expanding the possibilities for personalization.

This evolution represents a significant shift in how insurance companies engage with their customers. It paves the way for a more interactive and efficient insurance experience through mobile applications.

Competitor Analysis: Key Players in the Insurance Mobile Apps Market

The insurance mobile apps market is a dynamic arena with various key players competing for dominance. Each player brings unique strengths and faces distinct challenges, shaping the competitive landscape.

- Oscar Health – United States

- myCigna – United States

- Religare Health – India

- MyAmFam – United States

- Blue Shield of California – United States

- Reliance Self-i – India

- Geico – United States

- Progressive – United States

- State Farm – United States

- Lemonade – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Insurance Mobile Apps Market Report |

| Base Year | 2024 |

| Segment by Type |

· Claims Processing Apps · Policy Management Apps · Customer Support Apps |

| Segment by Application |

· Health Insurance · Auto Insurance · Life Insurance |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The insurance mobile apps market is about to undergo a major transformation. It is expected to reach a value of $18.13 billion by 2025, showcasing how digitalization can redefine traditional industries. Here are some key insights into this rapidly growing market:

- Technological Integration: Advanced technologies such as AI are being seamlessly integrated into mobile applications, enhancing user experiences and operational efficiencies.

- Global Growth Drivers: Major markets in the U.S., China, and India are leading the growth with increased consumer demand for digital solutions. In emerging economies, mobile apps are crucial for expanding insurance accessibility.

- Data Governance: As insurers implement AI strategies, strong data governance frameworks ensure the quality and security necessary to protect consumer interests and build trust.

- Consumer Engagement: Mobile apps offer unmatched convenience for managing policies and processing claims, meeting modern consumers’ expectations for quick, digital interactions.

- Talent Development: The shift towards a more digital-focused approach requires a workforce skilled in technical abilities related to AI and digital literacy.

This combination of technology adoption, changing consumer preferences, and strategic talent development signifies a significant change in the insurance industry. Insurers must embrace these changes to succeed in this ever-evolving market.

Global Insurance Mobile Apps Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Insurance Mobile Apps Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Insurance Mobile AppsMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Insurance Mobile Appsplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Insurance Mobile Apps Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Insurance Mobile Apps Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Insurance Mobile Apps Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofInsurance Mobile AppsMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the supply chain structure in the insurance mobile apps market?

The supply chain in the insurance mobile apps market consists of both upstream and downstream segments. Key players include technology providers, insurers, and various stakeholders who contribute to app development, implementation, and distribution.

How is AI influencing user experience in insurance mobile apps?

AI integration in insurance mobile apps enhances user experience by providing personalized recommendations, automating claims processing, and improving customer service through chatbots, ultimately leading to more efficient interactions.

What challenges do insurers face when adopting mobile apps?

Insurers encounter several challenges such as data governance issues, ensuring security measures are in place, and navigating regulatory hurdles that can delay app development and deployment.

How do geopolitical factors affect the production and trade of insurance mobile apps?

Global political dynamics impact insurance app production through trade policies that influence distribution across regions. Case studies show how specific markets are affected by these geopolitical factors.

What types of insurance mobile apps exist and what are their applications?

Insurance mobile apps can be categorized into various types such as claims processing apps and policy management apps. These applications serve different sectors including health, auto, and life insurance, enhancing operational efficiency.

What is the future outlook for personalized insurance solutions in mobile apps?

The future of insurance mobile apps is leaning towards personalized solutions by 2025, focusing on tailoring services based on individual preferences using advanced technologies like machine learning to enhance customer satisfaction and drive profitability.