Intermediary Service Market Forecast for Q1 and Q2 2025

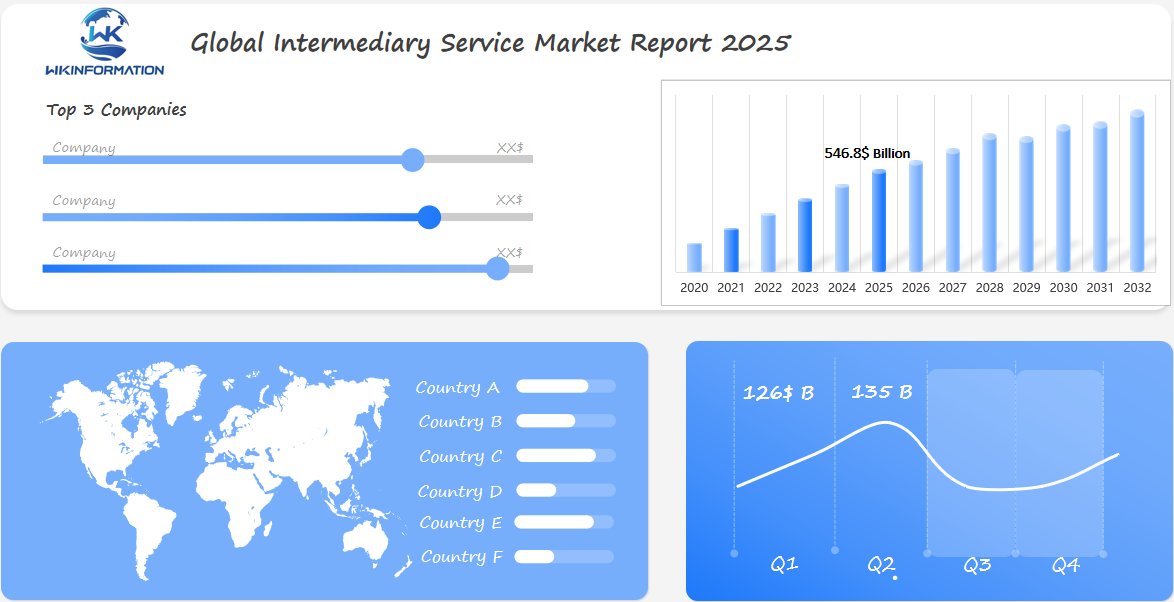

The Intermediary Service market is set to reach an estimated size of approximately USD 546.8 billion in 2025, with significant growth driven by advancements in logistics and supply chain management. In Q1 2025, the market is expected to generate around USD 126 billion, with the U.S. contributing a substantial share due to the country’s leading position in global trade, technology adoption, and logistics infrastructure. The U.K. follows closely behind in Q1, fueled by Brexit-related adaptations and a booming e-commerce market. China, on the other hand, continues to benefit from its central role in global manufacturing and exports, which propels the intermediary services sector forward. In Q2 2025, the market is projected to expand to approximately USD 135 billion, driven by the increased demand for faster delivery times, more sophisticated supply chain solutions, and the continued integration of digital platforms in logistics. With a compound annual growth rate (CAGR) of 5.42% expected through 2033, the intermediary services market is poised for steady growth. For a deeper understanding of the market dynamics, strategies of key players, and future trends, read the Wkinformation Research sample and full report.

Key players leading this growth include the United States, United Kingdom, and China. Each of these countries contributes uniquely to the financial and business services sectors:

- The U.S. is known for its dominance in financial services exports, leveraging its innovation hubs.

- The U.K., with London at its core, serves as a pivotal center for global finance.

- China’s rapid economic development has spurred demand for intermediary services, especially in logistics and supply chain management.

These countries collectively drive advancements and set benchmarks within the intermediary service market, positioning themselves as leaders in this dynamic industry.

Factors Driving Growth in Financial & Business Services

The intermediary service market is diverse, encompassing various segments that cater to the intricate needs of global trade. Key segments include:

- Financial Services: This segment covers banking, insurance, and investment services. These are essential for facilitating transactions and managing risks in international markets.

- Business Services: This includes consulting, legal services, and other professional services that support businesses in navigating complex regulatory environments and strategic decision-making.

- Trade Facilitation Services: Encompassing logistics and supply chain management, these services ensure smooth movement of goods across borders.

Impact of Globalization

Globalization plays a significant role in driving demand for intermediary services. The integration of global markets has increased the complexity of business operations, necessitating expert guidance provided by intermediaries. For instance:

- In Southeast Asia, burgeoning economies require robust financial infrastructure to support foreign investments.

- European companies seek legal expertise to comply with varying regulations across member states.

Influence of Digital Transformation

Digital transformation reshapes how these services are delivered. Technologies like artificial intelligence enhance customer service through chatbots and automated processes. Blockchain technology offers secure transaction methods, reducing fraud risks and improving transparency. Examples include:

- Fintech firms using AI to streamline investment advice.

- Logistics companies employing blockchain for real-time tracking.

These advancements not only enhance efficiency but also create new avenues for growth within the market. As service delivery models evolve, intermediaries can offer more personalized solutions, meeting specific client needs with precision.

By harnessing the power of digital tools, intermediary service providers continue to adapt to changing market demands, reinforcing their integral role within the global economy.

U.S. Market Trends: Dominance in Financial Services Exports

The United States is a leader in the intermediary services market, especially when it comes to exporting financial services. This success is supported by a strong financial system and a wide range of services such as banking, insurance, and investment advice. The U.S. stands out in exporting these services because of its advanced regulations that promote innovation while ensuring stability.

Key Factors Driving Growth

- Regulatory Changes

- Modifications in regulations have played a crucial role in creating a favorable environment for growth. By simplifying procedures and removing obstacles, U.S. policy changes have made cross-border transactions easier, leading to an increase in service exports.

- Innovation Centers

- Areas like Silicon Valley are key players in driving the digital transformation of financial services. These innovation centers are not only promoting technological advancements but also attracting global talent and investment, further strengthening the U.S.’s competitive advantage.

- Global Presence

- With a wide network of international trade agreements and partnerships, U.S. intermediary services can effectively enter various markets, offering customized solutions that meet global needs.

Challenges and Competition

Even though the U.S. is currently in the lead, it faces challenges from emerging foreign competitors who are gradually gaining market share with competitive pricing and localized solutions. For example:

- Developing Economies

- Countries like China and India are quickly building their own financial sectors, providing competitive options to traditional U.S.-based services.

- Technological Disruption

- The worldwide rise of fintech companies is changing how services are provided, forcing traditional players to constantly innovate.

To maintain its leadership position, the U.S. must make use of its strengths while adjusting to these evolving challenges through strategic investments in technology and policy changes.

U.K.’s Contributions to Global Financial Landscape

The United Kingdom plays a crucial role in the global financial scene, with London recognized as one of the top financial centers in the world. This status is not only due to its historical significance but also its strategic location and strong infrastructure that supports various financial activities. London serves as a central finance hub, attracting businesses and investors with its combination of expertise, regulatory framework, and concentration of talent.

U.K.’s Influence in Service Exports

When it comes to service exports, the U.K. holds significant influence, especially with key markets like the United States. The range of services exported covers multiple sectors, with legal services and fintech solutions emerging as areas of strength.

Legal Services

Legal services from the U.K. are highly regarded for their quality and adherence to international standards, making them highly sought after by foreign clients.

Fintech Solutions

The fintech sector in the U.K. has experienced substantial growth, supported by London’s thriving startup ecosystem and favorable regulatory environment. Innovations in digital finance have propelled fintech solutions to the forefront, improving service delivery and efficiency for consumers and businesses alike.

Service Exports to the U.S.

Service exports to the U.S. demonstrate this expertise, where there is a continuous demand for the U.K.’s knowledge in these areas. The collaboration between these two economic powerhouses highlights the significance of intermediary services in facilitating international trade and investment. According to a recent study, these intermediary services are not just beneficial but essential for maintaining robust economic relations between the U.K. and the U.S., underscoring the importance of service exports in driving economic growth.

The U.K.’s position in the intermediary service market is vital for maintaining its standing globally, using its strengths to overcome challenges and seize opportunities within this ever-changing landscape.

China’s Growth Potential: Tapping into Intermediary Services Demand

China’s economic expansion has been nothing short of remarkable, significantly impacting the demand for intermediary services. Key sectors such as logistics and supply chain management have seen increased activity, driven by the country’s efforts to enhance connectivity and efficiency across its vast consumer market. The Belt and Road Initiative exemplifies this push, emphasizing infrastructure development and cross-border trade facilitation.

The regulatory environment in China presents both opportunities and challenges for foreign businesses looking to enter this dynamic market. Understanding the complex regulatory landscape is crucial for success. Here are some practical tips for navigating these challenges:

- Engage Local Expertise: Partnering with local firms or employing experts familiar with Chinese regulations can provide invaluable insights and help mitigate compliance risks.

- Stay Informed: Regulations in China can change rapidly. Keeping abreast of legislative updates ensures that your business remains compliant and can adapt swiftly to new requirements.

- Cultural Sensitivity: Building relationships in China often requires a deep understanding of cultural nuances. Demonstrating respect for local customs can facilitate smoother negotiations and partnerships.

China’s commitment to expanding its global economic footprint suggests continued growth potential in intermediary services. By strategically positioning themselves within this evolving landscape, businesses can capitalize on the vast opportunities presented by China’s burgeoning market.

Key Players in the Intermediary Service Market

The intermediary service market, which facilitates the movement of goods and logistics across various industries, continues to expand with prominent players such as C.H. Robinson Worldwide, Schneider, J.B. Hunt Integrated Capacity Solutions, ArcBest Corp., Hub Group, MODE Global, Landstar System, WWEX Group, Total Quality Logistics, and Echo Global Logistics leading the charge. These companies provide a wide array of services, ranging from transportation management and freight brokerage to supply chain optimization, ensuring the seamless movement of goods across global markets. As demand for efficient, cost-effective logistics solutions grows, these market leaders are investing in technology and expanding their service offerings to meet the diverse needs of industries worldwide. The growth of e-commerce, globalization of supply chains, and the rise of digital platforms further contribute to the expansion of the intermediary services market. To gain a more comprehensive understanding of the competitive landscape, key strategies, and growth forecasts, read the Wkinformation Research sample and full report for in-depth insights.

Future Outlook: Technology Advancements Shaping Intermediary Services

The intermediary service market is expected to grow significantly by 2025, mainly due to technological advancements. Key innovations such as artificial intelligence (AI) and blockchain technology are expected to transform how services are delivered, making them more efficient and reliable.

How AI and Blockchain Will Impact Intermediary Services

- AI can streamline processes by automating routine tasks, reducing errors, and personalizing client interactions.

- Blockchain offers unprecedented security and transparency in transactions, making it a game-changer for sectors like finance and supply chain management.

Role of Fintech Firms in Driving Technological Shifts

Fintech firms are leading the way in these technological changes, playing a crucial role in reshaping how services are delivered. They introduce innovative solutions like digital payment platforms, which improve service efficiency and accessibility. These platforms enable smooth transactions across borders, meeting the increasing demand for fast and secure financial services.

This increased accessibility is particularly beneficial for small businesses and consumers in emerging markets, who traditionally face barriers in accessing financial services.

Rethinking Business Models with Technology Integration

The integration of technology into intermediary services goes beyond simply using new tools; it involves rethinking entire business models. Companies that use these advancements to provide more customized and agile services can gain a competitive advantage. This shift is indicative of how technology is disrupting traditional business models, prompting firms to adapt or risk obsolescence.

As fintech innovations continue to develop, we can expect further disruptions in traditional ways of delivering services, creating new growth opportunities within the intermediary service market.

Global Impact of Technological Evolution on Intermediary Services

This technological evolution will bring about significant changes in major economies, affecting how businesses operate and interact globally. The ongoing digital transformation is likely to redefine market boundaries and establish new standards for efficiency and customer satisfaction in intermediary services.

Investment Trends & Regulatory Environment Impacting Intermediary Services

The intermediary service market is witnessing a significant influx of foreign direct investment (FDI), driven by lucrative opportunities in major economies like the U.S., U.K., and China. These regions have become attractive for foreign entities seeking to capitalize on the burgeoning demand within sectors such as financial services, consulting, and trade facilitation.

1. United States

The U.S. continues to captivate investors with its robust financial infrastructure and innovation-driven economy. Key areas attracting FDI include fintech solutions and investment advisory services, where technological advancements promise enhanced service delivery and customer satisfaction.

2. United Kingdom

Known for its strong legal framework and expertise in financial services, the U.K. draws considerable foreign investment interest. London’s status as a global financial hub makes it a prime destination for investments in sectors like insurance, asset management, and legal consulting.

3. China

China’s rapid economic growth presents unique prospects for foreign intermediaries. The demand for expertise in logistics, supply chain management, and regulatory navigation is accelerating FDI inflows into these services. As businesses aim to tap into China’s expansive consumer base, opportunities abound for those adept at navigating its complex regulatory landscape.

The evolving regulatory environment plays a pivotal role in shaping the dynamics of this market. Governments are progressively adapting their frameworks to keep pace with market changes while ensuring consumer protection remains paramount. Regulatory reforms are being implemented to foster competitive environments that encourage innovation without compromising security or ethical standards.

The interplay between investment trends and regulatory adaptations highlights the strategic importance of staying informed about both local and international developments within the intermediary service market.

Conclusion

| Report Metric | Details |

|---|---|

| Report Name | Global Intermediary Service Market Report |

| Base Year | 2024 |

| Segment by Type |

·Leasing Service ·Buying and Selling Service ·Mortgage Service ·Others |

| Segment by Application |

·Real Estate ·Consumer Goods ·Others |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Intermediary Service Market is on the verge of significant growth as we approach 2025. This expansion is driven by key players such as the U.S., U.K., and China, each using their strengths to navigate and influence global trade networks. As these countries continue to shape the market, strategic positioning becomes crucial for industry players looking to take advantage of new opportunities.

Key areas of focus for businesses looking to strengthen their presence in this dynamic market include:

- Innovation: Using advanced technologies like fintech and blockchain to improve service delivery models.

- Globalization: Expanding into new markets while understanding local regulations and consumer behaviors.

- Collaboration: Forming partnerships with local and international companies to offer a wider range of services.

In 2025, market positioning will require a proactive approach to identifying trends and adjusting strategies accordingly. By prioritizing these elements, companies can not only maintain but also increase their influence in the intermediary service market. Therefore, stakeholders must stay alert in their pursuit of excellence, ensuring that they are prepared to meet the needs of a constantly changing global economy.

FAQs (Frequently Asked Questions)

1. What are intermediary services?

Intermediary services encompass a range of activities that facilitate transactions between buyers and sellers. They are crucial in sectors like finance, business, and trade facilitation, helping streamline operations and enhance efficiency.

2. Why is the intermediary service market important?

This market plays a pivotal role in global trade by enabling smoother transactions and fostering international business relationships. Its growth can drive economic development and innovation within the financial and business sectors.

3. Which countries are leading the intermediary service market?

The United States, United Kingdom, and China are key players, each contributing significantly to the market through their robust financial systems and strategic positioning in global trade networks.

4. How is technology influencing intermediary services?

Technological advancements such as artificial intelligence and blockchain are reshaping service delivery models, increasing efficiency, and improving accessibility for consumers worldwide.

5. What challenges do intermediary service providers face?

Providers often navigate complex regulatory environments, fierce competition from international entities, and the need to continuously innovate to meet evolving consumer demands.

For further inquiries or detailed insights into specific segments of the intermediary service market, feel free to reach out or leave your questions in the comments below.

Global Intermediary Service Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Intermediary Service Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Intermediary ServiceMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Intermediary Serviceplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Intermediary Service Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Intermediary Service Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Intermediary Service Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofIntermediary ServiceMarket Insights

- Actionable Recommendations for Stakeholders