$267 Million Lithium Silicon Battery Market Set to Revolutionize Energy Storage in the U.S., China, and Japan by 2025

The lithium silicon battery market is expanding rapidly due to the growing demand for electric vehicles and renewable energy. These batteries offer higher energy density and faster charging, with government support and ongoing R&D driving further adoption across industries.

- Last Updated:

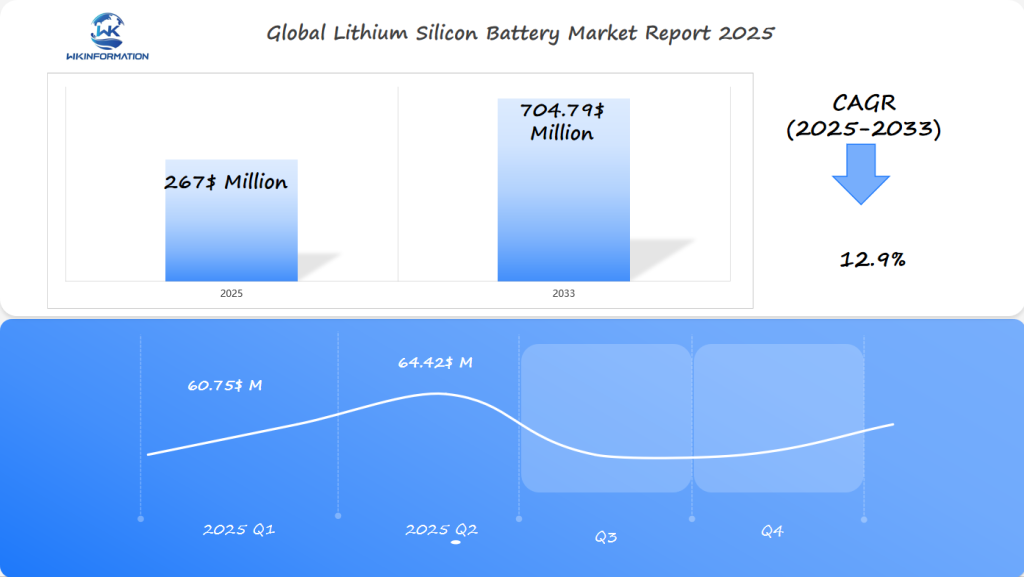

Projected Market Insights for Lithium Silicon Battery in Q1 and Q2 of 2025

The Lithium Silicon Battery market is projected to reach $267 million in 2025, with a CAGR of 12.9% from 2025 to 2033. In Q1, the market is expected to generate around $60.75 million, driven by the ongoing advancements in electric vehicles (EVs), consumer electronics, and renewable energy storage solutions. By Q2, the market is anticipated to grow to approximately $64.42 million, as battery manufacturers scale up production of high-performance lithium silicon batteries for EVs and next-gen mobile devices.

The U.S., China, and Japan are leading regions for this market. The U.S. benefits from its advanced electric vehicle market and green energy policies, while China remains a global leader in battery manufacturing and EV adoption. Japan’s strong presence in consumer electronics and automotive industries further strengthens its position. As lithium silicon batteries gain traction for their energy density advantages, the market is poised for significant growth.

Upstream and Downstream Industry Chains for Lithium Silicon Batteries

Understanding the supply chain for lithium silicon batteries begins with the sourcing of raw materials. Silicon, a key component, is derived from abundant sources such as quartz or silica sand. However, refining it to a purity level suitable for battery anodes involves complex chemical processes. Lithium, another essential element, is typically extracted from brine pools or hard rock mines. The supply chain dynamics are heavily influenced by geopolitical factors, impacting the availability and pricing of these critical resources.

In terms of production processes, manufacturing lithium silicon batteries involves several stages:

- Material Synthesis: Silicon is integrated with lithium through processes like chemical vapor deposition (CVD) or mechanical milling.

- Anode Fabrication: The synthesized material is then formed into anodes using techniques like slurry casting onto current collectors.

- Battery Assembly: Cells are assembled by stacking or winding electrodes with separators and electrolyte filling.

- Quality Control: Rigorous testing ensures performance metrics align with industry standards.

These processes require precision engineering and advanced technology to achieve the desired energy capacity and efficiency goals.

Upon completion of manufacturing, the distribution channels play a crucial role in bringing the product to market. Major players utilize a combination of direct sales and third-party distributors to reach various customer segments. The distribution strategy often includes:

- Direct Partnerships: Collaborations with automotive manufacturers or renewable energy companies for tailored integration.

- Retail Networks: Electronics retailers that cater to consumer electronics markets.

- Online Platforms: E-commerce channels that provide access to a wider audience, enhancing market penetration.

Navigating these channels efficiently requires strategic planning to ensure timely delivery and competitive pricing, ultimately fueling the widespread adoption of lithium silicon batteries across diverse applications.

Key Trends Driving the Lithium Silicon Battery Market Forward

The lithium silicon battery market is growing steadily, thanks to several key trends that are reshaping energy storage solutions. Here are some of the main factors contributing to this growth:

1. Increasing Energy Capacity

One of the most significant advantages of lithium silicon batteries over traditional lithium-ion batteries is their higher energy capacity. By using silicon-based anodes instead of graphite-based ones, these batteries can store more energy—over ten times the capacity of conventional batteries. This means longer-lasting power, making them highly attractive for industries that require high efficiency.

2. Growing Focus on Environmental Sustainability

With climate change and environmental conservation becoming major global concerns, industries are actively looking for eco-friendly alternatives. Lithium silicon batteries fit this trend perfectly as they have low operational potential and minimal environmental impact during production and disposal. Additionally, their ability to efficiently store renewable energy further enhances their appeal as a sustainable option.

3. Rising Demand from Specific Application Sectors

Certain sectors are driving the demand for lithium silicon batteries:

- Electric Vehicles (EVs): Manufacturers are constantly seeking ways to improve driving ranges and reduce charging times. Lithium silicon batteries meet these needs by offering higher capacities and faster charge rates—essential features for the next generation of EVs.

- Consumer Electronics: As devices become more advanced, requiring greater power without increasing size or weight, there is a growing need for innovative battery technologies. Lithium silicon batteries provide a viable solution with their compact design and high energy density.

These trends highlight the potential impact of lithium silicon batteries across various industries. The market’s growth reflects both technological advancements and changing consumer preferences towards more efficient and environmentally conscious energy solutions.

Challenges in Manufacturing and Commercializing Lithium Silicon Batteries

Scaling up production of lithium silicon batteries comes with several major challenges.

Material Stability During Cycling

Material stability during cycling is a primary concern, as silicon-based anodes tend to expand and contract more than traditional graphite anodes. This change in volume can cause structural damage over multiple charge-discharge cycles, affecting the battery’s lifespan and performance reliability.

Cost Factors

Cost factors are very important in determining who will succeed in the world of energy storage technologies. Even though lithium silicon batteries have the advantage of storing more energy in a smaller space, they are still expensive to produce. When we look at these costs compared to new technologies such as solid-state batteries, it becomes clear that we need new ideas and methods to make production faster and cheaper without sacrificing quality or efficiency.

Technological Awareness Among Consumers

Technological awareness among consumers presents another layer of complexity. For many potential users, the benefits of lithium silicon batteries are not immediately clear, often overshadowed by the familiarity and established reputation of lithium-ion counterparts. Educating consumers on the unique advantages—such as higher energy capacity and environmental benefits—can drive adoption rates, but requires concerted efforts from manufacturers and industry stakeholders.

In addressing these challenges, industry players must balance innovation with practicality, ensuring that advancements in battery chemistry translate into viable commercial products. Collaboration across sectors, investment in R&D, and strategic marketing initiatives will be vital for overcoming these barriers. Bridging the gap between technological potential and market reality continues to be a critical focus area for the lithium silicon battery market.

Geopolitical Factors Influencing Lithium Silicon Battery Adoption

Understanding the geopolitical landscape is crucial for comprehending the adoption of lithium silicon batteries. The relationships between countries can have a major impact on the market, especially through trade policies and international cooperation.

1. Trade Policies and Raw Material Sourcing

Trade policies play a crucial role in shaping how companies source their raw materials. Countries like China, which have abundant resources such as lithium and silicon, have significant control over supply chains. Manufacturers need to carefully navigate tariffs, trade restrictions, and bilateral agreements in order to secure these materials efficiently. For example, any changes in U.S.-China trade relations could impact sourcing strategies and production costs.

These situations emphasize the importance of understanding the geopolitics of energy transition, particularly when it comes to critical materials like lithium and silicon that are vital for battery production.

2. Government Incentives and Regulations

Government actions can either spur or stifle market growth. In the U.S., policies aimed at reducing carbon emissions drive demand for advanced batteries, while subsidies can make production more economically viable. In contrast, stringent regulations might slow down rollout if compliance costs are high. Japan’s focus on technological innovation supports research and development in battery technologies, aligning with national energy strategies.

These geopolitical elements underscore the complexity of advancing lithium silicon technology on a global scale. Manufacturers must remain adaptable to policy changes and foster international partnerships to mitigate risks and capitalize on emerging opportunities.

Market Segmentation: Types and Applications of Lithium Silicon Batteries

The world of lithium silicon batteries is wide-ranging, mainly categorized by how the anode is designed. There are two main types:

- Particle-based structures: These commonly use silicon particles blended with other materials to form a composite anode. This design balances energy capacity and stability, offering a practical solution for many applications.

- Nanowire arrays: A more innovative approach, these utilize silicon nanowires to create a high-surface-area anode. This architecture allows for significant energy storage improvements, presenting opportunities for applications that require higher performance.

Different sectors leverage the strengths of lithium silicon technology to match their specific needs, pushing the development of specialized solutions tailored to each market’s performance metrics. The evolution of these technologies continues to reshape the potential applications and adoption rates across various industries.

Each application sector has its own specific requirements for battery technology:

- Automotive industry: Electric vehicles need batteries that are lightweight but powerful, capable of storing large amounts of energy without adding significant weight.

- Stationary storage systems: These include solutions for grid-scale energy storage which prioritize long-term stability and efficient charge/discharge rates over compact size.

Understanding these demands helps manufacturers design lithium silicon batteries that cater to the unique needs of each industry.

Lithium Silicon Batteries in Electric Vehicles and Renewable Energy

Lithium silicon batteries are emerging as a breakthrough technology in energy storage, offering significantly higher energy density and faster charging capabilities compared to conventional lithium-ion batteries. These advancements make them particularly valuable for electric vehicles (EVs), where extended driving range and rapid recharging are critical factors.

In the renewable energy sector, lithium silicon batteries enhance grid storage efficiency, enabling better integration of solar and wind power into energy systems.

As industries strive for higher performance and sustainability, lithium silicon technology is poised to play a key role in the transition to cleaner energy solutions.

Global Market Insights into Lithium Silicon Battery Growth

The global lithium silicon battery market is experiencing rapid expansion, driven by rising demand for high-performance energy storage solutions in EVs and renewable energy systems. Innovations in anode materials, battery longevity, and manufacturing processes are accelerating adoption across various industries.

Key Regions Driving Growth

- Asia-Pacific: The dominant region for production and development, with strong investments from China, Japan, and South Korea.

- North America: Advancing research and scaling up domestic battery production to reduce supply chain dependencies.

- Europe: Similar efforts as North America to boost local battery manufacturing capabilities.

Strategies for Competitive Advantage

As competition intensifies, companies are focusing on:

- Cost reduction

- Energy efficiency

- Sustainability

These strategies are crucial for gaining a competitive edge in this evolving market.

U.S. Market Demand for Lithium Silicon Batteries in Energy Storage

In the U.S., the growing adoption of lithium silicon batteries is being driven by advancements in EV technology and grid energy storage. The push for cleaner energy solutions, combined with government incentives for domestic battery production, is fostering innovation and investment in next-generation battery technologies.

Key players in the U.S. are working on scaling up lithium silicon battery manufacturing to support the increasing demand from automakers and renewable energy developers. With a focus on enhancing energy density, cycle life, and cost efficiency, the U.S. market is poised for significant growth in lithium silicon battery adoption.

China's Market for Lithium Silicon Batteries: Innovation and Demand

China is leading the way in lithium silicon battery innovation, with top battery manufacturers and research institutions making significant improvements in anode materials and production efficiency. The country’s strong push for electric vehicle adoption, backed by government policies and subsidies, is driving the demand for advanced batteries that offer greater energy capacity and faster charging times. Furthermore, China’s position as a global leader in renewable energy is increasing the need for large-scale energy storage solutions.

As the market develops, Chinese companies are making substantial investments to expand their production capabilities and secure their sources of raw materials. This strategy aims to help them stay ahead of the competition.

Japan’s Role in Advancing Lithium Silicon Battery Technologies

Japan has always been at the forefront of battery technology, and its contribution to the development of lithium silicon batteries is no different. Japanese companies are pouring resources into advanced research aimed at enhancing battery lifespan, heat resistance, and energy efficiency.

With its expertise in precise manufacturing and materials science, Japan is creating top-notch lithium silicon batteries specifically designed for electric vehicles (EVs) and stationary energy storage solutions.

Key factors driving innovation in Japan’s lithium silicon battery sector include:

- Partnerships between major industry players

- Government initiatives supporting clean energy

- Collaboration with research institutions

These efforts are positioning Japan as a significant player in shaping the future of lithium silicon battery technology.

The Future Outlook for Lithium Silicon Batteries: Advancements and Opportunities Ahead

The future of the lithium silicon battery market looks bright with exciting developments that could greatly improve their performance. Researchers are working on enhancing silicon-based anode designs, which could result in batteries with higher energy storage capacity and longer lifespan. Nanotechnology also shows great potential, with possible breakthroughs in nanowire arrays and silicon nanotubes expected to boost important factors like charging cycles and discharging speeds.

Emerging Opportunities

Emerging opportunities lie in specific market segments like grid-scale energy storage. As renewable energy sources become more common, the need for efficient energy storage solutions grows. Lithium silicon batteries, known for their high capacity and environmental benefits, are expected to play a crucial role.

In the transportation sector, the ongoing shift toward electric vehicles presents a significant opportunity. As car manufacturers look for batteries that provide longer distances and quicker charging times, lithium silicon technology could become a preferred choice.

Consumer electronics also represent another area for growth. Devices that require small yet powerful batteries may benefit from silicon-based innovations, meeting the increasing demand for long-lasting and efficient portable gadgets.

The future of lithium silicon batteries holds exciting possibilities across various industries, depending on achieving commercial viability and overcoming current technological limitations.

Competitive Landscape in the Lithium Silicon Battery Industry

Major players:

- Sila Nanotechnologies —— USA

- Amprius Technologies —— USA

- Group14 Technologies —— USA

- Enovix Corporation —— USA

- NanoGraf Corporation —— USA

- Enevate Corporation —— USA

- Nexeon —— UK

- Samsung SDI —— South Korea

- Advano —— USA

- Ningbo Shanshan Co. Ltd. —— China

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Lithium Silicon Battery Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The lithium silicon battery market is about to experience significant growth, with forecasts showing an increase from USD 267 Million in 2025 to USD 704.79 Million by 2033. This growth is primarily driven by the rising demand for electric vehicles, renewable energy systems, and consumer electronics.

However, there are challenges that need to be overcome in order to fully realize this potential. These challenges include high production costs, scalability issues, and environmental concerns. It is crucial to address these obstacles in order to unlock the true power of lithium silicon batteries.

To move the market forward, continuous innovation in energy density and safety is essential. Additionally, strategic investments will play a key role in driving the industry ahead. These advancements will establish lithium silicon batteries as a fundamental component of the future energy landscape.

Global Lithium Silicon Battery Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Lithium Silicon Battery Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Lithium Silicon Battery MarketSegmentation Overview

Chapter 2: Competitive Landscape

- Global Lithium Silicon Batteryplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Lithium Silicon Battery Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Lithium Silicon Battery Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Lithium Silicon Battery Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Lithium Silicon Battery Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected value of the lithium silicon battery market by 2025?

The lithium silicon battery market is expected to be worth $267 million by 2025. This growth is mainly due to the rising demand in industries like electric vehicles and renewable energy integration.

What are the key trends driving the growth of the lithium silicon battery market?

The growth of the lithium silicon battery market is being driven by several key trends:

- Higher energy capacity and efficiency: Lithium silicon batteries offer greater energy storage capacity and efficiency compared to traditional lithium-ion batteries, making them an attractive choice for applications requiring high power output.

- Focus on environmental sustainability: With increasing concerns about climate change and environmental impact, there is a growing emphasis on developing sustainable energy solutions. Lithium silicon batteries, with their potential for higher energy density and longer lifespan, align with this focus.

- Demand from electric vehicles and consumer electronics: The rising adoption of electric vehicles (EVs) and the continuous growth of the consumer electronics industry are driving up demand for advanced battery technologies. Lithium silicon batteries are well-suited to meet the energy requirements of these sectors.

What challenges do manufacturers face in producing lithium silicon batteries?

Manufacturers face several challenges in scaling up production volumes of lithium silicon batteries, including:

- Material stability during cycling

- Cost competitiveness against other technologies like solid-state batteries

- The need for increased consumer awareness about new battery chemistries

How do geopolitical factors influence the adoption of lithium silicon batteries?

Geopolitical factors play a significant role in shaping the global landscape for lithium silicon battery adoption. Here’s how:

- Trade policies: These policies affect how companies source raw materials for battery production, which can impact the overall supply chain and availability of lithium silicon batteries.

- Government incentives and regulations: Countries like China, Japan, and the U.S. have their own policies in place that can either encourage or discourage the growth of the lithium silicon battery market. For example, subsidies or tax breaks for manufacturers may boost production, while strict regulations on imports could create barriers.

Understanding these geopolitical dynamics is crucial for stakeholders looking to navigate the complexities of the lithium silicon battery industry.

What types of applications utilize lithium silicon batteries?

Lithium silicon batteries are used in a wide range of applications, such as:

- Automotive: They power electric vehicles (EVs).

- Stationary storage solutions: These batteries store energy for various purposes, like renewable energy systems or grid support.

Each application has specific needs when it comes to performance factors like cycle life (how many times the battery can be charged and discharged) and charge/discharge rates (how quickly the battery can be charged or provide power). Lithium silicon batteries are designed to meet these requirements.

What does the future hold for lithium silicon batteries?

Lithium silicon batteries have a bright future ahead. Experts believe that new technological advancements will improve their performance even further. These batteries may also find applications in specific areas like large-scale energy storage, where they could become widely used once they prove to be commercially viable.