2025 Microduct Market: Capturing $13.54 Billion Global Opportunities, Driven by Demand in the United States, China, and India

Discover how microducts are revolutionizing fiber optic infrastructure deployment worldwide. Learn about microduct market growth trends, key industry players, and emerging opportunities in the US, China, and India as the global demand for high-speed connectivity continues to surge.

- Last Updated:

Q1 and Q2 2025 Microduct Market Analysis: Emerging Trends and Key Insights

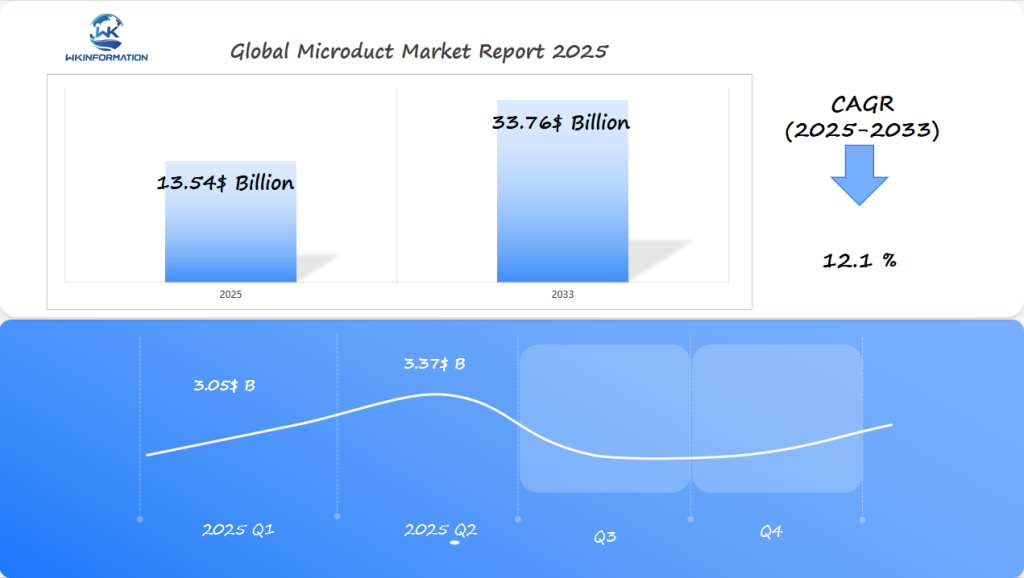

The microduct market is poised to reach a valuation of $13.54 billion in 2025, driven by a strong CAGR of 12.1% from 2025 to 2033. Based on annual projections, the market is estimated to generate approximately $3.05 billion in Q1 2025 and $3.37 billion in Q2 2025, reflecting an upward trend fueled by increasing demand for high-speed fiber-optic infrastructure.

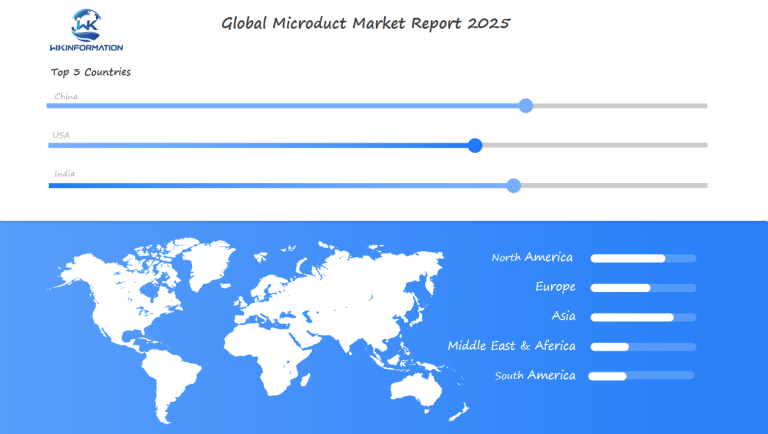

Notably, the United States, China, and India emerge as the most critical markets for analysis, given their accelerated deployment of broadband networks and expanding telecommunication investments. These regions are expected to set the pace for industry advancements, making them the focal points for market opportunities and strategic investments.

Key Takeaways

- Strong telecom investments in the U.S., China, and India position them as top promising markets for microducts.

- Fiber optic infrastructure expansions directly boost adoption of microduct technologies.

- National broadband policies in these countries drive global microduct industry growth.

- Microducts support critical infrastructure needs for 5G, IoT, and smart city projects.

- Market dynamics in these regions highlight opportunities for manufacturers and telecom providers.

Upstream and Downstream Industry Chain Analysis: The Microduct Supply Chain Explained

Understanding the microduct supply chain begins with its core parts. From raw materials to final installations, each link affects product quality and availability. Let’s see how materials turn into useful infrastructure.

Raw Material Suppliers and Manufacturing Processes

Upstream microduct production uses high-density polyethylene (HDPE), a strong plastic for HDPE microducts. Suppliers like Saudi Basic Industries and Dow Chemical offer this material. They shape HDPE into flexible tubes through extrusion.

Quality checks are crucial to ensure the tubes can withstand environmental stress. This is vital for their long-term performance.

- Raw materials: HDPE pellets sourced globally

- Manufacturing steps: Extrusion, cooling, cutting

- Quality control: Stress tests, diameter consistency checks

Distribution Networks and End-User Applications

Downstream uses include telecom, energy, and smart cities. Distributors like CommScope and Prysmian Networks handle logistics. They ensure timely delivery to installers.

End-users, like telecom firms, use these systems for reliable connectivity. They deploy fiber networks.

| Application | Key Use Case |

|---|---|

| Telecom | Fiber optic cable protection |

| Energy | Underground power line conduit |

| Smart Cities | Urban infrastructure backbones |

Value Chain Integration in the Microduct Industry

Vertical integration cuts costs and boosts efficiency. Companies that produce materials and install them have an advantage. This teamwork ensures a smooth flow from upstream microduct production to downstream applications.

Trend Analysis: Innovations and Trends in Microduct Technology

Modern microduct innovations are changing how we set up fiber optic networks. Companies focus on designs that are both effective and easy to use. These microduct technology trends help solve problems like limited space in cities and old infrastructure.

“Smart monitoring features in microducts are the future of infrastructure resilience,” states a 2024 industry report from Global Telecom Insights.

Miniaturization for Space Savings

Now, there are super small fiber optic microducts that fit in tight spots underground. For example, new 3mm-diameter ducts are strong but use less land. This lets telecom companies update city networks without digging up streets.

Multi-Cell Designs for Scalability

Multi-cell microducts pack many channels into one, making the most of space. These advanced microduct solutions help telecoms plan for future needs without wasting resources. Companies like Corning and AFL offer 12-cell layouts in one trench.

Smart Monitoring Integration

Now, microducts have sensors that track temperature, moisture, and pressure in real time. These systems send alerts through IoT devices, avoiding outages. Such smart features cut maintenance costs by 30% in tests.

From U.S. labs to Asian factories, there’s a worldwide effort for smarter, flexible infrastructure. As we move to 5G and 6G, these updates promise quicker setups and lower costs over time.

Restriction Analysis: Challenges Facing the Microduct Industry

The microduct sector is making progress, but it’s slow. Microduct industry challenges include tough regulations, technical limits, and market barriers. To move forward, governments, manufacturers, and telecom providers need to work together.

Regulatory Hurdles and Compliance Issues

Different microduct regulations cause problems. In the U.S., strict safety standards are required. In India, getting approval can take a long time. China wants fast deployment but often sacrifices quality. These differences make it hard to build global supply chains and increase costs.

Technical Limitations and Manufacturing Constraints

Manufacturing faces fiber optic infrastructure barriers. For example, materials can break down in extreme weather. Here are some main issues:

| Challenge | Issue | Solution Needed |

|---|---|---|

| Material Durability | Corrosion in humid climates | Weather-resistant coatings |

| Compatibility | Incompatibility with legacy systems | Adaptive design standards |

Market Barriers and Competitive Challenges

Telecom deployment restrictions include high costs and competition. Smaller companies find it hard to compete with big players. Also, not enough people know about microduct benefits in rural areas.

To overcome these challenges, we need new ideas and policies that work together. Everyone should focus on being open and investing in research and development to grow.

Geopolitical Analysis: The Impact of Global Politics on Microduct Production and Trade

Global microduct supply is always changing due to telecommunications geopolitics and new microduct trade policies. Trade fights between big countries like the U.S. and China have changed prices and where things are made. Now, how countries get along affects where fiber optic projects happen, from getting materials to delivering products.

Trade Tensions Reshape Industry Landscapes

- U.S. tariffs on Chinese goods have changed global microduct trade, making countries like India more important.

- EU rules on data security affect how fiber optic projects are planned.

Technology Transfer as a Political Tool

Rules on sharing new tech slow down progress. Countries like India are open to foreign investment in fiber optic infrastructure projects. This balance between tech leaders and public-private partnerships is tricky due to strict export rules.

Infrastructure as a Geopolitical Lever

Countries use telecom projects to make friends. The U.S. wants local materials in federal grants, while China funds fiber networks across borders. These actions show how telecommunications geopolitics affect who gets into the market and partnerships.

“Trade barriers aren’t just about tariffs—they redefine who builds tomorrow’s digital highways.”

Companies need to keep up with changes in microduct trade policies to stay strong against political ups and downs.

Segmentation Type Market Analysis: Microduct Market Segmentation by Type and Application

Understanding microduct types and microduct market segments is crucial. Businesses need to see how different products and uses affect demand in different places.

There are three main microduct types: Direct Install, Direct Burial, and Flame-Retardant. Direct Install is for fast fiber setup, Direct Burial is for outdoor use, and Flame-Retardant is for safety in risky areas. The way they’re installed differs too: Direct Install uses pullable tubes, while Direct Burial needs digging. Flame-Retardant types often have armored jackets for extra protection.

| Type | Application | Key Feature |

|---|---|---|

| Direct Install | Telecom backhaul | Low labor costs |

| Direct Burial | Power grid upgrades | UV resistance |

| Flame-Retardant | Transport hubs | Meets fire safety codes |

Fiber optic duct applications cover many fields. Telecom is the biggest, with 65% of the market. But CATV and power sectors are also growing. New uses in smart cities, like for IoT sensors and 5G, are becoming more common. The way these are installed, like aerial or through conduits, meets urban needs.

What’s popular changes by region. In the US, Direct Install is a hit in cities. But in rural China, Direct Burial is preferred. As smart cities grow, there’s a trend towards using microduct types that are both flame-resistant and durable.

Application Market Analysis: The Role of Microducts in Fiber Optic Networks

Microduct systems are changing how we build fiber networks. These telecom infrastructure ducts protect cables and make deployment flexible. They are key for both urban and remote areas.

Last-Mile Connectivity Solutions

Microducts save money in both rural and urban areas. Their light design speeds up fiber installation, cutting time by up to 30%. In the U.S., they help bring fiber to homes and small businesses.

Long-Haul Fiber Backbone Infrastructure

For long-distance networks, microducts offer fiber cable protection. Their tough materials protect against harsh weather, keeping data flowing. In India and China, they build reliable backbones.

Data Center Interconnect Applications

Data centers use microduct network applications to connect servers and storage. They handle cloud computing demands, supporting edge computing. Big cloud providers use them to increase capacity without changing old systems.

Real-world success stories show their impact:

- U.S. utilities cut costs by 25% with these systems

- Indian telecoms expanded in 150+ cities with modular setups

- Chinese providers upgraded 10,000 km of backbones with weather-resistant ducts

Microduct systems are a key part of next-gen connectivity. Their flexibility ensures they’ll keep up with growing data needs.

Global Microduct Market Region Analysis: Regional Market Dynamics

Looking into regional microduct markets shows how global microduct distribution meets local needs. Geographic market analysis shows big differences. In North America, the focus is on dense networks. But in Asia-Pacific, it’s all about reaching rural areas.

This change in international microduct demand shows different needs. Some areas need to be ready for climate changes. Others focus on underground networks in cities.

- North America: Upgrades to 5G and FTTH (Fiber-to the Home) networks

- Europe: EU-funded greenfield projects in smart cities

- Asia-Pacific: Rural broadband initiatives in India and Indonesia

- Middle East: Oil-rich nations investing in data center infrastructure

| Region | Market Maturity | 2023-2030 Growth Rate |

|---|---|---|

| North America | Highly developed | 5.2% |

| Europe | Mature but evolving | 4.8% |

| Asia-Pacific | Rapid expansion | 8.1% |

| Latin America | Emerging | 6.5% |

What people want in different places affects what gets made. For example, special microducts are used in places prone to wildfires. In areas with lots of rain, others are used. This means companies have to make products for each area, keeping global distribution in mind.

As the table shows, Asia-Pacific is growing fast. This makes it a key area for suppliers. It shows why understanding where demand is coming from is so important for planning.

China Microduct Market Analysis

China leads in fiber infrastructure, changing the game globally. The China microduct market drives innovation in Chinese fiber infrastructure. It supports huge 5G and broadband projects across the country.

These systems connect cities and remote areas smoothly. They make Asia a key player in future networks.

National Broadband Strategy and Telecom Ducts

High-speed internet is a top priority for the government. This boosts demand for strong China telecom ducts. Now, over 80% of rural areas are connected to fiber networks.

This effort closes the gap between cities and countryside. It also makes Chinese products competitive worldwide.

Manufacturing Scale and Global Reach

Chinese factories make 60% of Asia’s duct systems. They export to over 45 countries. Suppliers like Huawei Marine and ZTE lead with low costs and fast production.

Asian duct systems from China are popular in Southeast Asia and the Middle East. Government trade deals support their success.

Future Growth Drivers

Smart city projects and industrial IoT will increase demand. Plans to add AI to Chinese fiber infrastructure by 2025 show innovation. With 5G and data center upgrades, growth could reach 14% annually.

United States Microduct Market Analysis

Recent federal investments are changing the US microduct market, boosting growth in American fiber infrastructure. The $1.2 trillion Infrastructure Investment and Jobs Act has set aside over $65 billion for broadband expansion. This move is increasing demand for advanced North American duct systems.

This growth opens doors for telecom providers and local governments looking for scalable options.

Infrastructure Funding Sparks Growth

The American Rescue Plan focuses on rural connectivity, pushing microduct adoption. Federal grants now support systems that fit well with existing American fiber infrastructure. They prefer lightweight, durable United States telecom ducts for tough environments.

Competitors and Market Leaders

- Big names like Corning and AFL offer microduct solutions.

- Regional installers such as CTC Technology and Energy focus on federal contracts.

- Newcomers like FiberLight use private funds to innovate in duct designs.

Rural Expansion Challenges

Despite 70% of projects aiming at rural areas, deployment is tough. State regulations vary, like Texas’s rules versus Washington’s. These differences shape how North American duct systems are tailored for each area.

Yet, partnerships between telecom companies and local governments are speeding up deployment. The Rural Digital Opportunity Fund has given out $9.2 billion in 2023. This is creating a great market for microduct solutions that can grow.

India Microduct Market Analysis

India’s India microduct market is growing fast. This is thanks to efforts to improve Indian fiber infrastructure. The Digital India and BharatNet programs aim to connect 2.5 lakh gram panchayats. This is boosting demand for South Asian duct systems and India telecom ducts.

This growth makes India a key player in fiber optic technology worldwide.

Digital India Initiative and National Fiber Deployment Plans

Projects like BharatNet focus on connecting rural areas. They use microducts for the last mile. Plans include laying over 1.3 million kilometers of fiber optic cables.

This will link India telecom ducts to both urban and rural areas.

Emerging Manufacturing Hub for Microduct Technologies

India’s low production costs attract global companies. Local makers like Sterlite Technologies and Bharti Airtel are growing. They are making the India microduct market strong.

They are also exporting to South Asia, using South Asian duct systems.

- 30% cost advantage over global competitors

- Government tax incentives for tech adoption

- Partnerships with international R&D firms

Unique Challenges and Opportunities

| Challenges | Opportunities |

|---|---|

| Varied terrain | Urban smart city projects |

| Regulatory fragmentation | 5G rollout demands |

| Rural electrification gaps | Solar-powered duct systems |

Despite challenges like terrain and regulations, India’s Indian fiber infrastructure growth is promising. By 2028, it could reach a $2.3 billion market. Innovations in India telecom ducts are already meeting local needs.

Future Development Analysis: The Future of Microducts in High-Speed Data Transmission

As we move towards 6G and beyond, future microduct technology will be key. Innovators are working on next-generation fiber ducts for terabit speeds and low latency. These advancements will support new uses like self-driving cars and global communication in real-time.

Anticipating 6G and Beyond: Future-Proofing with Advanced Microducts

Teams in the U.S., China, and India are creating advanced telecommunication ducts. They have cooling systems and flexible paths. These ducts will meet changing data needs and use less energy, up to 30% less than today’s.

They will have:

- Embedded sensors for real-time tracking

- Materials that resist extreme temperatures

- Modular designs for easy network growth

Smart Infrastructure Integration

Future microducts will connect with smart city systems. In India, next-generation fiber ducts are being tested with IoT sensors. In the U.S., advanced telecommunication ducts are linked to 5G/6G towers, forming hybrid systems.

Green Manufacturing Breakthroughs

Companies like Corning and Prysmian are leading in sustainable microduct solutions. They use bio-based polymers to reduce carbon by 45%. Designs are also recyclable, meeting EU Circular Economy goals. China is exploring algae-based ducts that can biodegrade.

Competitor Analysis: Major Players in the Microduct Market

- Emtelle Holdings Ltd

- Primo

- Hexatronic Group AB

- Prysmian Group

- Datwyler Holding Inc

- Egeplast International GmbH

- Clearfield Inc

- Spur A.S.

- GM Plast A/S

- Belden Inc

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Microduct Market Report |

| Base Year | 2024 |

| Segment by Type | ·Direct Install Type

·Direct Burial Type ·Flame Retardant Type |

| Segment by Application | ·FTTX Networks

·Other Access Networks ·Backbone Network ·Others |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Investing in the microduct market within North America, China, and India presents a strategic opportunity for businesses aiming to expand globally. Each region offers unique strengths that make them prime candidates for investment.

North America stands out due to its rapid growth trajectory supported by substantial investments in communication networks. The U.S. Rural Digital Opportunity Fund is a driving force behind expanding broadband access, making it an ideal market for businesses focused on fiber optics.

China’s robust adoption of microduct systems is propelled by ambitious 5G rollout plans and rapid urbanization. Government initiatives are significantly shaping the landscape, offering fertile ground for companies looking to capitalize on these developments.

India, with its emerging microduct sector, holds immense potential through projects like BharatNet, which aims to enhance infrastructure development across the nation. This initiative underscores India’s commitment to advancing its digital infrastructure, presenting lucrative prospects for industry players.

Moreover, these opportunities align well with global trends and shifts in market dynamics, as highlighted in recent studies such as this one from Tandfonline. Aligning resources with these regional strengths can facilitate a strong market presence and drive future growth. Understanding these dynamics ensures informed strategic decisions, paving the way for successful integration into these promising markets.

Global Microduct Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Microduct Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- MicroductMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Microduct players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Microduct Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Microduct Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Microduct Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofMicroduct Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are microducts and why are they important?

Microducts are small tubes for fiber optic cables. They make installing and managing telecoms easier. They’re key for fast internet in crowded areas and big projects.

How do advancements in microduct technology impact the telecommunications industry?

New tech like miniaturization and smart microducts make installing networks better. They also make networks more reliable. This helps meet the growing need for fast internet.

What are the challenges faced in the global microduct market?

The industry faces issues like rules, different standards, and making them. High costs and not knowing about them are also barriers.

How does geopolitical context impact microduct production and trade?

Politics can change trade rules, tariffs, and sharing tech. This can mess up supply chains and change who’s leading the market.

What role do microducts play in smart infrastructure developments?

Microducts are key for smart cities. They connect sensors and traffic systems. This makes cities run better and communicate well.

How is the Indian microduct market evolving?

India’s market is growing fast. Programs like Digital India and fiber plans are driving demand. India is becoming a big player in telecom tech.

What are the expected future trends in microduct technology?

We’ll see 6G, more smart city links, and green tech. These changes will help meet our future internet needs.

Who are the major players in the microduct market?

The market has big names, local experts, and new players. Knowing who they are helps with partnerships or competition.