$2.16 Trillion Thriving Non-Life Insurance Market in the U.S., Japan, and France by 2025

Discover the dynamic landscape of the non-life insurance market across the U.S., Japan, and France, projected to reach $2.16 trillion by 2025. Explore key market trends, technological innovations, and sustainable solutions shaping the industry’s future, from AI-driven services to personalized coverage options.

- Last Updated:

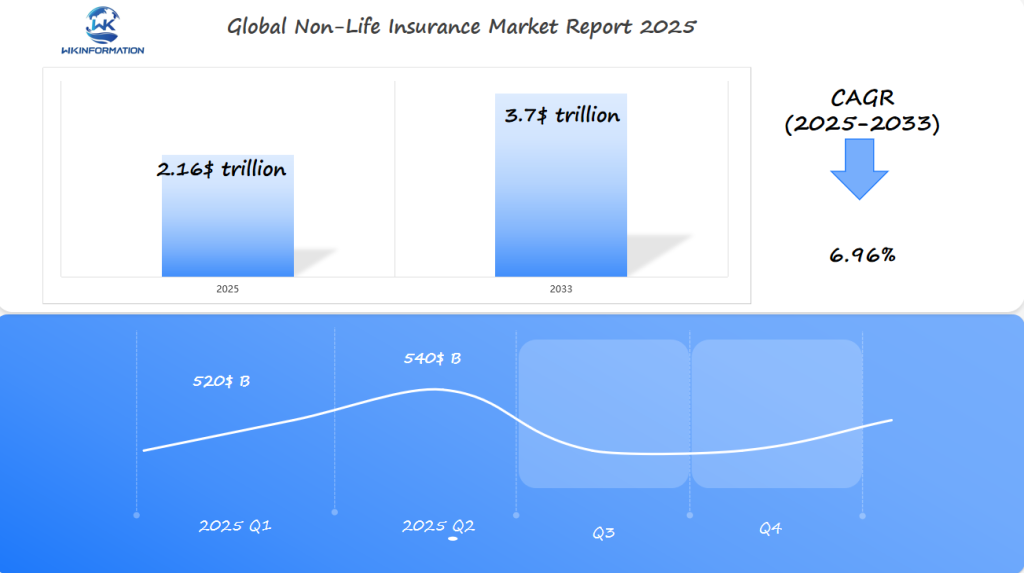

Non-Life Insurance Market Q1 and Q2 2025 Forecast

The Non-Life Insurance market is expected to reach $2.16 trillion in 2025, with a CAGR of 6.96% from 2025 to 2033. In Q1 2025, the market is projected to generate approximately $520 billion, driven by increasing demand for property, casualty, and health insurance in the U.S., Japan, and France. The growth is largely due to rising consumer awareness, urbanization, and rising risks related to natural disasters, healthcare costs, and transportation accidents.

By Q2 2025, the market is forecasted to reach $540 billion, supported by continued growth in the digitalization of insurance services, the adoption of AI-powered insurance products, and increased awareness about risk management. The U.S. continues to lead the market with its large insurance industry and advanced technologies, while Japan and France focus on innovative coverage for both businesses and individuals.

Examining the Non-Life Insurance Upstream and Downstream Industry Chains and Market Dynamics

The non-life insurance industry operates through a complex network of interconnected players and processes. Understanding the upstream and downstream components helps clarify how value flows through the system.

Upstream Activities

- Risk assessment and modeling

- Product development and pricing

- Reinsurance partnerships

- Investment management

- Regulatory compliance

The supply chain begins with insurers who create and underwrite policies. These companies work with actuaries to assess risks and determine appropriate premium levels. Reinsurance companies provide additional risk-sharing capacity, enabling primary insurers to take on larger policies.

Downstream Activities

- Distribution channels

- Policy administration

- Claims processing

- Customer service

- Risk mitigation services

Brokers and agents serve as intermediaries, connecting insurers with potential customers. These professionals analyze client needs, recommend appropriate coverage options, and facilitate policy purchases. Digital platforms have emerged as direct distribution channels, allowing customers to bypass traditional intermediaries.

Key Market Dynamics

- Price competition among insurers

- Shifting consumer preferences

- Technological advancement

- Regulatory changes

- Economic conditions

The interaction between these elements creates a dynamic marketplace where insurers must balance profitability with customer satisfaction. Technology adoption rates, claims frequency, and loss ratios directly influence pricing strategies and product offerings. Market consolidation through mergers and acquisitions reshapes competitive landscapes, while new entrants bring innovative solutions to address emerging risks.

Key Trends Driving Growth in Non-Life Insurance

The non-life insurance market’s growth is influenced by three main factors: economic conditions, technological innovation, and changing consumer behavior.

1. Economic Impact on Insurance Demand

Economic factors play a significant role in shaping the demand for non-life insurance. Here are some key ways in which the economy affects insurance needs:

- Rising property values drive increased coverage needs

- Business expansion creates demand for commercial insurance

- Economic stability encourages long-term insurance planning

- Market volatility pushes risk-averse behavior

2. AI-Driven Service Enhancement

Technological advancements, particularly in artificial intelligence (AI), are transforming the non-life insurance industry. Here are some ways in which AI is enhancing services:

- Automated claims processing reduces settlement time by 60%

- Chatbots handle 40% of customer inquiries

- Machine learning algorithms improve risk assessment accuracy

- Predictive analytics enable personalized premium pricing

- Real-time data analysis enhances fraud detection

3. Consumer Risk Awareness Evolution

Today’s consumers are more aware of potential risks than ever before. This increased awareness includes:

- Climate change impacts on property

- Cyber threats to digital assets

- Health-related uncertainties

- Business interruption scenarios

This awareness leads to proactive insurance purchasing decisions. Companies report a 35% increase in voluntary coverage adoption rates among informed customers. The combination of digital literacy and risk consciousness creates a market where consumers actively seek comprehensive protection instead of viewing insurance as just an expense.

Insurers’ risk management education programs are seeing strong participation rates, with a year-over-year increase of 45%. This indicates a growing interest among consumers to understand and mitigate potential threats through insurance solutions.

Challenges and Barriers in Non-Life Insurance Markets

The non-life insurance industry faces significant regulatory challenges in different regions. Insurance providers must navigate complex compliance requirements, including:

- Capital adequacy standards

- Risk-based solvency requirements

- Consumer protection regulations

- Data privacy laws

Emerging Risks reshape the insurance landscape daily. Cyber threats have evolved into a primary concern, with ransomware attacks causing unprecedented losses. Climate change introduces new variables in risk assessment, forcing insurers to reevaluate traditional underwriting models.

Natural disasters present a substantial challenge to pricing strategies. The increasing frequency and severity of events like:

- Hurricanes

- Wildfires

- Floods

- Earthquakes

These catastrophic events strain insurers’ capacity to provide affordable coverage while maintaining profitability. Many companies respond by:

- Implementing sophisticated risk modeling

- Adjusting coverage limits

- Raising premiums in high-risk areas

- Creating specialized catastrophe bonds

The rise of autonomous vehicles and smart homes creates additional complexity in risk assessment. These technological advances blur traditional liability boundaries, requiring insurers to develop new frameworks for claims evaluation and coverage determination.

Market competition intensifies as insurtech companies disrupt traditional business models. Established insurers must balance maintaining legacy systems while investing in digital transformation to remain competitive.

Geopolitical Impact on Non-Life Insurance Policies

Global political dynamics shape the non-life insurance landscape through regulatory changes, trade policies, and international relations. Recent shifts in U.S.-China trade relations have led to significant adjustments in coverage requirements for supply chain risks, affecting businesses operating across these markets.

Key Regional Impacts:

- United States: Sanctions policies influence coverage limitations for international business operations

- Japan: Strategic partnerships with ASEAN nations create new market opportunities

- France: EU regulatory frameworks dictate cross-border insurance operations

Trade agreements play a vital role in shaping market access and operational requirements. The U.S.-Japan Trade Agreement has streamlined insurance operations between these nations, reducing regulatory barriers and enhancing market opportunities for insurers in both countries.

Policy Changes Through Trade Relations:

- Standardization of regulatory requirements

- Cross-border insurance provision rights

- Digital commerce insurance regulations

- Data protection and privacy standards

Brexit’s impact on European insurance markets has created new compliance requirements for French insurers operating in the UK market. Japanese insurers have adapted their strategies to accommodate changing Asian trade dynamics, particularly in response to the Regional Comprehensive Economic Partnership (RCEP).

Political tensions between nations can trigger sudden policy changes, affecting coverage terms and pricing strategies. Insurance providers must maintain agile operational models to respond to these geopolitical shifts while ensuring compliance with evolving international regulations.

Types of Non-Life Insurance: Health, Property, Liability, and More

Non-life insurance products offer diverse coverage options to protect against specific risks and financial losses. Here’s a comprehensive breakdown of the main categories:

1. Property Insurance

- Home/Renters Insurance: Protects against damage to buildings and personal belongings

- Commercial Property: Covers business premises and assets

- Marine Insurance: Safeguards ships, cargo, and related assets

2. Auto Insurance

- Collision Coverage: Pays for vehicle damage from accidents

- Comprehensive Coverage: Protects against theft, vandalism, natural disasters

- Liability Protection: Covers damage to other vehicles or property

3. Liability Insurance

- Professional Liability: Protects against claims of negligence or malpractice

- Product Liability: Covers manufacturers against product-related claims

- General Liability: Provides broad protection for businesses

4. Specialty Coverage

- Cyber Insurance: Guards against data breaches and digital threats

- Environmental Liability: Protects against pollution-related claims

- Workers’ Compensation: Covers employee injuries and related expenses

These insurance types serve as essential risk management tools, helping individuals and businesses maintain financial stability during unexpected events. The right combination of coverage creates a protective shield against potential losses and legal liabilities.

Applications of Non-Life Insurance in Risk Management Strategies

Non-life insurance plays a vital role in comprehensive risk management strategies. It allows organizations and individuals to transfer specific risks to insurance providers through customized policies, providing financial protection for their assets and operations.

Key Risk Management Applications:

1. Business Continuity Protection

- Coverage for operational interruptions

- Supply chain disruption safeguards

- Employee liability protection

2. Asset Value Preservation

- Property damage compensation

- Equipment breakdown coverage

- Inventory loss protection

3. Financial Risk Mitigation

- Third-party liability coverage

- Professional indemnity protection

- Credit risk insurance

The strategic use of non-life insurance policies helps establish strong risk management frameworks. By implementing targeted coverage options, companies can safeguard their financial statements while ensuring smooth operations. Small businesses benefit from tailored policies that address industry-specific risks, while large corporations often utilize various insurance products to create comprehensive risk management solutions.

Risk managers rely on non-life insurance to assess potential losses and define clear procedures for transferring risks. This strategy enables organizations to concentrate on growth prospects while maintaining suitable safeguards against unexpected events.

Global Non-Life Insurance Market: Growth Projections 2025

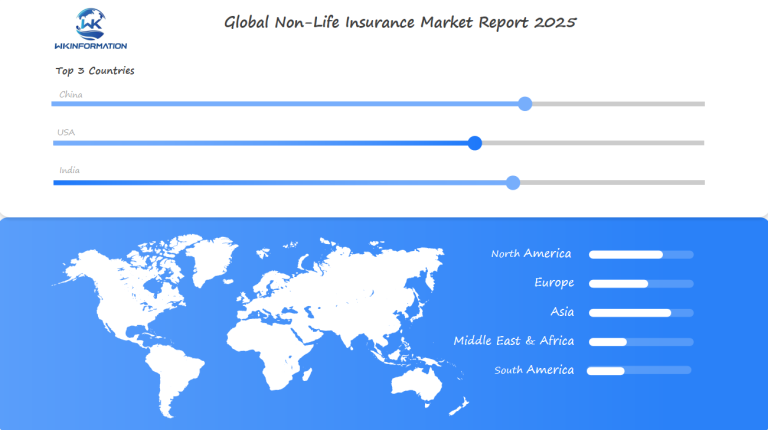

The global non-life insurance market shows strong potential for growth, with projections indicating a significant expansion to $2.16 trillion by 2025. Regional market analysis reveals distinct growth patterns:

Key Market Indicators:

- Asia-Pacific leads growth at 8.5% CAGR

- North America maintains stable 4.2% growth

- European markets show 3.8% steady expansion

The U.S., Japan, and France are critical markets driving this growth trajectory. These regions benefit from:

- Advanced digital infrastructure

- Strong regulatory frameworks

- High insurance penetration rates

- Mature distribution networks

Emerging markets display accelerated growth potential, particularly in:

- Southeast Asia

- Latin America

- Eastern Europe

Market analysts predict increased demand for specialized coverage options, including cyber insurance and parametric products. The integration of AI-driven underwriting models and blockchain technology shapes market evolution, creating new opportunities for insurers to expand their service offerings and reach previously underserved segments.

U.S. Non-Life Insurance Market: Demand Drivers & Future Trends Ahead

The U.S. non-life insurance sector is experiencing strong growth, driven by changing consumer needs and regulatory adaptations. Market analysis reveals several key factors shaping the industry’s trajectory:

Primary Growth Drivers:

- Rising property values pushing demand for comprehensive coverage

- Increased frequency of severe weather events

- Growing cyber security threats

- Aging infrastructure requiring enhanced protection

The U.S. market shows a strong preference among consumers for:

- Digital-first insurance solutions

- Personalized coverage options

- Usage-based insurance products

- Quick claim processing

Regulatory Influences

- State-specific insurance requirements

- Enhanced data protection mandates

- Climate risk disclosure requirements

The market is responding to these influences through innovative product development. Insurers are introducing AI-powered risk assessment tools and parametric insurance solutions to meet the evolving needs of consumers.

At the same time, there is a shift in consumer behavior towards proactive risk management. This presents opportunities for insurers to expand their service offerings beyond traditional coverage models.

Recent market data indicates a 15% increase in premium volumes, particularly in commercial lines and specialty insurance segments. Property insurance continues to lead growth metrics, followed closely by liability coverage and commercial auto insurance.

Japan's Innovative Approach Towards Non-Life Insurance Products & Services Offered

Japan’s non-life insurance market stands out with its distinctive regulatory framework and innovative product offerings. The Financial Services Agency (FSA) implements a principles-based supervision approach, allowing insurers greater flexibility in product development while maintaining strict consumer protection standards.

Key characteristics of Japan’s regulatory environment include:

- Risk-based capital requirements tailored to Japan’s unique market conditions

- Mandatory catastrophe reserves for natural disaster coverage

- Streamlined approval processes for innovative insurance products

Japanese insurers have pioneered several groundbreaking solutions:

- Weather-indexed insurance products that automatically trigger payouts based on specific climate conditions

- Parametric insurance offerings for earthquake protection

- IoT-integrated policies that use real-time data from connected devices for risk assessment

The market has embraced digital transformation through:

- AI-powered claims processing systems

- Blockchain solutions for policy management

- Mobile-first customer service platforms

These innovations position Japan’s non-life insurance sector as a model for technological integration and regulatory efficiency in the global insurance landscape.

France's Evolving Landscape In Response To Consumer Demands For Sustainable Solutions

France’s non-life insurance market is showing a strong shift towards solutions driven by sustainability. The French insurance industry has embraced green initiatives through innovative policy offerings that reward environmentally conscious behaviors.

Key sustainable insurance trends in France include:

- Premium reductions for low-emission vehicles

- Coverage extensions for renewable energy installations

- Special policies for eco-friendly building renovations

- Risk assessment tools incorporating climate change factors

French insurers have developed specialized products addressing environmental risks:

- Climate Resilience Coverage: Protection against extreme weather events

- Green Building Insurance: Enhanced coverage for sustainable construction materials

- Eco-Mobility Plans: Comprehensive packages for electric vehicles

The French regulatory framework now requires insurers to disclose their environmental impact, pushing companies to integrate sustainability metrics into their business models. This regulatory pressure, combined with growing consumer awareness, has sparked the development of data-driven solutions that measure and price environmental risks accurately.

Local insurers have partnered with environmental organizations to create risk assessment tools that help businesses transition to sustainable practices while maintaining comprehensive coverage.

The Future Of Non-Life Insurance: Technology Integration And Personalized Coverage Solutions

Artificial Intelligence and data analytics are changing the non-life insurance industry, creating new opportunities for personalized coverage solutions. Insurance providers now use machine learning algorithms to:

- Analyze customer behavior patterns

- Predict risk factors more accurately

- Develop flexible pricing models

- Make real-time adjustments to policies

The integration of Internet of Things (IoT) devices allows insurers to gather valuable data from connected homes, vehicles, and wearable devices. This data-driven approach enables companies to offer usage-based insurance policies tailored to individual needs and behaviors.

Key technological innovations transforming the industry:

- Blockchain technology for secure policy management

- Chatbots powered by natural language processing

- Automated claims processing systems

- Predictive analytics for risk assessment

The rise of digital ecosystems connects insurers with third-party service providers, creating comprehensive coverage solutions. These partnerships enable insurance companies to offer additional services beyond traditional coverage, such as:

- Preventive maintenance alerts

- Real-time weather warnings

- Health monitoring services

- Cyber threat detection

Advanced data visualization tools help customers understand their coverage options through interactive platforms, making complex insurance products more accessible and transparent. This technological transformation shifts the industry from reactive claim processing to proactive risk prevention, fundamentally changing how insurance products are designed, sold, and managed.

Competitive Overview In The Non-Life Insurance Market

The non-life insurance market is dominated by a mix of global insurance giants and strong regional players, each competing across various product lines such as property, casualty, automobile, and health insurance. Leading multinational companies like Allianz SE (Germany), AXA SA (France), Zurich Insurance Group (Switzerland), and Ping An Insurance (China) have established robust international footprints, leveraging technology, diversified portfolios, and strong capital positions. Their extensive distribution networks and strategic acquisitions have enabled them to tap into emerging markets while maintaining dominance in mature economies.

-

Allianz SE – Germany

-

AXA SA – France

-

Prudential plc – United Kingdom

-

MetLife Inc. – United States

-

Zurich Insurance Group Ltd. – Switzerland

-

Ping An Insurance Company of China Ltd. – China

-

Berkshire Hathaway Inc. – United States

-

State Farm Mutual Automobile Insurance Company – United States

-

Liberty Mutual Insurance Company – United States

-

Chubb Ltd. – Switzerland

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Non-Life Insurance Market Report |

| Base Year | 2024 |

| Segment by Type |

· Property Insurance · Auto Insurance · Liability Insurance · Specialty Coverage |

| Segment by Application |

· Business Continuity Protection · Asset Value Preservation · Financial Risk Mitigation |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The non-life insurance market is undergoing a transformative phase, marked by robust global demand, technological disruption, and evolving consumer expectations. With a projected market size of $2.16 trillion by 2025, key regions such as the U.S., Japan, and France are leading growth through innovation, regulatory support, and a heightened focus on risk mitigation. As insurers adapt to challenges including climate change, cyber threats, and market volatility, success in the coming years will hinge on agility, digital integration, and customer-centric strategies.

Global Non-Life Insurance Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Non-Life Insurance Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Non-Life Insurance Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Non-Life Insuranceplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Non-Life Insurance Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Non-Life Insurance Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Non-Life Insurance Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Non-Life Insurance Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected market value of the non-life insurance sector by 2025?

The non-life insurance market is projected to grow to $2.16 trillion by 2025, highlighting its significance in financial planning and risk management.

What are the key components of the non-life insurance supply chain?

The non-life insurance supply chain includes key players such as insurers, brokers, and consumers. These entities interact in upstream and downstream processes that influence overall market dynamics.

How do technological advancements impact the non-life insurance industry?

Technological advancements, particularly in artificial intelligence, enhance service delivery and improve customer experience, driving growth trends in the non-life insurance market.

What challenges does the non-life insurance market face today?

Insurers encounter various challenges including regulatory compliance issues, emerging risks like climate change and cyber threats, and the impact of natural disasters on underwriting practices and pricing strategies.

How do geopolitical factors affect non-life insurance policies?

Global politics significantly influence insurance regulations and policies across regions. Trade agreements can also affect non-life insurance markets in major countries such as the U.S., Japan, and France.

What types of coverage are included in non-life insurance?

Non-life insurance encompasses various types including auto, home, liability, health, and more. Each type plays a crucial role in consumer protection and effective risk management strategies.