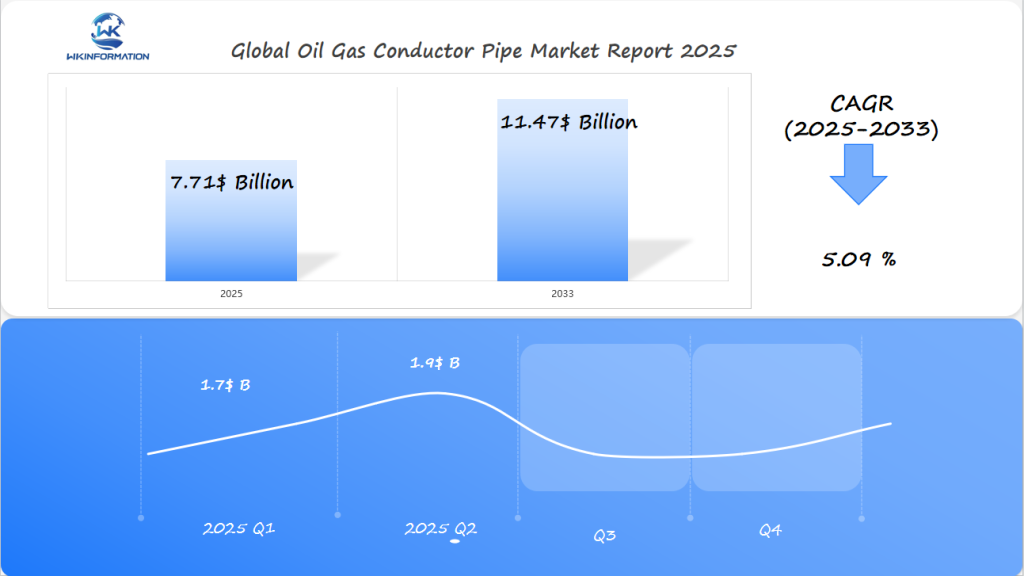

Oil Gas Conductor Pipe Market on Track to Reach $7.71 Billion by 2025: Energy Infrastructure Growth in the U.S., Saudi Arabia, and Canada

Explore the expanding Oil Gas Conductor Pipe Market as global energy demands rise. Analysis of market trends, key players, and growth forecasts driving industry expansion through 2025.

- Last Updated:

Oil Gas Conductor Pipe Market Q1 and Q2 of 2025

The Oil Gas Conductor Pipe market is expected to reach a valuation of $7.71 billion by the end of 2025, registering a CAGR of 5.09% from 2025 to 2033. Q1 2025 is projected to bring in roughly $1.7 billion, while Q2 is forecasted to grow to $1.9 billion due to sustained upstream exploration and drilling activity.

The market is heavily influenced by the resurgence of energy infrastructure projects and offshore oilfield developments. The U.S., Saudi Arabia, and Canada are key growth regions, supported by strong domestic energy demand and strategic initiatives aimed at boosting production capacity. Increasing focus on deepwater and unconventional reserves is also fueling demand for high-durability conductor pipes.

Key Takeaways

- The market is expected to reach $7.71 billion by 2025.

- There is significant growth in the energy sectors of the U.S. and Saudi Arabia.

- Technological innovations are driving the expansion of the market.

- The increasing global demand for energy is supporting the development of the market.

- Strategic investments are fueling the infrastructure of conductor pipes.

Upstream and Downstream Supply Chain Overview of Oil Gas Conductor Pipe

The supply chain for oil gas conductor pipes is a complex network. It drives the energy infrastructure market. Upstream operations start with getting raw materials and the first stages of making the pipes.

Key elements of upstream operations include:

- Steel sourcing from global metallurgical centers

- Advanced material selection for pipe durability

- Precision manufacturing techniques

- Quality control and metallurgical testing

Downstream operations are just as important. They handle distribution, logistics, and use in different energy sectors.

Downstream activities include:

- Transportation logistics

- Market distribution channels

- Installation support services

- Post-deployment maintenance

The balance between upstream and downstream operations is key. It ensures pipes are delivered smoothly to drilling platforms, refineries, and energy projects.

Strategic supply chain management is vital for staying competitive in the oil and gas conductor pipe market.

Trend Analysis in Oil Gas Conductor Pipe Across Offshore and Onshore Segments

The oil and gas conductor pipe market is changing fast. This change is happening in both offshore and onshore drilling areas. New technologies and market trends are changing how energy companies build and explore.

Recent studies show big changes in offshore and onshore drilling. Each area has its own special needs. These needs affect how much conductor pipe is needed and the technology used.

Deep-Water Exploration Dynamics

Offshore drilling is moving towards better technology. Some key advancements include:

- Enhanced corrosion-resistant pipe materials

- Improved structural designs for extreme marine conditions

- Deeper exploration capabilities in challenging oceanic environments

Shale Gas Exploration Innovations

Onshore drilling is also seeing big changes thanks to new tech. Important trends include:

- Horizontal drilling technique advancements

- Lightweight conductor pipe designs

- Cost-effective exploration strategies

Market trends show more money going into special conductor pipe tech. This tech helps deal with tough drilling conditions. Companies are focusing on flexible and strong solutions for both offshore and onshore areas.

Restrictions in Logistics, Regulation, and Environmental Compliance

The oil and gas conductor pipe market faces big logistics challenges. Moving huge pipe segments needs special infrastructure and careful planning. Companies must deal with complex supply chains and high costs.

Regulations have gotten stricter, changing how companies work with conductor pipes. Important rules include:

- Safety standards for making pipes

- Rules for moving pipes across borders

- Certifications for materials

- Rules for pipe size and structure

Environmental rules are key for the industry. Energy firms must add green practices to their work. Emission cuts and managing carbon are now key goals.

The best companies adapt to these challenges. They use new logistics tech, work with experts, and have strong compliance systems.

Companies use digital tracking, new materials, and analytics to beat logistics hurdles. They also keep up with environmental and regulatory rules.

Geopolitical Factors Influencing the Oil Gas Conductor Pipe Market

The global oil gas conductor pipe market is undergoing significant changes due to various geopolitical factors. These factors, such as shifts in international relations, have a direct impact on market dynamics and global trade. For countries with substantial energy infrastructure, conductor pipes play a crucial role in maintaining economic stability.

Key Geopolitical Influences Reshaping the Market

Some of the key geopolitical influences that are reshaping the oil gas conductor pipe market include:

- Ongoing trade tensions between major oil-producing countries

- Economic sanctions affecting international energy sectors

- Shifting energy policy landscapes

- Regional investment strategies in energy infrastructure

Energy-Rich Regions and Their Approach to the Market

Energy-rich regions are adapting their strategies in response to these geopolitical factors. Uncertainties in geopolitics present both challenges and opportunities for manufacturers and suppliers of conductor pipes. Countries like the United States, Saudi Arabia, and Russia play a significant role in shaping the market.

The Importance of Understanding Geopolitical Nuances

Companies operating in this industry must navigate complex global trade environments. Changes in regulations, technology, and geopolitics continuously reshape the competitive landscape. Those companies that can effectively adapt to these changes stand to benefit from increased growth opportunities on a global scale.

Collaboration Between Nations and the Private Sector

To mitigate geopolitical risks, collaboration between nations and the private sector is essential. Open lines of communication and flexibility in market strategies will be key components for success in this unpredictable world.

Type Segmentation in Oil Gas Conductor Pipe: Welded, Seamless, and Advanced Alloys

The oil and gas industry needs special conductor pipes for its work. These pipes are key for drilling and extracting oil and gas. Each type has its own strengths for the tough work of the energy world.

Conductor pipes are vital for energy work. There are three main ways to make them. Each type has its own benefits for the tough jobs of drilling and extracting.

Welded Conductor Pipes

Welded pipes are a budget-friendly choice for oil and gas work. They’re made by welding metal parts together at high temperatures. This makes strong connections that can handle a lot of pressure.

- Lower production costs compared to seamless alternatives

- Versatile application across multiple drilling environments

- Suitable for moderate pressure and temperature conditions

Seamless Conductor Pipes

Seamless pipes are high-quality conductors manufactured using advanced techniques. Unlike welded pipes, they lack any welding points, making them stronger and more dependable. This feature makes them ideal for extremely harsh conditions.

- Superior strength and uniformity

- Reduced potential for structural weaknesses

- Optimal performance in high-pressure offshore environments

Advanced Alloy Conductor Pipes

Advanced alloy conductor pipes are the latest in oil and gas tech. They’re made with special metals for the best performance in tough conditions.

- Enhanced corrosion resistance

- Superior performance in extreme temperature ranges

- Extended operational lifespan

The world of conductor pipes is always getting better. Makers are working hard to create stronger and more efficient pipes for oil and gas work all over the world.

Application Breakdown: Drilling Platforms, Refineries, and Support Installations

Oil and gas conductor pipes are vital in many energy projects. They are key parts of the oil and gas world. They help support structures and make important processes work.

Here are some main uses of conductor pipes:

- Offshore drilling platforms need strong pipes

- Onshore rigs need pipes that perform well

- Refineries need pipes for complex tasks

- Support installations for energy work

Drilling platforms are a big market for these pipes. These sea structures use special pipes to start wells and guide drilling. The pipes must handle tough sea conditions, like high pressure and corrosion.

| Application | Pipe Characteristics | Primary Function |

| Offshore Drilling Platforms | Corrosion-resistant alloys | Structural foundation and initial well establishment |

| Refineries | High-temperature tolerant materials | Processing and transportation of refined products |

| Support Installations | Versatile pipe configurations | Auxiliary infrastructure support |

Refineries use conductor pipes for key tasks. These pipes must last long and handle high temperatures and chemicals. Support installations also use these pipes, helping with energy production.

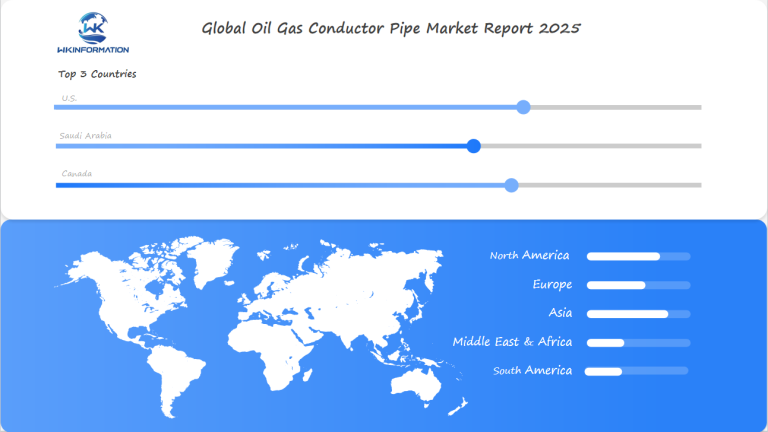

Global Demand Distribution and Regional Trade for Oil Gas Conductor Pipe

The world’s need for oil gas conductor pipes is complex. It involves regional trade and market distribution. Energy-hungry areas are pushing the market forward, with smart investments guiding the way.

Important areas affecting the global market include:

- North America: Leading market with extensive shale exploration

- Middle East: Significant infrastructure development

- Asia-Pacific: Rapid industrialization and energy infrastructure expansion

Trade patterns vary by region. The United States leads the world. It does so thanks to cutting-edge drilling tech and vast offshore exploration.

The market’s growth shows the rising need for energy worldwide. Technological advancements and smart investments are changing the oil gas conductor pipe market. They open doors for growth and new ideas.

U.S. Market Focus: Shale Activity and Deepwater Exploration Drives Demand

The U.S. market for oil gas conductor pipes has seen big changes. These changes come from shale exploration and deepwater drilling. New technologies have opened up new possibilities in these areas, changing how we get energy.

Shale Exploration Impact

Shale exploration has changed the energy landscape in the United States. Hydraulic fracturing has made it possible to get oil from places that were previously inaccessible. This has greatly increased the amount of oil we can produce in the United States.

- Shale areas like Permian Basin and Eagle Ford are now key oil producers.

- New drilling methods are making it cheaper to get oil.

- More oil from home means we need less from other countries.

Deepwater Drilling Importance

Deepwater drilling in the Gulf of Mexico is also key. Offshore platforms use special pipes that can handle tough sea conditions. This lets us get resources from deep in the ocean.

The mix of shale and deepwater drilling has made the U.S. a top energy producer. Continuous technological innovations and smart investments keep the oil gas conductor pipe market growing.

Saudi Arabia's Strategic Push in Oil Gas Conductor Pipe Infrastructure

Saudi Arabia is leading the way in oil and gas infrastructure. It aims to be a major player in the global energy scene. The kingdom is expanding conductor pipe infrastructure to fuel its energy growth.

Key initiatives driving market growth include:

- Saudi Aramco’s plan to increase energy production by 70%

- Strategic investments in oil and gas infrastructure development

- Signing of major agreements to support sector expansion

The kingdom is modernizing its infrastructure. Viking plans to open a manufacturing facility. STATS Group is also expanding, showing the market’s potential. These moves are changing the conductor pipe scene in the Middle East.

Notable partnerships are supporting this growth. Aramco is working with SIDF and Taulia for supply chain financing. Empower Insulated Pipe Systems is also expanding, showing the kingdom’s infrastructure development momentum.

The market growth looks promising for conductor pipe infrastructure in the region. Investors and industry players are watching as Saudi Arabia builds a strong, advanced energy ecosystem.

Canada's Pipeline Expansion and Energy Security Impacting Market Growth

Canada is changing the oil and gas pipe market with its pipeline plans. These plans are key for North America’s energy safety. The country’s big projects are making the pipe market grow fast in many areas.

Boosting Canada’s Energy Scene

Canada’s energy scene is getting a big boost with:

- Big pipeline projects linking western oil fields to markets

- More money going into making energy systems stronger

- More teamwork with the United States on energy

Economic Strategy Behind Pipeline Plans

Canada’s pipeline plans are a big part of its economic strategy. By building strong energy transport systems, Canada is becoming a big player in world energy markets. These projects help keep energy safe at home and open up big chances for pipe makers and sellers.

Easing Regulations for Pipeline Projects

New rules have made starting pipeline projects easier. The government is working to grow the economy while also caring for the environment. This has led to new ideas in pipe technology.

Advancements in Pipe Technology

New tech in making pipes is helping with these big projects. High-performance alloys and precise engineering make pipes work better and last longer, even in tough weather.

Growing Pipe Market with Investments

As Canada keeps investing in energy systems, the pipe market is growing fast. The focus on pipelines is expected to bring big economic wins and make Canada stronger in the world’s energy scene.

Long-Term Forecasts and Technological Upgrades in Oil Gas Conductor Pipe

The oil and gas conductor pipe market is set for big changes thanks to new tech. Experts say we’ll see a lot of growth because of better ways to make pipes and how they work.

The Impact of New Technology

New tech is changing the game. Companies are putting a lot of money into smart pipes. These pipes can watch themselves and tell us when they need fixing.

- Enhanced corrosion-resistant coatings

- Smart sensor integration

- Precision manufacturing techniques

- Lightweight yet durable material compositions

Growth Potential in Specialized Pipe Technologies

Experts think we’ll see huge growth in special pipe tech. Offshore and deepwater exploration will lead the way. They want pipes that work better, hurt the environment less, and last longer.

- Increased operational efficiency

- Reduced environmental impact

- Extended equipment lifespan

Advancements in Material Science

New materials are making pipes stronger and more reliable. These new alloys can handle tough conditions better than before.

Competitive Intelligence and M&A Activity in the Oil Gas Conductor Pipe Industry

The oil gas conductor pipe market has seen big changes lately. Companies are teaming up through mergers and acquisitions to get stronger and smarter. This helps them stay ahead in the game.

Key Players:

- EVRAZ — United Kingdom

- Tenaris — Luxembourg

- Jindal SAW Ltd. — India

- TMK — Russia

- Nippon Steel Corporation — Japan

- Essar Steel — India

- Baosteel — China

- Schlumberger — United States

- Baker Hughes — United States

- Halliburton — United States

Important moves in the competitive world show a few key strategies:

- Targeted consolidation of smaller regional manufacturers

- Vertical integration across supply chain segments

- Investment in advanced manufacturing technologies

Big names like Schlumberger, Baker Hughes, and Halliburton are leading the charge. They’re using smart mergers and acquisitions to grow and stay ahead.

Now, companies are focusing on new tech and reaching more places. They’re putting a lot of money into research to make better pipes. These pipes are stronger and work better.

- Technological advancements in pipe manufacturing

- Enhanced material performance

- Cost-effective production techniques

New markets in the Middle East and North America are full of chances. They offer great ways for companies to grow and get stronger in the oil gas conductor pipe world.

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Oil Gas Conductor Pipe Market Report |

| Base Year | 2024 |

| Segment by Type |

· Welded Conductor Pipes · Seamless Conductor Pipes · Advanced Alloy Conductor Pipes |

| Segment by Application |

· Drilling Platforms · Refineries · Support Installations · Others |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The oil gas conductor pipe market is full of investment chances thanks to global energy plans. The outlook is bright for growth in both upstream and downstream areas. New technologies are driving this growth.

Places like the United States, Saudi Arabia, and Canada are hotspots for energy investment. These areas see a lot of money going into energy projects.

Deepwater exploration and shale activities are where the real growth is happening. New materials and seamless technologies are opening up new investment paths. The need for better pipeline tech and rising energy demand make this market very appealing.

Politics and the environment are changing how the market works. Investors need to keep up with rules and find stable places to invest. Companies that use green tech and make pipelines more efficient will likely see big gains soon.

Investing in oil gas conductor pipe needs a deep understanding of local markets, new tech, and energy shifts. A mix of old and new energy projects is the best way to grow in this fast-changing field.

Global Oil Gas Conductor Pipe Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Oil Gas Conductor Pipe Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Oil Gas Conductor Pipe Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Oil Gas Conductor Pipe Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Oil Gas Conductor Pipe Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Oil Gas Conductor Pipe Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Oil Gas Conductor Pipe Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Oil Gas Conductor Pipe Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected market value for Oil Gas Conductor Pipes by 2025?

The Oil Gas Conductor Pipe Market is expected to hit $7.71 billion by 2025. This growth is fueled by rising global energy needs and more exploration in both sea and land areas.

What are the key differences between welded and seamless conductor pipes?

Welded pipes are made by joining metal plates. Seamless pipes, on the other hand, are made without a seam. Seamless pipes are better at handling pressure and are used in high-stress areas. Welded pipes are cheaper but still useful for some jobs.

How do geopolitical factors impact the Oil Gas Conductor Pipe Market?

Global politics, such as trade wars and oil sanctions, have a significant impact on the market. They influence demand, supply, and investment strategies within the industry.

Which regions are driving the most growth in the conductor pipe market?

The Middle East, North America, and Asia-Pacific are leading the growth. Countries like the U.S., Saudi Arabia, and Canada are investing heavily in oil and gas.

What technological advancements are expected in conductor pipe manufacturing?

New technology includes improved coatings, intelligent pipes, and stronger alloys. These advancements enhance the durability of pipes, optimize their performance in challenging environments, and increase operational efficiency.

What challenges does the Oil Gas Conductor Pipe Market currently face?

The market faces big challenges like moving big pipes and following new rules. It also needs to deal with the environment and keep up with new tech.

How are offshore and onshore drilling trends affecting conductor pipe demand?

Offshore, deep-water drilling and special pipe designs are key. Onshore, shale gas and horizontal drilling are driving demand for specific pipes.

What role do conductor pipes play in energy infrastructure?

Conductor pipes are vital in drilling. They support the drill, guide it, and carry fluids in sea and land rigs.

How are environmental regulations affecting the conductor pipe market?

Tighter rules are making manufacturers go green. They’re using eco-friendly materials and making pipes that harm the environment less.

What are the primary applications of oil gas conductor pipes?

These pipes are mainly used in:

- Offshore rigs

- Onshore rigs

- Refineries

- Other oil and gas facilities