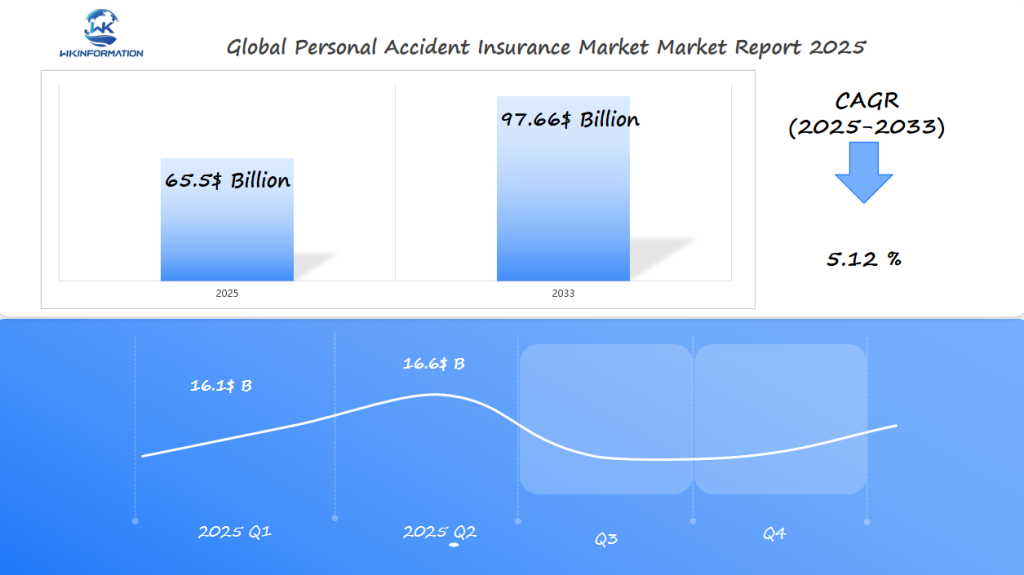

Personal Accident Insurance Market Expected to Reach $65.5 Billion by 2025: Key Markets in the U.S., China, and Brazil

Personal Accident Insurance Market is projected to reach $65.5 billion by 2025, driven by rising demand in key regions like the U.S., China, and Brazil. Key growth factors include expanding middle-class populations, increasing awareness of accident insurance, technological advancements, and evolving distribution channels. Emerging trends feature coverage expansion to new risks such as cyber-attacks and pandemics, personalized insurance products, and digitalization. Challenges include regulatory compliance, risk management, geopolitical impacts, and market barriers. Regional insights highlight significant opportunities and challenges in major markets, with demographic shifts shaping future demand and product innovation.

- Last Updated:

Personal Accident Insurance Market in Q1 and Q2 of 2025

The Personal Accident Insurance market is projected to reach $65.5 billion in 2025, with an expected CAGR of 5.12% from 2025 to 2033. Revenue in Q1 2025 is anticipated at about $16.1 billion, increasing to nearly $16.6 billion in Q2, supported by rising health risk awareness and demand for affordable insurance coverage.

In the U.S., the market is experiencing growth due to increasing participation in freelance and gig work, where traditional employer-provided benefits are lacking. China continues to expand digital insurance platforms that target younger, tech-savvy users. In Brazil, growing middle-class income and improved access to financial services are fueling insurance uptake.

The trend toward personalized insurance plans and increased use of mobile platforms for policy purchase and claims is shaping market momentum in early 2025.

Key Takeaways

- Growing demand in key markets such as the U.S.

- Rising awareness about accident insurance

- Expanding middle-class population

- Advancements in insurance products and distribution channels

- Significant growth opportunities in theinsurance market forecast

Personal Accident Insurance market upstream and downstream industry chain analysis

The upstream industry chain plays a vital role in shaping the Personal Accident Insurance market. It encompasses various components that enable the creation and distribution of insurance products.

Upstream Industry Analysis

The upstream industry for Personal Accident Insurance involves several key elements, including data analytics tools, actuarial services, and marketing agencies. These components are crucial for insurers to develop competitive products and pricing strategies.

Raw Materials and Suppliers

Raw materials and suppliers in the context of Personal Accident Insurance refer to the foundational elements that insurers rely on to create and deliver their products. This includes data analytics software, which helps in assessing risk and determining premiums, as well as actuarial services that provide critical insights into mortality rates, morbidity, and other statistical data essential for insurance product development.

Suppliers of these services play a vital role in the insurance industry’s value chain. For instance, companies that provide data analytics tools enable insurers to better understand their risk exposure and tailor their products accordingly. Similarly, actuarial services help insurers to price their products correctly, ensuring they remain competitive while managing their risk exposure.

The upstream industry’s influence on Personal Accident Insurance is significant. By leveraging advanced data analytics and actuarial insights, insurers can develop more sophisticated products that meet the evolving needs of their customers. This not only enhances customer satisfaction but also helps insurers to maintain a competitive edge in the market.

2025 Trends in the Personal Accident Insurance Market: Demand and Coverage Expansion

The Personal Accident Insurance Market is set for significant growth as new trends reshape the industry. With consumers becoming more aware of the need for financial protection against unexpected accidents, there is a growing demand for personalized and flexible insurance products.

According to industry experts, “The future of accident insurance lies in its ability to adapt to the changing needs of consumers, incorporating new risks and offering more comprehensive coverage options.” This shift is being driven by the increasing need for insurers to use technology and data analysis to provide more customized insurance solutions.

Emerging Trends in Personal Accident Insurance

One of the key emerging trends in the Personal Accident Insurance Market is the expansion of coverage to include new risks, such as cyber-attacks and pandemics. Insurers are now offering policies that cover a broader range of accidents and unforeseen events, providing consumers with greater peace of mind.

The use of technology is also playing a crucial role in shaping the future of accident insurance. Digitalization and data analytics are enabling insurers to offer more flexible and inclusive products, improving customer experience and driving market growth.

Some key trends shaping the Personal Accident Insurance Market include:

- Increased demand for customized insurance products

- Expansion of coverage to include new risks

- Leveraging technology to offer more flexible products

As the market continues to evolve, it is expected that the demand and coverage expansion will be driven by consumer needs and technological advancements. Insurers who adapt to these changes and offer innovative products are likely to gain a competitive edge in the market.

By 2025, the Personal Accident Insurance Market is expected to witness significant growth, driven by the increasing demand for accident insurance and the expansion of coverage options. As the market forecast suggests, the industry is poised for a major shift, with emerging trends playing a crucial role in shaping its future.

Challenges in Personal Accident Insurance: Regulatory, Risk, and Market Barriers

The personal accident insurance industry faces several challenges that affect its growth and profitability. Insurers need to deal with a complicated set of rules and regulations, handle risks efficiently, and find ways to overcome obstacles in the market in order to stay competitive.

Regulatory Challenges

One of the significant challenges faced by personal accident insurance providers is regulatory compliance. Regulatory changes can impact product offerings, pricing, and distribution channels. Insurers must stay informed about these changes to ensure compliance and maintain their market position.

Compliance and Risk Management

Effective risk management is crucial for personal accident insurance providers to maintain profitability. This involves:

- Assessing risks accurately

- Pricing policies appropriately

- Managing claims efficiently

Compliance with regulatory requirements is also essential to avoid penalties and reputational damage.

Insurers must adopt a proactive approach to compliance and risk management, leveraging technology and data analytics to enhance their capabilities. By doing so, they can not only mitigate risks but also identify new opportunities for growth.

Geopolitical Impact on Personal Accident Insurance Providers and Distribution Channels

The relationship between geopolitics and personal accident insurance is complex and has many aspects. Geopolitical factors like trade policies, economic sanctions, and global conflicts can have a significant effect on Personal Accident Insurance providers and how they distribute their products.

Insurers need to keep a close eye on these factors so they can adjust their strategies and stay competitive in the market. For example, changes in trade policies can impact the cost and availability of insurance products, while economic sanctions can restrict coverage in specific areas.

Geopolitical Factors Influencing Insurance Markets

Several geopolitical factors influence the personal accident insurance market, including:

- Global Conflicts: Conflicts can lead to increased claims and impact the ability of insurers to provide coverage in affected areas.

- Economic Sanctions: Sanctions can restrict insurance operations in certain countries, affecting distribution channels.

- Trade Policies: Tariffs and trade agreements can influence the cost of reinsurance and, consequently, the pricing of insurance products.

- Regulatory Changes: Geopolitical shifts can lead to changes in regulatory environments, impacting how insurance products are sold and distributed.

To navigate these challenges, insurers must adopt flexible strategies that can respond to geopolitical changes. This includes diversifying distribution channels and developing products that can adapt to changing global circumstances.

By understanding the geopolitical landscape and its potential impacts, personal accident insurance providers can better position themselves to serve their customers and maintain a competitive edge in the market.

Type Segmentation: Short-Term vs. Long-Term Personal Accident Insurance Plans

Personal accident insurance plans are broadly categorized into short-term and long-term products, each with its unique benefits and limitations. This segmentation allows consumers to choose plans that best fit their needs, whether they require temporary coverage or ongoing protection.

Short-Term Personal Accident Insurance Plans

Short-term personal accident insurance plans are designed to provide coverage for a limited period, typically ranging from a few days to a few months. These plans are ideal for individuals who need temporary insurance coverage due to specific circumstances such as travel, temporary work assignments, or seasonal activities.

Benefits and Limitations

The benefits of short-term personal accident insurance plans include flexibility and affordability. They offer quick coverage without the need for long-term commitment, making them suitable for unexpected or short-term needs. However, these plans also have limitations, such as limited coverage duration and potentially exclusion of pre-existing conditions.

When considering short-term personal accident insurance, it’s essential to review the policy’s terms and conditions carefully. Consumers should be aware of the coverage limits, deductibles, and any exclusions to ensure they understand what is covered and what is not.

In contrast to long-term plans, short-term personal accident insurance provides a flexible and cost-effective solution for temporary needs. However, for sustained protection, long-term plans may be more appropriate. Understanding the differences between these two types of plans is crucial for making an informed decision that aligns with one’s insurance needs.

Applications of Personal Accident Insurance in Healthcare, Travel, and Employment

Personal Accident Insurance is an essential part of financial security. It has many uses, such as in healthcare, travel, and employment. Its ability to offer protection against unexpected accidents makes it beneficial in various industries.

Healthcare Applications

Personal Accident Insurance plays a significant role in the healthcare sector by complementing health insurance. It covers expenses related to accidents, ensuring that individuals receive the necessary medical attention without financial strain. This type of insurance is particularly beneficial in reducing out-of-pocket expenses for accident-related treatments.

Travel Insurance and Personal Accident Coverage

Travel insurance often includes personal accident coverage to protect travelers against risks associated with traveling. This coverage is crucial for providing financial assistance in case of accidents during trips, whether domestic or international. Travelers can enjoy their journeys with peace of mind, knowing they are protected against unforeseen accidents.

The integration of Personal Accident Insurance into travel insurance policies highlights its importance in safeguarding against travel-related risks. By including personal accident coverage, travel insurance policies can offer comprehensive protection to travelers.

Key benefits of Personal Accident Insurance in travel include:

- Financial protection against accident-related expenses

- Assistance with emergency medical evacuations

- Coverage for loss of income due to accidents

By understanding the applications of Personal Accident Insurance in healthcare, travel, and employment, individuals can make informed decisions about their insurance needs.

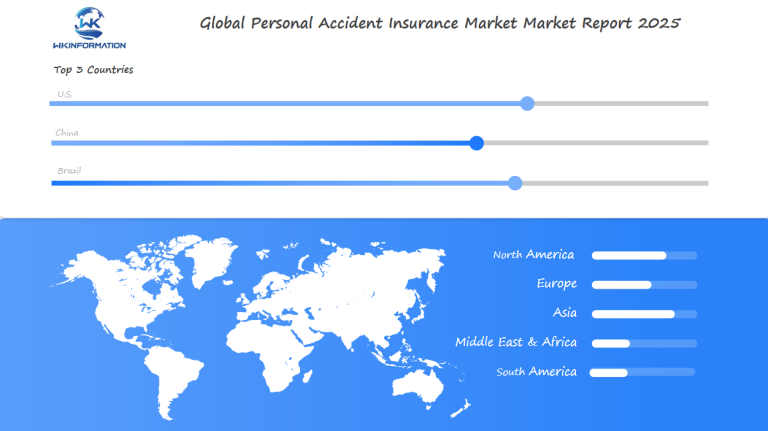

Global Market Trends: Regional Insights into Personal Accident Insurance Demand

Regional insights into the personal accident insurance demand reveal a complex landscape influenced by cultural, economic, and legal factors. The global personal accident insurance market is characterized by diverse trends across different regions.

The demand for personal accident insurance varies significantly across regions due to distinct socio-economic factors. For instance, in regions with higher disposable incomes, there tends to be a greater demand for comprehensive insurance coverage.

Regional Market Analysis

A closer examination of regional markets reveals that North America and Europe are leading the way in terms of market maturity, driven by well-established insurance industries and regulatory frameworks.

In contrast, Asia-Pacific regions are experiencing rapid growth due to increasing awareness about personal accident insurance and rising incomes.

- The demand for personal accident insurance is on the rise in emerging economies.

- Regulatory changes are influencing market trends.

- Cultural attitudes towards insurance vary significantly across regions.

Understanding these regional market trends is essential for insurers to tailor their products and marketing strategies effectively. By doing so, they can better meet the diverse needs of their clientele worldwide and capitalize on the growing demand for personal accident insurance.

U.S. Market Analysis: Growth in Personal Accident Insurance Coverage

The U.S. personal accident insurance market is growing due to a culture that values insurance protection. This growth is supported by a large and wealthy population, as well as a well-developed insurance system.

Several factors contribute to the increase in personal accident insurance coverage in the U.S., such as greater awareness of the need for financial protection against unexpected accidents.

Market Drivers and Trends

Several key drivers are influencing the growth of the personal accident insurance market in the U.S. Increasing awareness and the introduction of new, tailored insurance products are among the primary factors.

The trend towards personalized insurance plans is also gaining momentum, with insurers offering customized coverage options to meet the diverse needs of consumers.

- Rising demand for financial protection

- Advancements in insurance technology

- Expanding distribution channels

These factors are expected to continue driving the growth of the personal accident insurance market in the U.S., making it a significant segment within the global insurance industry.

China’s Expanding Personal Accident Insurance Market and Trends

China’s insurance landscape is evolving, with personal accident insurance emerging as a key area of growth driven by regulatory support and consumer demand. The country’s personal accident insurance market is characterized by a rising awareness of insurance benefits among the population, coupled with government initiatives aimed at developing the insurance sector.

China insurance market trends

The growth in China’s personal accident insurance market can be attributed to several factors, including economic reforms and an increasing focus on financial security. As the economy continues to grow, there is a heightened demand for insurance products that provide financial protection against unforeseen events. This trend is further supported by visual data representation which highlights key areas of growth within the insurance market.

Market Opportunities and Challenges

Despite the promising growth prospects, the Chinese personal accident insurance market faces several challenges. Intense competition among insurance providers is a significant challenge, as numerous companies vie for market share. Additionally, regulatory hurdles pose another challenge, as insurance companies must comply with stringent regulations governing the industry.

To capitalize on the market opportunities, insurance companies are focusing on innovative product offerings and enhanced customer service. By leveraging technology and data analytics, insurers can better understand consumer needs and tailor their products accordingly.

The future of China’s personal accident insurance market looks promising, with continued growth expected in the coming years. As the market evolves, it is likely that we will see further product diversification and increased penetration into underserved markets.

Brazil’s Role in the Latin American Personal Accident Insurance Industry

Brazil is a key player in the Latin American personal accident insurance market, thanks to its large and expanding middle class. The country’s diverse economy and growing understanding of the advantages of insurance have created an ideal environment for the personal accident insurance industry to thrive.

Market Analysis and Trends

The Brazilian personal accident insurance market has a mix of local and international insurers, which creates both opportunities and challenges. Local insurers understand the market well, while international insurers bring in global best practices and innovative products.

Key trends shaping the market include:

- Increasing demand for personalized insurance products

- Growing awareness of the importance of accident insurance

- Expansion of distribution channels, including digital platforms

The market is also seeing a shift towards more comprehensive coverage options, including long-term personal accident insurance plans, which provide policyholders with extended protection against accidents.

Market Opportunities:

- Developing tailored insurance products for specific consumer segments

- Leveraging technology to enhance customer experience and operational efficiency

- Exploring new distribution channels to reach a wider audience

Future Outlook: Shifting Demographics and Market Growth in Personal Accident Insurance

The personal accident insurance market is set for significant growth as demographic shifts reshape the industry landscape.

This growth is driven by various factors, including aging populations and changes in workforce dynamics.

Demographic Shifts and Insurance Demand

Demographic shifts are significantly influencing the demand for personal accident insurance.

Aging populations, for instance, require insurance products that cater to their specific needs, such as coverage for age-related health issues.

The insurance market forecast indicates a positive trend due to these demographic changes.

Insurers are adapting by developing products that meet the evolving needs of their customers, thereby driving market growth.

For example, insurers are now offering products with enhanced coverage for accidents related to recreational activities, which are popular among younger demographics.

The future outlook for the personal accident insurance market is promising, with demographic shifts playing a crucial role in shaping market growth.

Insurers who adapt to these changes are likely to benefit from the expanding market.

Competitive Landscape: Key Insurance Providers and Strategies in Personal Accident Insurance

Key Players

- Allianz SE – Germany

- AXA Group – France

- Zurich Insurance Group – Switzerland

- Prudential Financial, Inc. – United States

- MetLife, Inc. – United States

- Chubb Limited – United States

- Berkshire Hathaway (GEICO) – United States

- Manulife Financial Corporation – Canada

- HDFC Life Insurance Company – India

- ICICI Lombard General Insurance – India

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Personal Accident Insurance Market Report |

| Base Year | 2024 |

| Segment by Type | ·Short-Term

·Long-Term |

| Segment by Application | ·Healthcare

·Travel ·Employment |

| Geographies Covered | ·North America (United States, Canada)

·Europe (Germany, France, UK, Italy, Russia) ·Asia-Pacific (China, Japan, South Korea, Taiwan) ·Southeast Asia (India) ·Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The personal accident insurance market is about to grow significantly, driven by increasing demand for financial protection against unforeseen accidents. As discussed earlier, various factors contribute to this growth, including product innovation and expanding distribution channels.

Insurance industry analysis reveals that understanding trends, challenges, and opportunities in the personal accident insurance market is crucial for insurers, policymakers, and consumers. Market trends indicate a shift towards more comprehensive coverage options and personalized insurance products.

As the market continues to evolve, it is essential to monitor regional insights and demographic shifts that influence demand. The U.S., China, and Brazil are key markets driving growth in the personal accident insurance industry.

By staying informed about market trends and industry developments, stakeholders can make informed decisions and capitalize on emerging opportunities in the personal accident insurance market.

Global Personal Accident Insurance Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Personal Accident Insurance Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Personal Accident Insurance Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Personal Accident Insurance Players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: Personal Accident Insurance Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Personal Accident Insurance Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Personal Accident Insurance Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Personal Accident Insurance Market Insights

Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is Personal Accident Insurance?

Personal Accident Insurance provides financial protection against accidental injuries, disabilities, or death, helping individuals and families cope with the financial impact of unexpected events.

What are the main factors driving the growth of the Personal Accident Insurance Market?

The growth of the market is influenced by several key factors:

- Increasing awareness about accident insurance

- Expanding middle-class populations

- Advancements in insurance products

- Development of distribution channels

How is technology impacting the Personal Accident Insurance Market?

Technology is enabling insurers to offer more customized, flexible, and inclusive products, driving market growth and improving customer experience.

What are the emerging trends in Personal Accident Insurance?

Emerging trends include:

- the increasing demand for customized insurance products

- expansion of coverage to new risks like cyber-attacks and pandemics

- leveraging technology for product innovation

What are the challenges faced by Personal Accident Insurance providers?

Providers face regulatory compliance, risk management, and market barriers, which can impact product offerings, pricing, and profitability.

How do geopolitical factors influence Personal Accident Insurance markets?

Geopolitical factors such as trade policies, economic sanctions, and global conflicts can significantly impact insurers and their distribution channels, requiring strategic adjustments.

What is the difference between short-term and long-term Personal Accident Insurance plans?

Short-term plans offer temporary coverage, while long-term plans provide sustained protection. Each type has its benefits and limitations that consumers should understand to make informed decisions.

Where can Personal Accident Insurance be used?

Personal Accident Insurance can be used in the following sectors:

- Healthcare

- Travel

- Employment

It works alongside existing insurance coverage and provides protection against specific risks.

How does the demand for Personal Accident Insurance vary across regions?

Demand varies due to economic conditions, regulatory environments, and cultural attitudes towards insurance, requiring insurers to tailor products and marketing strategies to regional needs.

What is the outlook for the Personal Accident Insurance Market in the U.S. and China?

The U.S. market is driven by a large and affluent population, while China’s market is expanding due to economic growth and government initiatives, both presenting growth opportunities.

How will demographic shifts impact the Personal Accident Insurance Market?

Demographic shifts, including aging populations and changing workforce dynamics, will influence the market, requiring insurers to adapt products to evolving customer needs.