$1.67 Billion Polyethylene Chlorosulfonated Market Growth Forecast for South Korea, Germany, and the U.S. by 2025

Explore the $1.67 billion Polyethylene Chlorosulfonated Market trends, growth drivers, and regional analysis across South Korea, Germany, and emerging economies through 2030.

- Last Updated:

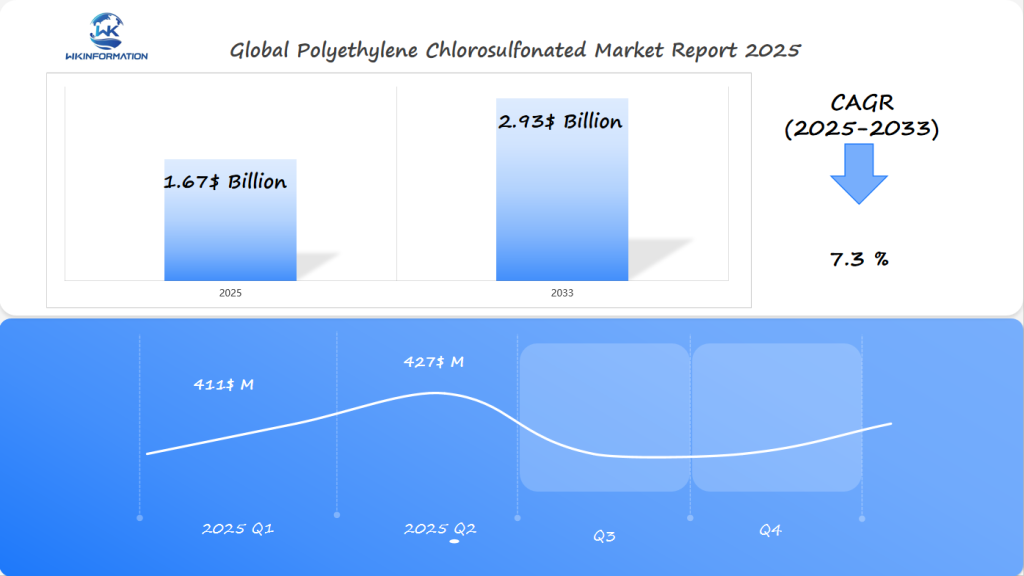

Projected Market Insights for Polyethylene Chlorosulfonated in Q1 and Q2 of 2025

The Polyethylene Chlorosulfonated market is expected to reach $1.67 billion in 2025, with a CAGR of 7.3% from 2025 to 2033. In Q1, the market is projected to generate around $411 million, driven by its increasing use in coatings, adhesives, and the automotive industry for its enhanced durability and chemical resistance properties. By Q2, the market is expected to grow to approximately $427 million, reflecting continued growth in demand.

Key Contributors to Market Growth

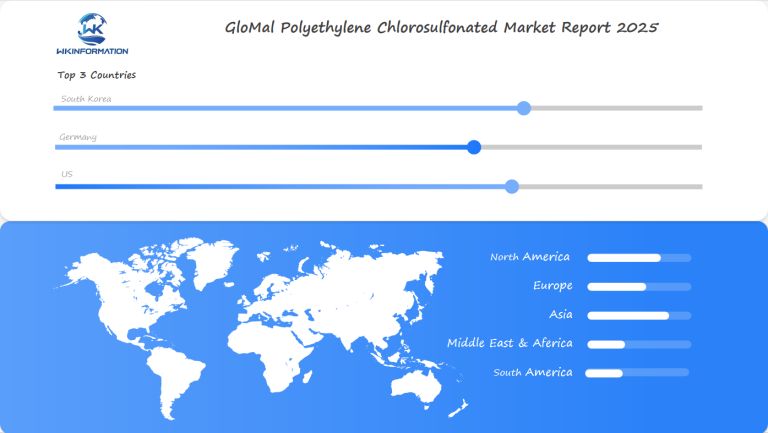

South Korea, Germany, and the U.S. will be key contributors to this market. The following factors will drive growth in these regions:

- South Korea’s automotive and industrial manufacturing sectors

- Germany’s strong chemicals industry

- The U.S.’s demand for advanced materials in a variety of sectors

As industries continue to prioritize high-performance materials, the market for Polyethylene Chlorosulfonated will expand steadily in these regions.

Upstream and Downstream Industry Chain for Polyethylene Chlorosulfonated

The Chlorosulfonated Polyethylene (CSM) supply chain is a complex web of processes and players. Raw materials are key to the quality and performance of this unique elastomer.

Key parts of the CSM supply chain include:

- Upstream raw material sourcing

- Manufacturing processes

- Product refinement

- Distribution channels

- End-use industries

Upstream Processes

In the upstream part, makers aim to get top-notch petrochemicals. These materials are then changed through precise chemical steps to make Chlorosulfonated Polyethylene. Petrochemical engineering skills are vital for making products of consistent quality.

Downstream Applications

The downstream parts cover various industries that use CSM’s special traits. The auto, construction, and industrial sectors are big users of this elastomer. They count on CSM for its great weather, chemical, and temperature resistance.

Importance of Collaboration

The complex CSM supply chain needs ongoing innovation and teamwork. Suppliers, makers, and users must work together to improve products and meet market needs

Key Trends Driving the Polyethylene Chlorosulfonated Market

The chlorosulfonated polyethylene (CSM) industry is going through big changes. New market trends and green initiatives are leading the way. Companies are changing how they make things and what they use.

Now, the CSM market is moving towards being more eco-friendly. Businesses are putting a lot of money into making sustainable CSM. They see how important it is to have green industrial materials.

Sustainable Practices in CSM Production

Leading companies are focusing on making CSM in a way that’s better for the planet. They’re working on:

- Using renewable resources

- Lessening the use of harmful chemicals

- Making production more energy-efficient

- Reducing waste

Technological Advancements in Material Formulation

New ways of making CSM are making it better. Scientists are creating materials with:

- Chemical Resistance: It lasts longer in tough conditions

- Thermal Stability: It works better in hot temperatures

- Mechanical Properties: It’s stronger and more flexible

These advances are opening up new uses for CSM. It’s now used in cars and buildings, among other things.

Challenges and Barriers in Polyethylene Chlorosulfonated Production

The polyethylene chlorosulfonated (CSM) market faces big challenges. These challenges test how well manufacturers can adapt and innovate.

Fluctuations in Raw Materials

Fluctuations in raw materials, like polyethylene and liquid chlorine, are a big problem. These prices change a lot because of the crude oil market.

Technical Hurdles for Domestic Companies

Domestic companies also face technical hurdles. Making high-chlorine-content chlorinated polyethylene (CPE) with more than 40% chlorine is hard. They need to meet complex production needs while keeping product quality high.

Key Challenges for Manufacturers

Manufacturers in the CSM market must overcome several key challenges:

- Technological investment required for greener production methods

- Complex material formulation challenges

- Stringent performance certification requirements

Environmental Standards as Market Barriers

Environmental standards add to the market barriers. Geomembrane applications need strict testing, including:

- Accelerated UV weathering tests (minimum 20,000 hours)

- Chemical immersion testing (30-180 days)

- Material stress cracking evaluations

The Importance of Technological Investment

Companies must invest in new tech to beat CSM production hurdles. Moving from old solvent-based methods to new aqueous-phase production is key. It helps cut down on environmental harm while staying competitive in the market.

Geopolitical Impact on Polyethylene Chlorosulfonated Market

The polyethylene chlorosulfonated (CSM) market is facing big challenges from global politics. Trade policies and tensions between regions are changing the market. This creates complex situations for makers and suppliers.

Important factors affecting the CSM market include:

- Trade restrictions between major industrial nations

- Shifting manufacturing capabilities across regions

- Economic sanctions impacting raw material access

- Strategic realignments in global supply chain networks

Companies are finding new ways to deal with these challenges. They are spreading out their supply chains, setting up factories in different places, and making their buying processes stronger. This helps them avoid problems.

The global supply chain for CSM materials is getting more complex. Countries like South Korea, Germany, and the United States are trying to stay ahead in this important market.

Strategic adaptability will determine long-term success in the polyethylene chlorosulfonated market.

Trade policies are key in making the market open and competitive. Companies need to be quick to change, ready for any global shifts. These changes could affect how they make, distribute, and sell their products.

Understanding Market Segmentation: Types and Uses

The Chlorosulfonated polyethylene (CSM) market is complex, filled with innovation and special uses. It’s important to understand the different market segments to grasp its global dynamics and growth.

CSM market segments are mainly divided into two types: industrial grade CSM and non-industrial grade CSM. Each type has unique features that meet specific industry needs.

Industrial Grade CSM: Precision Performance

Industrial grade CSM is the high-performance part of chlorosulfonated polyethylene materials. It offers:

- Chemical resistance

- Temperature durability

- Mechanical strength

Key Application Sectors for CSM

CSM is used in many important industries, showing its versatility and ability to adapt to new technologies.

Global leaders like DuPont, BASF SE, and Dow are pushing the CSM market forward. They are creating more advanced solutions for various industries.

Applications of Polyethylene Chlorosulfonated in Industries and Consumer Products

Chlorosulfonated polyethylene (CSM) is a versatile material that’s changing many industries.

Key Industries Using CSM

CSM is used in many important areas. Each one uses its special properties in different ways. Here are some key industries that use this advanced material:

- Automotive industry: It’s used for making seals, gaskets, and special hoses.

- Construction sector: It’s key for roofing membranes and waterproof coatings.

- Electrical and electronics: It provides top-notch cable insulation.

- Oil & Gas: It’s used for protecting equipment and pipelines.

Consumer Products Benefiting from CSM

Consumer products using CSM have also grown a lot. Its ability to resist environmental stress makes it perfect for durable items. Here are some examples:

- Protective footwear

- Weather-resistant outdoor gear

- Chemical-resistant industrial clothing

- High-performance sporting equipment

CSM’s versatility comes from its great chemical resistance, temperature tolerance, and durability. These qualities make it a key material in advanced manufacturing and creative product design.

Global Insights: Regional Trends in Polyethylene Chlorosulfonated Market

The global polyethylene chlorosulfonated (CSM) market shows different trends in each region. A detailed look at the CSM market reveals big differences in trends across the world.

Key regions leading the global CSM trends are:

- North America: Technological innovation hub

- Europe: Sustainable manufacturing focus

- Asia Pacific: Rapid industrial expansion

- Latin America: Emerging market potential

- Middle East and Africa: Growing industrial infrastructure

Each region has its own special opportunities for growth. Each area has its own way of using and making CSM, which affects the global market.

| Region | Market Share (%) | Growth Potential |

| North America | 35% | High |

| Europe | 25% | Moderate |

| Asia Pacific | 30% | Very High |

| Latin America | 5% | Emerging |

| Middle East & Africa | 5% | Developing |

Companies need to carefully plan how to work in each region. They must understand local rules, tech levels, and market needs to succeed globally.

U.S. Market Dynamics for Polyethylene Chlorosulfonated

The North American CSM industry is leading in new material technologies. The U.S. CSM market is growing fast and has a lot of potential. Recent studies show how chlorosulfonated polyethylene is becoming more important in many high-performance fields.

Several factors are driving the U.S. CSM market forward. These include different uses in industries and new technologies. The market is strong in many key areas:

- Construction industry materials

- Automotive performance components

- Advanced electrical insulation systems

- High-tech device manufacturing

Top companies are working on green solutions that meet tough standards. Significant growth is projected in specific market segments. For example, the wire and cable industry, which makes up about 35% of the market, is expected to grow a lot.

The automotive sector is also growing fast. It’s getting more involved in electric vehicle technology. Experts predict an 8% growth in 2024, thanks to new uses in battery sealing and charging station cables.

Big U.S. makers like Hanna Rubber Company and Minnesota Rubber and Plastics are leading in chlorosulfonated polyethylene. They make the U.S. a top player in advanced materials.

South Korea's Role in Polyethylene Chlorosulfonated Market Growth

The South Korean CSM industry is a key player in the Asian CSM market. It drives innovation and growth. South Korea’s strong technology and economic policies make it crucial in the polyethylene chlorosulfonated materials sector.

Strengths of South Korea’s Market

South Korea’s market has several strengths:

- Advanced manufacturing capabilities

- Significant government investment in high-tech industries

- Strong research and development ecosystem

- Competitive export strategies

South Korean manufacturers use advanced techniques to improve chlorosulfonated polyethylene materials. Their focus on technology gives them a global market advantage.

| Market Indicator | South Korean Performance |

| Market Growth Rate | 7.2% annually |

| Export Volume | 45,000 metric tons |

| R&D Investment | $152 million |

The Asian CSM market benefits a lot from South Korea’s strategy. Sectors like automotive, electronics, and construction use South Korea’s high-performance materials.

“South Korea’s technological expertise continues to drive innovation in polyethylene chlorosulfonated materials” – Industrial Materials Review

Government policies play a big role in South Korea’s CSM industry growth. Incentives and investments in advanced facilities support innovation and production.

Germany's Innovations in Polyethylene Chlorosulfonated

Germany is at the forefront of German CSM technology, making significant progress in the European CSM market. With its robust research and manufacturing capabilities, Germany has established itself as a global leader in polyethylene chlorosulfonated innovations.

Germany has made significant advancements in CSM technology. One notable example is CHEMOLINE 8, an exceptional soft rubber lining designed specifically for road drums and ISO containers. What sets it apart is its outstanding resistance to chemicals and flexibility.

The roots of German material science can be traced back to the 1950s when Karl Ziegler conducted groundbreaking research. His work on catalysts revolutionized the production process of polyethylene, resulting in improved and cost-effective manufacturing techniques.

Currently, German manufacturers continue to make strides in the European CSM market. Their primary areas of focus include:

- Environmentally friendly production methods

- Enhanced performance characteristics of materials

- Exploration of new applications for existing materials

These initiatives demonstrate Germany’s commitment to maintaining its leadership position in material technology.

Future Outlook: Polyethylene Chlorosulfonated Market Developments

The CSM market is set for growth, with experts predicting a global market value of USD 2.93 billion by 2033. This growth is expected to be steady, with a 7.3% compound annual growth rate. Strategic partnerships are key to driving innovation and expanding the market.

CSM applications are set to grow in many important industries. These include:

- Automotive electrical systems

- Advanced infrastructure materials

- Renewable energy equipment

- High-performance protective gear

Technological advancements are changing the polyethylene chlorosulfonated market. New trends focus on creating sustainable and high-performance elastomer solutions. Companies are investing in research to make more eco-friendly and advanced materials.

| Market Segment | Projected Growth Rate | Key Drivers |

| Automotive | 5.2% | Electric vehicle components |

| Electronics | 4.8% | Advanced insulation materials |

| Industrial Applications | 4.5% | Chemical resistance requirements |

Regional dynamics will be key in the market’s evolution. Asia-Pacific will lead in production and consumption. Meanwhile, North America and Europe will focus on high-value, specialized applications.

Competitive Landscape in the Polyethylene Chlorosulfonated Market

Strategic partnerships and new technologies are key in this competitive field. Firms are pouring money into research to make special products for areas like agriculture and construction. This shows their dedication to creating top-notch materials for changing market needs.

- Hangzhou Keli Chemical Co. Ltd – China

- Dow – United States

- Resonac Holdings Corporation – Japan

- Weifang Yaxing Chemical Co. Ltd – China

- Shandong Xiangsheng New Materials Technology Co. Ltd – China

- Jiangsu Huaxiang New Materials Co. Ltd – China

- Tosoh Corporation – Japan

- Lanxess – Germany

- Sundow Polymers Co. Ltd – China

- Shandong Tianchen Chemical Co. Ltd – China

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Polyethylene Chlorosulfonated Market Report |

| Base Year | 2024 |

| Segment by Type |

· Industrial Grade · Non-industrial Grade |

| Segment by Application |

· Construction · Automotive · Industrial Products · Wire and Cable |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The polyethylene chlorosulfonated market demonstrates robust growth, driven by increasing demand across industries such as automotive, construction, and healthcare. The global market is projected to maintain a steady growth rate during the forecast period, supported by technological advancements and rising adoption of CSM in diverse applications. Regional insights reveal significant contributions from Asia Pacific and North America, highlighting their pivotal roles in shaping market trends.

Innovation and sustainability remain critical for future market growth. Companies like DuPont and Tosoh Corporation lead the industry by integrating sustainable practices and advancing production technologies. As industries prioritize environmental sustainability, the chlorosulfonated polyethylene market is poised to address evolving demands while fostering long-term resilience. Opportunities abound, but challenges such as raw material volatility and competition from alternatives require strategic solutions.

Global Polyethylene Chlorosulfonated Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Polyethylene Chlorosulfonated Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Polyethylene Chlorosulfonatedplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Polyethylene Chlorosulfonated Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Polyethylene Chlorosulfonated Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Polyethylene Chlorosulfonated Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofPolyethylene Chlorosulfonated Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

Key Industries Using Chlorosulfonated Polyethylene

Chlorosulfonated Polyethylene (CSM) is widely used in various industries, including:

- Construction: CSM is utilized in roofing membranes, waterproofing systems, and sealants due to its excellent weather resistance and durability.

- Automotive: In the automotive sector, CSM is employed in manufacturing gaskets, seals, and protective coatings for its flexibility and resistance to chemicals.

- Industrial Products: CSM finds applications in industrial products such as conveyor belts, hoses, and tarpaulins where flexibility and resistance to harsh conditions are crucial.

- Wire and Cable: The wire and cable industry uses CSM as insulation and jacketing material for its outstanding electrical properties and resistance to environmental factors.

The unique combination of weather resistance, chemical durability, and flexibility makes CSM a highly valued material in these industries.

How is the CSM market addressing sustainability concerns?

Manufacturers are producing eco-friendly CSM by:

- Using sustainable production methods

- Focusing on technology to reduce environmental impact

Their goal is to maintain high performance while being environmentally conscious.

What challenges does the Polyethylene Chlorosulfonated market currently face?

The market faces challenges like:

- Changes in the prices of raw materials

- Competition from other companies

- Complex regulations that govern the industry

- The need to find ways to keep production costs low

How do geopolitical factors impact the CSM market?

International trade policies, regional conflicts, tariffs, and global economic shifts affect CSM production and use. They impact different markets around the world.

What distinguishes industrial grade from non-industrial grade CSM?

Industrial grade CSM has higher performance and chemical resistance. It’s designed for demanding applications, unlike non-industrial grade materials.

Which regions are leading in Polyethylene Chlorosulfonated production?

The key regions leading in the production of Polyethylene Chlorosulfonated are:

- North America

- Asia-Pacific, particularly South Korea

- Europe, with Germany as the frontrunner

- Latin America

- The Middle East

These regions play a crucial role in driving growth and innovation in the CSM market.

What technological innovations are emerging in CSM production?

New innovations include:

- Advanced materials

- Improved production methods

- Enhanced performance characteristics

These advancements expand CSM’s use across various industries.

How is the United States contributing to the CSM market?

The U.S. has strong automotive and construction industries. It also has technological advancements and a supportive regulatory framework. These factors support CSM development and application.

What future developments are expected in the Polyethylene Chlorosulfonated market?

The future holds market growth, new applications, and technological breakthroughs. There will be a focus on sustainability and changing consumer preferences. These factors will drive innovation in CSM production and use.