$1.56 Billion Polyethylene Naphthalate Resin Market Growth in the U.S., UK, and China by 2025

Explore the growth trends and market share of polyethylene naphthalate resin, highlighting its industrial applications and future prospects.

- Last Updated:

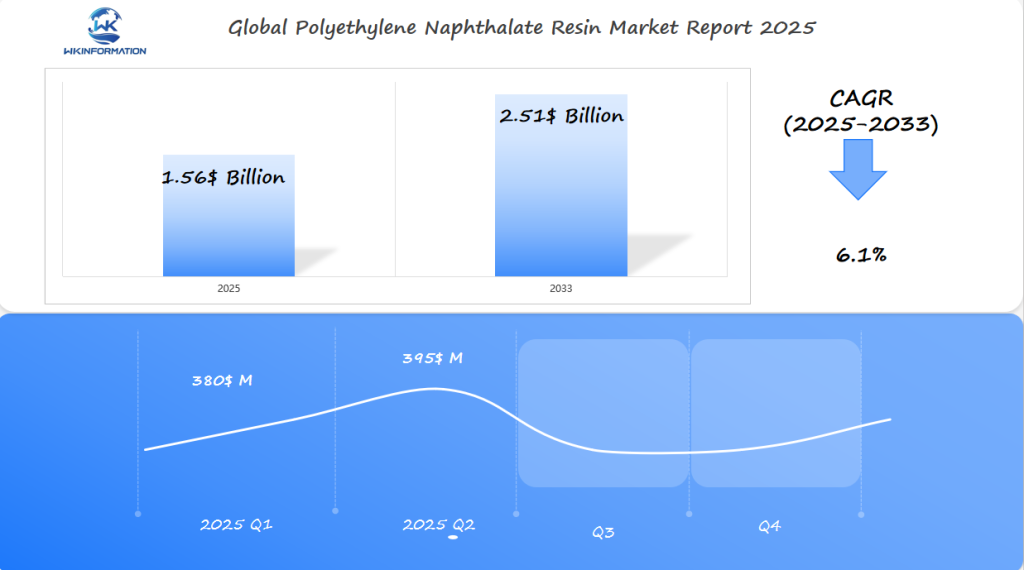

Projected Market Insights for Polyethylene Naphthalate Resin in Q1 and Q2 of 2025

The Polyethylene Naphthalate (PEN) Resin market is expected to reach $1.56 billion in 2025, with a CAGR of 6.1% from 2025 to 2033. In Q1, the market is projected to generate approximately $380 million, driven by the rising demand for high-performance materials in the packaging, automotive, and electronics industries. By Q2, the market is expected to grow to around $395 million, reflecting steady progress.

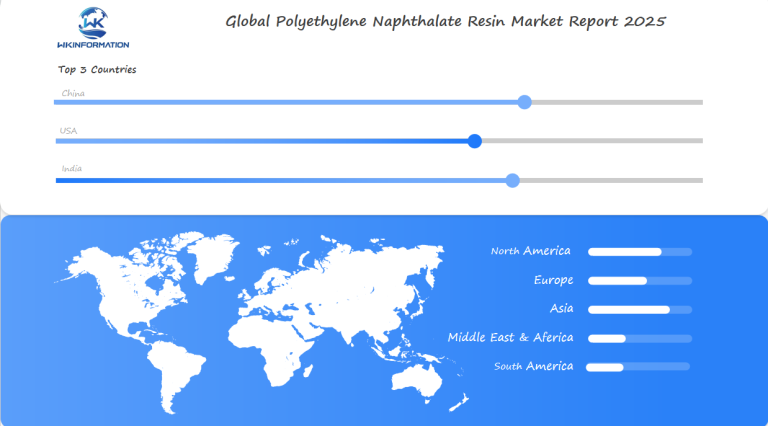

The U.S., UK, and China are the primary drivers of growth in this market. The U.S. is a key player due to its demand in the automotive and electronics sectors, the UK sees growth in the packaging industry, and China’s manufacturing and export sectors continue to support the use of high-performance resins. The increasing need for more durable and sustainable materials in various industries will further drive growth in these regions.

Upstream and Downstream Industry Chain Analysis for Polyethylene Naphthalate Resin

The PEN resin supply chain depends on two main materials: naphthalene dicarboxylic acid (NDC) and ethylene glycol. Changes in these materials’ global production affect resin prices and availability. Manufacturers aim to balance cost and quality to meet various needs.

Raw Material Supply Chain for PEN Resin Production

Getting NDC and ethylene glycol is key. Asia leads in NDC, while North America is a big player in ethylene glycol. Recent global changes have shown the risks in the PEN resin supply chain. This has led companies to look for more diverse suppliers.

PEN Manufacturing Process and Key Technological Considerations

- Two-step polymerization methods improve yield and thermal properties

- Advanced catalysts cut energy use in the PEN manufacturing process

End-User Industries and Distribution Channels

Downstream uses cover many areas:

- Packaging: High-barrier films for food preservation

- Electronics: Flexible circuit substrates

- Textiles: High-strength fibers for technical fabrics

More companies are linking resin production with conversion. This helps in fast-growing markets like flexible electronics.

Key Market Trends Shaping Polyethylene Naphthalate Resin Demand

New PEN market trends are changing how we see demand. Industries are focusing on being green and innovative. Three main areas are important: caring for the environment, improving packaging, and pushing electronics forward.

Driving Bio-Based PEN Development

Companies are working fast to make sustainable PEN resin. They want to reduce carbon emissions. Startups and big chemical companies are looking into plant-based materials and recycling.

This move matches global rules to use less fossil fuels. It’s all about meeting the needs of eco-friendly consumers.

High-Barrier Packaging Demands

High-barrier packaging is growing fast, especially for food and medical items. Biaxially oriented film made from PEN is top-notch for keeping things fresh. Here’s a quick look at how PEN compares:

| Material | Barrier Strength | Key Use |

| PEN film | 98% gas blockage | Medical vials, snack packaging |

| Standard PET film | 82% gas blockage | Basic food wraps |

Electronics Industry Demands

The electronics industry requires PEN for its heat resistance properties. Additionally, its lightweight nature makes it ideal for flexible screens and 5G circuit boards. According to experts, the use of PEN in electronics is projected to grow by 12% annually until 2025.

PEN is becoming increasingly important in various sectors. It addresses the demand for environmentally friendly solutions while delivering superior performance.

Barriers and Challenges in the Polyethylene Naphthalate Resin Market

PEN has many benefits, but it faces big challenges. Production cost barriers and processing limitations are major hurdles. These issues affect how widely PEN is used.

Cost Comparison with Alternative Materials

PEN is pricier than PET and polycarbonate. This makes it hard to find substitutes. Here’s a cost comparison:

| Material Cost Relative to PEN Main Use PET | 30% Lower | Bottles, Containers |

| Polycarbonate | 15-20% Lower | Electronics, Lenses |

| PEN | Higher Initial Investment | High-End Packaging, Medical Devices |

Technical Limitations in Processing and Application

- Requires higher melt temperatures (over 290°C), putting stress on machinery

- Existing plants need equipment upgrades to overcome processing limitations

- Challenging to form thin films compared to PET

Regulatory Hurdles for Food Contact and Medical Uses

Meeting regulatory compliance standards is costly and time-consuming. Medical-grade PEN needs a lot of testing. This delays its launch.

Getting approval for food packaging in the EU takes 12-18 months. This slow process makes it hard for PEN to enter the market.

Geopolitical Factors Affecting the Polyethylene Naphthalate Resin Industry

Global trade is changing the geopolitical impact on PEN market. Changes in international trade policies offer both challenges and chances for makers. Here’s how major areas are adjusting:

Trade Relations Between Major Manufacturing Countries

- China PEN manufacturing deals with tariffs that increase costs for U.S. buyers, changing prices.

- U.S. companies are looking for more suppliers to not rely too much on one place.

- EU carbon border taxes push makers to use cleaner methods.

Impact of Regional Policies on Production Capacity

| Country | Policy Focus | Impact |

| China | State-backed factories | Expands global China PEN manufacturing dominance |

| U.S. | Reshoring incentives | Boosts U.S. polymer industry competitiveness |

| UK | Post-Brexit trade deals | Strengthens UK chemical sector partnerships |

Supply Chain Resilience in Global Market Uncertainty

Companies are using a mix of strategies. U.S. polymer industry firms are setting up local plants and keeping ties with Asia. The UK chemical sector is teaming up with EU and Nordic countries to handle Brexit issues. China PEN manufacturing centers are investing in automated systems to fight off shipping delays.

Market Segmentation: Types and Key Applications of Polyethylene Naphthalate Resin

PEN resin grades are made for different needs. Knowing these types helps makers pick the right material. This balances performance and cost. Let’s see how each type fits specific uses.

Liquid Crystal Polymers vs. Standard PEN Formulations

Standard PEN is clear and heat-resistant. But liquid crystal polymers (LCPs) are better at high temperatures. They’re great for car and electronic parts because they stay stable under stress. Here’s a comparison:

| Property | PEN | Liquid Crystal Polymers |

| Heat Resistance | Up to 120°C | Up to 300°C |

| Flexibility | Excellent for films | Rigid structural components |

Film-Grade PEN vs. Bottle-Grade PEN vs. Fiber-Grade PEN

- Film-grade PEN: Thin, clear sheets for flexible electronics and packaging.

- Bottle-grade PEN: Made for soda bottles, it doesn’t bend under pressure.

- Fiber-grade PEN: Strong for ropes or advanced textiles.

Emerging Specialty Formulations for Niche Applications

Now, makers create specialty formulations for unique needs. For instance:

| Formulation Type | Application | Key Advantage |

| Medical-grade PEN | Surgical tools | Chemical resistance |

| UV-stabilized PEN | Outdoor signs | Lightweight and durable |

Picking the right PEN resin grade is key. It ensures products meet both performance and cost goals in various fields.

Applications of Polyethylene Naphthalate Resin in Key Industries

Polyethylene naphthalate (PEN) is more than just a material. It’s a game-changer for industries looking for new ideas. Its special properties make it perfect for areas needing strength, flexibility, and eco-friendliness. Let’s see how PEN is changing industries, from food packaging to cutting-edge electronics.

Food and Beverage Packaging Innovations

PEN is changing food and drink packaging. It keeps items fresh for up to 50% longer by blocking oxygen and moisture. Its heat resistance means you can fill bottles with hot liquids without needing heavy containers.

For example, soda companies use PEN bottles. These bottles keep the fizz and freshness in without getting damaged during pasteurization.

Electronics and Flexible Display Technologies

In electronics, PEN is great for electronic substrate materials in flexible displays. Smartphones and wearables now have bendable screens thanks to PEN. These screens are less likely to crack.

A tech expert said, “PEN’s low thermal expansion helps in making tiny circuits. This reduces defects by 30% compared to older materials.”

The advancements in flexible display technologies, largely driven by materials like PEN, have revolutionized the way we interact with our devices. The ability to produce bendable screens that are less prone to damage has opened up a plethora of possibilities in device design and functionality.

Automotive and Transportation Component Solutions

Car makers are using automotive PEN components to make cars lighter without losing strength. PEN replaces metal in engine parts and wiring, boosting fuel efficiency by up to 15%. It also resists chemicals and extreme temperatures, making it ideal for engine compartments.

- Lightweighting: 25% weight reduction in automotive parts

- Heat resistance: up to 150°C

- Sustainability: recyclable and meets EU automotive standards

PEN is versatile, from keeping snacks fresh to powering screens and making cars stronger. Its role in barrier films and flexible displays shows how innovation meets real-world needs.

Global Polyethylene Naphthalate Resin Market Insights

The global PEN market size is at a key point, with PEN market growth expected to hit $1.56 billion by 2025. This growth comes from changing regional demand analysis and shifts in production capacity worldwide. These changes show where new chances exist in a competitive field.

Current Market Size and Historical Growth Patterns

Since 2015, the market has grown steadily, thanks to new tech and green demands. Now, market share distribution is leaning towards makers who cut costs. Big names like Teijin and SKC lead with 45% of the market, thanks to their big production.

Regional Production and Consumption Distribution

| Region | Production Capacity (kt/year) | Consumption Growth (%) |

| North America | 12 | 6.2 |

| Asia-Pacific | 28 | 8.1 |

| Europe | 8 | 4.9 |

Asia-Pacific is ahead in production capacity worldwide because of its cheap manufacturing spots. Meanwhile, North America focuses on high-value special uses.

Key Global Players and Market Concentration Analysis

- The top 5 companies control 68% of the market share distribution.

While the market remains quite concentrated, a regional demand analysis reveals significant growth in emerging markets like India and Brazil. These areas are experiencing innovation-driven growth, presenting new opportunities for both local and international players.

U.S. Market Dynamics for Polyethylene Naphthalate Resin

The U.S. PEN market is crucial for the American polymer industry. It is expanding rapidly to fulfill global demands. To develop the American market in sectors such as food packaging and electronics, companies are increasing U.S. manufacturing capacity.

Domestic Production Capacity and Expansion Plans

| Company Current Capacity (tonnes/year) Expansion Plans Eastman Chemical | 18,500 | 2024 Texas plant expansion targeting 30,000 tonnes |

| Dow Chemical | 12,000 | Partnership with DuPont for $250M R&D facility |

U.S. End-User Industry Adoption Trends

- Food packaging: 65% of domestic demand driven by FDA-approved bottle-grade PEN

- Electronics: 20% market share growth in flexible circuit substrates since 2023

- Automotive: Limited adoption (5%) due to cost barriers

Innovation Ecosystem and R&D Investments

The American polymer industry is leading the way in PEN innovation. Collaborations such as MIT’s partnership with BioPEN Tech are developing bio-based PEN solutions. Additionally, startups like PolymerX secured $15 million in funding in 2023 to support domestic PEN production efforts.

Importance of Regulatory Approvals

Obtaining regulatory approvals is critical for the success of these initiatives. In 2023, the FDA approved 30% more food-contact applications, indicating a positive trend for the industry. Furthermore, the EPA’s recycling guidelines play a significant role in promoting sustainability within the sector.

These combined efforts are expected to contribute to the growth of the U.S. PEN market, with projections indicating that it will account for 40% of global demand by 2025.

China's Influence on the Polyethylene Naphthalate Resin Market

China leads the Chinese polymer industry by rapidly expanding its China PEN manufacturing sites. New chemical parks in Jiangsu and Zhejiang provinces have recently started operations. These parks host advanced production lines, resulting in a remarkable 40% increase in Asian resin production since 2020.

These facilities leverage reforms in the China chemical sector to streamline operations. Furthermore, they are designed to meet global quality standards, ensuring that the products manufactured are competitive on an international scale.

Manufacturing Capacity Expansion in Chinese Chemical Parks

- State-backed factories now account for 65% of global PEN resin capacity

- Automation upgrades cut production costs by 18% over three years

- Government incentives attract $2.3 billion in infrastructure investments

Export Strategies and Global Market Penetration

Export strategies aim to be price competitive while improving product durability. The focus is on EU packaging markets and US electronics suppliers. Recent agreements with Southeast Asian nations show Chinese polymer industry exports rising 27% annually.

Technological Advancements in Chinese PEN Production

Innovation hubs in Shanghai and Tianjin are working on new catalysts. These reduce energy use by 25%. Partnerships with German engineering firms help adopt closed-loop systems.

This aligns with China chemical sector sustainability goals in the 14th Five-Year Plan.

Domestic demand from beverage and tech sectors now consumes 40% of output. This forces exporters to improve logistics. These changes make China a key player in the $1.56B global PEN market.

UK's Role in Advancing Polyethylene Naphthalate Resin Technologies

The UK is leading the way in the polyester industry. Through UK polymer research, it’s making sustainable PEN development possible. The University of Manchester and Imperial College London work with big companies to make eco-friendly PEN.

They focus on post-Brexit manufacturing to keep the British chemical industry strong worldwide.

Research Leadership in Sustainable PEN Formulations

There have been significant advancements in PEN research, including the use of bio-based materials and recycling systems. The EPSRC-funded PEN-Cycle project aims to reduce carbon emissions by 40% by 2025.

Some key achievements are:

- Biodegradable additives for food packaging

- Lower-cost production methods

- Trials with Unilever and Procter & Gamble

Post-Brexit Industry Positioning in Specialty Polymers

After leaving the EU, the UK has focused on free trade deals with major European resin market players. It has set up rules that match EU standards but also offers tax breaks for green manufacturing. This move aims to make British companies a big part of the global PEN market by 2026.

Collaborative Projects with European and Global Partners

The UK and EU are working together on PEN projects. For example, the Anglo-German PEN Alliance brings together UK research and EU production. They’re working on:

- With DSM (Netherlands): Clear PEN for phone screens

- With SABIC (Saudi Arabia): PEN for cars

These partnerships help the British chemical industry stay ahead in sustainable PEN development. They balance the challenges of post-Brexit with chances for growth worldwide.

Future Innovations and Growth in the Polyethylene Naphthalate Resin Market

The PEN market forecast shows a bright future for PEN. New future polymer technologies will make PEN a key player in sustainable materials. It will be used in many areas, from energy to healthcare.

Next-Generation PEN Formulations in Development

Scientists are working on PEN resins that are stronger and last longer. These future polymer technologies will make PEN great for electric cars and gadgets. AI is helping speed up the testing process.

Emerging Applications Driving Future Demand

New uses for PEN are on the rise. It will be used in solar panels and medical devices. This will make PEN even more popular in the market.

Sustainability Innovations and Circular Economy Integration

There’s a big push for circular economy materials. Companies are making PEN from plant-based materials and recycling it. This will help the environment and make PEN more valuable.

As we look to the future, PEN is set to play a big role. It will be used in many new ways, thanks to future polymer technologies. This will help us make better products and use resources wisely.

Competitive Analysis of Polyethylene Naphthalate Resin Market

The PEN resin market is filled with both big names and new players. Companies are trying to get ahead in areas like packaging and electronics. This part talks about the main players, their plans, and how the market is changing.

-

Teijin Limited – Japan

-

MOSER Baer – India

-

Lamifil – Belgium

-

DuPont Teijin Films – United States / Japan

-

SASA Polyester Sanayi A.Ş. – Turkey

-

KOLON PLASTIC INC. – South Korea

-

GTS Flexible Ltd. – United Kingdom

-

Polyonics – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Polyethylene Naphthalate Resin Market Report |

| Base Year | 2024 |

| Segment by Type |

· Liquid Crystal Polymers · Standard PEN Formulations |

|

Segment by Application |

· Food and Beverage Packaging Innovations · Electronics and Flexible Display Technologies · Automotive and Transportation Component Solutions |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The polyethylene naphthalate resin market demonstrates a promising trajectory, with a projected growth rate of 6.1% from 2025 to 2033. This expansion reflects the increasing demand for high-performance materials across various industries. Key drivers include technological advancements and sustainability initiatives, which enhance the material’s appeal. The market’s future looks bright, with opportunities in packaging, electronics, and automotive sectors. Companies investing in innovation and strategic partnerships are well-positioned to capitalize on these trends, ensuring continued growth and relevance in the global market landscape.

Global Polyethylene Naphthalate Resin Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Polyethylene Naphthalate Resin Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Polyethylene Naphthalate ResinMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Polyethylene Naphthalate Resinplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Polyethylene Naphthalate Resin Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Polyethylene Naphthalate Resin Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Polyethylene Naphthalate Resin Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofPolyethylene Naphthalate ResinMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is polyethylene naphthalate (PEN) resin and why is it important?

PEN resin is a high-quality polymer. It’s known for its excellent heat resistance, chemical safety, and strong barrier properties. It’s becoming increasingly important in areas such as high-performance packaging and electronics.

How is the polyethylene naphthalate resin market expected to grow?

The PEN resin market is projected to reach $1.56 billion by 2025. This growth is primarily driven by demand in the U.S., UK, and China. Factors contributing to this growth include an emphasis on sustainability, improved packaging solutions, and advancements in electronics technology.

What are the main applications of PEN resin?

PEN resin is used in many areas:

- Food and drink packaging

- Flexible electronics

- Car parts

- Medical tools

Its unique qualities boost performance in these fields.

What challenges does the PEN resin market face?

The main challenges are PEN’s higher cost, processing issues, and regulations on food and medical use. Overcoming these obstacles is crucial for the growth of the market.

How do geopolitical factors impact the PEN resin market?

Global politics, such as U.S.-China trade relations, have an effect on the PEN resin market. These factors influence supply chains, production processes, and pricing strategies. As a response, companies are actively seeking alternative methods to source and manufacture PEN resin.

What recent trends are shaping the demand for PEN resins?

Trends such as sustainability and bio-based products, high-performance packaging, and miniaturized electronics are driving the demand for PEN resins. These trends promote innovation and contribute to the growth of the market.

How does the United States’ market dynamics influence PEN resin production?

The U.S. is growing its PEN production and investing in R&D. Different industries are adopting PEN at varying rates. This affects how PEN is developed and used in the U.S.

What role does China play in the global PEN resin market?

China is becoming a major player in the PEN resin market. It is expanding its production and exports, and Chinese technology is also making production more efficient.

What is the future outlook for innovations in PEN resin?

The future of PEN resin looks promising. There is ongoing research for new formulas, renewable energy uses, and sustainable practices. These efforts aim to make the industry more environmentally friendly.

Who are the major players in the PEN resin market?

The PEN resin market has several big players, each with its own share, production, and focus. Recent trends indicate more partnerships and mergers, which are reshaping the market landscape. Below is an image depicting some of these major players in the PEN Resin Market.