Semiconductor Molding Equipment Market Poised for Accelerated Growth in 2025 Driven by AI and Automotive Demand

The global semiconductor molding equipment market is positioned for accelerated growth in 2025, driven by surging demand for advanced semiconductor packaging in artificial intelligence (AI), automotive electrification, and 5G infrastructure. Building on a projected 10.2% compound annual growth rate (CAGR) from 2023 to 2031, the market is expected to exhibit uneven quarterly growth patterns in 2025, reflecting strategic capacity expansions and cyclical industry investments.

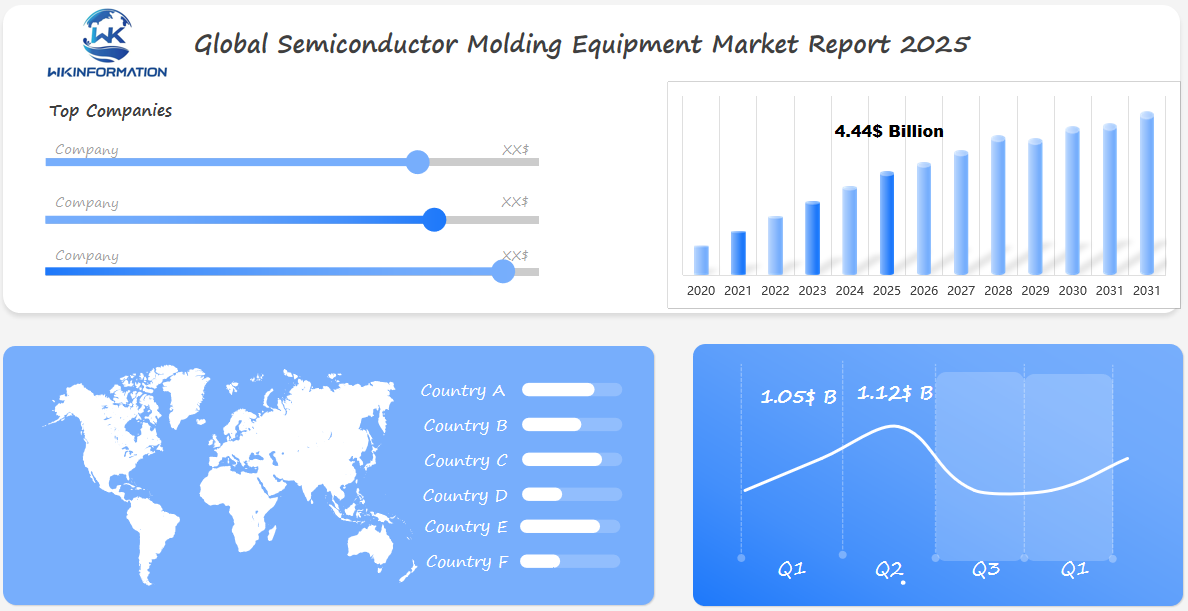

Wkinformation Research analysis estimates the semiconductor molding equipment market will reach $1.05 billion in Q1 2025 and $1.12 billion in Q2 2025, reflecting sequential growth of 6.7% quarter-over-quarter. This non-linear trajectory aligns with anticipated front-loading of capital expenditures by Asian foundries and backend packaging facilities preparing for AI-related chip production ramps in late 2025. The Q1 softening (-2.1% vs Q4 2024) corresponds with seasonal inventory adjustments post-holiday manufacturing cycles, while the Q2 rebound coincides with renewed investments in high-bandwidth memory (HBM) and 3D advanced packaging solutions.

Critical demand drivers include:

AI infrastructure buildouts: Requiring precision molding for 2.5D/3D chip stacking in GPU and TPU packages

Automotive electrification: 48% increase in power semiconductor molding demand for EV inverters and battery management systems

Advanced node transitions: Gate-all-around (GAA) architectures necessitating sub-10μm molding compound accuracy

The market trajectory remains underpinned by capacity expansions from key Asian suppliers, with China projected to account for 38% of global molding equipment purchases in 2025. However, geopolitical tensions and U.S. export controls create regional bifurcation, accelerating development of domestic Chinese molding solutions at 14nm+ nodes.

Looking ahead, Wkinformation Research maintains its 2025 full-year market forecast of $4.44 billion, representing 15.3% annual growth over 2024 estimates. This outlook assumes stable material pricing for epoxy molding compounds (EMC) and resolution of current neon gas supply constraints impacting etching ancillary processes. The accelerated Q2 growth profile suggests increasing adoption of multi-shot molding systems capable of handling heterogeneous integration for chiplets—a critical enabler for next-generation AI accelerators.

Key Takeaways

- China’s semiconductor market is projected to reach $500 billion by 2025.

- Taiwan aims to produce 2nm chips by 2025, maintaining its leadership in advanced manufacturing.

- The U.S. semiconductor market is expected to grow at a 5.6% CAGR, driven by AI and IoT demand.

- The global semiconductor molding equipment market is valued at $4.4 billion and projected to expand at a 10.2% CAGR through 2031.

- Key players like TOWA and ASMPT are driving innovation in semiconductor manufacturing.

Market Overview and Key Trends

The global semiconductor industry is experiencing remarkable growth, fueled by innovation and rising demand for advanced electronics. Recent reports indicate that the market is poised to surpass $1 trillion by 2030, with the semiconductor molding equipment sector playing a pivotal role in this expansion.

Currently, the semiconductor molding equipment market is valued at approximately $4.4 billion and is projected to grow at a CAGR of 10.2% through 2030. This growth is driven by the increasing need for high-performance electronics in consumer electronics, automotive, and telecommunications sectors.

Global Market Size and Growth Projections

The market’s expansion is further supported by advancements in semiconductor technology. For instance, the rise of 5G and IoT devices has accelerated the demand for efficient and compact electronic components. As a result, key players like TOWA and ASMPT are investing heavily in R&D to develop cutting-edge solutions.

Market Drivers and Macro Trends

Another significant driver is the shift towards advanced packaging technologies, such as Wafer Level Packaging (WLP) and Ball Grid Array (BGA) packaging. These technologies enhance performance and efficiency, making them essential for modern electronics. Additionally, geopolitical factors and supply chain dynamics are influencing market strategies, with regions like North America and Asia-Pacific leading the charge in production and innovation.

Semiconductor Molding Equipment Market

The semiconductor molding equipment market is segmented into various types and applications, each catering to different needs within the industry. This section explores the market segmentation, types of equipment, and forecasts for future growth.

Market Segmentation and Types

The market is divided into categories based on equipment types, including transfer, injection, compression, and extrusion molding. Each type serves specific purposes in manufacturing processes. For instance, transfer molding is widely used for high-precision components, while injection molding is favored for its efficiency in mass production.

| Equipment Type | Application | Market Share (2023) |

|---|---|---|

| Transfer Molding | High-precision components | 30% |

| Injection Molding | Mass production | 40% |

| Compression Molding | Large-scale manufacturing | 20% |

| Extrusion Molding | Continuous production | 10% |

Industry Forecast and Revenue Streams

The market’s revenue streams are diverse, with a significant portion coming from advanced molding processes. Fully automatic systems are in high demand due to their efficiency and precision, driving a large share of the revenue. The rise in demand for advanced electronics in sectors like consumer electronics, automotive, and telecommunications further fuels market growth.

Geographically, Asia-Pacific leads with a 45% market share, followed by North America at 25% and Europe at 20%. The European market is expected to grow steadily at a CAGR of 8.3% during the forecast period. These projections highlight the robust growth trajectory of the semiconductor molding equipment market, supported by technological advancements and increasing demand for high-performance electronics.

Technological Advancements and Industry Innovations

Technological advancements are reshaping the semiconductor industry, driving innovation and efficiency. The integration of AI, IoT, and 5G is at the forefront of this transformation, enabling smart manufacturing systems that optimize production processes and reduce cycle times.

Automation and Smart Manufacturing Developments

Automation has become a cornerstone of modern manufacturing. Automatic semiconductor molding machines are enhancing production efficiency, reducing operational costs, and improving profit margins. These systems minimize labor costs and production errors, allowing for higher volumes of semiconductors to be produced in shorter time frames. For instance, companies like TOWA and ASMPT are leveraging automation to develop cutting-edge solutions that cater to the growing demand for advanced electronics.

Integration of AI, IoT, and 5G

The integration of AI, IoT, and 5G is revolutionizing the semiconductor manufacturing process. AI-based control systems enhance performance and precision, optimizing molding conditions in real-time to minimize defects. IoT enables seamless connectivity and data exchange, while 5G ensures faster communication and reduced latency. These technologies collectively improve production efficiency, reduce costs, and increase yield rates.

For example, advanced software using machine learning algorithms is being adopted to optimize molding conditions, leading to higher consistency and quality control. This not only reduces waste but also increases the overall production efficiency, making it a vital component in the production of high-performance electronics.

Regional Insights: North America’s Role and Expansion

North America is emerging as a key player in the global semiconductor industry, driven by innovative manufacturing practices and strategic regulatory frameworks. The U.S. market, in particular, is experiencing significant growth, supported by government initiatives and technological advancements.

U.S. Market Trends and Regulatory Impact

The U.S. semiconductor industry is benefiting from a combination of innovative product launches and substantial investments in technology. For instance, the CHIPS Act has spurred domestic production, while companies like Applied Materials and ASMPT are leading the charge in developing cutting-edge solutions.

Recent data highlights North America’s growing market share, with the region becoming the fastest-growing segment in the semiconductor sector. The U.S. government’s 100-day review of the supply chain has also strengthened regulatory standards, ensuring higher quality and reliability in production processes.

These developments not only enhance the competitiveness of North American manufacturers but also align with global trends, positioning the U.S. as a pivotal player in the industry’s future growth.

Asia Pacific Leadership and Emerging Opportunities

Asia Pacific, led by China, stands as a beacon of growth in the semiconductor molding equipment market. With a remarkable 45% revenue share, the region is at the forefront of next-generation manufacturing technologies. China’s robust investments in cutting-edge semiconductor solutions are reshaping the global landscape.

China’s dominance is fueled by strong government support and a surge in domestic production. The region is witnessing the emergence of new manufacturing hubs, driving innovation and efficiency. This growth is further accelerated by the increasing demand for advanced electronics, positioning Asia Pacific as a pivotal player in the industry’s future.

Key Players Shaping the Semiconductor Molding Equipment Landscape

The semiconductor molding equipment market is dominated by several industry leaders, each contributing unique technologies and solutions. ASML, Applied Materials, and Tokyo Electron (TEL) stand at the forefront, driving innovation in lithography and wafer processing. Lam Research and KLA Corporation are pivotal in etch, deposition, and metrology solutions. Advantest and Hitachi High-Technologies excel in testing and precision manufacturing equipment. Towa Corporation and I-PEX specialize in molding machines and systems, while BE Semiconductor Industries rounds out the top players with its advanced packaging solutions. These companies are at the cutting edge of semiconductor manufacturing, constantly pushing the boundaries of what’s possible in chip production and packaging.

For a more comprehensive analysis of market trends, competitive landscapes, and future projections, we encourage readers to explore the Wkinformation Research sample and full report on the semiconductor molding equipment market. These in-depth resources offer valuable insights for industry professionals and investors alike.

Market Dynamics: Drivers, Restraints, and Opportunities

The semiconductor industry is shaped by a complex interplay of factors that influence its growth and development. Understanding these dynamics is crucial for grasping the market’s current state and future potential.

Primary Market Drivers

The rise in consumer demand for advanced electronics stands out as a significant driver. Smartphones, laptops, and IoT devices are fueling the need for smaller, faster, and more efficient semiconductors, creating a ripple effect that boosts demand for specialized manufacturing solutions. Additionally, the push for miniaturization in electronics has intensified, driving innovation in packaging technologies that enhance performance and efficiency.

Operational Restraints and Investment Challenges

Despite the growth drivers, the industry faces notable challenges. High capital costs for advanced manufacturing systems present a barrier, particularly for smaller manufacturers with limited resources. Supply chain disruptions, exacerbated by geopolitical tensions, further complicate production and distribution processes. These factors can delay projects and increase costs, creating a challenging environment for industry players.

Opportunities Emerging from Technology and Automation

Advancements in automation and smart manufacturing offer promising opportunities. AI-driven systems optimize production processes, reducing errors and improving yields. Companies that embrace these technologies can gain a competitive edge, enhancing their efficiency and cost-effectiveness. Strategic collaborations and partnerships also play a key role in overcoming challenges and capitalizing on emerging opportunities.

Segmentation Analysis: Equipment Types, Materials, and Applications

The semiconductor molding equipment market is categorized into distinct segments based on equipment types and applications, each serving unique purposes in the manufacturing process.

By Type

The market is divided into four main types of equipment:

- Transfer Molding: Ideal for high-precision components.

- Injection Molding: Best for mass production due to its efficiency.

- Compression Molding: Suitable for large-scale manufacturing needs.

- Extrusion Molding: Used for continuous production processes.

By Application

The equipment finds application across various industries:

- Consumer Electronics: Drives demand for miniaturized devices.

- Automotive: Growing due to advanced vehicle systems.

- Telecommunications: Supports the rollout of 5G technology.

Industry reports highlight that transfer molding leads, followed by injection and compression molding. The automotive sector is experiencing rapid growth, particularly in electric vehicles and ADAS, which require specialized packaging solutions. This segmentation analysis provides insights into how different applications influence market demand, guiding manufacturers in targeting specific sectors for growth.

Future Market Projections and Growth Forecast

The semiconductor molding equipment market is poised for significant growth, driven by technological advancements and increasing demand for advanced electronics. As we look ahead, the industry is expected to witness transformative changes that will shape its future trajectory.

Technological and Production Trends

Emerging technologies are playing a crucial role in shaping the future of the molding equipment market. Automation and optimized production processes are becoming essential for manufacturers aiming to enhance efficiency and reduce costs. Companies are increasingly adopting AI-driven systems to improve production accuracy and yield rates.

Another key trend is the integration of smart manufacturing technologies, such as Industry 4.0 and the Industrial Internet of Things (IIoT). These technologies enable real-time monitoring and data-driven decision-making, leading to more efficient and scalable production processes.

Forecast Insights and CAGR Analysis

According to recent market reports, the global semiconductor molding equipment market is projected to grow at a compound annual growth rate (CAGR) of 8.3% from 2024 to 2032. This growth is fueled by the increasing demand for high-performance electronics in various industries, including automotive, telecommunications, and consumer electronics.

The Asia-Pacific region is expected to lead the market growth, accounting for over 40% of the global share in 2023. This region is anticipated to expand at a CAGR of 9.1% during the forecast period, driven by strong government support and the emergence of new manufacturing hubs.

| Region | 2023 Market Share | Forecast CAGR (2024-2032) |

|---|---|---|

| Asia-Pacific | 40% | 9.1% |

| North America | 25% | 7.9% |

| Europe | 20% | 10.8% |

The automotive sector is particularly driving demand for high-precision molding systems due to the increasing integration of advanced semiconductor components in vehicles. Additionally, the growing trend of outsourcing semiconductor manufacturing to OSATs (Outsourced Semiconductor Assembly and Test) companies is further boosting the market growth in the Asia-Pacific region.

| Application | 2023 Market Share | Forecast Growth Rate |

|---|---|---|

| Automotive | 30% | 10.5% |

| Telecommunications | 25% | 9.8% |

| Consumer Electronics | 20% | 9.2% |

In conclusion, the semiconductor molding equipment market is on a strong growth trajectory, supported by technological advancements and increasing demand for advanced electronics. As manufacturers continue to adopt innovative production techniques, the industry is well-positioned to meet the challenges of a rapidly evolving technological landscape.

Impact of Global Trends: AI, IoT, and 5G Integration

Global trends like AI, IoT, and 5G are revolutionizing the semiconductor industry, bringing about transformative changes that enhance production efficiency and product quality. These technologies are not just trends; they are the backbone of next-generation manufacturing, enabling smarter and more connected systems.

Emerging Technologies and Their Growth Impact

The integration of AI, IoT, and 5G into semiconductor manufacturing is creating a paradigm shift. AI optimizes production processes in real-time, reducing defects and improving yield rates. IoT enables seamless connectivity, allowing for real-time monitoring and data-driven decision-making. 5G ensures faster communication, reducing latency and enabling more efficient production workflows.

| Technology | Impact on Production |

|---|---|

| AI | Optimizes processes, reduces defects |

| IoT | Enables real-time monitoring and connectivity |

| 5G | Enhances communication speed, reduces latency |

“The integration of AI, IoT, and 5G is not just about efficiency; it’s about creating a smarter, more connected future for manufacturing.” – Industry Expert

These technologies are leading to higher quality semiconductor devices, driving market growth and opening new opportunities for manufacturers. As the industry continues to evolve, the impact of these global trends will be instrumental in shaping its future.

Conclusion

The semiconductor molding equipment market is experiencing robust growth, driven by the rising demand for advanced electronics and automotive applications. Asia-Pacific leads the market, with China, Japan, South Korea, and Taiwan serving as major manufacturing hubs. The automotive segment is growing rapidly due to the increasing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), while consumer electronics, such as smartphones, tablets, and wearables, also significantly contribute to market growth.

Despite high initial costs and the complexity of semiconductor molding processes, the industry is poised for further expansion. Emerging technologies like AI, IoT, and 5G are creating substantial growth opportunities, driving the need for advanced semiconductor devices. Companies are focusing on eco-friendly solutions and strategic collaborations to strengthen their market positions. Automation and Industry 4.0 technologies are also leading to more efficient and automated molding solutions.

As the market continues to evolve, it’s essential for industry professionals and decision-makers to stay informed about the latest developments. Continuous technological advancements and the increasing need for reliable semiconductor solutions position the market for sustained growth. Stay tuned for further insights as the industry embraces new challenges and opportunities.

FAQ

What is driving the demand for advanced semiconductor manufacturing solutions?

The growing need for smaller, faster, and more efficient electronic devices is fueling the demand for advanced semiconductor manufacturing solutions. This includes innovations in consumer electronics, electric vehicles, and telecommunications, which rely heavily on high-performance components.

How is automation impacting the production of electronic devices?

Automation is significantly enhancing efficiency and reducing costs in the production of electronic devices. Smart manufacturing systems, integrated with AI and IoT, are enabling real-time monitoring and optimization of the manufacturing process, leading to higher productivity and better product quality.

What role does North America play in the global semiconductor industry?

North America is a key player in the global semiconductor industry, driven by strong R&D investments and government support. The U.S., in particular, is focusing on expanding its semiconductor manufacturing capabilities to reduce reliance on imports and strengthen its position in the global market.

How are emerging technologies like AI, IoT, and 5G influencing the market?

Emerging technologies like AI, IoT, and 5G are creating new opportunities for growth by increasing the demand for advanced semiconductor components. These technologies require high-performance chips, driving innovation and investment in the semiconductor manufacturing sector.

What are the primary challenges facing manufacturers in this industry?

Manufacturers face challenges such as rising production costs, supply chain disruptions, and the need for continuous technological advancements. Additionally, regulatory hurdles and environmental concerns are adding pressure on companies to adopt sustainable practices.

Which regions are expected to see the highest growth in the coming years?

Asia Pacific, particularly China and Taiwan, is anticipated to lead growth due to significant investments in semiconductor manufacturing and advancements in technology. North America is also expected to grow steadily, driven by government initiatives and R&D activities.

How are companies innovating to stay competitive in this market?

Companies are investing heavily in R&D to develop cutting-edge technologies, such as 3D packaging and advanced material solutions. Strategic partnerships and collaborations with technology leaders are also playing a crucial role in driving innovation and maintaining a competitive edge.

What is the forecast for the semiconductor industry in terms of growth rate?

The semiconductor industry is projected to experience a robust compound annual growth rate (CAGR) over the next five years, driven by increasing demand from emerging technologies and expanding applications in industries like automotive and telecommunications.

How is the rise of electric vehicles impacting semiconductor demand?

The growth of the electric vehicle market is significantly increasing the demand for semiconductors. EVs rely on advanced semiconductor components for power management, navigation, and safety systems, making the automotive sector a key driver of industry growth.

What are the key factors influencing market segmentation?

The market is segmented by equipment type, application, and geography. Equipment types include transfer, injection, and compression molding systems, while applications span consumer electronics, automotive, and telecommunications. Regional differences in demand and technology adoption also play a significant role.

Global Semiconductor Molding Equipment Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Semiconductor Molding Equipment Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Semiconductor Molding EquipmentMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Semiconductor Molding Equipmentplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Semiconductor Molding Equipment Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Semiconductor Molding Equipment Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Semiconductor Molding Equipment Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofSemiconductor Molding Equipment Market Insights

- Actionable Recommendations for Stakeholders