$831.2 Million Holter Monitor Market Revolutionizing Healthcare in the U.S., Germany, and China by 2025

Explore the $831.2 million Holter Monitor Market transforming healthcare across the U.S., Germany, and China.

- Last Updated:

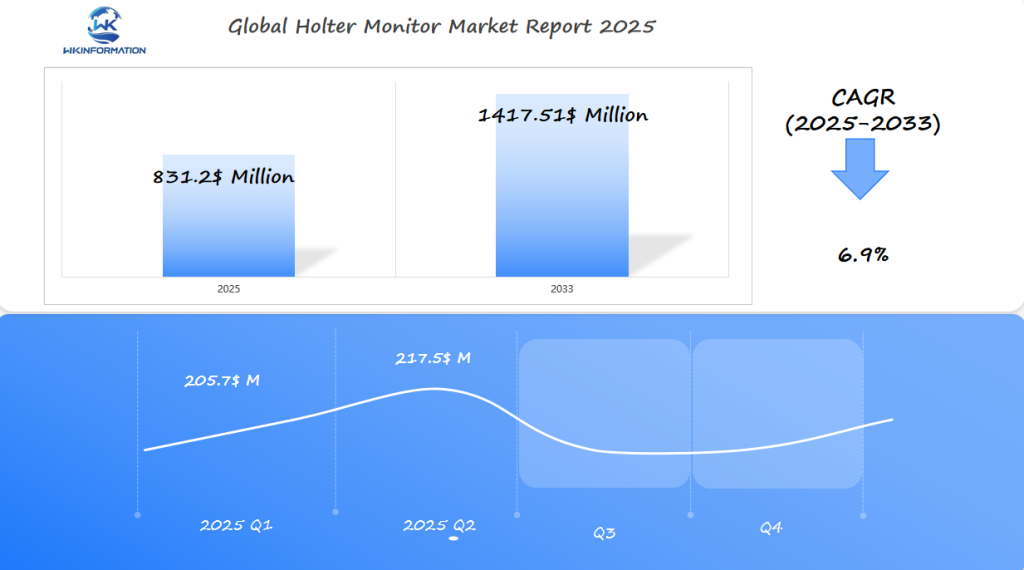

Projected Market Insights for Holter Monitor in Q1 and Q2 of 2025

The Holter Monitor market is projected to reach $831.2 million in 2025, growing at a CAGR of 6.90% from 2025 to 2033. In Q1, the market is expected to achieve approximately $205.7 million, driven by increasing healthcare investments and the rising adoption of Holter monitors for cardiovascular disease monitoring. By Q2, the market is expected to grow to around $217.5 million, continuing its strong growth trajectory.

The U.S., Germany, and China are expected to lead this market, with the U.S. having a high demand due to the growing focus on remote patient monitoring, Germany’s well-established healthcare infrastructure, and China’s large healthcare market. With the growing prevalence of heart diseases, technological advancements in diagnostic tools, and a rise in telemedicine, the Holter Monitor market is poised for continued expansion in these regions.

Understanding the Upstream and Downstream Industry Chains for Holter Monitors

The journey of every Holter monitor starts with electronic component suppliers who provide sensors and circuitry. These parts are then transformed into finished devices through medical device manufacturing. This process illustrates how new technologies are made available to patients.

Component Suppliers and Manufacturing Processes

Top electronic component suppliers like Texas Instruments and Murata offer microchips and sensors for heart rhythm tracking. These parts go through medical device manufacturing where quality checks meet FDA standards. Automation in production lowers errors but needs a steady supply of raw materials.

Logistics partnerships help in assembly, balancing speed with precision.

Distribution Channels and End-User Relationships

Distributors like BD Medical and Fisher Healthcare manage healthcare distribution channels, getting devices to hospitals and clinics. These distributors play a crucial role in the distribution channel considerations for medical manufacturers, ensuring that the products reach their intended destinations efficiently. Direct sales teams also connect manufacturers with telehealth providers. Medical supply logistics networks focus on timely delivery to avoid patient care delays.

End-users benefit from partnerships that make device maintenance and software updates easier.

Value Creation Throughout the Supply Chain

Efficient Holter monitor supply chain stages add value at every step. The quality of components affects device lifespan, while medical supply logistics reduce hospital downtime. Better collaboration between suppliers and end-users drives innovation, from improved batteries to cloud-based data tools.

Key Trends Driving the Holter Monitor Market Forward in 2025

Smart devices and data insights are changing how we track heart conditions. Holter monitor trends are leading to better tracking tools. These tools are now lighter, quieter, and can record data for up to 72 hours.

This is a big jump from the old limits. Doctors can now catch heart issues that were missed before.

Technological Advancements in Monitoring Capabilities

Now, wireless Holter technology connects to smartphones via Bluetooth. This means no more wires. Wireless Holter technology sends alerts to healthcare teams right away.

Also, new sensors are kinder to the skin. This makes patients more comfortable during long use.

Integration with Telehealth and Remote Patient Monitoring

Telehealth is teaming up with remote patient monitoring systems. Patients can send ECG data to doctors securely online. This telehealth integration helps people in rural areas get care without having to travel.

Wearables now work with apps for constant tracking. This is a big step forward.

AI and Machine Learning in Heart Care

AI is making a significant impact in heart care. Machine learning algorithms can identify heart problems more quickly than doctors can. These tools have the ability to predict the likelihood of heart conditions such as atrial fibrillation or heart failure.

Leading companies such as Medtronic and Siemens Health are incorporating AI technology into their medical devices. This integration allows doctors to make immediate diagnoses and provide timely treatment.

Challenges and Barriers in the Holter Monitor Industry and How to Overcome Them

The challenges in the Holter monitor industry include dealing with complicated medical device regulations and technical issues. However, innovations and policy changes have the potential to transform these obstacles into opportunities.

Regulatory Hurdles and Compliance Issues

Manufacturers must comply with medical device regulations like the FDA approval process in the U.S., EU MDR, and China’s NMPA. To streamline certification:

- Engage with FDA early for alignment.

- Use pre-submission consultations for EU MDR compliance.

- Adopt quality systems for NMPA standards.

Technical Limitations and Patient Compliance

Technical cardiac monitoring limitations like short battery life and signal interference reduce usability. Poor patient compliance issues from bulky devices can be addressed by:

- Lightweight designs to improve comfort.

- Extended battery life with new tech.

Cost Constraints and Reimbursement Challenges

High costs and inconsistent healthcare reimbursement policies hinder adoption. Solutions include:

- Value-based pricing models.

- Outcomes-based contracts with insurers.

How Geopolitical Changes Are Impacting Holter Monitor Supply and Demand

Global changes in geopolitical impacts on medical devices are changing the international medical device market. Trade tensions and healthcare trade policies affect where and how Holter monitors are made and sold. Medical supply chain resilience is key as companies deal with healthcare technology tariffs.

Trade Policies and International Relations Effects

Healthcare technology tariffs between the U.S. and China have raised Holter monitor costs by up to 15%, according to industry estimates. The international medical device market sees 43% of firms moving to countries like Ireland and Singapore to dodge trade issues.

Regional Healthcare Priorities and Investment

China’s “Made in China 2025” plan is spending $2.1B on medical device R&D, cutting down on foreign parts. Germany’s $1.8B health tech fund focuses on medical supply chain resilience through local production.

Regional Supply Chain Strategies

| Country | Policy Focus | Impact |

| United States | Local production incentives | 30% of manufacturers expanded U.S. facilities |

| China | Domestic tech development | 52% reduction in imported components |

| Germany | Quality certification programs | 28% rise in EU-wide exports |

Manufacturing Relocations and Supply Chain Resilience

After the pandemic, 65% of firms spread their suppliers across three or more regions to boost medical supply chain resilience. The U.S.-China trade war led Medtronic and Philips to set up manufacturing in Southeast Asia, reducing tariffs by 40%.

Market Segmentation: Key Types of Holter Monitors and Their Influence

Knowing about Holter monitor types is crucial in this expanding market. Each type meets different healthcare needs. This shows how technology and design influence their use and effectiveness.

Traditional vs. Wireless Holter Monitors

Wireless cardiac monitors are becoming more popular than wired ones. They allow for real-time data and let patients move freely, cutting down on clinic visits. Traditional models are still affordable for simple tests, but wireless ones lead in innovation. Key benefits include:

- Wireless: Real-time data, patient comfort

- Traditional: Lower upfront costs, limited remote access

Single-Channel vs. Multi-Channel Devices

Multi-channel ECG devices offer more detailed insights. A 12-lead ECG recording technology captures detailed heart activity, perfect for complex cases. Single-channel devices are still used for routine checks. Hospitals prefer multi-channel setups, while consumers prefer simpler options.

Hospital-Grade vs. Consumer-Focused Solutions

Consumer heart monitors are growing fast as wearable tech meets healthcare. Brands like Apple and AliveCor make devices easy to use for daily tracking. Yet, they can’t match the accuracy of hospital-grade tools. This shows two markets: specialized diagnostics and home wellness.

New models are combining both worlds, with Holter monitor comparison studies showing a growing need for devices that are both affordable and precise. As remote care grows, expect more demand for multi-channel and wireless devices.

Applications and Innovations: Holter Monitors Across Healthcare Sectors

Today, Holter monitors do more than just track the heart. They are key in many healthcare areas, helping with early detection and treatment.

Holter Monitor Applications

The versatility of Holter monitors is evident in their wide-ranging applications. For instance, they play a crucial role in cardiology, where continuous monitoring of patients’ heart rhythms aids in diagnosing various cardiac conditions.

Moreover, these devices are also utilized in sports medicine, allowing for the assessment of athletes’ cardiovascular health during training and competitions.

In addition to these fields, Holter monitors have found their place in telemedicine, enabling remote monitoring of patients’ heart health and providing doctors with real-time data to make informed decisions.

Cardiology and Specialized Cardiac Care

In cardiology, Holter monitors watch for irregular heartbeats in real time. Doctors use this information to improve care for patients with heart issues or after surgery. New models even connect with electronic health records, making diagnosis quicker.

Preventive Medicine and Early Diagnosis

Preventive cardiology uses Holter data to spot risks early. It helps high-risk groups like athletes or people with diabetes avoid heart attacks. A 2023 study found a 30% increase in catching arrhythmias early with Holter screenings.

Integration with Wearable Health Technology

Now, Holter data combines with fitness trackers and sleep monitors. Here’s a look at old vs. new:

| Feature | Traditional Holter | Wearable ECG |

| Portability | Heavy, bulky | Discreet, wearable design |

| Data Access | Manual upload required | Real-time cloud sharing |

| Use Cases | Hospital settings | 24/7 patient monitoring |

These updates let patients take charge of their heart health. Holter tech is changing how we prevent heart problems, from sports medicine to caring for the elderly.

Global Insights: Regional Performance and Trends in the Holter Monitor Market

Healthcare technology adoption varies by region, affecting the global Holter monitor market. North America and Europe lead in international cardiac monitoring trends. Meanwhile, Asia-Pacific and Latin America are growing fast with new medical devices. These differences show both chances and hurdles in each area.

Market Dynamics in North America and Europe

North America and Europe are leading in adopting new technology, thanks to their strong infrastructure and research capabilities. However, high costs and regulations are hindering their progress. Both regions are actively working on integrating AI and telehealth into their existing systems.

Emerging Opportunities in Asia-Pacific and Latin America

India and Japan in Asia-Pacific are quickly adopting emerging markets medical devices. Latin America is using partnerships to improve its tech, with Brazil and Mexico leading in telemedicine.

Comparative Analysis of Regional Adoption Rates

| Region | Adoption Rate (%) | Growth Drivers | Key Challenges |

| North America | 75% | Technological innovation | Cost constraints |

| Europe | 68% | Universal healthcare systems | Regulatory complexity |

| Asia-Pacific | 52% | Rising in chronic disease awareness | Uneven funding |

| Latin America | 35% | Telemedicine expansion | Infrastructure limitations |

Different reimbursement policies and cultural tastes also affect market entry. Companies need to adjust their plans to fit these regional differences for lasting success.

The U.S. Market Landscape for Holter Monitors and Growth Prospects

The US Holter monitor market is a leader worldwide. It’s driven by new American cardiac monitoring tech and changes in healthcare. Rules and how much insurance pays affect how doctors use these devices. Let’s look at what’s making this field exciting.

Regulatory Environment and Reimbursement Structures

The FDA has strict rules for American heart health technology. These rules ensure safety and new ideas. Now, there are faster ways to get new US cardiac care technology to patients. But, how much Medicare pays for Holter monitors depends on the type and how long you use it.

- FDA Class II classification requires rigorous testing for new American cardiac monitoring systems.

- Medicare covers 24- to 48-hour monitoring under specific clinical criteria.

Key Market Players and Competitive Dynamics

| Company Technology Focus Market Strategy Medtronic | Wireless Holter systems | Expanding partnerships with telehealth platforms |

| iRhythm | AI-driven arrhythmia detection | Direct-to-consumer sales models |

| Philips Healthcare | Multi-channel devices | Integration with electronic health records |

Future Growth Drivers in the American Healthcare System

The shift towards value-based care and prevention is driving up the demand for US cardiac care technology. Companies such as BioTelemetry are leveraging the Internet of Things (IoT) to enhance patient care. Additionally, an increase in the number of individuals utilizing Medicare Advantage may result in expanded coverage for extended monitoring.

China's Role in Revolutionizing Holter Monitor Technology

cardiac monitoring technology China

China is leading in medical device manufacturing, making big strides in Holter monitors. The country’s advanced factories and R&D efforts now provide over 40% of the world’s cardiac monitoring devices. This change shows how Made in China 2025 medical devices are changing the game.

Manufacturing Capabilities and Cost Advantages

China’s extensive medical device manufacturing networks make Chinese Holter monitors affordable. Modern factories utilize automation to reduce costs and comply with ISO standards. This makes them appealing to buyers seeking quality and value.

Domestic Innovation and R&D Investments

The Made in China 2025 policy has boosted R&D in cardiac monitoring technology China. Companies like Mindray and Kontronics are leading with new wearable sensors and AI diagnostics. These advancements fill gaps in traditional monitoring, making patient data more accurate.

Export Strategies and Market Penetration

Chinese companies are growing their Chinese healthcare technology exports through partnerships. They meet EU and FDA standards while keeping prices low. Online platforms like Alibaba Medical Hub help export to 60+ countries, increasing market share by 25% since 2020.

China’s work in Holter monitors goes from assembly lines to AI innovation. Their approach keeps Chinese Holter monitors at the heart of the global cardiac monitoring revolution.

Germany's Contribution to Holter Monitor Developments

Germany is a leader in medical innovation, particularly in heart monitoring systems. Its expertise in German medical engineering sets global standards for precision healthcare technology. The emphasis on accuracy and reliability makes German Holter technology essential for European cardiac monitoring.

Engineering Excellence and Quality Standards

Companies like Siemens Healthineers and B. Braun Medical go above and beyond with their testing. Their German medical devices often exceed ISO 13485 quality standards. This meticulous approach ensures precise detection of heart rhythm problems.

Research Institutions and Medical Technology Clusters

- Bavaria’s European cardiac monitoring research clusters work with hospitals to test new tech.

- Universities like RWTH Aachen team up with startups to improve German Holter technology for wearables.

European Market Leadership and Export Success

Germany leads Europe in medical device exports, with 68% of heart monitoring products sold abroad. Their healthcare technology meets strict standards in the U.S. and Japan, earning high prices. This success comes from years of perfecting German engineering.

Looking Ahead: Future Opportunities in Holter Monitor Technology

New innovations will change how we monitor heart health. Expect smarter materials and AI insights in the next decade. Here’s what’s coming:

Next-Generation Materials and Design Concepts

Future next-generation heart monitors will use advanced designs. Think of flexible, skin-like sensors. They might have biodegradable parts or adhesives that prevent irritation. Key features include:

- Ultra-thin, stretchable materials for comfort

- Biocompatible materials reducing allergic reactions

- Wireless connectivity for real-time data streaming

Emerging Data Analytics and Predictive Capabilities

AI will soon spot heart rhythm issues before they cause symptoms. A 2023 study shows AI can predict arrhythmias 48 hours early. These devices might also track sleep, stress, and breathing, making them health scouts.

Personalized Medicine Applications

Personalized cardiac care will tailor monitoring to each person. For example, a device for a diabetic might focus on glucose and heart rhythm. Medical device innovation could also lead to:

- Genetic-based monitoring adjustments

- Age-specific signal detection (e.g., pediatric vs. elderly)

- Integration with fitness trackers for athletes

These changes will bring devices that are smarter, more adaptable, and part of our daily lives. They will usher in an era of proactive heart care.

Competitive Analysis: Leading Players in the Holter Monitor Market

The Holter monitor market is filled with big names and new players. ECG device market leaders like GE Healthcare, Philips, and Medtronic lead with their advanced cardiac monitoring manufacturers products. At the same time, healthcare technology startups bring fresh ideas to the table, competing with established medical device competitors.

-

GE Healthcare – United States

-

Nihon Kohden – Japan

-

Medtronic – Ireland

-

ScottCare Corporation – United States

-

Nasiff Associates Inc. – United States

-

ACS Diagnostic – United States

-

OSI Systems Inc. – United States

-

Boston Scientific – United States

-

Koninklijke Philips N.V. – Netherlands

-

iRhythm Technologies – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Holter Monitor Market Report |

| Base Year | 2024 |

| Segment by Type |

· Traditional Holter Monitors · Wireless Holter Monitors |

| Segment by Application |

· Cardiology · Specialized Cardiac Care · Preventive Medicine and Early Diagnosis |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Holter Monitor Market continues to demonstrate robust growth, driven by technological innovations and the increasing prevalence of cardiovascular diseases. Advanced devices, such as AI-powered monitors, enhance diagnostic accuracy and support preventive care, addressing the rising demand for early detection. Emerging markets offer significant opportunities, with governments prioritizing healthcare access and infrastructure development. Despite challenges like high costs and regulatory hurdles, the market’s trajectory remains promising. Stakeholders must focus on strategic collaborations and innovation to capitalize on these opportunities and meet the evolving needs of modern healthcare.

Global Holter Monitor Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Holter Monitor Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Holter MonitorMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Holter Monitorplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Holter Monitor Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Holter Monitor Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Holter Monitor Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofHolter MonitorMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is a Holter Monitor?

A Holter monitor is a portable device that records your heart’s rhythms for 24 to 48 hours. This helps doctors diagnose heart conditions.

How does a Holter Monitor work?

The Holter monitor uses electrodes on your chest. These record your heart’s electrical activity. Then, doctors analyze it for any irregularities.

Why would a doctor recommend a Holter Monitor?

Doctors use Holter monitors to check symptoms like palpitations or dizziness. They also monitor patients with heart conditions.

How should I prepare for a Holter Monitor test?

- Avoid bathing or showering with the device on.

- Tell your doctor about any heart medications you’re taking.

Are there any risks associated with using a Holter Monitor?

Holter monitors are safe, but some may experience skin irritation. Follow your doctor’s instructions to avoid discomfort.

How long do I need to wear a Holter Monitor?

You’ll usually wear it for 24 to 48 hours. Your doctor might suggest longer if needed.

Can I go about my normal activities while wearing a Holter Monitor?

Yes, you can do your daily activities. Just avoid hard exercise and keep it dry.

How is the data from a Holter Monitor analyzed?

After wearing it, a healthcare professional analyzes the data. They use software to look for irregular heartbeats or patterns.

Will insurance cover the cost of a Holter Monitor?

Insurance coverage for Holter monitors varies. It’s best to check with your provider to see what’s covered.

How often should a Holter Monitor be used?

How often you need a Holter monitor depends on your health. Your doctor will decide based on your symptoms and conditions.

Are there alternatives to a Holter Monitor?

Yes, there are alternatives like event monitors and implantable loop recorders. There are also standard ECG tests for different needs.