2025 Submount for Laser Diode Market: Driving $169 Million Global Advancements, Led by Innovations in China, U.S., and Japan

Explore the evolving Submount for Laser Diode market from 2025-2030, examining global dynamics, regional powerhouses, and technological innovations. Discover how China’s dominance, U.S. innovation, and Japan’s precision engineering shape this crucial component market for laser diode technology, while uncovering future trends and growth opportunities.

- Last Updated:

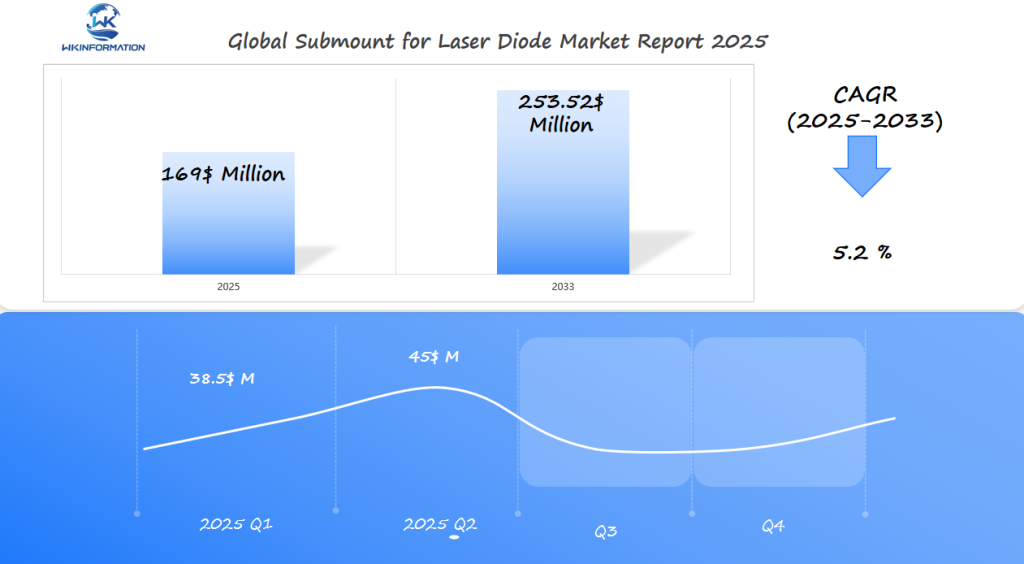

Submount for Laser Diode Market Forecast for Q1 and Q2 of 2025

The global submount for laser diode market is expected to reach approximately $169 million by the end of 2025, driven by the increasing demand for laser diodes in applications ranging from telecommunications to consumer electronics and industrial lasers.

For Q1 2025, the market is projected to be valued around $38.5 million, as the initial quarter typically sees a slower uptake due to seasonal production cycles and project start delays. However, by Q2 2025, the market is expected to experience a sharp rise to approximately $45 million, particularly as manufacturing ramps up in key regions like China, the U.S., and Japan. China, with its growing electronics manufacturing sector, will continue to drive a substantial portion of the demand, while the U.S. and Japan remain pivotal due to their advanced technological infrastructure and emphasis on research and development in optoelectronics.

The market is expected to maintain a Compound Annual Growth Rate (CAGR) of 5.2% by 2033, reflecting steady growth driven by continuous innovations in laser technology. For deeper insights into market trends, key players, and regional dynamics, we encourage you to explore the full Wkinformation Research report.

Key Takeaways

- China’s manufacturing scale drives Submount for Laser Diode Market volume production.

- U.S. leads in laser diode technology R&D for high-end applications like defense and aerospace.

- Japan’s precision engineering reduces failure rates in semiconductor packaging processes.

- Thermal management solutions are critical for high-power laser diode reliability.

- Global market forecast shows telecom and data centers as top revenue drivers by 2030.

Upstream and Downstream Industry Chain Analysis: The Submount for Laser Diode Supply Chain Explained

The supply chain for laser diode submounts connects raw material suppliers to end-users in fields like telecom and auto. This system needs tight coordination between suppliers, makers, and distributors to keep quality and efficiency high.

Raw Material Suppliers and Their Market Influence

Material suppliers lead the upstream segment, offering key parts like ceramic substrates and alloys. Companies like CoorsTek and Ferro Corp control rare materials, affecting prices and supply. These material suppliers often sign long-term deals to keep production steady for optoelectronics.

Manufacturing Process Integration Challenges

- Quality control gaps in bonding and sintering processes

- High costs of precision tooling and testing equipment

- Risk of defects during laser diode components assembly

Manufacturers must balance vertical integration with outsourcing. Companies like II-VI Incorporated produce materials in-house to cut down on external reliance.

Distribution Channels and End-User Industries

Downstream networks link producers to big names in telecom like Cisco and auto innovators like Toyota. China and Japan lead in shipments, while US companies focus on defense lasers. The demand for customization in 5G, data centers, and LiDAR systems keeps the supply chain dynamic.

Trend Analysis: Innovations and Trends in Submounts for Laser Diodes

Photonics innovation is changing submount design to meet new demands for efficiency and performance. Manufacturers are working on making submounts smaller while keeping them strong. This is driving progress in optical systems.

Miniaturization Advancements in Submount Technology

Submounts are getting smaller without losing power handling. Advanced ceramic substrates make it possible to have thinner, denser packages. These are perfect for small laser modules in gadgets. Some key examples include:

- Microvia interconnects for reduced size

- 0.1mm pitch solder bumps for high-density assembly

- Embedded heat sinks for space-saving thermal solutions

Thermal Management Innovations

As laser powers grow, so does the need for better thermal management. Diamond heat spreaders now have a thermal conductivity of 2,200 W/m·K. This is twice as good as aluminum nitride. Here’s a comparison of material performance:

| Material | Thermal Conductivity (W/m·K) | Use Case |

|---|---|---|

| Advanced ceramic substrates | 180-240 | Telecom modules |

| Polycrystalline diamond | 2000 | High-power lasers |

Material Integration Breakthroughs

New materials like aluminum oxide doped composites improve reliability under heat. Suppliers like CoorsTek and Morgan Advanced Materials are making hybrid substrates. These combine ceramic and diamond layers. This leads to 30% lower thermal resistance in automotive LiDAR systems.

These advancements are driving growth in 5G and medical imaging. Miniaturized, high-power submounts are key. As photonics innovation speeds up, material science is the backbone of future laser applications.

Restriction Analysis: Challenges Facing the Submount for Laser Diode Industry

The submount market is facing big challenges, even for top manufacturers. Issues like rare earth material constraints and manufacturing bottlenecks show weaknesses in global supply chains. The need to innovate while following rules adds to the complexity.

- Rare earth material constraints are a big topic. 90% of key elements like dysprosium come from unstable areas. This poses risks for companies that depend on these suppliers.

- Manufacturing bottlenecks come from the need for precision. Making uniform plating and ensuring thermal stability at large scales is hard. This leads to delays in big orders.

- Environmental regulations now demand cleaner processes. Companies must spend on waste management to meet EPA rules.

Quality control problems grow when making more products. Small defects in parts can stop shipments. Companies need to change how they source materials and invest in automation. This helps solve quality control issues and keeps them in line with rules. These steps increase costs, slowing the development of new laser systems.

Geopolitical Analysis: The Impact of Global Politics on Submount for Laser Diode Production and Trade

Global tensions are changing the laser diode submount industry. Semiconductor trade wars and national security concerns make submount production a key area for technological power. Governments use technology export controls to keep advanced manufacturing secrets safe. They also offer domestic manufacturing incentives to encourage companies to move their operations.

Strategic materials policies are creating regional production centers. This changes how companies operate worldwide.

US-China Trade Relations and Technology Transfer Restrictions

Washington’s rules on semiconductor exports to China affect submount R&D partnerships. Beijing’s “Made in China 2025” plan uses subsidies to copy US tech, creating rival supply chains. This forces companies to decide between markets or risk breaking technology export controls.

Regional Manufacturing Hubs and Government Incentives

| Region | Initiatives | Focus |

|---|---|---|

| US | CHIPS Act grants | Domestic manufacturing incentives for photonics |

| Malaysia/Vietnam | Tax breaks for tech parks | Submount assembly hubs |

| EU | EU Chips Act funding | Strategic materials policies for rare-earth sourcing |

National Security Implications of Photonics Supply Chain Control

Submounts are now seen as critical infrastructure. Defense companies need these parts for laser-guided systems, which raises national security concerns. Countries see photonics as strategic assets, blocking foreign ownership of key factories. They also enforce strict strategic materials policies.

Companies must now find diverse suppliers to avoid disruptions from global politics.

egmentation Type Market Analysis: Submount for Laser Diode Market Segmentation by Application

Understanding vertical market applications is key for laser diode submounts. Manufacturers are making products for specific needs in telecom, industrial, and consumer areas. This focus on application-specific submounts is changing how suppliers work.

Telecommunications and Data Centers: Here, submounts focus on keeping signals stable for 5G and fiber networks. They need to be low in thermal resistance and small to handle fast data. Big telecom companies want submounts that align perfectly to avoid signal loss.

- Telecom: High-precision alignment for 100G+ transceivers

- Data Centers: Thermal management for 24/7 operation

Industrial Laser Processing: Submounts for cutting and welding must handle high heat. They use diamond or copper substrates to spread up to 100W/cm². This keeps the laser beam steady, even when used a lot.

Consumer Electronics: For facial recognition and AR, submounts need to be tiny. Apple and Sony are looking for submounts under 1mm thick but still keep cool. This area wants to make lots of products without losing quality.

New markets like car LiDAR and medical imaging need submounts that can handle vibrations and align optics. Engineers use simulation tools to check how submounts perform in real stress situations.

Application Market Analysis: The Role of Submounts for Laser Diodes in Optical Communications

Submounts for laser diodes are key to modern optical networking. They power the backbone of global telecom infrastructure. These components keep signal stability in fiber optic communications.

They enable everything from 5G backhaul to cross-ocean data transfers. Their thermal and mechanical precision shape the performance of high-speed optical transceivers in critical networks.

5G Infrastructure and Fiber Backhaul Networks

Rapid 5G rollouts need submounts that handle extreme temperatures without signal loss. Telecom infrastructure projects require designs that:

- Reduce latency in fiber backhaul links

- Resist vibration and humidity in outdoor deployments

Data Center Interconnects and High-Speed Transceivers

Data center technology needs submounts for high-speed optical transceivers to meet 800G Ethernet standards. Key innovations include:

- Low-loss thermal interfaces for dense server racks

- Compatibility with OSFP and QSFP-DD modules

Submarine Cable Systems and Long-Haul Networks

In fiber optic communications, submarine systems rely on submounts rated for 20,000-meter depths. Critical features include:

- Corrosion-resistant coatings

- Wavelength stability over 25-year lifespans

These advancements show how submount innovations are defining global fiber optic communications expansion. As networks evolve, submount R&D is becoming a strategic priority for telecom equipment leaders.

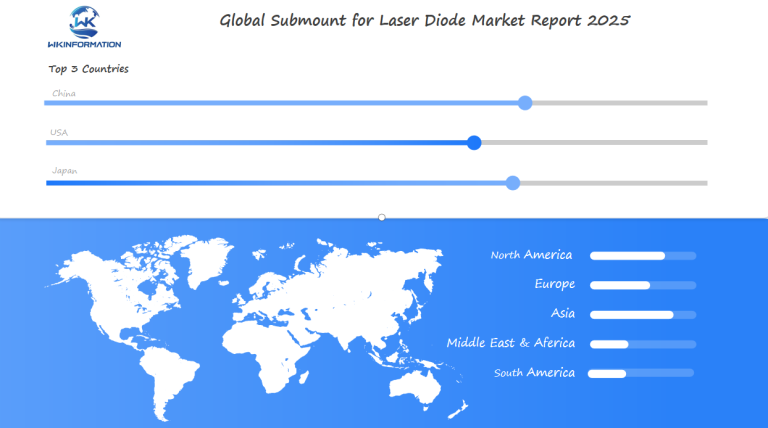

Global Submount for Laser Diode Market Region Analysis: Regional Market Dynamics

The laser diode submount market shows big differences in how things are made and sold. Asia-Pacific leads in making lots of products, while North America and Europe focus on special needs. This look into how different places buy and make things shows how the world competes.

| Region | Market Share | Manufacturing Focus | Key Countries | Key Companies |

|---|---|---|---|---|

| Asia-Pacific | 60% | High-volume production | China, Taiwan, South Korea | Epistar, Rohm Semiconductor |

| North America | 25% | High-end applications | USA, Canada | II-VI Incorporated |

| Europe | 15% | Precision engineering | Germany, Switzerland | Osram, II-VI |

Localized supply chains in Asia-Pacific have enabled manufacturers to reduce costs while maintaining quality, driving global production dominance.

Asia-Pacific Manufacturing Ecosystem and Market Growth

Asia-Pacific leads with 60% of the market, thanks to cheap labor and local supply chains. China makes a lot, Taiwan excels in packaging, and South Korea and Singapore add to the region’s strength. This makes Asia-Pacific a big player in making things.

North American Market Focus on High-Value Applications

In North America, the focus is on high-value areas like defense and telecom. The need for 5G and aerospace drives demand for special parts. Companies like II-VI in the U.S. make high-margin products.

European Precision Engineering and Specialized Solutions

Europe has 15% of the market, thanks to its focus on precision in medical and industrial lasers. German and Swiss companies focus on quality over quantity. This strategy helps them target specific markets with high prices.

The market shows Asia’s cost advantage, North America’s innovation, and Europe’s precision. These differences highlight how geography affects the submount market.

China Submount for Laser Diode Market Analysis

China leads in laser diode submounts thanks to production scaling and cost leadership. State-backed efforts have boosted the domestic photonics industry greatly. This has allowed factories to make submounts in huge volumes, unmatched anywhere else.

This large production scale lowers prices without sacrificing quality. As a result, China exports over 60% of the world’s submounts in 2024.

Vertical integration is crucial. Companies like HYC Electronic and Sino Nitride now get 85% of their raw materials locally. This reduces their need for foreign suppliers.

Their domestic photonics industry networks have also cut lead times by 40%. This makes their supply chain more resilient. Chinese R&D investment in photonics hit $2.3 billion in 2023. This money funded breakthroughs in thermal conductivity and precision machining.

“China’s focus on R&D investment has closed the gap with Japan and the U.S. in high-end submounts,” said a semiconductor analyst at TechInsights.

Top companies like Tecdia China use advanced automation for micron-level precision. They aim for the 5G and data center markets. Despite export restrictions and IP disputes, production scaling keeps going.

By 2025, they aim for 90% self-sufficiency in critical substrates. China’s mix of cost leadership and innovation will likely make it the top player in the $4.2 billion submount market by 2030.

U.S. Submount for Laser Diode Market Analysis

The U.S. is a leader in high-reliability applications, thanks to top research places like MIT and Stanford. These partnerships boost US photonics innovation. This ensures the U.S. stays ahead in defense and aerospace markets. Programs like the CHIPS Act help grow domestic manufacturing, securing key supply chains.

Innovation Ecosystem and R&D Leadership

Universities team up with companies like Kyocera America to make new submounts. They work on improving thermal management and materials, with $2 billion in federal support. This effort turns lab discoveries into products for defense, like missile guidance systems.

High-End Applications and Defense Sector Demand

Defense needs drive 40% of U.S. demand. Submounts for fighter jets and satellites must be perfect. Companies like Materion and IJ Research make products that meet strict military standards. These products work well in harsh environments.

Reshoring Initiatives and Supply Chain Security

The CHIPS Act funds efforts to bring manufacturing back to the U.S. This helps rebuild factories for submount production. It also reduces dependence on Asian suppliers and boosts capacity for reliable products. DARPA adds $500M each year to research and development.

But, there are challenges: U.S. factories cost 30% more than those overseas. There’s a need for more photonics engineers. Despite these issues, the U.S. remains a tech leader in high-end markets.

Japan Submount for Laser Diode Market Analysis

Japan’s submount makers are known for Japanese precision manufacturing. They mix old ways with new to meet worldwide needs. They focus on quality control processes and material skills, keeping them at the top for high-end laser diodes. Their aim for reliability and consistency means their parts work well even in harsh conditions.

Precision Engineering Excellence and Quality Control

Japanese makers use specialized ceramic production to make submounts with incredible accuracy. They work with materials like aluminum nitride and silicon carbide to improve thermal and electrical performance. Their strict quality control processes at every step ensure almost no defects. This makes their submounts perfect for aerospace, medical, and defense fields needing high-reliability components.

Automation and Advanced Manufacturing Techniques

Japan has embraced advanced automation systems to improve production while keeping precision. They have automated inspection lines and AI for quality checks, cutting down on human mistakes. This fits with the global move towards Industry 4.0, helping Japanese companies meet the growing need for small, powerful laser diodes.

Japan’s long history in precision engineering makes its submounts crucial in places where failure is unacceptable. As the world looks for a balance between cost and quality, Japan’s commitment to excellence keeps it key in the photonics supply chain.

Future Development Analysis: The Future of Submount for Laser Diode

The future development of submounts for laser diodes is expected to focus on improved thermal management, enhanced electrical performance, and advanced materials. Innovations in ceramic and diamond-based submounts will enable higher heat dissipation, extending the lifespan and efficiency of laser diodes. Additionally, integration with new packaging technologies, such as 3D packaging and silicon photonics, will further optimize performance for applications in telecommunications, medical devices, and industrial lasers. As demand for high-power and high-frequency laser diodes grows, submounts will continue to evolve to meet increasing performance and reliability requirements.

Competitor Analysis: Major Players in the Submount for Laser Diode Market

- SemiGen

- Thorlabs

- Kyocera

- Sheaumann

- LEW Techniques

- Applied Thin Film Products

- Remtec

- MARUWA

- Vishay

- ALMT Corp

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Submount for Laser Diode Market Report |

| Base Year | 2024 |

| Segment by Type |

· 0.25 – 1 mm · 1 – 1.5 mm · Other |

| Segment by Application |

· Semiconductor Industry · Consumer Electronics Industry · Other |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Submount for Laser Diode market is expected to undergo significant changes by 2030. Here’s what to expect:

- China’s Role: China will continue to be the leading manufacturer, known for its large-scale production and competitive pricing. As a center for cost-effective manufacturing, China will likely maintain its position as the top producer.

- U.S. Innovation: The United States will remain at the forefront of innovation in this market. Its advancements in high-power laser diode technologies demonstrate its commitment to research and development, which is vital for staying ahead in areas like inertial fusion energy (IFE). U.S. innovations are expected to bring about technological breakthroughs that will redefine industry standards.

- Japan’s Precision Engineering: Japan’s expertise in precision engineering will continue to play a crucial role in ensuring quality and reliability in submount production. Japanese manufacturers’ meticulous attention to detail significantly contributes to enhancing product performance and durability.

These three factors—China’s dominance, U.S. innovation, and Japan’s precision engineering—will shape the future of the Submount for Laser Diode market, creating both opportunities and challenges ahead.

Global Submount for Laser Diode Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Submount for Laser Diode Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Submount for Laser DiodeMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Submount for Laser Diodeplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Submount for Laser Diode Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Submount for Laser Diode Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Submount for Laser Diode Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofSubmount for Laser DiodeMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are laser diode submounts and why are they important?

Laser diode submounts are the base for laser diodes, ensuring they work well and stay cool. They make devices more reliable and useful. This is key in fields like telecom, healthcare, and cars.

How does China’s dominance in the laser diode submount market affect global supply?

China’s big manufacturing scale means lower costs and lots of products. This big role in the market can make it hard for others to get what they need.

What innovations are currently driving the laser diode submount market?

New ideas like making things smaller and better at cooling are leading the market. These advancements help devices work better and last longer, especially in data centers and medical tools.

What challenges does the laser diode submount industry face?

The industry struggles with finding the right materials, making things technically, and following green rules. These hurdles make it tough to keep up with demand.

How do geopolitical factors influence the laser diode submount market?

Politics, like the U.S. vs. China, can change how tech moves around the world. This affects who makes what and where, leading to new strategies in manufacturing.

What role does research and development play in the U.S. laser diode submount market?

The U.S. leads in R&D thanks to teamwork between labs and companies. This focus on new ideas helps create top-notch tech, especially for defense and space.

Why are Japanese manufacturers considered leaders in laser diode submount technology?

Japan is known for its exact engineering and quality. They use special materials and smart machines, making their submounts reliable and top-notch.

How is the demand for laser diodes in the healthcare sector impacting the submount market?

More medical devices using lasers are needed, driving the demand for advanced submounts. This push for better tech is boosting the market.

What applications are seeing the highest growth for laser diode submounts?

The biggest growth is in 5G, data centers, and new tech in gadgets. This includes facial recognition and augmented reality.