2025 Terminal Tractor Market Breakthrough: Unlocking a $1.01 Billion Opportunity with Efficient Logistics in U.S., China, and India

Discover insights into the Terminal Tractor Market’s evolution to a $1.01 billion industry by 2025. Explore key drivers including logistics efficiency, technological innovations, and regional growth in the U.S., China, and India. The market analysis covers sustainable solutions, automation trends, and strategic developments shaping the future of global cargo handling and transportation.

- Last Updated:

Terminal Tractor Market: Q1 and Q2 2025 Predictions

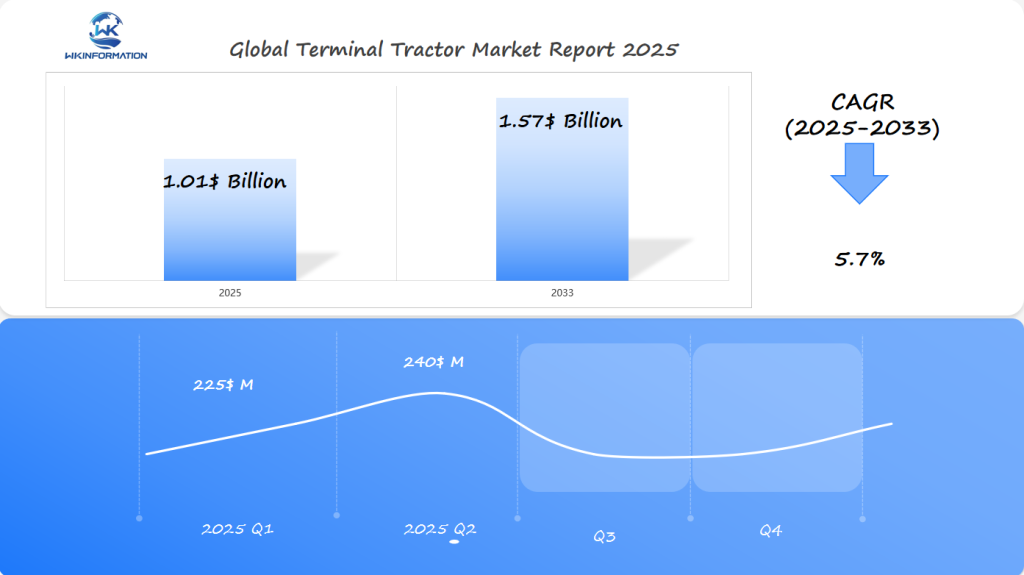

The Terminal Tractor market, projected to be valued at USD 1.01 billion in 2025, is poised for growth driven by the rising need for operational efficiency in logistics and port operations. With a projected CAGR of 5.7% from 2025 to 2033, this market is set to benefit from an increase in containerized cargo handling and the expansion of global supply chains.

In Q1 2025, the market is likely to generate around USD 225 million, or roughly 22% of the annual market value, with strong demand in U.S., China, and India, where port modernization projects are underway. By Q2 2025, the market will likely see an uptick to approximately USD 240 million, as the deployment of autonomous terminal tractors and electric-powered vehicles becomes more widespread, driven by sustainability regulations and the need for more efficient operations in busy ports and terminals.

Upstream and Downstream Analysis of Terminal Tractor Market

Understanding the supply chain dynamics in the terminal tractor market is crucial for navigating its complexities. Upstream suppliers and manufacturers play a pivotal role, providing essential components like engines, chassis, and advanced control systems. Their innovation and production efficiency directly influence the cost and quality of terminal tractors available to end-users.

The downstream users, primarily ports and warehouses, significantly impact market efficiency by driving demand for effective cargo handling solutions. Ports require robust terminal tractors to manage container movements seamlessly, while warehouses depend on them for efficient trailer handling. These entities are increasingly investing in technologies that enhance operational efficiencies, thus shaping the demand for advanced terminal tractors.

Key Dynamics

- Upstream Dynamics: Involves key component suppliers influencing product quality and pricing.

- Downstream Dynamics: Includes ports and warehouses where operational efficiency dictates technology adoption.

The interplay between these upstream and downstream factors creates a dynamic market environment where both ends of the supply chain continually adapt to technological advancements and evolving logistical needs. This interaction is crucial for understanding how terminal tractors can meet the growing demands of modern logistics operations.

Key Trends Shaping the Terminal Tractor Market

The terminal tractor market is witnessing pivotal trends that are reshaping its landscape, with automation at the forefront. Automated terminal operations are revolutionizing efficiency by reducing human error and enhancing precision in cargo handling. This shift towards automation ensures seamless operations, optimizing turnaround times and increasing throughput.

Electric terminal tractors are gaining traction as a sustainable alternative. As industries prioritize sustainability, these electric models offer reduced emissions and lower operational costs. Advancements in battery technology further bolster their appeal, providing longer operational hours and quicker charging times.

Regulatory pressures are steering the industry towards cleaner technologies. Governments worldwide are imposing stringent emission norms, pushing manufacturers to innovate and develop eco-friendly solutions. These regulations not only drive the adoption of electric tractors but also encourage investments in research and development for cleaner propulsion systems.

These trends underscore a transformative phase for the terminal tractor market, with automation, electric advancements, and regulatory frameworks collectively driving a more efficient and sustainable industry landscape.

Restrictions and Challenges in the Terminal Tractor Market

High Costs of Initial Investments

The high costs of initial investments are a significant challenge for companies looking to adopt advanced technologies in the Terminal Tractor Market. This financial barrier discourages many businesses from switching to innovative solutions, making it difficult for them to stay competitive.

Integration Issues

Integration problems make this situation even more complicated. New systems need to work smoothly with existing infrastructure to ensure efficient operations. However, differences between old and new technologies often lead to expensive delays, slowing down implementation and reducing overall productivity.

Infrastructure Limitations

Infrastructure limitations are another major obstacle. The limited number of electric charging stations makes it hard for electric terminal tractors to become widely used. As companies try to achieve their sustainability goals, the lack of sufficient charging facilities restricts their ability to transition to cleaner energy solutions effectively.

The Need for Investments

These challenges highlight the importance of investing in infrastructure development and technological innovation. Finding solutions for high costs, integration issues, and infrastructure limitations will be crucial in fully realizing the potential of the terminal tractor market. This, in turn, will lead to improved efficiency and sustainability in logistics operations.

Geopolitical Impact on the Terminal Tractor Industry

Geopolitical tensions significantly impact the logistics and transportation sectors, including the terminal tractor market. Fluctuations in trade policies can disrupt supply chains and influence the cost and availability of terminal tractors globally. For instance, tariffs and trade barriers may lead to increased production costs or limit access to crucial components, affecting manufacturers’ ability to meet demand.

Trade Agreements and Their Influence

Trade agreements play a pivotal role in shaping the imports and exports of terminal tractors across borders. Agreements like NAFTA or the EU’s customs union facilitate smoother trade flows, ensuring that terminal tractors are readily available in key markets. Conversely, protectionist measures may stifle growth by limiting market access for foreign manufacturers.

The Role of Market Stability

Market stability is another concern. Geopolitical factors such as international relations can lead to instability, which in turn affects investor confidence. Businesses might hesitate to invest in new technologies or expand their operations amid uncertainty, potentially slowing down market growth. For example, ongoing tensions between major economies like the U.S. and China could create volatility in the terminal tractor industry, influencing strategic decisions made by companies operating within these regions.

Understanding these geopolitical dynamics is essential for stakeholders aiming to navigate potential disruptions and capitalize on emerging opportunities within the terminal tractor market.

Market Segmentation: Types of Terminal Tractors and Their Roles

The terminal tractor market is divided into two main categories: fuel type and application areas. Both of these factors play a crucial role in logistics operations.

Fuel Type Segmentation

- Diesel Terminal Tractors: Currently holding the largest market share, diesel-powered tractors are preferred for their strong performance and ability to handle heavy tasks. They are widely used due to their proven reliability and the availability of fueling infrastructure.

- Electric Terminal Tractors: Rapidly gaining popularity, electric models offer an environmentally friendly option that aligns with global sustainability goals. This segment is experiencing growth due to advancements in battery technology and regulatory pressures to reduce carbon emissions, promising significant cost savings in the long run.

- Hybrid Models: Combining the advantages of both diesel and electric power, hybrid terminal tractors provide flexibility and lower emissions, catering to users who are transitioning towards greener solutions without compromising performance.

Application Areas

- Container Handling: Terminal tractors in this category are crucial for efficient movement within ports, enabling quick loading and unloading processes, thus optimizing cargo flow.

- Trailer Handling: In distribution centers and warehouses, these tractors improve operations by efficiently transporting trailers between docks and storage areas, boosting productivity.

Understanding these segments helps businesses choose the right terminal tractors that meet their operational requirements and sustainability goals.

Exploring Applications of Terminal Tractors in Global Logistics

Terminal tractors play a crucial role in improving operational efficiency in various logistics sectors. Their sturdy design and functionality make them essential for cargo handling applications in different settings:

1. Ports

Terminal tractors are critical in port operations, where they efficiently move containers between ships and storage areas. Their ability to maneuver heavy loads with precision ensures seamless transitions, minimizing idle times and streamlining port activities.

2. Warehouses

Within warehouses, terminal tractors facilitate the swift transport of trailers and containers. This capability allows for faster loading and unloading processes, optimizing space utilization and reducing turnaround times for incoming and outgoing shipments.

3. Distribution Centers

In distribution centers, terminal tractors enhance logistics workflows by ensuring that cargo is accurately positioned and prepared for dispatch. This contributes to faster order fulfillment and improved supply chain reliability.

4. Intermodal Yards

Terminal tractors are key players in intermodal yards, where they handle the transfer of cargo between different modes of transportation. Their adaptability supports efficient transitions from rail to road transport, boosting overall logistics efficiency.

These applications highlight the vital role terminal tractors have in the global Terminal Tractor Market, providing effective solutions for cargo handling challenges faced by modern logistics operations.

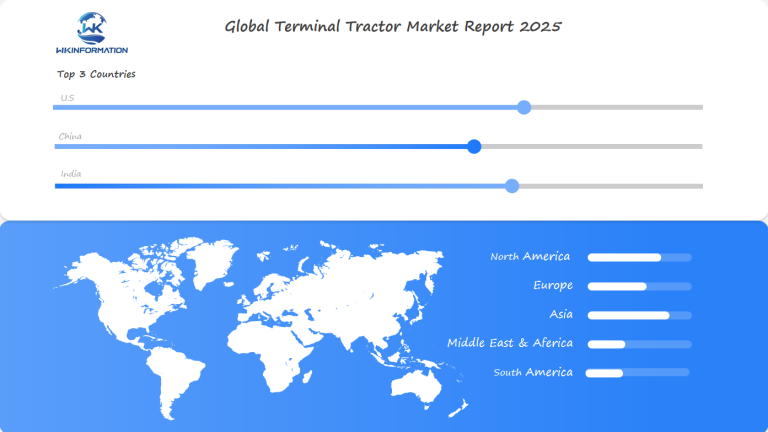

Regional Growth Insights for Terminal Tractor Market

North America Dominance

North America is a leader in the terminal tractor market, generating a significant portion of revenue. This dominance can be attributed to its advanced logistics infrastructure and strong industrial base. The region has a well-established network of ports and transportation hubs that require efficient cargo handling solutions.

Key Factors Driving Growth in North America

- Infrastructure: The presence of modernized ports and extensive warehousing facilities supports the widespread use of terminal tractors.

- Innovation: High levels of technological adoption in logistics fuel further growth, with U.S.-based companies continually pioneering innovative solutions tailored to meet evolving logistical challenges.

- Trade Activities: The vitality of North America’s trade activities enhances its position, driving the demand for efficient terminal operations.

Terminal Tractor Market in the USA: Key Developments

The U.S. logistics infrastructure is undergoing a major change, thanks to improvements in terminal tractor technologies. Companies in the U.S. are leading the way, creating innovative solutions designed to tackle the modern logistical problems faced by businesses operating globally.

Key Developments in the U.S. Terminal Tractor Market

Here are some of the key developments happening in the U.S. Terminal Tractor Market:

1. Innovative Technologies

American companies are making significant investments in automating and electrifying terminal tractors. This shift not only improves operational efficiency but also supports sustainability goals by lowering carbon emissions.

2. Collaborative Initiatives

Partnerships between major industry players and technology providers are driving innovation. These collaborations aim to optimize terminal operations by integrating smart technologies and data analytics.

3. Electric Models Launch

Companies such as TICO and Kalmar have launched new electric terminal tractor models. These vehicles are specifically designed to provide better energy efficiency while complying with regulatory requirements for cleaner transportation solutions.

These advancements position the U.S. as a leader in shaping the future of the Terminal Tractor Market, addressing both present logistical demands and future sustainability objectives.

Market Trends and Opportunities in China’s Terminal Tractor Sector

China’s terminal tractor sector is undergoing significant transformation driven by the nation’s rapid industrialization and unprecedented trade activities. As a major hub for global manufacturing, China presents unique opportunities for growth in the terminal tractor market.

Key trends include:

1. Rise of Electric Terminal Tractors

China’s commitment to reducing carbon emissions aligns with the global push towards electric vehicles. The government offers incentives for electric vehicle adoption, making electric terminal tractors an attractive option for companies aiming to reduce their carbon footprint.

2. Automation Enhancements

Automation technologies are increasingly being integrated into terminal operations across China. These advancements aim to enhance operational efficiency and reduce reliance on manual labor, particularly in bustling ports and warehouses.

3. Infrastructure Development

Large-scale infrastructure projects are underway to support the growing logistics industry. New terminals and expanded port facilities demand advanced equipment, including cutting-edge terminal tractors capable of handling increased cargo volumes efficiently.

Opportunities abound for companies willing to innovate and adapt to these emerging trends. Collaborations between Chinese firms and international players are enhancing technological capabilities, paving the way for future growth. This dynamic environment positions China as a pivotal player in shaping the future landscape of the terminal tractor market globally.

India’s Influence on Terminal Tractor Innovation

India is becoming an important player in the terminal tractor market due to its rapid industrial growth and expanding logistics industry. The country’s efforts to improve its infrastructure are driving innovation in terminal tractors, with several key factors playing a role in this trend:

1. Growing E-commerce Sector

The rapid growth of e-commerce activities requires efficient logistics solutions for timely deliveries. Terminal tractors are essential for optimizing operations in warehouses and distribution centers.

2. Government Initiatives

Policies that promote infrastructure development and the “Make in India” campaign support domestic production of advanced machinery, including terminal tractors. This policy environment encourages innovation and technological progress.

3. Sustainability Goals

India’s commitment to reducing carbon emissions is driving the transition towards electric terminal tractors. Investments in renewable energy sources and battery technology are making electric models more feasible.

4. Strategic Location

India’s geographical position as a trade hub between Asia, Europe, and Africa enhances its role in global supply chains. This strategic advantage increases the demand for modern terminal tractors to efficiently handle larger cargo volumes.

These factors combined make India an important market for terminal tractor innovations, with the potential to significantly impact global advancements in this industry.

Innovations in Terminal Tractor Technology and Future Developments

The terminal tractor industry is on the verge of significant change, driven by technological innovations that promise to redefine logistics efficiency. One key development is the integration of autonomous technologies, which are gradually being adopted to automate terminal operations. This shift towards automation enhances precision and reduces human error, offering significant improvements in operational efficiency.

Key Innovations Shaping the Future of Terminal Tractors

1. Autonomous Technologies

Autonomous technologies are being gradually integrated into terminal operations to automate processes. This transition towards automation improves accuracy and minimizes human mistakes, resulting in substantial enhancements in operational efficiency.

2. Electric Powertrains

Electric powertrains are another groundbreaking innovation leading the way towards sustainable solutions. The rise of electric terminal tractors is driven by advancements in battery technology, which offer longer range and shorter recharge times—critical factors for uninterrupted port activities. Companies such as Kalmar and Volvo Group are leading the charge by introducing new models that promise lower emissions without compromising performance.

3. Hydrogen Fuel Cell Technology

The emergence of hydrogen fuel cell technology offers a promising alternative to traditional fuel sources. Although still in its early stages, hydrogen-powered terminal tractors provide zero-emission solutions with quick refueling capabilities, addressing some limitations faced by electric models.

4. IoT and AI Technologies

Innovations are not limited to propulsion systems alone. The integration of IoT (Internet of Things) and AI (Artificial Intelligence) technologies enables real-time monitoring and predictive maintenance, optimizing fleet management and minimizing downtime. This technological advancement ensures that terminal tractors remain operationally efficient and cost-effective.

These innovations collectively indicate a future where terminal tractors are more efficient, environmentally friendly, and technologically advanced, setting new standards for global logistics operations.

Key Competitors in the Terminal Tractor Market

Several major players dominate the terminal tractor market, each bringing unique strengths and innovations to the table.

-

Kalmar – Finland

-

Konecranes Oyj – Finland

-

Sany Group – China

-

Terberg Group BV – Netherlands

-

Hyster-Yale Materials Handling, Inc. – United States

-

MAFI Transport-Systeme GmbH – Germany

-

Capacity Trucks – United States

-

TICO Tractors – Japan

-

Autocar – United States

-

Linde Material Handling – Germany

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Terminal Tractor Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The terminal tractor market is on the verge of a major transformation, expected to grow from over USD 1.01 billion in 2025 to approximately USD 1.57 billion by 2033. This growth trajectory highlights the critical role of terminal tractors in enhancing logistics and cargo handling efficiencies across various sectors.

Several factors contribute to this growth:

- Technological Innovation: The integration of automation and electric models is propelling operational capabilities, aligning with sustainability goals.

- Regional Dynamics: North America’s dominance stems from its advanced infrastructure, whereas Asia Pacific’s rapid industrialization drives market acceleration.

- Regulatory Impact: Increasing environmental regulations urge a shift towards cleaner technologies, fostering growth in the electric segment.

Challenges such as high initial investment costs and infrastructure limitations for electric charging remain prevalent. However, continuous advancements and strategic partnerships among key players like Kalmar, Terberg Special Vehicles, and TICO are paving the way for overcoming these hurdles.

In essence, the terminal tractor market stands at a crucial point, driven by innovation, regional growth strategies, and evolving regulatory landscapes. Embracing these changes will be vital for stakeholders aiming to take advantage of this growing market opportunity.

Global Terminal Tractor Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Terminal Tractor Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Terminal Tractor Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Terminal Tractor Players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: Terminal Tractor Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Terminal Tractor Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Terminal Tractor Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Terminal Tractor Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the terminal tractor market by 2025?

The terminal tractor market is projected to grow to $1.01 billion by 2025, driven by the increasing demand for efficient logistics solutions.

Which regions are key players in the terminal tractor market?

The key regions driving the terminal tractor market include the U.S., China, and India, which are significant contributors to logistics growth.

What are some key trends shaping the terminal tractor market?

Key trends include the rise of automation in terminal operations, the growing popularity of electric tractors as a sustainable option, and regulatory pressures promoting cleaner technologies.

What challenges does the terminal tractor market face?

Challenges in the terminal tractor market include high initial investment costs, infrastructure limitations for electric charging, and integration issues with existing systems.

How do geopolitical factors impact the terminal tractor industry?

Geopolitical tensions can influence logistics and transportation sectors, affecting trade policies and agreements that impact imports and exports of terminal tractors.

What applications do terminal tractors serve in global logistics?

Terminal tractors are utilized in various sectors such as ports and warehouses to improve operational efficiency through effective cargo handling solutions.